Specialty Biocides Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437127 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Specialty Biocides Market Size

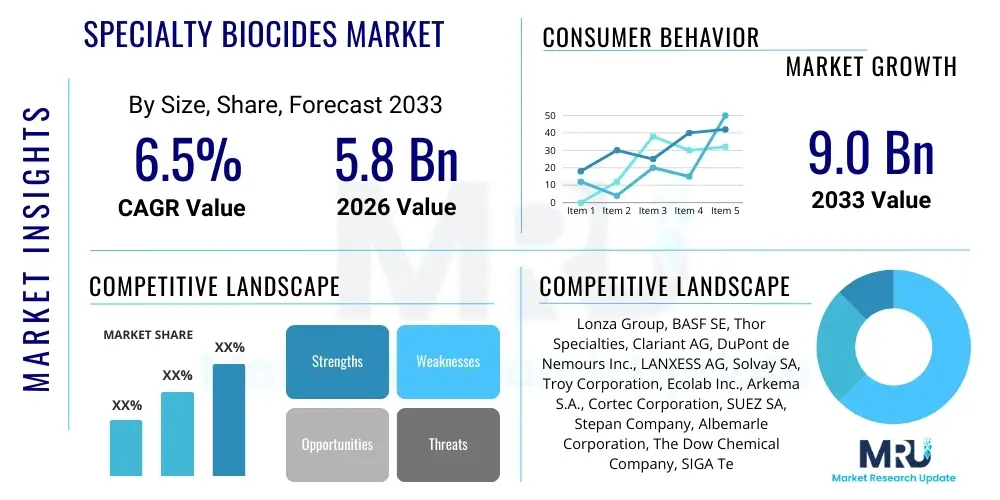

The Specialty Biocides Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 9.0 Billion by the end of the forecast period in 2033.

Specialty Biocides Market introduction

Specialty biocides are chemical substances utilized to control or inhibit the growth of harmful microorganisms, including bacteria, fungi, algae, and viruses, across a wide array of industrial and consumer applications. These specialized compounds are critical in ensuring product integrity, maintaining hygiene standards, and extending the operational lifespan of industrial systems. Unlike commodity biocides, specialty formulations are often tailored for specific, challenging environments, such as high pH levels, extreme temperatures, or resistance to certain microbial strains. The primary function of these biocides is to prevent biofouling, biodeterioration, and the transmission of infectious agents, making them indispensable to sectors like water treatment, paints and coatings, personal care, and wood preservation. The specificity and high efficacy required for these advanced applications differentiate specialty biocides, leading to higher price points and more complex regulatory approval pathways compared to general disinfectants.

The product description encompasses various chemical classes, including halogenated compounds (such as isothiazolinones and bromine-based chemistries), organosulfur chemicals, metallic salts (copper and zinc compounds), and phenolic derivatives, each offering unique mechanisms of action and spectrums of efficacy. Major applications are predominantly found in industrial water treatment, where biocides prevent slime and microbial corrosion in cooling towers, heat exchangers, and boilers, which are essential for maximizing energy efficiency and preventing costly equipment failure. In material preservation, specialty biocides protect products like lumber, textiles, and leather from mold, mildew, and decay, crucial for maintaining quality and extending the material life cycle under varied climatic conditions. Furthermore, the rising awareness regarding public hygiene, particularly in healthcare settings and food processing facilities, significantly drives the demand for high-efficacy specialty disinfectant formulations, which are crucial for stringent pathogen control and ensuring consumer safety.

The market benefits significantly from stringent regulatory frameworks globally, mandating the control of pathogens and mitigating the environmental impact of microbial contamination. Regulations such as the European Biocidal Products Regulation (BPR) and the U.S. Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA) enforce high standards for product safety and environmental performance, favoring specialized, well-tested formulations. Key driving factors include rapid global industrialization, particularly in the Asia-Pacific region, increasing investment in wastewater infrastructure, and the continuous need for advanced preservation technologies to combat sophisticated microbial resistance. The ongoing focus on sustainability has spurred innovation toward environmentally benign, yet highly effective, active ingredients, shaping the competitive landscape towards bio-based and non-oxidizing alternatives, providing differentiated value propositions to sophisticated end-users seeking both performance and compliance.

Specialty Biocides Market Executive Summary

The Specialty Biocides Market is characterized by robust expansion driven primarily by escalating industrial water consumption, heightened public health mandates, and increasingly complex regulatory requirements worldwide. Current business trends indicate a strong structural shift towards sustainable and environmentally responsible biocide chemistries. This necessitates substantial R&D investments by key industry players into non-halogenated, low-toxicity, and bio-based formulations that can meet stringent criteria without sacrificing performance. Strategic partnerships, mergers, and acquisitions remain central to market consolidation, enabling companies to rapidly integrate advanced application technologies, acquire niche intellectual property, and broaden their geographical footprint, particularly in rapidly urbanizing emerging economies where industrial growth is accelerating. Furthermore, the industry is increasingly focused on service-oriented models, integrating chemical supply with digital services, utilizing IoT and AI for real-time performance monitoring, predictive maintenance, and optimized dosage management in large-scale industrial systems.

Regionally, the Asia Pacific (APAC) continues to assert itself as the engine of growth, projected to achieve the highest Compound Annual Growth Rate (CAGR). This acceleration is fuelled by massive urbanization, extensive infrastructure development, and rapidly tightening environmental regulations that push local industries toward high-performance specialty chemicals for compliance. North America and Europe, while being mature markets, maintain leading positions in terms of market value, primarily due to established, high-tech industrial bases and sophisticated regulatory regimes (such as REACH and BPR) that favor complex, high-quality specialty chemical solutions. These regions are prioritizing technological innovation in efficacy and sustainability, driving the swift adoption of advanced delivery systems, including encapsulated and controlled-release biocide systems, which minimize environmental exposure while simultaneously maximizing operational efficiency in closed-loop systems.

Segment trends conclusively reveal that the water treatment application segment holds overwhelming dominance in market share, reflecting critical global concerns over water scarcity and the necessity for highly efficient recycling, reuse, and pathogen control processes across various industrial sectors. Within the product type segmentation, nitrogen-based compounds and optimized phenolic derivatives continue to hold significant market presence due to their broad-spectrum activity and long-standing acceptance, although the fastest growth is observed in environmentally friendly alternatives like bio-based polymers and advanced oxidizing biocides. The structural increase in demand for specialty paints and coatings that offer enhanced antimicrobial protection in high-traffic commercial and residential construction environments further solidifies the market's diversified revenue stream. This diversification, underpinned by regulatory evolution and technological integration, ensures sustained high-value growth throughout the forecast period, emphasizing precision chemistry and targeted efficacy over traditional bulk usage.

AI Impact Analysis on Specialty Biocides Market

Market inquiries and user questions regarding the impact of Artificial Intelligence on the Specialty Biocides Market predominantly center on three core areas: predictive optimization of chemical usage, the accelerated discovery of novel antimicrobial agents, and the creation of fully autonomous biocide management systems. Key themes indicate high user expectations for AI to effectively mitigate persistent industry challenges related to increasing microbial resistance, excessive chemical wastage, and system variability. Common concerns articulated by end-users include the high initial investment cost, the complexity of integrating advanced AI and IoT sensors into pre-existing legacy industrial infrastructure, and the pressing need for standardized, interoperable data protocols across diverse application environments, such as pulp and paper manufacturing, geothermal energy facilities, and large-scale industrial cooling circuits. Users are particularly interested in how advanced machine learning models can accurately interpret complex, multivariate microbial and physical data sets—including biofilm formation indicators and seasonal environmental shifts—to anticipate biofouling events, thereby shifting operational paradigms from costly reactive chemical dosing to proactive, data-informed management strategies.

The integration of sophisticated machine learning models is fundamentally transforming biocide application methods by enabling unprecedented levels of control and efficiency. These AI-driven platforms are capable of analyzing vast and continuously updating streams of data, encompassing detailed water quality metrics, temperature fluctuations, system flow rates, material composition, and real-time microbial load monitoring (often through genomic sequencing or ATP testing). Based on this deep analysis, AI algorithms calculate the minimum inhibitory concentration (MIC) required and determine the optimal application time. This scientific approach not only minimizes total chemical consumption and the associated operational costs, but, crucially, also reduces the environmental burden of chemical discharge by ensuring chemicals are used only when and where they are strictly necessary. Furthermore, in the realm of research and development, AI algorithms are becoming indispensable tools deployed to screen hundreds of thousands of potential antimicrobial molecules, predicting their efficacy profiles, potential toxicity, and propensity for inducing microbial resistance far faster than traditional wet-lab methods, dramatically accelerating the pipeline for next-generation, sustainable specialty biocides.

This technological shift significantly enhances operational reliability, safety, and regulatory compliance for end-users. For example, in large, geographically dispersed industrial cooling tower systems or oilfield operations, AI predictive models can simulate various operational and environmental stress scenarios, ensuring continuous compliance with extremely strict regulatory discharge limits while simultaneously maintaining peak system cleanliness and heat transfer efficiency. The resulting improvement in capital expenditure management, overall system efficiency, and measurable reduction in unscheduled maintenance position AI as a critical, high-value enabler for sustainable specialty biocide management. The long-term market impact is projected to foster a new generation of entirely smart, connected biocide systems, where chemical management is optimized based on dynamic, localized environmental conditions rather than rigid schedules, providing substantial added value and a competitive edge to companies that successfully transition to these advanced data-driven solutions.

- AI-driven predictive modeling for sub-surface biofouling and microbial induced corrosion (MIC) detection and prevention in oil and gas.

- Optimization of biocide dosage rates and frequency based on real-time environmental and microbiological parameters.

- Acceleration of novel, low-toxicity antimicrobial agent discovery through computational chemistry and virtual screening.

- Enhanced remote monitoring and automated control of complex industrial water treatment systems via integrated IoT sensor networks.

- Automated generation of compliance reports and detailed risk assessment for regulatory adherence (e.g., BPR reporting).

- Significant reduction of chemical wastage, improved resource efficiency, and minimization of chemical discharge environmental impact.

- Development of smart, autonomous chemical delivery and neutralization systems in critical infrastructure and high-purity manufacturing processes.

- Data synthesis from multi-source inputs (genomics, flow rates, pressure) to combat emerging strains of microbial resistance.

DRO & Impact Forces Of Specialty Biocides Market

The trajectory of the Specialty Biocides Market is dynamically shaped by a potent combination of accelerating drivers, structural restraints, and critical emerging opportunities, all interacting to form powerful impact forces that dictate investment and strategy. The most significant driver stems from the increasing global concern over microbial contamination, biofilm formation, and infectious diseases, necessitating the deployment of high-performance specialty biocides across critical sectors such as healthcare, food safety, and personal hygiene. Simultaneously, rapid global industrial expansion, particularly in high-growth manufacturing, energy generation, and infrastructure projects, fuels robust demand for highly effective biocidal solutions. These chemicals are essential for protecting high-value capital equipment, optimizing operational continuity in closed-loop systems like cooling towers and heat exchangers, and safeguarding against biological degradation of materials in construction and textiles. Furthermore, the global proliferation of stringent governmental regulations mandating specific water quality standards, industrial hygiene protocols, and discharge limits acts as a non-negotiable, systemic market accelerator, forcing industrial compliance and continuous demand for advanced solutions.

Despite the strong demand drivers, the specialty biocides market faces critical structural restraints, chiefly stemming from escalating environmental scrutiny and the increasing complexity of regulatory frameworks. Numerous traditional, highly effective broad-spectrum biocides are currently under review, facing restrictions, or targeted for potential phase-out due to established concerns regarding their acute toxicity, environmental persistence, and potential for bioaccumulation. This regulatory pressure imposes significant costs on manufacturers, compelling extensive, costly reformulation, re-registration under regimes like BPR, and exhaustive toxicology testing. A second, profound structural challenge is the relentless evolution of microbial resistance, where microorganisms rapidly adapt and develop resilience to established chemical modes of action. This phenomenon necessitates continuous, high-cost investment in research and development to discover novel active ingredients and sophisticated delivery systems, often leading to product obsolescence and increasing the technological risk profile for market participants. Additionally, the reliance on petrochemical feedstocks means the industry remains exposed to significant volatility in raw material pricing, impacting production costs and long-term supply chain stability.

However, substantial opportunities are emerging that promise to redefine the competitive landscape and drive future growth. The most prominent opportunity revolves around the imperative of green chemistry and the development of truly sustainable formulations, particularly including bio-based biocides, enzymatic solutions, and advanced non-oxidizing chemistries, which offer inherent regulatory advantages and appeal strongly to environmentally conscious end-users. The market is also capitalizing on the proliferation of advanced application technologies, such as highly sophisticated microencapsulation, polymeric delivery systems, and controlled-release matrices, which provide avenues for significant product differentiation, enhanced long-term efficacy, and reduced total lifetime cost of ownership. Moreover, the immense, largely untapped market potential in developing regions of Africa and parts of Latin America, combined with the increasing global demand for specialized, highly effective disinfectants catalyzed by recent public health crises and the requirements of advanced, high-purity manufacturing (e.g., microelectronics), provides clear and robust pathways for sustainable future revenue growth. These combined impact forces—regulatory restriction, microbial challenge, sustainability mandate, and digitalization—are collectively driving an irreversible market shift toward high-value, R&D-intensive specialty products that integrate seamlessly with smart industrial operations.

Segmentation Analysis

The comprehensive segmentation analysis of the Specialty Biocides Market provides essential clarity on the structural dynamics of demand, technological penetration, and geographic distribution across distinct end-user requirements. This detailed dissection, segmented by product type, application, and end-user industry, allows strategic stakeholders to pinpoint specific areas of accelerated growth, identify technological paradigm shifts, and accurately assess competitive intensity within high-value niche markets. The market structure is inherently complex, reflecting the vastly varied requirements for effective microbial control, which spans from ensuring the structural integrity of industrial materials to meeting zero-tolerance standards for pathogen control in sensitive sectors like medical devices and food processing, thereby requiring highly tailored and certified chemical solutions for distinct environmental and operational challenges.

Segmentation by product type critically highlights the chemical architecture underpinning the market, with key chemical classes serving distinct purposes. Halogenated compounds, such as isothiazolinones and dibromonitrilopropionamide (DBNPA), continue to hold a vital position due to their fast-acting, broad-spectrum efficacy, although they face regulatory pressures concerning aquatic toxicity. Nitrogen-based compounds, prominently including Quaternary Ammonium Compounds (QACs) and glutaraldehyde, maintain a significant presence, especially in cooling water treatment and institutional disinfection due to their effectiveness and relative stability. The rapid growth observed within the 'Others' category is reflective of intense innovation in bio-based, enzyme-driven, and metallic (e.g., nanosilver) biocide technologies, which address the growing market demand for safer, non-persistent, and regulatory-favorable active ingredients. Analyzing the revenue distribution and growth rates across these chemical classes provides direct insight into how manufacturers are strategically navigating the landscape defined by escalating regulatory restrictions and the urgent need for sustainable innovation.

The application segmentation is arguably the most pivotal differentiator, clearly illustrating the end-use structure and the primary vectors of market demand. The water treatment sector consistently maintains its dominant market share, driven globally by increasing industrial activity, the necessity for water reuse, and stringent mandates for wastewater management across diverse industries including refining, chemical processing, and power generation. However, high growth rates are also being recorded in specialized applications such as paints and coatings, where in-can preservation and dry-film protection are paramount to product warranties and aesthetics. Similarly, the disinfectant and sanitizer segment experienced accelerated growth, particularly following recent global health events, highlighting the critical role of specialty biocides in institutional hygiene and critical care environments. The demand structure across these segments is highly diverse, mandating that successful specialty biocide suppliers offer comprehensive technical expertise and customized formulation support, ensuring effective integration into complex end-user processes and delivering verified performance benefits.

- By Product Type: Halogen Compounds (Isothiazolinones, DBNPA, Bromine-based), Nitrogen-based (Quaternary Ammonium Compounds, Glutaraldehyde), Organosulfur Compounds, Phenolics (Triclosan replacements), Metallic Compounds (Silver, Copper, Zinc), Others (Bio-based Biocides, Enzymes, Peracetic Acid).

- By Application: Water Treatment (Cooling Towers, Boilers, Wastewater), Wood Preservation (Industrial Lumber, Composites), Paints and Coatings (In-Can Preservation, Dry-Film Protection), Disinfectants and Sanitizers (I&I, Healthcare), Fuel and Lubricants (Microbial Contamination Control in Hydrocarbon Storage), HVAC Systems, Personal Care Products (Preservatives), Leather and Textiles, Building & Construction Materials.

- By End-User Industry: Industrial & Institutional (I&I) Cleaning, Food & Beverage Processing, Manufacturing (Pulp & Paper, Textiles), Healthcare & Pharmaceuticals, Oil & Gas Exploration and Production, Power Generation (Utilities), Marine & Transportation, Agriculture.

- By Region: North America (US, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain), Asia Pacific (China, India, Japan, South Korea), Latin America (Brazil, Argentina), Middle East, and Africa (MEA) (GCC Countries, South Africa).

Value Chain Analysis For Specialty Biocides Market

The foundational stage of the Specialty Biocides Market value chain involves extensive upstream analysis, which is intrinsically linked to the procurement, logistics, and processing of critical base raw materials. This segment is centered on securing access to bulk commodity chemicals—such as basic chlorine and bromine sources, various amine intermediates, sulfur derivatives, and specific metal salts—which serve as the essential precursors for specialty biocide synthesis. The ultimate profitability, operational resilience, and competitive pricing strategy of biocide manufacturers are heavily reliant on the efficient and stable procurement of these basic inputs, which are frequently subject to significant price volatility dictated by global petrochemical market fluctuations and geopolitical supply risks. Key activities at this upstream level necessitate rigorous strategic sourcing agreements, comprehensive quality assurance checks of precursors, and the implementation of sophisticated inventory management systems designed specifically to minimize exposure to adverse price movements and secure long-term supply stability for complex formulation needs.

The midstream segment of the value chain constitutes the core manufacturing, formulation, and quality control of the highly specialized biocide products. This phase is characterized by high capital expenditure requirements for specialized chemical reaction equipment, significant ongoing costs associated with rigorous regulatory compliance (including the exhaustive process of product authorization and registration under bodies like the European Chemicals Agency and national EPA equivalent), and substantial, continuous investment in proprietary research and development. Manufacturers engage in complex, multi-step chemical synthesis, followed by precise formulation steps (e.g., creating stable aqueous solutions, microemulsions, or encapsulated solids) to enhance product stability, application safety, and targeted efficacy. Maintaining stringent control over reaction processes, purity standards, and batch consistency is crucial to ensure verifiable product performance and safety, often resulting in manufacturers developing unique, protected production methods and intellectual property that act as formidable competitive barriers to entry.

The downstream analysis comprehensively covers the complex distribution channel and the final strategic movement of the finished specialty biocide product to the diverse spectrum of end-users. Given the hazardous or technically specific nature of many specialty chemicals, the market requires highly specialized, often temperature-controlled distribution networks. This typically involves a dual approach: direct sales channels managed by technical field representatives for large industrial accounts (such as major petrochemical facilities or municipal water works) and indirect channels utilizing highly specialized chemical distributors and local application handlers. Effective downstream operations require more than just logistics; they demand integrated technical support, specialized hazard training for end-users, management of complex regulatory documentation, and precise, compliant logistics for handling hazardous or restricted materials. The success in this segment relies heavily on distribution partners who can provide localized application expertise, responsive technical troubleshooting, and reliable regional inventory management, effectively bridging the sophisticated capabilities of the manufacturer with the localized, precise needs of industrial and institutional customers.

Specialty Biocides Market Potential Customers

The comprehensive customer base for the Specialty Biocides Market is exceptionally diverse, spanning virtually every industry where microbial growth and contamination pose significant risks to public health, material integrity, or operational performance. Major potential customers include large-scale industrial entities such as chemical processing plants, massive power generation facilities (relying heavily on biocides for cooling water management), and large pulp and paper manufacturers. These operations utilize high-performance biocides specifically to prevent the formation of insulating biofouling layers, mitigate costly microbial-induced corrosion (MIC) in critical infrastructure, and optimize operational continuity and energy efficiency in high-volume process systems. Furthermore, institutional buyers—including expansive hospital networks, university campuses, and local and federal governmental facilities—represent a crucial market segment for high-grade, certified disinfectants and sanitizers, driven by continuously escalating hygiene standards and mandatory public health protocols, particularly in sensitive patient and educational environments.

Beyond traditional heavy industry, the high-tech and specialized manufacturing sector presents substantial and growing demand, encompassing companies specializing in sophisticated paints and protective coatings, high-performance adhesives, joint sealants, and construction materials like engineered wood products. These manufacturers strategically incorporate specialty biocides as essential preservatives (both for in-can product stability and long-term dry-film protection) to actively prevent biodeterioration during extensive storage periods and ensure performance longevity in end-use applications, thereby guaranteeing product quality, appearance, and warrantied lifespan. The global oil and gas sector remains a highly critical end-user, deploying robust, often concentrated biocides in complex applications such as drilling muds, hydraulic fracturing fluids, and crude oil pipeline systems to effectively mitigate the costly effects of Microbial-Induced Corrosion (MIC), control reservoir souring, and ensure the long-term asset integrity and operational safety across challenging, highly anaerobic environments.

The highly regulated food and beverage (F&B) industry represents a major, high-growth customer segment, characterized by stringent zero-tolerance microbial standards. F&B processors require highly specialized, low-toxicity, and food-contact-approved biocides for critical processes such as cleaning-in-place (CIP) operations, effective surface sanitation, and rapid cross-contamination prevention to adhere to rigorous domestic and international safety standards (HACCP, ISO). Lastly, the personal care and cosmetics industries are significant consumers of specialty preservatives, where biocides are essential for maintaining product stability, preventing bacterial or fungal growth throughout the designated shelf life, and ensuring consumer safety from pathogenic contamination. This highly varied collection of end-users is unified by a shared critical need for verified efficacy, demonstrated regulatory compliance, and tailored solutions that effectively integrate into their specific operational and environmental parameters, positioning specialty biocide suppliers not merely as chemical vendors, but as essential partners in maintaining sophisticated industrial and public health integrity globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 9.0 Billion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lonza Group, BASF SE, Thor Specialties, Clariant AG, DuPont de Nemours Inc., LANXESS AG, Solvay SA, Troy Corporation, Ecolab Inc., Arkema S.A., Cortec Corporation, SUEZ SA, Stepan Company, Albemarle Corporation, The Dow Chemical Company, SIGA Technologies, Buckman Laboratories International Inc., Veolia Environnement S.A., Kuraray Co. Ltd., Mitsubishi Chemical Holdings Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Specialty Biocides Market Key Technology Landscape

The technology landscape of the Specialty Biocides Market is undergoing rapid and fundamental transformation, driven primarily by the pursuit of enhanced efficacy, significant reduction of environmental persistence, and the critical need to counteract increasingly sophisticated microbial resistance mechanisms. A dominant technological trend involves a strategic shift away from older, broad-spectrum chemistries towards highly targeted, site-specific, and functionally superior formulations. Key technological developments are concentrated on advanced delivery and release mechanisms, specifically utilizing sophisticated encapsulation technology, which allows the biocide active ingredient to be released consistently and precisely over extended periods. This innovation not only dramatically improves the overall product longevity and effectiveness but also critically minimizes the necessary active concentration at any given point in time. This controlled-release strategy significantly reduces potential non-target toxicity, diminishes environmental exposure, and serves as a crucial factor for AEO-optimized search inquiries specifically focused on sustainable chemical usage and regulatory compliance.

A second, crucial technological domain driving innovation is the intensive development of non-oxidizing, low-persistence, and sustainable green chemistry biocides. Driven by increasingly stringent international regulations, such as the European Biocidal Products Regulation (BPR), research efforts are heavily focused on optimizing the performance of existing high-potential classes, including advanced Quaternary Ammonium Compounds (QACs), unique polymeric biocides, and complex organosulfur compounds. These alternatives offer highly effective microbial control without relying on traditional halogen sources (chlorine or bromine), which are known to produce harmful disinfection by-products (DBPs) that complicate wastewater treatment. Furthermore, the integration of computational tools—specifically computational biology, high-throughput screening, and predictive toxicology modeling—allows manufacturers to rapidly identify, screen, and optimize novel active ingredients. This technological acceleration significantly shortens the R&D cycle and facilitates the commercial introduction of bio-based specialty biocides derived from renewable natural sources, such as engineered plant extracts or microbial metabolites, directly catering to the substantial segment of end-users prioritizing verifiable sustainability and natural product sourcing.

Finally, the rapid proliferation and integration of digital technology, specifically the combination of industrial Internet of Things (IoT) sensors and powerful data analytics platforms, represents perhaps the most transformative technological shift in specialty biocide application management. Advanced sensor networks are now capable of monitoring multiple critical parameters (including pH, conductivity, oxidation-reduction potential, and nascent microbial activity indicators) in real-time, across complex, large-scale industrial systems. This stream of high-fidelity data feeds into intelligent dosing systems powered by AI and machine learning, enabling predictive modeling for biocide requirements. This crucial technology moves chemical management from outdated, periodic dosing schedules to sophisticated, continuous, and highly adaptive treatment strategies. These integrated smart systems provide maximized chemical efficiency, significantly reduced operational variability, and minimization of human error, making them highly valued across key industrial sectors like water treatment and large-scale facility maintenance, ultimately providing optimized performance data that is critical for enterprise-level cost control and strategic decision-making.

Regional Highlights

- Asia Pacific (APAC): This region is unequivocally positioned to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period, primarily attributable to the unprecedented scale of industrialization occurring across key economies, including China, India, and the rapidly modernizing nations of Southeast Asia. The region’s massive manufacturing output, coupled with accelerating development in construction, infrastructure, and textile production, generates enormous and continuous demand for advanced material preservation and high-efficiency industrial water treatment biocides. Critically, government mandates in these economies regarding environmental protection, particularly concerning industrial wastewater quality and discharge limits, are quickly converging with, or in some cases surpassing, Western regulatory standards. This intense regulatory pressure fundamentally compels local industries to transition away from low-cost, low-efficacy commodity chemicals toward superior, high-performance specialty biocides, representing the largest opportunity for market penetration and value growth.

- North America: As a technologically mature and highly regulated market, North America maintains its position as a major contributor to global market value. Growth in this region is substantially driven by the established energy sector, particularly the oil and gas industry, which requires highly specialized biocides for the prevention of Microbial-Induced Corrosion (MIC) in complex, high-pressure environments like hydraulic fracturing and deep-sea drilling. Furthermore, the region possesses the world’s most advanced water treatment infrastructure. The primary focus for innovation here is intensely placed on achieving verifiable sustainability and digital integration, meaning the swift adoption of sophisticated, AI/IoT-integrated dosing and monitoring solutions for precise, optimized chemical application, ensuring compliance with stringent and evolving EPA guidelines regarding chemical usage and environmental impact.

- Europe: The European market is structurally dominated and defined by the highly restrictive regulatory framework of the Biocidal Products Regulation (BPR), which mandates exhaustive testing and rigorous approval for all active ingredients sold within the economic area. This environment strongly favors approved, highly tested, and demonstrably environmentally safer active specialty ingredients. Key sectors driving consistent demand include the established paints and coatings industry, highly demanding wood preservation applications, and the sophisticated healthcare and institutional sectors. Innovation and investment are strategically concentrated on developing high-performance substitutes for recently restricted substances and continuously enhancing the long-term efficacy and safety profile of already approved compounds. This sustained regulatory demand creates a premium market structure, driving strong investment toward high-value, research-intensive specialty product development.

- Latin America (LATAM): Market growth across Latin America is intrinsically linked to accelerating industrial modernization and foreign investment across major economies, particularly Brazil, Mexico, and Chile, focusing heavily on the mining, oil and gas, and burgeoning food and beverage processing industries. Market penetration for specialty solutions is rapidly accelerating as industries across the continent standardize their operational protocols and hygiene standards to meet export market requirements, thereby necessitating the use of superior bio-control solutions. While the market faces inherent challenges related to economic volatility and a patchwork of varied national regulatory landscapes, the fundamental underlying need for effective industrial preservation and rigorous sanitation protocols guarantees a pathway for steady, specialized chemical demand growth.

- Middle East and Africa (MEA): This region is experiencing considerable specialty market expansion, predominantly fuelled by massive, government-backed infrastructure investments, crucial large-scale water desalination and purification projects, and the continued dominance of the petrochemical sector. The extreme focus on oil and gas exploration and transportation across the GCC countries necessitates highly effective and resilient biocides for Microbial-Induced Corrosion (MIC) control in harsh operating conditions. Furthermore, due to severe water scarcity, the intense push for advanced water recycling and reuse technologies in both municipal and industrial settings makes high-performance specialty biocides absolutely essential for maintaining the integrity, efficiency, and longevity of critical water treatment and reuse assets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Specialty Biocides Market.- Lonza Group

- BASF SE

- Thor Specialties Inc.

- Clariant AG

- DuPont de Nemours Inc.

- LANXESS AG

- Solvay SA

- Troy Corporation

- Ecolab Inc.

- Arkema S.A.

- Cortec Corporation

- SUEZ SA

- Stepan Company

- Albemarle Corporation

- The Dow Chemical Company

- SIGA Technologies

- Buckman Laboratories International Inc.

- Veolia Environnement S.A.

- Kuraray Co. Ltd.

- Mitsubishi Chemical Holdings Corporation

Frequently Asked Questions

What is the primary factor driving the demand for specialty biocides in industrial applications?

The primary driving factor is the escalating need for effective microbial control in industrial water systems, specifically cooling towers and boilers, to prevent biofouling, corrosion (MIC), and system downtime. Global regulatory standards for water hygiene and discharge also necessitate the use of advanced specialty formulations for compliance and asset protection.

How are environmental regulations influencing the development of new specialty biocides?

Environmental regulations, such as Europe's BPR and U.S. EPA guidelines, are fundamentally forcing manufacturers to innovate toward greener, lower-toxicity, and readily biodegradable active ingredients. This is driving the development and rapid adoption of non-halogenated, organosulfur, and bio-based specialty biocides that minimize environmental risk while maintaining high efficacy levels.

Which application segment holds the largest share in the Specialty Biocides Market?

The water treatment segment dominates the market share due to the global scale of industrial processes requiring high-volume water management, including power generation, chemical manufacturing, and municipal water recycling. Biocides are essential in this segment for asset protection, maintaining efficiency, and meeting stringent wastewater discharge criteria.

What role does AI and IoT play in the future of biocide application?

AI and IoT systems enable predictive biocide management by integrating real-time sensor data with machine learning algorithms. This technology allows for precise, optimized dosing, which minimizes chemical consumption, reduces operational costs, and actively combats microbial resistance, representing a major shift toward smart chemical management and efficiency.

What are the key chemical classes included under specialty biocides?

Key chemical classes include Halogen Compounds (e.g., isothiazolinones), Nitrogen-based compounds (e.g., DBNPA, QACs), Organosulfur compounds, Phenolics, and Metallic compounds (e.g., silver and copper salts). The selection depends heavily on the target microbe, the application environment, and specific regulatory approvals required by the end-user industry.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager