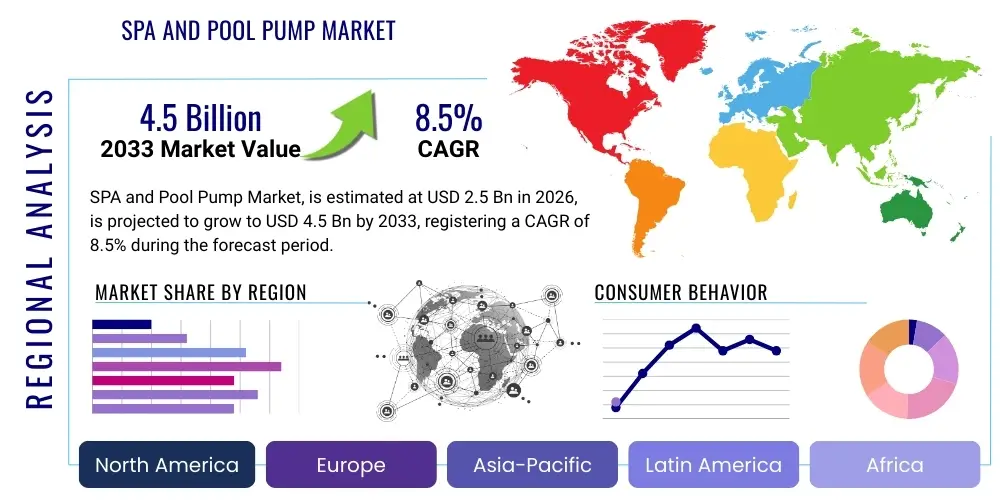

SPA and Pool Pump Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438586 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

SPA and Pool Pump Market Size

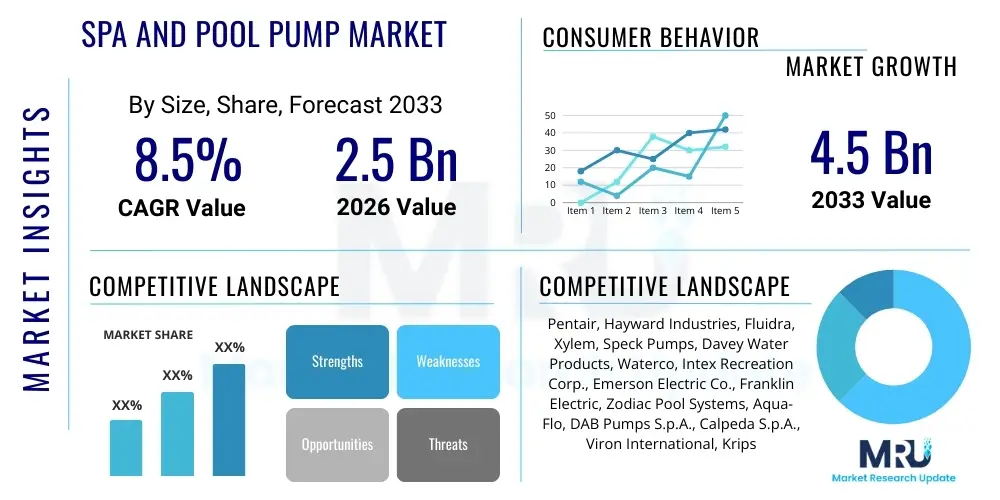

The SPA and Pool Pump Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 4.5 Billion by the end of the forecast period in 2033.

SPA and Pool Pump Market introduction

The global SPA and Pool Pump Market encompasses critical hydraulic components responsible for circulating water, ensuring filtration, heating, and sanitation within residential, commercial, and public aquatic facilities. This market is undergoing a significant transformation driven by stringent global energy efficiency regulations, primarily favoring variable speed pump (VSP) technology over traditional single-speed alternatives. VSPs offer substantial energy savings and quieter operation, positioning them as the standard for new installations and mandated replacements in major economies, thereby accelerating market value growth. The increasing adoption of smart home integration and the rise in discretionary consumer spending on home amenities further fuel demand for premium, connected pumping solutions, particularly in high-growth regions like North America and Europe where pool ownership rates are mature but efficiency upgrades are paramount.

Product descriptions within this segment typically span a variety of pump types tailored for specific applications, including circulation pumps, booster pumps, and specialty pumps for water features or heating systems. Key differentiators include energy efficiency ratings (like IE3 or IE4 standards), flow rate capabilities, noise levels, and integration compatibility with automation systems (IoT). Major applications range from small residential hot tubs and above-ground pools to large commercial complexes, municipal swimming centers, and therapeutic spas in the hospitality and healthcare sectors. The market’s resilience is underpinned by the essential maintenance and replacement cycle, as pumps have finite operational lifespans requiring periodic upgrades.

The primary benefits derived from modern pool and SPA pumps include reduced operational costs due to lower electricity consumption, improved water quality through consistent and optimized filtration cycles, and enhanced user experience via quieter operation and automated scheduling. Driving factors for market expansion include the global trend toward sustainable infrastructure, governmental rebates and mandates promoting high-efficiency equipment, continued housing market stability in key regions, and technological advancements allowing seamless integration with broader smart home ecosystems. These drivers collectively ensure sustained momentum and investment in R&D focusing on quieter, more durable, and intrinsically smart pumping solutions that meet evolving consumer expectations for convenience and sustainability.

SPA and Pool Pump Market Executive Summary

The SPA and Pool Pump Market is characterized by robust business trends centered on sustainability and digital integration. A dominant shift is evident in the regulatory landscape, particularly in North America and Europe, where mandates for variable speed pump (VSP) technology have reshaped the competitive environment. Companies are heavily investing in permanent magnet motors (PMM) and advanced inverter technology to meet stringent energy efficiency standards, leading to higher average selling prices (ASPs) but delivering substantial long-term value to end-users. Strategic partnerships between pump manufacturers and smart home platform providers are becoming commonplace, establishing integrated solutions that offer remote diagnostics, energy monitoring, and automated performance optimization, solidifying the market's transition toward sophisticated, digitally controlled systems.

Regionally, North America remains the leading market owing to a high existing base of pools and early adoption of mandatory VSP standards set by organizations like the Department of Energy (DOE) and California Energy Commission (CEC). Europe follows closely, driven by similar EU regulations focusing on eco-design requirements and energy labelling, with Germany and France exhibiting strong demand for premium, quiet pumps. The Asia Pacific (APAC) region, while still reliant on traditional pumps in developing areas, is poised for explosive growth, fueled by rising disposable incomes in China and Southeast Asia, increasing construction of luxury resorts, and a nascent, but accelerating, demand for energy-efficient products in urban centers, positioning it as the fastest-growing geographical segment over the forecast period.

Segmentation trends highlight the overwhelming dominance of the residential sector in terms of volume, though the commercial segment, including public pools, hotels, and water parks, demands higher-capacity, durable, and highly reliable products. In terms of technology, the Variable Speed Pump segment is rapidly outpacing Single Speed and Dual Speed pumps, driven exclusively by regulatory push and life-cycle cost savings, thereby defining future product innovation. Furthermore, the market for replacement and retrofit applications is particularly significant, often outperforming new construction sales, as existing pool owners seek to capitalize on government rebates and utility savings by upgrading aging, inefficient infrastructure, ensuring continuous revenue streams for manufacturers specializing in compatible upgrade solutions.

AI Impact Analysis on SPA and Pool Pump Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the SPA and Pool Pump Market predominantly revolve around three key areas: predictive maintenance capabilities, enhanced energy optimization, and integration with broader smart home ecosystems. Users frequently ask if AI can significantly extend pump lifespan, reduce electricity bills beyond standard VSP savings, and how complex the setup and maintenance of 'smart' pool systems are. They seek validation on whether the high initial investment in AI-enabled control systems justifies the long-term operational benefits, particularly concerning automated chemical balancing and proactive fault detection. The core expectation is that AI will transform pool ownership from a manually intensive chore into a completely autonomous, energy-minimized operation.

The current application of AI in the pool pump sector focuses on optimizing pump operation based on real-time environmental data, usage patterns, and predicted load requirements. AI algorithms process inputs from various sensors—temperature, water flow, chemical levels, and weather forecasts—to dynamically adjust pump speed and scheduling. This refinement moves beyond simple programming to truly adaptive performance, ensuring filtration is precisely calibrated to the exact needs of the pool at any given moment, minimizing wasted energy and chemical consumption. Furthermore, machine learning models analyze motor vibration and electrical signatures to predict potential mechanical failures days or weeks in advance, enabling owners or service technicians to perform preventative maintenance, thus drastically reducing unexpected downtime and costly emergency repairs.

- Predictive Maintenance: AI analyzes motor diagnostics (vibration, temperature, current draw) to forecast equipment failure, minimizing costly downtime.

- Dynamic Energy Optimization: Machine learning adjusts pump flow rates and run times based on real-time factors (bather load, weather, chemistry needs) to maximize energy savings beyond standard VSP programming.

- Automated Chemical Management: AI integrates with dosing systems to maintain perfect water chemistry, reducing corrosion on equipment and extending pump life.

- Remote Diagnostics and Troubleshooting: Allows service providers to identify and resolve issues remotely, significantly lowering service costs and response times.

- Seamless IoT Integration: AI acts as the central intelligence, coordinating the pump with heaters, sanitizers, lights, and covers within the smart home network for unified control.

DRO & Impact Forces Of SPA and Pool Pump Market

The market dynamics are governed by a powerful interplay of drivers stemming from regulatory pressures and consumer demand for sustainability, moderated by restraints related to high initial VSP costs and the complexities of integration, and bolstered by opportunities in developing regions and advanced technology adoption. Impact forces are currently leaning heavily toward growth, primarily propelled by global mandates enforcing energy efficiency, which compel a massive global installed base to upgrade their existing infrastructure. The convergence of favorable governmental policies—including tax credits and utility rebates—with intrinsic economic incentives (reduced long-term operating costs) creates an irresistible push toward high-efficiency variable speed pumps, overshadowing the primary short-term resistance posed by higher unit acquisition costs.

Key drivers include increasingly strict regulatory standards, such as the DOE regulations in the US and Ecodesign directives in the EU, which are eliminating single-speed pumps from the market. Consumer environmental consciousness and a desire for lower utility bills further accelerate the adoption of VSPs. However, major restraints involve the high initial investment required for VSPs and complex smart control systems, which can be prohibitive for budget-conscious homeowners or developing commercial sectors. Another restraint is the technical complexity associated with installing and programming advanced smart pumps, necessitating specialized training for service technicians, posing a challenge to widespread adoption in regions lacking adequate skilled labor.

Opportunities for expansion are primarily found in the rapid urbanization and rising leisure spending across APAC, where new pool construction is booming. Furthermore, technological innovation focused on miniaturization, solar integration for off-grid applications, and enhanced AI-driven automation presents significant commercial potential. The most impactful force is the substitution threat resistance, as VSPs fundamentally improve on older technology without viable external substitutes for the core function of water circulation, guaranteeing the continued relevance of the pump segment. The overall impact force matrix suggests a strong positive trajectory, driven predominantly by non-negotiable regulatory obligations and the long-term economic superiority of high-efficiency products.

Segmentation Analysis

The SPA and Pool Pump Market is systematically segmented based on product type, technology, application (end-user), and regional geography, allowing for precise market sizing and strategic targeting. The segmentation analysis reveals distinct characteristics regarding growth rate and adoption drivers across different categories. Variable speed technology dominates the growth trajectory, while the residential application segment accounts for the largest volume share. Geographical analysis emphasizes North America's maturity and high value, contrasted by Asia Pacific's high growth potential driven by new construction activity. Understanding these segments is crucial for manufacturers to tailor their product offerings, whether focusing on high-volume, cost-competitive residential units or high-durability, customizable commercial systems, ensuring maximum market penetration and competitive positioning.

- By Product Type:

- Self-Priming Pumps

- Booster Pumps

- Circulation/Filter Pumps

- Specialty Pumps (e.g., Waterfall, Fountain)

- By Technology:

- Variable Speed Pumps (VSP)

- Dual Speed Pumps

- Single Speed Pumps (Phasing out in regulated markets)

- By Application (End-User):

- Residential (In-ground Pools, Above-ground Pools, SPAs)

- Commercial (Hotels, Resorts, Public Pools, Water Parks, Fitness Centers)

- By Material:

- Thermoplastic Pumps

- Cast Iron Pumps

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For SPA and Pool Pump Market

The value chain for the SPA and Pool Pump Market begins with upstream activities focused on the sourcing and manufacturing of critical raw materials and components, including specialized plastics (thermoplastics like fiberglass-reinforced polymers), metals for motor casings and impellers, and high-tech electronic components (inverters, controllers, permanent magnet motors). Key suppliers are those providing high-efficiency motors and microcontroller units necessary for variable speed functionality and smart integration. Cost optimization at this stage is essential, particularly managing fluctuations in copper and resin prices. Manufacturers add value through proprietary impeller design, hydraulic optimization, noise reduction technology, and assembly processes that ensure compliance with stringent durability and energy standards.

Midstream activities involve core manufacturing, including precision casting, motor winding, and final assembly, followed by quality assurance and compliance certification (e.g., ETL, CE, DOE). Distribution channels form a critical link between manufacturers and the fragmented end-user market. Direct distribution often targets large commercial construction projects or major retail chains (e.g., Home Depot, specialty pool retailers), where large volume contracts are negotiated. Indirect channels, which dominate the residential aftermarket, rely heavily on a network of independent distributors, specialized pool and spa service companies, and third-party e-commerce platforms, offering installation services and localized support, which is vital for complex VSP installations.

Downstream analysis focuses on installation, maintenance, and the aftermarket services, which often generate higher-margin revenues than initial pump sales. End-users rely heavily on professional pool technicians for installation, particularly for VSPs which require precise sizing and programming. This dependence on skilled labor makes the relationship between manufacturers and service professionals crucial; many manufacturers offer training and certification programs to ensure proper product integration. The replacement market—driven by a 5-10 year typical lifespan—is the backbone of sustaining demand, where customer loyalty, brand reputation for reliability, and easy accessibility of spare parts and warranty service dictate long-term market success.

SPA and Pool Pump Market Potential Customers

Potential customers in the SPA and Pool Pump Market are broadly segmented into residential homeowners and commercial facility operators, each exhibiting distinct purchasing criteria and volume requirements. Residential end-users, encompassing individuals with private in-ground or above-ground pools and hot tubs, represent the highest volume segment. Their purchasing decisions are increasingly driven by long-term operating costs (energy savings), quiet operation, and ease of integration into existing smart home systems. While price sensitivity exists, the overwhelming regulatory push toward VSPs means homeowners are compelled to choose higher-efficiency options during replacement or new installation, often leveraging available utility rebates to offset initial costs.

The commercial segment includes high-throughput environments such as hotels, resorts, health and fitness clubs, municipal aquatic centers, water parks, and therapeutic facilities. These buyers prioritize product durability, reliability, high flow rates, redundancy, and low maintenance requirements, as downtime is extremely costly. Commercial installations utilize large, robust pumps and often require advanced chemical resistance and sophisticated control panels capable of handling fluctuating bather loads and stringent health regulations. Their purchasing cycle is driven by capital expenditure budgets, strict adherence to commercial building codes, and total cost of ownership (TCO) assessments, where long-term durability and warranty coverage significantly outweigh initial unit price concerns.

A third, rapidly growing customer demographic is the professional pool service and maintenance sector. These entities act as key influencers and direct purchasers, buying pumps in bulk for their clients' replacement needs and providing installation services. They are critical intermediaries whose recommendations heavily sway end-user choice. Manufacturers must focus on gaining the loyalty of these professionals by offering user-friendly installation, reliable technical support, training, and robust distributor partnerships, recognizing that the service industry represents the direct conduit for introducing and maintaining advanced pump technology in the sprawling aftermarket segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 4.5 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Pentair, Hayward Industries, Fluidra, Xylem, Speck Pumps, Davey Water Products, Waterco, Intex Recreation Corp., Emerson Electric Co., Franklin Electric, Zodiac Pool Systems, Aqua-Flo, DAB Pumps S.p.A., Calpeda S.p.A., Viron International, Kripsol, Pahlen AB, T-Star, CMP, Balboa Water Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

SPA and Pool Pump Market Key Technology Landscape

The technological landscape of the SPA and Pool Pump Market is defined by the dominance of permanent magnet motor (PMM) variable speed technology, which is displacing traditional induction motors. PMMs offer superior efficiency and torque across a wide range of speeds, allowing pumps to precisely match flow requirements, resulting in substantial energy savings—often exceeding 80% compared to single-speed models. The sophisticated control algorithms are managed by integrated digital controllers and inverters, which are now standard components, enabling automated scheduling, pressure monitoring, and seamless communication with external pool automation systems. This technological shift is entirely compliance-driven, ensuring manufacturers focus their R&D efforts on improving motor durability, reducing noise output (a crucial consumer preference), and enhancing the user interface for programming these complex devices.

A secondary, but increasingly critical, technological focus is the integration of Internet of Things (IoT) capabilities. Modern pumps are equipped with Wi-Fi or Bluetooth modules, enabling remote monitoring, diagnostics, and control via smartphone applications or dedicated pool controllers. This connectivity facilitates proactive maintenance alerts, allowing service technicians to diagnose issues before an on-site visit is necessary. Furthermore, advanced hydraulic design techniques are continuously optimized, utilizing computational fluid dynamics (CFD) software to refine impellers and volutes. The goal is to maximize water movement efficiency and self-priming capabilities while minimizing internal friction and hydrodynamic noise, contributing significantly to overall system performance and energy reduction targets mandated globally by energy efficiency standards.

The emerging technological frontier involves incorporating sensor fusion and AI processing directly into the pump's control unit. High-end models feature integrated flow meters, pressure sensors, and temperature probes that provide the data foundation for AI-driven optimization, moving beyond simple scheduling to predictive operational changes. Materials science also plays a vital role, with manufacturers developing enhanced thermoplastic and composite materials for pump housings and wet ends. These materials offer improved chemical resistance against harsh sanitizers (like chlorine and ozone), UV stability, and enhanced resistance to cavitation and corrosion, extending product lifespan and maintaining peak hydraulic performance over years of operation, addressing a major concern for both residential and commercial end-users.

Regional Highlights

North America maintains its status as the largest and most mature regional market, primarily driven by the vast installed base of residential pools, the high average household income supporting discretionary spending on pool upgrades, and, crucially, strict governmental regulations. The US Department of Energy (DOE) regulations, finalized in 2021, mandated VSP standards for most pool pump categories, effectively forcing market turnover and creating massive demand for replacement units. This regulatory environment, combined with high energy costs in states like California and Florida, incentivizes consumers to prioritize energy-efficient technology. The region benefits from highly organized distribution networks and widespread availability of skilled pool service professionals capable of installing and maintaining advanced VSP and automation systems, ensuring continued market value growth through high-ASP product penetration.

Europe represents the second-largest market, exhibiting strong growth propelled by the European Union’s Ecodesign Directive, which similarly pushes manufacturers toward highly efficient products (IE3/IE4 motors). Countries like Germany, France, and the UK demonstrate high consumer awareness regarding sustainability and acoustic performance, favoring premium, ultra-quiet pump models suitable for dense residential areas. The European market, however, is more fragmented compared to North America due to diverse national standards and pool construction preferences (e.g., preference for smaller, indoor pools or non-chlorine sanitation methods in certain regions). This diversity necessitates localized product customization but provides ample opportunities for niche manufacturers specializing in high-quality, customized, and integrated pool management solutions that meet localized aesthetic and regulatory requirements.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market over the projection period. This rapid expansion is primarily attributed to robust construction activity in the hospitality sector (resorts, luxury hotels) and rising affluence in metropolitan areas of China, India, and Southeast Asia, leading to increasing private pool ownership. While the adoption rate of mandatory energy standards remains inconsistent across the region, manufacturers are proactively introducing VSPs to cater to the premium segment and anticipate future regulatory changes. Investment in automated, durable pumping solutions for massive commercial water parks and municipal facilities across APAC is a key regional driver. Latin America and the Middle East and Africa (MEA) offer substantial, yet geographically constrained, growth opportunities, particularly in affluent coastal and desert regions where the heat necessitates long filtration cycles and reliance on cooling/heating systems, thereby requiring efficient pump infrastructure.

- North America (Dominant): Driven by mandated DOE VSP standards, high replacement rates, and strong smart home integration adoption.

- Europe (Strong Growth): Accelerated by the EU Ecodesign Directive and consumer demand for quiet operation and sustainability in densely populated areas.

- Asia Pacific (Fastest Growth): Fueled by rapid urbanization, luxury resort construction, and increasing disposable income, particularly targeting high-efficiency solutions in urban centers.

- Latin America & MEA (Emerging): Growth concentrated in commercial tourism sectors and high-end residential developments in climate-vulnerable zones requiring specialized durable equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the SPA and Pool Pump Market.- Pentair plc

- Hayward Industries Inc.

- Fluidra S.A.

- Xylem Inc.

- Speck Pumps

- Davey Water Products Pty Ltd

- Waterco Ltd.

- Intex Recreation Corp.

- Emerson Electric Co. (via Nidec/motors)

- Franklin Electric Co. Inc.

- Zodiac Pool Systems LLC (a subsidiary of Fluidra)

- Aqua-Flo Supply Inc.

- DAB Pumps S.p.A.

- Calpeda S.p.A.

- Viron International Corporation

- Kripsol (part of Fluidra)

- Pahlen AB

- T-Star Aqua Technology Co. Ltd.

- Custom Molded Products (CMP)

- Balboa Water Group

Frequently Asked Questions

Analyze common user questions about the SPA and Pool Pump market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of Variable Speed Pumps (VSPs)?

The primary factor is mandatory government regulations, specifically the US DOE standards and the EU Ecodesign Directive, which restrict the sale of inefficient single-speed pumps, compelling consumers and manufacturers toward VSP technology for compliance and significant long-term energy savings.

How much energy can a Variable Speed Pump save compared to a Single Speed Pump?

VSPs can typically reduce energy consumption by 60% to 85% compared to single-speed models. Savings are achieved by allowing the pump to operate at lower, optimized speeds for the majority of the filtration cycle, dramatically decreasing the energy drawn from the grid.

Is the high initial cost of smart pool pumps justifiable for residential users?

Yes, the higher initial cost is often justified by the total cost of ownership (TCO). Savings from reduced electricity bills, coupled with potential utility rebates and the extended lifespan due to optimized operation, ensure a favorable return on investment (ROI) typically within 2 to 4 years.

What is the role of IoT and AI integration in the future pool pump market?

IoT enables remote monitoring and control, while AI integration facilitates predictive maintenance, dynamic flow optimization based on environmental factors (weather, bather load), and automated chemical balancing, transitioning pool management toward fully autonomous, energy-efficient operation.

Which geographical region exhibits the fastest market growth potential for pool pumps?

The Asia Pacific (APAC) region, driven by rapid urbanization, significant investment in the commercial hospitality sector (resorts and hotels), and rising disposable incomes, is projected to demonstrate the highest Compound Annual Growth Rate (CAGR) over the forecast period.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager