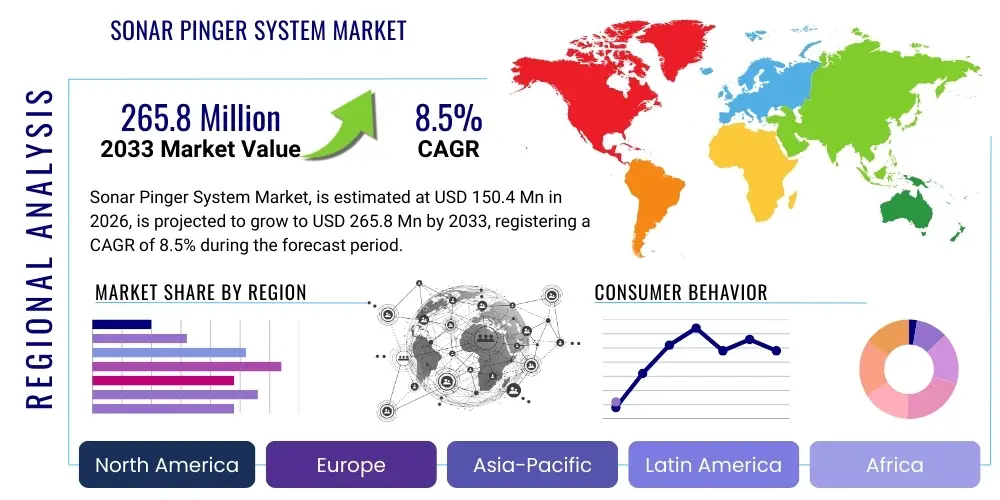

Sonar Pinger System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437761 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Sonar Pinger System Market Size

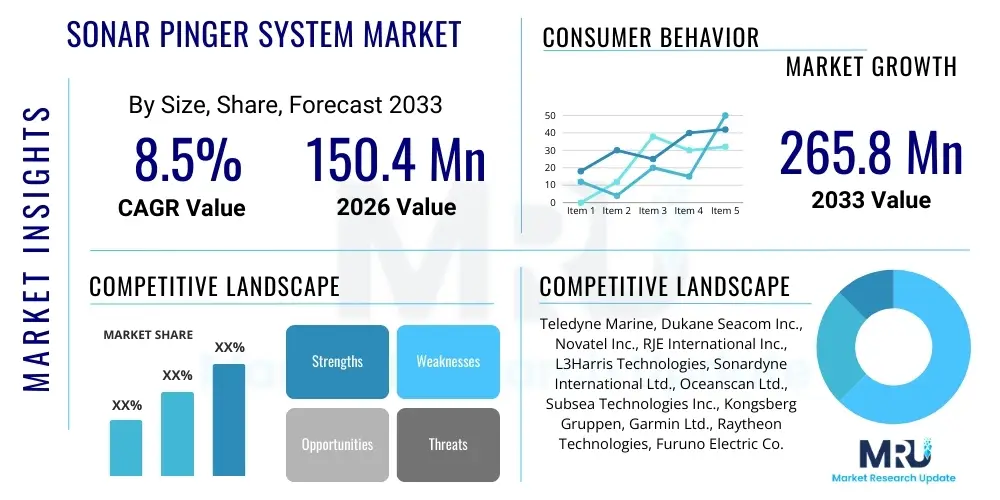

The Sonar Pinger System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 150.4 million in 2026 and is projected to reach USD 265.8 million by the end of the forecast period in 2033. This consistent expansion is primarily driven by rigorous international regulatory mandates regarding maritime and aviation safety, requiring mandatory installation of underwater locating devices (ULDs) on flight recorders and other critical submerged assets. The increasing complexity of deep-sea operations and the rising number of commercial aircraft requiring updated tracking technology further solidify this growth trajectory.

Sonar Pinger System Market introduction

The Sonar Pinger System Market revolves around the manufacturing, deployment, and servicing of acoustic transmitting devices designed to aid in the location and recovery of underwater assets, most notably aircraft flight recorders (FDRs and CVRs) after an incident at sea. These systems, often referred to as Underwater Locator Beacons (ULBs) or pingers, emit specific, high-frequency ultrasonic pulses (typically around 37.5 kHz) that are detectable by specialized towed pinger locators (TPLs) or hydrophones used by search and recovery teams. The core product is essential for forensic analysis following aviation disasters, providing crucial data for accident investigation boards globally. The operational parameters, including battery life (mandated usually for 30 or 90 days) and transmission specifications, are strictly governed by international bodies such as the International Civil Aviation Organization (ICAO).

Major applications of sonar pinger systems extend beyond commercial aviation to include military maritime applications, tracking Remotely Operated Vehicles (ROVs), locating deep-sea scientific instruments, and ensuring the retrievability of specialized subsea equipment utilized in the offshore oil and gas industry. The key benefit provided by these devices is the rapid reduction of the search radius during critical recovery phases, dramatically improving the chances of retrieving vital evidence before deep-sea currents or physical damage compromise the integrity of the data recorders. Driving factors for market growth include the global expansion of commercial air travel, mandatory replacement cycles for older pinger batteries, and increasing regulatory pressure to extend transmission duration and increase detection range, particularly following high-profile disappearance incidents that highlighted limitations in existing 30-day battery standards.

Furthermore, technological advancements are consistently pushing the boundaries of traditional pinger capabilities, incorporating features such as wider acoustic beam patterns, improved pressure resistance for extreme depths, and integration with secondary positioning technologies like GPS buoys, although the primary functionality remains the emission of a distinct acoustic pulse. The formal integration of extended-life pingers, such as those meeting the 90-day requirement, into the global fleet upgrade cycle represents a significant, long-term driver. This mandatory technological refresh ensures continued demand for high-reliability, certified sonar pinger units, fostering stable growth within a highly regulated but essential niche of the aerospace and maritime safety sectors.

Sonar Pinger System Market Executive Summary

The Sonar Pinger System Market is characterized by high barriers to entry, driven primarily by stringent international certification requirements and the criticality of product reliability in life-saving and forensic applications. Key business trends indicate a strong focus on research and development aimed at extending pinger battery longevity, increasing acoustic output power without compromising size, and developing combined systems that integrate both acoustic and satellite-based tracking functionalities to enhance asset recovery efficacy. Consolidation among specialized acoustic equipment manufacturers is also observed, as companies seek economies of scale and broader geographical reach to service major global aircraft manufacturers (OEMs) and Maintenance, Repair, and Overhaul (MRO) facilities. Regulatory compliance deadlines, particularly ICAO’s push for 90-day minimum transmission duration on new aircraft installations, are fueling significant market activity, driving upgrades and new procurements.

Regional trends demonstrate North America and Europe maintaining leadership, largely due to the presence of major aviation regulatory bodies, high concentrations of tier-one aircraft OEMs, and advanced naval and marine research activities requiring precise tracking capabilities. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth, propelled by the rapid expansion of commercial air fleets, substantial investments in maritime surveillance capabilities by emerging economies, and the growing offshore exploration sector. Regulatory harmonization efforts across disparate regions are standardizing product requirements, streamlining supply chains, but simultaneously increasing the complexity of obtaining universal certification. The demand in Latin America and the Middle East & Africa (MEA) is closely tied to fleet modernization programs and enhanced search and rescue (SAR) capabilities investments.

Segmentation trends highlight the dominance of the Aircraft segment due to mandatory compliance, although the demand for specialized Deep-Sea Research and Offshore Energy pingers is also growing steadily, driven by increasing depths of operation and the high value of submerged assets. Within the Technology segment, the transition towards longer-duration pingers (90-day) is the most impactful trend, rapidly displacing older 30-day technology in new installations and large retrofit programs. Furthermore, the market for ancillary equipment, such as acoustic releases and high-sensitivity hydrophones used for detection, is expanding correlatively, indicating a holistic growth pattern where the market benefits from both mandatory equipment sales and necessary supporting infrastructure required for successful recovery operations.

AI Impact Analysis on Sonar Pinger System Market

Common user questions regarding AI’s impact on the Sonar Pinger System Market often revolve around two key themes: how AI can improve the detection efficiency and accuracy of existing pinger signals, and whether AI could eventually replace traditional acoustic pingers with smarter, predictive tracking systems. Users are concerned about optimizing search grids, particularly in challenging underwater environments where signal scattering or noise interference is high. They also inquire about AI's potential in predictive maintenance for pinger systems, ensuring reliability before deployment. The consensus expectation is that while AI will not replace the fundamental requirement for a mandated acoustic signal, it will dramatically enhance the operational effectiveness of the recovery phase by optimizing the use of towed pinger locators (TPLs), filtering ambient noise, and modeling signal propagation to significantly reduce search times and operational costs, thereby transforming the downstream application of pinger technology rather than the product itself.

- AI-driven optimization of Towed Pinger Locator (TPL) search algorithms, reducing overall search time by modeling acoustic signal dispersion based on bathymetry and hydrodynamics.

- Enhanced signal processing capabilities using machine learning (ML) to filter out ambient ocean noise, improving the signal-to-noise ratio and increasing the effective detection range of existing pingers.

- Predictive maintenance analytics for pinger battery health and operational status, utilizing historical data to forecast potential failures and ensure compliance reliability prior to installation.

- Integration of AI into Autonomous Underwater Vehicles (AUVs) and Unmanned Surface Vessels (USVs) equipped with hydrophones, allowing for adaptive, smart search patterns in real-time without constant human intervention.

- Development of advanced visualization tools using AI to map potential pinger locations, incorporating variables such as drift rate, current speed, and known debris field data for more accurate hypothesis generation during recovery operations.

DRO & Impact Forces Of Sonar Pinger System Market

The dynamics of the Sonar Pinger System Market are fundamentally shaped by the interplay between regulatory urgency, technological necessity, and inherent operational constraints. The primary drivers are mandatory global aviation safety regulations, specifically ICAO and EASA directives, which require certified pingers on all commercial flight recorders and enforce specific upgrade timelines (such as the shift to 90-day battery life). These regulatory mechanisms create a non-discretionary demand floor. Opportunities lie in developing multi-function beacons that combine acoustic pulsing with satellite transmission capabilities upon surfacing, offering redundant location strategies. Conversely, significant restraints include the extremely high cost and long lead times associated with achieving international certification (TSO/ETSO), limiting market participation, and the physical constraints related to battery technology limitations regarding energy density, which governs pinger endurance and size.

Impact forces in this niche market are exceptionally strong, driven mainly by the high-stakes consequences of system failure. A major aviation incident resulting in unrecoverable flight recorders instantly magnifies regulatory scrutiny and accelerates the implementation of stricter pinger standards (e.g., the pressure for increased depth tolerance or longer battery life). This regulatory impact force overrides typical economic cycles. Additionally, technological impact forces are pushing manufacturers to innovate materials science for corrosion resistance and acoustic performance, ensuring the pinger remains functional in the harsh deep-sea environment. The inherent dependency of the market on a few key suppliers capable of meeting military-grade reliability standards further concentrates the impact of supply chain disruptions or competitive maneuvers.

Ultimately, the market trajectory is less dependent on price elasticity and more dependent on mandates and the public perception of safety. The core impact force remains the legal requirement to minimize the time between an incident and the recovery of forensic evidence. This mandates continuous improvement in detection probability. Restraints, primarily technical certifications and battery life limitations, force manufacturers into capital-intensive R&D cycles. Successful navigation of these forces determines market leadership, favoring entities with deep technical expertise, robust quality control systems, and strong lobbying influence with key regulatory bodies globally.

Segmentation Analysis

The Sonar Pinger System Market is segmented based on the type of asset requiring tracking (Application), the required duration of acoustic transmission (Endurance), and the specific type of technology used. This segmentation helps to delineate distinct product requirements and market demands. The Application segmentation is crucial, differentiating between the high-volume, mandatory needs of commercial aviation versus the specialized, deep-rated needs of maritime military and scientific exploration sectors. Each segment adheres to differing operational specifications regarding pressure tolerance, attachment methods, and acoustic signature. The highly structured nature of international regulation means that product compliance is the primary determinant of segment market share.

The Endurance segment, comprising 30-day and 90-day systems, reflects the most dynamic growth area, driven by the ongoing regulatory transition mandating the phase-out of 30-day battery life for new installations. This mandatory upgrade cycle ensures sustained high-value demand for the higher endurance systems across all global fleets. Furthermore, the segmentation by Technology Type, typically separating standard acoustic pingers from advanced integrated systems (which may include GPS or radio components for surface detection), illustrates the gradual technological diversification aimed at providing comprehensive search solutions. Though acoustic pingers remain the core mandatory requirement, integrated systems capture premium pricing and cater to high-value military or deep-sea assets where recovery assurance is paramount.

Analyzing these segments provides clarity for manufacturers regarding R&D investment prioritization, particularly focusing on miniaturization, enhanced power efficiency, and certification compliance tailored to specific regional regulatory bodies. For instance, manufacturers focusing heavily on the Aviation segment must prioritize ICAO and FAA/EASA certification above all else, while those targeting the Offshore segment must focus on certifications related to hazardous environments and extreme depth ratings. This highly specific demand structure dictates specialized product lines and distribution strategies to meet diverse global safety requirements.

- By Application:

- Commercial Aviation

- Military Maritime & Naval

- Deep-Sea Research & Scientific

- Offshore Oil & Gas (Subsea Equipment Tracking)

- By Endurance (Battery Life):

- 30-Day Systems

- 90-Day Systems (Extended Life)

- Custom Longer Duration Systems (Non-Standard)

- By Technology Type:

- Standard Acoustic Pinger (ULB)

- Acoustic Release Pinger Systems

- Integrated Acoustic & Radio/GPS Beacons

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Sonar Pinger System Market

The value chain for the Sonar Pinger System Market is characterized by a high degree of specialization and strict quality control requirements from raw material sourcing through to final deployment and maintenance. Upstream analysis focuses heavily on the procurement of high-performance components, primarily specialized lithium battery cells (must maintain power output stability under extreme pressure and temperature variations), piezoelectric transducers (critical for efficient acoustic transmission), and specialized, corrosion-resistant housing materials (often titanium or high-grade stainless steel). Because reliability is non-negotiable, the relationship between pinger manufacturers and certified component suppliers is highly integrated and subject to rigorous inspection and auditing processes to ensure compliance with aviation safety standards, leading to elevated raw material costs compared to general electronics manufacturing.

Midstream activities involve sophisticated manufacturing, assembly, and rigorous testing. The primary value-add here is precision assembly within controlled environments and the lengthy, expensive process of official certification (e.g., TSO, ETSO) by multiple international regulatory bodies. This certification bottleneck acts as a strong competitive moat, ensuring only a few established players can legally participate. Distribution channels are typically specialized: Direct sales are common for high-volume orders placed by major aircraft OEMs (e.g., Boeing, Airbus) and tier-one defense contractors, ensuring direct integration support and quality oversight. Indirect channels, primarily specialized aerospace and marine electronics distributors, and Maintenance, Repair, and Overhaul (MRO) facilities, handle the retrofit market, smaller fleet operators, and periodic battery replacement cycles.

Downstream analysis involves the installation, periodic testing, and mandated replacement of the ULB units (often tied to a specific expiry date or operational cycle, such as every six years for battery replacement). MRO service providers play a pivotal role in ensuring that installed pingers remain compliant and operational, generating a continuous revenue stream independent of new aircraft deliveries. The entire value chain is fundamentally driven by compliance; therefore, efficiency in certification management and adherence to mandated replacement schedules are key performance indicators. The tight coupling between manufacturers and regulatory bodies streamlines the process but limits flexibility and heavily favors entrenched relationships.

Sonar Pinger System Market Potential Customers

The potential customer base for the Sonar Pinger System Market is primarily concentrated within sectors where regulatory compliance dictates mandatory underwater location technology for safety or asset recovery purposes. The most dominant end-users are commercial airlines globally, spanning major flag carriers, regional operators, and cargo airlines, all mandated to install and maintain certified ULBs attached to cockpit voice and flight data recorders (FDR/CVR). The necessity for periodic replacement of these certified devices ensures a stable, recurring demand from this segment, driven not by choice, but by international legal obligations. Furthermore, aircraft manufacturers (OEMs) represent primary customers for initial system integration into new aircraft builds.

Another major segment encompasses military and government maritime organizations, including naval forces, coast guards, and marine search and rescue agencies. These entities require pingers for tracking high-value, sensitive assets such as submarines, drones, specialized surveillance equipment, and expendable ordnance testing systems. Their purchasing decisions prioritize extreme reliability, deep-water rating, and compatibility with proprietary acoustic detection systems. Unlike commercial aviation, military demand often involves specialized, custom-designed pingers with classified features, providing a separate, high-margin revenue stream for market participants.

Finally, specialized commercial sectors, including deep-sea scientific research institutions, oceanographic surveyors, and offshore energy companies (involved in deep-water drilling and pipeline monitoring), constitute growing end-user groups. These customers utilize pingers and acoustic releases to precisely locate and retrieve scientific sensors, seismic arrays, and complex subsea hardware. For these users, the value proposition lies in preventing the catastrophic loss of multi-million dollar assets deployed in inaccessible environments. The purchasing decision here is guided by maximum depth rating, extended operational life, and integration compatibility with existing vessel infrastructure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 150.4 Million |

| Market Forecast in 2033 | USD 265.8 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Teledyne Marine, Dukane Seacom Inc., Novatel Inc., RJE International Inc., L3Harris Technologies, Sonardyne International Ltd., Oceanscan Ltd., Subsea Technologies Inc., Kongsberg Gruppen, Garmin Ltd., Raytheon Technologies, Furuno Electric Co. Ltd., Edo Corporation, Saab AB, Precision Navigation Inc., General Dynamics Mission Systems, Honeywell International Inc., Northrop Grumman Corporation, Thales Group, Sparton Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sonar Pinger System Market Key Technology Landscape

The technological landscape of the Sonar Pinger System Market is dominated by advancements in acoustic emission and power management systems, dictated by the strict regulatory framework demanding increased performance metrics without altering the fundamental acoustic frequency (37.5 kHz). A key area of innovation is in battery chemistry and power harvesting. Manufacturers are intensively researching high-energy density lithium-based chemistries capable of sustaining the required acoustic output for 90 days or more under high-pressure conditions while adhering to stringent safety requirements, preventing thermal runaway or degradation. Miniaturization of internal electronics, achieved through specialized System-on-Chip (SoC) design, also contributes to extending battery life by reducing the overall power consumption of the timer, oscillator, and driver circuitry responsible for generating the ultrasonic pulse. This focus on maximizing energy efficiency is critical, as the physical size of the pinger is constrained by its attachment point on the flight recorder.

Another crucial technological development involves improving the robustness and acoustic efficiency of the transducers. Piezoelectric materials must be able to convert electrical energy into acoustic energy with minimal loss, ensuring the maximum possible detection range. Modern pingers often incorporate advanced ceramic or composite materials in their transducers to optimize the acoustic beam pattern, ensuring a wider, more omnidirectional acoustic output. Furthermore, pressure housing technology has seen continuous improvement, moving towards materials like high-strength titanium alloys and specialized engineered plastics that can withstand operational depths far exceeding the typical ocean floor (up to 20,000 feet) for extended periods without compromising the seal or electronic integrity. This robustness is essential for mitigating risks associated with extreme depth impacts or long-term submersion in highly corrosive saltwater environments.

Finally, the integration of smart features and redundancy is shaping the future technology landscape. While the core pinger remains acoustic, modern systems increasingly include integrated health monitoring that provides periodic status checks regarding battery voltage and pulse integrity. Furthermore, the push towards integrated ULBs, which incorporate both the mandated acoustic pinger and an emergency radio frequency (RF) transmitter or GPS capability (designed to activate if the recorder breaks free and surfaces), represents a major trend. Although not yet universally mandated, these hybrid systems offer superior recovery assurance, leveraging both underwater acoustic positioning and surface-based radio/satellite location technology, creating a demand for complex, multi-functional certified hardware.

Regional Highlights

- North America: Dominates the market share due to the presence of major aviation regulatory bodies (FAA), leading aircraft OEMs (Boeing), and advanced military/naval programs. High adoption rate of 90-day pingers driven by early regulatory mandates and strong R&D infrastructure supporting specialized defense applications. The substantial domestic fleet size necessitates continuous MRO support and pinger replacement cycles, ensuring stable demand.

- Europe: A significant market hub, strongly influenced by EASA regulations and the presence of Airbus and major European defense contractors. The region is a leader in implementing the ICAO standard for extended battery life (90 days). Market demand is also bolstered by extensive maritime commerce and scientific oceanographic research requiring reliable subsea tracking and recovery systems.

- Asia Pacific (APAC): Expected to register the highest CAGR. Growth is fueled by massive expansion and modernization of commercial air fleets, particularly in China and India. Increasing geopolitical activity and investment in advanced naval capabilities by regional powers drive demand for military-grade pingers. Regulatory adoption of international standards is rapidly accelerating, necessitating large-scale fleet retrofitting.

- Latin America (LATAM): Growth is steady, driven primarily by fleet modernization programs within commercial airlines and increasing offshore exploration activities, particularly in Brazil and Mexico. The market size is smaller but highly dependent on imports of certified systems from North America and Europe, focusing heavily on cost-effective compliance solutions.

- Middle East and Africa (MEA): Characterized by significant government investment in civil aviation expansion (driven by regional hub airports) and enhanced maritime security initiatives. High-value defense contracts and the stringent requirements of new, modern fleets are key demand drivers, although market stability can be susceptible to fluctuations in global oil prices impacting defense budgets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sonar Pinger System Market.- Teledyne Marine

- Dukane Seacom Inc.

- RJE International Inc.

- L3Harris Technologies

- Novatel Inc.

- Sonardyne International Ltd.

- Oceanscan Ltd.

- Subsea Technologies Inc.

- Kongsberg Gruppen

- Garmin Ltd.

- Raytheon Technologies

- Furuno Electric Co. Ltd.

- Edo Corporation

- Saab AB

- Precision Navigation Inc.

- General Dynamics Mission Systems

- Honeywell International Inc.

- Northrop Grumman Corporation

- Thales Group

- Sparton Corporation

Frequently Asked Questions

Analyze common user questions about the Sonar Pinger System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the mandated transmission duration for modern Sonar Pinger Systems (ULBs)?

The current international standard mandated by ICAO for new aircraft installations requires Sonar Pinger Systems (Underwater Locator Beacons) to have a minimum transmission duration of 90 days (Extended Life ULBs). This regulation is phasing out the older 30-day standard, ensuring significantly better recovery probability following an underwater incident.

What frequency do Sonar Pingers emit, and why is this standardized?

Standard certified Sonar Pingers emit an ultrasonic pulse at 37.5 kHz. This frequency is internationally standardized because it balances efficient acoustic propagation in seawater, minimizing signal attenuation, while remaining outside the normal range of ocean background noise, maximizing detectability by specialized search equipment (Towed Pinger Locators).

How often must a Sonar Pinger System be replaced or serviced?

Sonar Pinger Systems have a mandatory replacement or refurbishment cycle, typically determined by the certified battery life expiry date, often dictated by regulatory bodies like the FAA or EASA. For most commercial applications, the entire unit or the internal battery must be replaced approximately every six years to maintain operational compliance and guarantee the minimum required acoustic endurance.

What is the primary factor driving growth in the Sonar Pinger System Market?

The primary factor driving growth is stringent, non-discretionary regulatory compliance, specifically the global mandate requiring commercial air fleets to upgrade to the extended-life (90-day) pinger systems. This creates a predictable and consistent high-volume demand for certified hardware, irrespective of broader economic conditions.

Beyond aviation, which industries are significant end-users of Sonar Pinger Systems?

Significant end-users beyond commercial aviation include military naval forces (for tracking submarines and specialized assets), deep-sea scientific research institutions (for locating expensive sensors and arrays), and offshore oil and gas companies (for tracking subsea ROVs and production equipment in deep water environments).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager