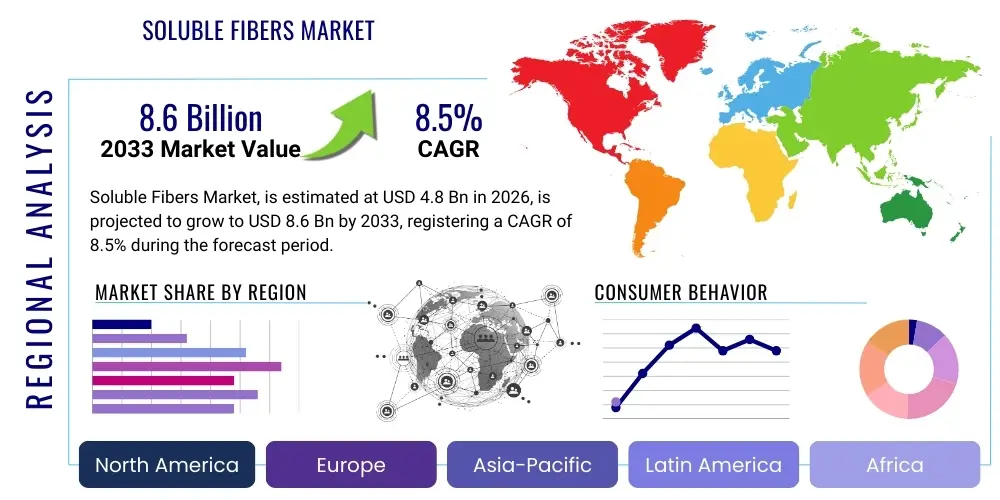

Soluble Fibers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438127 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Soluble Fibers Market Size

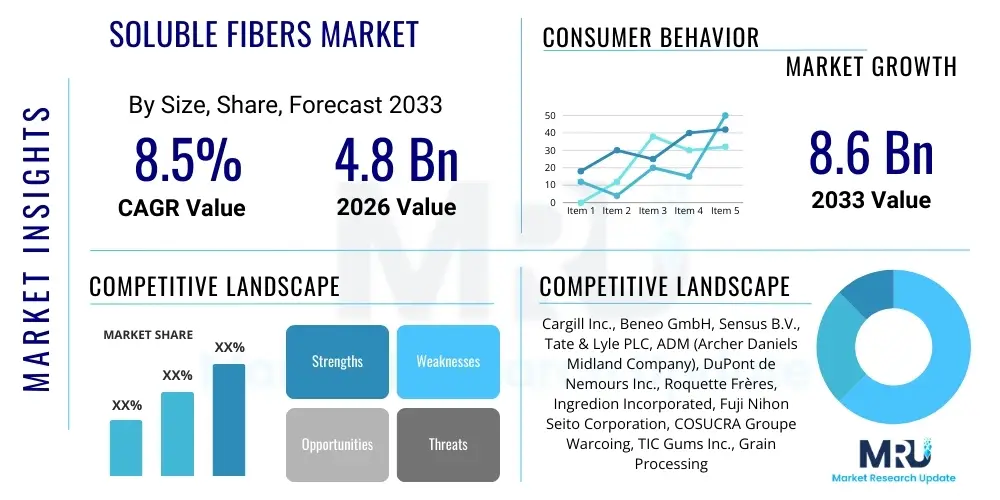

The Soluble Fibers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 8.6 Billion by the end of the forecast period in 2033.

Soluble Fibers Market introduction

The Soluble Fibers Market encompasses the production, distribution, and utilization of dietary components that dissolve in water, forming a gel-like substance in the digestive tract. These fibers, which include compounds such as inulin, oligofructose, pectin, beta-glucan, and polydextrose, are indigestible by human digestive enzymes but are readily fermented by gut microbiota in the colon. This fermentation process yields short-chain fatty acids (SCFAs), primarily acetate, propionate, and butyrate, which are crucial for maintaining gut health, enhancing mineral absorption, and regulating systemic metabolism. Soluble fibers are globally recognized for their critical role as effective prebiotics, thereby fueling substantial demand across the functional food, beverage, and dietary supplement sectors as consumer focus shifts intensely toward proactive health maintenance and personalized nutrition solutions.

Major applications of soluble fibers span across diverse sectors, driven by their multifunctional properties, including texturization, fat replacement, sweetness enhancement, and calorie reduction, alongside their primary health attributes. In the food and beverage industry, they are extensively used in dairy products, baked goods, cereals, nutritional bars, and functional beverages to improve satiety, stabilize emulsions, and enhance mouthfeel, often serving as critical ingredients in formulations designed for weight management and blood sugar control. Furthermore, the pharmaceutical and nutraceutical industries leverage soluble fibers for their proven benefits in managing chronic conditions such as Type 2 diabetes, hypercholesterolemia, and irritable bowel syndrome (IBS), positioning them as core components of preventative healthcare strategies and therapeutic diets.

The market growth is primarily driven by the escalating global prevalence of lifestyle-related diseases, particularly obesity and cardiovascular ailments, which necessitates dietary interventions focused on improved metabolic health. The heightened consumer awareness regarding the importance of gut microbiota and the direct correlation between digestive health and overall immunity has significantly boosted the acceptance of prebiotic ingredients. Regulatory bodies worldwide are increasingly supportive of health claims associated with dietary fiber, providing a robust framework for manufacturers to innovate and market fiber-enriched products. Additionally, technological advancements in fiber extraction and modification, particularly allowing for high-purity, highly functional, and taste-neutral products, are continually expanding the incorporation of soluble fibers into mainstream food and beverage formulations, overcoming traditional sensory barriers to fiber consumption.

- Market Intro: Focuses on prebiotic functionality and metabolic benefits derived from fermentation in the colon.

- Product Description: Includes Inulin, Pectin, Polydextrose, and Beta-Glucan, known for forming viscous gels in water.

- Major Applications: Extensive use in functional foods, fortified beverages, clinical nutrition formulas, and dietary supplements.

- Benefits: Improved gut microbiota balance, enhanced mineral absorption, reduced cholesterol levels, and blood glucose management.

- Driving factors: Rising chronic disease rates, strong consumer trend toward proactive digestive and immune health, and favorable regulatory endorsements for fiber benefits.

Soluble Fibers Market Executive Summary

The Soluble Fibers Market is characterized by rapid innovation and robust penetration into mainstream consumer goods, underpinned by compelling clinical evidence supporting their health claims. Current business trends indicate a strong shift towards sourcing novel fibers from sustainable and non-GMO sources, such as specific agricultural waste streams, addressing both environmental concerns and the consumer demand for clean-label ingredients. Strategic acquisitions and collaborations between major ingredient suppliers and smaller biotech firms specializing in fermentation-derived fibers are defining the competitive landscape, aiming to broaden application scope and improve scalability. Manufacturers are heavily investing in research and development to create highly process-stable fibers that maintain functionality even under harsh thermal processing conditions typical in large-scale food production, thereby unlocking new categories for fortification.

Regional trends highlight North America and Europe as mature markets leading in innovation and product launch volume, primarily driven by high consumer spending on health supplements and established regulatory pathways for functional ingredients. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, fueled by rapid urbanization, increasing disposable incomes, and a growing adoption of Western dietary habits which often require fiber supplementation due to highly processed food consumption. Within APAC, countries like China and India are seeing significant governmental and private sector investments focused on combating malnutrition and improving public health through fortified foods, positioning the region as the epicenter for future demand expansion. The Middle East and Africa (MEA) are also emerging, albeit slowly, driven by increased awareness regarding diabetes management and weight control.

Segment trends emphasize the sustained dominance of the Food and Beverage application segment, particularly within functional dairy, fortified water, and ready-to-eat meal solutions, where soluble fibers are indispensable for improving nutritional profile without compromising texture. By type, Inulin and Fructans maintain the largest market share due to their widespread availability, cost-effectiveness, and established use as prebiotics. However, newer segments like Resistant Starch and specialty fibers derived from gum acacia are experiencing accelerated growth, driven by their superior digestive tolerance and versatility in beverage applications. The segment focused on clinical nutrition and medical foods is also showing robust expansion, reflecting the fiber’s critical role in managing specific clinical dietary needs, especially in geriatric care and specialized hospital formulations.

- Business Trends: Increased focus on sustainable sourcing, vertical integration, strategic mergers and acquisitions among ingredient suppliers, and R&D investment in heat-stable fiber variants.

- Regional Trends: North America and Europe lead in market size and innovation; Asia Pacific (APAC) exhibits the fastest Compound Annual Growth Rate (CAGR) due to rapid urbanization and health consciousness.

- Segments trends: Food and Beverage application segment dominates; Inulin and Fructans lead by type, while specialty fibers like Resistant Starch show high growth potential; rise in utilization within clinical nutrition.

AI Impact Analysis on Soluble Fibers Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Soluble Fibers Market primarily revolve around how AI can accelerate product development, optimize production efficiency, and enhance consumer personalization. Users frequently inquire about the feasibility of AI models predicting optimal fiber blend formulations to achieve specific texture, solubility, and prebiotic efficacy without negatively impacting sensory attributes. There is significant interest in using machine learning to analyze large-scale microbiome data to tailor fiber recommendations based on individual genetic profiles and current gut composition. Furthermore, supply chain optimization using AI is a recurring concern, specifically how predictive analytics can manage the sourcing of raw materials, such as chicory root or corn starch, ensuring consistent quality and mitigating supply chain shocks globally.

AI’s most transformative influence is projected to be in the realm of predictive formulation and process optimization. Machine learning algorithms can process multivariate data—including physiochemical parameters, clinical trial outcomes, consumer taste panel results, and manufacturing tolerance limits—to generate optimized fiber blends faster than traditional trial-and-error methods. This accelerates the time-to-market for novel functional foods and supplements incorporating soluble fibers by ensuring ingredient synergy and maximum bio-efficacy. AI models are being trained on fermentation kinetics data to precisely control microbial conditions, enhancing the yield and purity of fermentation-derived fibers, such as high-purity FOS (Fructooligosaccharides) or resistant starches, thereby driving down production costs and improving consistency.

Moreover, AI is poised to revolutionize personalized nutrition services tied to soluble fiber intake. By integrating data from wearable devices, dietary logs, and at-home microbiome test kits, AI algorithms can provide highly customized recommendations for fiber type and dosage, optimizing gut health for individual users based on real-time feedback and physiological responses. This personalization capability transforms soluble fiber from a general ingredient into a targeted therapeutic tool, significantly increasing its value proposition in the high-growth personalized wellness sector. Predictive maintenance and quality control within manufacturing facilities also benefit immensely, with AI minimizing waste and ensuring the final soluble fiber product consistently meets stringent regulatory and purity standards.

- Product Formulation Optimization: AI uses predictive modeling to determine ideal fiber blends for specific functional outcomes (e.g., texture, reduced calorie count, maximum SCFA production).

- Personalized Nutrition: Machine learning analyzes individual microbiome, genetic, and dietary data to provide tailored recommendations for soluble fiber consumption, dosage, and type.

- Supply Chain Efficiency: AI algorithms predict demand fluctuations and optimize raw material procurement (e.g., chicory root harvest timing, corn starch availability) to ensure stable global supply.

- Quality Control: Enhanced sensor technology integrated with AI systems monitors and adjusts production parameters in real-time, improving the purity and consistency of extracted and modified fibers.

- Fermentation Yield Enhancement: Deep learning models optimize bioreactor conditions (temperature, pH, nutrient feed) for microbial production of specialized fibers, increasing yield and reducing batch variation.

DRO & Impact Forces Of Soluble Fibers Market

The Soluble Fibers Market is strongly driven by increasing consumer prioritization of preventive healthcare, particularly focusing on gut health as the foundation of overall wellness and immunity. This driver is powerfully supported by extensive scientific validation linking dietary fiber intake to reduced risk factors for cardiovascular disease, diabetes, and certain cancers. However, the market faces significant restraints, primarily stemming from the complexity of formulating products that are high in fiber yet appealing to the palate, as high concentrations of certain fibers can lead to undesirable textures or gastric distress in sensitive individuals. The economic challenge lies in the high investment required for advanced extraction and purification technologies necessary to produce premium, taste-neutral soluble fibers, which raises the final cost of fiber-enriched consumer products compared to traditional alternatives.

Significant opportunities are emerging in the expansion of soluble fibers into non-traditional matrices, such as clear beverages, high-protein supplements, and specialty infant formulas, which require highly stable and transparent ingredients. The growing emphasis on sustainable practices is also creating opportunities for fibers derived from agro-industrial waste streams, such as citrus peel or corn husk, transforming waste into high-value functional ingredients. Furthermore, clinical research focused on isolating and commercializing novel soluble fibers with targeted effects on specific gut bacteria strains presents a major avenue for premium product development and personalized therapeutic applications. The convergence of functional ingredients with pharmaceutical standards in the nutraceutical space provides a lucrative pathway for highly purified soluble fibers.

The core impact forces shaping this market include regulatory support, technological advancements, and shifting demographic profiles. Regulatory bodies increasingly recognize fiber as a critical nutrient, easing the approval process for health claims and encouraging fortification efforts. Technological innovation, particularly in enzymatic modification and fermentation, allows for the creation of next-generation fibers with tailored molecular weights and enhanced functional properties, addressing the palatability restraint. Demographic shifts, specifically the aging global population and the concurrent rise in demand for geriatric nutrition and digestive aids, structurally boost the long-term demand for soluble fiber ingredients, solidifying their status as essential components in the modern food supply chain.

- Drivers: Intensifying consumer demand for functional foods promoting gut health; established clinical evidence supporting metabolic benefits; increasing prevalence of chronic lifestyle diseases; favorable regulatory environment for fiber fortification claims.

- Restraints: High production costs associated with advanced purification techniques; technical challenges related to maintaining sensory quality and texture in high-fiber products; potential for digestive discomfort associated with excessive consumption of certain fiber types.

- Opportunity: Expansion into clear beverage and sports nutrition categories; utilization of sustainable and upcycled agricultural waste streams for fiber sourcing; development of highly targeted, personalized fiber blends based on microbial specificity.

- Impact forces: Strong influence of scientific research validating prebiotic benefits; growing acceptance by mainstream food manufacturers seeking clean-label fat and sugar reduction alternatives; tightening competition driving technological innovation in process optimization.

Segmentation Analysis

The Soluble Fibers Market is meticulously segmented based on Type, Source, and Application, reflecting the diversity of fiber structures available and their specific end-use requirements. This granular analysis is crucial for understanding market dynamics, allowing ingredient suppliers to tailor their product offerings to meet the specialized needs of manufacturers in the food, beverage, and pharmaceutical sectors. The Type segmentation, encompassing established ingredients like Inulin and newer specialties like Resistant Starch, dictates functional properties such as water solubility, viscosity, and prebiotic potency, which are critical factors for formulation success. The source material—whether chicory root, corn, or specialized microbial fermentation—influences cost structure, sustainability claims, and regulatory approval status in different global regions.

The application segment provides the clearest view of market utilization, with functional foods and beverages consuming the largest share. Within this segment, soluble fibers play dual roles: providing a health benefit and acting as an essential texturizer, stabilizer, or low-calorie bulking agent. For instance, polydextrose is widely used in sugar-free confectionery and baked goods, while beta-glucan is heavily integrated into heart-healthy oat products. The pharmaceutical and dietary supplements segment, though smaller in volume, holds a higher value share due to the requirement for high-purity, standardized ingredients utilized in specific nutraceutical formulations targeting chronic conditions like high cholesterol or IBS management.

Understanding the interplay between these segments is vital for strategic planning. The rapid growth observed in the Resistant Starch segment, for example, is driven by its excellent digestive tolerance and functional stability, making it highly preferred in low-viscosity applications. Similarly, the trend toward natural and non-GMO sourcing strongly favors fibers derived from chicory root or certain fruits and vegetables, influencing investment decisions across the value chain, from agricultural sourcing to final ingredient processing. This segmentation framework allows market players to accurately position their products based on specific functional advantages, regulatory suitability, and target consumer demographics.

- Type:

- Inulin

- Fructooligosaccharides (FOS)

- Polydextrose

- Beta-Glucan (Oats & Barley)

- Resistant Starch

- Gum Acacia (Arabic)

- Pectin

- Others (Glucomannan, Cellulose Derivatives)

- Source:

- Fruits and Vegetables

- Grains and Cereals (Oats, Corn, Barley)

- Roots and Tubers (Chicory Root)

- Synthetic/Engineered

- Microbial Fermentation

- Application:

- Food and Beverages

- Dairy Products

- Bakery and Confectionery

- Cereals and Snacks

- Functional Beverages

- Dietary Supplements

- Pharmaceuticals and Nutraceuticals

- Animal Feed

- Food and Beverages

Value Chain Analysis For Soluble Fibers Market

The Soluble Fibers value chain begins at the upstream segment with the sourcing of raw materials, which is highly diverse, ranging from conventional agriculture (chicory, corn, oats) to advanced biotechnology for microbial or enzymatic production. Upstream analysis focuses on agricultural yield optimization, sustainable harvesting practices, and specialized breeding programs designed to enhance fiber content in crops. Key stakeholders at this stage include farmers, agricultural cooperatives, and specialized chemical or biological synthesis companies. Ensuring a stable, high-quality supply of raw material is paramount, as fluctuations in crop yield directly impact the cost and availability of popular fibers like Inulin (derived from chicory root) and Beta-Glucan (from oats).

The midstream segment involves the critical steps of extraction, purification, and modification. This stage is highly technology-intensive, utilizing processes such as solvent extraction, enzymatic hydrolysis, and membrane filtration to isolate and refine the soluble fibers to meet specific functional requirements (e.g., degree of polymerization, molecular weight, purity). Major ingredient manufacturers invest heavily in proprietary technologies to produce highly functional, taste-neutral, and heat-stable grades suitable for complex food matrices. Distribution channels include both direct sales—where large ingredient manufacturers supply multinational food and beverage corporations (B2B)—and indirect channels involving specialized distributors and agents who cater to small-to-mid-sized enterprises (SMEs) and localized supplement manufacturers, providing technical support alongside the ingredients.

The downstream segment encompasses the formulation, manufacturing, and marketing of the final consumer products. This includes functional food processors, beverage manufacturers, and nutraceutical companies. The effectiveness of marketing relies heavily on clear communication of the prebiotic and health benefits of the incorporated fibers, often requiring substantiation through clinical studies and regulatory compliance with health claims. Direct distribution to consumers often occurs through retail channels, pharmacies, and increasingly, specialized e-commerce platforms focused on health and wellness. The value chain concludes with the end-users who consume the fiber-enriched products, providing feedback that drives future innovation and ingredient specification changes back up the chain.

Soluble Fibers Market Potential Customers

The primary customers for bulk soluble fiber ingredients are major manufacturers operating within the fast-moving consumer goods (FMCG) sector, particularly those focused on functional foods and health-conscious product lines. Food manufacturers utilize soluble fibers extensively as replacements for high-calorie bulking agents, texturizers in low-fat products, and essential components in bakery, dairy, and confectionery items to meet rising consumer demand for reduced sugar and enhanced nutritional profiles. Beverage companies represent a rapidly expanding customer segment, driven by the need for clear, stable fiber sources that can be integrated into fortified water, juices, and sports drinks without altering clarity or flavor, with polydextrose and certain types of resistant dextrins being highly sought after in this area.

Another crucial customer group includes the dietary supplement and nutraceutical industries, which require high-purity, standardized grades of soluble fibers, often combined with probiotics or other functional ingredients. These customers formulate products targeted at specific health outcomes, such as cholesterol reduction (using Beta-Glucan), specific digestive support (using targeted FOS and Inulin), or weight management (using Glucomannan). The pharmaceutical sector also utilizes highly refined soluble fibers as excipients, binding agents, or as active ingredients in prescription medical foods designed for managing gastrointestinal disorders or specific dietary deficiencies in hospital or clinical settings, representing a high-value niche market requiring rigorous quality control and certification.

Finally, the animal nutrition and feed industry represents a growing customer base, recognizing the parallel benefits of prebiotics in livestock and companion animal health. Soluble fibers are incorporated into specialized pet food and animal feed formulations to improve gut health, enhance nutrient absorption, and potentially reduce the reliance on antibiotics in livestock farming. These customers prioritize bulk quantities and cost-effectiveness, alongside demonstrated efficacy in enhancing animal welfare and productivity. The demand from this sector is particularly strong in Asia Pacific and North America, where regulatory scrutiny on antibiotic use in animal agriculture is increasing, making prebiotic fibers a valuable alternative for gut health management.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 8.6 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cargill Inc., Beneo GmbH, Sensus B.V., Tate & Lyle PLC, ADM (Archer Daniels Midland Company), DuPont de Nemours Inc., Roquette Frères, Ingredion Incorporated, Fuji Nihon Seito Corporation, COSUCRA Groupe Warcoing, TIC Gums Inc., Grain Processing Corporation, J. Rettenmaier & Söhne GmbH & Co. KG (JRS), Lonza Group AG, Wacker Chemie AG, AIDP Inc., Puris, Psyllium Fiber Industries, Shandong Lujian Biological Technology Co. Ltd., Shandong Sanyuan Biotechnology Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Soluble Fibers Market Key Technology Landscape

The technological landscape of the Soluble Fibers Market is dynamic, primarily focusing on improving extraction efficiency, achieving higher purity levels, and customizing the functional attributes of the fibers. A critical technology is advanced enzymatic modification, which utilizes specific enzymes to cleave or synthesize fiber molecules, allowing for precise control over the degree of polymerization (DP). For example, enzymatic hydrolysis can modify corn starch to produce resistant dextrins (Resistant Starch) with tailored molecular weights, thereby influencing their viscosity and digestive tolerance. These techniques are essential for developing next-generation fibers that offer superior sensory profiles and stability in diverse food matrices, addressing the challenge of incorporating high fiber quantities without textural defects or flavor impact.

Green extraction methods, such as Supercritical Fluid Extraction (SFE) and Ultrasound-Assisted Extraction (UAE), are gaining traction as they offer solvent-free or reduced-solvent alternatives for isolating fibers from plant sources. These technologies align with the clean-label trend by minimizing chemical residues in the final ingredient and promoting sustainability. SFE, utilizing pressurized carbon dioxide, is particularly effective for extracting high-purity pectin and certain specialty fibers, resulting in a premium ingredient suitable for pharmaceutical and high-end nutraceutical applications. Furthermore, membrane technology, including ultrafiltration and nanofiltration, is crucial in the purification stage, efficiently removing unwanted sugars, proteins, and minerals to achieve the high purity standards required for colorless and flavorless fiber ingredients used in beverages.

Biotechnology, specifically microbial fermentation, represents another pivotal technological area, especially for the production of novel or highly specialized soluble fibers like certain FOS and GOS (Galactooligosaccharides). Precision fermentation allows manufacturers to use engineered microbial strains (e.g., yeast or bacteria) to synthesize fibers with highly consistent and specific structures, overcoming the supply instability and seasonal variations inherent in agricultural sourcing. This controlled manufacturing process ensures batch consistency, scalability, and the ability to produce fibers tailored to specifically target certain strains of beneficial gut bacteria. The convergence of AI with these biotechnological processes further optimizes bioreactor conditions, maximizing fiber yield and accelerating the development timeline for novel prebiotic compounds.

- Advanced Enzymatic Hydrolysis: Used to control the molecular structure and degree of polymerization (DP) of fibers like resistant starch and fructans, improving stability and functional properties.

- Green Extraction Technologies: Includes Supercritical Fluid Extraction (SFE) and Ultrasound-Assisted Extraction (UAE) to isolate fibers from natural sources sustainably with minimal chemical residues.

- Precision Fermentation: Biotechnological method using microbial strains to produce specialized, highly consistent, and high-purity oligosaccharides (FOS, GOS) efficiently and reliably at scale.

- Membrane Filtration Systems: Employing ultrafiltration and nanofiltration for final purification steps, ensuring the removal of impurities to create transparent, taste-neutral fiber ingredients suitable for clear beverages.

- High-Throughput Screening: Automated systems used in R&D to quickly test and analyze the functional properties and prebiotic efficacy of various fiber prototypes against different microbial cultures.

Regional Highlights

North America maintains a dominant position in the Soluble Fibers Market, characterized by high consumer awareness regarding digestive health and a well-established market for functional foods and dietary supplements. The region benefits from substantial investment in clinical research validating fiber benefits, robust regulatory support from organizations like the FDA allowing specific health claims, and a culture that rapidly adopts innovative wellness products. The United States, in particular, drives demand through the high prevalence of obesity and diabetes, fueling the need for low-calorie, high-fiber food formulations. Major ingredient suppliers have established large-scale production facilities here, ensuring competitive pricing and reliable supply, particularly for corn-derived fibers and resistant starch.

Europe represents a mature yet continually growing market, propelled by stringent quality standards and a strong consumer preference for natural, organic, and locally sourced ingredients. The European Union’s focus on promoting sustainable agriculture and maintaining high levels of food safety drives demand for fibers sourced from chicory root (Inulin and Fructans) and oats (Beta-Glucan), which have established functional health claims recognized by the European Food Safety Authority (EFSA). Germany, France, and the UK are key markets within Europe, demonstrating robust demand in the fortified dairy and infant nutrition sectors, where soluble fibers are highly valued for their prebiotic effects and safety profiles. Innovation in Europe is often centered around clean-label ingredient solutions and sustainable production methods.

The Asia Pacific (APAC) region is projected to register the fastest growth rate throughout the forecast period. This accelerated growth is attributed to increasing disposable income, rapid adoption of Western dietary patterns (which often leads to insufficient fiber intake), and growing awareness of chronic diseases like diabetes and cardiovascular issues. Countries such as China, Japan, and India are seeing massive market expansion. Japan has historically been a leader in functional food (FOSHU) development, readily incorporating soluble fibers into daily diets. China's massive population and shifting health policies focused on preventative health care provide unprecedented opportunities for soluble fiber manufacturers, particularly in the beverage and dairy sectors where fortification efforts are scaling rapidly. Local ingredient manufacturers in APAC are also increasingly investing in advanced purification technologies to compete with global suppliers.

- North America: Dominant market share; driven by high chronic disease rates, robust supplement culture, and technological adoption in formulation; US leads consumption of resistant starch and corn-derived fibers.

- Europe: Mature market focusing on natural and clean-label sourcing; strong regulatory environment supporting chicory root fibers (Inulin) and oat Beta-Glucan; high demand in dairy and infant nutrition.

- Asia Pacific (APAC): Highest CAGR; growth fueled by urbanization, increasing disposable incomes, and preventative health governmental initiatives; Japan and China are key growth engines for functional beverages and fortified foods.

- Latin America (LATAM): Emerging market; growth driven by increasing health consciousness in urban centers like Brazil and Mexico, focusing on fiber integration into baked goods and fortified staple foods.

- Middle East and Africa (MEA): Growth stimulated by efforts to combat high rates of metabolic disorders; gradual adoption of functional foods and supplements, particularly in the UAE and Saudi Arabia.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Soluble Fibers Market.- Cargill Inc.

- Beneo GmbH

- Sensus B.V.

- Tate & Lyle PLC

- ADM (Archer Daniels Midland Company)

- DuPont de Nemours Inc.

- Roquette Frères

- Ingredion Incorporated

- Fuji Nihon Seito Corporation

- COSUCRA Groupe Warcoing

- TIC Gums Inc.

- Grain Processing Corporation

- J. Rettenmaier & Söhne GmbH & Co. KG (JRS)

- Lonza Group AG

- Wacker Chemie AG

- AIDP Inc.

- Puris

- Psyllium Fiber Industries

- Shandong Lujian Biological Technology Co. Ltd.

- Shandong Sanyuan Biotechnology Co. Ltd.

Frequently Asked Questions

Analyze common user questions about the Soluble Fibers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between soluble and insoluble fibers?

Soluble fibers dissolve in water, forming a gel that aids in glucose and cholesterol management and acts as a prebiotic, fermenting in the colon. Insoluble fibers, such as cellulose, do not dissolve, adding bulk to stool and promoting regularity. Both are essential for overall digestive health and are often used together in food formulation.

Which type of soluble fiber is most effective for prebiotic benefits?

Inulin and Fructooligosaccharides (FOS), primarily sourced from chicory root, are among the most recognized and studied soluble fibers for their prebiotic efficacy. They selectively stimulate the growth of beneficial gut bacteria, such as Bifidobacteria and Lactobacilli, supporting microbiome balance and immune function.

How is the demand for soluble fibers affected by the clean-label trend?

The clean-label trend significantly drives demand for soluble fibers sourced naturally, such as pectin, gum acacia, and chicory root fiber. Consumers and manufacturers prefer these identifiable, minimally processed ingredients over synthetic or highly modified alternatives, provided they are non-GMO and sustainably sourced.

What are the key technical challenges in formulating products with high concentrations of soluble fiber?

The main challenges involve managing viscosity and maintaining desirable texture, as high concentrations of soluble fibers can lead to excessive thickening or gelation. Furthermore, formulation must address potential off-flavors or the osmotic effect that can cause gastrointestinal discomfort if the fiber is not highly purified or properly dosed.

What applications are driving the fastest growth in the soluble fibers market?

The fastest growth is driven by the Functional Beverages segment, including fortified waters and clear sports drinks, due to consumer demand for convenient, health-boosting hydration. Additionally, personalized nutrition products and specialized clinical nutrition formulas requiring precise prebiotic input are seeing rapid commercial expansion.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager