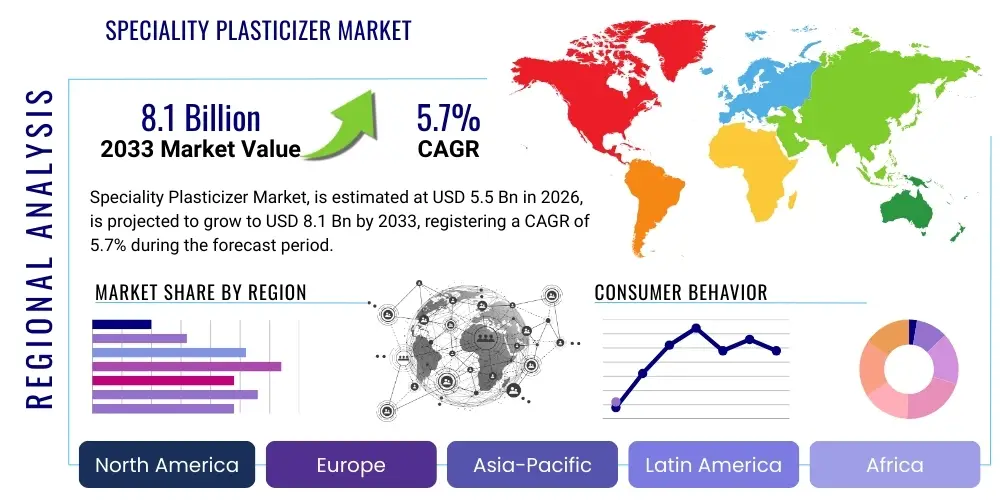

Speciality Plasticizer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435902 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Speciality Plasticizer Market Size

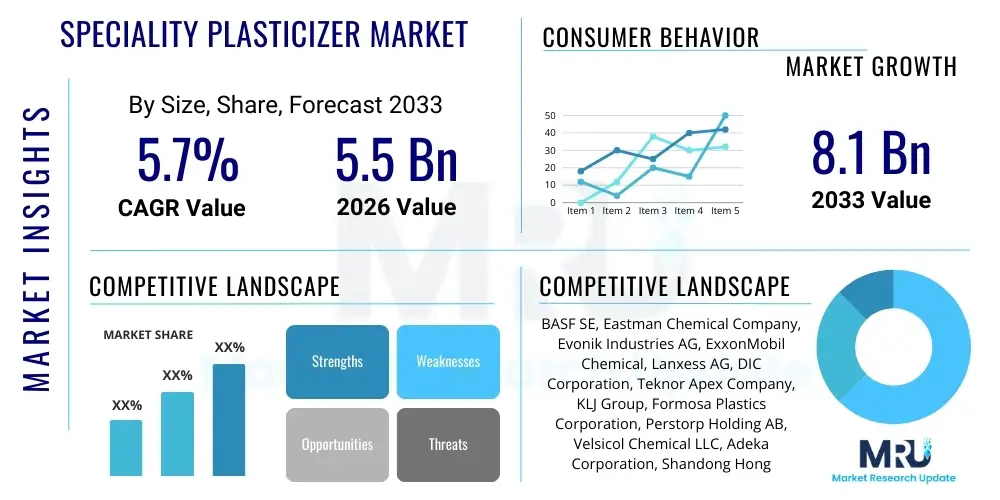

The Speciality Plasticizer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.7% between 2026 and 2033. The market is estimated at USD 5.5 Billion in 2026 and is projected to reach USD 8.1 Billion by the end of the forecast period in 2033.

Speciality Plasticizer Market introduction

The Speciality Plasticizer Market encompasses high-performance chemical additives essential for imparting flexibility, durability, and processing characteristics to polymers, primarily Polyvinyl Chloride (PVC) and other elastomers. Unlike general-purpose plasticizers (like high-volume phthalates), specialty plasticizers are designed to meet stringent requirements related to low volatility, high temperature resistance, low migration, enhanced extraction resistance, and specific toxicity profiles, making them critical for sensitive and high-demand applications. Key products include non-phthalate alternatives such as terephthalates (DOTP), trimellitates, adipates, sebacates, and novel bio-based plasticizers derived from natural oils.

The primary function of speciality plasticizers is to enhance the physical properties of end-products, ensuring compliance with rigorous safety and performance standards, particularly in the automotive, medical device, electrical cable insulation, and construction industries. The shift away from traditional ortho-phthalates, driven by tightening regulatory frameworks globally, has exponentially increased the demand for specialty alternatives, pushing manufacturers towards continuous innovation in sustainable and safer chemical structures. Furthermore, the rising adoption of flexible PVC in advanced applications, such as specialized tubing, blood bags, and interior automotive components, necessitates the superior performance characteristics that only specialty plasticizers can provide, ensuring product longevity and consumer safety.

Major applications of these plasticizers span across medical tubing, resilient flooring, wire and cable jacketing requiring flame retardancy and high thermal stability, synthetic leather for automotive interiors, and specialized coatings. The significant benefits include improved cold flexibility, excellent heat aging resistance, and reduced environmental footprint through the use of bio-based options. Driving factors include escalating environmental concerns, stringent global regulations regarding chemical usage, and rapid infrastructure development, particularly in Asia Pacific, demanding high-durability construction materials.

Speciality Plasticizer Market Executive Summary

The Speciality Plasticizer Market is characterized by a fundamental transition driven by regulatory mandates and robust end-user demand for high-performance, safer materials. Business trends indicate a strong move towards diversification, with major chemical producers prioritizing R&D investment into non-phthalate and sustainable (bio-based) plasticizer technologies. Strategic alliances and mergers focused on securing raw material access or proprietary technology for high-grade plasticizers are becoming commonplace, especially as companies seek to expand their portfolio of offerings compliant with major regulations like REACH in Europe and similar initiatives in North America. Furthermore, manufacturers are optimizing production processes to improve energy efficiency and reduce waste, aligning with broader corporate sustainability goals and customer demands for transparency in the supply chain.

Regional trends highlight Asia Pacific (APAC) as the primary growth engine, fueled by massive investments in infrastructure, escalating automotive production, and a rapidly expanding healthcare sector requiring high volumes of specialized medical-grade PVC components. While APAC focuses on volume and expanding adoption, North America and Europe lead in regulatory-driven innovation, witnessing the fastest conversion rates from general-purpose to specialty and bio-based alternatives. The European market, guided by stringent environmental and safety directives, places a premium on DINCH, DOTP, and complex bio-based esters, establishing global benchmarks for material safety and low toxicity in consumer products.

Segment trends underscore the dominance of the non-phthalate plasticizer segment, particularly DOTP (Di-octyl terephthalate), due to its excellent performance profile and lower toxicity profile, making it a direct and compliant substitute in numerous PVC applications. However, the fastest growth is observed in the bio-based and sustainable plasticizers segment, which, although currently small, is attracting significant investment owing to its appeal to environmentally conscious manufacturers and consumers. Application-wise, the automotive and wire & cable sectors remain the most lucrative, demanding plasticizers that can withstand extreme temperatures, vibrations, and harsh operating conditions, thereby requiring high-grade trimellitates and polymeric plasticizers.

AI Impact Analysis on Speciality Plasticizer Market

Common user questions regarding AI's impact on the Speciality Plasticizer Market typically revolve around enhancing material discovery, optimizing complex polymerization processes, improving quality control, and developing predictive models for supply chain resilience amidst fluctuating feedstock prices. Users frequently ask if AI can accelerate the screening of novel, environmentally friendly chemical structures to replace restricted plasticizers and how machine learning (ML) can refine the formulation of complex PVC compounds to achieve optimal performance characteristics (e.g., lower migration, improved heat stability) with minimal material use. The consensus points towards AI being a critical tool for achieving next-generation product innovation and operational efficiency, particularly in synthesizing bio-based monomers and ensuring product consistency in high-stakes applications like medical devices and electric vehicle battery components.

The application of Artificial Intelligence and advanced machine learning algorithms is profoundly transforming the research and development phase within the speciality plasticizer industry. AI is utilized to rapidly analyze vast datasets relating to molecular structures, toxicity profiles, and performance characteristics, significantly shortening the time required to identify and validate novel, compliant plasticizer candidates. This accelerated discovery process is crucial for staying ahead of continually evolving global chemical regulations. Furthermore, predictive modeling powered by AI assists in optimizing reaction conditions during synthesis, ensuring higher yield, purer product outcomes, and reducing operational energy consumption, thereby addressing both performance and sustainability objectives simultaneously.

Beyond R&D, AI is instrumental in refining the manufacturing supply chain and quality assurance protocols for speciality plasticizers. AI-driven predictive maintenance ensures minimal downtime for complex reactor units, while machine learning algorithms analyze real-time production data to detect subtle deviations in quality, migration rates, and thermal stability characteristics immediately, ensuring every batch meets the stringent specifications required by the automotive and medical end-users. This level of quality precision, unattainable through traditional statistical process control, solidifies AI's role in guaranteeing the reliability and high purity required for high-value specialty additives.

- Accelerated discovery of novel, compliant plasticizer molecules using computational chemistry.

- Optimization of synthesis pathways (reaction conditions, catalyst selection) for bio-based plasticizers.

- Enhanced quality control through real-time predictive analytics of product purity and migration rates.

- Supply chain resilience achieved via AI forecasting of feedstock price volatility and demand fluctuations.

- Simulation of polymer-plasticizer interaction to predict long-term performance and material aging.

DRO & Impact Forces Of Speciality Plasticizer Market

The Speciality Plasticizer Market is primarily driven by the imperative to comply with stringent global health and safety regulations, particularly the replacement of restricted phthalates across consumer goods, medical, and food-contact materials. This regulatory push acts as a strong driver, compelling industries to adopt high-performance, low-toxicity specialty alternatives. Opportunities lie extensively in the development and commercialization of bio-based and sustainable plasticizers, capitalizing on rising consumer and corporate environmental consciousness. However, the market faces significant restraints, including the high cost and complex synthesis pathways associated with specialty esters compared to commodity phthalates, alongside persistent volatility in the price of key petrochemical feedstocks. These factors collectively create a dynamic competitive landscape where innovation and regulatory compliance determine market success.

Key drivers include the burgeoning demand from the automotive industry, specifically the rapid electrification of vehicles (EVs), which necessitates specialized, heat-resistant plasticizers for cable insulation, battery components, and demanding interior surfaces that must meet extremely low VOC (Volatile Organic Compound) emission standards. Additionally, global infrastructure spending, particularly on resilient and durable construction materials like high-grade cables and specialized roofing membranes, further propels demand for polymeric and trimellitate plasticizers known for their exceptional durability and long-term performance under harsh environmental conditions. The increasing prevalence of disposable medical devices also mandates the use of non-toxic, specialty plasticizers such as DINCH and citrate esters, ensuring patient safety and regulatory adherence.

Restraints center on the scalability challenges of novel bio-based plasticizers, which currently lack the established, high-volume production infrastructure of conventional chemical synthesis, leading to higher manufacturing costs and limited immediate availability. Furthermore, the specialized nature of these additives requires sophisticated formulation expertise from end-users, posing a knowledge barrier for smaller manufacturers transitioning from older chemistries. The complex regulatory fragmentation across different regions, with varying acceptable limits and timelines for phase-out, also presents an operational challenge for global manufacturers who must manage multiple product lines and compliance requirements simultaneously. The long-term impact of regulatory forces remains overwhelmingly positive, continuously driving innovation toward safer, high-value specialty solutions.

Impact forces are driven by the shifting balance between cost-effectiveness and regulatory compliance. The intense competitive pressure within the PVC compounding industry compels players to seek the lowest-cost compliant plasticizer, often leading to rapid adoption of newly commercialized alternatives like high-volume DOTP. Technological advancement, particularly in esterification and transesterification processes, serves as a crucial impact force, enabling better product performance and reduced production costs for complex trimellitates and adipates, enhancing their competitiveness against traditional options.

Segmentation Analysis

The Speciality Plasticizer Market is comprehensively segmented based on the type of chemical structure, the specific application area, and the end-use industry, reflecting the diverse performance requirements across various sectors. The segmentation by type is dominated by non-phthalate and high-molecular-weight chemistries, which provide the enhanced performance characteristics required for critical applications. Application segmentation focuses on the key functions these plasticizers perform, such as flexibility enhancement in films and sheets or thermal stabilization in wire and cable jacketing. The primary end-use segments, including the rapidly expanding automotive sector and the highly regulated medical industry, define the stringent quality and compliance standards demanded from plasticizer manufacturers, driving premium pricing and innovation.

- By Type:

- Phthalate-Free Plasticizers (DOTP, DINCH)

- Trimellitates (TMTM, TOTM)

- Polymeric Plasticizers (Adipates, Sebacates)

- Epoxy Plasticizers (ESBO)

- Bio-based/Sustainable Plasticizers (Citrates, Castor Oil derivatives)

- Others (Phosphate Esters)

- By Application:

- Wire and Cable

- Film and Sheet

- Coating and Flooring

- Medical Devices (Blood Bags, Tubing)

- Automotive Interiors

- Consumer Goods and Toys

- By End-Use Industry:

- Construction

- Automotive

- Electrical & Electronics

- Healthcare and Medical

- Packaging

- Apparel and Textiles

Value Chain Analysis For Speciality Plasticizer Market

The value chain for the Speciality Plasticizer Market begins with the upstream procurement of essential petrochemical feedstocks, primarily crude oil and natural gas derivatives such as phthalic anhydride, 2-ethylhexanol (2-EH), isononanol (INA), and various acids (adipic, terephthalic). The efficiency and stability of this upstream segment are highly critical, as feedstock costs represent the largest component of plasticizer manufacturing expenses, and price volatility directly impacts final product margins. Manufacturers must maintain robust supply contracts and often engage in backward integration to secure key raw materials, especially for high-volume specialty plasticizers like DOTP. For bio-based plasticizers, the upstream involves agricultural sourcing and processing of natural oils (e.g., soybean or castor oil), adding complexity regarding agricultural supply chain management and refining purity.

The central manufacturing stage involves complex chemical reactions, primarily esterification or transesterification, transforming alcohols and acids into specialty esters. This stage requires significant capital investment in highly specialized reactors, distillation equipment, and advanced quality control systems to ensure the high purity and low-volatility standards demanded by end-users like the medical or automotive sectors. Differentiation at this stage is achieved through proprietary catalysts, process optimization to reduce energy consumption, and the synthesis of unique polymeric plasticizer structures offering superior performance attributes (e.g., migration resistance). Certification and compliance testing (e.g., FDA, USP Class VI, REACH registration) are integrated processes crucial for market access.

The downstream segment involves the distribution and final application of speciality plasticizers. Distribution channels are typically a mix of direct sales to large PVC compounders and specialty chemical distributors who manage inventories and technical support for smaller customers in fragmented end-use markets (e.g., construction materials, small electronics). Direct technical support is often necessary because integrating a new specialty plasticizer into a PVC formulation requires precise adjustments to the processing conditions (temperature, mixing time). The end-users—automotive component manufacturers, medical device producers, and wire and cable extruders—demand rigorous documentation regarding safety, migration profiles, and long-term durability, making technical collaboration a vital element of the downstream value delivery.

Speciality Plasticizer Market Potential Customers

Potential customers for speciality plasticizers represent industries requiring materials with exceptional durability, low toxicity, and compliance with stringent environmental and health standards, making them premium buyers compared to standard PVC users. The largest customer base is the PVC compounding industry, which purchases these plasticizers in bulk to create specialized compounds tailored for demanding applications such as high-temperature wire insulation, flexible flooring, and exterior roofing membranes. These customers prioritize plasticizers that offer processing ease combined with superior longevity and resistance to extraction or migration, which is essential for warranty and safety guarantees on their final products.

The automotive industry is a rapidly growing customer segment, driven by the increasing complexity of interior components and the strict requirements for low fogging, high heat resistance, and minimized VOC emissions in modern vehicles. Manufacturers of dashboards, synthetic leather upholstery, and under-the-hood cable assemblies are specific potential customers demanding high-performance trimellitates and high-molecular-weight polymeric plasticizers. The shift towards electric vehicles further amplifies this demand, requiring specialized plasticizers for high-voltage cable jacketing that can withstand elevated operating temperatures and provide long-term electrical stability.

Another crucial customer group is the healthcare and medical device manufacturing sector. Companies producing specialized medical tubing, blood bags, intravenous administration sets, and diagnostic devices are highly regulated buyers who primarily source non-phthalate plasticizers like DINCH and specialty citrate esters (e.g., ATBC). Their purchasing criteria are entirely focused on biocompatibility, non-toxicity, and compliance with global pharmacopoeial standards (e.g., USP Class VI). These buyers value long-term supply agreements and audited quality assurance, often paying a premium for certified medical-grade plasticizers to ensure patient safety and avoid regulatory risk.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.5 Billion |

| Market Forecast in 2033 | USD 8.1 Billion |

| Growth Rate | CAGR 5.7% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Eastman Chemical Company, Evonik Industries AG, ExxonMobil Chemical, Lanxess AG, DIC Corporation, Teknor Apex Company, KLJ Group, Formosa Plastics Corporation, Perstorp Holding AB, Velsicol Chemical LLC, Adeka Corporation, Shandong Hongxin Chemical Co., Ltd., Polynt-Reichhold Group, Wanhua Chemical Group Co., Ltd., Mitsubishi Chemical Corporation, Guangdong VTR Bio-Tech Co., Ltd., Dow Inc., UPC Technology Corporation, and Stepan Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Speciality Plasticizer Market Key Technology Landscape

The core technology in the Speciality Plasticizer Market revolves around advanced esterification and transesterification processes, which are continually being refined to achieve higher reaction efficiency, minimize energy use, and maximize the purity of the final specialty ester product. Modern synthesis facilities utilize continuous flow reactors rather than batch processes, allowing for tighter control over reaction parameters such as temperature and pressure, which is crucial for manufacturing complex, high-molecular-weight plasticizers like trimellitates and polymeric adipates. A major technological focus is the development of non-metallic or heterogeneous catalysts that facilitate cleaner reactions, reducing the need for extensive downstream purification and aligning with sustainability goals by minimizing waste streams and facilitating the creation of extremely low-odor products essential for automotive applications.

A significant technological shift is the intensive focus on developing viable, scalable processes for bio-based plasticizers. This involves the enzymatic transesterification of natural oils (like soybean, castor, or palm oil) to produce specialty esters, overcoming the limitations associated with traditional chemical routes which often require harsh conditions and yield lower purities. Key technological challenges being addressed include improving the shelf stability of these bio-derived plasticizers and tuning their performance characteristics (especially compatibility and migration resistance) to match or exceed those of established petrochemical alternatives. Researchers are increasingly applying high-throughput screening technologies, often coupled with AI, to rapidly test and optimize these novel bio-derived formulations, accelerating the time-to-market for sustainable solutions.

Furthermore, technology related to analytical chemistry plays a critical role in the specialty plasticizer segment. Sophisticated testing methods, including Gas Chromatography-Mass Spectrometry (GC-MS) and Differential Scanning Calorimetry (DSC), are indispensable for verifying low volatility, absence of restricted substances, and ensuring batch-to-batch consistency. For compliance, specialized analytical techniques are being developed to measure extremely low levels of migration in sensitive matrices, such as food simulants or human blood, providing the necessary assurance for medical and food-contact applications. Innovation in compounding technology also matters, with manufacturers developing specialized twin-screw extruders that can efficiently incorporate higher-viscosity polymeric plasticizers without degrading the polymer or the additive, enhancing the final product performance.

Regional Highlights

Regional dynamics in the Speciality Plasticizer Market are highly differentiated by regulatory enforcement and infrastructural development pace. Asia Pacific (APAC) dominates the market both in terms of consumption volume and growth rate, propelled by rapid urbanization, massive government investment in infrastructure (roads, housing, electrical grids), and the relocation of global manufacturing facilities to countries like China, India, and Southeast Asia. While the use of specialty plasticizers (like DOTP) is expanding rapidly across these regions due to local regulatory adoption and pressure from global export markets, some sub-regions still utilize older chemistries, presenting a significant future conversion opportunity. APAC manufacturers are increasingly focused on scalable, cost-effective non-phthalate solutions to meet growing domestic and international demand, particularly in the construction and electronics sectors.

Europe and North America represent mature markets characterized by strict regulatory oversight, acting as the primary catalysts for the adoption of premium, high-performance, and sustainable speciality plasticizers. Europe, particularly under the purview of REACH regulations, exhibits the highest penetration of non-phthalate options like DINCH and bio-based esters, especially in highly sensitive consumer product segments, medical devices, and automotive interiors where low VOC emissions are critical. North America mirrors this trend, with state-level mandates (e.g., California’s regulations) often accelerating the adoption of specialty plasticizers in children’s products and packaging. Manufacturers in these regions prioritize innovation, focusing on polymeric and trimellitate plasticizers that guarantee compliance and provide superior technical longevity in challenging applications.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging markets, displaying substantial growth potential tied to ongoing infrastructure and industrial projects. The MEA region, fueled by construction boom and localized manufacturing initiatives, shows rising demand for durable plasticizers for cable sheathing and pipe applications, favoring cost-effective specialty esters. LATAM markets are undergoing a slower but steady transition toward non-phthalate alternatives, often influenced by the regulatory frameworks of trading partners (US and EU). Market growth in these regions is expected to accelerate as local regulatory bodies standardize chemical safety protocols and as global companies continue to expand their manufacturing footprint into these geographically strategic areas.

- Asia Pacific (APAC): Highest volume consumption; dominant growth driver fueled by construction, automotive expansion, and increasing adoption of DOTP and high-grade PVC compounds.

- Europe: Regulatory leader; highest penetration of DINCH and bio-based plasticizers driven by stringent REACH and environmental standards, particularly in medical and luxury automotive sectors.

- North America: Strong demand for low-VOC and compliant solutions in automotive and healthcare; rapid shift away from traditional chemistries due to consumer pressure and state-level legislation.

- Latin America (LATAM): Emerging market with increasing industrialization; demand concentrated in construction and consumer goods, gradually moving toward non-phthalates.

- Middle East and Africa (MEA): Growth tied to mega-construction projects and oil & gas infrastructure; increasing need for heat-resistant specialty plasticizers for extreme climate conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Speciality Plasticizer Market.- BASF SE

- Eastman Chemical Company

- Evonik Industries AG

- ExxonMobil Chemical

- Lanxess AG

- DIC Corporation

- Teknor Apex Company

- KLJ Group

- Formosa Plastics Corporation

- Perstorp Holding AB

- Velsicol Chemical LLC

- Adeka Corporation

- Shandong Hongxin Chemical Co., Ltd.

- Polynt-Reichhold Group

- Wanhua Chemical Group Co., Ltd.

- Mitsubishi Chemical Corporation

- Dow Inc.

- UPC Technology Corporation

- Stepan Company

- Guangdong VTR Bio-Tech Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Speciality Plasticizer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for speciality plasticizers?

The central driver is the global regulatory shift mandating the phase-out or restriction of traditional ortho-phthalates in sensitive applications, compelling industries like medical, automotive, and consumer goods to adopt high-performance, compliant alternatives such as DOTP, DINCH, and bio-based esters.

How do bio-based plasticizers compare technically to petrochemical-derived specialty plasticizers?

Bio-based plasticizers, derived from natural sources like castor or soybean oil, offer excellent environmental profiles and low toxicity. While initial grades sometimes face challenges in achieving the same high-temperature performance or low migration rates as polymeric or trimellitate petrochemical grades, ongoing R&D is rapidly closing this performance gap, making them increasingly viable in applications like flexible packaging and certain consumer goods.

Which application segment consumes the largest volume of high-grade speciality plasticizers?

The Wire and Cable sector is a major consumer, demanding plasticizers with superior thermal stability, low volatility, and effective flame retardancy (often trimellitates or phosphate esters) for cable jacketing and insulation, especially in infrastructure and the rapidly expanding electric vehicle (EV) market.

What are the key technical challenges facing manufacturers of speciality plasticizers?

Key challenges include managing the high production cost and complex synthesis required for high-purity esters, mitigating the price volatility of petrochemical or agricultural feedstocks, and achieving consistency in migration resistance and long-term durability demanded by automotive and medical regulatory standards.

Which region is expected to demonstrate the fastest growth rate in the speciality plasticizer market?

Asia Pacific (APAC) is projected to exhibit the fastest growth, primarily due to large-scale infrastructure investments, burgeoning automotive manufacturing, and the accelerating adoption of non-phthalate plasticizers like DOTP to meet domestic quality requirements and international export compliance standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager