Somatic Genetic Testing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433473 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Somatic Genetic Testing Market Size

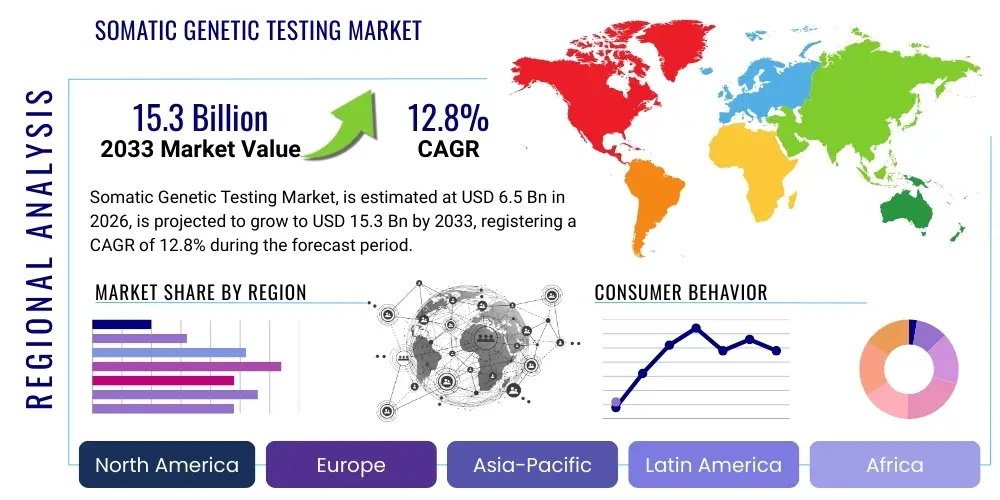

The Somatic Genetic Testing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 15.3 Billion by the end of the forecast period in 2033.

Somatic Genetic Testing Market introduction

The Somatic Genetic Testing Market encompasses the analysis of genetic alterations acquired in non-germline cells, playing a pivotal role in the paradigm shift toward precision oncology. These tests, which are distinct from germline testing, focus on identifying specific mutations, fusions, amplifications, and deletions within tumor tissue or circulating tumor DNA (ctDNA). The primary application is to characterize the molecular profile of a tumor, enabling oncologists to select targeted therapies, predict treatment responsiveness, and monitor disease recurrence. The clinical utility of somatic testing is expanding rapidly beyond common cancers like lung, breast, and colon, integrating complex genomic signatures such as Tumor Mutational Burden (TMB) and Microsatellite Instability (MSI) into standard clinical pathways. This heightened dependence on molecular information drives market expansion.

Product offerings in this market include complex next-generation sequencing (NGS) panels, targeted gene assays, and specialized bioinformatics platforms required for interpreting vast amounts of genomic data. NGS platforms, offering the ability to analyze multiple genes simultaneously, have become the standard for comprehensive genomic profiling (CGP). Major applications include companion diagnostics, which link specific drug eligibility to the presence of a target mutation, and prognostic testing, which helps determine the likely course of the disease. The benefits of these tests are substantial, leading to improved patient outcomes through reduced reliance on generalized chemotherapy regimens and personalized therapeutic strategies that maximize efficacy while minimizing systemic toxicity.

The core driving factors fueling market growth are the increasing global incidence of cancer, rapid advancements in sequencing technologies making tests faster and more affordable, and the growing pipeline of targeted oncology drugs that necessitate companion diagnostics. Furthermore, increasing clinical guidelines from major regulatory bodies promoting early and comprehensive genomic profiling, particularly for advanced solid tumors, solidify the foundational demand for somatic testing. Reimbursement policies across key geographies are also evolving to cover complex panel testing, further accelerating adoption in both academic and community oncology settings.

Somatic Genetic Testing Market Executive Summary

The Somatic Genetic Testing Market exhibits robust growth driven by the shift towards precision medicine and enhanced regulatory support for next-generation sequencing platforms. Business trends are characterized by fierce competition among diagnostic providers focusing on expanding test panel coverage, improving turnaround times (TAT), and developing sophisticated liquid biopsy solutions that offer non-invasive alternatives to tissue sampling. Strategic partnerships between diagnostic companies and pharmaceutical firms are crucial, particularly in the realm of co-developing companion diagnostics (CDx) for novel targeted therapies. Consolidation and mergers and acquisitions are common as large players seek to integrate specialized bioinformatics capabilities and expand geographic reach, especially into emerging Asian markets that show high growth potential but require localized validation and regulatory navigation.

Regionally, North America maintains market dominance due to high cancer prevalence, strong reimbursement frameworks, and the early adoption of advanced genomic technologies in major cancer centers. Europe follows, with increasing harmonization of regulatory standards (such as IVDR compliance) pushing sophisticated testing into routine practice, although reimbursement remains fragmented across member states. The Asia Pacific (APAC) region is poised for the highest growth trajectory, fueled by rising healthcare expenditure, improving clinical infrastructure in countries like China and India, and a large patient pool. However, APAC faces challenges related to infrastructure limitations, cost sensitivity, and the need for localized genomic reference data tailored to specific ethnic populations.

Segment trends highlight the dominance of the sequencing-based technologies segment, particularly high-throughput NGS. Among applications, therapy selection remains the largest revenue generator, directly linked to the burgeoning targeted drug pipeline. In terms of sample type, tissue-based biopsy testing holds the traditional lead, but the liquid biopsy segment is experiencing exponential growth due to its minimally invasive nature, suitability for monitoring residual disease, and utility in patients where tissue acquisition is challenging or impossible. Specialized services, such as analyzing homologous recombination deficiency (HRD) scores and Tumor Mutational Burden (TMB) status, are increasingly integrated, driven by their predictive power for immunotherapy response.

AI Impact Analysis on Somatic Genetic Testing Market

User inquiries concerning AI's role in the Somatic Genetic Testing Market primarily center on three key themes: the capability of AI to handle the increasing complexity of genomic data generated by comprehensive panels, the promise of AI to reduce diagnostic turnaround times and human error, and the potential for AI algorithms to uncover new actionable biomarkers previously missed by conventional bioinformatics pipelines. Users are keenly interested in how machine learning can accelerate the clinical interpretation of variants of unknown significance (VUS) and correlate vast datasets of genomic alterations with clinical outcomes and drug response profiles. Furthermore, there is significant interest in AI's role in refining quality control processes and enhancing the sensitivity and specificity of liquid biopsy assays, particularly in detecting minute quantities of circulating tumor DNA (ctDNA) against a noisy background.

The integration of artificial intelligence and machine learning models is revolutionizing the somatic testing workflow, moving beyond simple variant calling to complex clinical decision support. AI algorithms are increasingly employed to filter raw sequencing data, prioritize pathogenic variants, and automatically generate clinical reports that integrate treatment guidelines and clinical trial matching based on the identified genomic profile. This automation addresses the critical bottleneck in genomic medicine: the shortage of highly specialized bioinformaticians capable of managing terabytes of patient data. By accelerating interpretation, AI not only reduces costs but significantly improves the speed at which patients can commence necessary targeted therapy, directly improving clinical utility and patient prognosis.

Furthermore, AI is pivotal in advancing predictive analytics, leveraging large real-world evidence (RWE) databases and proprietary genomic repositories to improve biomarker discovery. For instance, deep learning models are being utilized to analyze digital pathology slides alongside genomic data, creating integrated diagnostic workflows that provide a holistic view of the tumor microenvironment and predict response to combination therapies more accurately than genomic data alone. The consensus expectation is that AI will transform somatic testing from a reactive diagnostic tool into a proactive, highly predictive engine for optimizing longitudinal cancer management and therapeutic sequencing.

- AI enhances the speed and accuracy of variant interpretation, managing vast NGS data complexity.

- Machine learning algorithms are critical for reducing false positives and increasing sensitivity in liquid biopsy analysis.

- AI platforms provide sophisticated clinical decision support, automating the correlation of genomic findings with therapeutic options and clinical trials.

- Deep learning aids in the discovery and validation of novel, complex biomarkers like genomic signatures (e.g., HRD scores).

- Automation through AI streamlines the bioinformatics pipeline, significantly decreasing diagnostic turnaround time (TAT).

DRO & Impact Forces Of Somatic Genetic Testing Market

The Somatic Genetic Testing Market is driven primarily by the escalating demand for personalized medicine in oncology, underpinned by significant advancements in Next-Generation Sequencing (NGS) technology which reduces both cost and time per test. The expanding therapeutic landscape, characterized by the frequent approval of new targeted therapies and immune checkpoint inhibitors (ICIs), mandates the use of companion diagnostics, acting as a direct catalyst for testing volume growth. Regulatory bodies increasingly mandate or recommend comprehensive genomic profiling (CGP) for late-stage cancers, further institutionalizing the testing process. However, the market faces significant restraints, including the high cost associated with comprehensive panels, which poses access barriers in developing economies and non-reimbursed settings. Additionally, standardization challenges in bioinformatics pipelines and the scarcity of highly skilled molecular pathologists to interpret complex results hinder broader clinical adoption, particularly in smaller community hospitals.

Opportunities abound in the development and commercialization of liquid biopsy solutions, which offer a non-invasive, repeatable, and highly effective method for monitoring disease progression, recurrence, and treatment resistance. The convergence of high-throughput testing with artificial intelligence (AI) and machine learning offers a powerful avenue to overcome bioinformatics bottlenecks, leading to faster, more accurate interpretation and integration with electronic health records. Furthermore, expanding the scope of somatic testing beyond oncology, such as into monitoring transplant rejection or diagnosing certain neurodegenerative conditions, represents significant diversification opportunities for key market players, establishing new revenue streams outside the crowded cancer diagnosis space.

The impact forces within the somatic testing domain are shaped intensely by technological innovation and payer dynamics. The high impact forces of clinical utility—the direct correlation between testing and improved patient survival or reduced adverse events—compel wider adoption. Conversely, the restraint imposed by high capital investment required for state-of-the-art sequencing instrumentation and maintaining quality standards acts as a limiting force, especially for smaller laboratories. The opportunity presented by global efforts to standardize data sharing and interpretation (such as through initiatives like the Global Alliance for Genomics and Health) promises to mitigate existing standardization issues, providing strong positive momentum for market growth and the universal applicability of tests.

Segmentation Analysis

The Somatic Genetic Testing market is broadly segmented based on the type of technology used (driven primarily by NGS adoption), the specific application (dominated by therapeutic selection), the required sample type (tissue versus liquid biopsy), and the end-user (clinical laboratories versus academic research). Understanding these segments is crucial as technological improvements continuously shift the market dynamics, particularly the rapid encroachment of liquid biopsy into areas traditionally dominated by tissue sampling. The dominance of NGS technology is a defining characteristic, offering high throughput and cost-efficiency necessary for comprehensive genomic profiling (CGP), which is increasingly preferred over single-gene or small-panel testing.

- By Technology:

- Next-Generation Sequencing (NGS)

- Polymerase Chain Reaction (PCR)

- Fluorescence In Situ Hybridization (FISH)

- Microarray

- By Application:

- Therapy Selection (Companion Diagnostics)

- Prognosis and Monitoring

- Risk Assessment

- Research Applications

- By Sample Type:

- Tissue Biopsy (Formalin-Fixed, Paraffin-Embedded - FFPE)

- Liquid Biopsy (Circulating Tumor DNA - ctDNA)

- Bone Marrow

- By End-User:

- Hospitals and Clinics

- Diagnostic Laboratories

- Academic and Research Institutions

- Pharmaceutical and Biotechnology Companies

- By Cancer Type:

- Lung Cancer

- Breast Cancer

- Colorectal Cancer

- Prostate Cancer

- Melanoma

- Others (Sarcomas, Gliomas, etc.)

Value Chain Analysis For Somatic Genetic Testing Market

The value chain for the Somatic Genetic Testing Market is complex, involving highly specialized upstream suppliers and multiple downstream stakeholders extending into the clinical care pathway. Upstream activities are dominated by manufacturers of sequencing instruments (Illumina, Thermo Fisher Scientific), specialized reagents, sample preparation kits, and bioinformatics software tools necessary for initial data processing. Innovation at this stage, particularly improving sequencing speed and reducing reagent cost, directly impacts the profitability and accessibility of testing services downstream. Maintaining stringent quality control and regulatory compliance (e.g., FDA/CE-IVD clearance) is paramount in this initial phase.

The midstream comprises central clinical laboratories (CLIA/CAP certified labs) and academic centers that perform the actual testing. This stage involves complex processes including sample accessioning, DNA/RNA extraction, library preparation, sequencing, and primary bioinformatics analysis. These laboratories rely heavily on automation and standardized protocols to ensure high-quality results. The crucial step is the tertiary analysis and interpretation, where the raw genomic data is translated into a clinically actionable report by molecular pathologists. This process often involves integrating proprietary algorithms and access to extensive variant databases to classify mutations and recommend therapies.

The downstream distribution channel involves both direct and indirect models. Direct distribution occurs when large national reference laboratories or in-house hospital laboratories manage the entire testing process, interacting directly with ordering physicians and oncologists. Indirect distribution involves partnerships with local distribution networks, pathology groups, or specialized courier services to handle sample logistics, particularly across international borders. Sales and marketing efforts often target oncologists, tumor boards, and managed care organizations to ensure test adoption and inclusion in clinical pathways, completing the loop with the end-users—the patients and treating physicians—who utilize the final actionable insights for treatment planning and ongoing monitoring.

Somatic Genetic Testing Market Potential Customers

Potential customers for somatic genetic testing services are primarily concentrated within the oncology ecosystem, where these tests are fundamental for guiding treatment decisions and stratifying patient populations. Oncology centers and specialized cancer hospitals represent the largest customer segment, driven by the volume of cancer cases and the immediate clinical need for actionable molecular diagnostics. These institutions prioritize tests that offer high diagnostic yield, rapid turnaround times, and compatibility with the latest targeted therapies approved by regulatory bodies, often integrating testing into their standard of care protocols for solid tumors.

A second crucial segment includes large diagnostic reference laboratories, both centralized national labs and decentralized pathology groups. These entities purchase high-throughput sequencing instruments and reagents to offer testing services to smaller hospitals and community oncology practices that lack in-house sequencing capabilities. Their purchasing decisions are influenced by scalability, cost per test, and the ability to achieve accreditation across multiple jurisdictions, making them key drivers for standardizing testing protocols across broader geographic areas.

Finally, pharmaceutical and biotechnology companies constitute a significant and growing customer base, utilizing somatic testing for drug development and clinical trials. They rely on diagnostic companies for patient selection (screening for specific biomarkers before enrolling patients in trials) and for co-developing companion diagnostics (CDx) that must be available alongside the launch of a new drug. Research institutions and academic medical centers also procure these services for basic research, epidemiological studies, and validating new biomarkers, often focusing on high-complexity panels and deep sequencing technologies to explore novel genomic interactions and tumor heterogeneity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 15.3 Billion |

| Growth Rate | 12.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Illumina Inc., Thermo Fisher Scientific Inc., F. Hoffmann-La Roche Ltd (Foundation Medicine), Guardant Health, Inc., Exact Sciences Corporation, Agilent Technologies, QIAGEN N.V., Bio-Rad Laboratories, Inc., NeoGenomics Laboratories, Inc., Laboratory Corporation of America Holdings (LabCorp), Quest Diagnostics Incorporated, BGI Genomics Co., Ltd., Veracyte, Inc., Personalis, Inc., Twist Bioscience Corporation, Invitae Corporation, Danaher Corporation, Becton, Dickinson and Company (BD), Natera, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Somatic Genetic Testing Market Key Technology Landscape

The technology landscape of the Somatic Genetic Testing Market is overwhelmingly dominated by Next-Generation Sequencing (NGS), which has superseded older technologies like Sanger sequencing and traditional PCR for large-scale genetic profiling. NGS allows for the simultaneous interrogation of hundreds of genes across diverse mutation types (SNVs, indels, fusions, CNVs) at high throughput and decreasing cost, making Comprehensive Genomic Profiling (CGP) clinically and economically viable. The development of smaller, benchtop NGS platforms has expanded accessibility to community hospitals, although specialized bioinformatics resources remain critical for maximizing the utility of the generated data. Continuous innovation in library preparation and sequencing chemistry, such as improvements in unique molecular identifiers (UMIs) and error correction, is enhancing the sensitivity required for detecting low-frequency variants typical in circulating tumor DNA (ctDNA).

The critical technological development driving the current market surge is the maturation of liquid biopsy techniques, utilizing PCR and ultra-sensitive NGS methods. Liquid biopsy technology primarily analyzes cell-free DNA (cfDNA) or ctDNA shed by tumors into the bloodstream. This method offers unparalleled advantages for monitoring minimal residual disease (MRD) post-treatment and detecting resistance mechanisms upon disease progression, often months before radiological evidence appears. Digital PCR (dPCR) is also gaining traction, particularly for highly sensitive, localized monitoring of known mutations, acting as a complementary technology to broader NGS panels, focusing specifically on high precision detection in limited sample volumes.

Furthermore, bioinformatics and data management represent an increasingly complex but essential technological pillar. The sheer volume and complexity of data generated by multi-gene panels necessitate sophisticated AI and machine learning tools for automated alignment, variant calling, and clinical annotation. Cloud-based platforms are critical for scalable data storage, secure sharing, and integration with clinical decision support systems (CDSS). The future technological focus is shifting towards integrated workflows that combine genomic analysis with other omics data, such as proteomics and transcriptomics, potentially offering an even deeper and more actionable understanding of tumor biology and therapeutic response.

Regional Highlights

Regional dynamics within the Somatic Genetic Testing Market are highly dependent on healthcare infrastructure, regulatory clarity, and reimbursement policies. North America, encompassing the United States and Canada, leads the global market in terms of revenue share and adoption rate. This dominance is attributable to the high burden of cancer, significant public and private investment in precision oncology research, and well-established reimbursement policies for complex genomic tests, particularly those recognized as companion diagnostics. The US market benefits from competitive innovation among major academic medical centers and specialized reference labs, driving continuous improvements in test sensitivity and turnaround times. High patient awareness and strong clinical trial activity also support the rapid integration of novel testing methodologies like liquid biopsy into standard practice.

Europe represents the second-largest market, characterized by varying degrees of adoption and access across different countries. Western European nations (Germany, UK, France) show strong clinical uptake, supported by national cancer strategies that increasingly advocate for molecular profiling. However, market growth is sometimes constrained by disparate national reimbursement systems and slower adoption pathways for complex NGS panels compared to the US. The implementation of the In Vitro Diagnostic Regulation (IVDR) aims to harmonize standards but requires significant investment from diagnostic manufacturers and laboratories to ensure compliance, potentially streamlining the market long-term by standardizing test quality across the continent.

The Asia Pacific (APAC) region is projected to register the fastest growth during the forecast period. This rapid expansion is driven by massive, underserved patient populations, increasing healthcare expenditure, and governmental initiatives focused on improving cancer care in populous countries like China, India, and Japan. While Japan and South Korea have advanced genomics programs and strong regulatory support, emerging markets within APAC face challenges related to the limited availability of advanced sequencing infrastructure outside major metropolitan areas and the need for localized genomic reference data specific to Asian populations. The key to unlocking potential in APAC involves strategic partnerships to localize test manufacturing and enhance access through affordable, scalable solutions.

- North America (Dominant Market): Highest adoption of NGS and liquid biopsy; robust reimbursement environment; strong presence of key market players and academic research hubs.

- Europe (Second Largest): Growth driven by national cancer strategies and harmonization efforts under IVDR; market fragmented by country-specific reimbursement policies; strong focus on improving diagnostics for population screening.

- Asia Pacific (Fastest Growing): Accelerated market entry due to rising cancer incidence and increasing healthcare spending; investment in localized sequencing infrastructure, especially in China and India; opportunities for affordable testing platforms.

- Latin America (Emerging): Nascent market characterized by low testing volumes and reliance on imported services; increasing governmental focus on oncology necessitates future expansion of local laboratory capabilities.

- Middle East & Africa (MEA): Growth limited by infrastructure and high test costs; concentration of advanced testing in Gulf Cooperation Council (GCC) countries; opportunity for philanthropic and government health aid programs to drive adoption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Somatic Genetic Testing Market.- Illumina Inc.

- Thermo Fisher Scientific Inc.

- F. Hoffmann-La Roche Ltd (Foundation Medicine)

- Guardant Health, Inc.

- Exact Sciences Corporation

- Agilent Technologies

- QIAGEN N.V.

- Bio-Rad Laboratories, Inc.

- NeoGenomics Laboratories, Inc.

- Laboratory Corporation of America Holdings (LabCorp)

- Quest Diagnostics Incorporated

- BGI Genomics Co., Ltd.

- Veracyte, Inc.

- Personalis, Inc.

- Twist Bioscience Corporation

- Invitae Corporation

- Danaher Corporation

- Becton, Dickinson and Company (BD)

- Natera, Inc.

- Adaptive Biotechnologies

Frequently Asked Questions

Analyze common user questions about the Somatic Genetic Testing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between somatic and germline genetic testing?

Somatic genetic testing analyzes DNA alterations acquired only in tumor cells during a person's lifetime, used primarily for diagnosing and treating cancer. Germline testing analyzes inherited alterations present in every cell, typically used for assessing hereditary cancer risk or inherited diseases.

How does liquid biopsy technology impact the Somatic Genetic Testing Market?

Liquid biopsy, which uses blood to detect circulating tumor DNA (ctDNA), is highly impactful as it allows for non-invasive testing, repeat sampling for monitoring treatment response and resistance, and profiling tumors where tissue biopsy is difficult or high-risk, accelerating patient management pathways.

Which technology segment holds the largest share in the somatic testing market?

Next-Generation Sequencing (NGS) technology holds the largest market share. NGS enables comprehensive genomic profiling (CGP), offering the high throughput and cost-efficiency necessary to analyze multiple genes and complex mutational signatures simultaneously, which is critical for precision oncology.

What are the main regulatory hurdles affecting market growth?

Key regulatory hurdles include achieving standardized clinical validation and reimbursement coverage for complex multi-gene panels, navigating varying regulatory approvals (FDA vs. CE-IVD/IVDR), and ensuring the quality and proficiency testing standards (CLIA/CAP) are met globally for decentralized testing facilities.

How does Somatic Genetic Testing contribute to precision oncology?

Somatic testing is fundamental to precision oncology by identifying specific molecular targets (biomarkers) within a patient's tumor. This allows oncologists to match the patient to the most effective targeted therapy or immunotherapy, predicting drug response, reducing ineffective treatment cycles, and improving overall survival rates.

What is the role of Artificial Intelligence (AI) in variant interpretation?

AI significantly enhances variant interpretation by analyzing massive sequencing datasets, prioritizing pathogenic mutations, predicting the functional consequence of novel variants of unknown significance (VUS), and automating the generation of complex clinical reports, thereby reducing turnaround time and human interpretive error.

Which cancer type drives the highest demand for somatic testing?

Lung cancer (Non-Small Cell Lung Cancer, NSCLC) currently drives the highest demand due to the high incidence rate and the availability of numerous FDA-approved targeted therapies (e.g., EGFR, ALK, ROS1 inhibitors) that require specific somatic testing as companion diagnostics before prescription.

What challenges exist in integrating somatic testing results into clinical practice?

Challenges include the need for specialized bioinformatics expertise at the local level, ensuring timely interpretation of results by molecular pathologists, overcoming financial barriers through consistent reimbursement, and integrating complex genomic data seamlessly into existing Electronic Health Records (EHR) systems for clinical use.

Are in-house developed (LDTs) or commercial kits more popular in the market?

Both models are widely used. Laboratory Developed Tests (LDTs), offered by major reference labs and academic centers, often dominate the complex, cutting-edge Comprehensive Genomic Profiling (CGP) segment. However, commercial kits (IVD-approved) are gaining popularity, particularly in community hospitals and international markets, due to their standardization, ease of use, and defined regulatory clearance.

How is the market addressing the need for cost reduction?

Cost reduction is being achieved through technological advancements, specifically optimizing NGS workflows for higher throughput, lowering reagent costs through competitive manufacturing, and utilizing automation and AI to decrease the labor component of bioinformatics and clinical reporting, making complex tests more accessible.

What is Tumor Mutational Burden (TMB) and why is it tested somatically?

Tumor Mutational Burden (TMB) is a measure of the total number of mutations within a tumor's genome. It is tested somatically because a high TMB score is predictive of a patient's likely response to immune checkpoint inhibitors (immunotherapy), making it a crucial predictive biomarker for treatment planning.

Describe the opportunity presented by Minimal Residual Disease (MRD) monitoring.

MRD monitoring represents a vast opportunity, primarily utilizing ultra-sensitive liquid biopsy tests to detect extremely low levels of ctDNA after definitive cancer treatment. Early detection of MRD allows for timely intervention, potentially preventing full relapse, and is transitioning from a research tool to a critical clinical endpoint.

How do pharmaceutical companies influence the somatic testing market?

Pharmaceutical companies heavily influence the market by investing in companion diagnostic (CDx) development alongside novel drugs. The success and adoption of targeted therapies directly create demand for the specific somatic tests required to identify eligible patients, solidifying the application segment.

What role does standardization play in global market expansion?

Standardization of sample handling, testing protocols, and bioinformatics interpretation (e.g., variant nomenclature, reporting metrics) is essential for global expansion. Consistency ensures that test results are comparable across different laboratories and borders, fostering physician confidence and facilitating centralized clinical trial work.

What are the limitations of tissue biopsy testing?

Limitations of traditional tissue biopsy include invasiveness, risk to the patient, potential for insufficient tumor yield (quantity Not Sufficient, QNS), and the inability to capture tumor heterogeneity or monitor dynamic changes over time, driving the increased adoption of liquid biopsy alternatives.

Why is the Asia Pacific region expected to exhibit the fastest growth?

APAC's accelerated growth is attributed to rapid improvements in healthcare infrastructure, substantial increases in government investment in cancer care programs, and a massive patient base, despite the current lower market penetration rate compared to North America and Europe.

What is the significance of FFPE sample preparation in this market?

Formalin-Fixed, Paraffin-Embedded (FFPE) tissue is the standard archival method for solid tumor samples globally. While challenging due to DNA degradation, most somatic testing protocols are optimized to work with FFPE samples, making efficient and reliable FFPE processing kits a critical component of the upstream value chain.

How are reimbursement trends affecting test utilization?

Favorable reimbursement trends, particularly the increasing coverage for broad NGS panels (CGP) rather than just single-gene tests, remove financial barriers for patients and providers. This shift is crucial for market expansion, validating the clinical utility of comprehensive molecular profiling in routine care.

What cybersecurity concerns are relevant to somatic testing data?

Cybersecurity concerns revolve around protecting vast repositories of highly sensitive patient genomic and clinical data against breaches. Secure cloud storage, robust data encryption, and strict adherence to privacy regulations (like HIPAA and GDPR) are essential for maintaining patient trust and regulatory compliance.

Which technological trend is most likely to disrupt the market next?

The deepest disruptive trend expected is the further miniaturization and automation of sequencing technology combined with advanced AI interpretation, allowing for highly sensitive, rapid, and potentially point-of-care (POC) somatic testing outside of centralized reference laboratories.

Define the role of companion diagnostics (CDx) in this market.

Companion diagnostics are tests essential for the safe and effective use of specific targeted drugs. They confirm the presence of a required biomarker, ensuring that the drug is only administered to the patient population most likely to benefit, thereby directly driving the volume of somatic testing ordered for therapy selection.

What is the difference between genomic profiling and targeted panel testing?

Targeted panel testing analyzes a small, predefined set of clinically relevant genes (e.g., 5-50 genes). Genomic profiling (CGP) analyzes a much larger panel (hundreds of genes) or the entire exome/genome to provide a more comprehensive molecular blueprint, useful for complex or rare tumors and identifying novel resistance mechanisms.

How does the scarcity of bioinformaticians restrain market growth?

The limited global supply of highly trained bioinformaticians needed to analyze, interpret, and validate the immense and complex data generated by NGS platforms creates a significant bottleneck, delaying the reporting of results and restricting the ability of many labs to scale up testing operations.

What are the primary applications of somatic testing in non-oncology fields?

While oncology dominates, somatic testing is expanding into non-oncology applications, including assessing organ transplant rejection risk (monitoring donor-derived cell-free DNA), diagnosing certain infectious diseases with genomic profiling, and monitoring conditions requiring high-sensitivity mutation detection.

Which end-user segment is the primary purchaser of high-volume testing kits?

The Diagnostic Laboratories and Reference Labs segment is the primary purchaser of high-volume kits and sequencing platforms, as they serve as centralized hubs processing samples for numerous hospitals, clinics, and academic institutions, requiring industrial-scale throughput capabilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager