Solid Waste Pyrolysis Plant Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438587 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Solid Waste Pyrolysis Plant Market Size

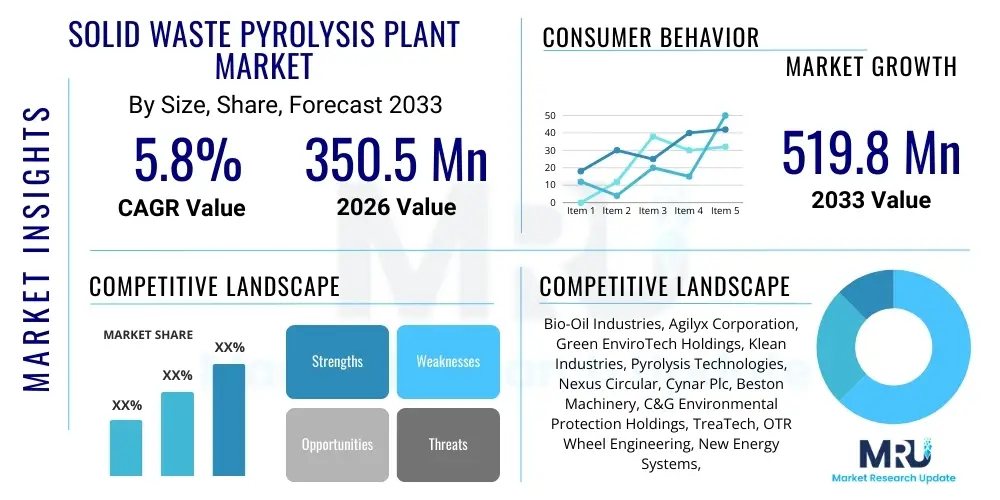

The Solid Waste Pyrolysis Plant Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 350.5 Million in 2026 and is projected to reach USD 519.8 Million by the end of the forecast period in 2033.

Solid Waste Pyrolysis Plant Market introduction

The Solid Waste Pyrolysis Plant Market encompasses the systems and infrastructure dedicated to thermal decomposition of organic solid waste materials, such as plastics, rubber tires, and biomass, in an oxygen-starved environment. This process, known as pyrolysis, effectively converts heterogeneous waste streams into valuable energy products, namely pyrolysis oil (bio-oil), non-condensable gases (syngas), and solid residue (char). The fundamental appeal of pyrolysis lies in its ability to manage waste volumes efficiently while simultaneously generating reusable resources, addressing the dual challenges of overflowing landfills and increasing global energy demands. This technology is viewed as a critical component in the transition towards a circular economy, particularly in regions facing stringent environmental regulations regarding waste disposal and pollution control, making it a high-growth sector within the wider waste-to-energy landscape.

Pyrolysis plants are increasingly deployed across municipal solid waste management sectors, industrial waste processing facilities, and agricultural residue management sites. The primary applications involve the treatment of waste tires, non-recyclable plastic packaging, and specific types of hazardous waste, transforming problematic materials into commodities. The resulting pyrolysis oil serves as a viable alternative fuel for industrial burners, boilers, and sometimes, after upgrading, as a feedstock for petrochemical processes. Syngas generated during the reaction can be utilized internally to power the pyrolysis process or externally for electricity generation. Furthermore, pyrolysis char possesses potential applications in activated carbon production or as a soil enhancer, ensuring near-zero waste output from the overall process.

Key driving factors accelerating market adoption include the escalating global volume of solid waste, particularly plastics, which presents a long-term disposal challenge; coupled with robust governmental support through subsidies and mandates favoring sustainable waste management techniques. The benefits, such as reduced reliance on conventional fossil fuels, minimization of landfill reliance, and lower greenhouse gas emissions compared to traditional incineration, significantly bolster its market positioning. Furthermore, continuous technological advancements focused on improving feedstock flexibility, optimizing reactor design for higher energy yield, and reducing operational expenditure (OPEX) are making pyrolysis a financially attractive option for both public and private entities seeking sustainable infrastructure investments and diversified energy portfolios.

Solid Waste Pyrolysis Plant Market Executive Summary

The Solid Waste Pyrolysis Plant Market is characterized by robust growth driven fundamentally by global imperatives to mitigate environmental pollution and achieve energy independence. Current business trends indicate a strong focus on modular and containerized pyrolysis units, which lower initial capital investment barriers and facilitate deployment in decentralized locations, thereby expanding market accessibility, particularly in emerging economies. There is a noticeable shift towards continuous pyrolysis processes over batch systems, optimizing throughput and ensuring consistent product quality, essential for securing downstream markets like petrochemical refining. Strategic alliances between waste management firms, technology providers, and end-users (e.g., chemical companies purchasing pyrolysis oil) are becoming standard practice to streamline the value chain and derisk large-scale projects, reflecting a mature and increasingly integrated business ecosystem.

Regionally, Asia Pacific (APAC) stands as the dominant market, propelled by rapid urbanization, massive population density, and historically underdeveloped municipal waste management infrastructure, creating an urgent need for scalable waste-to-energy solutions. Governments in countries like China, India, and Indonesia are actively promoting pyrolysis and similar thermal technologies to cope with unprecedented waste generation rates. Conversely, European trends are dictated by stringent regulatory frameworks focusing on the ‘circular economy’ package, emphasizing recycling and resource recovery; here, pyrolysis is highly utilized for treating contaminated or mixed plastic waste streams that are otherwise difficult or uneconomical to recycle mechanically. North America shows steady growth, largely spurred by the demand for alternative fuels and investments into converting waste tires and challenging plastic waste (e.g., polyethylene films) into valuable industrial inputs.

Segment trends highlight the dominance of the Plastic Pyrolysis segment due to the vast volumes of waste plastics generated globally and the high calorific value of the resulting pyrolysis oil, which provides substantial economic returns. Technological segmentation favors medium and fast pyrolysis systems, as these offer better control over product distribution, specifically maximizing the yield of liquid fuels. The End-Product segment sees pyrolysis oil commanding the highest market share, driven by its versatile application in industries requiring heavy fuel oil alternatives. Overall, the market trajectory is heavily influenced by the interplay between regulatory pressures demanding sustainable disposal and the economic viability of recovering high-value energy products from historically problematic waste streams.

AI Impact Analysis on Solid Waste Pyrolysis Plant Market

User queries regarding the impact of Artificial Intelligence (AI) on the Solid Waste Pyrolysis Plant market predominantly revolve around three key themes: predictive maintenance for complex reactor systems, optimization of the pyrolysis process based on variable feedstock, and the integration of AI-driven sorting mechanisms upstream. Users are concerned about how AI can mitigate the high operational costs associated with thermal processes, specifically relating to equipment lifespan and energy consumption. Expectations center on AI enhancing efficiency, ensuring stable product quality despite the heterogeneous nature of solid waste inputs, and automating critical decision-making processes regarding temperature, pressure, and catalyst injection rates to maximize the yield of desired products (e.g., maximizing bio-oil production over syngas). The consensus is that AI offers a pathway to transform these plants from rigid, manually-controlled facilities into smart, adaptive chemical processing units, thereby significantly boosting profitability and operational reliability, which are crucial factors influencing long-term investment viability in this capital-intensive sector.

The deployment of machine learning algorithms is set to revolutionize feedstock management, which is arguably the most complex variable in waste pyrolysis. AI systems can analyze real-time sensor data from incoming waste streams—including moisture content, chemical composition, and calorific value—and dynamically adjust the reactor parameters (such as heating rate and residence time) to maintain peak thermal efficiency. This level of optimization minimizes energy wastage, prevents potential reactor clogging or damage, and guarantees consistent output specifications, which is vital for commercial acceptance of pyrolysis products by refining and chemical industries. Furthermore, AI-powered digital twins of pyrolysis plants enable operators to simulate various operational scenarios and training events, drastically reducing downtime and accelerating the implementation of improvements based on continuous operational data feedback loops.

- AI-Enhanced Predictive Maintenance: Utilizes sensor data (vibration, heat, pressure) to forecast equipment failures in reactors, pumps, and blowers, minimizing unplanned shutdowns and maximizing plant uptime.

- Feedstock Optimization and Sorting: Machine vision and learning algorithms improve upstream waste segregation accuracy, ensuring a more homogeneous feedstock quality entering the reactor, leading to higher conversion rates and cleaner output products.

- Process Parameter Control: Real-time dynamic adjustments of temperature, pressure, and gas flow based on feedstock analysis and output quality monitoring, thereby maximizing the desired yield (e.g., oil or char).

- Energy Consumption Reduction: Optimization algorithms minimize auxiliary energy usage for heating and cooling cycles, lowering OPEX and improving the overall energy balance of the plant.

- Digital Twin Simulation: Creation of virtual models for testing process improvements, operator training, and scenario planning, speeding up commissioning and optimization cycles for new and existing plants.

DRO & Impact Forces Of Solid Waste Pyrolysis Plant Market

The Solid Waste Pyrolysis Plant Market dynamics are heavily influenced by a critical balance of drivers, restraints, and opportunities, all underscored by powerful external impact forces such as regulatory shifts and global commodity prices. The primary driver is the accelerating global crisis in solid waste management, necessitating solutions that go beyond traditional landfilling, coupled with supportive governmental policies mandating resource recovery and waste diversion targets. Restraints, predominantly centered on the substantial initial capital investment required for plant construction and the inherent complexity of managing highly variable feedstock, impede faster adoption, particularly in markets with limited access to financing. Opportunities, however, lie significantly in the advancements of catalytic pyrolysis, which promises higher-quality, refined products suitable for the petrochemical supply chain, moving the technology beyond simple fuel generation and into circular feedstock provision. These internal factors are amplified by external forces, especially fluctuating prices for crude oil (which directly competes with pyrolysis oil) and mounting public pressure for sustainable infrastructure development.

Key drivers include the technological maturity achieved in waste processing systems, making high-capacity, safe, and automated pyrolysis plants more viable than a decade ago. Furthermore, the strong market demand for carbon black derived from tire pyrolysis char and the increasing viability of bio-oil as a marine or industrial fuel source provide clear economic incentives for investment. The continuous refinement of reactor designs, particularly the shift towards continuous fluidized bed reactors, has significantly improved process reliability and energy efficiency, addressing previous concerns regarding operational stability. Regulatory bodies, especially in developed nations, are actively classifying pyrolysis-derived fuels and chemicals as renewable or recycled content, opening preferential procurement pathways and boosting the financial attractiveness of these products compared to virgin resources.

Despite the strong growth potential, the market faces significant hurdles related to standardization and public perception. The heterogeneity of incoming municipal solid waste demands complex pretreatment processes, which add considerably to the overall project cost and operational intricacy. Furthermore, obtaining necessary environmental permits can be challenging due to historical perceptions linking thermal processing to incineration, despite pyrolysis being inherently cleaner. Addressing these restraints requires standardized plant certification processes, clearer regulatory distinction from incineration, and consistent long-term off-take agreements for pyrolysis products to secure funding. The primary impact forces shaping the competitive landscape are the stringent criteria set by global investment funds (ESG mandates) that favor sustainable infrastructure, forcing traditional waste management companies to rapidly adopt advanced resource recovery technologies like pyrolysis to remain relevant and competitive in the modern waste economy.

- Drivers: Growing global solid waste volumes; strong regulatory support for waste-to-energy conversion; increasing demand for alternative, low-carbon fuels and chemical feedstocks; rising costs and diminishing capacity of landfills.

- Restraints: High initial capital expenditure (CAPEX) and long gestation periods; complex feedstock pretreatment requirements; competition from cheaper, established waste disposal methods (e.g., incineration); lack of standardized regulations for pyrolysis product grading.

- Opportunities: Integration of catalytic pyrolysis for producing high-value chemical monomers; decentralization and modularization of plant design for remote applications; utilizing pyrolysis char in construction materials or activated carbon production; favorable carbon credit markets for sustainable waste processing.

- Impact Forces: Crude oil price volatility affecting pyrolysis oil competitiveness; stringent environmental and circular economy mandates; technological breakthroughs in reactor efficiency; public and investor pressure for sustainable waste solutions (ESG focus).

Segmentation Analysis

The Solid Waste Pyrolysis Plant Market segmentation provides a granular view of specific market applications and technological preferences, essential for strategic investment and product development. Segmentation is primarily based on the type of feedstock processed, the technology utilized in the thermal decomposition, and the primary end-product targeted for recovery. Analyzing these segments reveals varying growth rates and adoption levels, reflecting regional waste profiles and industrial demands. For instance, the market for plastic pyrolysis is significantly different from tire pyrolysis due to variations in product yield quality, particularly the sulfur content and viscosity of the resulting oils, necessitating specialized reactor designs and downstream refining processes. Understanding these differences allows market players to tailor solutions—be it specialized pre-treatment units for Municipal Solid Waste (MSW) or high-efficiency continuous reactors for dedicated biomass processing—to address acute market needs effectively and capture maximum value from specific waste streams.

The segmentation by technology differentiates between slow, medium, and fast pyrolysis, each optimized for specific objectives. Slow pyrolysis, characterized by long residence times and low temperatures, maximizes the yield of solid char, typically used in agricultural or carbon sequestration applications. Conversely, fast and flash pyrolysis systems prioritize the production of liquid oil by rapidly heating the feedstock and quickly quenching the vapors; these technologies are critical for supplying the chemical and energy sectors. Market growth is heavily concentrated in fast and medium pyrolysis technologies as the demand for liquid fuels and chemical intermediates (circular hydrocarbons) continues to rise globally. Furthermore, advancements in catalytic pyrolysis, which involves the use of specialized catalysts to upgrade the pyrolysis vapors in situ, is emerging as a critical sub-segment, significantly enhancing the quality and purity of the resulting bio-oil, making it directly compatible with standard refinery inputs.

The final segmentation by end-product—Pyrolysis Oil, Syngas, and Carbon Black/Char—determines the primary revenue streams for plant operators. Pyrolysis oil (bio-oil) currently holds the dominant position due to its versatility as a fuel for industrial boilers, kilns, and power generation, as well as its increasing use as a sustainable feedstock substitute in the chemical industry. Syngas, a valuable byproduct, is primarily consumed internally to provide the necessary thermal energy for the pyrolysis process, contributing to the plant’s energy self-sufficiency, though excess gas can be used for electricity generation or sold. Carbon black and char, particularly derived from waste tires, constitute a niche but high-value segment, driven by the demand from the rubber and manufacturing industries for high-quality recycled carbon materials, emphasizing resource recovery beyond mere energy generation.

- By Feedstock Type:

- Waste Tires (Tyre Pyrolysis)

- Waste Plastics (Plastic Pyrolysis)

- Biomass (Agricultural Residue, Wood Waste)

- Municipal Solid Waste (MSW)

- Industrial Sludge and Hazardous Waste

- By Technology Type:

- Slow Pyrolysis (Maximized Char Yield)

- Medium Pyrolysis

- Fast Pyrolysis (Maximized Liquid Yield)

- Flash Pyrolysis

- Catalytic Pyrolysis

- By End Product:

- Pyrolysis Oil (Bio-Oil)

- Syngas (Non-Condensable Gases)

- Carbon Black/Char

Value Chain Analysis For Solid Waste Pyrolysis Plant Market

The value chain of the Solid Waste Pyrolysis Plant market is complex, integrating waste collection and sorting (upstream) with thermal conversion (midstream) and product refining and distribution (downstream). The upstream segment is critical and encompasses the rigorous activities of waste collection, transportation, and crucial pre-treatment—such as shredding, drying, and segregation—which significantly dictates the efficiency and success of the subsequent pyrolysis process. Challenges in the upstream segment include securing consistent, high-quality feedstock and managing the logistics costs associated with transporting bulky waste materials. Plant operators rely heavily on specialized equipment manufacturers for reactor components and pre-treatment machinery, fostering a dependent relationship that emphasizes long-term maintenance and technical support, making robust supply chain management a core competency for achieving operational stability.

The midstream segment is defined by the actual pyrolysis operation, where technological expertise and process optimization are paramount. This involves the proprietary design of the reactor, the management of reaction kinetics (temperature, pressure, residence time), and the immediate condensation and gas clean-up systems. Companies specializing in plant design and engineering, procurement, and construction (EPC) dominate this stage, often holding valuable patents for high-efficiency reactors, such as rotary kilns or advanced fluidized beds. Distribution channels in this stage are complex due to the nature of the products; syngas is typically consumed on-site (direct utilization), while pyrolysis oil requires specialized handling and storage before transfer. Indirect distribution via third-party logistics (3PL) providers is often employed for transporting large volumes of liquid products to industrial consumers, requiring compliance with strict hazardous material transport regulations.

Downstream activities involve the crucial steps of upgrading, refining, and marketing the recovered products. Pyrolysis oil, which is typically acidic and high in oxygen content, often requires catalytic upgrading to meet refinery specifications or established fuel standards, thereby moving its utilization from low-value heavy fuel oil to higher-value transportation fuels or chemical feedstocks. Direct distribution involves long-term contracts with energy-intensive industries (cement, steel) or power generation facilities that utilize the bio-oil directly. Indirect channels include sales to chemical companies seeking sustainable monomers or polymer feedstocks, often facilitated by brokers or specialized traders who manage product specifications and large-volume transactions. The economic viability of the entire value chain hinges on establishing stable, high-value off-take agreements downstream, ensuring the initial substantial investment in the upstream and midstream segments generates sustainable returns over the plant’s operational lifetime.

Solid Waste Pyrolysis Plant Market Potential Customers

The primary customers for Solid Waste Pyrolysis Plants are governmental entities and large industrial organizations seeking sustainable, large-scale solutions for waste disposal and resource recovery. Municipalities and regional waste management authorities constitute a massive customer base, driven by public health concerns, shrinking landfill capacity, and regulatory mandates requiring high rates of waste diversion and recycling. These governmental buyers typically prioritize high throughput capacity, proven reliability, and compliance with stringent emission standards. For these customers, the value proposition extends beyond waste reduction to include the generation of local energy sources and the creation of jobs, making the socio-economic benefits a key factor in procurement decisions. They often engage in Public-Private Partnerships (PPPs) to finance the substantial capital outlay required for these large infrastructure projects, relying on long-term operational guarantees from plant providers.

Industrial sectors, particularly those with significant internal waste streams or high energy demands, form the second major customer cohort. This includes large petrochemical and chemical manufacturing companies that generate substantial volumes of mixed plastic waste, and cement or steel manufacturers who can utilize the pyrolysis syngas and oil to supplement or replace fossil fuels in their high-temperature processes. Waste Management Service Providers (WMSPs) also represent a crucial customer segment, as they acquire and operate these plants to enhance their service offerings, moving beyond traditional waste collection to full resource recovery services. For these commercial entities, the decision to invest in a pyrolysis plant is primarily driven by operational cost savings (reduced landfill fees, internal fuel generation) and the opportunity to participate in the lucrative circular economy market by producing certified recycled materials and sustainable chemical feedstocks.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350.5 Million |

| Market Forecast in 2033 | USD 519.8 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bio-Oil Industries, Agilyx Corporation, Green EnviroTech Holdings, Klean Industries, Pyrolysis Technologies, Nexus Circular, Cynar Plc, Beston Machinery, C&G Environmental Protection Holdings, TreaTech, OTR Wheel Engineering, New Energy Systems, Vow ASA, Waste Systems Inc., Wornick Foods, Enrestec, GEP Ecotech, Lantech, BDI-BioEnergy International, and Advanced Recycling Technologies. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Solid Waste Pyrolysis Plant Market Key Technology Landscape

The technological landscape of the Solid Waste Pyrolysis Plant market is rapidly evolving, driven by the need for enhanced product yield, higher energy efficiency, and greater feedstock flexibility. Current research and development efforts are heavily focused on reactor design improvements, moving away from simple batch reactors toward sophisticated continuous systems. Fluidized bed reactors, both bubbling and circulating, are highly favored as they offer excellent heat transfer characteristics, ensuring rapid and uniform heating of the feedstock which is critical for achieving high liquid yields in fast pyrolysis applications. Rotary kilns remain relevant, particularly for larger scale operations or those processing highly variable or abrasive feedstocks like municipal solid waste (MSW) or waste tires, due to their robust design and ability to handle material heterogeneity. The integration of advanced process control systems, leveraging sensors and automation, is foundational to new plant construction, ensuring stable operational conditions despite external variables.

A major area of innovation is the development and commercialization of catalytic pyrolysis. Traditional pyrolysis oil, which is high in oxygen, water, and acidic compounds, requires intensive and expensive post-treatment before it can be used in conventional refineries. Catalytic pyrolysis addresses this by incorporating specialized catalysts directly within the reactor or in a secondary fixed-bed unit. These catalysts facilitate the removal of oxygen (deoxygenation) and crack larger molecules into smaller, more desirable hydrocarbons, yielding a synthetic crude oil that is chemically closer to petroleum-derived fuels and suitable for direct blending or refinery processing. This technological advancement significantly increases the commercial value of the end product and is critical for the long-term sustainability of pyrolysis plants, allowing them to participate directly in the high-value petrochemical supply chain rather than solely competing in the low-value heavy fuel oil market.

Furthermore, the market is seeing increased emphasis on integrated waste processing facilities, often combining pyrolysis with other thermal or biological treatments to maximize overall resource recovery. For example, co-pyrolysis of plastics and biomass is being explored to balance the high heating value of plastics with the renewable nature of biomass, optimizing the product yield and characteristics. Post-pyrolysis gas cleanup is also advancing, utilizing sophisticated scrubbers and filters to ensure syngas is free of contaminants before being utilized for energy production or hydrogen recovery, thus ensuring environmental compliance. The trend toward modular, skid-mounted pyrolysis units also represents a crucial technological shift, enabling rapid deployment, scalability, and simplified logistics for projects in remote locations or those requiring phased expansion, making the technology more accessible to smaller enterprises and specialized waste streams.

Regional Highlights

Regional dynamics play a crucial role in shaping the Solid Waste Pyrolysis Plant Market, with distinct growth drivers and technological adoption patterns observed across major geographical zones, reflecting differences in waste management maturity, regulatory environments, and energy infrastructure. Asia Pacific (APAC) currently dominates the market both in terms of capacity and new project initiation, primarily driven by explosive urbanization and the resulting overwhelming volumes of untreated municipal and industrial waste. Nations such as China, India, and Southeast Asian countries are heavily investing in waste-to-energy infrastructure, often through large-scale government programs, to transition away from polluting landfills. The sheer scale of waste generation here necessitates high-capacity thermal solutions like pyrolysis, particularly for processing mixed plastic waste and agricultural residues, establishing APAC as the epicenter of global pyrolysis plant deployment and capacity expansion.

Europe represents a highly mature but innovation-driven market, where growth is anchored less on waste volume mitigation and more on achieving ambitious circular economy goals and strict recycling targets set by the European Union. Pyrolysis is viewed as a key enabling technology for 'Chemical Recycling,' allowing complex, contaminated, or mixed plastic fractions—which cannot be economically or technically recycled mechanically—to be converted back into valuable chemical feedstocks. Germany, the Netherlands, and the Nordic countries are leading this adoption, characterized by private sector investments in sophisticated catalytic pyrolysis plants designed specifically to produce high-quality oil for the petrochemical industry. The European regulatory environment provides strong financial incentives and clear mandates for using recycled content, ensuring a secure, high-value market for pyrolysis products and driving continuous technological refinement.

North America demonstrates robust, steady growth, primarily concentrated in the United States, fueled by the demand for domestic alternative energy sources and effective management of challenging waste streams, notably waste tires and specific types of industrial plastics. In the U.S., decentralized deployment is common, driven by regional differences in waste management priorities and state-level policy support for sustainable energy projects. The market here is characterized by strong participation from established energy and chemical corporations investing in pyrolysis as a vertical integration strategy to secure alternative feedstocks and reduce environmental liabilities. Latin America and the Middle East & Africa (MEA) are emerging markets, where growth is accelerating due to improved economic stability, increasing regulatory push toward modern waste infrastructure, and high energy costs, making waste-to-energy solutions increasingly compelling as strategic national investments.

- Asia Pacific (APAC): Dominates the market due to high waste generation rates, rapid urbanization, and significant governmental investment in large-scale waste-to-energy infrastructure, particularly in China and India.

- Europe: Characterized by high-tech adoption, driven by EU Circular Economy mandates; focus on catalytic pyrolysis for high-quality chemical recycling and production of advanced sustainable feedstocks.

- North America: Steady market growth spurred by energy security concerns and the need for effective tire and specific plastic waste management, with significant commercial adoption by chemical and oil companies.

- Latin America (LATAM): Emerging market showing rapid expansion as countries modernize waste infrastructure and seek solutions to reduce reliance on landfilling and generate distributed power.

- Middle East & Africa (MEA): Growth driven by high energy demand and the need to address rapidly increasing municipal solid waste volumes in densely populated urban centers, often supported by infrastructure development funds.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Solid Waste Pyrolysis Plant Market.- Bio-Oil Industries

- Agilyx Corporation

- Green EnviroTech Holdings

- Klean Industries

- Pyrolysis Technologies

- Nexus Circular

- Cynar Plc

- Beston Machinery

- C&G Environmental Protection Holdings

- TreaTech

- OTR Wheel Engineering

- New Energy Systems

- Vow ASA

- Waste Systems Inc.

- Wornick Foods

- Enrestec

- GEP Ecotech

- Lantech

- BDI-BioEnergy International

- Advanced Recycling Technologies

Frequently Asked Questions

Analyze common user questions about the Solid Waste Pyrolysis Plant market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary economic benefit of investing in a Solid Waste Pyrolysis Plant?

The primary economic benefit stems from the dual revenue stream generated by avoided landfill disposal costs and the sale of high-value end-products, particularly pyrolysis oil and recycled carbon black. These revenues, combined with potential carbon credits and government incentives for sustainable waste management, significantly offset the high initial capital expenditure (CAPEX).

How does pyrolysis technology compare to traditional waste incineration in terms of environmental impact?

Pyrolysis is environmentally superior to traditional incineration because it operates in an oxygen-free environment, which prevents the formation of highly toxic dioxins and furans, common byproducts of combustion. It also significantly reduces the volume of solid waste requiring disposal and generates less particulate matter, aligning better with stringent global emission standards and resource recovery mandates.

What types of solid waste are best suited for commercial pyrolysis operations?

The most commercially viable feedstocks are those with high calorific value and relatively homogeneous composition, such as waste tires (yielding high-quality carbon black and oil) and certain non-recyclable plastic streams (producing valuable synthetic crude oil). While Municipal Solid Waste (MSW) can be processed, it requires extensive and costly pre-treatment (sorting and drying) to maximize efficiency and product quality.

What is the role of catalytic pyrolysis and how is it impacting market profitability?

Catalytic pyrolysis uses specialized catalysts to upgrade raw pyrolysis vapors in real-time, significantly improving the quality of the resulting liquid product by reducing oxygen content and acidity. This advancement allows the bio-oil to be used directly as a feedstock for conventional petrochemical refineries, dramatically increasing its market value and ensuring secure long-term off-take agreements, thereby boosting plant profitability.

What are the main regulatory hurdles faced by new Solid Waste Pyrolysis Plant projects?

Major regulatory hurdles include securing complex environmental permits, particularly regarding air emissions and solid residue management (char). Furthermore, inconsistencies in classifying pyrolysis products (oil and syngas) as recycled materials versus standard fuels across different jurisdictions often complicate project financing and market access, necessitating clearer, standardized regulatory definitions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager