Solvent Recovery Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434675 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Solvent Recovery Equipment Market Size

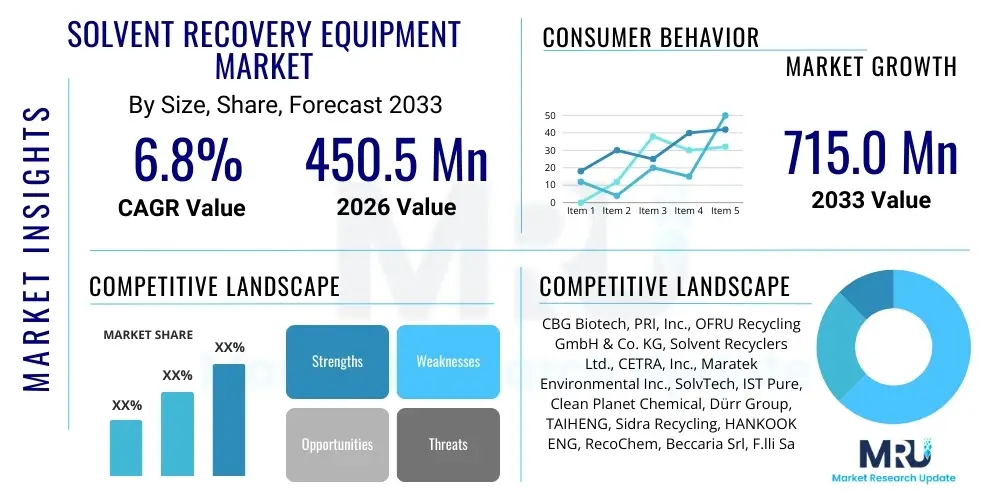

The Solvent Recovery Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 715.0 Million by the end of the forecast period in 2033. This consistent growth trajectory is primarily fueled by stringent environmental regulations regarding volatile organic compound (VOC) emissions and the increasing industrial focus on reducing operational costs through resource recirculation and waste minimization. The escalating demand for sustainable manufacturing processes across key industrial sectors, including pharmaceuticals, printing, and automotive coatings, is a pivotal factor driving the adoption of advanced solvent recovery systems globally.

Solvent Recovery Equipment Market introduction

The Solvent Recovery Equipment Market encompasses the technology, machinery, and systems utilized for separating reusable organic solvents from contaminated waste streams generated during various industrial processes. These systems typically employ distillation, fractional distillation, thin-film evaporation, or membrane separation techniques to purify solvents like acetone, toluene, ethanol, isopropyl alcohol, and xylene, allowing them to be reintroduced into the production cycle. The primary objective of implementing solvent recovery solutions is two-fold: enhancing economic viability by significantly reducing new solvent procurement costs and achieving environmental compliance by minimizing hazardous waste disposal volumes and mitigating harmful volatile organic compound emissions into the atmosphere.

Major applications of solvent recovery equipment span across diverse industries, with significant utilization observed in the manufacturing of pharmaceuticals, where high-purity solvents are essential; in the printing and packaging sector, specifically for reclaiming solvents used in inks and adhesives; and within the automotive and aerospace coating industries, where extensive cleaning and degreasing processes generate substantial solvent waste. The benefits derived from these systems are compelling, offering rapid return on investment due to the high cost of industrial-grade solvents and the rising expenses associated with regulatory compliant waste management. Furthermore, the implementation of recovery units enhances corporate social responsibility profiles by demonstrating a commitment to circular economy principles and sustainable operations.

Driving factors for this market expansion include the global impetus toward sustainable chemistry and green manufacturing practices, especially in developed economies like North America and Europe, where environmental protection agencies enforce rigorous emission standards. The high operational expenditure associated with hazardous waste treatment and disposal acts as a strong economic incentive for companies to invest in in-house recovery capabilities. Additionally, technological advancements, such as the development of more energy-efficient vacuum distillation units and continuous processing systems, are making recovery operations more cost-effective and accessible to small and medium-sized enterprises (SMEs), thereby broadening the market adoption landscape.

Solvent Recovery Equipment Market Executive Summary

The Solvent Recovery Equipment Market is characterized by robust growth driven by mandatory regulatory frameworks, particularly those targeting VOC reduction, and the fundamental shift towards circular manufacturing models across industrialized nations. Business trends indicate a strong preference for customized, modular systems that can be integrated seamlessly into existing production lines, favoring technologies like vacuum distillation for high-volume, low-boiling-point solvents and thin-film evaporators for heat-sensitive or high-viscosity materials. The market is witnessing increasing consolidation among established players who are leveraging strategic acquisitions to expand their technology portfolios, particularly in sophisticated separation techniques like supercritical fluid extraction and specialized membrane filtration tailored for complex solvent mixtures, thereby enhancing competitive barriers for new entrants.

Regional trends reveal Asia Pacific (APAC) as the fastest-growing market segment, primarily due to rapid industrialization, expansion of the pharmaceutical and electronics manufacturing hubs in countries like China and India, and the gradual adoption of stricter environmental policies mirroring those in the West. North America and Europe, while mature, maintain dominance in terms of technological sophistication and demand for premium, automated recovery units compliant with stringent local standards such as the European Union’s Industrial Emissions Directive (IED) and the U.S. EPA regulations. This regional disparity dictates product specialization, with Western markets focusing on automation, energy efficiency, and high throughput, while APAC markets prioritize initial cost-effectiveness and scalable capacity.

Segment trends highlight the dominance of the distillation segment based on product type, owing to its versatility and ability to achieve high solvent purity suitable for reuse in critical applications. Furthermore, the Pharmaceutical and Chemical sectors remain the largest end-users, driven by the necessity for closed-loop solvent management to prevent cross-contamination and ensure product quality integrity. The market is also experiencing a notable trend toward incorporating Industry 4.0 principles, including integrated sensors, predictive maintenance analytics, and remote monitoring capabilities, which enhance system uptime, optimize energy consumption, and provide crucial operational data for regulatory compliance reporting.

AI Impact Analysis on Solvent Recovery Equipment Market

User inquiries regarding the influence of Artificial Intelligence (AI) on the Solvent Recovery Equipment Market commonly revolve around themes of predictive maintenance, process optimization, and enhanced regulatory compliance. Users frequently ask if AI can significantly reduce energy consumption in highly intensive processes like distillation, how machine learning algorithms can predict fouling or mechanical failures before they occur, and whether AI integration can optimize complex solvent mixtures separation based on real-time contamination levels. The core expectation is that AI will transform solvent recovery from a batch-oriented, empirical process into a continuous, intelligent, and highly efficient operation, thereby maximizing solvent yield, minimizing energy inputs, and ensuring consistent purity levels necessary for pharmaceutical and electronics manufacturing. The integration of AI focuses on utilizing sensor data (temperature, pressure, flow rates, composition analysis) to create self-adjusting systems that dynamically adapt to varying waste stream characteristics, a critical challenge in traditional recovery methods.

- AI-powered predictive maintenance reduces unplanned downtime and lowers operational expenditure by anticipating equipment failure based on vibrational and thermal signatures.

- Machine learning algorithms optimize distillation column parameters (e.g., reflux ratio, temperature profiles) in real-time, significantly reducing the high energy demands associated with separation processes.

- Enhanced process control through AI allows for dynamic adjustment to inconsistent waste stream inputs, maximizing solvent purity and recovery yield.

- AI facilitates advanced regulatory reporting by automatically logging and analyzing operational data, proving compliance with VOC emission limits and waste minimization targets.

- Integration of deep learning for automated solvent purity verification using spectroscopic techniques ensures product quality without manual laboratory intervention.

DRO & Impact Forces Of Solvent Recovery Equipment Market

The Solvent Recovery Equipment Market is profoundly shaped by a combination of stringent environmental drivers (D) mandating solvent reuse, operational cost restraints (R) linked to initial high capital investment, and significant growth opportunities (O) arising from technological advancements and market penetration into emerging economies. The overarching impact forces include regulatory pressure, which mandates cleaner production, and economic volatility, which makes the consistent cost of new solvent procurement a major driver for internal recovery investment. Balancing the desire for sustainability against the required upfront capital outlay and the technical complexity of handling varied chemical waste streams defines the market dynamic. The long-term savings in disposal costs and raw material purchasing generally outweigh the initial investment, making the regulatory imperative an effective trigger for market expansion.

The primary drivers are anchored in global environmental legislation, such as the ongoing enforcement of VOC limits and hazardous waste reduction mandates, particularly impacting industries like printing, coatings, and chemicals. Economically, the spiraling cost of virgin solvents and the increasing regulatory fees associated with hazardous waste disposal provide compelling financial incentives for adoption. Furthermore, the corporate sustainability agendas, which increasingly necessitate achieving zero liquid discharge (ZLD) goals, push major corporations toward implementing comprehensive, closed-loop solvent management systems. These drivers collectively ensure sustained demand, even amid macroeconomic slowdowns, as regulatory compliance is non-negotiable for continued operation.

Conversely, restraints primarily center around the high initial capital expenditure required for purchasing sophisticated equipment, installation, and associated infrastructure changes. This financial hurdle often proves prohibitive for smaller enterprises, leading to hesitancy in adoption. Additionally, the inherent technical complexity involved in separating highly complex or multi-component solvent mixtures, which requires specialized fractional distillation or advanced membrane technology, necessitates skilled technical personnel for operation and maintenance, adding to operational costs. Opportunities are abundant, specifically in developing customized, energy-efficient solutions, expanding market presence in high-growth regions like Southeast Asia, and integrating advanced automation features to simplify operation and reduce the reliance on highly specialized labor, thereby mitigating some of the key restraints.

Segmentation Analysis

The Solvent Recovery Equipment Market is meticulously segmented based on product type, capacity, recovery method, and end-user industry, reflecting the diverse technical requirements and scale of solvent recovery needs across global manufacturing sectors. Segmentation is crucial as it dictates the optimal technology choice—for instance, small-scale batch distillation is suitable for laboratories or small printing shops, while large-scale continuous vacuum evaporation is preferred by major pharmaceutical or chemical plants. Analyzing these segments provides strategic insights into which technologies are dominating specific industrial applications and regional markets, thereby guiding product development and market penetration strategies for equipment manufacturers.

- By Product Type:

- Simple Distillation Units

- Fractionating Distillation Systems

- Thin Film Evaporators (TFE)

- Rotary Evaporators

- Others (e.g., Crystallizers, Extractors)

- By Capacity:

- Small Capacity (5-50 Liters/Hour)

- Medium Capacity (50-200 Liters/Hour)

- Large Capacity (>200 Liters/Hour)

- By Recovery Method:

- Vacuum Distillation

- Steam Stripping

- Fractional Distillation

- Membrane Separation

- Adsorption/Absorption

- By End-User Industry:

- Pharmaceuticals and Biotechnology

- Printing and Packaging

- Chemicals and Petrochemicals

- Automotive and Aerospace (Coatings and Degreasing)

- Electronics and Semiconductors

- Others (e.g., Cosmetics, Textiles)

Value Chain Analysis For Solvent Recovery Equipment Market

The value chain of the Solvent Recovery Equipment Market starts with the upstream activities of raw material procurement and component manufacturing, focusing primarily on high-grade stainless steel alloys, specialized heat exchangers, vacuum pumps, advanced control systems (PLCs), and precise instrumentation essential for handling corrosive or flammable solvents. Upstream suppliers are vital as the quality and durability of these components directly impact the equipment’s lifespan, safety rating, and operational efficiency. The next critical stage involves research, design, and engineering, where manufacturers specialize in developing systems optimized for high throughput, energy efficiency, and adherence to strict safety standards (like ATEX certification for explosion proofing). Differentiation at this stage often relies on proprietary separation algorithms and robust heat recovery designs.

The central manufacturing stage includes the fabrication, assembly, and rigorous testing of the recovery units, often involving customization based on the client's specific solvent mixtures and required purity levels. Distribution channels primarily utilize a hybrid model: Direct sales are common for large-scale, complex projects requiring extensive integration and commissioning (e.g., major chemical plant installations), allowing for direct consultation with the end-user’s engineering team. Conversely, indirect sales through specialized distributors and regional agents are utilized for standardized, smaller capacity units aimed at the SME market, leveraging the distributor’s local service network and technical support capabilities.

Downstream activities involve installation, commissioning, after-sales service, technical support, and the supply of spare parts and consumables. Given the specialized nature of the equipment and the critical role it plays in environmental compliance, ongoing maintenance contracts and rapid response service capabilities are crucial competitive differentiators. End-users require reliable service to maintain peak operational efficiency and avoid costly production shutdowns. This focus on long-term service relationships drives significant recurring revenue for equipment providers, solidifying the importance of a robust downstream presence, particularly in geographically dispersed manufacturing regions.

Solvent Recovery Equipment Market Potential Customers

The primary consumers and end-users of solvent recovery equipment are industrial entities that utilize large volumes of volatile organic solvents in their operational processes, subsequently generating contaminated solvent waste streams requiring responsible management. These customers prioritize operational efficiency, safety compliance, and rapid return on investment derived from reduced raw material costs and lower hazardous waste disposal fees. The market is broadly categorized into industries where solvent purity is critical (Pharmaceuticals, Electronics) and industries where volume reduction and environmental compliance are paramount (Printing, Automotive Coatings, General Chemicals). Their purchasing decisions are highly influenced by total cost of ownership (TCO), technological maturity, and the vendor’s ability to meet stringent regulatory requirements for both environmental protection and workplace safety.

In the Pharmaceutical and Biotechnology sectors, potential customers include manufacturers of Active Pharmaceutical Ingredients (APIs), contract manufacturing organizations (CMOs), and research laboratories. These buyers require equipment capable of achieving exceptionally high purity levels (often 99.5% or higher) to prevent product contamination and maintain Good Manufacturing Practice (GMP) standards. Equipment in this sector often features advanced clean-in-place (CIP) functionality and materials compliant with sanitary regulations. The investment is driven less by cost savings alone and more by regulatory necessity and quality control integrity, often favoring sophisticated fractional distillation and advanced thin-film evaporation technologies.

Other key customer segments include the Printing and Packaging industry, particularly gravure and flexographic printing operations, which use substantial quantities of solvents like ethyl acetate and toluene in inks. For these high-volume, continuous operations, the focus is on robust, energy-efficient equipment (often steam stripping or simple distillation) capable of high throughput and reliable operation in demanding industrial environments. Similarly, automotive OEM paint shops and aerospace manufacturers require recovery units to process solvents used in cleaning, degreasing, and paint sludge removal, prioritizing systems that can handle complex mixtures, often favoring vacuum distillation due to its lower operating temperature requirement, thus enhancing safety when dealing with flammable materials.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 715.0 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CBG Biotech, PRI, Inc., OFRU Recycling GmbH & Co. KG, Solvent Recyclers Ltd., CETRA, Inc., Maratek Environmental Inc., SolvTech, IST Pure, Clean Planet Chemical, Dürr Group, TAIHENG, Sidra Recycling, HANKOOK ENG, RecoChem, Beccaria Srl, F.lli Sacchi Srl, SOTAR, Inc., Finnegan's Standard Goods, Inc., BHS-Sonthofen GmbH, A.H. Wyatt. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Solvent Recovery Equipment Market Key Technology Landscape

The technology landscape of the Solvent Recovery Equipment Market is dominated by distillation-based methods, which remain the industry standard due to their robustness and ability to achieve high solvent purity, essential for reuse in sensitive processes. Simple batch distillation units represent the entry-level technology, suitable for small to medium solvent volumes with minimal contamination, prioritizing simplicity and lower capital cost. However, for handling large, complex mixtures requiring fine separation, advanced technologies such as fractional distillation columns are employed. These systems are significantly more complex and energy-intensive but deliver multiple distinct solvent fractions with exceptional purity, critical for industries managing proprietary or high-value multi-component solvents.

A significant trend involves the increasing adoption of vacuum distillation and thin film evaporation (TFE). Vacuum distillation operates at reduced pressures, lowering the boiling points of solvents, which substantially decreases the required energy input and allows for the safe processing of heat-sensitive or high-boiling-point solvents without thermal degradation. This technology is increasingly favored in the automotive and pharmaceutical sectors. TFE, on the other hand, is specifically engineered for processing highly viscous solutions or sludge containing dissolved solids, using a thin layer of solvent spread across a heated surface to rapidly evaporate the volatile components, minimizing residence time and preventing fouling. Both vacuum and TFE technologies address the market need for safer, more energy-efficient, and fouling-resistant solutions compared to traditional atmospheric boiling methods.

Emerging technologies, while currently holding a smaller market share, are rapidly gaining traction, particularly membrane separation and supercritical fluid extraction (SFE). Membrane separation technology offers a non-thermal alternative, utilizing selective polymer or ceramic membranes to separate solvents based on molecular size or chemical affinity, drastically reducing energy consumption compared to phase change methods. SFE uses supercritical carbon dioxide as an extraction solvent, particularly effective for removing high-value active ingredients from waste streams, offering residue-free separation. The future technological trajectory is geared towards hybrid systems combining the efficiency of distillation with the low energy footprint of membrane filtration or the high selectivity of SFE, driven by the overarching industry goals of achieving near-zero environmental impact and maximal resource recovery.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to exhibit the highest growth rate during the forecast period, fueled by rapid industrialization, particularly in chemical processing, pharmaceuticals (especially generic drug manufacturing), and electronics manufacturing in China, India, and South Korea. Government initiatives in countries like China to enforce stricter environmental protection laws regarding water pollution and air quality (VOC emissions) are creating massive demand for compliant recovery infrastructure. The regional market is highly competitive, focusing on scalable, cost-effective solutions capable of handling the diverse waste streams produced by large-scale, often decentralized, manufacturing operations. Investment is typically driven by both regulatory mandate and the economic necessity of recovering high-volume solvents like isopropyl alcohol and acetone used in electronics cleaning.

- North America: North America represents a mature yet robust market, dominating in terms of technological adoption and demand for highly automated, energy-efficient systems. The market growth here is primarily driven by rigorous federal and state regulations (e.g., EPA standards) and the high operational costs associated with hazardous waste disposal. Key end-user sectors include specialty chemicals, aerospace manufacturing, and the large pharmaceutical industry. Customers in this region prioritize safety certifications (e.g., UL, CSA) and require seamless integration with existing industrial automation frameworks (Industry 4.0). Investment is directed towards advanced technologies like vacuum distillation and predictive maintenance systems to ensure maximum uptime and compliance reporting accuracy.

- Europe: Europe holds a strong position, guided by the European Union’s commitment to sustainability and circular economy policies, notably the Industrial Emissions Directive (IED). The market is characterized by a high demand for bespoke solutions tailored for complex, often small-batch, chemical and pharmaceutical processes. Germany, France, and the UK are major contributors, emphasizing resource efficiency and minimized carbon footprints. European manufacturers often lead in the development of modular and compact recovery systems, minimizing installation footprint and energy consumption. The stringent ATEX requirements for explosion protection drive innovation in system design and material selection, maintaining a premium market segment focused on high safety standards.

- Latin America (LATAM): The LATAM market is in an emerging phase, with growth concentrated primarily in Brazil and Mexico, driven by foreign investment in automotive and consumer goods manufacturing. Adoption of solvent recovery equipment is less dictated by proactive environmental legislation and more by internal corporate mandates (set by multinational parent companies) and economic incentives related to solvent import costs. The region presents opportunities for mid-range, reliable, and easy-to-operate batch distillation units suitable for moderate capacity requirements, focusing on essential maintenance and localized support services.

- Middle East and Africa (MEA): The MEA market is small but expanding, primarily associated with the growing petrochemical, specialty chemical manufacturing, and coating industries in the Gulf Cooperation Council (GCC) countries. Growth is uneven, largely concentrated around industrial free zones. Adoption is driven by the need to manage environmental impact locally and secure raw material supply reliability amid global market fluctuations. Equipment procurement often involves large-scale, robust systems for continuous operation in harsh, high-temperature environments, often sourced through international turnkey project providers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Solvent Recovery Equipment Market.- CBG Biotech

- PRI, Inc.

- OFRU Recycling GmbH & Co. KG

- Solvent Recyclers Ltd.

- CETRA, Inc.

- Maratek Environmental Inc.

- SolvTech

- IST Pure

- Clean Planet Chemical

- Dürr Group

- TAIHENG

- Sidra Recycling

- HANKOOK ENG

- RecoChem

- Beccaria Srl

- F.lli Sacchi Srl

- SOTAR, Inc.

- Finnegan's Standard Goods, Inc.

- BHS-Sonthofen GmbH

- A.H. Wyatt

- Thermal Fluid Systems, Inc.

- Kleenair Systems Pvt. Ltd.

Frequently Asked Questions

Analyze common user questions about the Solvent Recovery Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Solvent Recovery Equipment Market?

The primary growth drivers are stringent global environmental regulations, particularly those aimed at reducing Volatile Organic Compound (VOC) emissions, coupled with the increasing operational costs associated with purchasing virgin industrial solvents and disposing of hazardous chemical waste, making in-house recycling economically mandatory.

Which solvent recovery technology is most energy-efficient for heat-sensitive solvents?

Vacuum Distillation is generally the most energy-efficient technology for heat-sensitive solvents. By lowering the operating pressure, it significantly reduces the boiling point of the solvent, requiring less thermal energy input and preventing solvent degradation while maximizing recovery yield.

Which end-user industry holds the largest market share for solvent recovery equipment?

The Pharmaceutical and Biotechnology industry currently holds the largest market share, driven by the critical necessity for closed-loop solvent management to maintain high product purity, prevent cross-contamination, and adhere strictly to Good Manufacturing Practices (GMP) and environmental compliance standards.

How does the integration of AI impact the operational efficiency of solvent recovery units?

AI integration improves operational efficiency primarily through predictive maintenance, minimizing unplanned downtime. Furthermore, AI algorithms dynamically optimize process parameters, such as distillation temperature and reflux ratios, in real-time based on waste stream analysis, leading to significant energy savings and maximized solvent purity.

What is the typical Return on Investment (ROI) period for solvent recovery equipment?

While the ROI period varies based on capacity, solvent type, and usage volume, most industrial solvent recovery systems demonstrate a typical ROI period ranging from 18 to 36 months, driven by substantial savings realized from reduced procurement of new solvents and elimination of high hazardous waste disposal fees.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager