Speaker Membranes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431646 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Speaker Membranes Market Size

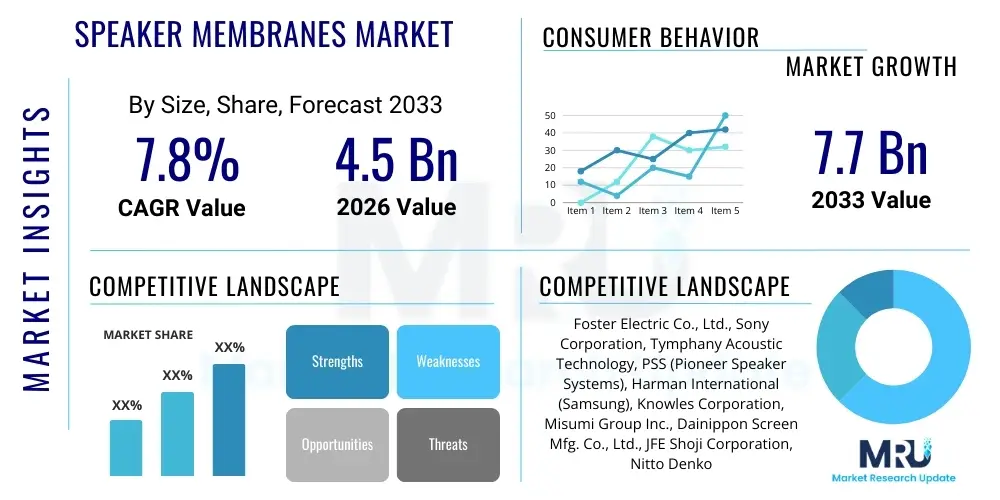

The Speaker Membranes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 4.5 billion in 2026 and is projected to reach USD 7.7 billion by the end of the forecast period in 2033.

Speaker Membranes Market introduction

The Speaker Membranes Market, fundamentally driven by the pervasive need for acoustic conversion, encompasses the design, manufacturing, and distribution of diaphragms used in electroacoustic transducers (speakers and headphones). These membranes are the critical components responsible for converting electrical energy into mechanical movement, thereby generating sound waves. The performance metrics of any audio system—including frequency response, transient behavior, distortion, and sensitivity—are directly linked to the material composition, geometry, and structural integrity of the speaker membrane. Key materials range from traditional treated paper pulp and synthetic polymers like Polypropylene (PP) and Polyethylene Terephthalate (PET) to highly advanced, stiff, and lightweight composites such as carbon fiber, aramid fiber, and specialized metals like aluminum and titanium. These membranes cater to a wide spectrum of applications, ensuring that products across the consumer and professional sectors meet increasingly sophisticated audio quality standards.

Product descriptions for speaker membranes vary significantly based on their intended use, categorized generally into dome, cone, and flat types, each optimized for different frequency ranges and power handling capabilities. Dome tweeters, often made from silk or metals, handle high frequencies, while cone woofers, typically larger and employing robust materials like paper or glass fiber, manage low-to-midrange frequencies. The major applications driving market demand include consumer electronics (smartphones, headphones, smart home devices, gaming consoles), the rapidly expanding automotive audio sector (driven by infotainment and electric vehicles), and professional audio equipment (studio monitors, public address systems, cinema sound). The inherent benefits of high-performance membranes include improved fidelity, enhanced sound pressure levels (SPL), reduced harmonic distortion, and increased product longevity, directly impacting the end-user listening experience.

The market is primarily driven by the exponential growth in consumer electronics production, particularly in emerging economies, coupled with the rising global demand for high-resolution audio formats and noise-canceling technology. Furthermore, the integration of advanced audio systems into modern vehicles, often featuring complex multi-speaker arrays, mandates the use of specialized, durable membranes capable of operating reliably under varying environmental conditions. Technological advancements focusing on miniaturization, material science innovation (e.g., thin-film technology, graphene integration), and precision manufacturing techniques are continually shaping the competitive landscape, pushing manufacturers to deliver lighter, stiffer, and more acoustically neutral diaphragms.

Speaker Membranes Market Executive Summary

The Speaker Membranes Market is characterized by robust technological development and intense competition, driven mainly by the high-volume demand originating from the Asia Pacific consumer electronics manufacturing base. Current business trends indicate a strategic pivot among leading manufacturers toward vertical integration and advanced material specialization, focusing heavily on developing composite materials that offer superior acoustic properties while maintaining cost-effectiveness for mass production. Key market players are investing significantly in research to integrate new materials, such as bio-plastics and advanced composites, to meet sustainability goals and performance benchmarks simultaneously. Furthermore, strategic mergers and acquisitions are common as companies seek to consolidate technological expertise, especially in areas like micro-speakers for wearable technology and sophisticated membranes required for active noise cancellation (ANC) systems.

Regional trends highlight the enduring dominance of the Asia Pacific (APAC) region, which serves as the primary hub for both raw material processing and end-product assembly, particularly in China, South Korea, and Japan. This region dictates global pricing and supply chain dynamics. North America and Europe, while representing smaller volume markets, are critical for high-margin segments such as luxury automotive audio, professional broadcasting, and premium headphones, demanding membranes with extremely tight tolerance and superior acoustic fidelity. The transition toward electric vehicles (EVs) in Western markets is also providing a unique opportunity, as EVs require specific acoustic solutions to compensate for the absence of engine noise, often leveraging specialized membrane materials for improved sound isolation and quality within the cabin.

Segmentation trends reveal that the Consumer Electronics application segment maintains the largest market share, driven by the massive volumes of smartphones and smart home devices produced annually. However, the Automotive segment is exhibiting the highest growth rate due, in part, to the increasing number of speakers per vehicle and the rising adoption of premium audio packages across mid-range and luxury models. In terms of material segmentation, synthetic polymers like Polypropylene remain essential due to their excellent balance of cost and performance, but there is a clear upward trend in the adoption of composite materials and thin metal alloys, especially in high-end applications where stiffness-to-weight ratio is paramount. This shift underscores the market's collective pursuit of enhancing acoustic performance beyond conventional limits, aligning with consumer demand for high-definition audio experiences.

AI Impact Analysis on Speaker Membranes Market

User queries regarding the impact of Artificial Intelligence (AI) on the Speaker Membranes Market predominantly center on three core themes: achieving optimal material composition, streamlining manufacturing efficiency, and enhancing acoustic quality through predictive modeling. Users are keen to understand how AI can move beyond simple automation to generative design processes, allowing for the creation of membrane geometries and material laminations that are acoustically perfect but difficult or impossible to design using traditional simulation methods. The primary concern is whether AI integration will significantly reduce the time-to-market for new diaphragm technologies and simultaneously lower the manufacturing defect rate, thereby improving quality consistency across large-scale production runs.

AI is fundamentally transforming the R&D phase by enabling rapid iteration and optimization of material properties. Machine learning algorithms can analyze vast datasets concerning material elasticity, density, damping characteristics, and acoustic output to predict the performance of novel composite structures before physical prototyping. This dramatically reduces material waste and R&D costs associated with empirical testing. Furthermore, in the manufacturing environment, AI-powered computer vision systems are being deployed for highly sensitive quality control, capable of detecting microscopic defects or inconsistencies in membrane thickness and coating uniformity that are imperceptible to the human eye, ensuring only flawless components proceed to final assembly. This move toward 'smart manufacturing' optimizes yield rates and increases reliability.

Beyond material science and quality control, AI is crucial in post-production tuning and personalized audio experiences. Advanced algorithms can model complex acoustic environments—such as a specific car cabin or the space within an ear canal for earbuds—and suggest precise membrane modifications or apply specific digital signal processing (DSP) corrections based on the membrane’s physical characteristics. This allows manufacturers to customize the acoustic signature of a speaker system automatically, leading to more consistent and tailored sound output for the end-user, thereby significantly enhancing the perceived value and performance of the final audio product. The long-term expectation is that AI will make the production of acoustically optimized, bespoke speaker membranes scalable and cost-effective.

- AI-driven Generative Design for Optimal Membrane Geometry.

- Predictive Modeling of Acoustic Performance based on Material Science data.

- Enhanced Quality Control using AI-powered Computer Vision for defect detection.

- Optimization of Manufacturing Parameters (e.g., curing temperature, coating thickness) through Machine Learning.

- Integration of AI algorithms for real-time membrane performance monitoring and calibration in smart devices.

DRO & Impact Forces Of Speaker Membranes Market

The dynamics of the Speaker Membranes Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the critical Impact Forces shaping its trajectory. The primary driver is the pervasive demand for higher quality audio experiences across all device categories, necessitating constant innovation in diaphragm performance, particularly concerning achieving wider frequency response and lower distortion in increasingly smaller form factors. This is coupled with the massive volume demand from consumer electronics giants, particularly those focused on smart home ecosystems and wearable audio. Conversely, the market faces significant restraints, including the high cost and complexity associated with processing advanced materials (such as Beryllium or certain carbon nanotubes) and the intense competitive pressure on pricing, particularly in the mass-market segments where manufacturers must balance performance and stringent cost targets. Furthermore, fluctuations in the supply chain for key raw materials, often petroleum-based polymers or specific rare metals, pose logistical and economic challenges.

Opportunities for growth are significant, centered around the rapid proliferation of Electric Vehicles (EVs) and the subsequent requirement for highly specialized, lightweight, and electromagnetically shielded speaker components. EVs necessitate premium audio solutions designed to operate effectively in an unusually quiet cabin environment. Another major opportunity lies in the medical and industrial sectors, where specialized membranes are required for ultrasonic applications, diagnostic equipment, and high-precision sensors. Manufacturers who successfully leverage additive manufacturing technologies (3D printing) to produce custom-geometry membranes with unparalleled consistency and minimized material waste will gain a considerable competitive advantage. Furthermore, the growing global focus on environmental sustainability is driving R&D into biodegradable and recycled membrane materials, offering a potential blue ocean market for eco-conscious innovations.

The impact forces currently exerting the strongest influence include rapid miniaturization trends, which push manufacturers to achieve high SPL and fidelity from micro-speakers used in true wireless stereo (TWS) earbuds and augmented reality (AR) glasses. Regulatory standards concerning material safety (e.g., REACH compliance in Europe) also act as a significant force, compelling suppliers to ensure material traceability and compliance, impacting product design choices. The continuous evolution of audio coding and transmission standards (e.g., lossless and spatial audio formats) dictates performance requirements, forcing diaphragm manufacturers to deliver membranes capable of reproducing the extreme dynamic range and high-frequency details inherent in these new formats. Overall, success in this market is dictated by the ability to rapidly innovate materials while maintaining scalable, cost-effective, and highly precise manufacturing processes to meet diverse application requirements.

Segmentation Analysis

The Speaker Membranes Market is broadly segmented based on Material Type, Speaker Type, and Application. This segmentation provides a granular view of demand drivers and technological focus areas within the industry. Material selection remains the single most critical factor, dictating acoustic performance, durability, and cost; therefore, market dynamics differ significantly between traditional paper cones used in budget systems and advanced composite diaphragms required for high-end professional equipment. The increasing diversity of consumer audio devices, ranging from tiny micro-speakers in smart watches to large floor-standing units, necessitates a constant innovation cycle across all segmented categories to meet varied performance envelopes and cost structures globally.

- By Material:

- Paper/Pulp

- Plastic (Polypropylene, Polyethylene Terephthalate, Polycarbonate)

- Metal (Aluminum, Titanium, Beryllium)

- Composites (Carbon Fiber, Aramid Fiber, Glass Fiber)

- Others (Graphene, Diamond-Like Carbon (DLC))

- By Speaker Type:

- Cone Speakers (Woofers, Midrange)

- Dome Speakers (Tweeters, Midrange)

- Flat Panel Speakers (Exciter/Planar Magnetic)

- By Application:

- Consumer Electronics (Smartphones, Headphones, Smart Home Devices)

- Automotive Audio Systems

- Professional Audio (Studio Monitors, PA Systems)

- Industrial and Medical Devices (Ultrasonic Sensors)

Value Chain Analysis For Speaker Membranes Market

The value chain for the Speaker Membranes Market is highly specialized and spans from raw material extraction and synthesis to final system integration. The upstream segment involves suppliers of critical raw materials, including chemical manufacturers providing specialty polymers (e.g., DuPont, SABIC), pulp manufacturers, and advanced materials suppliers dealing in carbon fiber, aramid, and rare metals like beryllium. Precision and quality control at this stage are paramount, as the consistency of the raw material directly affects the acoustic properties of the final membrane. Direct procurement relationships between membrane manufacturers and specialized material providers are common to ensure material purity and customized specification fulfillment, which is vital for high-fidelity applications.

The core midstream activity involves specialized membrane manufacturing, where companies utilize highly complex processes such as vacuum forming, thin-film deposition, molding, and specialized coating applications. These manufacturers focus on achieving incredibly precise tolerances in thickness, mass, and stiffness-to-weight ratio. Following membrane production, the components are supplied directly (direct distribution) to Transducer and Speaker Assembly Companies (e.g., Harman, Sony, Foster). These assembly companies integrate the membranes into complete drivers (voice coil, magnet, basket) and subsequently into final audio products like headphones, soundbars, or vehicle speaker systems. Indirect distribution typically involves large-scale component distributors who manage inventory and supply components to smaller, specialized audio equipment manufacturers, particularly in fragmented regional markets.

The downstream segment consists of Original Equipment Manufacturers (OEMs) who integrate the final drivers into finished products, catering to end-users across consumer, automotive, and professional markets. The increasing focus on design and integration, especially in compact devices, means that membrane characteristics are often negotiated early in the product development cycle, creating a tight feedback loop between the membrane manufacturer and the OEM. The complexity of distribution channels varies significantly by application; high-volume consumer electronics often rely on established, global supply chains managed by large contract manufacturers, while niche professional audio equipment relies on smaller, specialized distribution networks focused on technical support and performance calibration. This integration ensures that the membrane’s acoustic characteristics are perfectly matched to the overall system design and intended listening environment.

Speaker Membranes Market Potential Customers

The potential customers and primary buyers of speaker membranes are highly diversified but can be categorized mainly into major Original Equipment Manufacturers (OEMs) specializing in audio and electronics, as well as specialized acoustic component integrators. The largest volume buyers are the multinational consumer electronics corporations that require millions of micro-speakers and diaphragms annually for their smartphone, laptop, tablet, and TWS earbud product lines. These buyers demand scalability, cost efficiency, and materials suitable for miniaturization while meeting stringent acoustic performance metrics necessary for competitive differentiation in a saturated market. Brand recognition and established supply chain stability are key factors influencing their purchasing decisions.

A second substantial customer base is the global Automotive Industry, including Tier 1 suppliers (e.g., Continental, Bosch, Harman Automotive) and vehicle manufacturers themselves. As modern vehicles incorporate increasingly sophisticated infotainment and safety warning systems, the demand for durable, thermally stable, and lightweight speaker membranes designed for the harsh automotive environment is growing rapidly. These customers prioritize long-term reliability and compliance with automotive quality standards (e.g., AEC-Q100). The shift toward high-end audio packages in EVs further solidifies the automotive sector as a premium buyer segment, seeking advanced composite and metal membranes for superior bass and clarity.

Finally, the Professional and Industrial Audio sector, comprising companies that manufacture studio monitoring equipment, live sound reinforcement systems (PA systems), and specialized industrial transducers, represents a high-value, albeit lower volume, customer segment. These buyers prioritize absolute acoustic accuracy, transient response, and high power handling capability above all else. They often require custom-formulated membranes (e.g., specialized beryllium or magnesium alloys) and are willing to pay a premium for components that deliver audiophile-grade performance. Additionally, emerging end-users in the medical field (ultrasound probes) and defense sectors also purchase highly specialized membranes where consistency and specific frequency responses are mission-critical requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 billion |

| Market Forecast in 2033 | USD 7.7 billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Foster Electric Co., Ltd., Sony Corporation, Tymphany Acoustic Technology, PSS (Pioneer Speaker Systems), Harman International (Samsung), Knowles Corporation, Misumi Group Inc., Dainippon Screen Mfg. Co., Ltd., JFE Shoji Corporation, Nitto Denko Corporation, Kuraray Co., Ltd., Mitsubishi Chemical Corporation, Teijin Limited, Toray Industries Inc., 3M Company, DuPont de Nemours, Inc., Celanese Corporation, Arkema S.A., LG Chem, SABIC. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Speaker Membranes Market Key Technology Landscape

The technological landscape of the Speaker Membranes Market is defined by intense innovation focused on achieving optimal mechanical properties—high stiffness combined with extremely low mass—to maximize transient response and bandwidth. A key area of advancement is the utilization of advanced material synthesis, notably the incorporation of nanomaterials like Graphene and Carbon Nanotubes (CNTs). Graphene, due to its exceptional strength-to-weight ratio and superb electrical conductivity, is increasingly explored for thin-film diaphragms, promising superior high-frequency performance and exceptional rigidity compared to traditional polymers or aluminum. Manufacturers are deploying specialized chemical vapor deposition (CVD) techniques to create homogenous graphene layers or using advanced dispersion methods to integrate CNTs into composite polymer matrices, pushing the boundaries of acoustic fidelity in micro-speakers and high-end drivers.

Another dominant technological trend is the adoption of highly precise manufacturing methods, particularly additive manufacturing (3D printing) for creating complex, customized membrane geometries. While still nascent for large-scale production, 3D printing allows R&D teams to prototype and produce membranes with variable wall thickness or integrated damping structures that are impossible to achieve via traditional molding or stamping. This enables highly localized control over vibrational modes, reducing unwanted resonances and distortion. Furthermore, advancements in specialized surface treatments, such as Diamond-Like Carbon (DLC) coating, are used to enhance the stiffness and internal damping of polymer or metal diaphragms without significantly increasing their overall mass, providing an excellent acoustic damping solution essential for managing high power inputs without physical failure.

The market also heavily relies on sophisticated simulation and acoustic modeling software, which leverages Finite Element Analysis (FEA) and computational fluid dynamics (CFD) to predict membrane behavior under various operating conditions. This technology minimizes physical prototyping cycles and optimizes parameters such as surround geometry (the suspension system attached to the membrane edge) and voice coil attachment points. Crucially, the technological focus extends beyond the diaphragm itself to the integration technology. Innovations in voice coil bonding agents, suspension materials (like specialized thermoset elastomers), and the development of lightweight chassis materials are all interdependent with membrane technology, collectively aiming to produce transducer systems that are smaller, more efficient, and acoustically superior, especially for the high-demand segments of portable audio and embedded vehicle systems.

Regional Highlights

Regional dynamics within the Speaker Membranes Market are highly reflective of global manufacturing shifts, consumer wealth, and technological adoption rates.

- Asia Pacific (APAC): APAC, particularly countries like China, South Korea, Japan, and Taiwan, dominates the global market both in terms of production volume and consumption within the consumer electronics segment. This region serves as the world's manufacturing hub for smartphones, TWS earbuds, smart speakers, and high-definition televisions, driving massive, cost-competitive demand for polymer and paper-based membranes. South Korea and Japan, however, maintain a leading edge in the development and manufacturing of highly specialized, advanced material membranes (e.g., Beryllium, high-purity aluminum) destined for premium headphones and professional audio equipment. The rapid expansion of middle-class populations in India and Southeast Asia is further accelerating the overall volume growth.

- North America: North America is characterized by high demand for premium and specialized audio products. This region leads in the adoption of new audio technologies, such as spatial audio and high-resolution streaming, driving demand for membranes that support extended frequency response and low distortion. Key growth factors include the robust automotive sector, particularly the luxury and EV segments, which integrate complex multi-channel audio systems. The presence of major technology innovators and high R&D spending ensures continuous investment in advanced materials and acoustic engineering excellence.

- Europe: Europe represents a mature market focusing heavily on the automotive sector (Germany, France) and high-fidelity professional audio (UK, Scandinavia). European standards, particularly concerning material safety and environmental compliance (e.g., RoHS, REACH), influence product development, pushing manufacturers toward sustainable and traceable materials. Demand is strong for high-performance membranes that can withstand temperature extremes and offer superior acoustic isolation required for luxury vehicles. The professional audio segment, including studio monitors and broadcasting equipment, sustains a consistent, specialized demand for extremely accurate diaphragms.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions are emerging markets experiencing strong growth driven by increasing disposable income and better access to consumer electronics. While generally focusing on mid-range and budget-friendly components, the demand for basic and mid-grade polymer membranes is steadily rising. Urbanization and infrastructure projects requiring public address (PA) systems also contribute to market demand, though the technological focus remains primarily on durability and cost efficiency rather than cutting-edge acoustic performance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Speaker Membranes Market.- Foster Electric Co., Ltd.

- Sony Corporation

- Tymphany Acoustic Technology

- PSS (Pioneer Speaker Systems)

- Harman International (Samsung)

- Knowles Corporation

- Misumi Group Inc.

- Dainippon Screen Mfg. Co., Ltd.

- JFE Shoji Corporation

- Nitto Denko Corporation

- Kuraray Co., Ltd.

- Mitsubishi Chemical Corporation

- Teijin Limited

- Toray Industries Inc.

- 3M Company

- DuPont de Nemours, Inc.

- Celanese Corporation

- Arkema S.A.

- LG Chem

- SABIC

Frequently Asked Questions

Analyze common user questions about the Speaker Membranes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving demand for composite speaker membranes?

The demand for composite membranes (e.g., carbon fiber, aramid) is primarily driven by the need for extremely high stiffness-to-mass ratios, which is essential for achieving extended frequency response, lower distortion, and superior transient performance, particularly in high-end automotive and professional audio applications.

How does the shift to Electric Vehicles (EVs) impact the Speaker Membranes Market?

EVs create higher demand for lightweight, specialized membranes capable of minimizing internal vibration and maximizing acoustic efficiency. The quiet cabin environment of an EV highlights existing acoustic imperfections, necessitating high-fidelity membrane materials designed for optimal low-frequency performance and low resonance.

What role does Graphene play in the future of speaker diaphragm manufacturing?

Graphene is poised to revolutionize thin-film diaphragm manufacturing due to its exceptional stiffness, minimal mass, and damping properties. It allows for the creation of ultra-thin, highly sensitive diaphragms suitable for micro-speakers in TWS earbuds and advanced planar magnetic drivers, promising superior high-frequency reproduction.

Which application segment holds the largest market share for speaker membranes?

The Consumer Electronics segment, encompassing smartphones, headphones, and smart home devices, currently holds the largest volume market share globally, driven by continuous product refresh cycles, massive scale production, and the proliferation of personal audio devices in the Asia Pacific region.

What key manufacturing technologies are optimizing membrane production?

Key optimization technologies include high-precision vacuum forming and molding, advanced thin-film deposition techniques, and the integration of AI-powered computer vision systems for rigorous, non-contact quality control and defect detection during high-volume production runs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager