Space Qualified Atomic Clocks Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435428 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Space Qualified Atomic Clocks Market Size

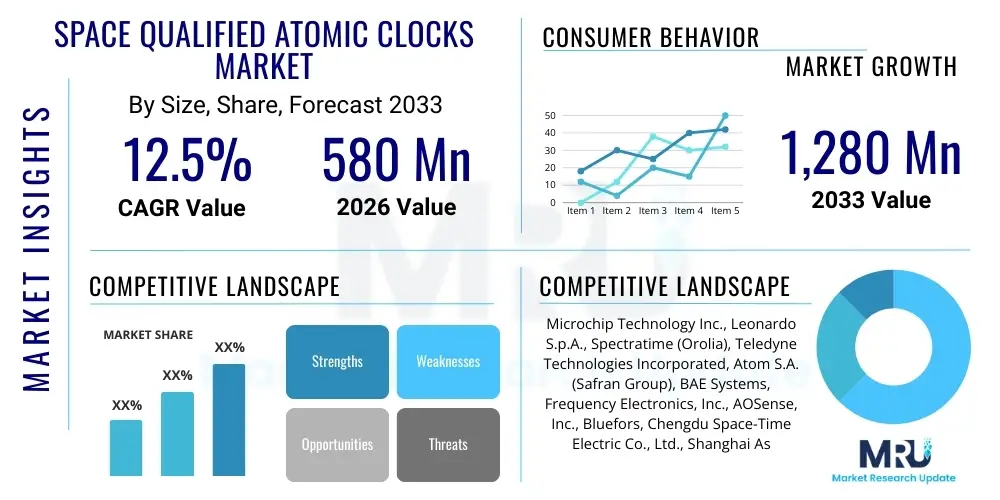

The Space Qualified Atomic Clocks Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 580 Million in 2026 and is projected to reach USD 1,280 Million by the end of the forecast period in 2033.

Space Qualified Atomic Clocks Market introduction

The Space Qualified Atomic Clocks Market encompasses the development, manufacturing, and deployment of highly precise frequency and time standards designed to operate reliably in the harsh environment of space, characterized by extreme temperature variations, radiation exposure, and vacuum conditions. These specialized clocks are fundamentally critical components for modern space infrastructure, serving as the backbone for global navigation satellite systems (GNSS), deep space communication, Earth observation, and scientific missions requiring unprecedented timing accuracy. The primary products include rubidium clocks, cesium clocks, and the emerging cold atom or optical clocks, each providing different levels of stability and longevity tailored to specific orbital altitudes and mission durations.

The core application of these clocks lies in enabling autonomous navigation and synchronization across vast distances. For GNSS constellations like GPS, Galileo, GLONASS, and BeiDou, atomic clocks onboard satellites ensure the precise determination of position, velocity, and timing (PVT) information essential for terrestrial users. Beyond navigation, these devices are integral to secure satellite communications, ranging from commercial broadband services to military command and control systems, where synchronized data transmission is paramount. Furthermore, scientific missions focused on fundamental physics, gravitational studies, and pulsar timing arrays heavily rely on the superior frequency stability offered by space-qualified standards.

Key market drivers include the accelerating pace of satellite launches, particularly the deployment of next-generation GNSS satellites requiring enhanced timing precision, and the increasing investment in deep space exploration projects by agencies like NASA, ESA, and CNSA. The benefits derived from these clocks include enhanced navigational accuracy (down to centimeters), improved data throughput and synchronization for high-speed communication links, and increased mission autonomy, reducing dependence on continuous ground control intervention. The transition toward compact, low-power, and ultra-stable chip-scale atomic clocks (CSACs) represents a significant technological shift driving market growth and expanding application possibilities in smaller satellite platforms (smallsats and CubeSats).

Space Qualified Atomic Clocks Market Executive Summary

The Space Qualified Atomic Clocks market is characterized by robust growth, driven primarily by the global modernization and expansion of national and commercial satellite infrastructure, particularly in the realm of GNSS and low Earth orbit (LEO) megaconstellations. Business trends indicate a shift toward miniaturization, focusing on developing highly resilient, low-power consumption atomic clocks suitable for mass production and rapid deployment in commercial space ventures. Regional trends show North America and Europe maintaining leadership due to strong governmental space budgets and the presence of established defense contractors, while the Asia Pacific region, led by China and India, is emerging rapidly, propelled by indigenous GNSS programs (BeiDou and NavIC) and increasing private sector investment in satellite communication infrastructure.

Segment trends highlight the dominance of Rubidium Atomic Clocks (RACs) in terms of current deployment volume due to their proven reliability, reduced size, and suitable performance for current-generation GNSS requirements. However, the Cesium Atomic Clocks segment commands a significant revenue share owing to their use as primary reference standards in critical infrastructure requiring the highest levels of long-term stability. Crucially, the emerging segment of next-generation clocks, including Cold Atom Clocks (CACs) and Optical Clocks, promises disruptive technological advancement, offering stability orders of magnitude better than current standards, positioning them as critical enablers for future deep space navigation and fundamental physics experiments.

The competitive landscape remains concentrated, featuring specialized aerospace and defense electronics providers. Strategic imperatives for market players include reducing the Size, Weight, and Power (SWaP) characteristics of current clocks, investing heavily in radiation hardening techniques, and integrating sophisticated AI-driven fault detection and self-correction mechanisms to enhance on-orbit longevity and performance. The market's future trajectory is tightly linked to international commitments regarding space domain awareness and the commercialization of space, which necessitates high-precision timing for coordinating complex orbital maneuvers and preventing catastrophic collision events.

AI Impact Analysis on Space Qualified Atomic Clocks Market

User queries regarding AI's influence on the Space Qualified Atomic Clocks Market frequently center on themes of enhanced autonomy, fault prediction, and optimization of clock performance under fluctuating space environments. Users are keen to understand how AI algorithms can compensate for environmental drift, mitigate radiation effects on clock stability, and ultimately extend the operational lifespan of timing devices far beyond current limits. Key concerns also revolve around integrating machine learning models into highly constrained, radiation-hardened computing platforms, and the regulatory challenges associated with deploying autonomous decision-making systems in critical GNSS infrastructure. The consensus expectation is that AI will transform atomic clock maintenance from a reactive ground-based operation to a proactive, autonomous satellite function.

The direct application of Artificial Intelligence and Machine Learning (ML) in atomic clock technology focuses primarily on two areas: predictive maintenance and real-time frequency stabilization. ML algorithms can analyze massive datasets related to satellite orbital parameters, environmental radiation fluxes, temperature fluctuations, and observed clock drift rates to build highly accurate predictive models. These models allow ground controllers, and increasingly, the onboard systems themselves, to anticipate performance degradation hours or days in advance, enabling timely adjustments (such as frequency steering) that maximize the clock's timekeeping precision. This shift from manual calibration to intelligent, autonomous management is vital for deep space missions where signal latency prevents effective real-time ground intervention.

Furthermore, AI is instrumental in the calibration and initialization phases of advanced atomic clocks, particularly next-generation optical clocks which involve complex laser cooling and atom trapping processes. ML optimization loops can rapidly tune the multiple physical parameters—laser frequencies, magnetic fields, and cooling pulse sequences—required to achieve optimum clock performance far faster and more consistently than traditional sequential calibration methods. This acceleration in deployment and tuning capability reduces the operational overhead and enhances the robustness of the timing system against physical disturbances encountered during launch and orbit insertion, thus providing a significant competitive advantage to manufacturers adopting these intelligent optimization techniques.

- AI algorithms enable autonomous frequency stabilization, compensating for environmental and aging drifts without ground intervention.

- Machine learning models predict and mitigate performance degradation caused by space radiation and temperature variations.

- Optimized calibration routines utilizing AI reduce clock initialization time and enhance on-orbit precision.

- AI supports the development of ultra-resilient timing redundancy systems and fault detection capabilities within satellite clusters.

- ML improves data integrity and synchronization for large LEO constellations relying on distributed, non-networked timing signals.

DRO & Impact Forces Of Space Qualified Atomic Clocks Market

The market for Space Qualified Atomic Clocks is profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities. The primary driver is the pervasive need for extreme precision in timing and synchronization across military, civil, and commercial space domains, specifically necessitated by the continuous modernization of global GNSS infrastructure and the proliferation of LEO satellite communication networks. Simultaneously, the market is restrained by the exceptionally stringent qualification requirements, the high cost associated with radiation hardening components, and the long development cycles required to achieve space heritage. Opportunities emerge primarily from the miniaturization trend (CSACs), the development of quantum-based cold atom and optical clocks, and the expansion into deep space navigation missions requiring ultra-stable, long-duration timing solutions. These forces collectively shape the competitive dynamics and investment landscape, determining which technologies and players will dominate the future of space timekeeping.

Key drivers include the global race for space technological supremacy and the resultant increase in government and private funding for advanced satellite systems. The enhanced requirement for PNT (Positioning, Navigation, and Timing) accuracy in military applications, coupled with the rising demand for high-bandwidth, synchronized data transmission in commercial broadband satellites, fuels the need for more stable and reliable atomic standards. Furthermore, the mandatory replacement cycles for aging GNSS satellites across major global systems ensure a stable demand pipeline for qualified clocks. The impact force of these drivers is high, ensuring continuous technological evolution and product upgrades.

Restraints, however, pose significant barriers. The rigorous space qualification process, involving years of testing for thermal vacuum, vibration, and radiation tolerance, significantly raises the entry barrier for new competitors and increases the time-to-market. The technical challenge of achieving superior long-term stability while maintaining low Size, Weight, and Power (SWaP) for smallsat applications requires expensive research and development. Opportunities, conversely, lie in leveraging non-traditional technologies; the transition from conventional microwave standards to quantum-enabled optical clocks promises unparalleled stability, paving the way for applications like relativistic geodesy and enhanced gravity mapping, opening entirely new high-value market segments.

Segmentation Analysis

The Space Qualified Atomic Clocks Market is segmented based on technology, application, platform, and orbit type, reflecting the diverse requirements of the space industry. Segmentation by technology—Rubidium, Cesium, and Cold Atom/Optical—is crucial as it delineates performance capabilities (stability, drift) versus physical constraints (SWaP). Application segmentation, covering GNSS, military communication, and scientific research, defines the primary use-cases and associated volume demands. Furthermore, segmenting by platform (Satellites, Probes/Rovers) and Orbit Type (LEO, MEO, GEO, Deep Space) helps address the specific environmental and operational challenges that dictate clock design and qualification standards.

- By Technology:

- Rubidium Atomic Clocks (RACs)

- Cesium Atomic Clocks (CACs)

- Hydrogen Masers (HMs)

- Chip Scale Atomic Clocks (CSACs)

- Next-Generation Clocks (Cold Atom Clocks, Optical Clocks)

- By Application:

- Global Navigation Satellite Systems (GNSS)

- Satellite Communication (SATCOM)

- Deep Space Navigation and Exploration

- Scientific Missions (e.g., Fundamental Physics, Earth Observation)

- Military and Defense Surveillance

- By Platform:

- Small Satellites (Smallsats/CubeSats)

- Large Satellites (Communication, Observation)

- Space Probes and Deep Space Vehicles

- By Orbit Type:

- Low Earth Orbit (LEO)

- Medium Earth Orbit (MEO)

- Geosynchronous Earth Orbit (GEO)

- Deep Space Missions

Value Chain Analysis For Space Qualified Atomic Clocks Market

The value chain for Space Qualified Atomic Clocks begins with the highly specialized upstream component manufacturing, involving the production of key physics packages, laser systems, vacuum chambers, and ultra-stable oscillators, often requiring rare earth elements and proprietary manufacturing processes. This phase is characterized by intense R&D investment and reliance on a select number of specialized suppliers for radiation-hardened electronics and frequency standards components. Midstream activities involve the integration, assembly, and rigorous testing of the full atomic clock unit, including packaging the device to withstand launch forces and qualifying it for space radiation environments—a major bottleneck that requires extensive infrastructure and regulatory compliance.

The downstream segment primarily consists of direct sales to prime contractors and government space agencies responsible for building and launching satellite platforms. Distribution is predominantly direct due to the bespoke nature and critical qualification requirements of the product; manufacturers work closely with system integrators (e.g., Lockheed Martin, Airbus Defence and Space) to ensure compatibility with the spacecraft bus. Indirect distribution channels, while limited, might involve specialized distributors managing smaller volumes for academic research or niche smallsat developers. Successful navigation of the value chain relies heavily on achieving a strong flight heritage and maintaining strict quality control throughout the manufacturing and integration process.

Crucially, the relationship between component suppliers and clock manufacturers is highly synergistic; advancements in chip-scale technology (CSAC) rely heavily on sophisticated MEMS (Micro-Electro-Mechanical Systems) fabrication techniques developed by upstream specialists. End-users, primarily government agencies controlling GNSS assets, exert immense pressure on the downstream segment regarding long-term reliability and stability specifications, driving the entire value chain toward incremental performance improvements and stringent certification standards. The high barrier to entry at the manufacturing and qualification stages ensures the market remains concentrated among players with established space infrastructure expertise and technological intellectual property.

Space Qualified Atomic Clocks Market Potential Customers

The potential customer base for space qualified atomic clocks is highly concentrated and dominated by sovereign entities and large defense and aerospace prime contractors. The primary customers are government space agencies (like NASA, ESA, Roscosmos, ISRO, CNSA) and national defense departments (e.g., U.S. Space Force, Ministry of Defence) that fund, build, and operate critical space infrastructure, most notably the multi-billion dollar GNSS constellations (GPS, Galileo, BeiDou, etc.). These entities require high-volume, extremely reliable, and highly stable clocks for maintaining timing accuracy across global navigation signals and securing military communication links.

A secondary, yet rapidly expanding, customer segment includes commercial satellite operators developing massive LEO and MEO communication megaconstellations (such as SpaceX Starlink, Amazon Kuiper, and OneWeb). While these operators might initially prioritize cost and low SWaP characteristics over the absolute stability required for MEO GNSS, their sheer volume demand for smaller, radiation-tolerant Chip Scale Atomic Clocks (CSACs) represents a significant growth vector. These commercial customers prioritize volume scalability and rapid integration into standardized satellite buses to achieve accelerated deployment timelines, contrasting with the often lengthy procurement cycles of traditional government programs.

Furthermore, scientific and academic institutions represent a niche but high-value customer group. These users typically procure ultra-high-precision clocks, often next-generation Cold Atom or Optical clocks, for dedicated research missions focused on testing fundamental physics, gravitational waves, or relativistic time transfer experiments. These missions demand the absolute cutting edge of timekeeping technology, often requiring custom designs and specialized performance characteristics, thereby driving innovation and pushing the technological boundaries of the market. Long-term sales strategies often involve establishing strong relationships with the prime integrators who supply the final satellite systems to these government and commercial end-users.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 580 Million |

| Market Forecast in 2033 | USD 1,280 Million |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Microchip Technology Inc., Leonardo S.p.A., Spectratime (Orolia), Teledyne Technologies Incorporated, Atom S.A. (Safran Group), BAE Systems, Frequency Electronics, Inc., AOSense, Inc., Bluefors, Chengdu Space-Time Electric Co., Ltd., Shanghai Astronomical Observatory (CAS), VTT Technical Research Centre of Finland, General Atomics, Advanced Navigation, EDO Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Space Qualified Atomic Clocks Market Key Technology Landscape

The technology landscape of the Space Qualified Atomic Clocks market is divided between legacy, mature technologies and disruptive quantum technologies. Current deployments are heavily reliant on Rubidium Atomic Clocks (RACs) and Cesium Atomic Clocks (CACs). RACs, particularly those based on the vapor cell principle, offer an optimal balance of stability, compactness, and cost-effectiveness, making them the workhorse for current-generation GNSS satellites. CACs, which define the primary second standard, offer superior long-term stability and are often used as master reference clocks, although they traditionally entail larger form factors and higher power consumption. The ongoing technological refinement in these established segments focuses on improving passive hydrogen masers (HMs) for ultra-stable deep space tracking and enhancing the radiation tolerance and lifetime of existing components.

A major technological trend reshaping the market is miniaturization, exemplified by the development and qualification of Chip Scale Atomic Clocks (CSACs). CSACs leverage MEMS technology to drastically reduce the Size, Weight, and Power (SWaP) footprint, making high-precision timing accessible to smallsat platforms and increasing redundancy possibilities on larger satellites. While CSACs currently lag traditional RACs in long-term stability, continuous improvements are closing this performance gap, positioning them as essential components for the massive LEO constellations being deployed. Qualification of these chip-scale devices for the space radiation environment remains a critical, high-investment technological hurdle for manufacturers seeking high-volume commercial contracts.

Looking ahead, the frontier of space timekeeping is dominated by Cold Atom Clocks (CACs) and eventually, Spaceborne Optical Clocks. These next-generation devices leverage quantum phenomena, using laser-cooled atoms to achieve frequency stability orders of magnitude better than microwave-based standards. Though still primarily in the research and demonstration phase (e.g., NASA’s Deep Space Atomic Clock mission utilizing a mercury-ion clock, a precursor to CACs), successful space qualification of a true optical clock would revolutionize deep space navigation, enabling centimeter-level terrestrial positioning accuracy and facilitating high-resolution tests of general relativity. The shift towards quantum sensing technologies represents the highest-value technological opportunity in the coming decade, driven by state-sponsored research initiatives across major spacefaring nations.

Regional Highlights

- North America: North America, led by the United States, represents the largest and most mature market for Space Qualified Atomic Clocks. This dominance is underpinned by substantial governmental defense and space budgets, continuous modernization of the GPS constellation (GPS III), and significant investment from organizations like NASA and the Department of Defense. The region is home to several leading players (e.g., Microchip, Frequency Electronics) that specialize in high-reliability, radiation-hardened components. The emerging commercial space sector, characterized by numerous LEO satellite startups and prime contractors, drives significant demand for miniaturized and volume-produced CSACs, solidifying the region's technological leadership and market scale.

- Europe: Europe is a key growth region, primarily driven by the deployment and sustainment of the Galileo GNSS program, which mandates extremely high stability requirements, often utilizing advanced clocks like the Passive Hydrogen Maser (PHM) and Rubidium Atomic Frequency Standard (RAFS). The European Space Agency (ESA) also actively funds research into next-generation cold atom and optical clocks, fostering innovation within companies like Leonardo and Safran. Governmental collaborative efforts, coupled with strong aerospace manufacturing capabilities in France, Germany, and Italy, ensure a stable and technologically advanced market demand focused on quality and regulatory adherence.

- Asia Pacific (APAC): The APAC region is the fastest-growing market, propelled by state-led initiatives in China (BeiDou Navigation Satellite System - BDS) and India (Navigation with Indian Constellation - NavIC). China's commitment to independent space infrastructure, including sophisticated communications and deep space capabilities, generates substantial indigenous demand for space-qualified timing standards. While historically reliant on imports, increasing governmental focus on self-sufficiency is driving local R&D and manufacturing capacity, particularly in proprietary rubidium clock technology, indicating strong potential for localization and significant market scaling over the forecast period.

- Middle East and Africa (MEA): This region currently holds a smaller share but exhibits emerging growth potential linked to national strategic goals focused on establishing independent satellite communication and Earth observation capabilities. Increased procurement of foreign-built satellites by nations like UAE and Saudi Arabia requires the integration of advanced timing solutions. The MEA market growth is predominantly driven by geopolitical necessity and strategic defense investments rather than commercial volume, focusing on high-end, reliable clocks supplied through international aerospace contractors.

- Latin America: The Latin American market remains niche, primarily focusing on utilizing existing GNSS systems rather than large-scale manufacturing or deployment of proprietary constellations. Demand for atomic clocks is mostly indirect, arising from scientific cooperation programs or procurement related to specific national observation or communication satellites, positioning the region as a consumer rather than a producer of advanced timing technology.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Space Qualified Atomic Clocks Market.- Microchip Technology Inc.

- Leonardo S.p.A.

- Spectratime (Orolia)

- Teledyne Technologies Incorporated

- Atom S.A. (Safran Group)

- BAE Systems

- Frequency Electronics, Inc.

- AOSense, Inc.

- Bluefors

- Chengdu Space-Time Electric Co., Ltd.

- Shanghai Astronomical Observatory (CAS)

- VTT Technical Research Centre of Finland

- General Atomics

- Advanced Navigation

- EDO Corporation (Exelis)

- L3Harris Technologies

- Honeywell International Inc.

- Raytheon Technologies Corporation

- Trimble Inc.

- T4Science

Frequently Asked Questions

Analyze common user questions about the Space Qualified Atomic Clocks market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for high-precision space qualified atomic clocks?

The foremost driver is the continuous modernization and expansion of Global Navigation Satellite Systems (GNSS) like GPS and Galileo, requiring ultra-stable timing to achieve higher accuracy in Positioning, Navigation, and Timing (PNT) services globally. Deep space exploration missions also necessitate enhanced long-duration stability.

How do Chip Scale Atomic Clocks (CSACs) impact the satellite market?

CSACs, due to their significantly reduced Size, Weight, and Power (SWaP), enable the integration of high-precision timing into smaller platforms (CubeSats and SmallSats) and increase redundancy across large LEO communication megaconstellations, dramatically lowering the barrier to entry for precise timekeeping in commercial space.

What are the main technical restraints affecting the deployment of atomic clocks in space?

The primary technical restraints include the need for extensive radiation hardening to ensure survival in the space environment, the high cost and long duration of rigorous space qualification testing (vibration, thermal vacuum), and the fundamental trade-off between maximizing long-term frequency stability and minimizing device size and power consumption.

How do next-generation Cold Atom and Optical Clocks differ from traditional Rubidium standards?

Next-generation clocks (Cold Atom/Optical) utilize laser cooling and quantum physics to achieve frequency stability that is orders of magnitude superior (up to 10-18) compared to traditional microwave standards like Rubidium (10-12 to 10-14), enabling breakthrough applications in relativistic geodesy and autonomous deep space navigation.

Which regional market holds the highest growth potential for space qualified atomic clocks?

The Asia Pacific (APAC) region is forecasted to exhibit the highest growth rate, primarily fueled by massive state-sponsored investments in independent GNSS systems (BeiDou, NavIC) and the regional push toward establishing autonomous, secure satellite communication infrastructure.

What role does Artificial Intelligence play in optimizing atomic clock performance on orbit?

AI utilizes machine learning to analyze environmental data (temperature, radiation) and clock drift in real time, enabling autonomous frequency stabilization and proactive, predictive maintenance scheduling. This extends the clock's operational lifespan and maintains optimal precision without constant ground intervention.

In which orbit type is the demand for the most stable atomic clocks typically highest?

Medium Earth Orbit (MEO) demands the highest precision and stability, as MEO is the operational orbit for all major GNSS constellations (GPS, Galileo), where minor timing errors translate directly into significant navigational errors on Earth.

Who are the primary end-users of Space Qualified Atomic Clocks?

The core end-users are government space agencies, national defense departments, and large aerospace prime contractors responsible for building and maintaining critical sovereign space assets, particularly Global Navigation Satellite Systems and military communication satellites.

What is the current industry focus regarding technological development in this market?

The current focus is split between the mass-producible miniaturization of reliable Rubidium clocks (CSACs) for LEO commercial needs and the highly complex development and space qualification of quantum-enabled Cold Atom and Optical clocks for future high-precision scientific and deep space missions.

How does clock frequency stability directly affect GNSS user accuracy?

High clock stability minimizes the drift in the satellite's internal time base. Since GNSS positioning relies on accurately measuring the time delay of signals from multiple satellites, even minute clock errors translate directly into meters of position error for the user on Earth. Superior stability ensures better positional accuracy.

What distinguishes a space qualified atomic clock from a terrestrial atomic clock?

Space qualification involves stringent engineering requirements to withstand extreme mechanical stress during launch, operational temperature extremes, and, most importantly, chronic exposure to space radiation (total ionizing dose and single-event effects), necessitating complex shielding and radiation-hardened electronics.

How significant is the role of commercial LEO constellations in market growth?

Commercial LEO constellations drive significant volume growth, demanding thousands of smaller, cost-effective, but still space-qualified, atomic standards. While LEO satellites might tolerate lower stability than MEO GNSS clocks, their sheer number necessitates robust supply chains and affordable, high-volume manufacturing solutions, expanding the market dramatically.

What is the current market penetration level of Hydrogen Masers?

Hydrogen Masers have relatively low market penetration by volume, but they command a high-value niche. They are utilized almost exclusively in ground stations and select high-precision deep space probes requiring the utmost long-term frequency stability, acting as master reference clocks rather than high-volume satellite payloads.

What is meant by the term "Space Heritage" in this industry?

Space heritage refers to the proven track record of a component or technology having successfully operated in orbit for a substantial period. Gaining "Space Heritage" is a critical requirement for securing future contracts, as reliability under harsh space conditions is paramount, making it a significant barrier to entry for new market players.

What are the environmental constraints that directly affect atomic clock performance in space?

The primary constraints include temperature fluctuations, vacuum conditions leading to material outgassing, high levels of ionizing radiation that degrade electronic components and alter internal clock physics, and mechanical vibration and shock experienced during launch, all of which can induce frequency drift or catastrophic failure.

Why is long-term stability more critical for deep space missions than for LEO missions?

Deep space missions rely on long-term stability because signal latency prevents continuous real-time calibration from Earth. The onboard clock must maintain precision autonomously over mission durations spanning years or decades, as timing errors accumulate over vast distances, severely impacting navigation accuracy upon arrival.

How does the emergence of quantum technology influence the competitive landscape?

Quantum technology elevates the competitive focus from incremental improvements in existing microwave standards to disruptive innovation. Companies that successfully qualify robust Cold Atom or Optical clocks for space will gain a decisive technological advantage, potentially disrupting market shares currently held by legacy clock manufacturers.

What is the typical lifespan expectation for a space qualified atomic clock in GEO?

For high-reliability applications like GEO GNSS, the expected operational lifespan for atomic clocks (e.g., Rubidium or Cesium) is typically mandated to exceed 10 to 15 years, corresponding to the service life of the satellite platform itself, necessitating complex aging compensation and redundancy mechanisms.

In the value chain, which stage incurs the highest level of specialized R&D investment?

The upstream component manufacturing and midstream qualification phases incur the highest specialized R&D investment, particularly in developing proprietary physics packages, high-Q microwave cavities, radiation-hardened control electronics, and advanced thermal stabilization systems essential for space operation.

How does the military sector influence market specifications for atomic clocks?

The military sector influences specifications by demanding extreme robustness against jamming and interference, enhanced security features, and absolute reliability under failure scenarios. This drives the requirement for high spectral purity, instantaneous frequency switching capabilities, and guaranteed long-term performance resilience.

What recent geopolitical factors affect the Space Qualified Atomic Clocks market?

Geopolitical factors include the acceleration of national space programs aiming for technological self-reliance (especially in China and India), the increasing focus on space domain awareness and secure PNT by NATO countries, and export control regulations that restrict the sale of advanced timing technology to certain foreign entities.

What are the key differences in clock requirements between LEO and MEO satellites?

LEO satellites generally require smaller, lower-power CSACs due to mass constraints and large constellation numbers, often accepting slightly lower stability. MEO satellites (GNSS) demand much higher long-term stability (e.g., Passive Hydrogen Masers or high-end Rubidium standards) because their timing directly dictates global navigation accuracy.

Beyond navigation, what is the fastest growing application segment for these clocks?

The fastest growing application segment is high-throughput Satellite Communication (SATCOM), particularly within commercial LEO megaconstellations, which require precise internal synchronization across thousands of non-networked satellites to manage complex data relay and high-speed beam steering efficiently.

What role do academic institutions play in the Space Qualified Atomic Clocks market?

Academic institutions are primarily drivers of innovation, often pioneering the development and first space demonstration of highly experimental, next-generation technologies, such as microgravity optical clocks, which eventually transition into commercially viable products through industry partnerships and spin-off companies.

What challenges exist in scaling up the production of high-precision space clocks?

Scaling challenges involve maintaining ultra-high quality control and cleanliness during physics package assembly, securing stable supply chains for specialized, radiation-hardened components, and ensuring every production unit meets the extremely tight performance tolerances demanded by space certification bodies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager