Solid Phase Extraction (SPE) System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434740 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Solid Phase Extraction (SPE) System Market Size

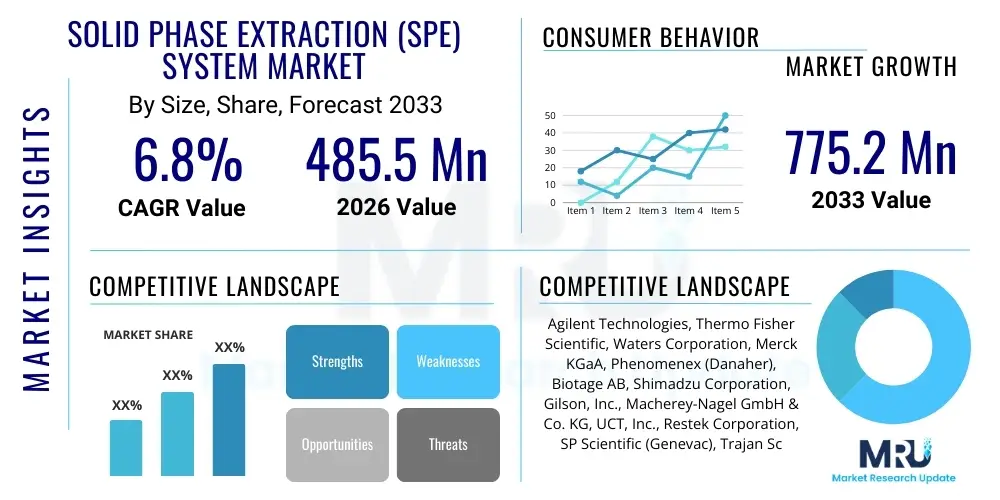

The Solid Phase Extraction (SPE) System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 485.5 million in 2026 and is projected to reach USD 775.2 million by the end of the forecast period in 2033. This consistent growth trajectory is primarily driven by the increasing need for highly reliable and efficient sample preparation techniques across diverse analytical laboratories globally, particularly in sectors mandated by stringent regulatory compliance such as pharmaceuticals and environmental testing. The ongoing technological advancements focusing on automation and miniaturization further enhance the market potential, allowing for higher throughput and reduced solvent consumption, which are critical factors influencing adoption in high-volume testing environments.

Solid Phase Extraction (SPE) System Market introduction

The Solid Phase Extraction (SPE) System Market encompasses instruments, consumables, and accessories utilized for the selective isolation and concentration of analytes from complex matrices prior to sophisticated analytical techniques like High-Performance Liquid Chromatography (HPLC) or Gas Chromatography (GC). SPE is a fundamental sample preparation method that offers significant advantages over traditional liquid-liquid extraction (LLE), including cleaner extracts, higher analyte recovery, and reduced processing time. The systems range from simple manual vacuum manifolds to fully automated robotic workstations capable of handling hundreds of samples unattended, catering to various throughput requirements in modern laboratories.

SPE systems find major applications across highly regulated industries, including pharmaceutical drug development and quality control, clinical toxicology and forensic analysis, environmental monitoring of pollutants in water and soil, and food safety testing for contaminants like pesticides and mycotoxins. The core function of an SPE system is to improve the sensitivity and accuracy of subsequent analysis by effectively removing matrix interferences that could otherwise compromise chromatographic column performance or detector response. The increased complexity of sample matrices and the trend toward detecting trace levels of contaminants necessitate the use of advanced and reliable SPE technology.

Key benefits driving the adoption of SPE systems include enhanced reproducibility, significant reduction in manual labor through automation, lower consumption of expensive and hazardous organic solvents, and overall cost-effectiveness when scaled for high-throughput analysis. Market growth is further propelled by driving factors such as the global rise in drug screening activities, the implementation of stricter environmental protection regulations requiring constant monitoring, and continuous innovation in sorbent chemistries, offering improved selectivity for difficult separation challenges. The pharmaceutical sector's push for standardized methods in bioanalysis remains a central growth catalyst.

Solid Phase Extraction (SPE) System Market Executive Summary

The Solid Phase Extraction (SPE) System Market is characterized by a strong shift toward automation and miniaturization, driven by the demand for higher throughput and reduced laboratory processing costs. Business trends indicate significant capital investment in fully automated SPE workstations that integrate seamlessly with analytical instruments (e.g., LC-MS/MS), minimizing human error and enhancing data quality. Manufacturers are also focusing on developing specialized sorbent chemistries, such as polymeric and mixed-mode phases, to address increasingly complex sample preparation needs in proteomics and metabolomics research. Strategic partnerships between technology providers and major contract research organizations (CROs) are shaping the competitive landscape and accelerating product commercialization.

Regional trends highlight North America and Europe as dominant revenue contributors, benefiting from established pharmaceutical R&D infrastructure, stringent regulatory frameworks, and high adoption rates of advanced laboratory technologies. However, the Asia Pacific (APAC) region is poised for the fastest growth, propelled by rapidly expanding healthcare expenditure, increasing investment in food safety infrastructure, and the establishment of numerous domestic and international clinical testing laboratories, particularly in countries like China and India. Government initiatives supporting environmental quality testing also contribute substantially to the growing demand for SPE systems in APAC.

In terms of segment trends, the automated SPE systems segment is experiencing explosive growth due to productivity gains and improved analytical precision compared to manual methods. Consumables, particularly pre-packed cartridges and plates, represent the largest market share owing to their recurring necessity and the continuous expansion of testing volumes across various end-user industries. Application-wise, the pharmaceutical and biotechnology segment remains the core driver, utilizing SPE extensively for drug metabolism studies, pharmacokinetics, and clinical trials, ensuring this segment maintains its dominance throughout the forecast period.

AI Impact Analysis on Solid Phase Extraction (SPE) System Market

Users frequently inquire about how Artificial Intelligence (AI) can streamline the historically tedious and highly variable process of SPE method development and optimization. Common questions revolve around the use of machine learning (ML) algorithms to predict optimal sorbent type and elution conditions based on analyte properties and sample matrix composition, thereby eliminating extensive trial-and-error experimentation. Furthermore, there is significant user interest regarding the application of AI in pattern recognition to monitor automated SPE system performance, predict potential hardware failures, and ensure the quality and consistency of high-throughput sample preparation, reducing the necessity for constant manual oversight in regulated environments. Expectations center on AI providing faster, more reliable, and standardized SPE protocols.

The integration of AI is transforming the SPE workflow from a labor-intensive empirical process to a data-driven, predictive activity. AI algorithms can analyze vast repositories of experimental SPE data, including chromatographic properties, molecular structures, and matrix effects, to rapidly propose and validate extraction methods. This capability significantly shortens the time required for establishing robust analytical methods, particularly critical in fast-paced drug discovery and clinical toxicology where rapid method deployment is essential. The ability of AI to identify and correct deviations in automated protocols further guarantees high sample integrity and reduces costly retesting.

AI also plays a pivotal role in optimizing resource utilization within large-scale analytical labs. By predicting the exact amount of solvent required or the optimal flow rates, AI tools help laboratories adhere to green chemistry principles by minimizing waste. Moreover, the connectivity provided by the Industrial Internet of Things (IIoT) coupled with AI allows for centralized management and diagnostic monitoring of multiple SPE units across different locations, ensuring global operational consistency and compliance with standardized quality assurance procedures, fundamentally enhancing the reliability and efficiency of sample preparation across the entire analytical landscape.

- AI-driven automated method development accelerates protocol optimization.

- Machine Learning predicts optimal sorbent chemistries and elution parameters.

- Predictive maintenance utilizes AI to monitor SPE system component health.

- Data interpretation algorithms enhance quality control by verifying extraction efficiency.

- Integration with LIMS and analytical instruments ensures seamless, traceable workflows.

- AI standardizes high-throughput clinical and forensic screening protocols.

DRO & Impact Forces Of Solid Phase Extraction (SPE) System Market

The Solid Phase Extraction (SPE) System Market is propelled by strong regulatory drivers and technological advancements, countered by significant initial investment constraints, while presenting considerable scope for innovation through advanced materials and integrated laboratory solutions. Drivers center on stringent global guidelines from bodies like the FDA and EPA demanding extremely low detection limits for contaminants, necessitating highly efficient sample cleanup provided by SPE. Restraints include the high capital expenditure required for acquiring fully automated SPE workstations, the need for skilled personnel to develop and manage complex SPE methods, and the continuous need to optimize sorbent materials for novel and highly polar analytes. Opportunities lie primarily in the development of miniaturized and portable SPE devices for field analysis and the integration of microfluidics, alongside the market penetration in emerging economies focusing on improving their analytical infrastructure.

Impact forces acting upon the market are complex, intertwining regulatory pressure, technological shifts, and economic viability. Regulatory mandates act as a constant driving force, compelling laboratories in environmental, food safety, and pharmaceutical sectors to adopt advanced SPE systems to ensure compliance. The technological impact force is evident in the rapid evolution of automation and sorbent science; the continuous introduction of specialty phases (e.g., molecularly imprinted polymers or MIPs) creates new market niches but also demands specialized knowledge, acting as a moderate restraint. Economic forces, characterized by price sensitivity in developing markets and the high cost of sophisticated consumables, temper market expansion despite the clear productivity benefits offered by automated systems.

Furthermore, substitution risk remains a measurable impact force, although SPE generally outperforms older techniques like LLE. Newer techniques, such as QuEChERS (Quick, Easy, Cheap, Effective, Rugged, and Safe) preparation for food safety, present a competitive alternative in specific application areas, potentially restraining the growth of traditional SPE formats in agriculture-related testing. However, the versatility and precision of SPE, particularly in clinical and pharmaceutical bioanalysis where highly selective cleanup is non-negotiable, solidify its position. The market continues to benefit from the overarching trend toward laboratory efficiency, where the investment in SPE technology is often justified by significant long-term savings in analyst time and solvent expenditure.

Segmentation Analysis

The Solid Phase Extraction (SPE) System Market is comprehensively segmented based on its components, format, sorbent type, and application, reflecting the diverse analytical needs across various industries. Components segmentation distinguishes between instruments (automated and manual systems) and essential consumables (cartridges, plates, disks, and accessories), with consumables dominating revenue generation due to high turnover rates. Format segmentation highlights the ongoing trend toward automated systems driven by high-throughput requirements in pharmaceutical toxicology and clinical testing, while manual systems maintain relevance in smaller academic or research laboratories with limited budgets.

Segmentation by sorbent type is crucial as it determines the selectivity and efficacy of the extraction process, encompassing traditional silica-based phases, polymeric phases offering wider pH stability, and specialized phases like mixed-mode and ion exchange materials tailored for specific analyte classes. Application segmentation confirms the market dominance of the pharmaceutical and biotechnology sector, followed closely by environmental testing, food and beverage analysis, and clinical toxicology, each demanding unique SPE configurations and chemistries to meet their distinct analytical challenges and detection limits. This detailed segmentation allows market players to tailor product development and marketing strategies towards specific high-growth segments.

- By Product Type:

- Instruments (Automated Systems, Manual Systems)

- Consumables and Accessories (SPE Cartridges, SPE Disks, SPE Plates, Manifolds, Vacuum Pumps, Specialized Tips)

- By Sorbent Type:

- Silica-based Sorbents (C18, C8, CN, Si)

- Polymeric Sorbents (Hydrophilic-Lipophilic Balanced HLP)

- Ion-Exchange Sorbents (Anion Exchange, Cation Exchange)

- Mixed-Mode Sorbents

- Others (Immunoadsorbents, Molecularly Imprinted Polymers MIPs)

- By Application:

- Pharmaceutical and Biotechnology

- Clinical and Forensic Toxicology

- Environmental Testing (Water, Soil, Air)

- Food and Beverage Analysis

- Petrochemical and Industrial Analysis

- By End User:

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutes

- Contract Research Organizations (CROs)

- Government Laboratories

- Hospitals and Clinical Laboratories

Value Chain Analysis For Solid Phase Extraction (SPE) System Market

The value chain for the SPE system market begins upstream with the sourcing of essential raw materials, primarily high-purity silica or polymeric monomers required for the manufacture of sorbent materials, along with specialized plastics for cartridge and plate fabrication. Key players in this stage are chemical suppliers providing highly characterized raw materials crucial for ensuring the reproducibility and quality of the final SPE consumables. Efficiency in this upstream segment directly impacts the cost and performance attributes of the finished product, making reliable, high-quality supply chains essential for maintaining competitive advantage and regulatory compliance, particularly regarding extractables and leachables.

The midstream involves the manufacturing and assembly of SPE consumables and instruments. Consumables manufacturing focuses on sorbent packing techniques and plate/cartridge design, requiring specialized cleanroom conditions and strict quality control to ensure uniform flow rates and consistent retention properties. Instrument manufacturing involves complex engineering to develop robust automated liquid handlers and robotic systems capable of precise volume dispensing and vacuum/positive pressure control. Downstream distribution involves moving these specialized products to the end-user laboratories, which include pharmaceutical companies, CROs, and environmental testing labs. This stage relies heavily on trained sales teams and specialized technical support to assist customers with method development and instrument validation.

Distribution channels are categorized into direct sales and indirect sales through authorized distributors and dealers. Direct channels are typically utilized for high-value automated systems or for large strategic accounts like major pharmaceutical companies, allowing manufacturers to maintain direct control over pricing and technical support. Indirect channels, using specialized analytical product distributors, are crucial for penetrating geographically diverse markets, particularly in emerging regions, and for selling high-volume consumables. Both distribution methods emphasize technical expertise, as SPE systems require application-specific knowledge and ongoing customer education to ensure maximum utilization and optimal analytical results in complex laboratory settings.

Solid Phase Extraction (SPE) System Market Potential Customers

Potential customers for Solid Phase Extraction (SPE) systems are primarily institutions and organizations engaged in high-precision analytical chemistry requiring trace-level detection and robust sample cleanup prior to instrumental analysis. The largest segment of end-users comprises pharmaceutical and biotechnology companies, which utilize SPE extensively throughout the drug lifecycle, from discovery and preclinical metabolism studies to clinical pharmacokinetics (PK) trials and routine quality control of final drug products. These entities rely on automated SPE for high-throughput bioanalysis of drugs and metabolites in biological matrices such as plasma and urine, necessitating systems that offer both speed and high analytical fidelity.

Another major customer base includes government-affiliated and private environmental testing laboratories responsible for monitoring water, soil, and air quality. These laboratories must adhere to strict regulatory mandates (e.g., EPA methods) for detecting trace levels of persistent organic pollutants (POPs), pesticides, and emerging contaminants, where SPE is often the mandated sample preparation technique due to its ability to concentrate analytes from large volumes. Furthermore, clinical toxicology and forensic laboratories represent significant buyers, using SPE to prepare samples for drug screening, alcohol confirmation, and analysis of highly complex biological fluids for medicolegal purposes, where accuracy and chain of custody are paramount.

Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs) form a rapidly growing customer segment, as pharmaceutical and biotech companies increasingly outsource their analytical needs. CROs require flexible, high-capacity automated SPE platforms to manage diverse projects ranging from early-stage screening to large-scale clinical sample analysis. Academic research institutions, although typically utilizing smaller, manual systems, also represent a constant demand stream, especially for novel sorbent development and exploratory research in fields like metabolomics and proteomics, driving the demand for specialized, low-volume SPE consumables and technology.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 485.5 Million |

| Market Forecast in 2033 | USD 775.2 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Agilent Technologies, Thermo Fisher Scientific, Waters Corporation, Merck KGaA, Phenomenex (Danaher), Biotage AB, Shimadzu Corporation, Gilson, Inc., Macherey-Nagel GmbH & Co. KG, UCT, Inc., Restek Corporation, SP Scientific (Genevac), Trajan Scientific and Medical, Hudson Robotics, LCTech GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Solid Phase Extraction (SPE) System Market Key Technology Landscape

The technology landscape of the SPE system market is characterized by rapid advancements focused on increasing efficiency, reproducibility, and automation levels while improving sorbent selectivity. A primary technology trend is the widespread adoption of robotics and sophisticated liquid handling systems that form the backbone of automated SPE platforms. These systems employ multi-channel pipetting heads, precise syringe pumps, and integrated vacuum or positive pressure control mechanisms to process samples unattended in 96-well or 384-well plate formats, drastically improving throughput and minimizing the variability associated with manual sample manipulation. Integration with subsequent analysis instruments, such as LC-MS/MS, through robotics ensures a continuous workflow from sample preparation to final data acquisition.

Sorbent chemistry innovation represents the second crucial technological pillar. While traditional silica-based phases remain relevant, the market is rapidly embracing polymeric sorbents (e.g., HLB) which offer superior chemical stability across a wider pH range, enhancing robustness for difficult matrices. Moreover, mixed-mode SPE (MM-SPE) technology, combining ion-exchange and reversed-phase mechanisms, has become standard practice, particularly in bioanalysis, offering highly selective cleanup for complex biological samples like urine and plasma. The continuous development of specialized materials, such as Molecularly Imprinted Polymers (MIPs), tailored to recognize and bind specific target molecules, promises ultra-high selectivity, opening new avenues for targeted analysis of biomarkers and therapeutic agents.

Miniaturization is another defining technological trend, manifesting in micro-SPE formats and tips designed for very small sample volumes (micro-liters), critical for pediatric clinical testing or highly precious research samples. Furthermore, Positive Pressure Extraction (PPE) systems are increasingly replacing traditional vacuum manifolds, providing more uniform flow rates across all wells of an extraction plate, ensuring more consistent sample processing and extraction recovery. The shift towards disposable, high-performance cartridges and plates that are pre-conditioned and ready-to-use supports the laboratory goal of maximizing uptime and minimizing the time spent on method preparation and validation, thereby optimizing the entire analytical workflow.

Regional Highlights

- North America: North America maintains its position as the dominant market for SPE systems, driven by robust funding for pharmaceutical research and development, particularly in the United States, which hosts numerous large biotech and pharmaceutical corporations. The stringent regulatory environment mandated by the FDA requires highly validated and precise analytical methods, propelling the adoption of advanced automated SPE technology. Furthermore, significant investment in environmental monitoring infrastructure, coupled with the high volume of clinical diagnostics and toxicology testing, ensures a consistent and high demand for both instruments and high-quality consumables.

- Europe: The European market is a mature and significant contributor, characterized by stringent environmental regulations (e.g., REACH) and established pharmaceutical manufacturing hubs in countries like Germany, Switzerland, and the UK. Emphasis on green chemistry and reducing solvent use accelerates the adoption of efficient, automated SPE techniques. Eastern Europe presents growing opportunities as laboratory infrastructure modernization progresses, aligning local analytical standards with Western European guidelines, resulting in increasing investment in high-end laboratory equipment.

- Asia Pacific (APAC): APAC is projected to exhibit the highest CAGR during the forecast period. This rapid growth is attributed to burgeoning healthcare infrastructure development, increasing government focus on food safety standards, and expanding capacity of domestic pharmaceutical and contract research organizations in China, India, and South Korea. The region is witnessing a transition from manual, traditional sample preparation methods to automated SPE systems to meet rising testing volumes and international quality standards, making it the most dynamic market region for future growth.

- Latin America (LATAM): The LATAM market, while smaller, is growing steadily, primarily driven by rising investment in clinical diagnostic laboratories and improvements in regional pharmaceutical manufacturing capabilities, particularly in Brazil and Mexico. Economic volatility often restricts capital expenditure on fully automated systems, favoring cost-effective manual and semi-automated SPE solutions and locally manufactured consumables, though demand for imported high-end technology is increasing in highly regulated sectors.

- Middle East and Africa (MEA): The MEA market growth is moderate but promising, primarily focused around government-led initiatives in the Gulf Cooperation Council (GCC) states to diversify economies and enhance healthcare and food safety standards. Increasing investment in establishing local environmental monitoring laboratories, particularly concerning water resource management, necessitates the procurement of reliable SPE technology, though logistical challenges and varied regulatory landscapes present market entry complexities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Solid Phase Extraction (SPE) System Market.- Agilent Technologies

- Thermo Fisher Scientific

- Waters Corporation

- Merck KGaA

- Phenomenex (Danaher Corporation)

- Biotage AB

- Shimadzu Corporation

- Gilson, Inc.

- Macherey-Nagel GmbH & Co. KG

- UCT, Inc.

- Restek Corporation

- SP Scientific (Genevac)

- Trajan Scientific and Medical

- Hudson Robotics

- LCTech GmbH

- Jordi Labs

- SepaChrom SAS

- Orochem Technologies Inc.

- Hamilton Company

- Tecan Group

Frequently Asked Questions

Analyze common user questions about the Solid Phase Extraction (SPE) System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Solid Phase Extraction (SPE) and why is it preferred over Liquid-Liquid Extraction (LLE)?

Solid Phase Extraction (SPE) is a selective sample preparation technique used to isolate and concentrate analytes from a complex matrix using a solid sorbent phase. It is preferred over traditional Liquid-Liquid Extraction (LLE) because SPE provides significantly cleaner extracts, higher analyte recovery, reduced consumption of hazardous organic solvents, and is much easier to automate, leading to improved throughput and analytical precision in high-volume laboratories.

How does automation benefit the Solid Phase Extraction (SPE) workflow in regulated industries?

Automation in SPE systems dramatically reduces human error and method variability, which is critical for compliance in regulated industries like pharmaceuticals and clinical toxicology. Automated systems ensure highly reproducible results, minimize manual processing time, and facilitate 24/7 operation for high-throughput screening, leading to lower operating costs and faster turnaround times for critical sample analysis and validation protocols.

Which sorbent types are driving innovation in the SPE market?

Innovation is primarily driven by advanced sorbent chemistries, particularly polymeric sorbents (like HLP/HLB), which offer greater pH stability and loading capacity than traditional silica-based materials. Mixed-mode sorbents (combining reversed-phase and ion exchange) are crucial for high selectivity in bioanalysis, while specialized materials such as Molecularly Imprinted Polymers (MIPs) are gaining traction for ultra-selective extraction of specific target molecules or biomarkers.

What is the primary constraint limiting the adoption of automated SPE systems in smaller laboratories?

The primary constraint limiting the adoption of fully automated SPE systems in smaller or academic laboratories is the high initial capital expenditure (CapEx) required for the instrumentation, combined with the ongoing operational costs of specialized consumables and the need for highly trained personnel to develop and validate complex automated extraction methods, often making simpler manual systems a more viable option.

How is the Solid Phase Extraction market responding to trends in sample miniaturization and trace analysis?

The SPE market is actively responding through the development and commercialization of miniaturized formats, including micro-SPE cartridges and 96/384-well plate formats designed for low-volume samples, often down to microliter levels. These systems are essential for trace analysis and precious sample conservation (e.g., in pediatrics or forensic science), allowing high concentration factors while minimizing solvent use, supporting both higher sensitivity and environmentally friendly analytical practices.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager