Specialty Commercial Vehicles Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433690 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Specialty Commercial Vehicles Market Size

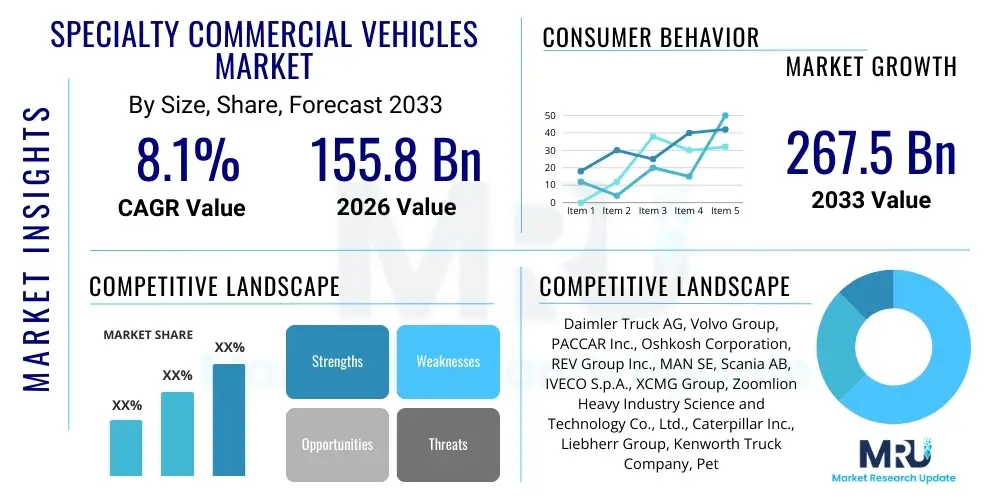

The Specialty Commercial Vehicles Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.05% between 2026 and 2033. The market is estimated at USD 155.8 Billion in 2026 and is projected to reach USD 267.5 Billion by the end of the forecast period in 2033.

Specialty Commercial Vehicles Market introduction

The Specialty Commercial Vehicles Market encompasses a diverse range of customized motorized transport units designed for specific, non-standard operational tasks beyond general cargo or passenger transport. These vehicles are engineered to meet stringent performance, safety, and regulatory requirements associated with specialized applications such as construction, public works, emergency services, waste management, and heavy-duty logistics. Key product categories include concrete mixers, dump trucks, fire fighting apparatus, ambulances, mobile cranes, and highly specialized utility maintenance vehicles. Their distinction lies in their custom body structures, specific equipment integration (e.g., hydraulic systems, lifting mechanisms), and robust chassis configurations, enabling them to operate effectively in demanding environments where standard commercial vehicles would fail.

Major applications of specialty commercial vehicles span critical economic sectors. In municipal services, they are indispensable for sanitation, public infrastructure maintenance, and emergency response, ensuring urban functionality and safety. The construction and mining industries rely heavily on specialized vehicles, such as heavy-duty dumpers and mixers, to handle bulk material transport and site development efficiently, which is directly correlated with global infrastructure spending and urbanization rates. The inherent benefits of these vehicles include enhanced operational efficiency due to task-specific design, improved safety performance through integrated safety systems tailored to high-risk operations, and increased productivity enabled by powerful, purpose-built machinery that reduces manual labor requirements.

The market is currently being driven by significant global trends, notably the surge in public infrastructure investments in developing economies, the strict enforcement of environmental regulations pushing the adoption of alternative fuel specialty vehicles, and the increasing demand for advanced telematics and safety features. Technological integration, particularly the incorporation of IoT sensors and sophisticated fleet management systems, is optimizing vehicle utilization and reducing downtime, further boosting market growth. Furthermore, the push towards urbanization necessitates continuous upgrades and expansion of municipal fleets, ensuring sustained demand for specialized vehicles designed for waste compression, street cleaning, and utility repair.

Specialty Commercial Vehicles Market Executive Summary

The global Specialty Commercial Vehicles Market is undergoing a rapid transformation characterized by three dominant themes: electrification, autonomous readiness, and advanced connectivity integration. Business trends indicate a strong shift towards customization and modular design, allowing manufacturers to quickly adapt base chassis platforms for diverse applications, thereby catering effectively to niche industry requirements and reducing lead times. Strategic collaborations between chassis manufacturers and specialized body builders are becoming increasingly common to ensure optimal integration of sophisticated equipment and compliance with evolving global safety standards. Furthermore, the market is experiencing consolidation driven by the need for economies of scale, particularly among suppliers focusing on complex powertrain systems and high-strength, lightweight materials necessary for efficiency improvements.

Regionally, the market dynamics are polarized. The Asia Pacific (APAC) region stands out as the primary growth engine, fueled by massive government investments in smart city projects, high-speed rail networks, and rapid urbanization, particularly in China and India, generating exceptional demand for construction and municipal specialty vehicles. Conversely, North America and Europe, representing mature markets, are leading the transition toward electric and autonomous specialty vehicles, mandated by stringent emissions targets and supported by robust charging infrastructure development. These developed regions exhibit high adoption rates for advanced telematics and predictive maintenance services, significantly impacting the aftermarket service revenues. The Middle East and Africa (MEA) are also showing promising growth, primarily driven by large-scale oil and gas infrastructure projects and diversification efforts.

Segment trends reveal that the Construction & Mining application segment remains the largest revenue contributor due to its reliance on high-cost, heavy-duty equipment such as concrete pumps and large dump trucks. However, the Municipal & Logistics segment, encompassing refuse collection and last-mile delivery vehicles, is anticipated to register the fastest growth rate, propelled by the increasing complexity of urban operations and the imperative for sustainable waste management solutions. Propulsion-wise, while Internal Combustion Engine (ICE) vehicles currently dominate, the Battery Electric Vehicle (BEV) sub-segment within specialty vehicles, especially for urban applications like ambulances and smaller utility trucks, is poised for exponential growth as battery costs decrease and performance specifications suitable for heavy loads improve.

AI Impact Analysis on Specialty Commercial Vehicles Market

Common user inquiries regarding AI's influence on the Specialty Commercial Vehicles Market predominantly center on achieving operational autonomy, enhancing vehicular safety, and maximizing uptime through predictive analytics. Users frequently question how AI algorithms can manage the unique driving characteristics of specialized vehicles (e.g., maintaining stability while operating a boom or managing highly asymmetrical loads), ensuring that autonomous functions do not compromise safety during complex tasks like fire suppression or refuse collection. Furthermore, there is significant interest in how AI-powered predictive maintenance models can reduce the expensive and often unexpected downtime associated with highly customized equipment. The summarized user expectation is a future where AI facilitates safer, more efficient deployment of specialized fleets, moving beyond basic driver assistance towards full functional integration for specific operational tasks, such as automated route planning optimized for highly variable refuse collection routes or precision spreading of materials by maintenance trucks.

- AI-driven Predictive Maintenance: Utilizing machine learning algorithms to analyze real-time sensor data from critical specialized components (e.g., hydraulic pumps, PTO systems) to predict imminent failures, significantly reducing unplanned downtime and maintenance costs.

- Enhanced Safety and Stability Control: Implementing AI to interpret complex vehicular dynamics and operational environments, adjusting stabilization features (outriggers, load distribution) automatically to prevent rollovers or loss of control during demanding operations like lifting or high-speed emergency response.

- Optimized Autonomous Operations: Deployment of AI for specialized tasks such as automated street sweeping patterns, precise spraying/spreading of road materials, or pre-programmed waste container grappling and dumping sequences, improving efficiency and consistency.

- Advanced Route and Fleet Management: AI algorithms considering specialized parameters (weight restrictions, access limitations, specific service points) to create optimal routes for complex municipal services (e.g., snow plowing or street repair) and logistics operations.

- Driver Behavior Monitoring and Training: AI systems analyzing driver inputs specific to operating specialized equipment to identify risky behaviors and provide targeted feedback, crucial for vehicles requiring high operational precision.

DRO & Impact Forces Of Specialty Commercial Vehicles Market

The dynamics of the Specialty Commercial Vehicles Market are shaped by a complex interplay of positive and negative forces, coupled with significant untapped opportunities. The primary driver stems from global urbanization trends and associated public sector spending on infrastructure renewal and expansion, particularly in emerging economies requiring large volumes of construction and sanitation equipment. Restraints largely revolve around the high initial capital investment required for these customized vehicles and the complex regulatory landscape, which necessitates continuous vehicle redesigns to meet evolving safety and environmental standards (such as Euro VI and stricter EPA mandates). However, opportunities abound in the development of modular electric vehicle architectures tailored for specialty applications, the integration of advanced telematics for remote diagnostics, and the expansion into niche markets such as specialized disaster relief and green energy infrastructure maintenance vehicles. These forces collectively dictate market trajectory, pushing manufacturers towards innovation in efficiency and sustainability.

The impact forces within the market are predominantly characterized by governmental infrastructure mandates and rapid technological obsolescence. Governments act as major purchasers, making procurement policies (e.g., buy-local mandates, emissions requirements) a critical external impact force. Furthermore, the rapid advancement in battery technology and sensor systems exerts pressure on existing fleets, accelerating the rate at which operators must update or replace their specialized assets to maintain operational competitiveness and compliance. The high customization level inherently makes economies of scale challenging, keeping per-unit costs high, which acts as a persistent dampener on rapid market growth, especially in price-sensitive developing regions. Balancing bespoke design requirements with standardized, mass-producible components is a continuous strategic challenge for market participants.

Another crucial impact force is the shortage of specialized skilled labor required to operate and maintain these complex machines. This shortage drives demand for enhanced automation and user-friendly interfaces, compelling manufacturers to invest heavily in smart vehicle systems that reduce reliance on highly experienced technicians and operators. The cyclical nature of the construction and mining industries also introduces volatility; periods of economic slowdown directly translate into delayed fleet replacement cycles. Conversely, growing global focus on environmental sustainability acts as a long-term, powerful driver, fostering innovation in areas like hydrogen fuel cell integration for heavy-duty specialty applications where pure battery power remains inadequate due to weight and range limitations.

Segmentation Analysis

The Specialty Commercial Vehicles Market is extensively segmented based on several key operational and technical criteria to accurately reflect the diversity of products and end-user needs. Segmentation by Vehicle Type is critical, differentiating standard workhorse vehicles like dump trucks and concrete mixers from highly specialized emergency or utility vehicles. The Application segment defines the primary end-use sectors, establishing market demand patterns linked directly to governmental spending or industrial activity. Furthermore, segmenting by Propulsion Type (ICE, Electric, Hybrid) highlights the current technological transition phase and projections for sustainable mobility adoption across various specialized tasks. This multi-faceted segmentation provides granular insights necessary for strategic planning and targeted product development across regional markets.

- By Vehicle Type:

- Dump Trucks

- Mixer Trucks (Concrete Mixers)

- Tanker Trucks (Fuel, Water, Chemical)

- Refuse and Garbage Trucks

- Fire Trucks and Rescue Vehicles

- Ambulances and Emergency Medical Vehicles

- Mobile Cranes and Lifting Vehicles

- Utility and Maintenance Vehicles (Bucket Trucks, Sewer Cleaners)

- Snow Removal Vehicles

- By Application:

- Construction and Mining

- Municipal and Logistics (Waste Management, Street Cleaning, Delivery)

- Emergency Services (Fire, Medical, Rescue)

- Utility and Maintenance (Power, Telecom, Water)

- Oil and Gas Exploration

- By Propulsion Type:

- Internal Combustion Engine (ICE)

- Battery Electric Vehicle (BEV)

- Hybrid Electric Vehicle (HEV)

- Fuel Cell Electric Vehicle (FCEV)

- By Payload Capacity:

- Light-Duty

- Medium-Duty

- Heavy-Duty

Value Chain Analysis For Specialty Commercial Vehicles Market

The Specialty Commercial Vehicles value chain is complex, starting with upstream activities involving raw material procurement (specialized steel alloys, high-strength plastics, composite materials) and the manufacturing of core components such as heavy-duty axles, specialized transmissions, and robust engine systems. Upstream suppliers are vital as the performance and durability of the finished vehicle heavily depend on the quality and specificity of these components, necessitating close collaborative partnerships between component manufacturers and chassis builders. The midstream involves the core manufacturing process: chassis production followed by the specialized body fabrication and integration of application-specific machinery (e.g., pumps, booms, hydraulic systems), often requiring highly skilled fabrication shops and strict quality control processes to ensure safety compliance.

The downstream activities involve distribution channels, which are typically segmented into direct sales to large governmental bodies or major construction firms, and indirect sales through a network of specialized dealers and distributors who provide regional servicing, customization consultation, and financing options. Direct channels are preferred for high-volume or highly customized defense/utility contracts, while the dealership network efficiently handles sales and support for smaller municipal fleets and independent contractors. The efficacy of the distribution channel is heavily reliant on the capability of dealers to offer prompt, specialized aftermarket maintenance services, given the unique engineering of these vehicles.

The direct and indirect nature of the market is crucial. Direct interaction often facilitates feedback loops, allowing manufacturers to rapidly incorporate end-user operational data into future designs, particularly for specialized vehicles like fire trucks or large excavators. Indirect distribution, leveraging authorized service centers, plays a massive role in sustaining profitability through the aftermarket segment—providing replacement parts, preventative maintenance contracts, and necessary regulatory inspections. Effective value chain management, particularly optimizing logistics for customized part delivery and minimizing build-to-order times, is a key competitive differentiator in this highly specialized and lead-time-sensitive market.

Specialty Commercial Vehicles Market Potential Customers

The primary end-users and buyers in the Specialty Commercial Vehicles Market are concentrated across public sector agencies and large-scale industrial enterprises requiring robust, purpose-built assets for operational continuity. Municipal governments and state entities constitute a significant customer base, procuring vehicles for essential public services, including waste collection, street maintenance (sweeping, lighting, plowing), public transportation infrastructure repair, and emergency response fleets (ambulances, fire engines). These institutional buyers often prioritize durability, adherence to strict emission standards, and long-term service contracts over initial purchase price, driving demand for premium, high-quality products.

Another major segment includes players in the heavy industry, particularly construction, mining, and large-scale infrastructure development companies. These customers require high-capacity dump trucks, concrete mixers, mobile cranes, and specialized transporters capable of enduring extreme working conditions and handling immense payloads. Their purchasing decisions are primarily influenced by total cost of ownership (TCO), fuel efficiency, and regulatory compliance regarding on-site safety and load limits. The cyclical nature of these industries means demand from this segment can fluctuate based on global commodity prices and government approval of mega-projects.

Furthermore, utility providers (telecommunications, power generation, water supply) and specialized logistics operators represent growing customer segments. Utility companies frequently require highly specialized bucket trucks, digger derricks, and cable installation vehicles optimized for working at heights and managing complex electrical or fiber infrastructure. Logistics companies focusing on dangerous goods, oversized cargo, or temperature-sensitive specialized transport also constitute critical buyers, demanding customized tanker specifications and robust safety features. The increasing complexity of urban operations mandates a continual upgrade of these fleets with connected and environmentally compliant vehicles.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 155.8 Billion |

| Market Forecast in 2033 | USD 267.5 Billion |

| Growth Rate | 8.05% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Daimler Truck AG, Volvo Group, PACCAR Inc., Oshkosh Corporation, REV Group Inc., MAN SE, Scania AB, IVECO S.p.A., XCMG Group, Zoomlion Heavy Industry Science and Technology Co., Ltd., Caterpillar Inc., Liebherr Group, Kenworth Truck Company, Peterbilt Motors Company, Rosenbauer International AG, FAW Group Co., Ltd., Isuzu Motors Ltd., Foton Motor Group, TATA Motors, Pierce Manufacturing Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Specialty Commercial Vehicles Market Key Technology Landscape

The technology landscape of the Specialty Commercial Vehicles Market is rapidly evolving, driven primarily by the need for greater efficiency, lower emissions, and enhanced operational safety. Key technological advancements center around powertrain electrification and the integration of sophisticated digital systems. Battery Electric Vehicle (BEV) and Fuel Cell Electric Vehicle (FCEV) technologies are moving from niche pilot projects to viable solutions, particularly for high-torque applications in urban environments (refuse collection, delivery) where duty cycles are predictable. However, developing robust battery thermal management systems and high-power charging infrastructure capable of supporting heavy-duty operations remains a critical focus area for technology providers. Furthermore, significant material science advancements are enabling the use of lighter, high-strength steels and composites, crucial for maximizing payload capacity while adhering to safety regulations.

Connectivity and the Internet of Things (IoT) constitute the second pillar of technological transformation. Telematics systems are becoming standard, offering comprehensive data logging, real-time diagnostics, and remote software updates. Specialized vehicles utilize these systems not only for fleet tracking but critically for monitoring the performance and health of the specialized attachments—such as boom cycle counts, pump pressure levels, and hydraulic fluid temperature. This connectivity fuels the development of sophisticated predictive maintenance algorithms, utilizing sensor data to anticipate component wear specific to the vehicle’s specialized operational profile, thereby minimizing expensive operational downtime and extending asset life.

A third significant area is the incremental introduction of Advanced Driver Assistance Systems (ADAS) and partial autonomy (Level 2/3), specifically tailored for specialty tasks. Unlike standard highway autonomy, specialty vehicle automation focuses on low-speed, highly repetitive, and predictable movements, such as automated digging sequences, precision spreading, or autonomous maneuvering within controlled environments like construction sites or waste depots. Technologies like high-definition GPS, LiDAR, and computer vision are essential for ensuring the vehicle can accurately perceive its immediate working environment, particularly when interacting with complex obstacles or when operating large, potentially unstable attachments. Cybersecurity is also emerging as a foundational technological requirement, safeguarding the sensitive operational data transmitted between the vehicle, fleet management centers, and critical infrastructure networks.

Regional Highlights

- North America: Characterized by high technological maturity, North America represents a crucial market for specialty commercial vehicles, particularly in the heavy-duty segment associated with oil and gas, construction, and advanced municipal services. The region leads in the adoption of sophisticated telematics, AI-driven predictive maintenance solutions, and stringent safety standards, compelling manufacturers to integrate cutting-edge ADAS features. Government incentives, particularly related to infrastructure bills and climate action plans, are accelerating the replacement of aging ICE fleets with electric refuse trucks and utility vehicles.

- Europe: Driven by the European Union’s ambitious Green Deal objectives and extremely strict emissions standards (Euro VI/VII preparation), Europe is the global frontrunner in the transition towards alternative propulsion specialty vehicles. Demand is exceptionally high for compact, high-efficiency specialty vehicles suited for dense urban environments, such as electric ambulances and highly specialized, low-emission construction equipment. The region places a strong emphasis on modularity and standardization to facilitate cross-border operability and efficient maintenance.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, primarily fueled by the massive scale of infrastructure development and rapid urbanization across nations like China, India, and Southeast Asia. The demand here is largely volume-driven, focusing on reliable, cost-effective heavy-duty vehicles (dump trucks, mixers) for construction and essential municipal services (waste management). While price sensitivity is higher, regulatory pressure in megacities is increasingly driving investment in high-end, electrified specialty vehicles to combat severe air pollution.

- Latin America (LATAM): Growth in LATAM is closely linked to resource extraction industries (mining, agriculture) and ongoing public works investments. The market favors robust, easily maintainable vehicles capable of operating reliably in challenging terrain and varying fuel quality conditions. While adoption of advanced technology is slower than in North America or Europe, there is a growing interest in vehicle connectivity and fleet optimization solutions to improve logistics efficiency.

- Middle East and Africa (MEA): The MEA region exhibits specialized demand patterns. The Middle East segment, propelled by massive diversification projects and smart city initiatives (e.g., NEOM), requires high-specification construction equipment and specialized utility vehicles capable of withstanding extreme heat. Africa's market growth is concentrated in municipal sanitation and basic infrastructure development, driving demand for durable, affordable utility and waste management vehicles.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Specialty Commercial Vehicles Market.- Daimler Truck AG

- Volvo Group

- PACCAR Inc.

- Oshkosh Corporation

- REV Group Inc.

- MAN SE

- Scania AB

- IVECO S.p.A.

- XCMG Group

- Zoomlion Heavy Industry Science and Technology Co., Ltd.

- Caterpillar Inc.

- Liebherr Group

- Kenworth Truck Company

- Peterbilt Motors Company

- Rosenbauer International AG

- FAW Group Co., Ltd.

- Isuzu Motors Ltd.

- Foton Motor Group

- TATA Motors

- Pierce Manufacturing Inc.

Frequently Asked Questions

Analyze common user questions about the Specialty Commercial Vehicles market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are driving the shift toward electric specialty commercial vehicles?

The primary drivers are stringent government emission standards (such as ZEV mandates in urban zones), tax incentives for green fleets, high operating efficiency over the asset lifespan, and reduced noise pollution, which is crucial for municipal vehicles operating during sensitive hours.

How does the specialization complexity impact the total cost of ownership (TCO) for these vehicles?

Specialization significantly increases the initial capital expenditure (CAPEX) due to custom engineering and proprietary component integration. While specialty vehicles generally exhibit higher durability, their TCO is often higher due to specialized maintenance requirements, expensive customized parts, and the need for highly skilled technicians.

Which application segment holds the largest market share in specialty commercial vehicles?

The Construction and Mining application segment traditionally holds the largest market share, driven by the consistently high global demand for large-capacity dump trucks, concrete mixers, and mobile cranes essential for both residential and governmental infrastructure projects worldwide.

What role does telematics play in the operation of specialty commercial fleets?

Telematics provides critical operational intelligence by monitoring specialized equipment status (e.g., PTO use, hydraulic cycles), optimizing complex routes tailored to service points, enhancing driver safety through operational feedback, and enabling AI-driven predictive maintenance to maximize vehicle uptime.

What are the main regulatory challenges faced by specialty vehicle manufacturers?

Manufacturers must navigate complex, fragmented global regulations concerning vehicle weight and dimension limits, unique safety certifications for specialized machinery (e.g., crane stability standards), and rapidly evolving environmental emission standards (e.g., CO2 reduction targets), requiring constant design adaptation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager