Solid Phase Extraction (SPE) Consumables Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436166 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Solid Phase Extraction (SPE) Consumables Market Size

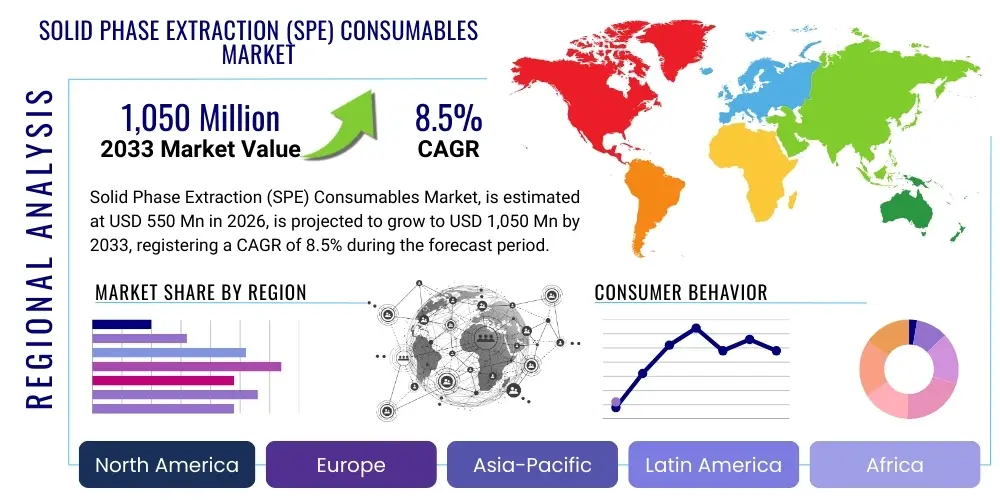

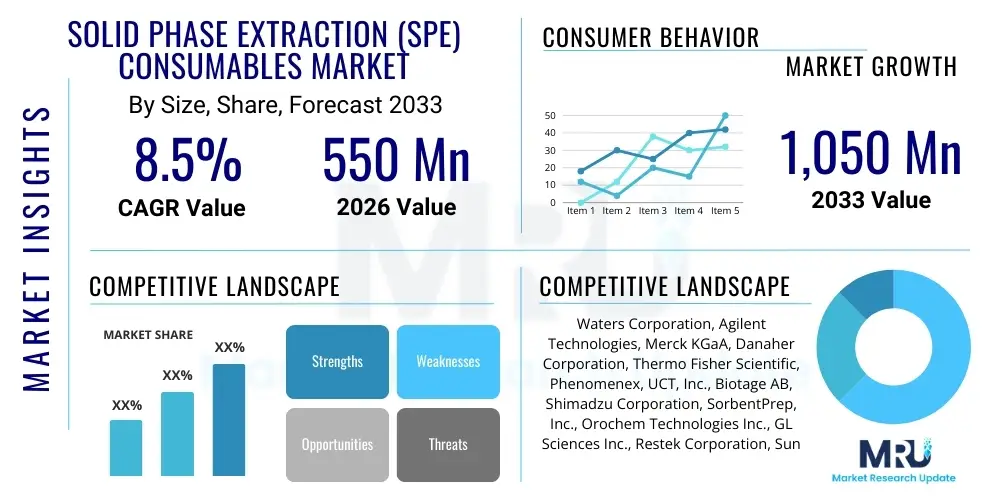

The Solid Phase Extraction (SPE) Consumables Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $550 Million in 2026 and is projected to reach $1,050 Million by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by increasing global regulatory scrutiny concerning sample preparation quality, particularly in pharmaceutical development, forensic toxicology, and environmental analysis. SPE consumables, recognized for their efficiency, selectivity, and reproducibility compared to traditional liquid-liquid extraction (LLE) methods, are becoming indispensable tools in high-throughput analytical laboratories worldwide. The market expansion is also fueled by technological advancements leading to miniaturized and automated SPE systems, driving the demand for specialized cartridges and plates.

Solid Phase Extraction (SPE) Consumables Market introduction

The Solid Phase Extraction (SPE) Consumables Market encompasses all disposable components utilized in the SPE technique, a crucial sample preparation method in analytical chemistry designed to isolate and concentrate analytes from complex matrices prior to analysis via techniques like HPLC, GC, or Mass Spectrometry. Products within this market primarily include cartridges, disks, 96-well plates, and various specialized sorbent materials (e.g., silica-based, polymeric, or mixed-mode phases). Major applications span pharmaceutical research (drug metabolism, pharmacokinetics), clinical diagnostics (therapeutic drug monitoring), food safety (pesticide residue testing), and environmental monitoring (water quality analysis).

Key benefits of employing SPE consumables include superior matrix cleanup, reduced solvent consumption, enhanced recovery rates, and significantly improved chromatographic data quality, which are paramount in regulated industries. Driving factors propelling this market include the escalating complexity of samples requiring highly selective cleanup, the global expansion of the pharmaceutical and biotechnology sectors leading to increased R&D spending, and stringent governmental regulations enforcing limits on contaminants in food and the environment. Furthermore, the rising adoption of automated SPE platforms necessitates a constant supply of high-quality, reproducible consumables suitable for high-throughput screening (HTS).

Solid Phase Extraction (SPE) Consumables Market Executive Summary

The Solid Phase Extraction (SPE) Consumables Market is characterized by robust growth driven by high-throughput analysis demands and increasing application complexity in life sciences. Business Trends indicate a strong pivot towards automation and miniaturization, particularly the growth of 96-well and 384-well plate formats, positioning technology leaders capable of providing specialty sorbents (like molecularly imprinted polymers and advanced mixed-mode materials) for a competitive advantage. Regional Trends show North America dominating the market due to substantial pharmaceutical R&D investment and a mature regulatory environment, while the Asia Pacific region is expected to demonstrate the highest CAGR, spurred by rapid expansion in contract research organizations (CROs) and growing governmental emphasis on food and environmental quality standards. Segments trends highlight Reverse Phase and Mixed-Mode sorbents as the leading types, given their versatility in separating diverse analyte classes, and the Pharmaceutical & Biotechnology application segment maintaining its highest market share due to continuous drug discovery efforts and rigorous quality control protocols.

AI Impact Analysis on Solid Phase Extraction (SPE) Consumables Market

Users frequently inquire about how Artificial Intelligence (AI) can optimize the historically empirical nature of SPE method development, specifically asking if AI tools can predict optimal sorbent type, solvent combinations, and elution protocols for novel or complex samples. Key themes center on leveraging AI and machine learning (ML) to handle vast spectroscopic and chromatographic data generated during method scouting, thereby reducing human trial-and-error, improving reproducibility, and accelerating the time-to-market for new analytical methods. Concerns often revolve around the initial data input required to train robust SPE prediction models and the integration compatibility of AI software with existing laboratory information management systems (LIMS) and automated SPE instruments. The expectation is that AI will transform SPE from an art into a highly standardized, predictable science, dramatically lowering consumable waste and enhancing the efficiency of sample preparation workflows, particularly for multi-residue and complex toxicological assays.

- AI-driven optimization of SPE protocols minimizes solvent usage and selection errors, enhancing consumable efficiency.

- Machine Learning (ML) algorithms analyze sample matrix characteristics to predict the optimal SPE sorbent and elution gradient, reducing method development time by up to 50%.

- Integration of AI with automated SPE instruments enables real-time performance monitoring and predictive maintenance, ensuring consistent consumable quality and throughput.

- AI facilitates high-throughput screening (HTS) by rapidly processing data from 96-well SPE plates, identifying extraction anomalies, and flagging potentially contaminated batches.

- Enhanced predictive modeling capabilities lead to the design of new, highly selective sorbent chemistries tailored for specific analytical challenges, directly influencing the type of consumables manufactured.

DRO & Impact Forces Of Solid Phase Extraction (SPE) Consumables Market

The Solid Phase Extraction (SPE) Consumables Market is primarily driven by escalating global mandates for analytical sensitivity, requiring better sample cleanup, coupled with the increasing adoption of highly selective mass spectrometry techniques that rely heavily on contamination-free samples. Restraints include the high initial cost associated with automated SPE instrumentation and the persistent variability in SPE method reproducibility across different laboratories, which sometimes favors the retention of traditional techniques like liquid-liquid extraction for certain validated methods. However, the opportunity for market expansion lies in developing eco-friendly, bio-compatible SPE materials and providing integrated, AI-optimized consumable packages for clinical and forensic toxicology, sectors facing rapidly evolving testing needs. These forces combine to create a dynamic environment where technological innovation in sorbent chemistry (Impact Force) dictates market share, while global regulatory compliance (Driver) solidifies demand, compelling manufacturers to invest heavily in quality control and application support.

The core Impact Force shaping the market is the continuous evolution of analytical instrumentation (e.g., UHPLC and high-resolution MS), which requires samples to be cleaner and analyte concentrations to be higher than ever before. This drives a necessity for next-generation SPE consumables, such as polymeric and mixed-mode cartridges, capable of highly efficient matrix removal. Additionally, the shift towards personalized medicine and complex biological sample analysis (e.g., plasma, urine, tissue homogenates) necessitates specialized, biocompatible SPE consumables optimized for biological matrices, providing a significant market differentiation opportunity for specialized vendors. Ultimately, the market trajectory is defined by the balance between the demand for cost-effective, high-throughput solutions (Driver) and the challenge of standardizing highly complex multi-analyte extractions (Restraint).

Segmentation Analysis

The Solid Phase Extraction (SPE) Consumables Market is segmented based on product type, sorbent phase, application, and end-user, reflecting the diverse requirements of modern analytical laboratories. The product type segmentation distinguishes between cartridges, disks, and plates, with cartridges remaining the conventional choice for single-sample analysis, while 96-well plates dominate high-throughput and automation workflows. Sorbent phase segmentation is crucial as it dictates the extraction mechanism; major phases include reverse phase (C18, C8), ion exchange (strong/weak), and the increasingly popular mixed-mode sorbents which combine two or more mechanisms for superior selectivity. Understanding these segments is vital for manufacturers aiming to align their product portfolios with specific application needs in regulated environments, ensuring both selectivity and cost-efficiency for end-users across clinical, pharmaceutical, and environmental testing sectors.

- By Product Type:

- Cartridges (Standard size, Micro-SPE)

- Disks

- Plates (96-well, 384-well)

- Bulk Sorbents

- By Sorbent Phase:

- Reverse Phase (e.g., C18, C8)

- Normal Phase (e.g., Silica, Florisil)

- Ion Exchange (Strong Cation Exchange - SCX, Strong Anion Exchange - SAX)

- Mixed-Mode Sorbents (e.g., Mixed-Mode Cation Exchange - MCX)

- Specialty/Affinity Phases (e.g., Molecularly Imprinted Polymers - MIPs)

- By Application:

- Pharmaceutical & Biotechnology Testing (ADME, Bioanalysis, Drug Discovery)

- Food & Beverage Testing (Pesticides, Antibiotics, Mycotoxins)

- Environmental Testing (Water, Soil Analysis)

- Clinical & Forensic Toxicology (Therapeutic Drug Monitoring, Drug Abuse Testing)

- Academic Research & Government Labs

- By End-User:

- Pharmaceutical and Biotechnology Companies

- Contract Research Organizations (CROs)

- Academic & Research Institutes

- Food Testing Laboratories

- Environmental Testing Agencies

Value Chain Analysis For Solid Phase Extraction (SPE) Consumables Market

The value chain for the SPE Consumables Market begins with the upstream suppliers of raw materials, primarily high-purity silica gel, polymeric monomers, and specialized bonding chemicals used to manufacture the sorbent media. Quality and consistency at this stage are paramount, as they directly influence the performance and reproducibility of the final consumable product. Leading manufacturers maintain stringent control over sorbent synthesis and packing procedures to minimize batch-to-batch variation, a critical performance metric demanded by regulated end-users. After manufacturing, products move through sophisticated distribution channels, which include both direct sales forces specializing in analytical chemistry solutions and indirect channels such as global distributors and specialized laboratory supply houses.

The downstream analysis focuses heavily on the end-user adoption and integration of these consumables into automated workflows. Pharmaceutical and CRO labs demand just-in-time inventory management and bulk purchasing capabilities, driving the need for efficient logistical networks. Direct distribution models are often preferred for highly technical or custom-designed consumables, allowing manufacturers to provide immediate application support and method development consultation. Conversely, indirect channels are essential for penetrating geographically diverse academic and smaller environmental testing markets, leveraging the existing network of established scientific equipment vendors. The efficacy of the distribution channel is directly linked to timely delivery of high-quality products that meet critical analytical timelines.

Solid Phase Extraction (SPE) Consumables Market Potential Customers

The primary purchasers and end-users of Solid Phase Extraction (SPE) consumables are institutions and commercial entities engaged in high-precision chemical analysis requiring sample cleanup or analyte concentration. Pharmaceutical and Biotechnology Companies represent the largest customer base, utilizing SPE extensively in preclinical drug metabolism studies (ADME), bioanalysis for clinical trials, and quality control (QC) of finished products. Contract Research Organizations (CROs) are rapidly expanding customers, driven by outsourcing trends in the drug development pipeline, requiring high-volume, standardized SPE consumables for bioanalytical services. Additionally, governmental and commercial Food Testing Laboratories rely on SPE for extracting trace contaminants, such as pesticides and veterinary drugs, ensuring regulatory compliance. The critical need for precise, matrix-free samples across these sectors defines the high-value customer profile for SPE consumables.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $550 Million |

| Market Forecast in 2033 | $1,050 Million |

| Growth Rate | CAGR 8.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Waters Corporation, Agilent Technologies, Merck KGaA, Danaher Corporation, Thermo Fisher Scientific, Phenomenex, UCT, Inc., Biotage AB, Shimadzu Corporation, SorbentPrep, Inc., Orochem Technologies Inc., GL Sciences Inc., Restek Corporation, Sun SRI, Macherey-Nagel GmbH & Co. KG, PerkinElmer Inc., Regis Technologies, Sepax Technologies, Tosoh Bioscience, Chem Service Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Solid Phase Extraction (SPE) Consumables Market Key Technology Landscape

The technology landscape of the Solid Phase Extraction (SPE) Consumables Market is primarily defined by the chemistry and physical format of the sorbent material, moving toward enhanced selectivity and miniaturization. Recent advancements focus heavily on the development of novel sorbent chemistries, particularly Mixed-Mode Sorbents (MM-SPE), which utilize a combination of hydrophobic and ion-exchange mechanisms within a single particle, significantly improving the cleanup of complex matrices like plasma and urine. This advancement allows analysts to use a single protocol for multiple classes of compounds, enhancing laboratory throughput and reducing the inventory of specialized consumables. Furthermore, the push for automation has popularized 96-well and 384-well plate formats, requiring precision-packed sorbents that ensure uniform flow rates across all wells, a critical technological benchmark for high-throughput screening (HTS) in drug discovery.

Another dominant technological trend is the rise of Molecularly Imprinted Polymers (MIPs) and restricted-access media (RAM). MIPs are highly selective synthetic polymers engineered with binding sites specific to a target analyte or compound class, offering unprecedented matrix specificity and highly clean extracts. RAM technology allows for the direct injection of biological samples without extensive protein precipitation, as the outer layer of the particle excludes large molecules (proteins) while the inner layer retains small-molecule analytes. These sophisticated technologies command a premium price point but are increasingly favored in regulated bioanalytical environments due to their superior performance in removing highly interfering matrix components, thereby protecting costly analytical columns and detectors. The drive for smaller sample volumes and higher sensitivity techniques like micro-SPE (µ-SPE) also dictates ongoing innovation in cartridge design and sorbent particle size.

Regional Highlights

Geographically, the Solid Phase Extraction (SPE) Consumables Market exhibits diverse growth patterns influenced by regional regulatory environments, R&D spending, and the maturity of the analytical infrastructure. North America currently holds the largest market share, driven by the massive presence of leading pharmaceutical and biotechnology companies in the United States, significant government funding for clinical and forensic toxicology labs, and rigorous environmental monitoring standards enforced by agencies like the EPA. The established infrastructure and early adoption of automated SPE systems ensure continuous high demand for specialized, high-quality consumables suitable for validated methods. Furthermore, the high volume of outsourced clinical trials handled by North American CROs contributes substantially to the region’s dominance.

Europe represents the second-largest market, characterized by stringent European Union regulations regarding food safety (e.g., limits on mycotoxins and pesticides) and water quality, necessitating constant, high-volume testing using SPE. Countries like Germany, the UK, and Switzerland are key hubs for chemical and life science research, fostering demand for advanced mixed-mode and bulk sorbents. Conversely, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This rapid growth is attributable to expanding healthcare infrastructure, increased investment in domestic pharmaceutical manufacturing (especially in China and India), and growing awareness and enforcement of environmental and food quality standards, leading to widespread adoption of modern sample preparation techniques across emerging analytical laboratories.

- North America: Market leader due to large pharmaceutical R&D base, high automation rates, and stringent regulatory demands in clinical and environmental sectors.

- Europe: Strong demand driven by comprehensive food safety regulations (EFSA) and a robust academic research sector, favoring both standard and specialized cartridges.

- Asia Pacific (APAC): Fastest-growing region; rapid expansion of CROs and generic drug manufacturing, coupled with rising governmental investment in infrastructure for quality control testing.

- Latin America (LATAM): Moderate growth influenced by increasing modernization of food and agricultural testing laboratories and growing foreign investment in healthcare.

- Middle East and Africa (MEA): Emerging market primarily focused on petrochemical and environmental testing, with growth tied to infrastructure development and localized efforts to establish standardized food quality monitoring.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Solid Phase Extraction (SPE) Consumables Market.- Waters Corporation

- Agilent Technologies

- Merck KGaA

- Danaher Corporation (including Phenomenex)

- Thermo Fisher Scientific

- UCT, Inc.

- Biotage AB

- Shimadzu Corporation

- SorbentPrep, Inc.

- Orochem Technologies Inc.

- GL Sciences Inc.

- Restek Corporation

- Sun SRI

- Macherey-Nagel GmbH & Co. KG

- PerkinElmer Inc.

- Regis Technologies

- Sepax Technologies

- Tosoh Bioscience

- Chem Service Inc.

- TE Instruments

Frequently Asked Questions

Analyze common user questions about the Solid Phase Extraction (SPE) Consumables market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of using Mixed-Mode SPE consumables over traditional sorbents?

Mixed-Mode SPE consumables offer superior selectivity by combining two extraction mechanisms, typically hydrophobic (Reverse Phase) and ion exchange, within a single device. This allows for highly effective cleanup of complex biological matrices, resulting in cleaner chromatograms and improved sensitivity compared to single-mechanism sorbents.

How does the shift toward high-throughput analysis affect the demand for specific SPE consumable formats?

The increasing need for high-throughput analysis (HTA) in pharmaceutical and clinical labs drives significant demand for 96-well and 384-well SPE plates. These formats are optimized for automated liquid handling systems, enabling rapid, parallel sample processing, which is essential for bioanalytical validation and drug screening workflows.

What key regulations influence the quality requirements for SPE consumables in food safety testing?

Food safety testing is heavily influenced by regulations set by the FDA (US), EFSA (Europe), and ISO standards. These regulations mandate low detection limits for contaminants (like pesticides and mycotoxins), requiring SPE consumables to demonstrate exceptionally high recovery rates, minimal extract variability, and verifiable batch-to-batch consistency.

Is the market trending towards generic or proprietary SPE sorbent chemistries?

While standard silica-based (C18) generics maintain high volume, the market is trending towards proprietary, high-performance chemistries, such as polymeric sorbents and Molecularly Imprinted Polymers (MIPs). These specialized chemistries offer necessary selectivity for complex modern analyses, justifying their higher cost.

How is environmental concern influencing the future design of SPE consumables?

Growing environmental awareness is driving innovation towards green chemistry solutions. This includes developing micro-SPE techniques that require drastically reduced solvent volumes and the creation of biodegradable or more sustainable polymeric materials for cartridges and disks, minimizing laboratory waste footprint.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager