Soy Sauce Packaging Bottles Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433675 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Soy Sauce Packaging Bottles Market Size

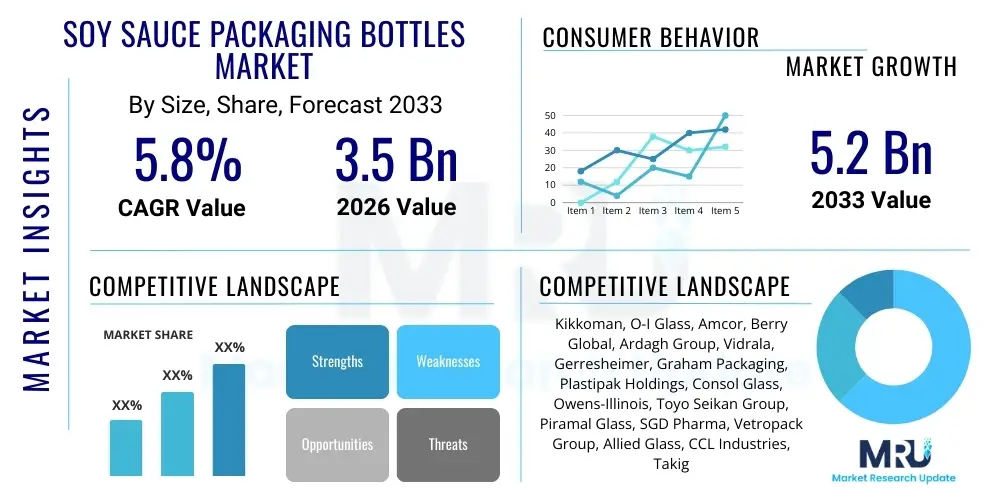

The Soy Sauce Packaging Bottles Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. This robust growth is primarily fueled by the escalating global consumption of Asian cuisines and the resultant demand for convenient, safe, and aesthetically pleasing packaging solutions that preserve product integrity and flavor profile over extended shelf life. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.2 Billion by the end of the forecast period in 2033. Factors such as innovation in dispensing mechanisms and the increasing preference for sustainable packaging materials, particularly bio-based plastics and recyclable glass, are expected to significantly influence this valuation throughout the forecast period.

The market expansion is segmented largely by material type, with glass historically dominating due to its inert properties, providing superior barrier protection against oxygen and moisture, which is critical for maintaining the complex flavor notes of high-quality soy sauce. However, the plastic segment, particularly PET and HDPE, is exhibiting the fastest growth due to reduced transportation costs, resistance to breakage, and increasing adoption in large-volume institutional packaging and emerging markets where logistics are challenging. Manufacturers are keenly focused on optimizing bottle designs for better ergonomics, shelf appeal, and integration with automated filling lines, catering to both premium and mass-market segments globally.

Geographical dynamics further influence market size, with the Asia Pacific region remaining the epicenter of consumption and manufacturing, driven by giants like China, Japan, and South Korea, which are also primary exporters. North America and Europe demonstrate accelerating demand, fueled by immigration patterns and the mainstreaming of international flavors in everyday cooking. The shift towards smaller, single-serving, or highly specialized packaging formats also contributes incrementally to the overall market valuation, reflecting changing consumer lifestyles that prioritize convenience and portion control.

Soy Sauce Packaging Bottles Market introduction

The Soy Sauce Packaging Bottles Market encompasses the specialized containers used for storing, preserving, and distributing soy sauce across retail, foodservice, and industrial channels. These packaging solutions are engineered to protect the product from light, oxidation, and contaminants while facilitating easy pouring and dispensing for the end-user. Key materials utilized include glass, various plastics (primarily PET and HDPE), and occasionally ceramics for ultra-premium segments. The market is intrinsically linked to the global rise of Asian food consumption, urbanization, and advancements in food preservation technology, mandating high barrier properties and chemical inertness to maintain the fermented product’s quality and safety throughout its lifecycle.

The core product description revolves around containers ranging typically from 150 ml for retail use up to 5-liter industrial containers, featuring specific neck finishes compatible with standard caps, often incorporating tamper-evident seals and specialized pouring spouts or dropper inserts. Major applications span retail supermarket sales, where brand differentiation heavily relies on bottle aesthetics; the HoReCa (Hotel, Restaurant, Catering) sector, demanding durable and high-volume dispensers; and large-scale food manufacturing, requiring bulk packaging for ingredient integration. The inherent benefits of specialized soy sauce packaging include extended shelf life, enhanced brand visibility through customizable shapes and labeling, and crucial consumer convenience through ergonomic design.

Driving factors propelling market growth include the substantial increase in ready-to-eat meals incorporating Asian flavors, the burgeoning population in high-consumption regions of Asia, and continuous innovation in sustainable materials like recycled PET (rPET) and lightweight glass to reduce environmental footprints and logistic costs. Furthermore, consumer demand for premium, imported soy sauce necessitates robust packaging that conveys quality and ensures the integrity of the product during complex international supply chains. These dynamics underscore the critical role packaging plays not just in logistics but in brand presentation and product preservation.

Soy Sauce Packaging Bottles Market Executive Summary

The Soy Sauce Packaging Bottles Market is experiencing significant upward momentum, driven predominantly by shifting global culinary preferences toward Asian flavors and the necessity for highly specialized barrier packaging. Business trends indicate a strong move toward lightweighting initiatives across both glass and plastic materials to minimize freight costs and environmental impact, coupled with a focus on implementing smart packaging features such as QR codes for traceability. Strategic alliances between packaging suppliers and large food manufacturers are becoming commonplace to co-develop custom bottle designs that enhance pouring functionality and market differentiation, particularly within the competitive premium soy sauce segment, emphasizing sustainability certifications.

Regionally, Asia Pacific continues its market leadership, commanding the largest share due to deeply rooted consumption habits and the presence of global soy sauce manufacturing hubs. However, North America and Europe are rapidly increasing their market contribution, characterized by high adoption rates of premium imported products and a strong consumer willingness to pay for eco-friendly packaging, driving investment in recycled content and mono-material structures. The growth in Latin America and MEA is accelerated by expanding quick-service restaurant (QSR) chains and greater penetration of international grocery brands, demanding standardized and economical packaging formats suited for varying climate conditions.

Segment trends highlight the dominance of PET and glass materials. While glass maintains prestige and superior barrier performance, PET is witnessing explosive growth in value and institutional segments due to cost-effectiveness and durability. The bottle size segment indicates a growing preference for smaller retail bottles (under 500 ml) catering to smaller households and trial sizes, while the bulk packaging segment (over 2 liters) remains crucial for industrial clients. Furthermore, the market is characterized by a drive towards sophisticated closures and tamper-evident mechanisms, essential for maintaining product safety and consumer trust across diverse distribution channels.

AI Impact Analysis on Soy Sauce Packaging Bottles Market

User queries regarding AI's impact on soy sauce packaging predominantly center around supply chain optimization, predictive quality control, and the automation of customized bottle production lines. Consumers and manufacturers are keen to understand how AI-driven demand forecasting can reduce inventory wastage and how machine vision systems can ensure flawless bottle integrity and label placement at high speeds. Key themes include the implementation of AI for optimizing material usage, predicting equipment maintenance needs in glass manufacturing, and personalizing packaging design iterations based on real-time market feedback. The expectation is that AI will enhance efficiency, drive sustainability by minimizing defects, and allow for ultra-responsive production scheduling, though concerns remain regarding the initial investment required for sophisticated AI integration within existing packaging facilities.

- AI-Powered Demand Forecasting: Optimizes production scheduling, reducing overstocking and material waste by accurately predicting regional soy sauce consumption trends.

- Quality Control Automation: Utilizes high-speed machine vision systems (AI-driven cameras) to instantly identify minute flaws in bottle geometry, glass stress points, or label application errors.

- Predictive Maintenance: AI algorithms analyze operational data from packaging machinery (blow molders, fillers) to predict failures, minimizing costly downtime and improving overall equipment effectiveness (OEE).

- Sustainable Material Optimization: AI simulates material performance under various stress conditions, helping designers optimize bottle weight and structure while ensuring adequate barrier properties, supporting lightweighting goals.

- Supply Chain Traceability: Integration of blockchain and AI processing enhances the tracking of materials (e.g., recycled plastic sources) and finished goods, improving consumer trust and regulatory compliance.

DRO & Impact Forces Of Soy Sauce Packaging Bottles Market

The market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively constituting the Impact Forces. The primary driver is the accelerating global integration of Asian cuisines, fueling sustained demand for soy sauce in new geographic areas. This is powerfully complemented by consumer shifts toward packaged, branded food products over unpackaged alternatives, particularly in developing economies, necessitating high volumes of packaging. Conversely, the market faces significant restraint from volatile raw material prices, especially for crude oil derivatives impacting PET costs, and the increasingly stringent global regulations regarding single-use plastics and packaging waste, compelling costly R&D into alternative sustainable materials. Opportunities reside in the expansion of premium, low-sodium, and organic soy sauce varieties, which demand specialized, high-end packaging formats that command higher margins, and the adoption of cutting-edge recycling infrastructure. These factors exert high impact forces, dictating strategic investments in both material science and manufacturing efficiency.

Impact forces specifically center on sustainability mandates. Manufacturers are under intense pressure from retailers and consumers to reduce their environmental footprint, leading to rapid material substitution and innovation. For instance, the pressure to use higher percentages of post-consumer recycled (PCR) content in plastic bottles or to transition to ultra-lightweight glass is a defining force. Economic downturns or logistical disruptions, such as shipping container shortages or energy price spikes, directly influence operational costs, affecting profitability and pricing strategies across the packaging value chain. Furthermore, the imperative for functional convenience, driven by modern lifestyles, compels continuous refinement of dispensing mechanisms (e.g., non-drip spouts, specialized pourers) to enhance the user experience, making packaging design a competitive battleground.

Technological impact forces are crucial, with advancements in barrier coatings for PET allowing it to compete more effectively with glass, particularly for ambient storage applications. Automation and Industry 4.0 principles are also forcing manufacturers to invest in highly automated production lines to maintain cost competitiveness and rapid response times. The collective impact of these forces ensures the market is constantly evolving, requiring continuous adaptation in material selection, process optimization, and compliance with evolving international food safety and labeling standards. The drive for enhanced product safety and authentication, often achieved through advanced sealing and labeling technologies, further shapes investment decisions within the industry.

Segmentation Analysis

The Soy Sauce Packaging Bottles Market is extensively segmented based on material, capacity, closure type, and end-user application, allowing for granular analysis of market trends and consumer preferences. Understanding these segmentations is crucial for packaging manufacturers to align their production capabilities with specific market needs, such as supplying high-barrier materials for premium products or cost-effective, bulk containers for institutional use. The material segmentation (Glass, PET, HDPE) remains the most critical differentiator, influencing shelf life, brand perception, and logistical viability. Capacity segmentation reflects household size and distribution channels, distinguishing between single-serve portions, standard retail volumes, and large industrial drums. This diversified structure ensures that packaging solutions are optimized for various economic and functional requirements across the global supply chain.

- By Material:

- Glass (Clear, Amber)

- Plastic (PET, HDPE, PP)

- Others (Ceramic, Metal Cans – Niche/Industrial)

- By Capacity:

- Up to 250 ml

- 250 ml to 500 ml

- 500 ml to 1,000 ml

- Above 1,000 ml (Bulk/Industrial)

- By Closure Type:

- Screw Caps (Standard, Child-resistant)

- Dispensing Closures (Flapper caps, Pour spouts, Droppers)

- Pump and Spray Closures (Niche application)

- By End-User:

- Retail (Household consumption)

- Food Service/HoReCa (Restaurants, Cafes)

- Industrial (Food Manufacturers, Ingredient Suppliers)

Value Chain Analysis For Soy Sauce Packaging Bottles Market

The value chain for soy sauce packaging bottles begins with upstream activities involving raw material extraction and synthesis, primarily sand (for glass) and crude oil (for plastics). Key upstream suppliers include major petrochemical companies and specialized glass producers, whose pricing and supply consistency significantly influence the final packaging cost. The manufacturing stage involves intricate processes such as glass blowing, injection molding, or blow molding to produce the specific bottle forms, followed by secondary processes like surface treatments, printing, and labeling. Efficiency in these upstream and manufacturing phases, particularly energy consumption during glass production, is a major determinant of competitive advantage.

Midstream activities involve the conversion of packaging materials into finished bottles and coordination with closure and dispensing mechanism suppliers. Effective quality control and certification (e.g., ISO, FDA compliance) are crucial here. The finished bottles then enter the distribution channel, which is complex and bifurcated. Direct distribution typically occurs between large, integrated packaging firms and major multinational soy sauce manufacturers (like Kikkoman or Haitian), often involving bespoke contracts and dedicated supply lines. Indirect channels utilize distributors, wholesalers, and specialized packaging brokers, which is more common for serving smaller, regional soy sauce producers, particularly those requiring flexible order quantities and customized service.

Downstream activities are centered around the end-users: the soy sauce manufacturers who fill and seal the bottles, and subsequently, the final consumers. Critical downstream considerations include optimizing bottle design for high-speed filling lines (process compatibility) and ensuring the packaging meets retailer shelf space requirements (retail readiness). The distinction between direct sales (high-volume, specific contract fulfillment) and indirect sales (smaller batches, accessible to SMEs) is vital for market penetration. The efficiency of this downstream segment relies heavily on logistics, inventory management, and the ability of the packaging to withstand varying environmental conditions during global transport and long-term storage.

Soy Sauce Packaging Bottles Market Potential Customers

Potential customers for soy sauce packaging bottles are multifaceted, spanning the entire food industry ecosystem, but primarily concentrated among large-scale producers and institutional buyers. The primary end-users are the global, national, and regional manufacturers of soy sauce and related condiments, such as Kikkoman, Lee Kum Kee, and regional producers in China (Haitian, Pearl River Bridge). These clients require highly reliable, certified packaging solutions in massive volumes, often necessitating customized designs for brand differentiation and specialized closures for functional pouring, making consistent quality and supply chain stability paramount.

A secondary, yet significant, customer base resides in the Food Service/HoReCa sector. This includes international hotel chains, major restaurant groups (especially Asian cuisine specialists), and catering companies that require robust, easy-to-handle bulk packaging (e.g., 2L to 5L plastic containers) or attractive tabletop glass dispensers for direct customer use. Furthermore, industrial food processors who utilize soy sauce as a key ingredient in sauces, marinades, frozen foods, and snack flavoring constitute a substantial segment, demanding large-capacity drums or Intermediate Bulk Containers (IBCs) for efficient integration into their production lines, where factors like chemical compatibility and high-throughput filling capability are essential requirements.

Emerging opportunities are concentrated among niche and specialized food manufacturers, including producers of organic, gluten-free, low-sodium, or fermented artisanal sauces. These customers frequently prioritize premium packaging—often customized, heavy-base glass bottles—to justify higher price points and convey artisanal quality. Therefore, packaging suppliers must cater to high-volume contracts with major players while simultaneously offering flexible, design-forward solutions suitable for smaller, premium brands entering the market. The ultimate decision-makers are purchasing managers focused on cost-efficiency, quality assurance, regulatory compliance, and increasingly, verifiable sustainability credentials.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kikkoman, O-I Glass, Amcor, Berry Global, Ardagh Group, Vidrala, Gerresheimer, Graham Packaging, Plastipak Holdings, Consol Glass, Owens-Illinois, Toyo Seikan Group, Piramal Glass, SGD Pharma, Vetropack Group, Allied Glass, CCL Industries, Takigawa Corporation, Ball Corporation, Silgan Holdings |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Soy Sauce Packaging Bottles Market Key Technology Landscape

The technology landscape for soy sauce packaging bottles is rapidly evolving, driven by the dual pressures of enhancing product preservation and meeting rigorous sustainability targets. Key technological advancements center on barrier technology, particularly for plastic solutions, enabling PET bottles to offer shelf lives comparable to glass. Advanced multi-layer co-extrusion and plasma deposition techniques apply ultra-thin barrier coatings (e.g., SiOx or carbon-based) on plastic surfaces, drastically reducing oxygen transmission rates (OTR) and mitigating flavor loss and oxidation, which are critical issues for fermented products like soy sauce. This technological parity is allowing plastic to gain market share even in premium segments previously reserved exclusively for glass.

In the glass segment, innovation focuses on lightweighting and enhanced durability. Narrow Neck Press and Blow (NNPB) technology is widely adopted, allowing for the manufacture of lighter glass bottles without compromising structural integrity or filling line performance. Furthermore, surface treatment technologies, such as external polymer coatings, are used to increase the abrasion resistance of glass bottles, reducing scuffing during high-speed handling and extending the aesthetic lifespan of the packaging. These advancements are essential for reducing the energy required for transportation and manufacturing, directly contributing to sustainability goals and improving cost efficiencies for brand owners.

The functional aspect of packaging is also seeing technological refinement, particularly concerning dispensing systems. Non-drip pour spouts, often integrated with the cap or neck finish, utilize complex geometrical designs to ensure precision pouring and eliminate mess, significantly enhancing the consumer experience. Furthermore, the integration of smart packaging features, such as NFC or RFID tags and advanced printing technologies for high-resolution graphics, are being tested to provide consumers with extended product information, traceability data, and enhanced brand interactivity. These technological integrations move the bottle beyond a mere containment vessel into a sophisticated tool for logistics, marketing, and consumer engagement.

Regional Highlights

The global Soy Sauce Packaging Bottles Market exhibits distinct regional consumption and manufacturing patterns. Asia Pacific (APAC) dominates the market, serving as both the largest consumer base due to traditional dietary habits and the primary manufacturing hub for the raw condiment. Countries like China, Japan, and South Korea, which host major global soy sauce producers, drive demand for high-volume, cost-efficient packaging, increasingly favoring robust, lightweight PET for large formats and traditional, high-quality glass for specialty and domestic premium brands. The rapid modernization of retail and logistics infrastructure in Southeast Asia further accelerates the consumption of packaged, branded soy sauce.

North America and Europe represent the fastest-growing regions, characterized by demand driven by culinary diversification and large immigrant populations. These markets exhibit a strong preference for premium, imported soy sauce, leading to higher consumption of distinctively shaped, often smaller-sized glass bottles that convey authenticity and quality. Furthermore, sustainability concerns are most pronounced here; regulatory pressures and consumer sentiment strongly favor packaging solutions that utilize high levels of Post-Consumer Recycled (PCR) content in plastic or easily recyclable, single-material structures, mandating suppliers to invest heavily in circular economy packaging designs.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging markets experiencing strong growth, fueled by the expansion of international QSR chains and growing urbanization. Packaging requirements in these regions often lean towards durable, heat-resistant, and cost-effective plastic containers (HDPE and PET) suitable for diverse and often challenging climate conditions and logistical environments. While volume growth is high, the focus tends to be more on functional stability and cost minimization rather than premium material aesthetics, although premium segments are gradually developing in major metropolitan areas.

- Asia Pacific (APAC): Market leader by volume; manufacturing center; high reliance on both bulk PET and premium glass; China, Japan, and South Korea are key consumption drivers.

- North America: High growth rate; strong preference for imported premium products; emphasis on sustainable materials (PCR content) and sophisticated dispensing caps.

- Europe: Rapidly adopting environmentally friendly packaging standards; demand concentrated in convenient, retail-sized formats; focus on lightweighting and compliance with EU plastics directives.

- Latin America (LATAM): Emerging growth market; demand driven by food service expansion; preference for robust, economical plastic solutions suitable for high ambient temperatures.

- Middle East and Africa (MEA): Growth fueled by increased urbanization and Westernization of diet; strong potential for basic, functional, and heat-resistant plastic packaging.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Soy Sauce Packaging Bottles Market. These companies include major packaging manufacturers providing proprietary and customized bottling solutions to global soy sauce brands.- Amcor plc

- Berry Global Group, Inc.

- O-I Glass, Inc. (Owens-Illinois)

- Ardagh Group S.A.

- Vidrala, S.A.

- Gerresheimer AG

- Graham Packaging Company

- Plastipak Holdings, Inc.

- Consol Glass (Pty) Ltd

- Toyo Seikan Group Holdings, Ltd.

- Piramal Glass Private Limited

- SGD Pharma

- Vetropack Group

- Allied Glass Containers Ltd.

- CCL Industries Inc.

- Takigawa Corporation

- Ball Corporation (Focusing on sustainable alternatives/niche)

- Silgan Holdings Inc.

- Sonoco Products Company

- Huhtamaki Oyj

Frequently Asked Questions

Analyze common user questions about the Soy Sauce Packaging Bottles market and generate a concise list of summarized FAQs reflecting key topics and concerns.What materials are primarily used for soy sauce packaging bottles, and which is dominating the market?

The primary materials are Glass and Plastic (PET and HDPE). Historically, glass dominated due to superior inert barrier properties, crucial for preserving complex flavors. However, PET is gaining significant traction and is highly dominant in the high-volume and bulk segments due to its lightweight nature, reduced breakage risk, and lower logistical costs, especially with the use of advanced barrier coatings.

How does the shift towards sustainable packaging impact the design of soy sauce bottles?

The demand for sustainability drives innovation towards lightweighting (reducing material per unit), increasing the use of Post-Consumer Recycled (PCR) content in PET bottles, and optimizing glass bottle designs using technologies like NNPB. Design also focuses on mono-material structures and easily removable labels to improve recyclability and comply with international waste reduction mandates.

Which region holds the largest market share for soy sauce packaging, and why?

Asia Pacific (APAC), particularly driven by countries like China, Japan, and South Korea, holds the largest market share. This dominance is attributed to high traditional consumption rates of soy sauce, the presence of major global manufacturing hubs for the condiment, and the vast scale of retail and industrial packaging required across the region.

What technological advancements are improving the shelf life of soy sauce in plastic bottles?

Key technological advancements include the use of multi-layer co-extrusion and advanced plasma barrier coating techniques (such as SiOx deposition) on PET bottles. These technologies significantly decrease the oxygen transmission rate (OTR) and moisture permeability, thereby protecting the soy sauce from oxidation and extending its effective shelf life, making plastic viable for longer storage periods.

What are the primary factors restraining growth in the soy sauce packaging bottles market?

The main restraining factors are the volatility and high cost of raw materials (especially petrochemicals for plastics and energy for glass production), coupled with the increasing complexity of environmental regulations globally. These regulations often necessitate expensive investments in new machinery and sustainable material R&D, adding to the operational costs for packaging manufacturers.

Why is functional design, such as non-drip spouts, becoming increasingly important?

Functional design elements like non-drip spouts are crucial for enhancing the consumer experience and providing brand differentiation in competitive retail environments. Modern consumers prioritize convenience and cleanliness; specialized closures that prevent spillage and allow for precise measurement elevate product perception and drive repeat purchase decisions.

How does the segmentation by capacity influence market trends?

Capacity segmentation reveals a dual trend: growing demand for smaller retail bottles (under 500 ml) catering to smaller household sizes and the convenience sector, and sustained demand for large industrial volumes (above 1,000 ml) utilized by food manufacturers and the expansive food service sector. Packaging providers must manage diverse production lines to address both extremes effectively.

What role does the HoReCa segment play in the packaging market demand?

The HoReCa (Hotel, Restaurant, Catering) segment is a significant volume driver, requiring durable, often branded, medium-to-large capacity dispensers (500 ml to 2L) that can withstand rigorous use in commercial kitchens and dining settings. This segment prioritizes robustness, ergonomics for frequent handling, and cost-efficiency over complex aesthetics.

Are ceramic or metallic packaging options still relevant in this market?

Ceramic packaging is highly niche, reserved exclusively for ultra-premium, artisanal, or limited-edition soy sauce varieties where heritage and high perceived value are paramount, serving as collectible items rather than mainstream containers. Metallic options, such as industrial metal drums, are relevant only in large-scale bulk shipping or industrial supply contexts, not retail.

How is AI impacting quality control in bottle manufacturing?

AI utilizes sophisticated machine vision systems and deep learning algorithms to monitor manufacturing lines in real-time. This enables instant identification of minute defects in glass stress points, plastic geometry, or label positioning, ensuring near-perfect quality assurance at speeds unattainable by human inspection, thereby reducing waste and recall risks.

What is the key differentiator between PET and HDPE used in soy sauce packaging?

PET (Polyethylene Terephthalate) is preferred for its transparency, rigidity, and superior barrier properties against gases, making it ideal for retail bottles requiring longer shelf life and clarity. HDPE (High-Density Polyethylene) is generally opaque, more cost-effective, and highly durable, making it more common for larger, industrial or institutional packaging where clarity and aesthetic appeal are secondary to sturdiness and volume.

Why are amber and opaque glass bottles sometimes used for soy sauce?

Amber or opaque glass is used primarily to protect the soy sauce from light exposure. Light, particularly UV radiation, can degrade the quality, color, and flavor profile of the fermented product over time. Using colored glass provides a necessary barrier, ensuring the product maintains its integrity throughout its shelf life, often seen in high-end, premium offerings.

How do packaging suppliers cater to the diverse needs of regional soy sauce manufacturers?

Suppliers employ flexible business models, utilizing both direct distribution for large multinational corporations requiring highly customized, contract-based production (GEO strategy) and relying on indirect distribution through brokers and wholesalers to serve smaller, regional manufacturers who need standard formats, lower minimum order quantities, and rapid turnaround times.

What is the significance of the Narrow Neck Press and Blow (NNPB) technology in glass packaging?

NNPB technology is significant because it allows glass manufacturers to produce lighter-weight bottles with reduced material input while maintaining structural strength and stability. This process enhances sustainability by lowering glass usage and reducing the carbon footprint associated with both manufacturing and transportation.

How does the rising demand for low-sodium soy sauce affect packaging requirements?

The demand for specialized varieties, like low-sodium or organic soy sauce, often elevates the packaging requirements. These products are typically positioned as premium, necessitating high-quality, aesthetically pleasing glass bottles with specific closures and premium labeling to justify a higher price point and convey purity and health benefits to the consumer.

What impact do fluctuating crude oil prices have on the packaging market?

Fluctuating crude oil prices directly impact the production cost of all plastic materials, including PET and HDPE, which are oil derivatives. Sharp increases in crude oil prices lead to higher raw material costs for packaging manufacturers, potentially tightening margins or forcing price increases on finished bottles, affecting downstream soy sauce producers.

What are tamper-evident seals and why are they mandatory for soy sauce bottles?

Tamper-evident seals are mechanisms (such as plastic rings or foil induction seals) designed to show visible evidence if the package has been opened prior to purchase. They are mandatory for ensuring consumer safety and trust, protecting the product from contamination or adulteration during the complex supply chain from factory to retail shelf.

How are packaging companies addressing the challenge of ocean plastic pollution?

Packaging companies are addressing this by increasing the use of Post-Consumer Recycled (PCR) plastic content in their PET bottles, investing in advanced recycling infrastructure, and designing bottles for maximum recyclability (mono-material design) to divert plastic waste from landfills and oceans and support the circular economy.

Does bottle shape significantly influence consumer purchasing decisions for soy sauce?

Yes, bottle shape is a critical factor in brand differentiation and retail shelf appeal. Unique, proprietary bottle shapes convey brand identity and premium status. Ergonomic designs, ensuring comfortable handling and pouring, also significantly enhance the user experience, often influencing consumer choice in a crowded condiment aisle.

What are the primary logistical considerations for soy sauce packaging bottles?

Primary logistical considerations include minimizing bottle weight (lightweighting both glass and plastic to reduce freight costs), optimizing geometric shapes for efficient pallet stacking and container utilization, and ensuring the packaging is robust enough to prevent breakage or leakage during long-distance transportation and handling.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager