Space Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434419 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Space Equipment Market Size

The Space Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 45.8 Billion in 2026 and is projected to reach USD 81.5 Billion by the end of the forecast period in 2033.

The robust expansion of the space equipment sector is fundamentally driven by the accelerated pace of satellite deployment, particularly within the Low Earth Orbit (LEO) constellation segment, alongside increasing government and private sector investment in advanced exploration missions. This growth trajectory reflects a critical shift from traditional, monolithic satellite architectures towards modular, scalable, and rapidly deployable systems, necessitating innovation across launch systems, payload components, and ground infrastructure. The competitive landscape is intensely dynamic, characterized by the emergence of new aerospace entrants focused on cost-efficiency and rapid iteration, challenging established defense contractors and system integrators. Furthermore, the global military utilization of space assets for intelligence, surveillance, and reconnaissance (ISR) capabilities continues to be a major financial catalyst, ensuring sustained demand for sophisticated, resilient space equipment.

Market valuation growth is intrinsically linked to advancements in material science, miniaturization technologies, and propulsion systems, specifically electric and nuclear thermal propulsion, which promise enhanced mission flexibility and reduced operational costs for deep space activities. The increasing requirement for robust, secure, and high-throughput communication networks, supported by next-generation broadband satellites, constitutes the largest demand pool for space-based equipment. As regulatory environments adapt to accommodate the rise of commercial space tourism and manufacturing, new market segments are emerging, further bolstering the anticipated revenue generation toward 2033. This consistent technological push, coupled with supportive governmental policies aimed at fostering domestic space capabilities, positions the Space Equipment Market for significant expansion.

Space Equipment Market introduction

The Space Equipment Market encompasses the design, manufacture, and deployment of hardware and components essential for space exploration, satellite operations, and orbital activities. This extensive portfolio includes launch vehicle components, satellite bus systems (such as power units, attitude determination and control systems, thermal controls, and structures), payload instruments (like sensors, cameras, and communication transponders), and critical ground segment infrastructure required for command, control, and data reception. The market serves a diverse range of applications, including global communication, precise navigation (GNSS), environmental monitoring, Earth observation for climate science, meteorological forecasting, military intelligence, and scientific exploration of the solar system and beyond. The complexity and high reliability required of this equipment mandate rigorous testing and adherence to stringent quality standards, often requiring specialized manufacturing techniques and materials resistant to the harsh conditions of space.

Key product descriptions within this market focus heavily on innovation in propulsion technology, shifting from solid and liquid chemical rockets to more sustainable and efficient electric and hybrid propulsion systems, which reduce launch mass and increase satellite lifespan. Major applications are predominantly dominated by the commercial satellite sector, especially the burgeoning demand for ubiquitous global internet connectivity driven by large-scale LEO constellations like Starlink and OneWeb. The benefits derived from advanced space equipment include vastly improved global connectivity, enhanced disaster response capabilities through high-resolution imaging, greater geopolitical stability via advanced ISR capabilities, and fundamental scientific breakthroughs concerning planetary science and astrophysics. These technological benefits reinforce the strategic importance of space infrastructure for modern economies and national security frameworks.

Driving factors for sustained market growth are multifaceted, spanning increased governmental defense spending focused on space domain awareness, rapid technological obsolescence necessitating replacement cycles for older satellite generations, and significant private investment spurred by favorable risk-adjusted returns in the New Space economy. The confluence of lower launch costs, driven by reusable rocket technology, and the miniaturization of components allowing for smaller, more capable CubeSats and SmallSats, has democratized access to space, fundamentally altering the competitive landscape. This increased accessibility facilitates new commercial models, such as space-based manufacturing and orbital servicing, which further solidify the long-term demand for highly specialized and reliable space equipment.

Space Equipment Market Executive Summary

The Space Equipment Market is currently experiencing a profound paradigm shift driven by commercialization and unprecedented technological acceleration. Business trends emphasize vertical integration among launch providers and satellite operators, enabling optimized mission planning and reduced supply chain complexity. There is a strong global focus on developing sustainable space practices, leading to increased investment in equipment designed for orbital debris mitigation, satellite refueling, and in-space manufacturing. Key business metrics point towards a growing reliance on Public-Private Partnerships (PPPs) to fund high-capital exploration and infrastructure projects, successfully distributing risk and leveraging private sector efficiency. The market is also heavily influenced by standardization efforts in satellite bus interfaces and communications protocols, aiming to lower costs and accelerate the deployment timeline for large constellations.

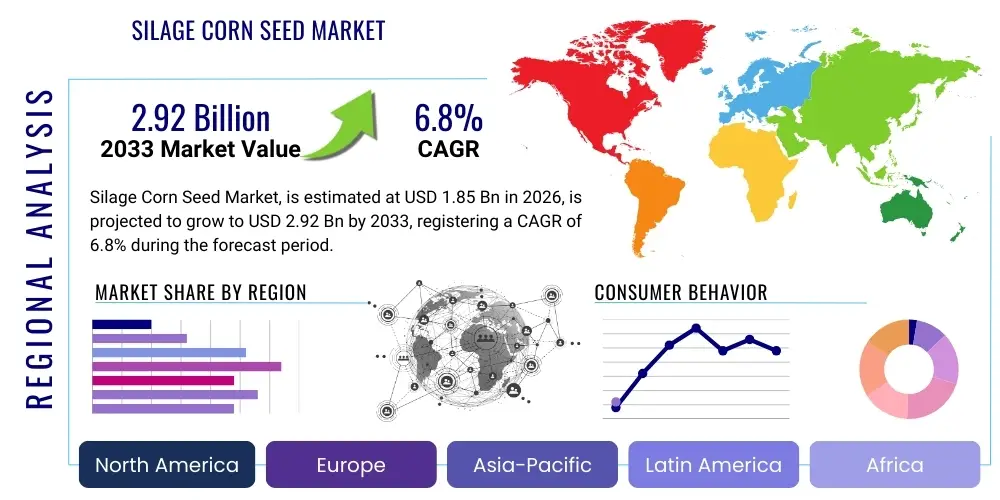

Regional trends indicate North America maintaining its dominance, fueled by the aggressive innovation of U.S.-based private companies (e.g., SpaceX, Blue Origin) and substantial defense contracts from NASA and the Department of Defense. However, the Asia Pacific (APAC) region is demonstrating the fastest growth trajectory, led by robust space programs in China, India, and Japan, focusing particularly on indigenous launch capabilities and expanded commercial satellite services for their vast populations. Europe is strengthening its position through the European Space Agency (ESA) initiatives focused on advanced Earth observation systems and sovereign launch access via vehicles like Ariane 6. Geopolitical tensions are also driving regional self-sufficiency, compelling nations to invest heavily in their own space infrastructure, thereby generating regionalized demand for domestic equipment manufacturers.

Segment trends highlight the exceptional growth within the satellite manufacturing segment, particularly for LEO constellations, overshadowing traditional GEO satellite production in terms of unit volume. Within equipment types, the demand for advanced communication transponders, high-efficiency solar arrays, and high-thrust electric propulsion systems is accelerating rapidly. Furthermore, the ground equipment segment is witnessing substantial technological upgrades, transitioning towards complex software-defined radio (SDR) systems and enhanced cybersecurity infrastructure to manage the massive data flows generated by thousands of new satellites. The market structure continues to favor suppliers who can offer miniaturized, radiation-hardened components capable of operating reliably in harsh orbital environments, catering primarily to the burgeoning small satellite market segment.

AI Impact Analysis on Space Equipment Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Space Equipment Market center primarily around autonomy, data efficiency, and mission resilience. Common questions revolve around how AI can enhance satellite longevity through predictive maintenance, optimize complex launch trajectories in real-time, and process the immense volume of observational data generated by Earth-sensing payloads. Concerns often include the reliability of autonomous decision-making in critical space environments and the cybersecurity risks associated with integrating sophisticated AI algorithms into mission-critical hardware. Overall user expectation is that AI will transition space equipment from reactive systems to truly autonomous platforms, reducing the reliance on constant human ground control intervention and unlocking complex missions currently considered too risky or data-intensive for manual operation.

- AI optimizes payload data processing directly on board satellites, reducing downlink bottlenecks and improving data latency for Earth observation applications.

- Predictive maintenance algorithms driven by AI monitor equipment health (e.g., batteries, thermal systems, propulsion units) to anticipate failures, thereby extending the operational lifespan of expensive orbital assets.

- Autonomous guidance, navigation, and control (GNC) systems use machine learning to optimize orbital maneuvers, collision avoidance, and docking procedures, enhancing mission safety and fuel efficiency.

- AI-powered mission planning tools rapidly analyze variables to select optimal launch windows, trajectory corrections, and resource allocation for deep space exploration probes.

- Ground station operations utilize AI for automated tasking, scheduling, and anomaly detection, significantly enhancing the efficiency of managing large satellite constellations.

- AI contributes to the design and testing phase by simulating equipment performance under extreme radiation and temperature conditions, accelerating the development cycle for new space equipment.

DRO & Impact Forces Of Space Equipment Market

The dynamics of the Space Equipment Market are governed by a robust combination of drivers (D), restraints (R), and opportunities (O), whose interplay shapes the industry's trajectory. Key drivers include the exponential increase in demand for satellite-based broadband services, the modernization of military satellite fleets globally to ensure strategic dominance, and the continuous downward pressure on launch costs resulting from successful reusable rocket technologies. These drivers collectively necessitate rapid innovation and production capacity increases across all segments of space equipment, from sophisticated high-throughput satellite payloads to ground station antennas capable of handling massive data streams. Furthermore, renewed political emphasis on lunar and Martian exploration missions, spearheaded by initiatives like Artemis, creates substantial long-term demand for specialized deep space equipment, including habitat systems, advanced robotics, and nuclear power sources.

Despite strong growth drivers, the market faces significant restraints. The exceptionally high cost associated with R&D, stringent qualification procedures for space-grade hardware, and the lengthy lead times required for manufacturing specialized, radiation-hardened components pose considerable barriers to entry and expansion. Regulatory complexities, particularly concerning orbital debris mitigation, spectrum allocation, and international technology transfer (e.g., ITAR regulations), introduce uncertainties and slow down deployment schedules. Moreover, the inherent risks associated with space operations, including potential launch failures and in-orbit malfunctions, necessitate high insurance premiums and intensive quality assurance protocols, which collectively elevate the overall operational cost structure of the industry, potentially tempering investment growth in smaller ventures.

Opportunities abound, primarily driven by technological convergence and emerging operational domains. The development of in-space servicing, assembly, and manufacturing (ISAM) offers a transformative opportunity, potentially reducing reliance on Earth-based launch limitations and enabling the construction of larger, more complex structures in orbit. The expansion of commercial human spaceflight and orbital tourism represents a nascent but high-value niche market for specialized life support systems and habitat modules. Furthermore, the global need for pervasive monitoring systems related to climate change and resource management ensures sustained opportunities for advanced Earth observation equipment utilizing hyper-spectral imaging and synthetic aperture radar (SAR) technologies, driving demand for innovative sensor equipment and processing units.

Segmentation Analysis

The Space Equipment Market is systematically segmented based on Product Type, Application, and Orbital Regime to accurately reflect the diverse technology landscape and end-user requirements. Product segmentation distinguishes between the hardware dedicated to launch systems, the comprehensive suite of components that constitute the satellite bus, the mission-specific payload instruments, and the expansive network of ground segment equipment. Application segmentation delineates demand based on the primary function, recognizing key high-growth areas such as global communication and navigation, alongside critical national security requirements like intelligence, surveillance, and reconnaissance (ISR). Understanding these segments is crucial for manufacturers to align their R&D investments with proven market needs and forecasted growth areas, particularly within the fast-evolving LEO constellation market.

- By Product Type:

- Launch Vehicles & Components (Engines, Avionics, Structures)

- Satellite Bus Equipment (Power Systems, ADCS, Thermal Control, Structures)

- Payload Equipment (Communication Transponders, Remote Sensing Instruments, Scientific Sensors)

- Ground Segment Equipment (Antennas, Control Centers, Data Processing Systems)

- By Application:

- Communication (Broadband, Mobile Satellite Services)

- Navigation & Positioning (GNSS Components)

- Earth Observation (Imagery, Weather Monitoring)

- Scientific Research & Exploration

- Military & Government (ISR, Secure Communications)

- By Orbital Regime:

- Low Earth Orbit (LEO)

- Medium Earth Orbit (MEO)

- Geosynchronous Earth Orbit (GEO)

- Deep Space

Value Chain Analysis For Space Equipment Market

The value chain of the Space Equipment Market begins with extensive upstream analysis, focusing on the sourcing of highly specialized raw materials and complex subcomponents. This initial stage involves suppliers of high-performance composite materials (carbon fiber, advanced polymers), radiation-hardened electronics, specialized optics, and precision mechanical systems. Due to the mission-critical nature and harsh operating environment of space, component qualification is a dominant factor, requiring suppliers to adhere to rigorous standards set by defense organizations and space agencies. The manufacturing phase often involves sophisticated integration and assembly processes, usually conducted by prime contractors who serve as system integrators, managing thousands of components and ensuring compatibility and mission success for both launch vehicles and orbital platforms.

Midstream activities are characterized by the rigorous testing, integration, and deployment preparation of the final equipment. This includes propulsion system testing, thermal vacuum chamber testing of satellite buses, and pre-launch integration of the payload onto the launch vehicle. The distribution channel is heavily concentrated, dominated by direct sales between prime contractors (such as Boeing, Lockheed Martin, Airbus) and the end-users—primarily national governments, military organizations, and large commercial satellite operators (e.g., SES, Viasat, Starlink). Indirect distribution channels are minimal but may include specialized distributors for COTS (Commercial Off-The-Shelf) components used in specific non-critical small satellite applications, though this remains an exception rather than the norm in high-assurance space equipment.

Downstream analysis focuses on the operational phase, where the equipment fulfills its mission. This involves continuous command and control executed via ground segment facilities, data acquisition, and subsequent processing and delivery to the final end-users, whether they are telecommunication companies, climate scientists, or defense analysts. The increasing complexity and quantity of assets in orbit necessitate advanced software and data analytics providers who sit at the end of the value chain, converting raw satellite data into actionable intelligence. The value chain is seeing structural compression as large players like SpaceX integrate launch manufacturing, satellite production, and operational services internally, streamlining the process and challenging traditional reliance on fragmented supply chains.

Space Equipment Market Potential Customers

Potential customers and primary end-users of space equipment are segmented into three major categories: Government and Defense Agencies, Commercial Entities, and Scientific and Academic Institutions. Government and Defense Agencies represent the most significant and historically stable customer base, procuring equipment for national security, intelligence gathering (ISR), secure military communications, and developing sovereign launch capabilities. These customers prioritize reliability, redundancy, and performance specifications over cost, driving demand for the highest-grade, radiation-hardened components and complex, bespoke satellite systems for critical defense infrastructure and long-term scientific missions managed by organizations like NASA, ESA, and Roscosmos.

The Commercial Sector is the fastest-growing customer segment, profoundly shifting market dynamics. This includes large-scale telecommunication providers deploying massive LEO broadband constellations, operators of commercial Earth observation services (providing imagery and climate data), and new entrants focused on emerging domains like orbital servicing, space tourism, and future space resource utilization. Commercial buyers are highly sensitive to cost and efficiency, driving demand for mass-producible, miniaturized equipment and relying heavily on reusable launch vehicle components to minimize capital expenditures. The recent surge in private investment into space infrastructure has cemented commercial entities as pivotal decision-makers in shaping future equipment specifications and deployment strategies.

Scientific and Academic Institutions constitute a specialized but crucial customer segment, purchasing highly sensitive instruments and experimental payloads for fundamental research in astrophysics, planetary science, and technological demonstration missions. Although their budget allocation is generally smaller than government or commercial expenditures, these institutions drive innovation in sensor technology, quantum communication components, and miniature propulsion systems. Additionally, international organizations, such as the United Nations (for disaster relief coordination) and global meteorological bodies, act as indirect buyers, relying on services enabled by advanced Earth observation and communication satellites, thereby reinforcing the core demand for high-performance space equipment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.8 Billion |

| Market Forecast in 2033 | USD 81.5 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SpaceX, Boeing, Lockheed Martin, Northrop Grumman, Airbus SE, Thales Alenia Space, Maxar Technologies, Sierra Nevada Corporation, Blue Origin, Rocket Lab, Mitsubishi Electric, IAI (Israel Aerospace Industries), Viasat, L3Harris Technologies, BAE Systems, Raytheon Technologies, OHB SE, China Aerospace Science and Technology Corporation (CASC), Axiom Space, Momentus. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Space Equipment Market Key Technology Landscape

The Space Equipment Market is characterized by rapid advancements across several critical technology domains, aimed at achieving higher efficiency, greater reliability, and increased mission longevity. A cornerstone of this technological evolution is the propulsion sector, witnessing a major shift toward high-efficiency electric propulsion systems, such including Hall-effect thrusters and ion engines, which utilize minimal propellant mass, significantly extending the lifespan of LEO and GEO satellites. Concurrently, there is intense development in reusable launch vehicle technology, driven by advanced material science for thermal protection systems and highly sophisticated autonomous landing guidance software, drastically lowering the cost per kilogram to orbit and democratizing space access for smaller equipment manufacturers and research payloads.

Another pivotal area is the miniaturization and radiation hardening of electronics. The proliferation of small satellites and CubeSats necessitates components that retain computational power while operating reliably in the high-radiation environment of space. This involves developing specialized Field-Programmable Gate Arrays (FPGAs) and System-on-Chip (SoC) solutions that are resilient to single-event upsets (SEUs). Furthermore, the integration of advanced satellite communication technologies, particularly optical communications (laser links), is transforming the payload segment, promising terabit-per-second data rates essential for managing the aggregated traffic of massive LEO broadband constellations, far surpassing the capabilities of traditional radio frequency (RF) systems.

Finally, the development of sophisticated in-space power generation and management systems is critical for future deep space and crewed missions. This includes next-generation solar array technology with improved photovoltaic efficiency and flexibility, as well as the research into radioisotope thermoelectric generators (RTGs) and small-scale nuclear fission reactors for persistent power in environments lacking sufficient solar illumination. These power systems are directly tied to the ability to operate demanding payloads, such as high-resolution SAR and complex scientific instruments, ensuring the long-term viability and capabilities of future space equipment deployed beyond Earth orbit. The relentless pursuit of quantum communication technologies and resilient ground control software also defines the modern technological landscape.

Regional Highlights

North America currently dominates the Space Equipment Market, primarily driven by the robust governmental funding mechanisms provided by NASA and the Department of Defense (DoD), coupled with the unparalleled technological innovation stemming from major private aerospace entities located in the United States. The region benefits from a mature industrial base, sophisticated R&D infrastructure, and a competitive environment fostering the rapid deployment of reusable launch vehicles and large-scale LEO constellations. The U.S. remains the world leader in both military and commercial satellite deployment, creating continuous, high-volume demand for high-specification equipment, particularly in avionics, propulsion, and advanced remote sensing payloads.

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) over the forecast period. This rapid growth is underpinned by significant government investment in sovereign space capabilities, especially in China (CNSA) and India (ISRO), which are focusing on establishing indigenous infrastructure across launch, satellite manufacturing, and deep space exploration. The immense demand for enhanced communication services and connectivity across the densely populated APAC area fuels the requirement for a vast array of ground equipment and communication satellite components. Japan and South Korea also contribute substantially, specializing in precision components, robotics for space, and advanced Earth observation payloads, positioning APAC as a critical hub for future market expansion and manufacturing.

Europe holds a substantial market share, supported by multinational collaboration through the European Space Agency (ESA) and major defense programs. European efforts prioritize environmental monitoring (e.g., Copernicus program) and securing guaranteed access to space via the development of advanced launch systems like Ariane 6. Companies like Airbus and Thales Alenia Space are key global players, specializing in complex, high-reliability GEO and MEO satellites, including advanced navigation components for the Galileo system. While facing stiff competition from the U.S. commercial sector, Europe maintains leadership in specific high-precision scientific instruments and advanced material science crucial for future generation space equipment.

- North America: Dominant market share; driven by SpaceX, DoD contracts, and aggressive commercial LEO constellation deployment. Focus on reusable launch and advanced GNC systems.

- Asia Pacific (APAC): Fastest growth rate; propelled by national space agencies (China, India) and soaring demand for regional communication satellite services and indigenous technology development.

- Europe: Strong presence in GEO satellite manufacturing, navigation systems (Galileo), and Earth observation payloads (Copernicus). Focus on high-reliability, long-life components.

- Latin America (LATAM): Emerging market focused primarily on ground segment upgrades and purchasing foreign-built communication satellites to bridge digital divides.

- Middle East and Africa (MEA): Growth driven by national efforts to establish strategic space programs for regional security and telecommunications independence, necessitating equipment procurement from established international suppliers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Space Equipment Market.- SpaceX

- Boeing

- Lockheed Martin

- Northrop Grumman

- Airbus SE

- Thales Alenia Space

- Maxar Technologies

- Sierra Nevada Corporation

- Blue Origin

- Rocket Lab

- Mitsubishi Electric

- IAI (Israel Aerospace Industries)

- Viasat

- L3Harris Technologies

- BAE Systems

- Raytheon Technologies

- OHB SE

- China Aerospace Science and Technology Corporation (CASC)

- Axiom Space

- Momentus

Frequently Asked Questions

Analyze common user questions about the Space Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth surge in the Space Equipment Market?

The primary driver is the large-scale deployment of LEO satellite mega-constellations (e.g., Starlink, OneWeb) for global broadband internet services, which generates massive demand for standardized, mass-produced satellite bus components, advanced high-throughput payloads, and efficient ground infrastructure.

How are reusable launch vehicle technologies impacting the demand for space equipment?

Reusable launch technologies drastically reduce the cost per launch, which in turn lowers the entry barrier for smaller satellite operators and increases the overall launch frequency. This sustained reduction in access costs stimulates greater production volume and faster iteration cycles for satellite and payload equipment manufacturers.

Which segment of the Space Equipment Market is projected to witness the highest rate of innovation?

The Payload Equipment segment, specifically related to advanced communication and sensing technologies, is witnessing the highest innovation. This includes the rapid development of optical inter-satellite links (laser communication) and miniaturized, multi-band, high-resolution Earth observation sensors that enhance data capacity and system efficiency.

What role does government spending play in the Space Equipment Market outlook?

Government spending, particularly from defense and space agencies, remains foundational, ensuring stability and funding complex, long-term exploration missions (e.g., lunar and Mars programs) and highly specialized military ISR satellite procurement. This spending often dictates the required standards for reliability and radiation hardening in core equipment.

What are the key technical restraints limiting rapid equipment deployment?

Key technical restraints include the extensive time and cost required for the rigorous radiation qualification and testing of new electronic components (high-TRL requirements), combined with the scarcity of materials specifically optimized for extreme orbital thermal and vacuum environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager