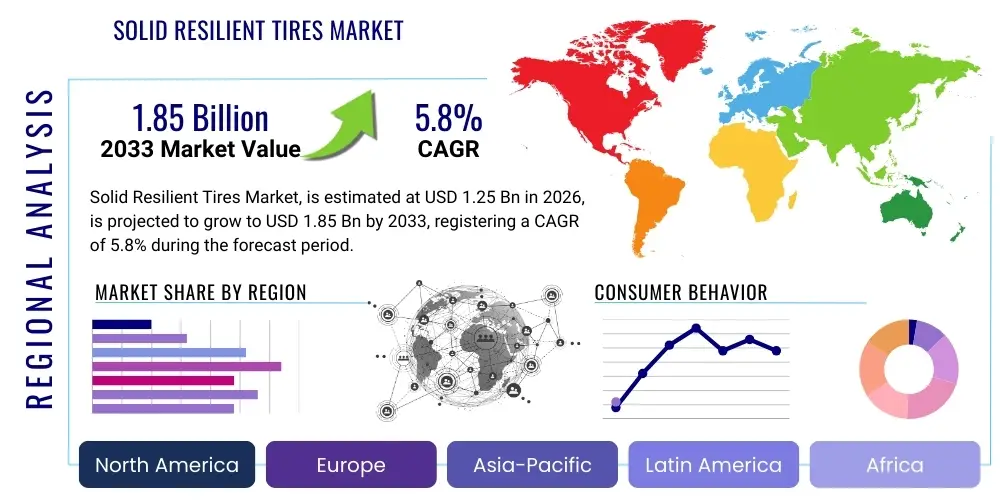

Solid Resilient Tires Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436683 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Solid Resilient Tires Market Size

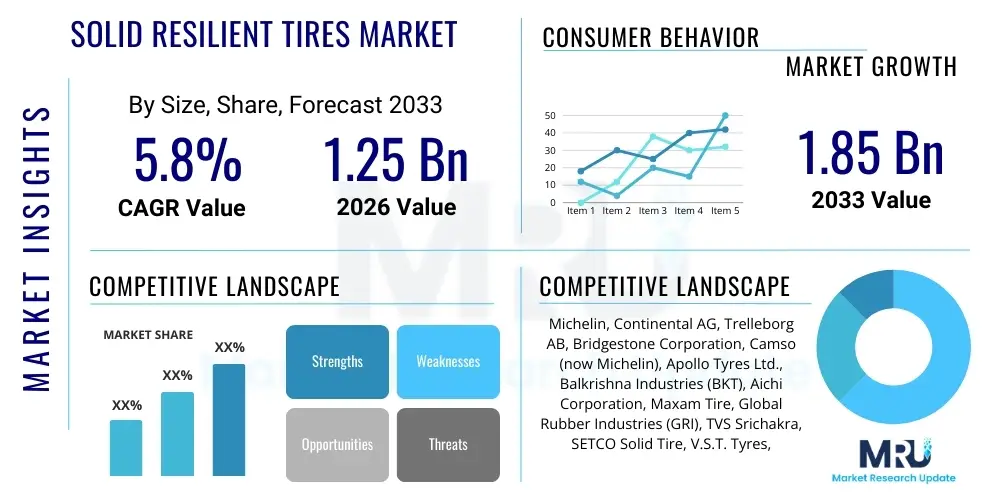

The Solid Resilient Tires Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $1.85 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily fueled by the accelerating expansion of the global logistics and material handling sectors, which rely heavily on durable, maintenance-free tire solutions for operational efficiency. Solid resilient tires offer superior stability and load-bearing capacity compared to pneumatic alternatives, making them indispensable in rigorous industrial environments such as ports, warehouses, and manufacturing plants.

Solid Resilient Tires Market introduction

The Solid Resilient Tires Market encompasses the production, distribution, and consumption of heavy-duty, puncture-proof tires specifically designed for industrial equipment operating in severe conditions. Unlike standard pneumatic tires, solid resilient tires are constructed entirely of rubber compounds and polymers, often utilizing three layers—tread, cushion, and base—to provide load stability, comfort, and enhanced operational lifespan without the risk of deflation or unexpected downtime. These characteristics are essential for high-throughput industries where operational continuity is paramount.

Major applications of these tires include forklifts, skid steers, aerial work platforms (AWPs), ground support equipment (GSE) at airports, and heavy-duty vehicles used in mining and construction sites. The primary benefit derived from adopting solid resilient tires is the reduction in maintenance costs and increased safety, particularly in environments prone to debris, sharp objects, or chemical exposure. Furthermore, modern solid resilient tires incorporate advanced rubber formulations and specialized tread patterns designed to optimize energy efficiency and minimize heat buildup, addressing historical concerns regarding ride quality and traction.

Driving factors for this market include rapid global industrialization, especially across Asia Pacific, increased automation in warehousing and logistics (e-commerce boom), and stringent regulatory requirements emphasizing safety and reliability in material handling equipment. The shift towards electrification in industrial vehicles further boosts demand, as solid tires provide the requisite stability for heavier battery packs and consistent performance needed for electric motor efficiency.

Solid Resilient Tires Market Executive Summary

The Solid Resilient Tires Market is characterized by robust growth driven by infrastructural development and the globalization of supply chains. Current business trends indicate a strong focus on sustainable manufacturing processes, including the use of recycled materials and specialized non-marking compounds to cater to indoor industrial applications, particularly in the food and beverage and pharmaceutical sectors. Technological innovation centers around enhanced compounding techniques to improve heat dissipation and reduce rolling resistance, which directly impacts the energy efficiency of battery-powered vehicles. Leading manufacturers are investing heavily in digitally integrated tire pressure monitoring systems (TPMS) and smart sensing technology, although traditional solid tires inherently simplify maintenance.

Regional trends highlight the Asia Pacific (APAC) region as the dominant and fastest-growing market, largely due to massive investments in manufacturing, infrastructure, and port expansion in China, India, and Southeast Asian nations. North America and Europe, while mature, exhibit high demand for premium, specialized tires, focusing on non-marking variants and tires optimized for cold storage or highly abrasive environments. Conversely, the market in Latin America and the Middle East and Africa (MEA) is poised for substantial growth as logistics infrastructure modernization accelerates, shifting away from conventional tire solutions to more durable solid alternatives to withstand challenging terrain and climate conditions.

Segmentation trends show that the "Forklift" application segment maintains market dominance due to the ubiquitous use of these vehicles in material handling operations worldwide. However, the "Aerial Work Platform (AWP)" segment is projected to experience the highest growth rate, supported by increasing height safety regulations and construction activity. By type, the standard solid resilient tires segment holds the largest market share, but non-marking solid tires are rapidly gaining traction, reflecting the rising necessity for clean operational environments across various sophisticated manufacturing and storage facilities.

AI Impact Analysis on Solid Resilient Tires Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Solid Resilient Tires Market often center on how AI can optimize manufacturing efficiency, enhance tire performance prediction, and integrate smart tires into autonomous industrial fleets. Users are keenly interested in predictive maintenance facilitated by machine learning algorithms that analyze operational data (load, temperature, speed) collected through embedded sensors to estimate remaining tire life and prevent premature failure. Key concerns revolve around the integration cost of sensors, data security, and the ability of AI models to accurately predict failure modes unique to solid rubber compounds, such as chunking or thermal degradation. Expectations are high regarding AI’s role in optimizing rubber compound formulations for specific applications by simulating performance under various environmental stressors, thereby accelerating R&D cycles and customizing tire properties for niche market requirements, ultimately positioning solid resilient tires as a critical component of intelligent industrial ecosystems.

- AI optimizes the rubber compounding process by simulating molecular structures and predicting viscoelastic properties, reducing material testing time and cost.

- Predictive maintenance algorithms use real-time data from embedded sensors (temperature, stress) to forecast the end-of-life cycle for solid tires, minimizing unscheduled downtime.

- AI-driven routing and fleet management systems ensure optimal utilization of industrial vehicles, considering tire wear parameters to maximize efficiency and safety.

- Quality control in manufacturing is enhanced through AI-powered visual inspection systems, identifying microscopic defects in the curing and molding process.

- Supply chain optimization benefits from AI forecasting demand for specific tire types (e.g., non-marking vs. standard) across various regions and industrial sectors.

DRO & Impact Forces Of Solid Resilient Tires Market

The Solid Resilient Tires Market is primarily driven by the escalating demand for operational reliability and safety in demanding industrial environments, coupled with the rapid expansion of global logistics and warehousing infrastructure fueled by e-commerce penetration. The inherently flat-proof nature of solid tires eliminates the costly and time-consuming process of tire repairs and replacements associated with pneumatic tires, providing a substantial return on investment (ROI) for equipment operators prioritizing uptime. Furthermore, environmental and safety regulations are increasingly favoring solid tires in areas where tire blowouts could lead to catastrophic industrial accidents or hazardous spills. However, the market faces constraints related to the initial high purchase price compared to pneumatic alternatives and historical limitations regarding heat generation and reduced cushioning, which can impact equipment life and operator comfort, though modern designs are significantly mitigating these issues.

Opportunities for market expansion are significant, particularly in emerging applications such as automated guided vehicles (AGVs) and autonomous mobile robots (AMRs), where the precision, stability, and longevity offered by specialized solid tires are crucial for robotic systems. The push towards sustainable industrial practices also opens avenues for innovation in recycled rubber compounds and non-toxic, eco-friendly solid tire variants. Additionally, customization is a growing trend, allowing manufacturers to tailor load ratings, tread depths, and compounding characteristics to highly specific end-user requirements, such as extremely cold temperatures in cold storage facilities or high static discharge resistance in explosive environments.

The impact forces shaping this market include the pervasive influence of globalization on supply chain robustness, driving the necessity for reliable material handling equipment. Technological evolution, particularly in advanced material science and automated manufacturing, acts as a pivotal force, enabling lighter, more efficient, and higher-performing solid tires. Regulatory pressure related to safety standards (e.g., OSHA in the US, similar agencies globally) mandates the use of highly stable tires in heavy lifting applications. Economic volatility, characterized by fluctuating raw material prices (synthetic and natural rubber), continues to exert pressure on profit margins, necessitating operational efficiencies and strong procurement strategies from key market players.

Segmentation Analysis

The Solid Resilient Tires Market is intricately segmented based on construction type, application, and end-use industry, reflecting the diverse and demanding operational environments these products serve. Understanding these segments is vital for manufacturers to tailor their product offerings, sales strategies, and distribution networks effectively. The market structure highlights the specialization required to meet varying standards related to load-bearing capacity, operational speed, surface type, and regulatory compliance (e.g., non-marking requirements). This comprehensive segmentation allows stakeholders to accurately gauge market size and potential within specific industrial niches, such as heavy machinery operation in mining versus light material handling in controlled warehouse settings, emphasizing the market's differentiation based on performance characteristics rather than sheer volume.

- By Type:

- Standard Solid Resilient Tires (Conventional black rubber, high durability)

- Non-Marking Solid Resilient Tires (Used in clean environments like food processing, pharmaceuticals, and sensitive flooring)

- Cushion Solid Resilient Tires (Designed for press-on applications on smooth, indoor surfaces)

- By Application:

- Forklifts (Counterbalance, Reach Trucks, Pallet Stackers)

- Aerial Work Platforms (AWPs/Scissor Lifts, Boom Lifts)

- Port Handling Equipment (Straddle Carriers, Terminal Tractors)

- Ground Support Equipment (GSE) (Tugs, Baggage Loaders at airports)

- Construction and Mining Equipment (Skid Steers, Loaders)

- By End-Use Industry:

- Logistics and Warehousing (E-commerce fulfillment centers, distribution hubs)

- Manufacturing (Automotive, Heavy Machinery)

- Construction

- Aviation and Ports

- Waste Management and Recycling

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Rest of Europe)

- Asia Pacific (China, India, Japan, South Korea, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East and Africa (UAE, Saudi Arabia, South Africa, Rest of MEA)

Value Chain Analysis For Solid Resilient Tires Market

The value chain for the Solid Resilient Tires Market begins with the upstream procurement of raw materials, predominantly natural rubber, synthetic rubber (such as SBR and Butyl), carbon black, reinforcing agents (like steel wire or nylon), and various specialized chemicals (plasticizers, vulcanizing agents). The competitiveness in this segment is driven by global commodity price fluctuations and the ability of manufacturers to secure stable, high-quality supplies, often necessitating long-term contracts with key chemical and rubber producers. Innovation at this stage focuses on developing advanced, high-performance compounds that enhance load stability, thermal resistance, and rolling efficiency, directly impacting the final product's quality and longevity.

The midstream stage involves the highly specialized manufacturing process, including mixing, compounding, molding, and curing, often utilizing sophisticated hydraulic presses and rigorous quality control measures, sometimes integrated with AI and sensor technologies. Solid tire manufacturing requires distinct machinery and expertise compared to pneumatic tires due to the need to ensure uniformity and prevent air pockets in dense rubber masses. Key players differentiate themselves here through operational excellence, proprietary compounding recipes, and economies of scale. Direct distribution channels, where manufacturers sell directly to Original Equipment Manufacturers (OEMs) like forklift and construction equipment makers, constitute a significant portion of the sales structure, ensuring tires are matched perfectly to the equipment specifications.

The downstream segment primarily involves sales to the aftermarket, facilitated through a network of specialized tire distributors, material handling equipment dealers, and authorized service centers. This channel is crucial for replacement sales, driven by end-user operational wear and tear. Indirect distribution through third-party logistics (3PL) providers and large industrial supply retailers also plays a role. The end-users—logistics companies, manufacturing plants, and port operators—are the ultimate consumers, requiring reliable installation, maintenance advice, and disposal services. The focus downstream is on providing exceptional service life, quick availability of replacement inventory, and expert technical support to minimize customer downtime and maximize equipment utilization across diverse operational footprints.

Solid Resilient Tires Market Potential Customers

The primary consumers and end-users of solid resilient tires are enterprises heavily involved in material handling, internal logistics, construction, and high-volume manufacturing where equipment reliability is non-negotiable and the operational environment poses a high risk of puncture. These customers prioritize total cost of ownership (TCO) over initial purchase price, valuing the significant reduction in maintenance expenses and the complete elimination of flat tires. Key decision-makers in these organizations, such as fleet managers, procurement officers, and safety directors, are actively seeking solutions that enhance operational continuity and comply with stringent industrial safety standards.

The largest volume buyers are manufacturers of industrial vehicles (OEMs), particularly those specializing in forklifts and aerial work platforms, who integrate these tires into their base models to offer reliable performance guarantees. Furthermore, multinational logistics giants, operating expansive, mechanized warehouses and distribution centers, represent a substantial aftermarket segment. These customers require non-marking solid tires for high-performance operations on polished concrete floors and demand superior wear resistance to handle 24/7 operational cycles associated with the e-commerce supply chain. The growing reliance on specialized equipment in niche areas such as cold storage warehousing further necessitates solid tires specifically engineered for extreme temperature resilience and anti-slip properties, targeting food and pharmaceutical distributors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion |

| Market Forecast in 2033 | $1.85 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Michelin, Continental AG, Trelleborg AB, Bridgestone Corporation, Camso (now Michelin), Apollo Tyres Ltd., Balkrishna Industries (BKT), Aichi Corporation, Maxam Tire, Global Rubber Industries (GRI), TVS Srichakra, SETCO Solid Tire, V.S.T. Tyres, Solideal, Starco, Advance Tyre. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Solid Resilient Tires Market Key Technology Landscape

The technological landscape of the Solid Resilient Tires Market is rapidly evolving, moving beyond simple compounding to incorporate advanced material science and smart integration. A core technological focus remains the optimization of the three-stage construction (base, cushion, tread) to simultaneously maximize load capacity and minimize heat generation, which is a critical failure point for solid tires operating under high stress. Manufacturers are utilizing sophisticated computational fluid dynamics (CFD) and finite element analysis (FEA) to simulate tire performance and predict stress distribution, leading to the development of specialized venting systems and proprietary rubber polymer blends that enhance thermal resilience and significantly extend operational life. Furthermore, press-on band technology, which bonds solid rubber to a steel band, continues to be refined, ensuring secure fitting and high torque transfer capacity, essential for modern high-performance industrial equipment.

Material innovation is also central to technological advancements, particularly the creation of specialized non-marking compounds using high-silica fillers and white chalk instead of carbon black. These technologies maintain high abrasion resistance and durability while ensuring clean operation in controlled environments like pharmaceutical production or food processing. A burgeoning area of technology is the integration of embedded smart sensors (Internet of Things or IoT devices) within the tire structure, transforming traditional rubber products into data-generating components. These sensors monitor vital operational parameters such as internal temperature, strain, pressure distribution (even in solid structures), and rotational speed, feeding data back to fleet management systems.

The deployment of these smart tire technologies is crucial for facilitating predictive maintenance, a key driver for customer satisfaction and operational efficiency, especially within large, automated warehouses utilizing AGVs and AMRs. These systems leverage wireless communication protocols to transmit performance data, allowing fleet managers to preemptively address potential tire failures, optimize replacement schedules, and confirm that the tires are operating within safe load limits, thereby directly enhancing the value proposition of solid resilient tires in the context of Industry 4.0 applications. The ability to provide real-time performance analytics is increasingly becoming a competitive necessity, pushing the market towards more integrated and technologically advanced product offerings.

Regional Highlights

The global Solid Resilient Tires Market exhibits distinct regional dynamics influenced by varying levels of industrialization, infrastructure investment, and regulatory frameworks. Market dominance and the highest growth potential are concentrated within Asia Pacific (APAC), specifically driven by China and India's sustained growth in manufacturing output, port capacity expansion, and the explosion of regional e-commerce logistics demanding dense networks of forklifts and other material handling equipment. APAC also serves as a major manufacturing hub for industrial machinery, driving high OEM demand for robust tire solutions. This region benefits from lower manufacturing costs and rapidly improving technological adoption, making it the epicenter of volume growth for both standard and specialized solid tire variants.

North America and Europe represent mature, high-value markets characterized by demand for premium, highly engineered products focusing heavily on specialized applications. In North America, stringent workplace safety regulations (OSHA) necessitate the use of stable and reliable tires, particularly in lumber, recycling, and heavy manufacturing sectors. The European market, particularly Germany and the UK, emphasizes sustainability and advanced technology integration, leading to high adoption rates of non-marking, energy-efficient solid tires that minimize rolling resistance and contribute positively to battery life in electric forklifts. These regions are also early adopters of high-end smart tire technologies integrated with fleet telematics, focusing on data-driven operational optimization rather than mere cost efficiency.

The Latin America and Middle East & Africa (MEA) regions are high-potential emerging markets. Latin America, particularly Brazil and Mexico, is witnessing significant infrastructural investment in ports and logistics to support trade flows, creating a strong demand for durable tires capable of handling often challenging road and indoor surfaces. In MEA, major investments in diversification away from oil, especially in Saudi Arabia and the UAE, are spurring growth in manufacturing, tourism, and logistics infrastructure, driving the demand for reliable material handling equipment. While price sensitivity remains higher in these regions, the need for maintenance-free operation in remote or challenging climates makes solid resilient tires a compelling choice, resulting in steady, albeit smaller, market penetration compared to APAC or North America.

- Asia Pacific (APAC): Dominates the market due to massive investments in warehousing, port modernization, and industrial manufacturing capacity, particularly in China, India, and Southeast Asia. Focus on volume production and rapid technological absorption.

- North America: High-value market focused on premium, specialized solid tires for construction, mining, and advanced logistics; strong demand for non-marking tires and smart tire integration driven by strict safety and efficiency standards.

- Europe: Characterized by high technological maturity, emphasizing sustainability, reduced carbon footprint, and energy efficiency; strong adoption of non-marking tires in sectors like food and pharmaceutical manufacturing.

- Latin America (LATAM): Emerging market driven by modernization of port facilities and growing demand in mining and agriculture sectors; greater price sensitivity, but rising need for durable, low-maintenance solutions.

- Middle East and Africa (MEA): Growth fueled by large-scale infrastructure projects, airport expansions, and logistics hub development (e.g., UAE, Saudi Arabia); demand for highly heat-resistant compounds suitable for arid climates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Solid Resilient Tires Market.- Michelin Group

- Continental AG

- Trelleborg AB

- Bridgestone Corporation

- Camso (acquired by Michelin)

- Apollo Tyres Ltd.

- Balkrishna Industries (BKT)

- Aichi Corporation

- Maxam Tire

- Global Rubber Industries (GRI)

- TVS Srichakra

- SETCO Solid Tire & Rim Assembly, Inc.

- V.S.T. Tyres

- Solideal

- Starco (part of the Kenda Group)

- Advance Tyre (Guizhou Tyre Co., Ltd.)

- Trelleborg Wheel Systems

- Destone Tire Co., Ltd.

- Polymer-Compagnie Schweiz AG

- Mitas (Trelleborg Group)

Frequently Asked Questions

Analyze common user questions about the Solid Resilient Tires market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of solid resilient tires over pneumatic tires in industrial settings?

Solid resilient tires offer absolute puncture-proof operation, eliminating downtime and maintenance costs associated with flats. They provide superior load stability, essential for heavy lifting and high-speed turns, and have a significantly longer operational lifespan compared to air-filled tires, enhancing overall equipment reliability in debris-prone environments.

Which industrial application segment drives the highest demand for solid resilient tires globally?

The Forklift application segment generates the highest demand for solid resilient tires. Forklifts are utilized ubiquitously across logistics, warehousing, manufacturing, and distribution centers worldwide, and the need for zero downtime and maximum stability in these demanding, high-cycle operations ensures strong and consistent adoption.

How is the market addressing the historical concern regarding heat buildup in solid resilient tires?

Manufacturers are addressing heat buildup through advanced polymer compounding technologies, incorporating specialized anti-heating rubber blends, and utilizing proprietary tire designs featuring innovative venting or apertures (hole patterns) that facilitate superior thermal dissipation, allowing for faster operational speeds and longer duty cycles without premature degradation.

What role do non-marking solid resilient tires play in the modern industrial market?

Non-marking solid resilient tires are crucial for industries requiring stringent cleanliness standards, such as food and beverage, pharmaceuticals, and high-tech manufacturing. These tires, typically white or light-colored, prevent black carbon residue from marking sensitive floors, ensuring compliance with hygiene regulations and maintaining facility aesthetics.

How does the expansion of e-commerce logistics influence the Solid Resilient Tires Market?

The rapid expansion of e-commerce necessitates highly efficient, automated warehousing and distribution centers. This drives increased demand for reliable, maintenance-free solid tires for forklifts, AGVs, and other internal material handling equipment operating continuously to meet tight delivery schedules, making operational reliability paramount.

Detailed Analysis of Market Dynamics and Strategic Imperatives

The Solid Resilient Tires Market operates within a framework of evolving industrial automation and escalating global logistical requirements, defining a complex set of dynamics that influence competitive strategies and product development trajectories. The imperative for maximizing throughput and minimizing operational expenditure in sectors like warehousing and port operations strongly favors the inherent durability of solid resilient tires. Companies operating in these fields are continually evaluating the Total Cost of Ownership (TCO) of their equipment fleets, and the substantial reduction in unforeseen downtime provided by solid tires offers a compelling economic argument against the lower initial cost of pneumatic alternatives. This shift in purchasing focus—from upfront cost to long-term operational efficiency—is a fundamental driver reshaping procurement practices across mature industrial economies.

Furthermore, the market is highly sensitive to technological integration, particularly as industrial equipment shifts towards electric power sources. Electric forklifts and AGVs necessitate tires that can efficiently handle the increased weight of battery packs while minimizing rolling resistance to preserve battery life and maximize the operational range. This technical requirement is pushing manufacturers to invest heavily in specialized rubber compounds that strike an optimal balance between low energy consumption, high load-bearing capacity, and necessary cushioning properties. Strategic alliances between tire manufacturers and leading Original Equipment Manufacturers (OEMs) of material handling equipment are becoming increasingly common, ensuring that tire development is aligned with future equipment design specifications, especially concerning autonomous vehicle stability and sensor integration protocols.

Competitive dynamics in this market are characterized by a clear division between global giants offering comprehensive industrial tire portfolios (like Michelin and Continental) and specialized firms focusing on niche high-performance segments or specific regional requirements. Differentiation is achieved not only through superior product quality and compounding expertise but also through the strength of the aftermarket service network. The ability to provide fast delivery, expert fitting services, and proper disposal consultancy adds significant value to the offering. Geo-political stability, trade tariffs affecting rubber commodity prices, and labor costs in major manufacturing regions (especially APAC) also continually influence production costs and strategic pricing decisions across the industry, requiring flexible and resilient supply chain management practices.

In-Depth Competitive Landscape Analysis

The competitive landscape of the Solid Resilient Tires Market is mature yet highly dynamic, featuring intense rivalry among a few multinational players who possess significant technological capabilities and global distribution networks. Key companies like Michelin (which integrated Camso’s industrial tire strength) and Continental leverage their extensive R&D resources to introduce proprietary compounding techniques, such as multi-layer construction designed to optimize cushioning and wear characteristics. These market leaders compete primarily on performance specifications, product longevity, safety certifications, and their ability to supply high-volume OEM contracts across multiple continents. A crucial differentiating factor is the continuous development of specialized tires, including those resistant to harsh chemicals, extreme temperatures (hot and cold), and highly abrasive surfaces, thereby catering to niche high-margin sectors.

Mid-tier and regional players, such as GRI and SETCO, often focus on optimizing their manufacturing processes for cost efficiency and speed, providing competitive alternatives, particularly in the robust aftermarket sector. These companies typically compete on price, regional inventory availability, and focused product lines tailored to specific local industrial needs, such as heavy-duty tires for small-to-medium enterprises (SMEs) in emerging markets. The integration of vertical capabilities, where manufacturers control raw material procurement or offer comprehensive fitting and maintenance solutions, provides a strategic edge by ensuring quality consistency and capturing a larger portion of the value chain profit. Mergers and acquisitions (M&A) remain a common strategy, allowing large firms to quickly absorb specialized technology or secure established regional distribution channels, as demonstrated by Michelin’s acquisition of Camso, which significantly solidified its leadership in the off-highway and industrial tire segments.

The future competitive environment will increasingly revolve around digital capabilities. Manufacturers are competing to offer the most sophisticated "Tire as a Service" models, leveraging IoT-enabled smart tires to provide fleet health analytics rather than just selling rubber products. This strategic pivot shifts competition away from traditional hardware metrics towards data-driven value propositions. Companies that can effectively analyze and translate real-time operational data into actionable insights for fleet managers—such as precise optimal replacement timing or load distribution recommendations—will gain a significant competitive advantage. Additionally, compliance with increasing global environmental standards, including sustainable sourcing of materials and efficient end-of-life tire recycling programs, is rapidly becoming a key competitive battleground and a necessity for maintaining brand reputation among large, environmentally conscious corporate buyers.

Solid Resilient Tires Manufacturing Processes and Quality Control

The manufacturing of solid resilient tires is a highly specialized process, demanding precision in material science and engineering to achieve the desired balance of load stability, cushioning, and longevity. The process fundamentally involves three main stages: compounding, molding, and curing. Compounding is the initial and most critical phase, where raw materials—natural and synthetic rubbers, carbon black, processing oils, and vulcanizing agents—are precisely mixed in Banbury mixers to create homogenous rubber batches. The formulation recipe dictates the final tire properties, such as hardness, wear resistance, and heat dissipation capabilities. Significant technological efforts are currently directed at enhancing the efficiency and consistency of this mixing phase, often utilizing automated dosing systems and advanced rheometers to ensure material quality before subsequent stages, directly impacting the tire's performance guarantee.

Following compounding, the rubber is layered onto steel base bands (for press-on solid tires) or pre-formed structures (for standard solid tires), often through highly calibrated extrusion processes to create the three distinct layers: the hard base (for rim adhesion), the soft cushion layer (for shock absorption), and the durable outer tread layer. The molding stage utilizes heavy hydraulic presses to form the tire into its final shape, applying extreme pressure and heat. This process ensures the complete densification of the rubber, eliminating voids and guaranteeing structural integrity. Modern manufacturing relies on sophisticated mold designs and computer-controlled presses to maintain tight tolerances, especially crucial for fitting precision on industrial wheel rims and hubs, where variations can lead to operational instability.

The final and most energy-intensive stage is curing (vulcanization), where the molded tires are subjected to high temperatures and pressure for a defined period. This chemical process transforms the rubber structure into a durable, elastic, and high-strength final product. Quality control at this juncture is paramount; it includes rigorous non-destructive testing (NDT) methods, such as ultrasonic inspection and advanced visual analysis (often AI-assisted), to detect internal defects, homogeneity issues, or curing irregularities that could compromise the tire's safety and lifespan. Continuous process monitoring throughout these stages is essential to ensure that every tire meets the specified load rating and dimensional requirements demanded by stringent international safety standards (e.g., ETRTO or TRA guidelines).

Solid Resilient Tires Market Future Outlook and Growth Opportunities

The future outlook for the Solid Resilient Tires Market remains highly positive, underpinned by secular growth trends in global logistics, automation, and infrastructure development, particularly in emerging economies. The most significant growth opportunity lies in capitalizing on the rapid adoption of electric industrial vehicles (E-forklifts, E-AWPs) and the proliferation of Autonomous Guided Vehicles (AGVs) and Autonomous Mobile Robots (AMRs) within the burgeoning Industry 4.0 landscape. These automated systems require tires that offer unmatched stability, zero maintenance, and high data reliability (via integrated sensors), areas where solid resilient technology inherently excels. Manufacturers who successfully integrate sophisticated sensor technology and data analytics into their product offerings will be best positioned to capture market share in this high-growth automation segment, transitioning their role from mere component suppliers to providers of essential data-driven operational intelligence.

Another major avenue for future expansion is the increased focus on sustainability and specialized applications. Demand is rising for solid resilient tires made from advanced recycled content and bio-based materials, driven by corporate sustainability mandates from major end-users (like multinational retailers and automotive manufacturers). Furthermore, niche applications, such as tires specifically engineered for extreme environments (e.g., arctic cold storage, high-heat smelting operations, or anti-static requirements for explosive zones), offer lucrative, high-margin opportunities requiring specialized R&D investment. As regulatory scrutiny on safety and environmental impact tightens globally, the inherent stability and potential for eco-friendly compounding in solid tires will cement their long-term relevance across diverse industrial sectors.

Strategic growth over the forecast period (2026-2033) will involve expanding production capacity in high-demand regions, particularly Southeast Asia and India, to mitigate long-distance supply chain risks and leverage regional manufacturing cost advantages. Moreover, optimizing the digital customer experience, including easy online access to detailed technical specifications, performance guarantees, and predictive maintenance software platforms, will be essential for retaining and acquiring enterprise clients. The continuous development of lighter, more energy-efficient solid tires that minimize rolling resistance without sacrificing load capacity represents the critical technological pathway for sustained market leadership, ensuring solid resilient tires remain the preferred solution for the next generation of industrial material handling equipment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager