Sound Absorbing Material Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433884 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Sound Absorbing Material Market Size

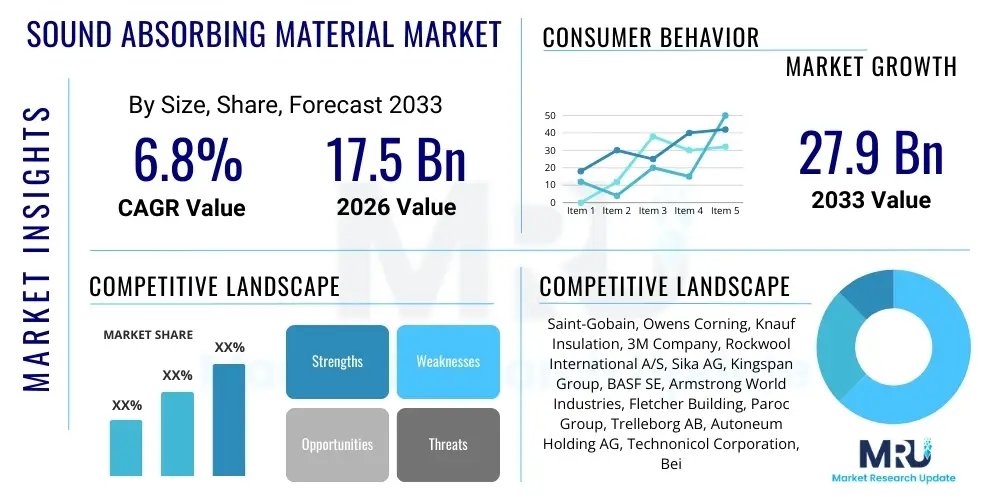

The Sound Absorbing Material Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 17.5 Billion in 2026 and is projected to reach USD 27.9 Billion by the end of the forecast period in 2033.

Sound Absorbing Material Market introduction

The Sound Absorbing Material Market encompasses a wide range of specialized products designed to mitigate noise pollution by absorbing sound energy rather than reflecting it. These materials work by converting acoustic energy into small amounts of heat, thereby reducing reverberation time and improving the overall acoustic quality of an environment. Key products include porous materials like acoustic foam, mineral wool, fiberglass, and complex composite structures utilized extensively across various sectors. The primary goal of deploying sound absorbing materials is to achieve noise reduction coefficient (NRC) standards required for occupant comfort, regulatory compliance, and functional efficacy in professional settings such as recording studios, data centers, and manufacturing plants. The increasing global focus on occupational health and safety regulations, coupled with the rapid expansion of urban infrastructure, provides a robust foundation for market growth, driving demand for high-performance, aesthetically pleasing, and sustainable acoustic solutions.

Major applications of these materials span critical industries including building and construction, where they are integral to soundproofing residential, commercial, and institutional buildings to meet stringent building codes. In the automotive sector, sound absorbing materials are crucial for reducing engine and road noise, enhancing passenger comfort, and improving vehicle weight efficiency through advanced material composites. Furthermore, the industrial sector relies heavily on these solutions to minimize operational noise from machinery and production lines, ensuring worker safety and adherence to environmental noise limits. Benefits derived from the adoption of sound absorbing materials are substantial, ranging from enhanced privacy and reduced stress levels in office environments to improved speech intelligibility in educational institutions and performance venues. The ongoing innovation in material science is introducing lighter, fire-resistant, and recycled content materials, further broadening their applicability and appeal.

Driving factors for the substantial expansion of the Sound Absorbing Material Market include the rising awareness regarding the detrimental effects of prolonged noise exposure on human health, spurring governmental interventions and mandatory acoustic standards globally. The globalization of manufacturing and the resultant increase in industrial automation necessitate advanced noise control solutions at the source. Moreover, the accelerating adoption of sustainable and green building practices mandates the use of materials that not only offer superior acoustic performance but also adhere to environmental certifications regarding material composition and lifecycle assessment. The technological shift towards electric vehicles (EVs) is also creating new demand, as the absence of engine noise amplifies internal cabin noise issues, requiring innovative sound absorption solutions tailored for low-frequency sound mitigation.

Sound Absorbing Material Market Executive Summary

The Sound Absorbing Material Market exhibits significant growth potential driven by evolving global regulatory landscapes prioritizing noise abatement and acoustic comfort across residential, commercial, and industrial domains. Key business trends indicate a strong shift towards advanced material compositions, particularly lightweight composites and bio-based acoustic materials, catering to the demands of the automotive and green building sectors. Manufacturers are focusing on integration and aesthetic appeal, offering panels and architectural elements that double as functional acoustic treatments. Investment in research and development is predominantly centered on optimizing noise reduction coefficients (NRC) while ensuring fire safety compliance, positioning performance and sustainability as core competitive differentiators. Strategic mergers and acquisitions are common as large players seek to consolidate regional market presence and acquire specialized technology in niche material segments like porous metallic foams or specialized polymers.

Regionally, the Asia Pacific (APAC) stands out as the fastest-growing market, primarily fueled by massive infrastructure development, rapid urbanization, and increased foreign direct investment in manufacturing facilities, particularly in China and India, which necessitates industrial noise control. North America and Europe, while mature, maintain substantial market share due to stringent noise pollution regulations (such as OSHA guidelines and European Directive 2002/49/EC) and high consumer willingness to invest in premium acoustic solutions for residential and office spaces. The shift in manufacturing supply chains and heightened focus on energy-efficient building standards are further invigorating market demand across Western economies. The Middle East and Africa (MEA) region is showing nascent growth, tied closely to large-scale construction projects and diversification away from oil economies, which includes developing tourism and commercial hubs requiring sophisticated noise management.

Segment trends reveal that the porous absorber category, including fiberglass and mineral wool, continues to dominate the market share due to their cost-effectiveness and proven efficacy, especially in large volume applications like HVAC ductwork and wall insulation. However, specialized segments such as plastic and polymer foams (melamine, polyethylene) are gaining traction due to their excellent performance-to-weight ratio, crucial for the aerospace and automotive industries. Application analysis highlights the significant role of the Building and Construction sector, which remains the largest consumer, driven by governmental mandates for acoustic performance (e.g., LEED certification requirements). The industrial and manufacturing segment is projected to show robust growth, reflecting the global trend of increased automation and the need for localized noise isolation solutions within factory floors and machinery enclosures to protect workers and maintain operational efficiency.

AI Impact Analysis on Sound Absorbing Material Market

Users frequently inquire about how Artificial Intelligence (AI) can revolutionize the development and deployment of sound absorbing materials, focusing heavily on optimizing material design, predicting performance under variable conditions, and enhancing customization. Key themes revolve around AI's ability to simulate complex acoustic environments faster than traditional modeling, identifying novel material structures that yield superior Noise Reduction Coefficient (NRC) values, and automating the material selection process for specific end-user requirements (e.g., frequency range, weight constraints, temperature resistance). Concerns often include the accessibility of AI tools for smaller manufacturers and the accuracy of AI-driven predictions compared to empirical testing. Overall, expectations are high for AI to reduce R&D cycles, facilitate mass customization of acoustic solutions, and drive the emergence of 'smart' acoustic systems that dynamically adapt absorption properties based on real-time sound inputs.

- AI-driven topology optimization accelerates the design of micro-perforated panels and composite structures, maximizing sound absorption with minimal material use.

- Predictive modeling using machine learning algorithms forecasts the acoustic performance and durability of novel materials before physical prototyping, significantly reducing R&D costs and time.

- AI-powered generative design tools assist architects and engineers in developing aesthetically complex, yet acoustically optimized, panel layouts for commercial and residential spaces.

- Real-time sensor integration and AI analytics enable the creation of smart acoustic environments where absorption properties can be dynamically adjusted based on ambient noise levels or specific frequencies.

- Supply chain optimization through AI improves inventory management and forecasting for raw materials, particularly sustainable or recycled content used in acoustic panels.

DRO & Impact Forces Of Sound Absorbing Material Market

The market trajectory is primarily influenced by strong regulatory drivers mandating lower noise levels in urban and industrial environments, coupled with significant technological opportunities arising from material innovation and digitization in construction. Restraints largely center around the volatility of raw material costs, particularly petrochemical derivatives used in plastic foams, and the inherent challenge of balancing high acoustic performance with requirements for fire safety and environmental sustainability. The primary impact forces include the accelerating urbanization trend worldwide, demanding greater noise isolation in high-density living spaces, and the rapid expansion of the electric vehicle market, which requires lightweight and highly efficient cabin noise absorption solutions. Strategic manufacturers are leveraging opportunities in bio-based and recyclable materials to mitigate regulatory risks and address the growing consumer preference for sustainable products, positioning the market for sustained expansion over the forecast period despite cost pressures.

Drivers contributing to market expansion include stringent government noise pollution standards globally, especially in North America and Europe, which compel industries and builders to integrate advanced acoustic mitigation solutions. The robust growth of the building and construction industry, particularly in developing economies, further necessitates the adoption of sound insulation to meet modern comfort and certification standards. A rising disposable income in key markets allows consumers and businesses to invest in high-quality acoustic treatments for improved living and working conditions. The industrial segment is seeing increased adoption due to regulatory pressure to protect occupational health from excessive machinery noise, driving demand for specialized heavy-duty acoustic enclosures and damping materials.

Restraints impeding market growth primarily include the substantial fluctuation in the prices of critical raw materials, such as polymer resins, glass fibers, and mineral ores, which impacts the overall manufacturing cost and pricing stability of finished goods. The technical challenge associated with achieving high Sound Transmission Class (STC) ratings while simultaneously ensuring fire resistance (e.g., Class A fire ratings) and maintaining material permeability often complicates product development and deployment. Furthermore, the lack of standardized installation practices and the high initial cost of premium specialized acoustic treatments, particularly reactive absorbers and tuned resonators, sometimes deter widespread adoption in price-sensitive markets. Opportunities, however, lie in the rapid innovation of sustainable materials, including recycled polyester fiber (PET) and natural fibers (hemp, cotton), reducing dependence on volatile petrochemicals and enhancing the green credentials of products. The growing interest in retrofitting older buildings for energy efficiency and acoustic enhancement presents a considerable revenue stream, alongside the development of multifunctional materials that offer thermal insulation in addition to sound absorption.

- Drivers:

- Stringent governmental regulations regarding noise pollution and occupational safety.

- Rapid growth in residential and commercial construction worldwide.

- Increasing demand from the electric vehicle (EV) sector for lightweight noise reduction.

- Growing awareness of the health impacts of chronic noise exposure.

- Restraints:

- Volatility and high cost of raw materials (e.g., petrochemicals, glass fibers).

- Technical complexity in achieving optimal acoustic performance simultaneously with high fire resistance.

- High initial investment required for sophisticated acoustic treatments.

- Opportunities:

- Development and adoption of sustainable, bio-based, and recycled acoustic materials.

- Expansion of smart city infrastructure requiring advanced noise mapping and mitigation solutions.

- Retrofitting of existing commercial and industrial buildings to meet modern acoustic standards.

- Impact Forces:

- Urbanization and high-density living requiring effective noise isolation.

- Technological advancements in composite and nanotechnology-enabled sound absorbers.

- Global industrial automation leading to increased machinery noise requiring control.

Segmentation Analysis

The Sound Absorbing Material Market is comprehensively segmented based on material type, product form, application, and end-use industry, providing a granular view of demand dynamics across various economic sectors. The segmentation by material is crucial, differentiating between traditional, inorganic mineral fibers like fiberglass and mineral wool, and modern, organic foams and textiles such as melamine, polyurethane, and natural fibers. Product forms are categorized primarily into panels, tiles, foams, and blankets, reflecting different installation methods and intended acoustic functions, such as wall treatment versus machinery damping. The application segment delineates the primary environments where these materials are deployed, ensuring tailored solutions for construction, automotive manufacturing, and various industrial processes. This multilayered segmentation allows market players to strategically focus R&D efforts and sales initiatives on high-growth segments driven by specific regulatory or technological requirements, such as high-temperature resistance in industrial settings or aesthetic appeal in commercial interiors.

The Material Type segment highlights the dominance of porous absorbers, driven by their cost-efficiency and excellent broad-spectrum noise reduction capabilities. Fiberglass, known for its non-combustible properties and high NRC ratings, remains a mainstay in the building and construction sector, particularly in cavity insulation and suspended ceilings. Conversely, the Polymer Foams segment, while often more expensive, is gaining significant traction due to its light weight and adaptability, making it indispensable in noise reduction for automotive interiors, aerospace components, and specialized electronic enclosures where weight minimization is critical. Within the Application segment, the Building and Construction industry represents the largest volume consumer, continuously driven by evolving aesthetic demands for architecturally integrated acoustic solutions, often leading to the adoption of fabric-wrapped panels and specialized ceiling treatments.

Furthermore, segmentation by End-Use Industry underscores the specialized needs of different verticals. The Industrial and Manufacturing sector demands heavy-duty, durable materials capable of resisting oils, moisture, and extreme temperatures, such as metallic foams or high-density mineral wool enclosures for machinery. The Transportation sector (Automotive, Rail, Aerospace) prioritizes light, thin, yet highly efficient damping and absorption layers to meet strict fuel efficiency and performance metrics. The growing demand for advanced acoustics in professional environments, including data centers, theaters, and hospitals, emphasizes the need for materials that offer superior low-frequency absorption and easy maintenance. This segmentation structure is vital for understanding competitive positioning and identifying future pockets of high investment, particularly in customized, performance-driven solutions.

- By Material Type:

- Mineral Wool (Glass Wool, Rock Wool)

- Polymer Foams (Polyurethane Foam, Melamine Foam, Polyethylene)

- Fiberglass

- Natural Fibers (Hemp, Wood Wool, Cotton)

- Metal Foams and Composites

- By Product Form:

- Panels (Fabric-wrapped, Perforated)

- Tiles and Ceilings

- Foams and Sheets

- Blankets and Mats

- Vibration Dampers

- By Application:

- Building and Construction (Residential, Commercial, Institutional)

- Transportation (Automotive, Aerospace, Marine)

- Industrial and Manufacturing (Machinery Enclosures, HVAC Systems, Power Generation)

- Acoustic Solutions and Audio Equipment (Studios, Theaters, Data Centers)

Value Chain Analysis For Sound Absorbing Material Market

The value chain for the Sound Absorbing Material Market begins with the sourcing of critical raw materials, which represents the upstream segment. This includes the extraction and processing of natural resources such as basalt and diabase for mineral wool, silica sand for fiberglass, and petrochemical derivatives for polymer foams. Upstream analysis highlights that the market is highly dependent on the stability and pricing of global commodity markets, particularly energy costs necessary for high-temperature manufacturing processes like melting glass or rock fibers. Key stakeholders at this stage are specialized chemical companies and mining operators. Efficient sourcing, focusing on recycled content (like recycled PET for acoustic panels), is becoming a major differentiator to mitigate cost volatility and meet sustainability criteria demanded by regulatory bodies and end-users.

The midstream involves the core manufacturing and conversion processes. This stage encompasses the production of the base material (fiber spinning, foaming, or compression), followed by fabrication, cutting, shaping, and often the integration of materials into finished products such as acoustic panels, baffles, or complex automotive molded parts. Quality control, particularly compliance with fire safety standards (e.g., ASTM E84, EN 13501), and the achievement of specific NRC ratings are paramount here. Manufacturers must invest heavily in specialized machinery for high-volume, low-cost production or highly customized, precision fabrication, such as CNC cutting for architectural acoustic solutions. Product differentiation is achieved through surface treatments, aesthetic finishes, and integration of multifunctional properties like thermal insulation.

The downstream activities involve distribution channels and end-user deployment. Distribution is complex, utilizing both direct and indirect channels. Direct sales are often preferred for large, customized industrial projects (e.g., machinery enclosures, power plant acoustic treatment) or major OEM contracts in the automotive sector, allowing for deep technical consultation. Indirect distribution relies heavily on professional construction material distributors, specialized acoustic solution providers, interior design firms, and large retail chains for DIY acoustic foam or residential insulation products. Potential customers, including architects, contractors, interior designers, and vehicle manufacturers, significantly influence demand based on project specifications, budgetary constraints, and aesthetic requirements. Optimization of logistics, inventory management, and technical support at the deployment phase is crucial for ensuring product efficacy and overall customer satisfaction, completing the value cycle.

Sound Absorbing Material Market Potential Customers

Potential customers for sound absorbing materials span a diverse range of end-users whose primary goal is to control noise, enhance acoustic comfort, or meet specific regulatory mandates across various environments. The largest segment of buyers consists of general contractors and building developers in the commercial and residential construction sectors, who purchase large volumes of fiberglass, mineral wool, and acoustic ceiling tiles for new projects and renovations. These buyers prioritize materials that offer verifiable Sound Transmission Class (STC) and Noise Reduction Coefficient (NRC) ratings, ease of installation, and compliance with stringent fire safety codes (e.g., NFPA standards). Architectural firms and interior designers also represent critical influencers, driving the adoption of premium, aesthetically integrated acoustic panels and bespoke solutions to achieve high-design results in offices, schools, and cultural centers.

The industrial sector, including heavy manufacturing facilities, HVAC system manufacturers, and power generation plants, constitutes another major customer base. These buyers require robust, often high-density, materials like specialized acoustic blankets, baffles, and enclosures capable of withstanding harsh operating conditions, extreme temperatures, and exposure to chemicals or moisture. Their purchasing decisions are primarily driven by regulatory adherence (OSHA noise limits) and the need to protect machinery investment and worker health. Furthermore, the transportation industry, particularly automotive Original Equipment Manufacturers (OEMs), is a rapidly growing customer segment, purchasing lightweight polymer foams and composites for noise, vibration, and harshness (NVH) mitigation in vehicles. These manufacturers emphasize material density, weight reduction, and performance longevity under dynamic operating conditions.

Finally, specialized customers include recording studios, data centers, hospitals, and educational institutions, each having unique acoustic needs. Data centers, for example, require materials capable of absorbing high-frequency noise generated by cooling systems and servers, ensuring equipment longevity and reducing technician exposure. Educational and healthcare facilities prioritize speech intelligibility and patient/student comfort, leading them to select specialized, non-shedding, and easily cleanable acoustic surfaces. The purchasing power of these specific end-users often leans towards high-performance, validated solutions, rather than solely focusing on the lowest cost, thereby supporting the premium segment of the market focused on technologically advanced materials and architectural integration.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 17.5 Billion |

| Market Forecast in 2033 | USD 27.9 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Saint-Gobain, Owens Corning, Knauf Insulation, 3M Company, Rockwool International A/S, Sika AG, Kingspan Group, BASF SE, Armstrong World Industries, Fletcher Building, Paroc Group, Trelleborg AB, Autoneum Holding AG, Technonicol Corporation, Beijing New Building Material Co., Ltd., Trocellen GmbH, Sound Seal Inc., Johns Manville, Recticel NV/SA, Zotefoams plc |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sound Absorbing Material Market Key Technology Landscape

The technology landscape of the Sound Absorbing Material Market is continuously evolving, moving beyond conventional porous materials to incorporate advanced structures and smart materials for enhanced performance and integration. A significant technological focus is on developing lightweight, high-performance composites, particularly for the automotive and aerospace sectors, where minimal weight addition is critical. This involves the use of micro-perforated panels (MPPs) and meta-materials, which utilize carefully engineered geometric structures (resonators or microscopic cavities) rather than bulk density to achieve high absorption coefficients at specific, targeted frequencies. MPPs offer superior performance, especially in low to mid-frequency ranges, while maintaining non-fibrous, non-shedding, and often aesthetically pleasing surfaces, making them ideal for clean room environments and architectural acoustics.

Another crucial technological advancement involves the synthesis and commercialization of sustainable and bio-based acoustic materials. This shift is driven by rigorous green building certifications and corporate sustainability goals. Innovations include the use of recycled polyethylene terephthalate (rPET) fibers, often derived from plastic bottles, processed into high-density acoustic boards and panels, offering excellent noise reduction while significantly reducing environmental footprint. Furthermore, natural fibers like hemp, cork, and cotton scraps are being treated and engineered to meet fire safety standards without relying on harmful chemical flame retardants, thereby positioning these materials as leading choices in environmentally conscious construction projects across Europe and North America. The optimization of fiber orientation and density using advanced manufacturing techniques allows these sustainable alternatives to compete effectively with traditional fiberglass and mineral wool in terms of NRC ratings.

The digital frontier is also reshaping the market through the integration of computational fluid dynamics (CFD) and acoustic simulation software. These tools allow manufacturers and design engineers to accurately model the performance of acoustic solutions within complex real-world environments before physical deployment. This predictive capability enhances product customization, minimizes installation errors, and accelerates the development cycle for specialized products like acoustic baffles and sound-dampening coatings. Looking forward, the development of active noise control (ANC) technology, although distinct from passive absorption, increasingly complements material-based solutions, particularly in demanding applications like large industrial machinery and premium transportation segments, creating a hybrid approach to total noise mitigation.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market due to unprecedented growth in infrastructure spending, led by China, India, and Southeast Asian nations. Regulatory pushes in high-density urban areas regarding noise control (e.g., mandating sound insulation in residential towers) combined with significant foreign investment in manufacturing facilities requiring industrial noise abatement solutions drive this growth. The region sees strong demand for cost-effective porous materials like mineral wool and fiberglass in the construction sector.

- North America: North America holds a substantial market share, driven by strict regulatory requirements imposed by organizations like OSHA and EPA, necessitating comprehensive acoustic solutions in commercial and industrial settings. The market benefits from high consumer awareness regarding acoustic comfort and significant technological adoption in the premium architectural segment. The surge in data center construction, requiring specialized acoustic treatment for cooling systems, is a key regional driver.

- Europe: Europe is characterized by stringent environmental and safety standards (e.g., REACH regulations and various EU directives on noise exposure), leading to high demand for advanced, sustainable, and fire-resistant acoustic materials. Germany, France, and the UK are major contributors, exhibiting high adoption rates for aesthetically pleasing, architecturally integrated acoustic panels in office refurbishment and new green building projects. The automotive sector, heavily focused on NVH reduction in premium and electric vehicles, is a core consumer.

- Latin America (LATAM): The LATAM market is experiencing steady growth, linked primarily to urbanization in major economies like Brazil and Mexico, leading to increasing construction activities. While price sensitivity remains a factor, regulatory compliance related to worker safety in the growing industrial sector is driving baseline demand for acoustic materials, particularly insulation boards and acoustic enclosures.

- Middle East and Africa (MEA): Growth in MEA is largely project-specific, tied to large-scale construction initiatives such as major real estate developments and infrastructure expansions (e.g., Saudi Vision 2030 and UAE projects). The region presents opportunities for specialized, high-temperature resistant materials for oil and gas facilities, alongside demand for architectural acoustics in luxury hotels and entertainment venues.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sound Absorbing Material Market.- Saint-Gobain

- Owens Corning

- Knauf Insulation

- 3M Company

- Rockwool International A/S

- Sika AG

- Kingspan Group

- BASF SE

- Armstrong World Industries

- Fletcher Building

- Paroc Group (acquired by Owens Corning)

- Trelleborg AB

- Autoneum Holding AG

- Technonicol Corporation

- Beijing New Building Material Co., Ltd.

- Trocellen GmbH

- Sound Seal Inc.

- Johns Manville

- Recticel NV/SA

- Zotefoams plc

- Huntsman Corporation

- Jeld-Wen Holding, Inc.

- Acoustical Surfaces Inc.

- Silentium Group

- Noise Control Products Inc.

Frequently Asked Questions

Analyze common user questions about the Sound Absorbing Material market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between sound absorbing and sound blocking materials?

Sound absorbing materials, like acoustic foam or mineral wool, convert acoustic energy into heat, reducing echoes and reverberation within a space (improving NRC). Sound blocking materials, typically high-density structures such as mass-loaded vinyl or thick drywall, are designed to reflect sound and prevent its transmission between spaces (improving STC).

Which material type currently dominates the Sound Absorbing Material Market?

Mineral wool (including both glass wool and rock wool) currently dominates the market by volume and revenue, primarily due to its cost-effectiveness, proven performance in broad-frequency absorption, excellent thermal insulation properties, and high non-combustible fire ratings crucial for the global building and construction industry.

How does the shift to electric vehicles (EVs) impact demand for sound absorbing materials?

The shift to EVs significantly increases demand for lightweight, high-performance sound absorbing materials. Since the noise of the engine is eliminated, external noises (tire, wind, and road noise) become more prominent, requiring advanced polymer foams and specialized lightweight composites to maintain passenger comfort without adding excessive vehicle mass.

What are the key sustainability trends influencing the acoustic material industry?

Sustainability trends mandate the increased use of recycled content (like rPET fibers) and natural fibers (hemp, cotton, wood wool) in acoustic panels. Manufacturers are also focusing on bio-based binders and developing materials that are recyclable at the end of their lifecycle, adhering to strict green building certifications such as LEED and BREEAM standards.

What role does the Noise Reduction Coefficient (NRC) play in purchasing decisions?

The NRC rating, ranging from 0.0 to 1.0, is a critical metric indicating how much sound a material absorbs across a range of frequencies. Higher NRC values (typically 0.70 and above) are preferred by professional buyers (architects, engineers) for applications requiring high acoustic clarity, such as recording studios, auditoriums, and open-plan offices.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager