Specialized Formula Medical Nutrition Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434351 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Specialized Formula Medical Nutrition Market Size

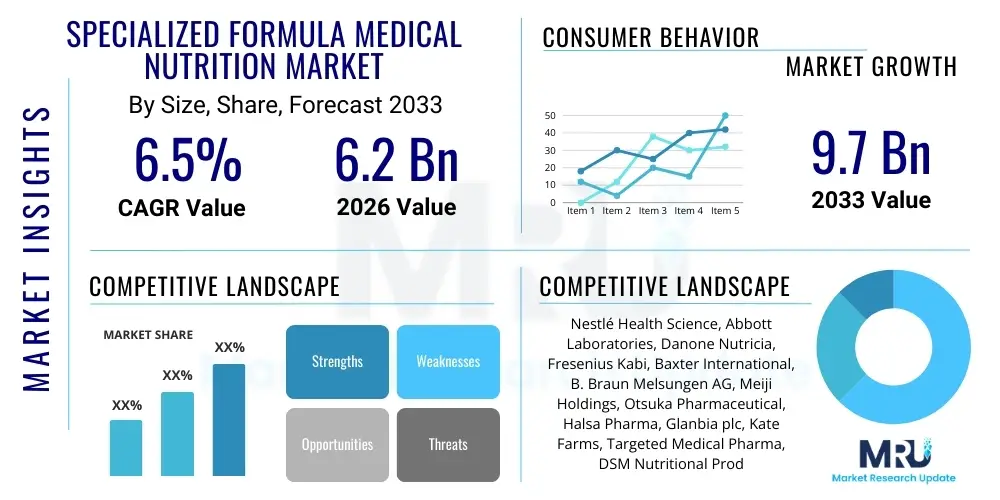

The Specialized Formula Medical Nutrition Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 6.2 Billion in 2026 and is projected to reach USD 9.7 Billion by the end of the forecast period in 2033.

Specialized Formula Medical Nutrition Market introduction

The Specialized Formula Medical Nutrition Market encompasses nutritional products designed to meet the unique dietary requirements of patients suffering from specific diseases, medical conditions, or metabolic disorders. These formulas, which include oral nutritional supplements (ONS), tube feeds (enteral nutrition), and parenteral nutrition solutions, are meticulously formulated to manage conditions such as diabetes, renal failure, liver disease, metabolic disorders, and various types of cancer. Unlike general dietary supplements, specialized medical nutrition is intended for use under medical supervision and plays a critical role in clinical care, aiding in recovery, preventing malnutrition, and managing disease progression, particularly in vulnerable populations like the critically ill, the elderly, and infants with specialized needs. The growing prevalence of chronic diseases globally and the increasing acceptance of nutritional therapy as an integral component of patient management strategies are the primary accelerators for this sophisticated market segment.

Product descriptions within this market vary widely based on targeted pathology. For instance, specialized formulas for renal patients restrict electrolytes and protein to manage kidney stress, while diabetic formulas are designed with lower glycemic index carbohydrates. Major applications span oncology, where nutrition is vital for mitigating cachexia and supporting therapy tolerance; gastroenterology, addressing malabsorption issues like Crohn’s disease; and critical care settings, providing complete nutrition to unconscious or mechanically ventilated patients. The key benefits include enhanced clinical outcomes, reduced hospital stays, improved quality of life, and cost-effectiveness in overall healthcare expenditure by preventing complications related to poor nutritional status. The precision and clinical efficacy of these formulas distinguish them from standard dietary products, necessitating rigorous clinical testing and regulatory oversight.

Driving factors propelling market expansion include significant advancements in nutritional science, allowing for the creation of highly targeted and palatable formulas, alongside the demographic shift toward an aging global population, which correlates strongly with an increased incidence of chronic degenerative diseases requiring long-term nutritional support. Furthermore, rising awareness among healthcare professionals regarding the crucial role of nutrition in holistic patient care, coupled with favorable reimbursement policies in developed economies, supports the prescription and uptake of these specialized products. Innovation in delivery systems, such as ready-to-use liquid formulations and specialized pump technologies for enteral feeding, enhances convenience and patient compliance, further stimulating market growth.

Specialized Formula Medical Nutrition Market Executive Summary

The Specialized Formula Medical Nutrition Market is characterized by robust growth, driven primarily by the escalating global burden of chronic illnesses, advancements in personalized nutrition, and increasing geriatric demographics. Business trends point towards a consolidation phase, with major pharmaceutical and food science conglomerates heavily investing in research and development to create novel, disease-specific formulas, particularly those addressing metabolic syndromes and critical care malnutrition. Strategic partnerships between nutrition companies and specialized clinics or home healthcare providers are becoming common to improve product accessibility and adherence. Key technological innovations center around microencapsulation techniques to improve taste and stability, and the development of formulas supporting the gut microbiome crucial for immune function and disease management. The shift towards preventative health and outpatient care is expanding the scope of medical nutrition beyond traditional hospital settings, emphasizing the homecare segment.

Regionally, North America and Europe currently dominate the market due to established healthcare infrastructure, high awareness levels, and supportive reimbursement frameworks. However, the Asia Pacific (APAC) region is projected to exhibit the highest CAGR during the forecast period. This accelerated growth in APAC is attributed to rapidly improving healthcare accessibility, a vast patient pool, and rising disposable incomes allowing greater spending on premium clinical nutritional products. Governments in emerging economies are also starting to recognize and integrate nutritional support into national health guidelines, further fostering regional market maturity. Latin America and the Middle East and Africa (MEA) represent nascent but promising markets, fueled by urbanization and increasing incidence of lifestyle-related chronic diseases, though constrained somewhat by variable regulatory landscapes and limited healthcare spending.

Segmentation trends highlight the increasing importance of specialized metabolic formulas designed for rare genetic disorders and highly complex conditions, alongside strong demand for oncology-specific nutrition due to the intensity and systemic effects of cancer treatments. The End-User segment shows a decisive shift from traditional hospital settings towards the Homecare segment, driven by cost containment pressures and patient preference for receiving care in a comfortable environment. Within product types, Oral Nutritional Supplements (ONS) remain the most accessible and widely used category, especially for rehabilitation and general malnutrition management, while technological advancements are enhancing the safety and efficacy of Enteral (tube) nutrition, making it a reliable choice for long-term feeding needs.

AI Impact Analysis on Specialized Formula Medical Nutrition Market

Common user questions regarding AI's influence in the Specialized Formula Medical Nutrition Market typically revolve around personalized nutrition algorithm accuracy, the role of AI in supply chain optimization for highly specialized ingredients, and how machine learning can accelerate the development of novel formulas targeting specific genetic or metabolic pathways. Users are keen to understand if AI can accurately predict nutritional requirements based on real-time patient biometric data, thereby moving beyond standard protocols. Furthermore, there is significant interest in how AI can be leveraged to analyze vast clinical trial data to validate efficacy claims and identify optimal therapeutic nutritional interventions faster than traditional methods, ultimately enhancing product specificity and clinical relevance while reducing development time and cost.

The integration of Artificial Intelligence and Machine Learning (ML) is fundamentally transforming the approach to medical nutrition, transitioning it from standardized prescriptions to precision therapy. AI algorithms are being deployed to analyze comprehensive patient data—including genetic profiles, microbiome composition, disease severity, and treatment regimens—to calculate highly individualized macronutrient and micronutrient requirements. This level of personalization ensures maximum therapeutic benefit, minimizing the risk of nutritional deficits or complications. For formula manufacturers, AI is crucial in optimizing complex ingredient matrices, ensuring stability, bioavailability, and targeted delivery of nutrients specific to a patient's pathology, such as inflammation management in IBD or muscle preservation in cancer cachexia. This capability accelerates the innovation pipeline and enhances the efficacy of specialized formulas.

- AI-driven personalization of nutritional formulas based on genomics and metabolomics data.

- Machine Learning optimization of supply chain logistics for highly perishable and rare specialized ingredients.

- Predictive analytics for identifying patient groups at high risk of malnutrition requiring specialized intervention.

- AI-assisted formulation design, simulating nutrient interactions and stability profiles.

- Improved clinical decision support systems for healthcare providers recommending appropriate specialized formulas.

DRO & Impact Forces Of Specialized Formula Medical Nutrition Market

The Specialized Formula Medical Nutrition Market is primarily driven by the rising global prevalence of chronic diseases, particularly diabetes, cardiovascular diseases, and cancer, which necessitate specific dietary interventions for optimal disease management. The growing aging population globally serves as a foundational driver, as geriatric patients often experience co-morbidities and difficulty meeting nutritional needs through conventional means. Technological advancements in product formulation, focusing on improved taste, texture, and bioavailability, enhance patient adherence and quality of life. Conversely, market growth is restrained by stringent regulatory approval processes, particularly in novel therapeutic areas, which increase time-to-market and development costs. Lack of standardization in reimbursement policies across different geographies, especially in emerging markets, limits accessibility for large patient segments. Opportunities are significant in the development of microbiome-targeted formulas, expanding into personalized therapeutic nutrition, and penetrating underserved markets in APAC and Latin America, where healthcare systems are rapidly modernizing. These forces collectively shape the competitive landscape and strategic direction of the market, dictating investment priorities in R&D and geographic expansion strategies.

The primary drivers are structurally linked to global health trends. The increasing sophistication of medical treatments, such as advanced chemotherapy or organ transplants, demands highly precise nutritional support to manage side effects and improve recovery outcomes. Furthermore, extensive research validating the clinical and economic benefits of nutritional intervention, proving that specialized formulas reduce hospital readmissions and overall healthcare costs, encourages broader adoption by health systems. This evidence base is crucial for overcoming initial skepticism regarding the necessity of medical nutrition versus standard dietary advice. Supporting this trend is the professionalization of dietetics and clinical nutrition, with healthcare guidelines increasingly integrating specialized formulas into standard care pathways for numerous conditions, thus institutionalizing demand.

Restraints are often operational and economic. High product costs, especially for formulas designed for rare metabolic disorders, can create significant access barriers if not adequately covered by insurance. Furthermore, the perceived complexity of administering enteral or parenteral nutrition, particularly in the home setting, requires specialized training and robust support services, which are not universally available. A key ongoing challenge is product shelf-life and stability, requiring sophisticated packaging and cold chain management for certain sensitive ingredients, particularly in biologically active formulas. The primary impact forces influencing future market trajectory are the regulatory push for clearer labeling and ingredient transparency, and the pressure from cost-conscious payers to demonstrate measurable health outcomes justifying the premium pricing of highly specialized nutritional products.

Segmentation Analysis

The Specialized Formula Medical Nutrition Market is comprehensively segmented based on product type, application, and end-user, reflecting the diverse clinical needs and varied commercial landscapes. Product segmentation is critical, differentiating standard complete nutrition formulas from highly specialized formulas targeting complex medical conditions like inherited metabolic disorders or specific organ failures (renal, hepatic). Application analysis provides insight into the largest areas of clinical usage, with oncology and gastroenterology dominating due to high prevalence and severe nutritional impact of these diseases. The end-user analysis highlights the evolution of care delivery, tracking the proportional shift between acute care settings (Hospitals) and long-term care environments (Homecare), which significantly influences packaging, volume, and distribution channel requirements for manufacturers.

Detailed evaluation of the product landscape confirms that specialized formulas, particularly those designed for metabolic control (e.g., specific amino acid restrictions or additions), are the fastest-growing sub-segment, driven by increased screening and diagnosis of rare diseases. However, the sheer volume of patients receiving nutrition for chronic conditions like diabetes and renal disease ensures these established categories maintain the largest market share. From an application perspective, the rising global incidence and complexity of cancer treatments necessitate continual innovation in oncology nutrition, focusing on anti-inflammatory and immune-modulating properties to combat cachexia, making it a high-value sector for R&D investment. Furthermore, the burgeoning field of geriatric care demands specialized formulas focusing on preventing sarcopenia and bone health maintenance.

- By Product Type

- Standard Formulas (Polymeric, Oligomeric)

- Specialized Formulas

- Diabetic Nutrition

- Renal Nutrition

- Hepatic Nutrition

- Oncology Nutrition

- Gastrointestinal Nutrition

- Neurological Nutrition (e.g., Alzheimer's, Epilepsy)

- Metabolic Disorder Nutrition (e.g., PKU, MSUD)

- Critical Care Formulas

- Parenteral Nutrition (Total Parenteral Nutrition - TPN)

- By Application

- Oncology

- Gastroenterology

- Nephrology and Urology

- Metabolic Disorders

- Pediatrics and Neonatology

- Geriatrics

- Critical Care and Surgery

- By End-User

- Hospitals and Clinics

- Homecare Settings

- Long-Term Care Facilities and Nursing Homes

Value Chain Analysis For Specialized Formula Medical Nutrition Market

The value chain for Specialized Formula Medical Nutrition is highly complex, beginning with upstream activities focused on sourcing high-quality, often pharmaceutical-grade raw materials and specialized nutritional compounds, such as specific amino acid profiles, complex carbohydrate matrices, and essential fatty acids (e.g., Omega-3s). This stage involves stringent quality control, verification of ingredient traceability, and managing partnerships with specialized raw material suppliers who meet certified standards for clinical use. Manufacturing is the central stage, requiring specialized equipment for blending, sterilization, and aseptic filling, often governed by strict regulatory frameworks (e.g., FDA, EMA) specific to clinical products. Innovation at this stage focuses on enhancing palatability, extending shelf life, and ensuring nutrient stability under various storage conditions. Research and Development plays a continuous upstream role, generating clinical evidence needed for product launch and gaining regulatory approval.

Downstream activities focus heavily on distribution and clinical prescription. Due to the nature of medical nutrition, the primary distribution channel is highly regulated, often involving specialty pharmacies, hospital supply chains, and dedicated home care providers who manage complex patient feeding requirements (e.g., pump rentals, nursing support). Direct distribution to hospitals and clinics is common for high-volume products used in acute care, ensuring immediate availability. The indirect channel utilizes wholesalers and distributors, particularly for lower-volume specialized retail products (e.g., OTC nutritional shakes recommended by physicians). Effective distribution must navigate complex logistics, ensuring temperature control for certain products and timely delivery to critically ill patients in the home setting, distinguishing it significantly from conventional food or supplement distribution networks.

The critical element of the value chain is the prescriptive relationship. Sales and marketing efforts are clinically focused, targeting healthcare professionals (HCPs)—physicians, dietitians, and clinical pharmacists—rather than the general consumer. Education and clinical trial dissemination are paramount to drive demand. Customer interaction, post-sale, is often managed by specialized patient support programs provided by the manufacturers or their distribution partners, ensuring proper usage, compliance monitoring, and handling of complex feeding protocols. Profit margins are generally higher for highly specialized, patented formulas (like those for metabolic disorders) compared to generic standard polymeric feeds, reflecting the higher R&D investment and complexity involved in their production and clinical substantiation.

Specialized Formula Medical Nutrition Market Potential Customers

The primary end-users and buyers of specialized formula medical nutrition are institutional healthcare providers, long-term care facilities, and individual patients utilizing homecare services. Hospitals, including acute care centers, specialized oncology units, and intensive care units (ICUs), are foundational customers, purchasing large volumes of enteral feeds and total parenteral nutrition (TPN) solutions for critical and surgical patients. Clinical decision-makers within these institutions, primarily hospital procurement officers, clinical dietitians, and multidisciplinary nutrition support teams, drive bulk purchases based on formulary inclusion, cost-effectiveness analyses, and established clinical guidelines. The critical care segment represents a high-priority customer base due to the immediate life-saving necessity of timely and appropriate nutritional support.

A rapidly expanding segment consists of homecare patients and their families, often managed through specialized home healthcare agencies or durable medical equipment (DME) providers. These customers typically require specialized formulas for chronic, long-term conditions such as neurological disorders (difficulty swallowing), chronic kidney disease, or recovery from extensive surgery, where continuous nutritional support is required outside the hospital. For this segment, convenience, ease of use, palatability, and availability through local or online specialty pharmacies are paramount purchasing considerations. Reimbursement coverage, managed typically by private insurers or government programs, dictates product choice and access for these individual buyers.

Additionally, specialized clinics, such as dialysis centers, cancer outpatient facilities, and pediatric clinics focused on inherited metabolic disorders, represent highly concentrated customer segments. These clinics serve patients with highly niche nutritional needs that require precision formulas (e.g., low-protein meals, specific vitamin/mineral blends). Clinical dietitians in these specialized settings act as influential customers, determining which manufacturers’ products are best suited for their patient population based on clinical efficacy, compliance rates, and formulation purity. This group often demands customized solutions and strong clinical support from manufacturers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.2 Billion |

| Market Forecast in 2033 | USD 9.7 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nestlé Health Science, Abbott Laboratories, Danone Nutricia, Fresenius Kabi, Baxter International, B. Braun Melsungen AG, Meiji Holdings, Otsuka Pharmaceutical, Halsa Pharma, Glanbia plc, Kate Farms, Targeted Medical Pharma, DSM Nutritional Products, Pfizer Inc., Ajinomoto Co., Ltd., Nutrinovo, Victus, Medifood International, Sandoz (Novartis), and Sichuan Tongsheng Pharmaceutical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Specialized Formula Medical Nutrition Market Key Technology Landscape

The technological landscape of specialized medical nutrition is rapidly evolving, driven by the need for enhanced efficacy, bioavailability, and patient compliance. A core focus area involves lipid technology, particularly the use of structured lipids, medium-chain triglycerides (MCTs), and highly purified essential fatty acids (e.g., DHA/EPA) derived from specialized sources. These technologies optimize fat absorption in patients with compromised gastrointestinal function, common in critical illness or certain cancers. Furthermore, advanced processing technologies, such as microencapsulation, are used to mask the unpleasant tastes associated with specific nutrients (like high-protein components or certain vitamins) without compromising their clinical effectiveness. This significantly improves palatability, which is a major factor in patient adherence, especially for long-term oral nutritional supplements.

Another crucial technological frontier is the integration of ingredients specifically targeting the gut microbiome. Research has validated the critical link between gut health and systemic disease management (e.g., immunity, neurological function). This has spurred the development of specialized formulas incorporating prebiotics, postbiotics, and specific strains of probiotics tailored to particular disease states (e.g., reducing C. difficile infection risk in hospitalized patients). The manufacturing complexity associated with maintaining the viability and stability of these biologically active components requires advanced formulation and packaging techniques, often involving multi-compartment containers or specialized aseptic processing lines. Furthermore, the development of highly concentrated, low-volume formulas represents a major technical achievement, enabling patients with fluid restrictions (like those with renal or cardiac failure) to receive full caloric and nutritional support without excess liquid intake.

In the delivery system domain, technological advancements are centered on improving the safety and usability of enteral feeding devices and parenteral solutions. This includes the widespread adoption of ENFit connectors to prevent misconnections between feeding tubes and IV lines, a significant patient safety improvement. For parenteral nutrition, innovation focuses on developing stable, all-in-one admixtures (TNA/AIO) that are ready-to-use, minimizing compounding errors and contamination risk in the clinical setting. Future technologies, heavily influenced by AI, are moving towards point-of-care diagnostics and integration with smart medical devices, allowing real-time adjustments to feeding rates or formula composition based on continuous patient monitoring of biomarkers, ushering in an era of true physiological responsiveness in medical nutrition.

Regional Highlights

- North America: This region holds a dominant market share, primarily due to sophisticated healthcare infrastructure, high awareness regarding disease-related malnutrition, and robust reimbursement policies, particularly in the United States and Canada. The region benefits from high R&D investment by key market players, focusing on highly specialized formulas for metabolic disorders and critical care. The shift towards outpatient and home-based care strongly drives the demand for specialized oral and tube feeding products in the long-term care segment.

- Europe: Characterized by established clinical nutrition societies and supportive government guidelines (e.g., ESPEN), Europe is a mature market. Strong demand comes from geriatric care facilities and hospitals managing high rates of cancer and chronic cardiovascular disease. Germany, France, and the UK are key contributors, emphasizing regulatory compliance (EFSA standards) and continuous clinical validation. There is a strong focus on formulas that improve patient outcomes in malnutrition screening programs.

- Asia Pacific (APAC): APAC is the fastest-growing market, propelled by rapid urbanization, expanding middle class, and improving healthcare access in countries like China, India, and Japan. The immense patient pool suffering from diabetes and chronic kidney disease fuels demand for specialized products. While hospital-based care is significant, the rapid expansion of homecare services, driven by cost pressures and technology adoption, presents major growth avenues for multinational and local manufacturers alike.

- Latin America (LATAM): Growth in LATAM is gradual but accelerating, driven by increasing awareness and healthcare reforms in Brazil and Mexico. The market is often constrained by fragmented distribution and variable regulatory environments. Opportunities exist primarily in addressing pediatric malnutrition and nutritional support post-surgery, though affordability remains a significant factor influencing product adoption.

- Middle East and Africa (MEA): MEA represents a developing market, with significant investment concentrated in affluent Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia). Demand is fueled by high prevalence of lifestyle diseases (diabetes) and advanced medical tourism sectors requiring high-quality clinical nutrition products. African markets face challenges related to infrastructure and high import costs, limiting specialized formula penetration primarily to major urban hospitals.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Specialized Formula Medical Nutrition Market.- Nestlé Health Science

- Abbott Laboratories

- Danone Nutricia

- Fresenius Kabi

- Baxter International

- B. Braun Melsungen AG

- Meiji Holdings

- Otsuka Pharmaceutical

- Halsa Pharma

- Glanbia plc

- Kate Farms

- Targeted Medical Pharma

- DSM Nutritional Products

- Pfizer Inc.

- Ajinomoto Co., Ltd.

- Nutrinovo

- Victus

- Medifood International

- Sandoz (Novartis)

- Sichuan Tongsheng Pharmaceutical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Specialized Formula Medical Nutrition market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between specialized medical nutrition and standard dietary supplements?

Specialized medical nutrition is formulated specifically for managing disease-related malnutrition or metabolic disorders under medical supervision. Unlike standard supplements, these products are rigorously clinically tested, often contain precise, altered ratios of macronutrients (e.g., high protein for oncology or restricted electrolytes for renal failure), and are classified as medical foods or specific clinical feeds intended for therapeutic use, requiring a physician's prescription or recommendation.

Which disease applications drive the highest demand within the Specialized Formula Medical Nutrition Market?

Oncology (cancer care) and Gastroenterology (conditions like Crohn's, colitis, and malabsorption syndromes) currently represent the largest application segments. Oncology nutrition is vital for managing cachexia and supporting therapy tolerance, while GI formulas address nutrient absorption and intestinal recovery. Demand is also rapidly accelerating in Nephrology (renal nutrition) due to the rising global prevalence of chronic kidney disease.

How significant is the shift towards homecare settings for specialized medical nutrition delivery?

The shift towards homecare is profoundly significant and represents the fastest-growing end-user segment. Driven by cost efficiencies, improved patient quality of life, and advancements in user-friendly delivery systems, patients are increasingly receiving both oral nutritional supplements and complex enteral feeding at home. This trend requires manufacturers to focus on product stability, simplified administration protocols, and robust logistical support for specialized home delivery.

What impact does AI and personalized nutrition have on future formula development?

AI is crucial for the next generation of specialized formulas, enabling precision nutrition. AI algorithms analyze individual patient data, including genomics and clinical biomarkers, to predict precise nutritional requirements. This leads to the development of highly customized therapeutic formulas that maximize clinical efficacy and minimize adverse effects, moving the market away from standardized solutions toward highly targeted, individualized medical interventions.

What are the main regulatory challenges faced by specialized formula manufacturers?

Manufacturers face challenges related to stringent regulatory classifications, varying across regions (e.g., Medical Food vs. Prescription Product). Demonstrating efficacy often requires extensive, costly clinical trials specifically validating the nutritional intervention's effect on disease endpoints. Furthermore, ensuring global compliance regarding complex labeling requirements and ingredient traceability for highly specialized, pharmaceutical-grade components adds significant operational complexity and cost.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager