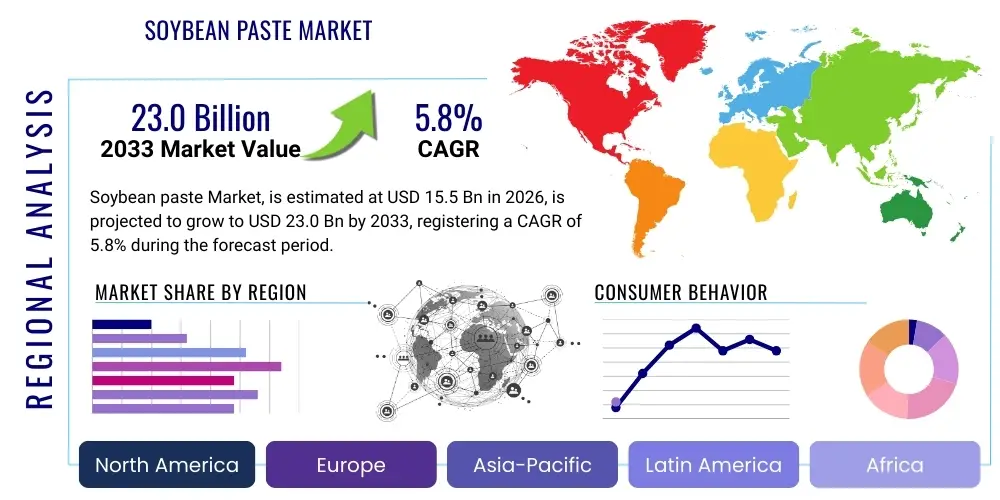

Soybean paste Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436074 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Soybean paste Market Size

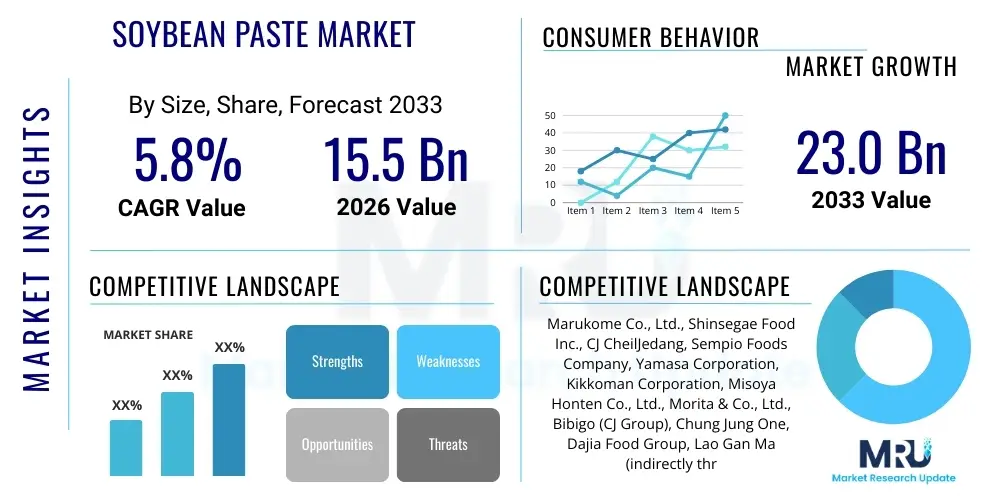

The Soybean paste Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 23.0 Billion by the end of the forecast period in 2033.

Soybean paste Market introduction

The Soybean Paste Market encompasses the global production, distribution, and consumption of fermented soybean products, which are fundamental culinary staples across East and Southeast Asia, and increasingly popular in Western cuisine due to rising demand for umami flavors and plant-based proteins. Soybean paste, derived from soybeans, salt, and fermentation agents (such as Koji mold or various bacteria), serves as a versatile flavor base, seasoning agent, and dipping condiment. Products include Japanese Miso, Korean Doenjang/Gochujang (often mixed with chili), and Chinese Doubanjiang or Taucu. The historical significance and deeply ingrained cultural acceptance of these pastes ensure a stable demand foundation, while innovation in flavor profiles and packaging caters to modern consumer needs for convenience and specific dietary requirements, such as low-sodium or gluten-free variations.

Major applications of soybean paste extend across household cooking, the expansive food service industry (restaurants, cafes, fast food chains), and industrial food processing, where it is used as a core ingredient in marinades, sauces, soups (like Miso soup and Kimchi Jjigae), stews, and snack flavorings. The functional benefits of soybean paste are significant; being a naturally fermented product, it offers probiotic advantages, is rich in essential amino acids, B vitamins, and minerals. Furthermore, its ability to enhance the savory depth (umami) of dishes makes it an indispensable component in savory processed foods, driving its adoption in ready-to-eat meals and specialized vegetarian and vegan product lines globally.

Key factors driving market expansion include the globalization of Asian cuisine, particularly the widespread popularity of Japanese, Korean, and Chinese culinary traditions in Europe and North America. Health consciousness among consumers is also a major catalyst, as fermented foods are often perceived as beneficial for gut health. The continuous development of innovative, convenient product formats, such as concentrated pastes, liquid sauces, and ready-to-use seasoning packets, allows for easier integration into diverse cooking styles. Economic development in key consumption regions, coupled with improved cold chain logistics facilitating the export of premium, traditionally fermented products, further stimulates the overall market growth trajectory.

Soybean paste Market Executive Summary

The Soybean paste market demonstrates robust expansion, fueled primarily by sustained interest in authentic Asian flavors and the global health trend emphasizing fermented foods. Business trends indicate a strong focus on strategic mergers and acquisitions among key producers to consolidate global supply chains and acquire specialized regional fermentation expertise. Furthermore, investment is rapidly shifting towards sustainable and traditional production methods, such as non-GMO and organic soybean sourcing, to meet premium consumer expectations, driving up the average price point. Manufacturers are also leveraging digital marketing channels to educate Western consumers on the diverse applications of various soybean paste types, moving beyond traditional staple uses into contemporary culinary experiments, thereby broadening the consumer base and maximizing market penetration.

Regionally, Asia Pacific maintains its dominance, driven by high per capita consumption in China, Japan, and South Korea, where soybean paste is integral to daily diet and food culture. However, North America and Europe are emerging as the fastest-growing regions, benefiting from increasing multicultural populations and rising demand from the food service sector for specialized, authentic ingredients. In these Western markets, the adoption of soybean paste is characterized by its use in fusion cuisine and as a core component of plant-based flavor development, substituting animal products to provide necessary savory complexity. Governments in key producing countries are actively promoting their traditional fermented pastes through cultural diplomacy and quality standard enforcement, securing their position in international trade.

Segment-wise, the market sees the fermented soybean type holding the largest volume share, yet the specialty and artisanal segment, focusing on specific geographical origins, unique aging processes, and premium ingredients, is projected to witness the highest CAGR. Application trends show significant growth in the food processing segment, particularly in the production of packaged sauces, marinades, and ready meals that require consistent, high-quality umami base flavors. The trend towards spicier variants, notably Gochujang and spicy Doubanjiang, continues to gain momentum globally, reflecting a broader consumer acceptance of intense and complex heat profiles in everyday condiments, necessitating higher production volumes for chili-infused pastes.

AI Impact Analysis on Soybean paste Market

User inquiries regarding AI's impact on the Soybean paste market frequently center on optimizing the complex, sensitive fermentation process, enhancing quality control and consistency, and predicting regional consumer preference shifts. Consumers and industry stakeholders are keen to understand how machine learning can analyze environmental factors (temperature, humidity, microbial activity) in real-time to shorten aging periods without compromising traditional flavor depth, which is currently highly variable. There is also significant interest in using AI-driven image processing and sensor technologies to rapidly detect potential contaminations or variations in texture and color, ensuring adherence to stringent global food safety and quality standards, addressing concerns about large-scale industrial consistency versus artisanal quality preservation.

- AI-driven Precision Fermentation: Optimization of microbial culture conditions, temperature, and moisture levels using predictive analytics to ensure batch-to-batch consistency and potentially accelerate the maturation process of pastes like Miso or Doenjang while maintaining essential flavor compounds.

- Automated Quality Control: Deployment of computer vision systems and spectral analysis to monitor texture, color, and aroma profiles during production, identifying defects or deviations from quality benchmarks much faster and more accurately than human inspection.

- Supply Chain & Inventory Management: Utilization of machine learning algorithms to forecast demand fluctuations based on seasonal changes, promotional activities, and localized culinary trends, optimizing the inventory of raw soybeans and finished paste products, thereby reducing waste and storage costs.

- New Product Development (NPD): AI analysis of vast flavor databases (flavor chemistry, ingredient interactions) to generate novel soybean paste formulations that appeal to specific non-traditional markets, such as low-sodium or fortified variants, tailoring products to regional palates and nutritional requirements.

- Consumer Trend Prediction: Leveraging natural language processing (NLP) on social media and recipe sites to identify emerging culinary trends and ingredient pairings involving soybean paste, enabling faster market adaptation and targeted marketing campaigns toward specific demographic groups.

DRO & Impact Forces Of Soybean paste Market

The Soybean paste market dynamics are shaped by a complex interplay of Drivers, Restraints, and Opportunities, which collectively exert significant impact forces on strategic decision-making and investment. Strong drivers include the accelerating demand for savory, umami-rich ingredients globally, fueled by the expanding popularity of Asian fast casual and fine dining concepts. Simultaneously, the inherent health halo associated with traditional fermented foods positions soybean paste favorably among health-conscious consumers seeking natural sources of probiotics and plant-based protein, cementing its role as a functional food. Furthermore, technological advancements in packaging and preservation techniques have significantly extended shelf life and maintained product integrity, allowing widespread international distribution into previously inaccessible markets, thereby magnifying the accessible consumer base.

Conversely, the market faces considerable restraints, primarily concerning raw material price volatility, particularly soybeans, which are susceptible to climatic changes, geopolitical trade policies, and commodity market speculation, leading to unstable input costs for manufacturers. Another major constraint is the long and inconsistent fermentation time required for high-quality, traditionally aged pastes, which limits mass production capacity and scalability, creating a bottleneck for producers aiming for premium market segments. Moreover, regulatory barriers concerning food labeling (especially related to fermentation process definitions and sodium content) in Western markets pose compliance challenges, necessitating significant investment in R&D to meet diverse international quality and safety standards without compromising traditional flavor profiles.

Opportunities for growth are abundant, notably through geographical diversification beyond traditional Asian markets, focusing on leveraging the product in non-Asian culinary applications, such as incorporating it into BBQ sauces, salad dressings, and artisanal bread recipes in North America and Europe. Innovation in product line extensions, including the introduction of low-sodium, organic, and certified gluten-free (using rice or alternative grains for fermentation) variants, addresses specific modern dietary needs and expands market accessibility. The industry also benefits significantly from vertical integration, allowing manufacturers to control the quality of the raw soybean supply and fermentation environment, thereby improving efficiency and reducing the vulnerability associated with external supply chain shocks, reinforcing overall market resilience and competitive positioning.

Segmentation Analysis

The Soybean paste market is comprehensively segmented based on Type, Flavor, Application, and Distribution Channel, allowing for granular analysis of consumer preferences and market dynamics across various regions. This structured approach helps stakeholders identify high-growth niches, especially within specialty fermentation types and industrial applications. Understanding these segments is crucial for tailoring product development and marketing strategies, ensuring that the offerings align precisely with the specific needs of household consumers seeking convenience, and industrial buyers requiring large volumes of consistent, high-quality base flavor ingredients. The distinct characteristics of products like sweet Miso versus pungent Doenjang necessitate careful segmentation based on flavor profile, which directly impacts regional consumption patterns and potential export opportunities.

The segmentation by Type, distinguishing between Miso, Doenjang, Doubanjiang, and general fermented soy paste, reflects the vast cultural diversity in production and usage, with Miso holding a significant value share due to its established global presence and versatility in Japanese cuisine. By Application, the market is driven predominantly by the household sector, yet the food service and food processing industries are exhibiting accelerated growth, demanding large, bulk packaging and specialized industrial formulations. Analyzing Distribution Channels highlights the shift towards e-commerce and specialized Asian grocery stores, particularly in regions outside APAC, facilitating easier access for consumers seeking authentic international ingredients, thereby bypassing traditional supermarket supply chain hurdles and increasing direct-to-consumer engagement.

- Type:

- Miso (Shiro, Aka, Awase, Barley, Hatcho)

- Doenjang (Korean Fermented Soybean Paste)

- Doubanjiang (Chinese Fermented Bean Paste, often spicy)

- Taucu (Indonesian/Malaysian Fermented Paste)

- Other Specialty Fermented Pastes (Natto Paste, Tempeh Paste)

- Flavor:

- Spicy/Chili-Infused

- Non-Spicy/Traditional

- Sweet/Reduced Salt

- Application:

- Household/Retail

- Food Service (Restaurants, Cafeterias, Hotels)

- Food Processing/Industrial (Sauces, Marinades, Ready Meals)

- Distribution Channel:

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores (Asian Groceries)

- Online Retail/E-commerce

Value Chain Analysis For Soybean paste Market

The value chain of the Soybean paste market begins with the rigorous upstream analysis encompassing the sourcing and processing of raw materials, primarily soybeans, salt, and various fermentation agents such as rice, barley, and specialized fungal cultures (Koji). Critical upstream activities involve securing high-quality, often non-GMO or organic, soybean crops, followed by processes like soaking, boiling, and steaming, which prepare the base matrix for fermentation. Given the significant environmental impact of soybean cultivation and the premium placed on sustainable sourcing, vertical integration and establishing long-term contracts with specialized soybean farmers are becoming vital strategic imperatives for major market players to ensure traceability, quality consistency, and cost control throughout the initial production stages, mitigating risks associated with commodity price fluctuations.

The core manufacturing process constitutes the midstream, which involves inoculation with Koji or bacterial starters, mixing with salt, and the critical aging or fermentation phase, which can span from a few weeks to several years depending on the desired product profile (e.g., light Miso versus aged Hatcho Miso). This stage demands stringent quality control and specialized temperature and humidity management, utilizing sophisticated bioreactors or traditional earthen vats. Following fermentation, the paste is ground, blended, often pasteurized (to stabilize shelf life, although artisanal producers might skip this), and finally packaged. Packaging innovation plays a key role here, focusing on airtight, hygienic, and consumer-friendly containers that preserve the flavor and prevent secondary fermentation or oxidation during the extended distribution cycle.

Downstream analysis focuses on distribution channels, which are characterized by both direct and indirect routes. Indirect distribution, leveraging major third-party logistics providers, large international importers, and established retailer networks (supermarkets, hypermarkets), handles the majority of mass-market, shelf-stable products. Direct distribution is increasingly important for high-value, artisanal, or niche products, often involving direct-to-consumer e-commerce or specialized, regionally focused distributors who cater exclusively to Asian grocery stores and high-end restaurants, ensuring product integrity and cultural context are maintained. The effectiveness of the overall value chain relies heavily on maintaining a seamless cold chain where applicable and utilizing efficient international shipping routes, particularly when moving high-volume products between Asia Pacific and Western consumer hubs.

Soybean paste Market Potential Customers

The potential customer base for the Soybean paste market is diverse and spans multiple commercial and consumer sectors, driven by cultural heritage, nutritional requirements, and culinary experimentation. Traditional customers remain deeply rooted in East and Southeast Asia, including households and ethnic restaurants in regions like China, Japan, and South Korea, where the paste is a non-negotiable daily food ingredient used in staple meals, soups, and marinades. This core demographic seeks authenticity, quality reflective of specific regional fermentation traditions, and value pricing for high-volume consumption, demanding consistent availability through conventional retail channels and neighborhood markets that prioritize bulk purchasing and local sourcing networks.

The rapidly expanding segment of potential customers includes modern, health-conscious Western consumers, encompassing millennials and Generation Z in North America and Europe, who are actively seeking functional foods, plant-based alternatives, and unique, complex flavor enhancers. These buyers are less restricted by traditional usage and utilize soybean paste (particularly high-end Miso and Gochujang) in novel applications such as flavoring roasted vegetables, adding depth to vegan stews, or creating innovative dips and glazes. This demographic prioritizes transparency regarding ingredients (non-GMO, organic, low-sodium), sustainable packaging, and accessibility through premium grocery chains and online marketplaces, demonstrating a willingness to pay a premium for certified ethical and high-quality products.

Furthermore, significant potential lies within the global Food Processing and Manufacturing (FPM) industry. FPM companies utilize soybean paste as a foundational ingredient for creating proprietary savory flavor bases for packaged soups, instant noodle flavor packets, vegetarian patties, processed meats (as a natural tenderizer and flavor enhancer), and large-scale marinades and ready-to-eat meal kits. These large industrial buyers require substantial, consistent supply volumes, precise technical specifications (e.g., specific protein content, low moisture level), and rigorous compliance with B2B quality standards, making them a crucial revenue stream that necessitates specialized bulk packaging and direct contractual sourcing from large-scale manufacturers focusing on industrial-grade quality and continuous supply reliability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 23.0 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Marukome Co., Ltd., Shinsegae Food Inc., CJ CheilJedang, Sempio Foods Company, Yamasa Corporation, Kikkoman Corporation, Misoya Honten Co., Ltd., Morita & Co., Ltd., Bibigo (CJ Group), Chung Jung One, Dajia Food Group, Lao Gan Ma (indirectly through chili bean paste), Eden Foods, Hanamaruki Foods, S.B. Foods, Otafuku Sauce Co., Ltd., Tofuna Fuyu, Miyasaka Jozo, Weijuan Food Co., Ltd., Ohsawa. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Soybean paste Market Key Technology Landscape

The technological landscape in the Soybean paste market is characterized by a blend of deeply traditional, centuries-old fermentation methods and cutting-edge industrial biotechnological advancements aimed at enhancing efficiency, quality, and safety. A primary technological focus involves optimizing and controlling the fermentation environment through advanced bioreactor design and automated monitoring systems. These systems utilize sophisticated sensors to track crucial parameters such as pH levels, temperature gradients, dissolved oxygen, and specific volatile organic compounds released during aging. This precision control allows manufacturers to accelerate the fermentation process for certain industrial grades while minimizing the risk of contamination, ensuring a consistent chemical and microbiological profile across massive production batches, bridging the gap between traditional flavor complexity and modern supply demands.

Another pivotal technological area is the deployment of advanced microbial strain selection and genetic sequencing. Manufacturers are increasingly isolating and utilizing highly effective, robust Koji and bacterial starter cultures, often genetically modified or specifically adapted for industrial environments, to standardize fermentation kinetics and enhance desirable flavor development (e.g., higher umami components). Furthermore, technologies related to extraction and filtration are employed post-fermentation to produce clean-label ingredients, such as liquid Miso concentrate or highly refined paste variants used in low-sodium formulations, allowing the retention of key flavor components while reducing salt or moisture content, thereby meeting stricter dietary regulations and consumer preference for healthier products without flavor sacrifice.

Packaging technology also plays a crucial role in maintaining product quality over extended international logistics chains. This includes the widespread adoption of Modified Atmosphere Packaging (MAP) and aseptic filling systems, particularly for pastes sold in pouches or tubs, which help prevent oxidation and control residual fermentation post-packaging. In addition, the integration of traceability technologies, such as RFID tags and advanced blockchain systems, is becoming standard practice, allowing consumers and regulators to verify the origin, fermentation duration, and authenticity of premium soybean pastes, satisfying the growing consumer demand for transparency and ensuring the integrity of the product throughout its journey from farm to shelf, thus underpinning the market’s trust and premium positioning.

Regional Highlights

- Asia Pacific (APAC): APAC represents the bedrock and primary consumption hub for the global Soybean paste market, driven by the deeply ingrained culinary traditions of China, Japan, and South Korea, which are the world's largest consumers and producers. The market here is mature but experiences robust growth fueled by population expansion and urbanization, leading to higher consumption of convenience food incorporating soybean paste. Manufacturers in this region focus heavily on maintaining the authenticity of regional varieties (e.g., Japanese Miso vs. Korean Doenjang) while simultaneously innovating in flavor integration and developing low-cost industrial-grade pastes for the massive local food processing sector. The sheer volume of household consumption makes APAC the dominant segment in terms of revenue and production capacity, setting global trends for flavor and usage.

- North America: North America is characterized by explosive growth, driven primarily by changing demographics, the rise of Asian-inspired dining experiences, and the high penetration of health and wellness trends. Consumers, particularly in urban centers, are adopting soybean paste as a healthy, naturally fermented, savory condiment and plant-based protein source. The North American market emphasizes premiumization, focusing on organic, non-GMO, and specialized artisan pastes imported from specific regions of Asia, attracting higher margins. E-commerce platforms and specialty grocers act as crucial distribution channels, overcoming traditional supermarket inertia regarding ethnic foods, ensuring the rapid introduction and accessibility of diverse paste types like Gochujang and various Miso varieties to a curious, experimental consumer base.

- Europe: Similar to North America, the European market is a high-growth region, strongly influenced by the globalization of food culture and increasing consumer awareness regarding gut health benefits derived from fermented products. Countries such as the UK, Germany, and France are seeing significant uptake of soybean paste, mainly driven by the food service industry using it to create innovative fusion dishes and enhance vegetarian offerings. Regulatory standards regarding salt content and novel food ingredient approvals pose specific challenges, encouraging producers to invest in advanced R&D to develop low-sodium alternatives specifically tailored for the European palate and adherence to strict EU food safety and labeling directives, promoting market expansion across the continent.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions currently represent smaller but developing markets for soybean paste, primarily concentrated within major metropolitan areas with established Asian expatriate communities and niche luxury food importers. Growth in LATAM is gradually accelerating due to increased trade agreements and growing interest in healthy, global cuisines among the middle and affluent classes. The MEA market, while constrained by low traditional awareness, offers long-term opportunity, particularly as tourism and international business exposure increase, leading to slow but steady demand for international ingredients, often sourced through specialized international distributors catering to the hospitality and high-end retail sectors in the Gulf Cooperation Council (GCC) countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Soybean paste Market.- Marukome Co., Ltd.

- CJ CheilJedang

- Sempio Foods Company

- Yamasa Corporation

- Kikkoman Corporation

- Shinsegae Food Inc.

- Misoya Honten Co., Ltd.

- Chung Jung One

- Dajia Food Group

- Hanamaruki Foods

- Morita & Co., Ltd.

- Eden Foods

- Otafuku Sauce Co., Ltd.

- Miyasaka Jozo

- Weijuan Food Co., Ltd.

- S.B. Foods

- Tofuna Fuyu

- Ohsawa

- Thai Fermented Soy Sauce Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Soybean paste market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Soybean paste Market?

The primary factor driving market growth is the intensified globalization of Asian culinary traditions, especially Japanese and Korean cuisine, coupled with a robust global consumer shift towards fermented foods perceived as beneficial for gut health and rich in plant-based proteins, significantly boosting demand across Western markets.

How does the high sodium content in traditional soybean pastes impact consumer adoption?

High sodium content is a major restraint, particularly in health-conscious Western markets. This concern is driving manufacturers to heavily invest in technological processes to develop and commercialize low-sodium or reduced-salt variants, using advanced fermentation and filtration techniques to meet dietary guidelines without compromising the essential umami flavor profiles.

Which geographical segment offers the highest potential for future market expansion?

While Asia Pacific remains the largest segment by volume, North America and Europe offer the highest potential for future market expansion due to increasing multicultural adoption, rapid growth in the plant-based food sector, and strong consumer acceptance of premium, artisanal imported pastes used in fusion cooking and industrial food processing applications.

What role does technology play in standardizing the quality of traditionally fermented soybean paste?

Technology plays a critical role through the use of AI-driven precision fermentation systems, advanced sensor monitoring, and microbial strain isolation. These tools help standardize the complex aging process, ensuring batch-to-batch consistency in flavor, texture, and nutritional value, which is essential for large-scale industrial buyers and export markets demanding strict quality assurance.

What are the key raw material challenges facing soybean paste producers?

The key challenge is the volatile pricing and supply chain instability of raw soybeans, which are highly susceptible to global climate patterns and international trade policies. Producers often mitigate this through strategic sourcing, forward contracts, and increasing the use of certified non-GMO and organic soybeans to appeal to premium market segments.

How are environmental concerns affecting soybean sourcing within the market?

Environmental concerns are leading to increased demand for sustainably sourced and identity-preserved soybeans. Consumers and industrial buyers are requiring clear traceability, pushing manufacturers toward stricter certification standards like organic or regenerative agriculture to ensure their supply chains minimize ecological impact and adhere to global sustainability goals.

Is there a noticeable trend toward specialized, regional soybean paste varieties globally?

Yes, there is a strong trend toward specialized, regional varieties. Consumers are moving beyond generic soybean paste towards specific types like Hatcho Miso (Japan), Gochujang (Korea), or specific Sichuan Doubanjiang, valuing authenticity, unique terroir, and traditional, long-aging processes, which command a higher price point in international specialty markets.

How is the food service segment utilizing soybean paste to drive consumption?

The food service segment utilizes soybean paste extensively to create complex, umami-rich flavors necessary for Asian fusion dishes, vegetarian, and vegan menu items. It is employed in large volumes for glazes, marinades, deep flavor bases for soups and sauces, providing cost-effective flavor enhancement that caters to diverse modern palates.

What distribution channel is gaining the most momentum outside of Asia?

Outside of Asia, the Online Retail/E-commerce distribution channel is gaining the most momentum. This allows niche manufacturers to bypass traditional retail gatekeepers and directly access specialized consumer bases seeking authentic international ingredients, offering a wider variety of specialized and artisanal products directly to the consumer's home.

What is the significance of the fermented soy market segment compared to simple soybean paste?

The general fermented soy segment often includes derivatives and highly processed or flavored products (like pre-mixed sauces or seasonings) that use soybean paste as a base. This segment is highly significant in industrial food processing due to its cost-effectiveness and consistency, though traditional pastes (Miso, Doenjang) still dominate the household and premium segments demanding pure, minimally processed fermentation.

How do trade agreements and tariffs influence the export of soybean paste?

Favorable trade agreements, such as those within the Asia-Pacific region and between Asia and Western markets, facilitate lower tariffs and smoother customs processes, significantly boosting export volumes. Conversely, trade disputes or new protectionist tariffs can introduce volatility, requiring manufacturers to adjust pricing or localize production to maintain market access and competitive advantage in key international territories.

Are there health concerns regarding additives or preservatives in industrial soybean pastes?

Consumers express concerns regarding synthetic additives or excessive use of preservatives in industrial pastes, preferring 'clean label' products. This preference is pushing manufacturers towards natural preservation methods (e.g., higher salt/sugar content, or improved thermal processing) and leveraging technologies like aseptic packaging to extend shelf life while maintaining ingredient transparency and appealing to the clean label movement.

What innovation trends are emerging in soybean paste packaging?

Packaging innovation focuses on sustainability and convenience. Trends include the use of biodegradable or recyclable materials, smaller single-serving packets for convenience meals, and specialized airtight containers or tubes that minimize oxidation and messy handling for consumers, making the product more accessible for diverse cooking styles and portability.

How is competition impacting pricing strategies in the market?

Competition is intensely bifurcated. In the mass market (Asia), competition drives aggressive value pricing and operational efficiency. In the premium international segment (West), competition centers on demonstrating authenticity, quality certifications (organic, non-GMO), and unique regional origin, allowing premium manufacturers to maintain high margins despite strong competitive pressure from local, generic imitation products.

What is the role of traditional knowledge preservation in the market?

Preserving traditional knowledge, especially unique Koji strains and aging techniques passed down through generations, is crucial for maintaining the authenticity and high value of artisanal pastes. Major players often acquire or partner with traditional producers to integrate this heritage knowledge into modernized, quality-controlled production lines, safeguarding cultural authenticity while scaling production.

How is climate change expected to affect the supply of soybeans?

Climate change poses a significant risk to soybean supply stability, primarily through increased frequency of droughts, floods, and unpredictable growing seasons in major producing regions. This necessitates investment in climate-resilient farming techniques, diversification of sourcing locations, and potential use of advanced agricultural technology to maintain consistent raw material supply despite environmental stressors.

What are the typical shelf life expectations for different types of soybean paste?

Shelf life varies significantly; traditional, highly salted, and minimally processed pastes (like aged Doenjang or Hatcho Miso) can last for many months, often improving with age even after opening, due to the high salt content inhibiting spoilage. Conversely, low-sodium or lightly fermented industrial pastes typically have a shorter shelf life and rely heavily on refrigeration or pasteurization to ensure quality over the product’s guaranteed period.

Is the market seeing more localized production outside of Asia to serve regional demands?

Yes, there is an emerging trend of localized production outside of Asia, particularly in North America and Europe, driven by the desire to reduce logistics costs, minimize environmental impact associated with long-distance shipping, and cater specifically to local palates and regulatory requirements, resulting in the creation of 'fusion' or Western-style soybean paste products.

What are the main differences between Miso and Doenjang regarding market applications?

Miso (Japanese) is typically milder, sweeter, and more versatile in applications ranging from soups, dressings, and desserts, having broad global acceptance. Doenjang (Korean) is generally saltier, earthier, and more pungent, used primarily in hearty stews (Jjigae), dips (Ssamjang), and robust marinades, retaining strong cultural association with traditional Korean comfort food.

How does the demand for vegan and vegetarian products influence the soybean paste sector?

The exponential growth in vegan and vegetarian diets strongly influences the market, as soybean paste is a crucial source of umami flavor and essential amino acids, serving as an effective, naturally derived replacement for savory animal bases (like bone broth or fish sauce) in countless plant-forward dishes globally, cementing its indispensable role in the modern plant-based food industry.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager