Space Launch Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433358 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Space Launch Market Size

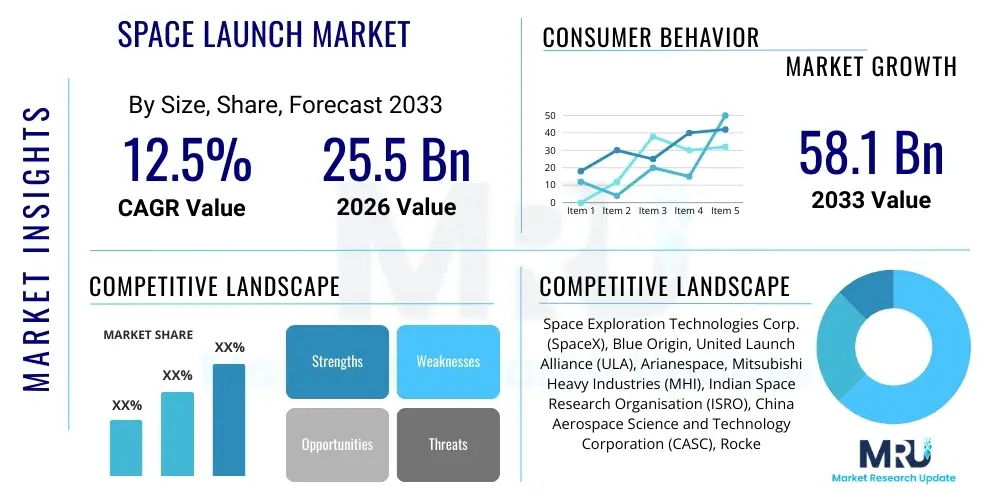

The Space Launch Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at $25.5 Billion in 2026 and is projected to reach $58.1 Billion by the end of the forecast period in 2033. This significant expansion is primarily fueled by the accelerating demand for satellite constellations in Low Earth Orbit (LEO), driven by commercial communication, Earth observation, and remote sensing requirements. The decrease in launch costs dueattributable to the adoption of reusable launch vehicle (RLV) technology is democratizing access to space, transforming the industry from one dominated by government entities to a vibrant commercial ecosystem.

Space Launch Market introduction

The Space Launch Market encompasses the infrastructure, vehicles, and services required to transport payloads, including satellites, probes, and crew, from Earth's surface into various orbital trajectories or deep space. This critical market is characterized by intense technological innovation, focusing on reducing turnaround times, enhancing reliability, and drastically decreasing the cost per kilogram to orbit. The primary products include expendable launch vehicles (ELVs) and, increasingly, reusable launch systems (RLSs), which are fundamentally altering market economics. Major applications span commercial telecommunications, military surveillance, global navigation systems, and scientific research.

The fundamental benefits derived from advancements in the Space Launch Market include global connectivity provision, essential data collection for climate modeling, enhanced national security capabilities, and driving scientific discovery that is often unobtainable through terrestrial means. The recent influx of private capital and the success of New Space companies have introduced disruptive business models, shifting procurement dynamics from large, bespoke government contracts to high-volume, standardized commercial launches. This competitive pressure ensures continuous technological refinement and efficiency gains across the entire value chain.

Key driving factors accelerating market growth include the proliferation of mega-constellations such as Starlink and OneWeb, demanding thousands of launches over the next decade. Furthermore, increasing geopolitical competition and strategic investments by nations in independent space capabilities, coupled with the burgeoning market for sub-500 kg small satellites, are contributing significantly to the demand side. Regulatory clarity concerning space debris mitigation and spectrum allocation, while challenging, is also establishing a framework that supports sustained commercial investment and operational scaling.

Space Launch Market Executive Summary

The Space Launch Market is undergoing a rapid commercialization phase, characterized by horizontal integration and standardization, moving away from government-monopoly structures. Business trends indicate a clear shift towards vertically integrated companies controlling both satellite manufacturing and launch services, offering streamlined end-to-end solutions. The primary technological driver remains the reusability of first-stage boosters, which offers exponential reductions in operational costs compared to fully expendable systems. Furthermore, the development of smaller, dedicated launch vehicles (DLVs) is catering specifically to the burgeoning small satellite market, enabling greater mission flexibility and specific orbital deployment capabilities not achievable with rideshare missions on heavy lift vehicles.

Regionally, North America maintains market dominance, primarily due to the high volume of launches executed by private entities and extensive government contracts from NASA and the Department of Defense (DoD). However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, led by concerted governmental investments from nations such as China, India, and Japan, focusing on developing indigenous heavy-lift capabilities and establishing robust sovereign space infrastructure. Europe is concentrating on restructuring its launch access strategy, emphasizing competitive cost structures and ensuring autonomous access to orbit through programs like Ariane 6, counterbalancing the powerful commercial competition emanating from the United States.

Segment trends reveal that the Low Earth Orbit (LEO) destination segment is expected to dominate launch traffic volume, particularly in the medium and heavy payload capacity categories necessary for deploying mass communication constellation infrastructure. In terms of service type, the commercial launch segment is rapidly outpacing the government/military segment in terms of launch frequency, although government contracts still represent significant revenue anchors for key players. The long-term segmentation forecast highlights increasing market share for launch service providers utilizing advanced propulsion technologies, including methalox engines and electric propulsion for orbital transfers, prioritizing performance and efficiency.

AI Impact Analysis on Space Launch Market

User questions regarding the impact of Artificial Intelligence (AI) on the Space Launch Market frequently revolve around three core themes: operational reliability, mission planning efficiency, and the development of autonomous launch systems. Users are concerned with how AI can mitigate the inherent risks of space flight, particularly in complex areas like trajectory optimization, real-time anomaly detection, and predictive maintenance of ground support equipment and launch vehicles. There is also significant interest in AI's role in satellite autonomy post-deployment, but specifically for launch, the expectation is centered on maximizing successful payload insertion while minimizing resource expenditure. Users seek assurance that AI integration will lead to cheaper, safer, and faster launch campaigns rather than introducing new points of failure or requiring prohibitive infrastructure costs. Furthermore, autonomous rendezvous and docking capabilities, crucial for future in-orbit servicing and assembly, are perceived as a key area where AI will unlock new business opportunities, reducing dependency on ground commands and improving mission timelines.

- AI-driven trajectory optimization minimizes fuel consumption and maximizes payload capacity, offering significant economic benefits during pre-launch planning.

- Predictive maintenance algorithms analyze sensor data from launch vehicle components (e.g., engines, avionics) to forecast potential failures, increasing launch reliability and reducing delays.

- Autonomous flight termination systems, utilizing machine learning, enhance safety by making real-time, instantaneous decisions faster and more reliably than human operators in catastrophic scenarios.

- Enhanced mission control software employs AI for rapid data processing and visualization, supporting real-time decision-making during ascent and orbital insertion phases.

- AI is instrumental in manufacturing processes, particularly in additive manufacturing (3D printing) of engine parts, optimizing material usage and structural integrity based on stress modeling.

DRO & Impact Forces Of Space Launch Market

The dynamics of the Space Launch Market are governed by a robust interplay of Drivers (D), Restraints (R), Opportunities (O), and associated Impact Forces. The primary drivers include the escalating demand for global broadband connectivity, catalyzed by the deployment of massive commercial LEO satellite constellations, and the geopolitical imperative for nations to maintain independent access to space for security and strategic advantages. These drivers are fundamentally economic and strategic, necessitating rapid technological scaling and manufacturing prowess. Concurrently, the successful demonstration and operationalization of reusable launch technology, exemplified by key market leaders, have created a powerful impact force by drastically reducing marginal launch costs, enabling the current commercial boom.

However, significant restraints temper this expansion. These include the extreme capital intensity required for developing and iterating next-generation launch systems, posing a substantial barrier to entry for smaller firms. Furthermore, regulatory hurdles, particularly concerning orbital debris mitigation and the allocation of limited radio frequency spectrum, introduce operational complexity and necessitate international coordination. Supply chain vulnerabilities, particularly for specialized components like high-performance rocket engine materials and advanced avionics, pose a continuous risk to timely launch schedules. These restraints force established players and newcomers alike to invest heavily in vertical integration and secure strategic material partnerships.

Opportunities for future growth are concentrated in the emerging segments of in-space servicing, assembly, and manufacturing (ISAM), which rely on high-frequency, reliable launch services to deliver necessary orbital infrastructure. Moreover, the increasing focus on lunar and deep-space missions, driven by both governmental programs (like NASA’s Artemis and corresponding international efforts) and commercial aspirations, opens a lucrative high-value segment for heavy-lift and super-heavy-lift vehicles. The competitive pressure exerted by market disruptors acts as an intense impact force, compelling traditional aerospace primes to innovate or acquire cutting-edge technologies, thus accelerating the overall pace of technological evolution within the sector.

Segmentation Analysis

The Space Launch Market is comprehensively segmented based on various technical and operational parameters, including the payload capacity, the orbital destination, the type of launch vehicle employed, the nature of the launch service, and the end-user application. This multi-dimensional segmentation provides crucial insights into market dynamics, revealing where investment capital is currently concentrated and which technological pathways are proving most disruptive. The increasing diversification of payloads, from highly miniaturized cubesats to multi-ton crew vehicles, necessitates a varied supply of launch solutions, driving growth across all capacity segments. The dominance of LEO missions is contrasted by the rising strategic importance of GEO and translunar injection (TLI) missions, requiring robust performance capabilities.

- By Payload Capacity:

- Small Payload (Under 500 kg)

- Medium Payload (500 kg – 5,000 kg)

- Heavy Payload (Above 5,000 kg)

- By Orbit:

- Low Earth Orbit (LEO)

- Medium Earth Orbit (MEO)

- Geostationary Earth Orbit (GEO)

- Others (Deep Space, Sun-Synchronous Orbit (SSO), TLI)

- By Launch Vehicle Type:

- Reusable Launch Vehicle (RLV)

- Expendable Launch Vehicle (ELV)

- By Service Type:

- Commercial Launch Services

- Government/Military Launch Services

- Testing and Deployment Services

- By End User:

- Commercial Satellites

- Government and Military

- Research and Development/Academic

- Manned Missions/Space Tourism

Value Chain Analysis For Space Launch Market

The Space Launch Market value chain begins with highly complex upstream activities, primarily involving Research & Development (R&D), the design of propulsion systems (engines), and the manufacturing of primary structures (stages, fairings). This phase is characterized by intense capital expenditure, reliance on specialized materials (e.g., carbon composites, high-temperature alloys), and stringent quality control. Key upstream suppliers include component manufacturers for avionics, specialized telemetry systems, and ground support equipment. Vertical integration, where launch providers design and manufacture their own components, is a distinguishing trend, enabling cost control and rapid iterative development.

The core of the value chain involves the integration, testing, and ultimately, the launch services themselves. Downstream activities focus on mission management, including payload processing, securing launch licenses, range operations, and post-launch data dissemination. Direct distribution involves launch service providers contracting directly with large commercial satellite operators (e.g., constellation providers) or governmental agencies (e.g., defense departments). Indirect channels often involve mission integrators or brokers who aggregate multiple small satellites onto a single launch vehicle, optimizing capacity utilization for rideshare missions and catering to the small satellite ecosystem. This indirect method is vital for the SmallSat segment, providing cost-effective access to space for numerous emerging players.

The effectiveness of the distribution channel is increasingly measured by launch frequency and reliability, particularly as the market demands rapid deployment schedules for LEO constellations. Commercial launch providers are focusing heavily on developing highly reliable and adaptable launch systems that can support both dedicated and rideshare missions, minimizing logistical overhead. The interplay between upstream innovation (e.g., high-performance engine technology) and downstream service delivery (e.g., efficient payload integration) dictates profitability and market leadership. Companies that successfully optimize this vertical integration, securing both the technology supply and the high-volume demand, establish a durable competitive advantage.

Space Launch Market Potential Customers

The Space Launch Market serves a diverse, yet technologically sophisticated, clientele whose mission requirements fundamentally shape the demand curve. The primary end-users are large commercial operators, often telecommunications giants and emerging New Space companies, requiring robust and frequent launch access to deploy and maintain massive LEO and MEO satellite constellations for global communication and data services. These customers prioritize low cost per kilogram to orbit, high reliability, and schedule flexibility, making them the key drivers for reusable launch vehicle adoption.

A second crucial customer base is the global collection of government and military entities. These sovereign customers require dedicated launch services for classified payloads, intelligence gathering satellites, strategic communication networks, and crewed missions (e.g., ISS resupply, lunar exploration). For this segment, mission assurance, security, and independent access to space often outweigh marginal cost savings. The demand from national space agencies (like NASA, ESA, Roscosmos, ISRO, and CNSA) for exploration and scientific missions provides anchor contracts for heavy-lift and super-heavy-lift development programs.

Finally, the growing segment of academic institutions and research organizations, alongside nascent space tourism ventures, represents emerging customers. While individually small, the collective demand from universities and startups requiring launch access for scientific cubesats, technology demonstrators, and proof-of-concept missions is substantial and primarily addressed through rideshare opportunities or small, dedicated launchers. Space tourism, particularly suborbital and orbital flight providers, will become a significant, high-value customer once regulatory frameworks mature and launch infrastructure scales to support frequent crewed flights.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $25.5 Billion |

| Market Forecast in 2033 | $58.1 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Space Exploration Technologies Corp. (SpaceX), Blue Origin, United Launch Alliance (ULA), Arianespace, Mitsubishi Heavy Industries (MHI), Indian Space Research Organisation (ISRO), China Aerospace Science and Technology Corporation (CASC), Rocket Lab USA, Northrop Grumman Corporation, Boeing Defense Space & Security, Lockheed Martin Corporation, Virgin Galactic, Relativitiy Space, Firefly Aerospace, ILS International Launch Services. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Space Launch Market Key Technology Landscape

The technological landscape of the Space Launch Market is dominated by innovations aimed at achieving cost-effectiveness, scalability, and enhanced mission flexibility. The most impactful technological advancement is the maturation of reusable launch vehicle (RLV) systems, which fundamentally changes the cost structure of accessing space by amortization of high capital costs over multiple missions. This requires sophisticated engine throttleability, advanced guidance, navigation, and control (GNC) systems, and highly resilient thermal protection materials capable of handling repeated atmospheric re-entry stresses. Methalox propulsion (Methane/Liquid Oxygen) is emerging as the fuel standard for next-generation RLVs due to its high efficiency, lower cost, and simplified ground operations compared to traditional kerosene or hydrogen-based systems.

Furthermore, the development of smaller, highly optimized launch vehicles (often referred to as 'microlaunchers') is crucial for catering to the small satellite market. These vehicles leverage lightweight composite structures and often employ advanced manufacturing techniques like 3D printing (additive manufacturing) for complex engine components, reducing lead times and minimizing material waste. The technology focus here is on rapid manufacturing and high launch cadence, allowing for dedicated launches to specific orbital planes without the scheduling compromises inherent in rideshare missions. This agility is a key competitive differentiator in the SmallSat segment.

Future technological advancements are heavily invested in enhanced upper stage performance, utilizing kick stages or orbital transfer vehicles (OTVs) equipped with electric or high-performance chemical propulsion. These OTVs are critical for deploying large constellations efficiently across complex orbital shells. Additionally, automated flight safety systems (AFSS) utilizing state-of-the-art avionics and AI are becoming standard, replacing traditional, more cumbersome ground-based tracking systems. These technological strides collectively enhance reliability and reduce the operational footprint, paving the way for further decreases in overall launch costs and increasing the feasibility of complex orbital activities, such as in-orbit refueling and servicing.

Regional Highlights

- North America (Dominance and Innovation Hub): North America holds the largest market share due to the presence of global market leaders like SpaceX, Blue Origin, and ULA, coupled with robust, sustained funding from governmental agencies (NASA, DoD). The region is the epicenter of RLV technology and commercialization, setting the global benchmarks for launch frequency and cost efficiency. The competitive environment fosters continuous technological iteration, ensuring the region maintains its technological lead, particularly in heavy-lift capabilities and rapid satellite deployment for communications.

- Asia Pacific (Fastest Growth Trajectory): APAC is experiencing the highest CAGR, primarily driven by substantial state investments from China, India, and Japan aimed at developing indigenous launch vehicle families and sovereign satellite communication systems. China’s CASC and India’s ISRO are executing high-frequency launch missions, rapidly expanding their commercial market presence and geopolitical influence. The region's focus is on ensuring reliable access to space for domestic needs while aggressively competing for international commercial launch contracts.

- Europe (Strategic Autonomy and Restructuring): European nations, led by the European Space Agency (ESA) and Arianespace, are intensely focused on securing autonomous access to space, primarily through the Ariane 6 program. The region is restructuring its launch capabilities to reduce dependency on foreign providers and to become more cost-competitive against American RLV systems. Investment is concentrated on modular launch systems and optimizing ground operations to achieve necessary economies of scale.

- Latin America (Emerging Infrastructure Development): While smaller, the Latin American region is showing nascent growth, driven by regional governments seeking to establish basic satellite infrastructure for connectivity and earth observation. Development is constrained by capital availability, often resulting in reliance on international partners for launch services, although countries like Brazil are investing in indigenous spaceport and technology development programs.

- Middle East and Africa (Strategic Investment in Space): MEA nations are increasingly recognizing the strategic value of independent space capabilities, particularly for national security and diversifying their economies away from oil. Nations like the UAE and Saudi Arabia are investing heavily in establishing advanced satellite operations and are partnering with international launch providers for strategic payload insertion, driving demand for specialized launch services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Space Launch Market.- Space Exploration Technologies Corp. (SpaceX)

- Blue Origin

- United Launch Alliance (ULA)

- Arianespace

- Mitsubishi Heavy Industries (MHI)

- Indian Space Research Organisation (ISRO)

- China Aerospace Science and Technology Corporation (CASC)

- Rocket Lab USA

- Northrop Grumman Corporation

- Boeing Defense Space & Security

- Lockheed Martin Corporation

- Virgin Galactic

- Relativitiy Space

- Firefly Aerospace

- ILS International Launch Services

- Exos Aerospace

- Vector Launch Inc.

- IHI Corporation

- OHB SE

- Kosmotras

Frequently Asked Questions

Analyze common user questions about the Space Launch market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current exponential growth in the Space Launch Market?

The primary driver is the large-scale deployment of commercial Low Earth Orbit (LEO) satellite mega-constellations, necessitated by the global demand for ubiquitous, low-latency broadband connectivity. This requires high-cadence, cost-effective launch capabilities, chiefly enabled by reusable launch vehicle (RLV) technology.

How is reusable launch technology fundamentally impacting market dynamics and costs?

Reusable launch technology significantly reduces the marginal cost per launch by spreading the vehicle's manufacturing cost over multiple missions. This decrease in operational expenditure has intensified commercial competition, democratized access to space for smaller entities, and increased the frequency of launches possible globally.

Which orbital destination segment dominates the Space Launch Market volume, and why?

The Low Earth Orbit (LEO) segment dominates market volume due to LEO's suitability for high-throughput communication and Earth observation constellations. Deploying these vast networks requires thousands of satellites, necessitating high launch frequency and rideshare capabilities, making LEO the most active orbital destination.

What are the key technological restraints limiting further cost reduction in the launch sector?

Key restraints include the high development costs associated with advanced propulsion systems (e.g., methalox engines), the complex regulatory environment surrounding reusability and flight safety, and the inherent volatility and specialization required in the supply chain for critical, high-performance aerospace materials.

How is the Asia Pacific (APAC) region influencing the global competition in space launches?

APAC, led by governmental space programs in China and India, is influencing competition by rapidly expanding indigenous heavy-lift capabilities and offering increasingly competitive launch pricing for international commercial payloads. This expansion challenges the historical dominance of North American and European launch providers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Inertial Navigation System (INS) Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Mechanical Gyro Technology, Ring Laser Gyro Technology, Fiber Optics Gyro Technology, MEMS Technology, Others), By Application (Aircraft, Missiles, Space Launch Vehicles, Marine, Military Armored Vehicles, Unmanned Aerial Vehicles, Unmanned Ground Vehicles, Unmanned Marine Vehicles), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Space Launch Services Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Pre-Launch, Post-Launch), By Application (Commercial, Military & Government), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager