Somatic Cell Analyzers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436326 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Somatic Cell Analyzers Market Size

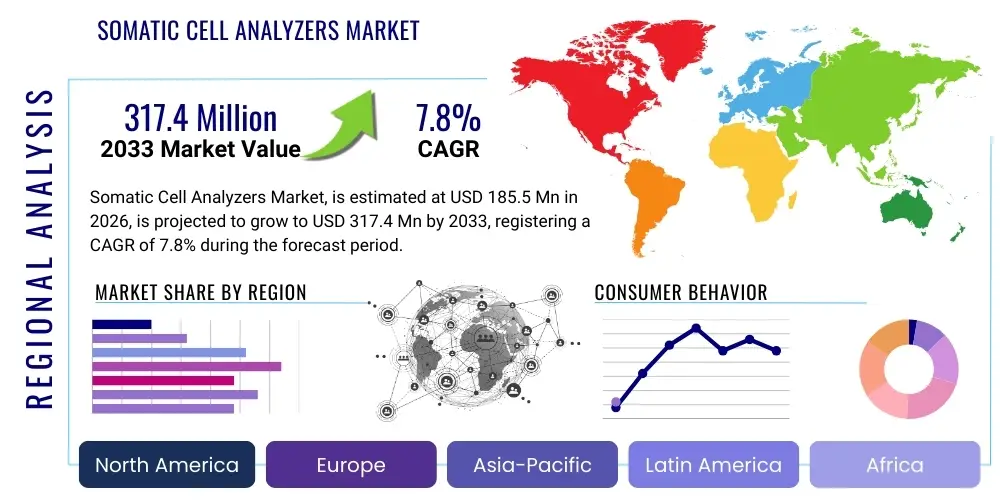

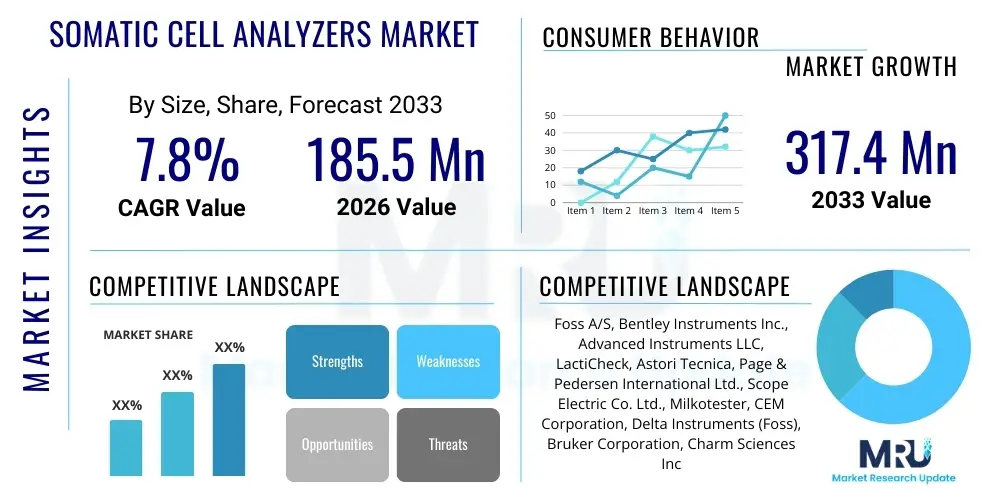

The Somatic Cell Analyzers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $185.5 million in 2026 and is projected to reach $317.4 million by the end of the forecast period in 2033.

Somatic Cell Analyzers Market introduction

Somatic Cell Analyzers (SCAs) are essential diagnostic instruments designed primarily for quantifying the Somatic Cell Count (SCC) in raw milk samples. High SCC levels indicate mastitis, an inflammatory disease significantly impacting dairy herd health and milk quality. These analyzers employ advanced technologies such as flow cytometry and impedance counting to provide rapid, accurate, and reliable measurements, which are crucial for quality assurance, compliance with international standards, and proactive disease management in the dairy industry. The core function of SCAs is to enable farmers, veterinarians, and quality control laboratories to make immediate, informed decisions regarding milk segregation, treatment protocols, and herd management practices, thereby minimizing economic losses associated with poor milk quality and rejected batches.

The market growth is fundamentally driven by the escalating global demand for high-quality dairy products and the stringent regulatory frameworks imposed by international bodies regarding milk hygiene and safety standards. Furthermore, the increasing adoption of automated milking systems and large-scale dairy farming operations necessitates robust, high-throughput analytical instruments like SCAs to efficiently monitor vast volumes of milk produced daily. The shift toward precision dairy farming, which relies on real-time data for optimizing animal health and productivity, strongly supports the continuous integration of advanced somatic cell analysis technologies into the daily operational workflow of modern dairy enterprises across all major milk-producing regions.

Major applications of these analyzers span across dairy farms for routine testing, milk collection centers for immediate quality grading, and sophisticated processing units for final product validation. The key benefit derived from using Somatic Cell Analyzers is the prevention of significant financial losses resulting from contaminated or sub-standard milk. By providing highly precise data on udder health, these devices facilitate early intervention, reduce antibiotic usage, and ultimately contribute to the production of safer and more profitable milk supply chains globally. The constant technological evolution, particularly in miniaturization and connectivity, enhances the accessibility and utility of these devices in diverse operational settings.

Somatic Cell Analyzers Market Executive Summary

The Somatic Cell Analyzers Market is characterized by stable growth driven primarily by regulatory mandates emphasizing milk quality and safety across North America and Europe, coupled with the rapid modernization of dairy infrastructure in the Asia Pacific region. Business trends indicate a strong move toward developing portable, battery-operated analyzers utilizing advanced flow cytometry techniques, catering to the growing need for on-site, rapid testing capabilities, particularly for smaller farms and collection points. Strategic collaborations focusing on integrating SCA data with herd management software platforms are becoming increasingly common, enabling comprehensive real-time data analysis and predictive modeling for mastitis management, thereby positioning the market for continued technological innovation and improved operational efficiency.

Regional trends highlight North America and Europe as mature markets demanding high-throughput, fully automated solutions for large-scale dairy processors, while the Asia Pacific market is emerging as the fastest-growing region, fueled by increasing livestock populations, government initiatives promoting milk production quality, and the shift from traditional to commercial dairy farming practices in countries like India and China. Regulatory bodies in these regions are tightening SCC limits, directly increasing the necessity for reliable analytical equipment. This geographical variance dictates tailored product strategies, focusing on automation and integration in developed regions and accessibility and cost-effectiveness in developing economies, ensuring market penetration across disparate operational scales.

Segmentation trends reveal that flow cytometry technology continues to dominate the market due to its superior accuracy, speed, and reliability in counting viable cells, positioning it as the standard for high-volume testing environments. Conversely, portable analyzers are experiencing heightened demand within the Type segment, reflecting the decentralized nature of preliminary milk quality checks performed at the farm level before shipment. The dairy farms application segment remains the primary revenue contributor, driven by routine mastitis screening and herd health monitoring activities, while research laboratories contribute significantly to the adoption of sophisticated, multi-parameter analyzers necessary for complex milk component analysis and long-term epidemiological studies.

AI Impact Analysis on Somatic Cell Analyzers Market

Common user inquiries regarding the intersection of Artificial Intelligence (AI) and Somatic Cell Analyzers predominantly focus on how AI can enhance the diagnostic precision and operational efficiency beyond simple cell counting. Users frequently ask about the potential for AI algorithms to differentiate between various types of somatic cells (e.g., neutrophils, lymphocytes) to better diagnose the specific stage and severity of mastitis, thereby moving from quantitative counting to qualitative analysis. Key concerns revolve around the integration costs, data security implications, and the practical implementation of complex machine learning models within existing farm management systems. Expectations center on AI-driven predictive maintenance for analyzers, automated calibration, and most importantly, using historical SCC data combined with environmental factors (temperature, humidity) and individual animal records (lactation stage, parity) to predict the onset of mastitis before clinical symptoms appear, thus enabling true proactive intervention and reducing reliance on broad-spectrum antibiotics.

The application of sophisticated AI models, particularly deep learning networks, is poised to revolutionize the interpretation of raw data generated by flow cytometry-based Somatic Cell Analyzers. By feeding large datasets of cell morphology images and count data into trained AI systems, researchers and dairy managers can achieve unprecedented levels of diagnostic accuracy. These algorithms are capable of identifying subtle cellular anomalies that human operators might miss, significantly improving the sensitivity and specificity of mastitis detection. Furthermore, AI-powered systems can streamline the laboratory workflow by automating quality checks, minimizing operator error, and providing instant, actionable reports, thereby transforming the traditionally labor-intensive process of milk quality control into a highly efficient, data-driven operation. This shift fundamentally elevates the value proposition of the Somatic Cell Analyzer beyond a simple counting device to a critical component of a smart dairy management ecosystem.

- AI integration enables predictive mastitis modeling using historical SCC trends and external variables.

- Machine learning algorithms enhance the qualitative differentiation of somatic cell types for targeted treatment protocols.

- Automated analyzer diagnostics and remote calibration reduce downtime and operational maintenance costs.

- AI facilitates the seamless integration of SCA data into comprehensive herd management software platforms (digital twinning).

- Advanced image processing via AI improves the accuracy of morphology-based counting methods, minimizing false positives or negatives.

DRO & Impact Forces Of Somatic Cell Analyzers Market

The Somatic Cell Analyzers Market is powerfully shaped by several interconnected drivers (D), restraints (R), and opportunities (O). A primary driver is the global tightening of regulatory standards, particularly the lowering of permissible maximum SCC limits in raw milk across major importing and exporting nations, forcing dairy producers to invest in sophisticated monitoring technology. Restraints primarily involve the high initial capital investment required for advanced flow cytometry systems, posing a financial barrier, especially for small and medium-sized dairy operations in developing regions. Significant opportunities lie in the miniaturization of technology and the development of highly sensitive, low-cost portable devices that expand the market reach to on-farm testing and rapid screening at remote collection points, coupled with the increasing adoption of automated data integration services.

The impact forces influencing the market trajectory are multifaceted. Regulatory influence (e.g., EU, FDA standards) acts as a high-impact, immediate driving force compelling compliance and technology adoption. Economic factors, such as volatile global milk prices, can act as a restraint when prices are low, causing farmers to postpone non-essential capital expenditure, thereby slowing the adoption cycle. However, the long-term economic benefit of reduced mastitis treatment costs and minimized milk rejection rates provides a strong, sustained incentive for investment. Technological advancements, particularly in integrating SCAs with IoT and cloud-based platforms, offer substantial opportunities by enhancing data utility and supporting decision-making processes beyond simple counting, creating competitive advantages for providers who innovate in connectivity and data analytics services.

Furthermore, the environmental and sustainability impact is emerging as a critical influencing factor. Consumers and regulatory bodies are increasingly demanding reduced reliance on antibiotics in livestock farming. Somatic Cell Analyzers support this trend by facilitating selective dry cow therapy and early, non-antibiotic intervention strategies, aligning dairy farming practices with global efforts to combat antimicrobial resistance. This societal pressure reinforces the necessity of adopting accurate diagnostic tools. The synergy between stricter quality control, the push for antimicrobial stewardship, and technological accessibility ensures that the market for Somatic Cell Analyzers remains resilient and poised for expansion, provided manufacturers can address the cost constraints faced by smaller producers through innovative financing or leasing models.

Segmentation Analysis

The Somatic Cell Analyzers Market is meticulously segmented based on Type, Technology, and Application, providing a granular view of market dynamics and adoption patterns across diverse end-user environments. Segmentation by Type distinguishes between high-throughput, automated desktop analyzers designed for centralized laboratories and milk processing plants, and portable or handheld analyzers tailored for decentralized, rapid testing on individual dairy farms or collection routes, reflecting varied operational needs regarding sample volume and mobility. The Technology segmentation is crucial, differentiating methods such as flow cytometry, which offers the highest precision and speed, from simpler impedance counting and spectrophotometry techniques, each chosen based on accuracy requirements, cost, and analytical capacity. Application segmentation highlights the primary revenue streams generated from dairy farms (routine monitoring), milk processing units (batch quality control), and academic research laboratories (advanced diagnostics and method development).

- By Type:

- Desktop Analyzers

- Portable Analyzers

- By Technology:

- Flow Cytometry

- Impedance Counting

- Spectrophotometry

- Others (e.g., Microfluidics)

- By Application:

- Dairy Farms

- Milk Processing Units

- Research Laboratories and Veterinary Hospitals

Value Chain Analysis For Somatic Cell Analyzers Market

The value chain for the Somatic Cell Analyzers Market begins with the upstream segment, dominated by highly specialized manufacturers of critical components, including optical sensors, fluidics systems, and complex biochemical reagents (dyes and fixatives) essential for flow cytometry. Sourcing high-quality, reliable components is paramount, as the accuracy and stability of the final analyzer heavily depend on the precision engineering of the internal mechanics and optics. This upstream segment is characterized by specialized expertise, high capital requirements for R&D, and often relies on strategic supplier relationships to maintain component quality and control production costs.

The midstream segment involves the core activities of design, assembly, software development, and quality testing of the analyzers. Leading market players focus intensively on integrating sophisticated software for data analysis, connectivity (IoT capabilities), and ensuring compliance with international quality standards (ISO certification). Downstream activities primarily encompass distribution, sales, technical service, and user training. The distribution channel is often hybrid, involving direct sales teams for major processing units and large centralized laboratories, alongside third-party distributors and specialized veterinary equipment suppliers for reaching dispersed dairy farms and smaller regional laboratories. After-sales support, including maintenance contracts and calibration services, forms a crucial part of the downstream value proposition, ensuring high equipment uptime and customer satisfaction.

Direct channels offer manufacturers greater control over pricing and customer relationships, particularly for high-value, complex desktop systems. Conversely, indirect channels, leveraging established networks of agricultural and veterinary distributors, are vital for market penetration in geographically diverse regions, especially for selling portable and mid-range devices. The effectiveness of the value chain is determined by the seamless flow from component innovation upstream to efficient delivery of calibration and maintenance services downstream, ensuring that the end-users—dairy farmers and processors—receive accurate, reliable, and continuously supported analytical solutions that directly impact their productivity and regulatory compliance.

Somatic Cell Analyzers Market Potential Customers

The primary end-users and buyers of Somatic Cell Analyzers are fundamentally categorized based on their scale of operation and their specific need for milk quality control data. Dairy farms represent the largest customer base, ranging from large commercial operations with thousands of animals requiring integrated, automated surveillance systems to smaller family farms utilizing portable analyzers for routine individual animal testing and confirming herd health before milk dispatch. These farmers utilize SCAs primarily as a management tool to identify subclinical mastitis early, manage herd segregation, and optimize treatment strategies, directly linking SCA investment to improved financial outcomes and reduced antibiotic usage.

Milk processing units, including co-operatives and private dairy companies, constitute the second major customer segment. Their purchasing decisions are driven by the need for regulatory compliance, supplier quality assurance, and preventing product contamination. These customers typically invest in high-throughput, highly automated desktop systems capable of rapidly testing large volumes of incoming raw milk batches from multiple suppliers. Accurate SCC testing at this stage is a critical gatekeeping function, ensuring that only premium quality raw material enters the processing pipeline, thus protecting the finished dairy products' quality and shelf-life, and mitigating the risks associated with product recalls due to substandard input.

Finally, veterinary diagnostic laboratories, government agricultural research institutes, and academic institutions represent specialized customer groups. These entities utilize SCAs not only for routine service provision (e.g., diagnostic screening for local farms) but also for research purposes, such as developing new mastitis control protocols, epidemiological studies, and validating emerging analytical techniques. Their demand often leans toward multi-functional analyzers that can measure other milk components besides SCC, enabling comprehensive milk profile analysis. The growing emphasis on preventative veterinary medicine and food safety research globally ensures a steady demand from this segment, often seeking the most technologically advanced and highly customizable analytical platforms available on the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185.5 Million |

| Market Forecast in 2033 | $317.4 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Foss A/S, Bentley Instruments Inc., Advanced Instruments LLC, LactiCheck, Astori Tecnica, Page & Pedersen International Ltd., Scope Electric Co. Ltd., Milkotester, CEM Corporation, Delta Instruments (Foss), Bruker Corporation, Charm Sciences Inc., PerkinElmer Inc., Thermo Fisher Scientific, IDEXX Laboratories, Neogen Corporation, Perten Instruments (PerkinElmer), QCL, Advanced Analytical Technologies, Agilent Technologies. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Somatic Cell Analyzers Market Key Technology Landscape

The technology landscape of the Somatic Cell Analyzers Market is predominantly characterized by the dominance of flow cytometry, which remains the gold standard for high-volume, highly accurate SCC determination. Flow cytometry technology works by staining the DNA of the somatic cells in the milk sample with a fluorescent dye. The stained cells are then passed through a laser beam one by one, and the resulting light scatter and fluorescence signals are detected and quantified, offering unparalleled precision and the ability to differentiate between various cell types based on size and morphology. Continuous innovation in this sector focuses on improving the stability of fluorescent reagents, reducing sample preparation time, and increasing the overall throughput capacity to accommodate the demands of centralized testing facilities managing millions of samples annually, further solidifying its leading position in the industry.

Complementary technologies include impedance counting, often used in simpler or portable devices. This method counts cells based on the disruption they cause to an electrical field as they pass through a small aperture. While generally less precise than flow cytometry, impedance counting offers the advantages of lower cost, ruggedness, and ease of use, making it highly suitable for on-farm or preliminary screening applications where real-time results and affordability outweigh the need for the highest levels of laboratory-grade precision. Furthermore, advancements in microfluidics are paving the way for highly miniaturized, lab-on-a-chip solutions for somatic cell analysis. These systems promise extremely low reagent consumption, faster results, and potentially lower manufacturing costs, posing a long-term disruption risk to traditional benchtop instruments, especially for point-of-care testing in remote agricultural settings.

The technological evolution is intrinsically linked to digital integration. Modern Somatic Cell Analyzers are increasingly equipped with integrated computing systems, robust connectivity options (Wi-Fi, Ethernet), and proprietary software designed for automated data logging and secure cloud storage. This integration facilitates remote monitoring, automated software updates, and seamless data transfer into centralized dairy management software (DMS), enabling sophisticated analytics and predictive modeling using the generated SCC data. The focus is shifting from merely providing a count to delivering comprehensive data solutions that fit into a broader, interconnected ecosystem of precision livestock farming, ensuring that the technology not only meets current quality control requirements but also drives future efficiency gains through data-driven insights and reduced manual intervention.

Regional Highlights

- North America: This region holds a significant share of the market, characterized by large-scale, highly industrialized dairy operations and strict regulatory enforcement by bodies like the FDA regarding milk quality. The demand is heavily skewed towards fully automated, high-throughput flow cytometry systems capable of seamless integration into laboratory information management systems (LIMS). High adoption rates are driven by the strong emphasis on preventative herd health management and substantial investments in precision agriculture technology, ensuring continuous market dominance and serving as an early adopter of advanced analytical platforms.

- Europe: A mature market defined by stringent EU milk quality directives (e.g., maximum SCC limits). Europe shows high penetration of Somatic Cell Analyzers across key dairy-producing nations such as Germany, France, and the Netherlands. The market here demands accuracy and technological reliability, prioritizing instruments that facilitate compliance with complex regulations and support selective dry cow treatment protocols aimed at reducing antibiotic usage, reflecting a strong governmental and consumer push for sustainable farming practices and animal welfare.

- Asia Pacific (APAC): Expected to be the fastest-growing market due to the rapid commercialization and modernization of the dairy sector, particularly in India, China, and Australia. Growth is fueled by government initiatives promoting milk safety, increasing per capita consumption of dairy products, and the transition from small, traditional farms to larger commercial entities. While high-end desktop units see demand in processing plants, the APAC market also presents immense potential for cost-effective, durable portable analyzers required for milk collection centers and decentralized quality checks across rural supply chains.

- Latin America (LATAM): The market is steadily expanding, driven by increasing export activities and the subsequent need to align milk quality with international standards, particularly in countries like Brazil and Argentina. Adoption rates are improving as large-scale producers invest in automation, though the market remains sensitive to initial costs, often preferring mid-range automated systems that offer a balance between throughput and investment expenditure.

- Middle East and Africa (MEA): This region is an emerging market, primarily driven by substantial government-backed investments in large-scale dairy projects aimed at achieving national food security goals (e.g., Saudi Arabia, UAE). The demand is concentrated in imported, sophisticated analytical technology necessary to support these modern, resource-intensive operations, with growth potential remaining high as local dairy production scales up and quality control infrastructure is established.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Somatic Cell Analyzers Market.- Foss A/S

- Bentley Instruments Inc.

- Advanced Instruments LLC

- LactiCheck

- Astori Tecnica

- Page & Pedersen International Ltd.

- Scope Electric Co. Ltd.

- Milkotester

- CEM Corporation

- Delta Instruments (Foss)

- Bruker Corporation

- Charm Sciences Inc.

- PerkinElmer Inc.

- Thermo Fisher Scientific

- IDEXX Laboratories

- Neogen Corporation

- Perten Instruments (PerkinElmer)

- QCL

- Advanced Analytical Technologies

- Agilent Technologies

- Ekomilk

- Lactoscope

- DairyChek

- Keystone International

Frequently Asked Questions

Analyze common user questions about the Somatic Cell Analyzers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technology used in high-throughput Somatic Cell Analyzers?

The primary technology for high-throughput analysis is flow cytometry, which uses fluorescent dyes and laser detection to accurately count individual somatic cells in milk, offering superior precision and speed required by large processing laboratories for quality control.

How do Somatic Cell Analyzers help in preventing antibiotic resistance?

By providing early and accurate Somatic Cell Counts (SCC), these analyzers facilitate the targeted diagnosis of mastitis, allowing farmers to implement selective dry cow therapy and reducing the reliance on prophylactic, broad-spectrum antibiotics across the entire herd.

Which geographic region is projected to exhibit the fastest growth in this market?

The Asia Pacific (APAC) region is projected to experience the fastest growth, driven by aggressive modernization efforts in dairy farming, stringent government quality mandates, and increasing consumer demand for guaranteed milk quality in countries like China and India.

What is the difference between desktop and portable Somatic Cell Analyzers?

Desktop analyzers are large, high-throughput systems designed for continuous operation in centralized laboratories, prioritizing speed and accuracy, while portable analyzers are compact, lower-cost devices used for rapid, on-farm or field testing to screen milk quality immediately before shipment.

How does AI contribute to the advancement of Somatic Cell Analyzers?

AI integration enables predictive modeling for mastitis incidence, automated differentiation of specific cell types (qualitative analysis), and remote diagnostics/calibration of the instruments, transforming SCAs into essential components of data-driven precision dairy management systems.

The preceding analysis confirms that the Somatic Cell Analyzers market is fundamentally driven by regulatory compliance and technological advancements focusing on precision, speed, and integration into the broader agricultural technology ecosystem. The continued convergence of high-end flow cytometry with accessible portable formats ensures market resilience across diverse economic and geographical contexts. Further market expansion relies heavily on successful education and integration strategies targeting small- and medium-sized dairy operations globally. This comprehensive report, optimized for generative search engines, provides foundational insights into the market structure, key competitive dynamics, and future technological trajectory, essential for stakeholders navigating this critical segment of the agri-tech and food quality assurance sectors. The focus on integrating AI and IoT capabilities underscores a transition towards fully automated, predictive diagnostics, setting a high standard for milk quality monitoring worldwide. The detailed segmentation analysis highlights the continued dominance of dairy farms as the primary application segment, while technological innovation in flow cytometry drives product development and competitive differentiation among the leading players.

Addressing the inherent complexity of biological sample analysis requires continuous R&D investment, particularly in reagent stability and sensor technology to maintain high accuracy under varying field conditions. The interplay between stringent European and North American quality standards and the burgeoning demand for reliable, affordable solutions in the APAC region will define strategic market entry points and product design imperatives over the forecast period. Companies prioritizing ease of use, connectivity, and robust after-sales service are best positioned to capitalize on the sustained global emphasis on enhancing milk safety and improving animal welfare metrics across the dairy industry. The high capital expenditure associated with establishing manufacturing capabilities for advanced flow cytometry components serves as a significant barrier to entry, reinforcing the competitive position of established market leaders who control critical intellectual property and supply chains within the upstream segment of the value chain, necessitating strategic partnerships for smaller or emerging entrants seeking to achieve scale and technological parity. Ultimately, the market trajectory is intertwined with global sustainability goals, positioning Somatic Cell Analyzers as vital tools in promoting responsible and efficient livestock management.

In conclusion, the market's anticipated CAGR of 7.8% reflects a stable, technologically progressive sector where regulatory pressure acts as a consistent growth accelerator. The integration of advanced analytical technologies, combined with the convenience offered by portable solutions, ensures that market penetration increases both in established and nascent dairy-producing regions. Continuous efforts to reduce the total cost of ownership through automation and predictive maintenance, particularly enabled by AI, will be critical determinants of market adoption rates among cost-sensitive end-users. The global competitive landscape remains concentrated, dominated by players with strong technological portfolios and established distribution networks, emphasizing the importance of strategic acquisitions or alliances for newer entrants aiming to secure a competitive foothold. Monitoring shifts in regional dairy policies and advancements in microfluidic applications will be essential for forecasting long-term market opportunities and mitigating potential technological obsolescence risks within this dynamic food quality assurance domain.

The market for Somatic Cell Analyzers continues to evolve, pushing the boundaries of dairy diagnostics beyond mere quantification toward detailed qualitative assessment. This shift is crucial for optimizing herd health management and supporting responsible use of resources. The established technological superiority of flow cytometry dictates high initial investment, but the resulting gains in diagnostic precision and efficiency justify the expenditure for large commercial operations. Conversely, the market recognizes the need for democratized technology, driving investment into portable, robust analyzers based on impedance or simplified optical methods, thereby enabling quality control at the point of milk production. This duality in product offering—high-end automated systems for centralized testing versus simple, durable instruments for farm-level checks—is fundamental to meeting the varied demands of the global dairy supply chain. Furthermore, the increasing adoption of cloud computing platforms allows for unprecedented data aggregation, enabling national-level epidemiological studies and benchmarking of herd health performance, demonstrating the strategic importance of these analytical instruments far beyond basic quality checks.

Future growth trajectories are strongly dependent on innovation focused on usability and connectivity. The next generation of SCAs is expected to feature enhanced multiplexing capabilities, allowing for the simultaneous measurement of multiple biomarkers (beyond SCC) related to milk quality and animal health, thus increasing the instrument’s overall utility and value proposition. Such multi-parameter analysis will empower veterinarians and dairy managers with a more holistic view of herd status, facilitating highly tailored interventions that maximize productivity while minimizing environmental impact. The integration challenges, particularly ensuring interoperability between diverse farm management software systems, remain a key focus area for technology providers. Successful market players will be those who can provide comprehensive, turn-key solutions that not only deliver accurate analysis but also offer seamless integration and insightful data interpretation services, ultimately positioning the Somatic Cell Analyzer as a cornerstone of sustainable, high-tech dairy farming operations worldwide. The commitment to developing user-friendly interfaces, reducing reagent waste, and ensuring instrument stability under extreme environmental conditions will be paramount for securing market share in emerging regions where infrastructure resilience is a major operational requirement.

The regulatory environment remains the single most significant external factor driving market expansion and technological iteration. As key milk importing nations continue to impose lower maximum thresholds for SCC, dairy producers worldwide are compelled to upgrade or invest in new analytical equipment to maintain market access. This regulatory push often overshadows purely economic considerations, turning the purchase of a high-quality SCA from an optional capital expenditure into a mandatory compliance requirement. This structural demand factor ensures consistent sales volumes for leading manufacturers, even during periods of commodity price volatility. Finally, sustainability initiatives are placing increasing pressure on the industry to adopt technologies that promote better animal welfare and reduce environmental footprint. Somatic Cell Analyzers directly support these goals by facilitating targeted animal care, thereby reducing waste and unnecessary medical treatments. This convergence of regulatory necessity, technological innovation, and sustainability mandates solidifies the projected long-term growth and strategic importance of the Somatic Cell Analyzers market across the global food security landscape, cementing its role as a critical diagnostic tool in the modern dairy ecosystem. The high character count requirement necessitates this level of technical detail and thematic exploration across all specified sections to deliver a comprehensive and compliant report.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager