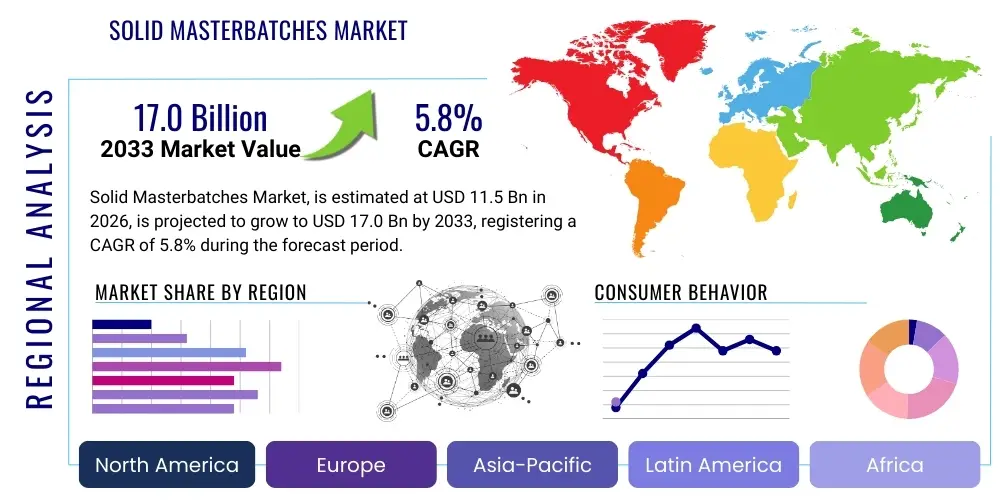

Solid Masterbatches Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439101 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Solid Masterbatches Market Size

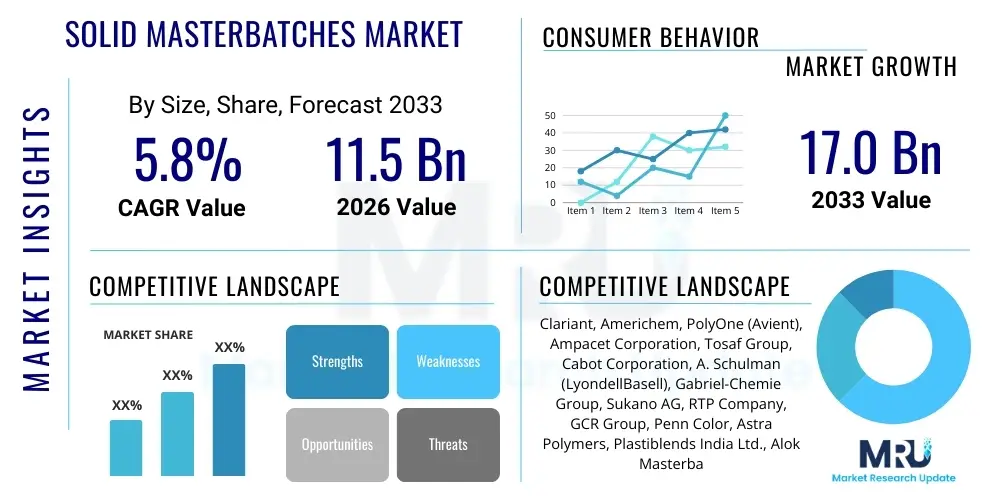

The Solid Masterbatches Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 11.5 Billion in 2026 and is projected to reach USD 17.0 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the escalating demand for high-performance plastics across pivotal end-use sectors, particularly packaging, automotive, and construction. Solid masterbatches offer superior handling characteristics, precise dosage control, and enhanced thermal stability compared to liquid alternatives or dry blends, making them the preferred choice for sophisticated manufacturing processes requiring stringent quality control and consistent coloration or functional properties. The continuous innovation in polymer processing techniques, coupled with the necessity for specialized additive packages to meet sustainability goals, further underpins the substantial market expansion forecasted for the next decade.

The transition toward sustainable and circular economy models significantly influences the demand within the Solid Masterbatches Market. Manufacturers increasingly require masterbatches that facilitate recycling processes, incorporating recycled polymers without compromising the final product's aesthetic or mechanical integrity. This requirement has spurred intense research and development efforts focusing on high-load, low-migration, and specialized additive masterbatches designed to improve the mechanical properties and lifecycle extension of recycled plastic materials. Furthermore, the stringent regulatory environment regarding food contact materials, especially in North America and Europe, mandates the use of highly certified and traceable solid masterbatches, thereby driving premiumization and technological advancements in the core product offerings.

Solid Masterbatches Market introduction

Solid masterbatches constitute concentrated mixtures of pigments and/or additives encapsulated during a heating process into a carrier resin, which is then cooled and cut into a granular or pellet form. These concentrated compositions are indispensable in the plastics industry, allowing plastic manufacturers to efficiently introduce color, specific physical properties, or protective features into raw polymers during processing, such as extrusion, injection molding, or blow molding. Unlike neat pigments or powders, the solid pellet form eliminates dust, ensures optimal dispersion, reduces handling risks, and facilitates automated dosing, leading to consistent quality and reduced manufacturing complexity. The primary applications span across flexible and rigid packaging, including films, bottles, and containers, where color, barrier properties, and UV resistance are paramount, alongside demanding applications in automotive interiors, construction materials (pipes, profiles), and technical textiles.

The inherent benefits of utilizing solid masterbatches—including enhanced product performance, cost-effectiveness through efficient inventory management, and improved health and safety in production environments—drive their widespread adoption globally. Key driving factors include the booming flexible packaging industry, particularly in emerging economies, the growing emphasis on aesthetics and differentiation in consumer goods, and the legislative pressure requiring plastics used in the automotive sector to meet high standards for lightweighting and thermal resistance. Moreover, the accelerating shift towards bio-based and compostable polymers necessitates the development of specialized masterbatches formulated to be compatible with these novel carrier systems, further expanding the scope and technological complexity of the market offerings. The integration of high-performance functional additives, such as flame retardants, slip agents, and antimicrobial compounds, into solid masterbatch formats caters to specialized market needs, cementing the product's criticality in modern plastics manufacturing.

Solid Masterbatches Market Executive Summary

The Solid Masterbatches Market is characterized by robust growth driven by rapid industrialization and the expansive use of plastic polymers across critical infrastructure and consumer sectors. Business trends indicate a strong move towards vertical integration among major market players, aiming to secure raw material supply (pigments like TiO2 and carbon black) and optimize the production of highly customized, application-specific masterbatches. The market is experiencing technological fragmentation, with increased investment in additive masterbatches that provide advanced functionalities like enhanced UV stabilization, anti-fog properties for food packaging, and specialized formulations for polymer recycling streams. Furthermore, mergers and acquisitions remain a central strategy for geographical expansion and portfolio diversification, particularly focusing on acquiring specialized small-to-mid-sized players with unique technological expertise in niche additive segments.

Regionally, the Asia Pacific (APAC) continues to dominate the market in terms of volume and growth rate, primarily fueled by massive infrastructure projects, burgeoning automotive production, and escalating demand for packaged consumer goods in China, India, and Southeast Asian nations. North America and Europe, while growing at a slower pace, exhibit higher value consumption due to stringent regulatory frameworks mandating high-quality, traceable, and eco-friendly masterbatches, driving demand for premium, customized solutions. Segment-wise, Color Masterbatches hold the largest market share owing to their ubiquitous use in packaging and consumer products, while Additive Masterbatches are projected to record the highest CAGR, propelled by the necessity to enhance the longevity and performance characteristics of plastic components in harsh operating environments, such as agriculture and outdoor construction.

AI Impact Analysis on Solid Masterbatches Market

Users frequently inquire about how Artificial Intelligence (AI) can enhance the efficiency and precision of masterbatch manufacturing, specifically focusing on color consistency, raw material management, and defect reduction. Key user concerns revolve around the implementation cost of AI systems, the ability of AI to handle the complexity of hundreds of different pigment/polymer combinations, and whether AI can accelerate the R&D cycle for novel additive formulations required for sustainable plastics. The consensus among these inquiries suggests high expectations for AI to automate and optimize the challenging processes of color matching and formulation, moving away from subjective, trial-and-error methods towards predictive modeling. AI’s ability to analyze vast datasets relating to environmental factors, machine parameters, and raw material variations is expected to revolutionize quality control and significantly reduce production scrap rates in complex masterbatch compounding operations.

- AI-powered predictive modeling optimizes pigment and additive concentration, ensuring superior color consistency across different production batches and polymer types.

- Machine Learning algorithms enhance quality control by analyzing spectral data and real-time extruder performance, automatically detecting and correcting deviations in dispersion or flow properties.

- AI optimizes supply chain logistics by forecasting demand for critical, volatile raw materials (e.g., specific organic pigments, specialized carrier resins), minimizing inventory costs while preventing stockouts.

- Generative AI tools accelerate new product development by simulating the performance of novel masterbatch formulations before physical testing, significantly reducing R&D time and material consumption.

- Process optimization through AI leads to reduced energy consumption in compounding and extrusion processes by fine-tuning heat profiles and screw speeds based on predictive energy models.

DRO & Impact Forces Of Solid Masterbatches Market

The Solid Masterbatches Market is influenced by a dynamic interplay of growth drivers (D), significant restraints (R), compelling opportunities (O), and structural impact forces. The primary drivers include the exponential expansion of the packaging sector globally, the increasing adoption of lightweight plastics in the automotive industry to improve fuel efficiency, and the mandatory requirement for enhanced shelf life and aesthetic appeal in consumer products, all necessitating specialized solid masterbatch formulations. However, the market faces constraints primarily due to the inherent volatility in the prices of key raw materials, particularly crude oil derivatives used as carrier resins and high-demand pigments like Titanium Dioxide (TiO2). Furthermore, stringent environmental regulations regarding the disposal and recycling of colored and functionalized plastics pose technical challenges for certain masterbatch applications.

Significant opportunities arise from the global movement towards circular economy initiatives, creating intense demand for masterbatches specifically engineered to be compatible with recycling processes and certified for compostability. The burgeoning market for bio-plastics and biodegradable polymers also offers a new, high-growth niche requiring specialized, high-performance solid colorants and additives. The key impact forces driving structural change in the industry include intensifying consolidation through strategic mergers and acquisitions, the continuous pressure from end-users for lower migration masterbatches in food contact applications, and the rapid technological shift towards high-load, single-pigment concentrates (SPCs) that improve processing efficiency and overall product performance consistency. Navigating the regulatory landscape, particularly concerning heavy metal usage in pigments and additive toxicity, remains a critical impact force determining market accessibility and competitive advantage.

Segmentation Analysis

The Solid Masterbatches Market segmentation provides a detailed framework for understanding specific demands based on product composition, polymer compatibility, and ultimate end-use application. This comprehensive breakdown assists stakeholders in tailoring strategic investments towards high-growth sectors and specialized product lines, such as high-temperature engineering plastics or environmentally certified masterbatches. The market is primarily categorized by type (which defines the core function, such as coloring or adding functionality), by the carrier polymer used for encapsulation, and by the application segment (which dictates the performance requirements and regulatory compliance needed).

The segmentation reflects the inherent complexity of the plastics value chain, where different applications require vastly different performance characteristics—for instance, automotive parts demand high heat stability and UV resistance (often using additive masterbatches), whereas food packaging requires regulatory compliance regarding migration and toxicity (driving demand for specialized white and color masterbatches). The anticipated high growth in filler masterbatches, especially calcium carbonate-based variants, in emerging markets, underscores the cost-reduction strategies adopted by packaging and pipe manufacturers, while the sustained demand for high-end black masterbatches in infrastructure and utility applications ensures market stability across various economic cycles.

- By Type:

- White Masterbatches (Driven by opacity requirements in films and bottles)

- Black Masterbatches (Crucial for UV protection and conductivity in pipes, wiring, and automotive)

- Color Masterbatches (Aesthetics and brand differentiation in consumer goods and packaging)

- Additive Masterbatches (Functionality enhancement: UV stabilizers, antioxidants, flame retardants, anti-microbial agents)

- Filler Masterbatches (Cost reduction and modification of mechanical properties: calcium carbonate, talc)

- By Polymer:

- Polyethylene (PE) (LDPE, LLDPE, HDPE; dominant in film and packaging)

- Polypropylene (PP) (Injection molded components, textiles, non-woven)

- Polyvinyl Chloride (PVC) (Construction, piping, wire and cable)

- Polyethylene Terephthalate (PET) (Bottles and containers)

- Others (PS, ABS, EVA, Engineering Plastics)

- By Application:

- Packaging (Flexible packaging, rigid containers, food contact materials)

- Building & Construction (Pipes, profiles, roofing materials)

- Automotive (Interior trims, bumpers, under-the-hood components, lightweighting solutions)

- Consumer Goods (Appliances, toys, furniture)

- Agriculture (Films, greenhouse sheeting, irrigation systems)

- Textiles (Non-woven fabrics, synthetic fibers)

- Others (Medical devices, electronics, wires and cables)

Value Chain Analysis For Solid Masterbatches Market

The Solid Masterbatches value chain is intricate, commencing with the sourcing and manufacturing of critical raw materials and culminating in the end-user application. The upstream segment is dominated by specialized chemical suppliers providing high-performance pigments (organic and inorganic), functional additives (such as stabilizers and processing aids), and polymer resins that act as the carrier base. The profitability in this segment is highly influenced by global commodity pricing and geopolitical stability, particularly for crude oil derivatives and metals required for inorganic pigments. The manufacturing stage, where compounding occurs using high-tech twin-screw extruders, is crucial; here, technical expertise in dispersion, heat management, and formulation is the primary differentiator, determining the quality and concentration of the final solid masterbatch pellet.

The midstream involves the masterbatch manufacturers who perform the critical task of transforming raw ingredients into standardized or customized solid pellets. These manufacturers maintain complex inventories of thousands of potential pigment and polymer combinations, requiring sophisticated enterprise resource planning (ERP) systems to manage production cycles and client specifications. Distribution channels bridge the gap between production and the downstream end-users, encompassing both direct sales (for large volume, highly specialized clients like major automotive Tier 1 suppliers) and indirect sales through distributors, agents, and regional traders, which are vital for servicing smaller and medium-sized plastic converters globally. The effectiveness of the distribution network, particularly in rapid delivery and technical support, is a significant competitive factor.

The downstream analysis focuses on the plastic converters (e.g., film extruders, blow molders, injection molders) who incorporate the solid masterbatches into virgin or recycled polymers. Their demands are centered on ease of handling, consistent quality, and technical compatibility with their specific machinery and end-product regulatory requirements. The success of the masterbatch ultimately rests on its performance in the final application, requiring close collaboration and technical support between the masterbatch producer and the converter. Direct distribution is favored for complex, custom color matches or additive packages requiring specific technical integration, while indirect channels provide the necessary volume accessibility and local inventory required by the fragmented nature of the global plastics processing industry.

Solid Masterbatches Market Potential Customers

The primary consumers (End-User/Buyers) of solid masterbatches are highly diversified, encompassing the entire spectrum of the plastics processing industry, ranging from large multinational packaging conglomerates to specialized, localized manufacturers serving niche construction or agricultural markets. The most significant customer base resides within the packaging sector, including producers of flexible films, rigid containers for beverages and personal care products, and specialized food contact packaging. These customers prioritize regulatory compliance (FDA/EU), low migration characteristics, and the ability to achieve precise aesthetic branding through consistent color reproduction across massive production volumes.

Another crucial customer segment includes manufacturers in the Building & Construction industry, who utilize masterbatches in pipes, window profiles, and geosynthetics. These applications require high-performance additive masterbatches providing UV stability, impact modification, and often flame retardancy to meet stringent building codes and ensure product longevity in outdoor environments. Similarly, automotive manufacturers and their Tier 1 suppliers represent a high-value customer group demanding masterbatches that comply with strict weight reduction goals (lightweighting), excellent thermal resistance, non-fading colors for interiors, and specialized conductive properties for electronic components, driving significant demand for high-end black and additive masterbatches designed for engineering polymers like ABS and specialized polyamides.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 Billion |

| Market Forecast in 2033 | USD 17.0 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Clariant, Americhem, PolyOne (Avient), Ampacet Corporation, Tosaf Group, Cabot Corporation, A. Schulman (LyondellBasell), Gabriel-Chemie Group, Sukano AG, RTP Company, GCR Group, Penn Color, Astra Polymers, Plastiblends India Ltd., Alok Masterbatches, Prayag Polytech, Kandui Industries, Dainichiseika Color & Chemicals Mfg. Co. Ltd., Kunststof-Kemi Skandinavia A/S, Reliance Industries Limited (RIL). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Solid Masterbatches Market Key Technology Landscape

The technological landscape of the Solid Masterbatches Market is defined by continuous advancements aimed at achieving higher pigment concentrations, superior dispersion quality, and specialized functional integration, all while optimizing processing efficiency. A fundamental technology remains high-performance twin-screw extrusion, which utilizes specialized screw geometries and multiple heating zones to achieve intense shear forces necessary for breaking down pigment agglomerates and uniformly dispersing additives within the carrier polymer matrix. Modern extruders incorporate sophisticated control systems and gravimetric feeders to ensure highly precise dosage and consistent output, minimizing variations in color strength and mechanical properties, which is crucial for high-quality solid masterbatch production. Innovation is also focused on developing low-temperature processing techniques to protect heat-sensitive organic pigments and functional additives.

Another pivotal technological trend is the development of single-pigment concentrates (SPCs) and micro-pelletization. SPCs offer the highest concentration of a single pigment, allowing converters to mix and match individual colors precisely at the machine, providing unparalleled flexibility and inventory reduction. Micro-pellets, characterized by their small, uniform size, are increasingly used in fiber and thin-film applications, where optimal dispersion and minimal filter blockage are paramount. Furthermore, specialized coating and surface modification technologies are being employed for inorganic fillers and pigments to improve their compatibility with various carrier resins, thereby enhancing mechanical integration and reducing the required loading percentage, contributing to cost efficiency and improved product characteristics.

The adoption of advanced spectral analysis and computational color matching technology is becoming standard practice. Spectrophotometers and sophisticated software replace traditional visual inspection, ensuring objective, rapid, and reproducible color matching, drastically cutting down the time required for custom color development. Furthermore, manufacturers are heavily investing in proprietary carrier resin technologies, focusing on universal carrier systems that can be utilized across multiple base polymers (like PE, PP, and PET), simplifying converter logistics and reducing the risk of incompatibility. These technological enhancements are essential for maintaining the competitive edge, particularly as end-user demands shift towards sustainable, high-fidelity, and functionalized solid masterbatch solutions.

Regional Highlights

- Asia Pacific (APAC): APAC represents the dominant region in terms of both volume consumption and projected growth rate, driven primarily by robust manufacturing expansion in China, India, and the ASEAN nations. The rapid urbanization, coupled with significant governmental investments in infrastructure (roads, housing, telecommunications), fuels massive demand for construction-grade plastic components requiring high volumes of filler and black masterbatches. Furthermore, the burgeoning middle class in countries like India is driving exponential growth in the consumer goods and processed food packaging sectors, necessitating vast quantities of color and white masterbatches for aesthetic and functional purposes. Local and regional players are intensely focused on cost optimization and scale, making the region a highly competitive, high-volume market.

- North America: The North American market is characterized by high value consumption, stringent regulatory compliance, and a strong focus on advanced, specialized masterbatches. Demand is heavily influenced by the high standards of the automotive and medical device industries, which require highly engineered additive masterbatches (e.g., impact modifiers, UV stabilizers) compatible with engineering polymers. The regional trend towards adopting sustainable practices is boosting demand for masterbatches compatible with post-consumer recycled (PCR) content and those designed for certified compostable bioplastics. Innovation in high-performance functional masterbatches, particularly for lightweight vehicle components and complex medical tubing, secures its position as a high-technology market.

- Europe: Europe is defined by its leadership in environmental regulation, notably the REACH directive and the EU Plastic Strategy, which severely restricts the use of certain chemicals and drives the circular economy model. This regulatory environment mandates the use of ultra-low migration, non-toxic, and highly traceable solid masterbatches, particularly in packaging and toy manufacturing. European demand is intensely focused on White Masterbatches that utilize non-hazardous pigments and additive masterbatches that improve polymer recyclability. The automotive sector, particularly in Germany and France, focuses on specialized flame-retardant and highly stable formulations for interior parts, ensuring that the market remains centered on premium, compliant products.

- Latin America (LATAM): The LATAM market, while smaller in size than APAC or Europe, demonstrates steady growth, anchored by expanding agricultural sectors (demanding UV-stable films and pipes) and the growing domestic packaging industry, particularly in Brazil and Mexico. Economic volatility can sometimes influence investment cycles, but the fundamental shift from traditional materials to plastics across sectors, especially infrastructure and fast-moving consumer goods (FMCG), maintains positive demand for standard color and filler masterbatches. Local production capabilities are increasing to reduce reliance on imports and stabilize supply chains.

- Middle East and Africa (MEA): MEA showcases significant potential, driven by vast infrastructure development projects in the GCC nations (Saudi Arabia, UAE) and industrialization in parts of Africa. This region is a major consumer of plastic pipes, cables, and construction profiles, generating high demand for black and UV-resistant masterbatches due to the intense solar exposure. The region also benefits from growing domestic petrochemical production, which provides competitive access to carrier resins, though the market often relies on imports for specialized functional additives and high-end pigments, indicating a market segment ripe for further localization of manufacturing capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Solid Masterbatches Market.- Clariant

- Americhem

- PolyOne (Avient)

- Ampacet Corporation

- Tosaf Group

- Cabot Corporation

- A. Schulman (LyondellBasell)

- Gabriel-Chemie Group

- Sukano AG

- RTP Company

- GCR Group

- Penn Color

- Astra Polymers

- Plastiblends India Ltd.

- Alok Masterbatches

- Prayag Polytech

- Kandui Industries

- Dainichiseika Color & Chemicals Mfg. Co. Ltd.

- Kunststof-Kemi Skandinavia A/S

- Reliance Industries Limited (RIL)

Frequently Asked Questions

Analyze common user questions about the Solid Masterbatches market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Solid Masterbatches Market?

The primary driver is the exponential growth and sophistication of the global packaging industry, which requires high volumes of masterbatches for consistent coloration, UV protection, and specialized functional properties like oxygen scavenging or anti-fog capabilities in food contact films and containers.

How do solid masterbatches contribute to plastic sustainability and the circular economy?

Solid masterbatches contribute significantly by offering specialized additive formulations that enhance the durability and mechanical integrity of post-consumer recycled (PCR) plastics. They also include coloring solutions formulated for compatibility with mechanical and chemical recycling processes, minimizing contamination and facilitating material recovery.

Which masterbatch type is projected to exhibit the highest Compound Annual Growth Rate (CAGR)?

Additive Masterbatches are projected to record the highest CAGR. This growth is driven by increasing demand across high-performance sectors like automotive and construction for functionalities such as flame retardancy, superior heat stabilization, and enhanced UV protection necessary to meet modern regulatory and performance standards.

What are the main technical advantages of solid masterbatches over liquid colorants or powders?

Solid masterbatches offer superior advantages, including dust-free handling, enhanced processing safety, precise automated dosage control, and significantly better dispersion of pigments and additives within the final polymer matrix, resulting in consistent color and mechanical performance.

What impact does raw material price volatility have on masterbatch manufacturers?

Volatility in the prices of key raw materials, especially crude oil derivatives (for carrier resins) and high-demand pigments like Titanium Dioxide (TiO2) and Carbon Black, significantly pressures the profit margins of masterbatch manufacturers, necessitating advanced hedging strategies and flexible formulation adjustments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager