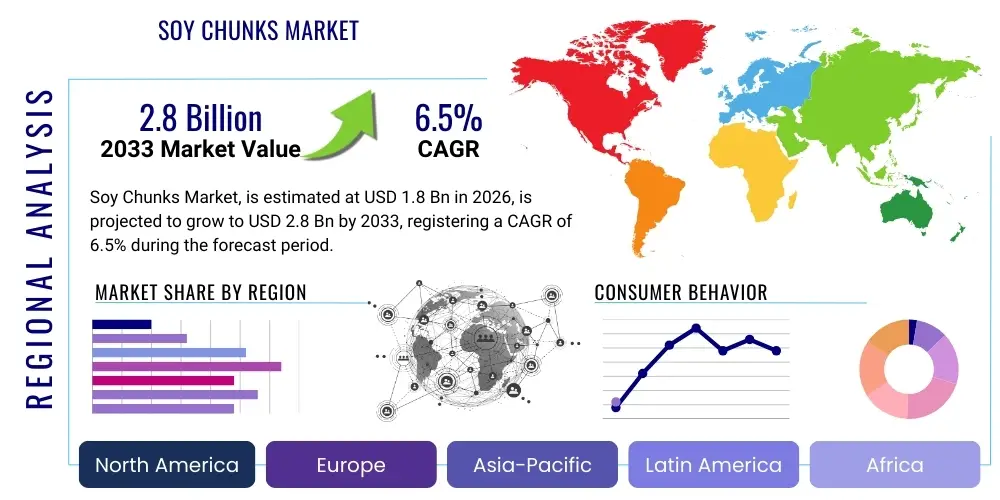

Soy Chunks Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436380 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Soy Chunks Market Size

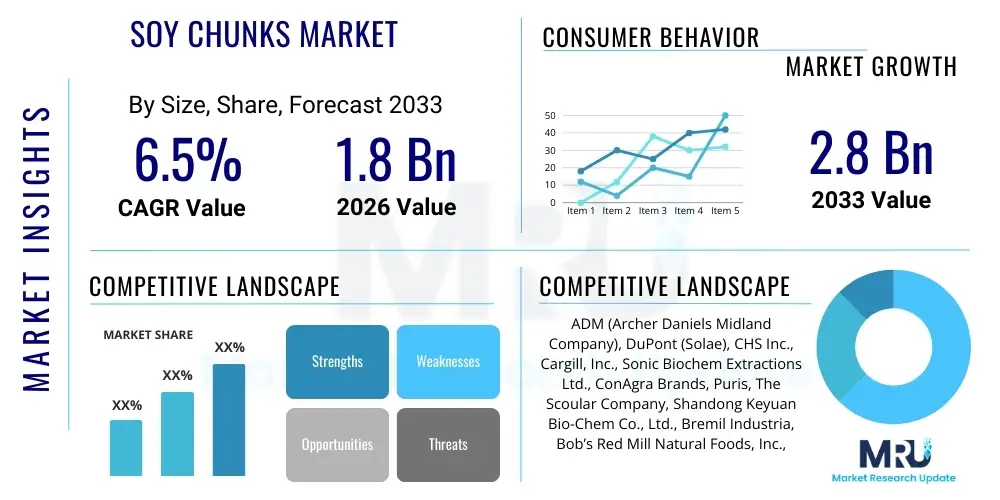

The Soy Chunks Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.8 Billion by the end of the forecast period in 2033.

Soy Chunks Market introduction

The Soy Chunks Market is fundamentally driven by the accelerating global shift towards sustainable and plant-based protein sources, positioning soy chunks, also known as textured vegetable protein (TVP) or soya badi, as a cornerstone product in modern nutritional trends. Soy chunks are derived from defatted soy flour, a byproduct of soybean oil extraction, which is subjected to high-pressure extrusion processes to create a fibrous, porous texture mimicking meat. This process enhances their capacity to absorb flavors and moisture, making them highly versatile for integration into diverse culinary applications, ranging from traditional curries and stews to modern meat analogs like burgers and sausages. The product is valued for its high protein content (typically exceeding 50%), low fat profile, and absence of cholesterol, making it an extraordinarily attractive option for health-conscious consumers and vegetarians globally. The versatility of the product also extends to its ability to be used as a protein extender in traditional meat products, thereby reducing overall food costs for consumers and commercial kitchens alike. This dual functionality as a standalone substitute and an enhancer cements its market position and appeal across various consumer groups, from value seekers to premium purchasers of plant-based foods.

Major applications of soy chunks span across the food service industry, including restaurants, institutional catering, and specialized vegan and vegetarian outlets, and the rapidly expanding retail sector, where they are marketed as convenient, shelf-stable ingredients for home cooking. The growth in ready-to-eat and ready-to-cook meal kits incorporating pre-hydrated or pre-seasoned soy chunks is a significant trend, addressing the modern consumer's demand for speed and minimal culinary effort. Their economic viability and efficient protein delivery system make them particularly appealing in developing economies facing protein deficiency challenges, offering a nutritionally complete and affordable alternative to expensive animal products. In developed markets, they cater strongly to the flexitarian and vegan populations seeking ethical and environmental alternatives to animal protein, often carrying certifications such as Non-GMO and organic to satisfy discerning consumer segments, thus broadening the market's demographic reach beyond traditional vegetarian communities.

Key driving factors propelling market expansion include rising consumer awareness regarding the environmental impact of industrial meat production, increasing prevalence of lifestyle diseases driving demand for low-cholesterol and high-fiber foods, and robust government support, particularly in Asia Pacific and parts of Europe, promoting sustainable agriculture and plant protein processing infrastructure. Furthermore, continuous innovation in flavor masking techniques, texture modification technologies, and fortification with essential micronutrients (e.g., B12, iron) is successfully overcoming historical consumer hesitations related to the intrinsic sensory profile of traditional soy products. This technological refinement allows manufacturers to create highly palatable products that appeal to a broader, non-vegetarian consumer base, facilitating accelerated market penetration across all demographics and solidifying soy chunks' role in the future global food system, focusing heavily on enhancing convenience and nutritional value proposition.

Soy Chunks Market Executive Summary

The Soy Chunks Market is experiencing robust growth fueled by secular business trends, notably the mainstream acceptance of plant-based diets and strategic diversification by major food corporations entering the meat analog segment. Business trends indicate a strong focus on enhancing transparency, including clean label ingredients, ethical sourcing practices, and the utilization of non-GMO soybeans, which is compelling processors to invest heavily in advanced, high-shear extrusion technologies to maximize nutritional retention and minimize waste streams. The competitive landscape is dynamic, characterized by large multinational agricultural processors leveraging vertical integration against specialized plant-based food innovators focusing on niche, high-margin, flavored products. This competitive tension results in frequent and sophisticated product launches aimed at improving mouthfeel, texture resilience post-cooking, and long-term shelf stability of the packaged goods. Long-term forecasting suggests that strategic partnerships between raw material suppliers and brand owners will be crucial for managing supply chain resilience and price stability in volatile commodity markets and addressing consumer demands for sustainability.

Regionally, the Asia Pacific continues to dominate the consumption landscape, underpinned by deep-rooted culinary traditions and massive consumer bases prioritizing affordable, accessible protein; however, North America and Europe are registering the highest year-over-year value growth due to the rapid proliferation of sophisticated vegan and flexitarian lifestyles, backed by high consumer disposable income allocated towards premium, fortified plant-based foods. Regulatory environments in these Western markets are rapidly evolving to accommodate plant-based innovation, standardizing labeling for meat alternatives and facilitating smoother international trade. Concurrently, government nutritional programs in emerging markets are increasingly incorporating soy chunks due to their cost-effectiveness and substantial nutritional contribution, thereby ensuring stable demand growth in developing regions and widening the global reach of the product by tapping into institutional consumption channels and food security initiatives.

Segment trends highlight a pronounced shift in consumer expenditure away from basic, unflavored commodity soy chunks toward high-convenience, flavored, and pre-seasoned varieties. This trend significantly boosts the average revenue per unit, especially within the retail sector as brands move up the value chain. The granules and mini chunk formats are particularly favored, primarily due to their superior ability to replicate ground meat textures and blend seamlessly into hybrid recipes (e.g., combining soy granules with ground beef to lower fat content and cost). Furthermore, while traditional supermarket distribution remains dominant for volume, the e-commerce segment is fundamentally disrupting the market by offering a curated selection of gourmet and specialized soy chunk brands, often catering to specific dietary needs (e.g., organic, gluten-free), enabling manufacturers to achieve higher margin sales and gather crucial direct consumer feedback for future product iterations and personalized offerings.

AI Impact Analysis on Soy Chunks Market

Common user questions regarding AI's impact on the Soy Chunks Market typically center on how technology can improve supply chain transparency, optimize manufacturing efficiency, and enhance product quality consistency. Users frequently inquire about AI-driven predictive analytics for fluctuating soybean commodity prices, precision farming techniques impacting raw material sourcing, and the use of machine learning to fine-tune the complex extrusion process necessary to achieve the desired fibrous texture and optimal water absorption capacity. The key themes revolve around achieving significant cost reduction through process automation, utilizing sophisticated consumer sentiment analysis to rapidly introduce novel flavors or textures that meet evolving dietary preferences, thereby minimizing R&D risk, and accelerating market responsiveness. This technological integration is propelling the industry towards highly personalized, efficient, and sustainable protein production systems, ensuring the product remains competitive against other meat analog categories like pea and wheat protein.

- AI-driven predictive maintenance optimizes extrusion machinery scheduling, utilizing sensor data analysis to anticipate equipment failure, minimizing costly downtime, and ensuring uninterrupted, consistent product quality (texture and density).

- Machine learning algorithms analyze vast datasets including soybean crop yields, meteorological patterns, and commodity futures, providing processors with precise, data-backed procurement strategies to mitigate raw material price volatility risks.

- Automated visual inspection systems, powered by computer vision and deep learning models, monitor soy chunk size, color uniformity, and structural integrity in real-time, achieving unparalleled batch consistency and reducing reliance on traditional, slower manual quality checks.

- AI-powered consumer sentiment analysis tracks social media, online reviews, and sales performance data across regions, identifying emerging flavor profiles, preferred texture improvements, and desired nutritional enhancements for faster, consumer-validated product innovation cycles.

- Enhanced supply chain visibility through AI-integrated blockchain technology ensures ethical sourcing verification, streamlines regulatory compliance, and enables rapid, granular traceability of raw materials from sustainable farms to the final processing plant, crucial for Non-GMO assurance.

- Optimization of energy consumption within high-temperature extrusion and drying processes using neural networks to dynamically adjust parameters, maximizing thermal efficiency and significantly reducing the overall environmental footprint of manufacturing operations.

DRO & Impact Forces Of Soy Chunks Market

The dynamics of the Soy Chunks Market are complex, characterized by potent drivers stemming from health and sustainability trends, balanced by inherent challenges related to consumer perception and volatile supply chain dependencies. A primary driver is the accelerating global acceptance of flexitarian and plant-forward diets, substantially influenced by widespread dietary recommendations and medical research linking reduced intake of red and processed meats to improved cardiovascular health and reduced cancer risk. This societal shift directly increases the demand for protein-rich, low-fat alternatives like soy chunks. Furthermore, the robust environmental credentials of soy, including its relatively minimal ecological footprint—requiring significantly less land, water, and generating substantially fewer greenhouse gas emissions compared to traditional livestock farming—resonates powerfully with the growing segment of environmentally conscious consumers and aligns with corporate sustainability mandates across the food industry, driving brand loyalty.

Restraints primarily revolve around persistent challenges in overcoming consumer sensory expectations, particularly regarding the need to completely mask the intrinsic beany flavor (lipoxygenase activity byproduct) that requires extensive processing or seasoning to mitigate. This flavor issue, alongside the preparation barrier posed by the dry, compressed nature of the product requiring hydration prior to cooking, acts as a convenience hurdle compared to ready-to-cook animal proteins. Crucially, the market’s reliance on global soybean supplies subjects it to high volatility in commodity prices, influenced heavily by macroeconomic factors, geopolitical tensions, and unpredictable agricultural weather patterns. This instability poses a significant financial risk to manufacturers, complicating cost forecasting and impacting retail pricing stability, which is a major concern for a product primarily valued for its affordability. The market also faces regulatory and consumer pushback regarding Genetically Modified (GM) soybeans, necessitating substantial investment in verifying and maintaining robust Non-GMO supply chains, especially for entry into premium European and Asian markets.

Opportunities for exponential growth are concentrated in three strategic areas: product diversification, geographical penetration, and technological integration. Innovation focusing on functional soy chunks, achieved through bio-fortification with essential micronutrients like Vitamin B12, specialized iron compounds, or Omega-3 fatty acids, appeals directly to consumers seeking maximum health return from plant proteins. Developing convenient, ready-to-use formats, such as pre-hydrated, frozen, or retort-packaged pre-seasoned soy chunk meals, significantly enhances consumer appeal and removes the preparation barrier, targeting the burgeoning market for quick, healthy, on-the-go meals. Impact forces, particularly substantial venture capital and corporate investments channeled into food technology start-ups, are accelerating innovation across the value chain. Moreover, shifting governmental policies worldwide favoring sustainable and domestic plant protein production, coupled with increasing economies of scale in modern extrusion facilities, are rapidly decreasing the relative cost of high-quality soy protein, thereby accelerating its substitution rate across global food economies and ensuring its long-term competitive advantage in the expanding protein market.

Segmentation Analysis

The Soy Chunks Market is segmented primarily based on Type, Form, and Distribution Channel, reflecting the diverse applications and highly varying consumer requirements across different regional and demographic segments. The comprehensive segmentation strategy allows manufacturers to implement highly customized production cycles, targeted marketing campaigns, and optimized logistical distribution strategies designed to effectively capture specific consumer needs, ranging from industrial food processors requiring bulk, highly pure, unflavored ingredients to modern households demanding specialized, highly convenient, pre-flavored meal components. Continuous, granular analysis of these segment performance metrics provides essential insights into market maturity, key growth vectors, and consumer willingness to pay, generally indicating a pronounced long-term trend toward premium, value-added finished products over basic, low-margin commodity forms, fundamentally reshaping brand profitability strategies and accelerating product diversification across culinary applications globally.

- By Type: Unflavored, Flavored (e.g., Spicy, BBQ, Smoky)

- By Form: Mini Chunks (small pieces/granules), Regular Chunks (standard size), Flakes/Grains

- By Distribution Channel: Supermarkets/Hypermarkets, Convenience Stores, Online Retail (E-commerce), B2B (Food Service/Food Processing)

- By End-User: Household, Commercial (Restaurants, Cafeterias, Institutional Feeding)

Value Chain Analysis For Soy Chunks Market

The value chain of the Soy Chunks Market begins with the highly agricultural upstream segment, involving the rigorous cultivation, harvesting, and primary processing of soybeans. Critical activities here include sourcing high-quality, often non-GMO, soybeans and managing the subsequent processes of crushing and oil extraction to efficiently yield defatted soy flour, which serves as the fundamental raw material for TVP. Efficiency in this initial stage is highly sensitive to external factors, including agricultural yields, global commodity price fluctuations, and the effectiveness of risk mitigation strategies like commodity price hedging. Strategic partnerships and long-term contracts with large-scale soybean producers in major global hubs such as Brazil, the United States, and India are essential to ensure a stable, cost-effective, and traceable supply chain, vital for maintaining competitive pricing downstream. Compliance with global sustainability standards (e.g., zero deforestation policies) is becoming increasingly non-negotiable in this upstream segment, influencing procurement decisions for ethically focused brands.

The midstream processing stage represents the technological and capital-intensive core of soy chunk production, where the defatted soy flour is mixed with water, conditioned, and subjected to high-temperature, high-pressure, high-shear twin-screw extrusion. This sophisticated thermo-mechanical treatment is meticulously calibrated to instantly expand and restructure the protein matrices, creating the desirable porous, fibrous, and resilient texture characteristic of high-quality meat analogs. The process necessitates extremely specialized, expensive, and energy-intensive equipment. Post-extrusion steps involve precise drying to achieve a stable moisture content (typically below 10% for shelf stability), cooling, and cutting into the desired standardized formats (mini, regular, granules). Manufacturers also incorporate flavor infusions, seasoning mixtures, or nutrient fortifications during or immediately after this stage, adding value and appealing to the convenience segment. Rigorous quality control, assessing structural integrity, water absorption ratio, and microbial safety, is paramount before the product moves toward final packaging and entering the complex distribution network.

The downstream distribution channel requires navigating a complex and diverse marketplace through a combination of direct and indirect sales strategies. Indirect channels, particularly B2B sales to large food service conglomerates, institutional feeders, and packaged food manufacturers, account for the largest tonnage volume and demand sophisticated bulk logistics and standardized product specifications. The direct-to-consumer channel involves retail sales through established supermarket chains, convenience stores, and the burgeoning e-commerce platforms. E-commerce platforms, offering superior geographical reach and direct consumer interaction, are crucial for premium brands and niche products (like organic or fortified varieties), enabling efficient inventory management and minimizing intermediary costs. Effective cold chain management, while less critical for dry chunks, is essential for pre-hydrated and frozen soy-based finished products, requiring focused investment in specialized refrigerated logistics networks to ensure product integrity and freshness until it reaches the end-user.

Soy Chunks Market Potential Customers

The primary customer base for the Soy Chunks Market is remarkably broad, spanning health-conscious individuals, cost-sensitive consumers, and large commercial food operators seeking versatile protein solutions. Households adopting vegetarian, vegan, or flexitarian diets constitute a rapidly expanding segment, motivated by documented health benefits (low saturated fat, high fiber) and ethical and environmental concerns related to animal farming. These consumers prioritize convenience and look for product innovation in terms of enhanced flavor, rapid preparation time, and clean label ingredients, often opting for pre-seasoned or fortified variants available through modern retail and specialized online channels, demonstrating a high willingness to pay for premium attributes that simplify plant-based cooking.

A second crucial segment includes institutional and commercial buyers, specifically quick-service restaurants, corporate cafeterias, correctional facilities, school meal programs, and government-aided food distribution systems. For commercial users, the key purchasing criteria are defined by cost-efficiency, maximum stability in pricing, high protein density necessary for bulk catering, and the product's superior ability to be stored long-term without refrigeration. Soy chunks serve as an excellent, economical base for protein extension and substitution in large-scale dishes like curries, chili, and stews, providing significant cost savings compared to traditional meat sources without compromising nutritional delivery standards required by institutional contracts. This segment drives high-volume, continuous, and highly price-sensitive demand.

Emerging markets also present a significant and growing customer base where soy chunks play a pivotal role in addressing nutritional security and protein accessibility challenges. In regions facing affordability constraints on traditional animal protein sources, soy chunks offer an accessible, shelf-stable, and nutritionally dense alternative. Government agencies and non-governmental organizations (NGOs) involved in humanitarian and school feeding programs often procure massive quantities, highlighting the essential role soy plays in improving dietary diversity and protein intake among low-income and vulnerable populations. The market’s future growth is increasingly tied to the ability of manufacturers to customize product formats and nutritional profiles to effectively serve both the premium, convenience-seeking Western consumer and the budget-conscious, protein-seeking consumer in densely populated developing economies, requiring a bifurcated market strategy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ADM (Archer Daniels Midland Company), DuPont (Solae), CHS Inc., Cargill, Inc., Sonic Biochem Extractions Ltd., ConAgra Brands, Puris, The Scoular Company, Shandong Keyuan Bio-Chem Co., Ltd., Bremil Industria, Bob’s Red Mill Natural Foods, Inc., Crown Soya Protein Group, Jiangsu Jianyuan Foods, Nutralys (Roquette), Novotech Nutraceuticals, Ajinomoto Co., Inc., Tereos S.A., Fuji Oil Co., Ltd., Gushen Biological Technology Group Co., Ltd., Devahuti Proteins Food Pvt. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Soy Chunks Market Key Technology Landscape

The technological landscape underpinning the Soy Chunks Market is intrinsically linked to advancements in high-moisture and low-moisture extrusion techniques, which are paramount for transforming defatted soy flour into the desired highly functional textured vegetable protein (TVP). Twin-screw extrusion remains the industry benchmark, providing superior control over process variables such as temperature gradient, moisture content, and shear forces compared to older single-screw methods. This technological advantage allows manufacturers to precisely manipulate the molecular structure and orientation of the soy protein fibers, directly influencing the product's textural attributes—namely its firmness, elasticity, chewiness, and crucial water absorption capacity. Contemporary R&D is intensely focused on leveraging these sophisticated extruders to create specific, long-strand fibrous textures that better replicate animal muscle fibers (e.g., chicken breast or beef shreds), thereby significantly improving the overall realism and palatability of next-generation soy chunks used in high-end meat analog formulations and overcoming previous sensory limitations.

Crucially, technological innovation extends beyond structural processing into sensory enhancement, focusing heavily on flavor stabilization, masking, and aroma engineering. Flavor masking technologies are continuously being refined, utilizing advanced proprietary compounds, enzymatic treatments, and sophisticated blending processes to effectively neutralize the intrinsic beany off-notes that have historically deterred some consumers. Simultaneously, nutrient delivery systems are being integrated through technologies such as micro-encapsulation, which protects sensitive, essential micronutrients—including Vitamin B12, crucial for vegan diets, iron, and various omega fatty acids—from degradation during the high-heat extrusion and subsequent consumer cooking processes, ensuring maximal nutritional impact and shelf stability, thereby positioning soy chunks as truly functional foods and expanding their market appeal beyond basic protein supplementation into the specialized health food category.

Furthermore, the industry is increasingly adopting principles of Industry 4.0, integrating real-time monitoring and advanced process control systems to optimize operational efficiency and quality consistency. Systems utilizing real-time NIR (Near-Infrared) spectroscopy and hyperspectral imaging are deployed along the processing line to continuously measure and adjust crucial parameters such as moisture content, protein density, and particle size distribution. This automation minimizes batch variability and significantly reduces waste. In terms of environmental sustainability, ongoing technological advancements target the reduction of energy footprint by developing optimized low-moisture extrusion profiles, thereby minimizing the subsequent energy demands of the drying phase. This focus on resource efficiency not only reduces operational costs but also aligns the manufacturing process with stringent corporate social responsibility and environmental sustainability goals demanded by global retailers and environmentally conscious consumers, ensuring long-term operational viability and competitive differentiation.

Regional Highlights

Regional dynamics heavily influence the consumption patterns and manufacturing landscape of the Soy Chunks Market, presenting a clear contrast between volume-driven consumption in the East and high-value growth in the West. The Asia Pacific (APAC) region stands as the dominant market, driven by historical dietary habits where soy is a traditional staple, particularly in countries like India, China, and Indonesia. High population density, coupled with governmental support for affordable protein sources and a substantial vegetarian consumer base, ensures consistent high-volume demand. India, in particular, showcases robust consumption, utilizing soy chunks extensively in daily cooking as an accessible, cost-effective meat replacement and protein supplement, solidifying the region's position as the primary volume market globally.

North America and Europe, while having smaller historical consumption volumes, represent the fastest-growing regions for value-added soy chunk products. Growth here is primarily driven by socio-cultural shifts, including the rapid adoption of veganism, increased environmental consciousness, and high disposable incomes that support premium plant-based options. These regions demand highly innovative, pre-seasoned, flavored, and fortified soy chunks that serve as convenient meal starters. Regulatory harmonization regarding novel foods and plant protein labeling further accelerates market entry for innovators, turning these regions into key strategic areas for global brand expansion, premium product testing, and capturing the high-margin flexitarian consumer segment through sophisticated marketing and product positioning.

Latin America, particularly Brazil and Argentina, is critical due to its role as a major global soybean producer, ensuring a localized and cost-effective raw material supply for regional processors, which significantly lowers their operational costs compared to import-reliant regions. The market in the Middle East and Africa (MEA) is nascent but expanding, largely fueled by rising urbanization and changing dietary habits influenced by global Western trends, coupled with the necessity for shelf-stable, imported protein solutions in food-insecure regions. Market penetration in MEA is often challenging due to reliance on complex imports and diverse localized cultural preferences, yet offers long-term opportunity as economic development and awareness of the nutritional benefits of plant-based protein increase among both institutional buyers and modern retail consumers, gradually shifting demand dynamics.

- Asia Pacific (APAC): Dominates the market share due to large vegetarian populations, deep cultural integration of soy into staple diets, and government focus on affordable nutrition. India and China are central hubs for high-volume consumption and major manufacturing output.

- North America: Exhibits the highest CAGR, driven by the strong penetration of flexitarian diets, consumer willingness to pay a premium for highly textured and flavored meat alternatives, and proactive investment and marketing by plant-based food innovation companies.

- Europe: Characterized by stringent Non-GMO labeling requirements and a high demand for sustainable sourcing; strong growth driven by Western European nations like Germany, the UK, and the Netherlands, which are leading the sophisticated plant-based movement with regulatory support.

- Latin America (LATAM): Strategic importance lies in being a key global supplier of raw soybeans; regional market growth is linked to economic development, increased local processing capacity, and internal demand for low-cost, domestically sourced protein.

- Middle East & Africa (MEA): Emerging market primarily focused on institutional catering and addressing nutritional needs; growth constrained by complex logistics and import dependence but supported by demographic shifts towards urbanization and increasing consumer awareness of alternative proteins.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Soy Chunks Market.- ADM (Archer Daniels Midland Company)

- DuPont (Solae)

- CHS Inc.

- Cargill, Inc.

- Sonic Biochem Extractions Ltd.

- ConAgra Brands

- Puris

- The Scoular Company

- Shandong Keyuan Bio-Chem Co., Ltd.

- Bremil Industria

- Bob’s Red Mill Natural Foods, Inc.

- Crown Soya Protein Group

- Jiangsu Jianyuan Foods

- Nutralys (Roquette)

- Novotech Nutraceuticals

- Ajinomoto Co., Inc.

- Tereos S.A.

- Fuji Oil Co., Ltd.

- Gushen Biological Technology Group Co., Ltd.

- Devahuti Proteins Food Pvt. Ltd.

Frequently Asked Questions

Analyze common user questions about the Soy Chunks market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Soy Chunks Market?

The Soy Chunks Market is projected to grow at a robust CAGR of 6.5% between 2026 and 2033, driven primarily by the global increase in plant-based food consumption, health trends, and the demand for affordable, shelf-stable protein alternatives.

What are the primary factors restraining market growth in developed economies?

Primary restraints include consumer preference challenges regarding the inherent beany flavor of traditional soy products, the preparation time required for dry chunks (hydration), and persistent regulatory and consumer concerns surrounding the use of genetically modified (GM) soybeans in specific European and North American markets.

How is technological innovation impacting the texture and quality of soy chunks?

Advanced twin-screw extrusion technology is critical, allowing manufacturers to precisely control the internal fibrous structure and density of soy chunks, significantly improving their meat-like texture, elasticity, and water absorption capacity, thereby enhancing their function as high-quality meat analogs.

Which geographical region currently holds the largest market share for soy chunks?

The Asia Pacific (APAC) region currently dominates the market in terms of volume and consumption, attributed to the long-standing cultural acceptance of soy, large vegetarian population bases, and the product’s essential role as an affordable, high-protein staple.

What is the difference between unflavored and flavored soy chunk segments?

Unflavored soy chunks are primarily sold as cost-effective, adaptable raw ingredients for B2B and institutional use. Flavored soy chunks are value-added products, pre-seasoned with complex flavor profiles (e.g., smoky, BBQ) to offer consumers a convenient, ready-to-cook meal component that requires minimal culinary effort.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager