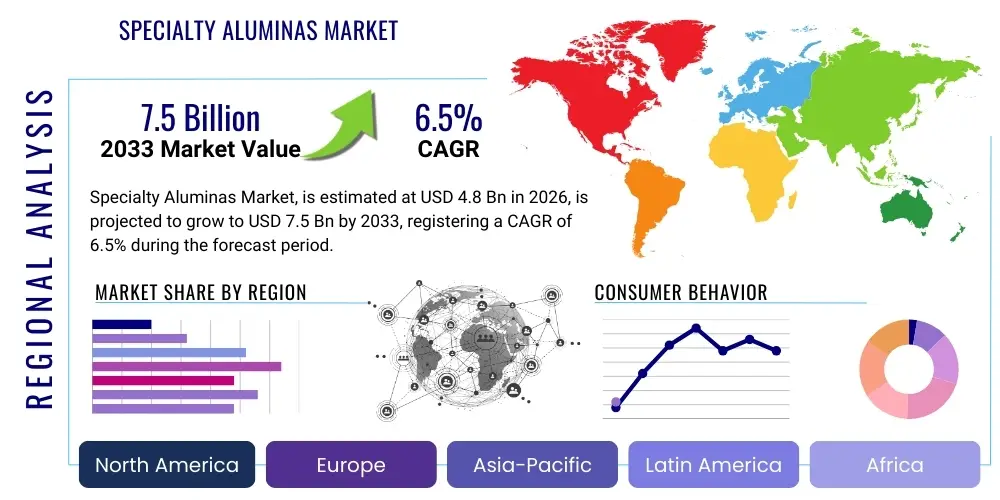

Specialty Aluminas Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438093 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Specialty Aluminas Market Size

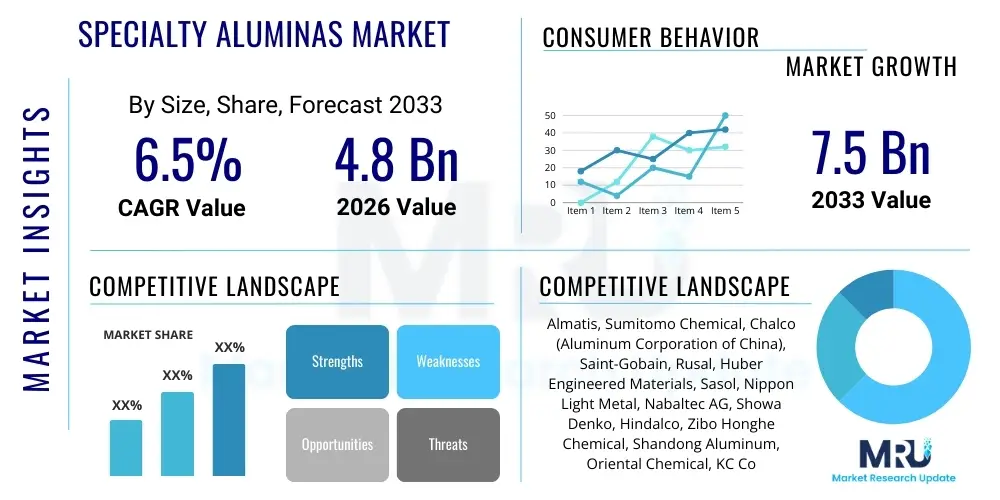

The Specialty Aluminas Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033.

Specialty Aluminas Market introduction

Specialty aluminas represent a refined class of aluminum oxide (Al2O3) products characterized by high purity, controlled particle size distribution, specific crystal phases (such as alpha, gamma, theta, and chi), and tailored surface chemistries. Unlike commodity-grade alumina used primarily in aluminum smelting, specialty aluminas are critical performance materials engineered to impart superior mechanical, thermal, electrical, and catalytic properties across diverse high-tech industries. These products are synthesized through specialized processes, often involving the modification of the traditional Bayer process or utilizing alternative methods like sol-gel and precipitation, ensuring consistency and precision required for advanced applications. The defining characteristic of specialty aluminas is their functional specialization, enabling improved performance in end-products where standard materials fail to meet stringent requirements.

The primary applications of specialty aluminas span refractories, where high thermal stability and corrosion resistance are essential for furnace linings; advanced ceramics, utilizing their hardness and dielectric properties in automotive parts and industrial tools; and catalytic supports, leveraging their high surface area and chemical inertness in petrochemical and environmental control processes. Furthermore, the electronics sector demands high-purity grades for substrates, thermal management materials, and polishing slurries critical for semiconductor manufacturing. Specialty aluminas are fundamental enablers of technological progress, allowing industries to achieve greater operational efficiencies, higher durability, and miniaturization of electronic components. The inherent benefits include exceptional hardness, high melting point (above 2000°C), superior dielectric strength, and chemical resistance, positioning them as irreplaceable components in severe operating environments.

The market expansion is principally driven by the relentless pace of industrialization in emerging economies, particularly in Asia Pacific, coupled with global trends toward energy efficiency and technological sophistication. Growing demand for lightweight and high-performance components in the automotive industry, catalyzed by the shift towards electric vehicles (EVs), significantly boosts the need for specialty ceramic materials. Concurrently, the proliferation of 5G infrastructure, advanced consumer electronics, and increased global refining capacity necessitate customized alumina products for high-frequency circuits and complex catalytic reactions. The imperative for higher efficiency and reliability in industrial processes, such as increased operating temperatures in refractory applications and stringent emissions controls demanding sophisticated catalysts, acts as a continuous and robust driving force for sustained market growth across all specialty alumina segments.

Specialty Aluminas Market Executive Summary

The Specialty Aluminas Market landscape is defined by intense competition focused on product differentiation, strategic vertical integration, and aggressive capacity expansion, predominantly driven by established chemical and material science giants. Key business trends involve significant investments in research and development aimed at developing nano-structured aluminas and ultra-high-purity grades (e.g., 5N purity or higher) crucial for microelectronics and advanced lithium-ion battery separators. Market players are strategically acquiring smaller, technologically adept firms to gain access to proprietary synthesis methods and expand their intellectual property portfolio related to particle morphology and surface modification. Furthermore, there is a distinct business shift towards sustainable manufacturing practices, driven by both regulatory pressures and corporate social responsibility goals, leading to the optimization of energy-intensive processes like calcination and a focus on reducing waste streams, thereby creating a competitive edge for environmentally conscious producers.

Regionally, the market exhibits a clear bifurcation: the Asia Pacific (APAC) region, spearheaded by China, Japan, and South Korea, dominates both production capacity and consumption volume, largely due to its concentrated electronics manufacturing base and rapid infrastructure development requiring refractory materials. This region is the epicenter for mass production of specialty grades, often leveraging scale economies to offer competitive pricing. In contrast, North America and Europe, while consuming smaller volumes, remain critical centers for innovation and the demand for premium, ultra-specialized grades used in niche, high-value applications such as aerospace components, high-end medical devices, and advanced catalytic converters. Regulatory frameworks, particularly the European Union’s stringent environmental and chemical standards (e.g., REACH), significantly influence product formulation and manufacturing standards for global players operating within or supplying to these regions, fostering a market trend towards documented and certified high-quality materials.

Segment trends underscore the dynamic nature of specialty alumina utilization. The refractories segment, while historically the largest consumer, experiences moderate but steady growth tied to steel and cement production cycles. However, the fastest expansion is observed within the catalyst and electronics segments. Catalytic aluminas are seeing a surge due to stricter global mandates on vehicle emissions (requiring advanced washcoats) and growth in the production of high-octane fuels. Within electronics, the demand for high-performance dielectric materials, chemical-mechanical planarization (CMP) slurries, and transparent ceramics drives the need for increasingly pure and consistently controlled particulate aluminas, particularly those optimized for thermal dissipation in high-power devices. This high-growth trajectory forces manufacturers to prioritize scalable, high-precision synthesis routes over conventional bulk production methods, further fragmenting the competitive landscape based on technical competence and specialized production capability.

AI Impact Analysis on Specialty Aluminas Market

Common user inquiries concerning the integration of Artificial Intelligence (AI) into the Specialty Aluminas sector frequently revolve around optimization of the energy-intensive production phases, predictive quality control for high-purity grades, and acceleration of materials discovery. Users are highly concerned with how AI can mitigate the high operating costs associated with calcination and grinding processes, which constitute a significant portion of the total cost of ownership. Another major theme is the expectation that AI and machine learning (ML) algorithms can analyze complex synthesis parameters (temperature profiles, mixing speeds, raw material variability) to predict and prevent batch contamination or non-conformance, thereby guaranteeing the ultra-high purity required for semiconductor and electronic applications. Furthermore, there is keen interest in using AI-driven simulation tools to rapidly screen potential novel crystalline structures and surface modifications of alumina for targeted functional performance in emerging applications like advanced battery technology or specialized filtration media, drastically shortening the R&D cycle from years to months.

- AI optimizes energy consumption in high-temperature calcination furnaces by predictive modeling of heat flow and material transition states.

- Machine learning algorithms enhance real-time quality control by analyzing spectroscopic data and particle imaging, ensuring strict morphology and purity standards are met.

- Predictive maintenance schedules for high-wear equipment (grinding mills, classifiers) are established using AI, minimizing unscheduled downtime and improving overall asset utilization.

- AI accelerates new product development by simulating the physical and chemical behavior of novel alumina compositions and surface coatings under extreme operational stress.

- Supply chain management benefits from AI-powered forecasting, optimizing raw material procurement (bauxite or aluminum hydroxide) based on volatile demand signals and reducing inventory holding costs.

- Automated visual inspection systems utilizing computer vision monitor critical process steps, such as spray drying or crystallization, identifying subtle deviations that impact final particle properties.

- Market forecasting models driven by AI improve strategic capacity planning by correlating macroeconomic indicators with specific end-user industry performance (e.g., semiconductor shipment forecasts).

DRO & Impact Forces Of Specialty Aluminas Market

The dynamics of the Specialty Aluminas Market are profoundly influenced by a complex interplay of industrial drivers, stringent regulatory restraints, and expansive technological opportunities. A primary driver is the accelerating global shift towards electric vehicles (EVs) and hybrid vehicles, which mandates lightweighting efforts and demands sophisticated materials for battery components and thermal management systems, where specialty aluminas excel due to their heat dissipation capabilities and electrical isolation. Complementary to this is the massive infrastructure buildout for 5G telecommunications and data centers, which requires high-performance ceramic substrates and encapsulation materials to manage the intense thermal loads generated by advanced processors and high-frequency components. Furthermore, the increasing complexity and efficiency requirements of industrial catalysts, particularly those designed to meet tightening global environmental standards regarding NOx, SOx, and particulate matter emissions from both stationary sources and vehicle exhausts, necessitate the use of tailored, high-surface-area catalytic aluminas, creating sustained demand across various regional markets.

However, the market expansion is significantly constrained by several factors, chief among them being the high energy intensity inherent in specialty alumina production. The processes of calcination and grinding require substantial thermal energy inputs, leading to high operating costs and increased vulnerability to fluctuating global energy prices, which directly impacts profitability margins, especially for lower-grade specialty products. Another critical restraint is the increasingly rigorous environmental regulation pertaining to residue management and greenhouse gas emissions associated with the production processes, particularly the handling of bauxite residue (red mud). Compliance necessitates significant capital investment in advanced filtration and waste treatment technologies. Furthermore, the specialized nature of these materials means that end-users require highly specific grades, leading to reliance on a few dominant suppliers with proprietary production knowledge, which can result in supply chain bottlenecks and price opacity, slowing adoption in price-sensitive applications.

Opportunities for disruptive growth emerge primarily from technological innovation, particularly the development and commercial adoption of nano-aluminas. These ultra-fine particles offer unprecedented surface area to volume ratios and unique quantum effects, enabling breakthroughs in areas like next-generation adsorbents, high-performance battery separators (enhancing safety and efficiency in Li-ion cells), and transparent armor applications. Another major opportunity lies in the circular economy initiatives, focusing on developing cost-effective methods for sourcing specialty alumina precursors from secondary sources, such as industrial waste streams or recycled materials, thereby reducing reliance on primary bauxite mining and enhancing the sustainability profile of the industry. The rapid expansion of additive manufacturing (3D printing) technologies also presents a lucrative niche, as specialty alumina powders with highly spherical and controlled particle morphology are essential feedstock materials for producing complex ceramic parts, opening entirely new avenues for customized, high-precision component manufacturing in aerospace and medical device sectors.

Segmentation Analysis

The Specialty Aluminas Market is comprehensively segmented based on its defining characteristics—Type, Application, and geographic regions, reflecting the functional diversity and end-use specialization of these advanced materials. Segmentation by Type is crucial as it dictates the physical and chemical properties, such as crystal structure and surface area, necessary for specific industrial performance requirements. The major types—Tabular, Calcined, Activated, Fused, and Reactive—each serve distinct purposes, ranging from mechanical reinforcement to chemical adsorption. For instance, Activated Alumina, known for its high porosity, is primarily used in desiccation and catalysis, whereas Tabular Alumina, characterized by its large, dense alpha-alumina crystals, is indispensable in high-end refractory applications requiring superior resistance to thermal shock and creep. Understanding this structural differentiation is key to market strategy, as production processes and cost structures vary significantly across these types, influencing competitive positioning.

Segmentation by Application reveals the underlying demand structure and growth potential driven by megatrends such as sustainable energy and technological miniaturization. The market’s primary applications include Refractories (historically dominant), Ceramics (covering structural, technical, and electronic ceramics), Catalysts (both automotive and industrial), Abrasives (for grinding and polishing), and Adsorbents/Desiccants. The growth profile across these applications is heterogenous; while refractories offer volume stability, segments like Catalysts and Electronics demonstrate superior growth rates due to rapid technological evolution and regulatory mandates, such as the global push for stricter emission controls. This application-based analysis helps stakeholders identify high-growth investment pockets, such as materials for advanced thermal coatings or substrates in 5G devices, providing a focused approach to product portfolio expansion and maximizing return on investment.

- By Type:

- Tabular Alumina (High density, large crystal size, used for high-end refractories)

- Calcined Alumina (Intermediate purity, general-purpose ceramic and abrasive applications)

- Activated Alumina (High surface area, porous structure, primarily for adsorption and catalysis)

- Fused Alumina (Electrically fused, extremely hard, used mainly for abrasives and specialized refractories)

- Reactive Alumina (Ultra-fine particle size, high reactivity, used to lower sintering temperatures in ceramics)

- High-Purity Alumina (HPA) (Purity ≥99.99%, critical for electronics, LED, and battery separators)

- By Application:

- Refractories (Steel, cement, glass industries)

- Ceramics (Advanced technical ceramics, electronic ceramics, structural ceramics)

- Catalysts & Catalyst Supports (Petrochemical processing, automotive emissions control)

- Abrasives (Grinding media, polishing slurries, sandpaper)

- Adsorbents & Desiccants (Gas drying, liquid filtration, air separation)

- Electronics & Electrical (Substrates, thermal interface materials, CMP slurries)

- Others (Fillers, pigments, dental materials)

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of LAMEA)

- Middle East and Africa (MEA)

Value Chain Analysis For Specialty Aluminas Market

The value chain for specialty aluminas begins with the upstream sourcing and processing of raw materials, primarily high-grade bauxite or metallurgical-grade aluminum hydroxide (gibbsite). Upstream analysis reveals that integrated producers often possess captive or long-term contracted bauxite mines, affording them significant cost advantages and control over feedstock quality, which is paramount for producing high-purity grades. The chemical processing phase involves energy-intensive steps such as the modified Bayer process, followed by precipitation, filtration, and highly controlled calcination or fusion, depending on the desired product characteristics (e.g., crystal phase, density, specific surface area). This stage is characterized by high capital expenditure and proprietary technological knowledge, representing the major value-add component, as precise control over these chemical transformations determines the final specialty application suitability of the alumina powder. Non-integrated specialty producers typically rely on purchasing high-purity aluminum hydroxide from large integrated primary producers, leading to higher raw material costs but allowing for greater flexibility in specialized downstream processing.

The intermediate steps involve further processing and surface modification, where bulk specialty alumina powders are often micronized, milled, and classified to achieve specific particle size distributions (PSD), or coated to enhance dispersion or chemical compatibility in the final matrix material. Distribution channels in this specialized market are highly technical and often bypass broad commodity distribution networks. Direct sales predominate, especially for ultra-high-purity grades sold to large original equipment manufacturers (OEMs) in the electronics and aerospace sectors, where technical support and stringent quality assurance documentation are essential prerequisites for supplier selection. Specialized distributors, possessing deep technical knowledge of materials science and application engineering, handle indirect sales, focusing on smaller customers, research institutions, and niche manufacturers, often providing formulation advice and managing localized inventory to meet fluctuating demand for diverse grades and small-batch orders across various geographies.

Downstream analysis centers on the diverse end-user manufacturing processes. For refractories, specialty aluminas are compounded with binders and other materials to form castables or bricks; in ceramics, they are formulated into slurries for molding or pressing; and in catalysis, they are applied as washcoats onto monoliths or utilized as support media for active metals. The profitability downstream is highly sensitive to the consistency and technical specifications of the specialty alumina supplied. A slight variation in particle size or purity can lead to catastrophic failure in high-performance applications like semiconductor polishing or turbine blade coatings. Consequently, the value chain emphasizes rigorous quality testing and strong collaborative relationships between the specialty alumina producer and the end-user, often resulting in co-development agreements to tailor material specifications precisely to evolving application needs, securing long-term contracts and strengthening proprietary knowledge linkages throughout the chain.

Specialty Aluminas Market Potential Customers

The primary customers for specialty aluminas are large industrial manufacturers operating in high-temperature, high-stress, or high-tech environments, where material performance directly correlates with operational efficiency and product reliability. Key end-user segments include manufacturers of advanced refractories, such as those supplying the iron and steel, cement, glass, and non-ferrous metals industries, requiring tabular and fused aluminas to withstand extreme thermal cycling and chemical attack within furnaces and kilns. These buyers prioritize materials that offer superior mechanical strength at elevated temperatures and resistance to creep, focusing on long-term service life to minimize relining frequency and associated downtime costs. Secondly, the rapidly expanding technical and electronic ceramics sector represents a crucial customer base, including producers of ceramic armor, automotive engine components, industrial wear parts, cutting tools, and high-frequency electronic substrates, which demand calcined, reactive, and High-Purity Alumina (HPA) grades for their exceptional hardness, dielectric properties, and fine grain microstructure control during sintering.

Another major segment encompasses the global petrochemical, refining, and automotive sectors, specifically the manufacturers of industrial and automotive catalysts. These customers utilize high-surface-area activated aluminas as support media for expensive noble metals (e.g., platinum, palladium, rhodium) in catalytic converters and large-scale refining reactors. Their purchasing criteria are centered on thermal stability, optimized pore structure, and chemical inertness to maximize the active site availability and longevity of the catalyst, which is critical for meeting stringent environmental regulations and maximizing chemical yields. Furthermore, specialized chemical producers and water treatment facilities are consistent buyers of activated aluminas for desiccation, fluoride removal, and selective adsorption applications, valuing the material's regenerative capacity and selective affinity for moisture and specific chemical contaminants in gas and liquid streams.

The high-purity end of the market targets the advanced electronics and emerging energy storage sectors. Potential customers here include LED manufacturers, lithium-ion battery separators producers, and semiconductor fabricators (fabs). These highly demanding customers require High-Purity Alumina (HPA), often exceeding 99.99% purity (4N) or even 99.999% (5N), as contaminants can severely compromise device performance, efficiency, and lifespan. For instance, in Li-ion batteries, HPA coatings enhance the thermal safety and lifespan of the separator membrane, making material reliability non-negotiable. These customers are highly sensitive to batch-to-batch consistency and require comprehensive material certification and traceability, often forming deep, long-term technical partnerships with a limited number of certified specialty alumina suppliers capable of consistently delivering materials to their exacting specifications in massive volumes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Almatis, Sumitomo Chemical, Chalco (Aluminum Corporation of China), Saint-Gobain, Rusal, Huber Engineered Materials, Sasol, Nippon Light Metal, Nabaltec AG, Showa Denko, Hindalco, Zibo Honghe Chemical, Shandong Aluminum, Oriental Chemical, KC Corporation, Alpha HPA Limited, R&D Alumina, Evonik Industries, Axens, and BASF SE. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Specialty Aluminas Market Key Technology Landscape

The technological landscape of the Specialty Aluminas Market is characterized by continuous process refinement aimed at achieving higher purity, tighter particle size distribution (PSD) control, and novel morphological structures. A cornerstone technology remains the sophisticated modification of the traditional Bayer process, shifting from bulk production to specialized, controlled precipitation and crystallization techniques. Innovations in this area include seeding methods and precise temperature/pH control during the aluminum hydroxide precipitation phase, which determine the crystal structure and size of the precursor material, directly impacting the final specialty alumina characteristics after calcination. Furthermore, advances in high-temperature calcination, particularly flash calcination and rotary kiln optimization, focus on minimizing energy usage while achieving complete phase transformation (e.g., to stable alpha-alumina) at specific temperatures, ensuring consistent density and minimal residual reactivity, crucial for tabular and high-purity grades used in demanding ceramic applications. The ongoing refinement of these foundational chemical engineering processes dictates the cost-effectiveness and scalability of advanced specialty alumina production.

Beyond traditional methods, the industry increasingly leverages advanced synthesis routes such as the Sol-Gel process and chemical vapor deposition (CVD) for producing ultra-fine and nano-sized aluminas. The Sol-Gel method offers unparalleled control over chemical composition and homogeneity, enabling the creation of highly pure, monodisperse powders essential for advanced electronics, catalysts, and transparent ceramics. While Sol-Gel production is often more expensive, its ability to produce materials with superior performance attributes justifies the cost in high-value applications. Concurrent technological advancements focus on surface modification and coating techniques, where specialty aluminas are treated with specific chemical functional groups or thin inorganic coatings (like silica or zirconia) to enhance their dispersion stability, tailor their interaction with polymer matrices, or improve their resistance to specific chemical environments, thereby expanding their functional utility in composite materials and thermal insulation applications, ensuring seamless integration into complex chemical formulations for diverse end-use manufacturing processes.

Finally, the advent of advanced particle processing technologies, including specialized air classification, high-speed jet milling, and precise spray drying, is critical for defining the final product quality. These mechanical techniques are essential for achieving the extremely narrow particle size distributions required for Chemical-Mechanical Planarization (CMP) slurries in semiconductor manufacturing and for ensuring optimal packing density in refractory castables, which directly affects the final material integrity and wear resistance. The future technological trajectory is heavily invested in digital manufacturing and AI-driven process control, where sensors and ML models monitor crystallization and sintering processes in real-time, adjusting parameters dynamically to correct for minor variations in raw materials or ambient conditions. This integration of Industry 4.0 principles ensures the ultra-consistency and traceability required for 5N-purity materials, establishing a new technological barrier to entry for prospective competitors and maintaining the competitive advantage of technologically advanced established market leaders in the highly sensitive specialty alumina sphere.

Regional Highlights

- Asia Pacific (APAC): APAC stands as the undisputed leader in both consumption and production of specialty aluminas, driven primarily by robust industrial growth, massive infrastructure projects, and the region's dominance in global electronics, battery, and automotive manufacturing. China, in particular, is a powerhouse, focusing heavily on expanding domestic HPA production capacity to reduce reliance on imports for its rapidly growing LED and display industries. South Korea and Japan remain pivotal markets for high-end, specialized grades used in advanced catalytic converters and sophisticated electronic components, emphasizing research and quality control. The high volume consumption across refractories (due to substantial steel and cement output) and technical ceramics ensures that APAC will maintain the highest CAGR throughout the forecast period, leveraging its cost advantages and economies of scale.

- North America: This region is characterized by high demand for premium, performance-driven specialty aluminas, particularly in the aerospace, defense, medical, and advanced catalyst sectors. While production volumes are lower than in APAC, the average selling price (ASP) of specialty aluminas is often higher due to the stringent purity requirements (e.g., 5N HPA) and specialized application standards (e.g., FDA approval for medical grades). The transition to electric vehicles and the resultant demand for high-safety battery components and advanced thermal management materials are key drivers. Investment is heavily focused on R&D for next-generation materials and sustainable production technologies, often prioritizing proprietary solutions for high-security or complex industrial applications.

- Europe: The European market is mature and highly regulated, with a strong focus on sustainability and compliance (e.g., REACH regulations). Demand is stable in traditional refractory and ceramic sectors (notably in Germany and Italy), but growth is most prominent in environmental technology, including advanced catalyst manufacturing for strict Euro emissions standards, and specialized technical ceramics for industrial machinery. European manufacturers often lead in developing innovative, low-carbon production methods and specialized chemical formulations. The region excels in niche markets requiring precision engineering, such as medical implants and complex filtration systems, which drive demand for ultra-high quality, traceable specialty alumina products.

- Latin America (LAMEA): The LAMEA market is smaller but experiencing moderate growth linked primarily to mineral processing, energy infrastructure development, and automotive manufacturing in countries like Brazil and Mexico. Demand is concentrated in general-purpose refractories and catalytic applications related to refining. Market penetration of advanced specialty grades remains lower compared to developed regions, but modernization efforts in industrial sectors are slowly increasing the requirements for higher-performance aluminas, presenting a developing opportunity for global suppliers to introduce premium products and advanced technical support.

- Middle East and Africa (MEA): Growth in MEA is strongly tied to major petrochemical refining and aluminum smelting activities. Large-scale catalytic refining operations drive significant demand for activated and catalyst support aluminas. Infrastructure development necessitates specialized refractory materials. The region often imports most advanced specialty grades, offering growth potential for suppliers capable of establishing reliable logistics and technical service networks to cater to the region's large-scale energy and industrial operations, with particular emphasis on products that can handle high-sulfur or unconventional crude oil processing requirements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Specialty Aluminas Market.- Almatis GmbH

- Sumitomo Chemical Co., Ltd.

- Aluminum Corporation of China Limited (Chalco)

- Saint-Gobain S.A.

- UC Rusal

- Huber Engineered Materials

- Sasol Limited

- Nippon Light Metal Holdings Co., Ltd.

- Nabaltec AG

- Showa Denko K.K.

- Hindalco Industries Limited

- Zibo Honghe Chemical Co., Ltd.

- Shandong Aluminum Company Limited

- Oriental Chemical (Sichuan) Co., Ltd.

- KC Corporation

- Alpha HPA Limited

- R&D Alumina Products, Inc.

- Evonik Industries AG

- Axens SA

- BASF SE

Frequently Asked Questions

Analyze common user questions about the Specialty Aluminas market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between specialty alumina and commodity alumina, and why is specialty alumina necessary?

Specialty alumina differs fundamentally in purity (often >99.9% up to 99.999%), highly controlled particle morphology, and specific crystalline phases (e.g., tabular, reactive, or gamma). Commodity alumina is typically lower purity and used mainly for primary aluminum smelting. Specialty grades are necessary for high-performance applications like advanced ceramics, electronics, and catalysts, where specific material properties—such as superior thermal resistance, hardness, and dielectric strength—are non-negotiable for product functionality and longevity.

Which end-use application segment is projected to experience the fastest growth rate in the market?

The Electronics and Electrical segment, alongside the Catalysts and Catalyst Supports segment, is projected to exhibit the fastest growth. This acceleration is driven by global expansion in 5G infrastructure, electric vehicle battery technology (requiring High-Purity Alumina for separators), and increasingly stringent environmental regulations necessitating advanced, high-efficiency catalytic systems for emissions control in both industrial and automotive sectors.

What is High-Purity Alumina (HPA), and why is it critical for the future market?

High-Purity Alumina (HPA) refers to specialty alumina with purity levels typically ranging from 99.99% (4N) to 99.999% (5N) or higher. HPA is critical because its ultra-low impurity content is essential for high-tech applications such as synthetic sapphire manufacturing (used in LED screens and watches), lithium-ion battery separators (improving thermal safety), and semiconductor substrates. Future market growth heavily depends on reliable, cost-effective HPA production processes to support the expanding global microelectronics and energy storage industries.

How do volatile energy prices impact the production and pricing of specialty aluminas?

Specialty alumina production, particularly the calcination and fusion stages required to achieve high density and specific crystal structures, is extremely energy-intensive. Volatile global energy prices directly increase operational costs for manufacturers, forcing price adjustments for specialty grades. This impact is particularly pronounced for Tabular and Fused Aluminas, creating margin pressure and incentivizing producers to invest in energy-efficient technologies and geographically diversified production sites to mitigate risk and stabilize pricing structures for end-users.

What is the role of Artificial Intelligence (AI) in optimizing specialty alumina manufacturing?

AI plays a critical role in enhancing efficiency and quality control within specialty alumina manufacturing. Specifically, AI-driven process optimization uses machine learning to monitor real-time parameters (temperature, pressure, chemical flow) during the synthesis and calcination stages, enabling predictive quality control to maintain ultra-high purity and consistency. AI is also deployed in predictive maintenance to minimize costly equipment downtime and in R&D simulations to rapidly screen new material formulations for specific high-performance characteristics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager