Solo Kayaks Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435157 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Solo Kayaks Market Size

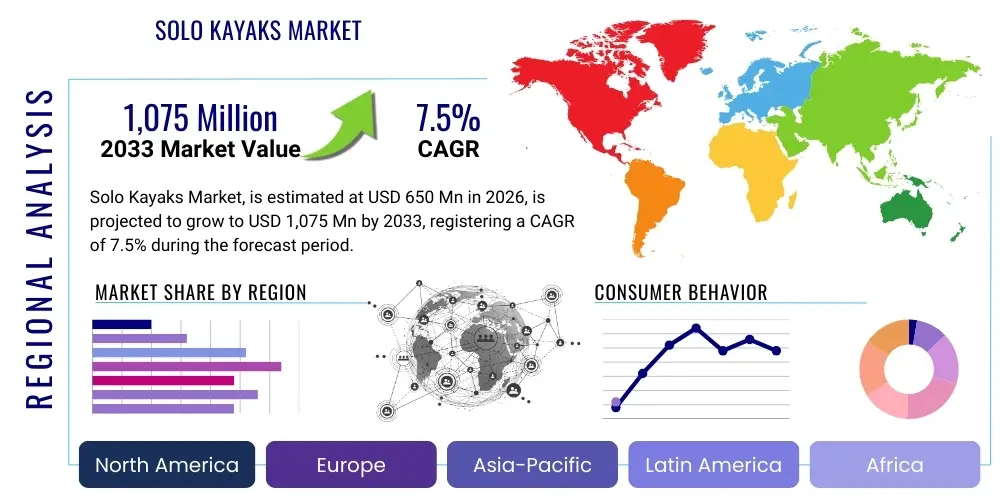

The Solo Kayaks Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 650 Million in 2026 and is projected to reach USD 1,075 Million by the end of the forecast period in 2033.

Solo Kayaks Market introduction

The Solo Kayaks Market encompasses the global production, distribution, and sale of single-person watercraft designed for paddling. These kayaks are characterized by their capacity to accommodate only one paddler, offering superior maneuverability, portability, and personal experience compared to tandem models. The market is highly diversified, serving recreational enthusiasts, specialized anglers, and professional touring paddlers. Key product variations include sit-on-top models favored for ease of use and fishing, and sit-inside models preferred for touring, speed, and cold-water protection. The fundamental appeal of solo kayaking lies in its accessibility as a low-impact exercise and a means of exploring natural waterways independently, driving consistent demand across mature and emerging economies.

The product description spans various materials such as high-density polyethylene (HDPE) for durability and affordability, composite materials (fiberglass and carbon fiber) for lightweight performance and speed, and inflatable materials (PVC, Hypalon) emphasizing portability and storage convenience. Major applications include recreational paddling in lakes and slow rivers, specialized fishing using highly equipped fishing kayaks, and long-distance touring on open waters. The primary benefits driving consumer adoption include improved mental health associated with outdoor activity, physical fitness, and the relatively low barrier to entry regarding required infrastructure. Technological advancements, particularly in lightweight materials and ergonomic design, continue to refine the product offering, catering to specific user needs.

Driving factors for market expansion are multifaceted, anchored by the increasing global emphasis on health and wellness, the rising popularity of adventure tourism, and the significant growth of the recreational fishing industry. Furthermore, the COVID-19 pandemic spurred unprecedented interest in socially distant outdoor activities, solidifying the market base for solo water sports equipment. Digital marketing and e-commerce platforms have expanded the reach of manufacturers, allowing specialized and high-end models to reach niche consumer groups efficiently. The market continues to mature through innovation in ancillary equipment, such as integrated GPS and paddle assistance systems, further enhancing the solo paddling experience and accessibility for diverse user groups.

Solo Kayaks Market Executive Summary

The Solo Kayaks Market demonstrated robust resilience, transitioning from pandemic-fueled recreational spikes to sustainable growth driven by established outdoor enthusiasts and the expanding fishing segment. Business trends indicate a strong move toward sustainable manufacturing practices, with consumer preference increasingly leaning toward environmentally friendly and durable materials. Manufacturers are focusing on optimizing supply chains to manage the volatility in raw material costs, particularly polymers and advanced composites. Key market leaders are expanding their product portfolios to capture both the budget-conscious recreational segment (via affordable rotational-molded polyethylene) and the premium touring segment (via performance composite models). Strategic collaborations with regional tourism boards and rental operators are also crucial for maintaining market visibility and stimulating first-time purchases.

Regionally, North America remains the dominant market, characterized by extensive waterways and a deeply ingrained culture of outdoor recreation and angling. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth, fueled by rising disposable incomes in countries like China and Australia, coupled with developing water sports infrastructure and increasing participation rates in coastal tourism. European markets show stable growth, focusing heavily on eco-tourism and technologically advanced, lightweight folding and inflatable models suitable for diversified use and storage in smaller urban environments. This geographic diversity necessitates tailored marketing strategies focusing on specific regional preferences, such as prioritizing fishing features in North America and portability features in densely populated European and Asian cities.

Segmentation trends highlight the enduring dominance of the Recreational Type segment due to its broad appeal and lower entry price point. However, the Fishing Application segment is experiencing accelerating growth, supported by innovations such as pedal-drive systems, specialized gear tracks, and heightened stability designs essential for standing while casting. Material segmentation indicates a steady shift toward high-performance composites among experienced users seeking speed and lower weight, while the Inflatable segment continues to gain market share among urban consumers due to unparalleled convenience. The shift in distribution channels toward online retail and direct-to-consumer (D2C) models is redefining competitive dynamics, offering manufacturers greater control over branding and pricing strategies.

AI Impact Analysis on Solo Kayaks Market

User inquiries concerning AI's impact on the Solo Kayaks Market predominantly center on how artificial intelligence can enhance the design process, improve the consumer experience, and optimize manufacturing efficiencies. Common questions revolve around AI-driven hull design optimization for hydrodynamics, the integration of smart features (like self-navigating capabilities or safety alarms), and how predictive analytics can forecast demand for specific kayak models or accessories based on weather patterns and environmental conditions. Users express expectation that AI could lead to hyper-personalized kayak recommendations and more efficient customer support through chatbots. Furthermore, supply chain optimization using machine learning to manage inventory for seasonal demand shifts is a major theme, reducing overstocking and minimizing waste in production. The consensus suggests AI’s primary role will be in enhancing safety, personalization, and operational efficiency, rather than fundamentally changing the physical product itself.

- AI-Driven Design Optimization: Utilizing machine learning algorithms to simulate water dynamics and optimize hull shapes for specific performance metrics (speed, stability, tracking).

- Predictive Maintenance and Safety: Integration of sensors and AI models in high-end kayaks to monitor water conditions, user fatigue, and stability, offering real-time safety alerts.

- Personalized Product Recommendation: AI systems analyze user profiles, typical paddling environments, and intended applications to recommend the most suitable solo kayak model and accessories.

- Supply Chain and Inventory Management: Machine learning models forecast seasonal demand fluctuations and regional preferences, optimizing raw material procurement and production schedules.

- Enhanced Customer Service: Deployment of sophisticated chatbots and natural language processing (NLP) to handle technical specifications, assembly guides, and warranty inquiries efficiently.

DRO & Impact Forces Of Solo Kayaks Market

The Solo Kayaks Market is shaped by a confluence of accelerating drivers (D), persistent restraints (R), evolving opportunities (O), and dynamic impact forces. The primary driver is the accelerating consumer adoption of outdoor recreational activities globally, intensified by the pursuit of physical and mental well-being following prolonged periods of reduced mobility. Simultaneously, the expanding technological landscape surrounding lightweight materials and ergonomic design improves the performance and accessibility of kayaks. However, the market faces significant restraints, chiefly the high initial investment cost associated with quality composite and specialized fishing kayaks, coupled with the seasonal nature of the sport which limits year-round sales potential in specific geographies. Furthermore, the sheer size and storage requirements of traditional rigid kayaks remain a logistical challenge for urban consumers, often diverting them toward more compact recreational alternatives.

Key opportunities emerge from the expansion of water tourism and the development of eco-friendly kayaking programs, particularly in untapped regions of Southeast Asia and Latin America, which are investing heavily in waterfront infrastructure. There is a substantial opportunity within the specialized fishing segment, where anglers are willing to invest heavily in advanced, accessory-ready solo kayaks, often equipped with premium features like pedal drives and integrated electronic mounts. Furthermore, the continuous improvement in the quality and durability of inflatable kayak materials is opening new avenues for mass-market adoption, offering a compelling blend of performance and portability that mitigates the urban storage restraint.

The market impact forces are categorized into competitive intensity and regulatory scrutiny. Competitive intensity is high, driven by the presence of both large multinational outdoor equipment corporations and specialized boutique kayak manufacturers, leading to continuous price pressure and aggressive innovation cycles. Regulatory forces, particularly concerning environmental protection and water usage, influence where and how kayaks can be used, potentially limiting access to certain sensitive waterways, but also driving innovation toward less impactful, sustainable designs. Overall, while macroeconomic uncertainty and raw material price volatility pose short-term challenges, the underlying sociological trend favoring experiential outdoor recreation provides strong momentum for sustained long-term growth.

Segmentation Analysis

The Solo Kayaks Market is comprehensively segmented based on material, type, application, and distribution channel, providing a granular view of consumer preferences and market dynamics. Understanding these segments is critical for manufacturers aiming to tailor product offerings and marketing strategies effectively. Material segmentation distinguishes between performance, durability, and cost-effectiveness, driving product positioning from entry-level recreational models to professional-grade equipment. Type segmentation focuses on the structural design, catering to preferences regarding speed, stability, and protection from the elements. Application analysis provides insights into end-user spending habits, with the rapidly growing fishing segment representing the highest potential for value addition and accessory sales.

- By Material:

- Polyethylene (Rotomolded)

- Composite (Fiberglass, Carbon Fiber, Kevlar)

- Inflatable (PVC, Hypalon, Drop-stitch)

- By Type:

- Sit-on-Top Kayaks

- Sit-Inside Kayaks

- Folding Kayaks

- By Application:

- Recreational Paddling

- Kayak Fishing

- Touring/Sea Kayaking

- Whitewater Kayaking

- By Distribution Channel:

- Online Retail (E-commerce Platforms, Company Websites)

- Specialty Retail Stores (Outdoor and Sporting Goods Stores)

- Direct Sales (Rental Services, Guided Tours)

Value Chain Analysis For Solo Kayaks Market

The value chain for the Solo Kayaks Market begins with upstream activities involving the sourcing of raw materials, primarily specialized polymers (polyethylene, PVC), composite fibers (carbon, fiberglass), and advanced resins. Efficiency in this stage is critical as material costs represent a substantial portion of the final product cost. Key suppliers in the chemical and polymer industries hold considerable bargaining power, necessitating strong supplier relationships to ensure consistent quality and pricing stability. Technological R&D focusing on sustainable and lighter materials is integrated early in this phase, influencing subsequent manufacturing costs and product marketability. Manufacturers focus on optimizing techniques like rotomolding for mass production or specialized layup processes for high-end composite models.

Midstream processes involve manufacturing, assembly, quality control, and branding. Production efficiency, particularly minimizing waste in polymer molding and ensuring high structural integrity in composite hulls, determines profitability. Branding and intellectual property protection around hull design are crucial competitive elements. Once manufactured, the downstream portion of the chain involves distribution and sales. The distribution channel is segmented into direct and indirect methods. Direct sales often include manufacturer websites or specialized brand-owned outlets, offering higher margins and direct customer interaction. Indirect distribution relies heavily on specialty outdoor retailers and large e-commerce platforms, offering broader reach and logistics support, but typically involving lower margins for the manufacturer.

The final stage involves reaching the potential customer, often through targeted digital marketing, partnership with rental agencies, and experiential marketing events. Specialty retail stores play a vital role in allowing customers to physically examine and compare different models before purchase, especially for high-value items. E-commerce platforms, however, facilitate easy access to a vast inventory and are increasingly dominant for inflatable and entry-level rigid models. The efficiency of the after-sales service, including warranty support and accessory availability, completes the value loop, fostering brand loyalty and driving repeat purchases in this enthusiast-driven market.

Solo Kayaks Market Potential Customers

The potential customer base for the Solo Kayaks Market is diverse, extending beyond traditional outdoor enthusiasts to include specific demographic and interest-based groups. Primary end-users fall into three broad categories: recreational paddlers, specialized anglers, and professional touring athletes. Recreational paddlers are often first-time or casual buyers seeking affordable, stable, sit-on-top or inflatable models for use on lakes and sheltered coastal waters. This group prioritizes ease of use, stability, and minimal maintenance, and is highly sensitive to pricing and introductory marketing efforts through large sporting goods retailers.

Specialized anglers represent a high-value customer segment. These buyers require robust, feature-rich kayaks, often equipped with pedal drives, extensive storage, and mounts for electronic fish finders. They are less price-sensitive than recreational users and are driven by performance, stability (to stand and fish), and customization options. Their purchasing decisions are heavily influenced by online reviews, fishing forums, and brand reputation within the angling community. This group often invests heavily in accessories immediately following the kayak purchase, generating significant ancillary revenue.

The third group, touring and whitewater enthusiasts, comprises experienced paddlers requiring high-performance composite or specialized rotomolded kayaks. Touring paddlers seek speed, tracking, and large storage capacity for overnight trips, while whitewater users demand extreme durability and specific designs for handling turbulent waters. These consumers prioritize technical specifications, material quality, and brand heritage. Additionally, rental companies, adventure tourism operators, and educational institutions form a significant B2B customer base, purchasing kayaks in bulk for fleet management and educational programs, driven primarily by durability, ease of maintenance, and fleet pricing.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 Million |

| Market Forecast in 2033 | USD 1,075 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hobie, Old Town Canoe & Kayak, Perception Kayaks, Wilderness Systems, Prijon, Jackson Kayak, Pelican International, Oru Kayak, Advanced Elements, BIC Sport (Tahe Outdoors), Vibe Kayaks, Native Watercraft, Riot Kayaks, Feelfree Kayaks, Aqua Glide, Sea Eagle, Trak Kayaks, Stellar Kayaks, Aire, Necky Kayaks. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Solo Kayaks Market Key Technology Landscape

The Solo Kayaks Market is witnessing continuous technological evolution focused primarily on improving hydrodynamics, reducing weight, and enhancing user experience through accessory integration. A foundational technology driving market change is the advancement in material science, particularly the development of high-performance thermoplastic polymers (like cross-linked polyethylene) offering enhanced rigidity and UV resistance while keeping manufacturing costs manageable. For premium kayaks, vacuum infusion processing (VIP) for composite materials minimizes resin usage and voids, resulting in lighter, stiffer hulls necessary for speed and efficient paddling over long distances. Innovations in drop-stitch technology are revolutionizing the inflatable segment, providing rigid, high-pressure structures that mimic the performance of hard-shell kayaks, thus addressing previous concerns regarding rigidity and tracking.

Ergonomics and propulsion systems constitute another critical technology area. The shift from traditional paddling to alternative propulsion methods, particularly sophisticated pedal-drive systems (like Hobie’s MirageDrive or Native’s Propel Drive), represents a significant technological leap, particularly beneficial for the fishing segment. These systems free up the user’s hands for fishing or photography while providing powerful, efficient movement. Furthermore, manufacturers are focusing on modular designs, incorporating proprietary mounting rails (e.g., universal track systems) and integrated electronic ports for easy installation of GPS, fish finders, and camera gear. This focus on "accessory readiness" ensures that the kayak serves as a versatile platform rather than just a simple watercraft, maximizing utility for the specialized user.

Digital integration is also emerging as a key differentiator. While full AI integration remains nascent, many high-end touring kayaks are now incorporating smart features such as integrated waterproof phone charging stations, dedicated slots for GPS beacons, and hull designs optimized using Computational Fluid Dynamics (CFD) modeling software. The manufacturing process itself benefits from automation, ensuring greater consistency in complex rotomolding processes and minimizing material variations. Ultimately, the technology landscape is characterized by a push for performance (lighter, faster), convenience (pedal drives, modularity), and accessibility (high-pressure inflatables), catering to a more demanding and technologically savvy consumer base seeking superior value and specialized utility from their solo kayak investment.

Regional Highlights

North America (USA and Canada) maintains its position as the largest market for solo kayaks, attributed to the vast network of inland waters, extensive coastlines, and a deeply ingrained culture of outdoor sports and competitive fishing. High disposable incomes support demand for premium, specialized models, especially those featuring advanced composite materials and innovative pedal-drive systems favored by the affluent kayak fishing community. The region benefits from strong brand presence, established distribution networks, and robust retail infrastructure dedicated to sporting goods.

Europe represents a mature and stable market, characterized by strict environmental regulations and a high demand for eco-friendly and compact solutions. Countries such as Germany, the UK, and France show high adoption rates, particularly for touring and recreational sit-inside models suitable for coastal and lake exploration. The popularity of folding and high-end inflatable kayaks is notably high here, driven by the logistical challenges of storing rigid kayaks in densely populated urban centers. European manufacturers often emphasize design aesthetics and compliance with regional water safety standards.

Asia Pacific (APAC) is forecasted to be the fastest-growing region. This acceleration is driven by the rapid development of coastal tourism in countries like Australia, New Zealand, and Southeast Asian nations. Increasing affluence in urban centers, combined with government investments in public water recreation areas, is stimulating demand for recreational and entry-level rigid kayaks. Australia, in particular, is a significant market for specialized fishing kayaks. As outdoor lifestyles gain traction, the awareness and accessibility of high-quality solo kayaks continue to increase across the region.

- North America: Market dominance driven by recreational and professional kayak fishing, high adoption of pedal-drive technology, and strong consumer spending on premium composite materials.

- Europe: Focus on stability, eco-tourism, and compact solutions (folding/inflatable), stable growth fueled by mature outdoor culture and stringent quality standards.

- Asia Pacific (APAC): Highest growth potential due to expanding middle class, government promotion of water sports, and burgeoning coastal tourism industries, particularly strong growth in Australia and China.

- Latin America: Emerging market, driven by adventure tourism and developing infrastructure; demand primarily for durable, rotomolded polyethylene models suitable for rugged environments.

- Middle East and Africa (MEA): Niche market focused mainly on coastal recreational use and expatriate communities; growth hampered by extreme climates and limited access to waterways in some areas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Solo Kayaks Market.- Hobie

- Old Town Canoe & Kayak

- Perception Kayaks

- Wilderness Systems

- Prijon

- Jackson Kayak

- Pelican International

- Oru Kayak

- Advanced Elements

- BIC Sport (Tahe Outdoors)

- Vibe Kayaks

- Native Watercraft

- Riot Kayaks

- Feelfree Kayaks

- Aqua Glide

- Sea Eagle

- Trak Kayaks

- Stellar Kayaks

- Aire

- Necky Kayaks

Frequently Asked Questions

Analyze common user questions about the Solo Kayaks market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Solo Kayaks Market?

The Solo Kayaks Market is projected to experience a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033, driven by increasing recreational outdoor participation and advancements in specialized kayak technology, particularly in the fishing segment.

Which kayak material is most popular and why?

Rotomolded Polyethylene remains the most popular material due to its high durability, impact resistance, and cost-effectiveness, making it the preferred choice for recreational users and rental operators seeking long-lasting, low-maintenance kayaks.

How significant is the kayak fishing segment to the overall market?

The kayak fishing segment is critically important, representing the fastest-growing application area. Anglers are high-value consumers who invest heavily in specialized, stable solo kayaks featuring advanced accessories like pedal-drive systems and integrated electronic mounts, boosting overall market value.

Which region currently dominates the Solo Kayaks Market?

North America currently dominates the Solo Kayaks Market in terms of market share, owing to a deeply established outdoor culture, extensive waterways, high consumer spending power, and strong adoption of specialized high-end kayak models.

What are the primary restraints affecting market growth?

The primary restraints include the high initial cost of premium composite and specialized kayaks, the inherent seasonality of the sport in non-tropical regions, and significant storage and transportation difficulties for rigid models in densely populated urban environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager