Specialty Cosmetics Ingredients Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433094 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Specialty Cosmetics Ingredients Market Size

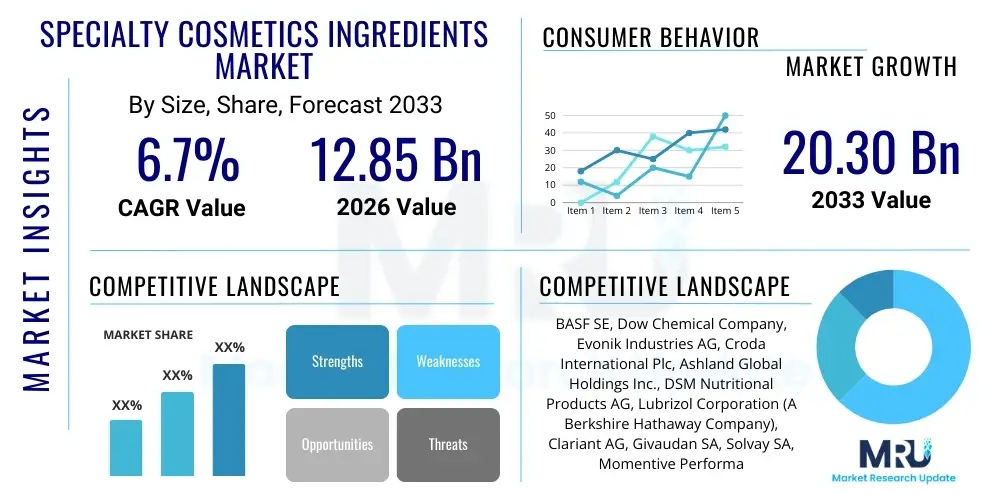

The Specialty Cosmetics Ingredients Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.7% between 2026 and 2033. The market is estimated at USD 12.85 billion in 2026 and is projected to reach USD 20.30 billion by the end of the forecast period in 2033.

Specialty Cosmetics Ingredients Market introduction

The Specialty Cosmetics Ingredients Market encompasses a diverse range of complex chemicals, natural extracts, and advanced functional compounds utilized to enhance the performance, safety, and aesthetic qualities of personal care and cosmetic products. These ingredients, which include specialty surfactants, active ingredients, thickeners, UV filters, and emollients, are critical for developing innovative formulations that address specific consumer needs, such as anti-aging, moisturizing, sun protection, and skin barrier repair. The demand is heavily influenced by accelerating consumer awareness regarding ingredient efficacy and sourcing, pushing manufacturers toward high-value, research-backed compounds that deliver measurable physiological benefits.

The primary applications of specialty cosmetic ingredients span across skincare, haircare, color cosmetics, and toiletries. In skincare, the emphasis is on high-performance actives like peptides, retinoids, and hyaluronic acid, crucial for product differentiation and premium positioning. Similarly, in haircare, specialized ingredients such as silicone alternatives, protein derivatives, and conditioning agents are employed to achieve targeted results like damage repair and volume enhancement. The shift towards "clean beauty" and natural sourcing mandates increased investment in biotechnology and green chemistry to sustainably produce efficacious ingredients, driving complexity and value within the supply chain.

Key driving factors fueling market expansion include rapid urbanization across emerging economies, increased disposable incomes supporting the purchase of high-end personal care products, and global demographic shifts, particularly the aging population demanding potent anti-aging solutions. Additionally, stringent regulatory frameworks demanding ingredient safety and transparency compel cosmetic manufacturers to utilize certified, high-quality specialty components. The ongoing scientific advancements in material science and fermentation technology further unlock new possibilities for bio-based and highly specialized ingredients, ensuring sustained growth and innovation within this essential segment of the consumer goods industry.

Specialty Cosmetics Ingredients Market Executive Summary

The Specialty Cosmetics Ingredients Market is experiencing robust expansion, primarily steered by shifting consumer preferences towards natural, sustainable, and multifunctional products, coupled with significant technological breakthroughs in green chemistry and biotechnology. Business trends highlight intense consolidation among major ingredient suppliers seeking vertical integration and geographical diversification, alongside strategic partnerships with emerging biotechnology firms to secure exclusive access to next-generation active compounds. Supply chain resilience, transparency, and ethical sourcing have become paramount competitive differentiators, influencing procurement decisions and driving premiumization across the formulation landscape. Furthermore, the rising adoption of personalized beauty regimes requires ingredients capable of highly specific functional delivery, spurring demand for customized specialty solutions.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, propelled by massive consumer bases in China and India, escalating awareness of personal grooming, and increased penetration of international beauty brands introducing sophisticated formulations. Europe maintains its lead in setting stringent regulatory standards, particularly concerning chemical safety and microplastic reduction, which necessitates continuous reformulation using specialized, compliant ingredients. North America is characterized by high demand for 'clean label' products and a rapid adoption rate for cutting-edge active ingredients, especially those derived from advanced scientific techniques or sustainable agricultural practices. These regional variations dictate specific ingredient portfolios and marketing strategies for global players.

Segment trends reveal a significant surge in demand for active ingredients, primarily driven by the efficacy promise of anti-aging and moisturizing formulations. Within the active ingredients category, peptides, vitamins (like Vitamin C and E derivatives), and botanical extracts designed for targeted delivery systems are witnessing exceptional growth. The functional ingredients segment, including specialty emollients and rheology modifiers, is expanding due to the need for enhancing product texture and stability while meeting non-toxic, non-irritant criteria. Sustainability mandates are accelerating the substitution of petrochemical-derived ingredients with natural alternatives, such as bio-based surfactants and sustainable thickening polymers, reshaping the composition of commodity and specialty ingredients alike.

AI Impact Analysis on Specialty Cosmetics Ingredients Market

User queries regarding the impact of Artificial Intelligence (AI) on the Specialty Cosmetics Ingredients Market primarily center on how AI accelerates R&D cycles, optimizes formulation development, and enhances predictive toxicology and efficacy testing. Common concerns involve the displacement of traditional lab work, the ethical implications of data-driven personalized ingredient recommendations, and the ability of smaller firms to afford the necessary AI infrastructure. Users are particularly interested in AI's role in identifying novel bio-active molecules from vast biological databases, predicting ingredient compatibility and stability in complex formulations, and tailoring ingredient mixes based on real-time consumer genetic or environmental data. The key theme emerging from user expectations is the shift towards 'smart formulation,' where AI reduces trial-and-error, enhances speed-to-market for specialized ingredients, and ensures compliance with global regulatory nuances by simulating ingredient interactions under various conditions.

- AI-Driven Discovery: Accelerates the identification of novel botanical extracts and synthetic molecules with specific dermatological properties, drastically reducing initial screening time.

- Formulation Optimization: Utilizes machine learning algorithms to predict the optimal concentration and combination of specialty ingredients for desired stability, texture, and sensory attributes.

- Predictive Toxicology: Employs deep learning models to screen specialty ingredients for potential adverse effects or allergenicity before expensive in vivo or in vitro testing.

- Personalization at Scale: Enables the recommendation of customized specialty ingredient profiles based on consumer data (skin type, environment, age, genomics), driving demand for highly adaptable ingredient platforms.

- Supply Chain Forecasting: Improves demand forecasting for niche specialty ingredients, optimizing inventory management and reducing waste, particularly for volatile natural materials.

- Regulatory Compliance Check: Automatically flags formulations containing ingredients that might breach regional regulatory limitations, enhancing global market accessibility and speed.

- Efficacy Modeling: Predicts the biological effectiveness (e.g., anti-wrinkle efficacy, moisturizing power) of new specialty compounds based on structural similarity to known actives.

DRO & Impact Forces Of Specialty Cosmetics Ingredients Market

The Specialty Cosmetics Ingredients Market is dynamically shaped by a confluence of driving factors, primarily the increasing global consumer demand for high-performance, multifunctional cosmetic products and the relentless pursuit of novel natural and sustainable raw materials. Restraints include the high cost associated with R&D and clinical trials required for novel specialty actives, along with the stringent and complex regulatory landscape that varies significantly across major geographies (e.g., EU REACH, China NMPA), which can delay market entry. Opportunities are abundant in the integration of biotechnology and precision fermentation for scalable, clean production of formerly rare natural compounds, and the growing focus on microbiome-friendly ingredients offers a vast avenue for specialized innovation. The primary impact forces are regulatory pressure favoring clean labels and transparent sourcing, and shifting consumer preferences toward customization and ethical sustainability, compelling suppliers to continuously innovate their ingredient portfolios.

Major market drivers include the pervasive trend of premiumization in cosmetics, where consumers are willing to pay more for products containing scientifically validated specialty ingredients like advanced peptides, stem cells, and encapsulated delivery systems that promise superior results. Furthermore, the pervasive influence of social media and beauty influencers rapidly disseminates information about ingredient efficacy, significantly boosting demand for specific, often previously niche, specialty compounds. The expanding application scope of specialty ingredients beyond traditional skincare into new areas such as specialized scalp treatments, ingestible beauty supplements, and blue light protection formulations also acts as a powerful driver, opening new revenue streams for manufacturers specializing in functional materials.

Conversely, significant restraints hinder growth, most notably the high capital expenditure required for establishing production facilities for bio-based or synthetic specialty ingredients, which often require complex extraction or synthesis processes. The inherent volatility in the pricing and availability of natural raw materials, often subject to climate change and agricultural yields, poses supply chain risks for key botanical extracts. Moreover, the development of specialty ingredients with new safety profiles necessitates lengthy and costly regulatory submissions, which disproportionately affects smaller innovators. However, these challenges are countered by substantial opportunities, including the untapped potential in developing specialty ingredients tailored for specific ethnic skin types and the escalating adoption of circular economy principles, transforming cosmetic manufacturing waste into valuable specialty components.

Segmentation Analysis

The Specialty Cosmetics Ingredients Market is comprehensively segmented based on functionality (e.g., Active Ingredients, Functional Ingredients), source (Natural vs. Synthetic), and application (e.g., Skincare, Haircare, Color Cosmetics). This structured segmentation enables stakeholders to analyze specific demand patterns, identify high-growth niches, and tailor their product development strategies effectively. The Active Ingredients segment, which includes components like anti-aging agents, UV filters, and skin lighteners, is the most dynamic due to intense consumer demand for visible results and high-performance formulations. Meanwhile, the Functional Ingredients segment focuses on improving the product's physical characteristics, such as texture, stability, and sensory profile, encompassing emollients, thickeners, and surfactants.

The segmentation by source highlights the accelerating transition towards natural and naturally derived specialty ingredients, driven by environmental consciousness and the 'clean beauty' movement, placing pressure on synthetic ingredient manufacturers to develop green chemistry alternatives. This segmentation is crucial for understanding regulatory compliance requirements, as natural extracts often face unique sourcing and standardization challenges. Application-wise, the skincare segment holds the largest market share, consistently demanding advanced specialty ingredients due to its direct link to medical and dermatological benefits, followed closely by haircare, which is increasingly focused on specialized treatments for scalp health and damage repair.

Understanding these segmentations provides critical insight into market maturity and investment potential. For instance, within the Active Ingredients segment, the development of microbiome-friendly ingredients and sophisticated encapsulation technologies represents key investment areas. Conversely, in the Functional Ingredients segment, the focus is on developing high-performance, sustainable alternatives to silicones and petrochemical surfactants. These detailed breakdowns allow market participants to focus resources on segments exhibiting superior growth rates and favorable regulatory environments, thereby maximizing market penetration and securing long-term competitive advantages.

- By Functionality:

- Active Ingredients (Anti-aging Agents, UV Absorbers, Conditioning Agents, Skin Lighteners, Peptides, Vitamins, Antioxidants)

- Functional Ingredients (Surfactants, Emulsifiers, Thickeners/Rheology Modifiers, Emollients, Preservatives, Colorants, pH Adjusters)

- By Source:

- Natural (Plant Extracts, Marine Derivatives, Biotechnological/Fermentation Products)

- Synthetic

- By Application:

- Skincare (Facial Care, Body Care)

- Haircare (Shampoos, Conditioners, Styling Products)

- Color Cosmetics

- Oral Care

- Fragrances

- Toiletries

Value Chain Analysis For Specialty Cosmetics Ingredients Market

The value chain for Specialty Cosmetics Ingredients is inherently complex, starting with the sourcing of raw materials, which involves both petrochemical derivatives (upstream analysis) and increasingly, high-purity natural sources such as specialized botanicals, marine algae, and biotechnological feedstocks. Upstream activities involve extensive R&D, focused on discovering and stabilizing novel active molecules, followed by complex manufacturing processes that ensure purity, efficacy, and regulatory compliance. Suppliers often rely on advanced extraction techniques, fermentation, or precision synthesis to produce ingredients suitable for cosmetic application, often necessitating significant capital investment in highly specialized production facilities. This phase is characterized by intellectual property protection and high barriers to entry due to the technical expertise required.

The midstream segment involves ingredient refinement, quality control, and distribution. Major specialty ingredient producers act as central hubs, supplying their portfolios directly or indirectly to cosmetic formulators and contract manufacturers (downstream analysis). Distribution channels are critical, comprising direct sales forces for major accounts and a network of specialized distributors and agents for smaller formulators globally. Indirect distribution channels, utilizing local warehousing and technical support, are crucial for penetrating fragmented regional markets and ensuring prompt delivery of sensitive, high-value components, often requiring temperature-controlled logistics. The technical service provided by ingredient suppliers—including formulation guidance and regulatory dossiers—is an essential value-added service in the midstream.

Downstream activities include the formulation and manufacturing of finished cosmetic products, followed by branding, marketing, and final retail distribution to end consumers. Direct distribution often involves large multinational cosmetic companies that procure directly from specialty ingredient houses for their high-volume, global brands. Indirect distribution involves smaller, niche brands, or contract manufacturers purchasing through regional distributors. The consumer, at the end of the chain, drives demand trends which feed back to the upstream R&D activities, particularly through the growing emphasis on transparency and clean labeling. The integrity of the distribution channel, ensuring ingredient traceability and quality preservation, is paramount to maintaining brand trust in the highly sensitive consumer goods sector.

Specialty Cosmetics Ingredients Market Potential Customers

The primary potential customers and end-users of Specialty Cosmetics Ingredients are the global cosmetic and personal care product manufacturers, ranging from large multinational corporations (MNCs) to small and medium-sized enterprises (SMEs) and private label brands. These customers are highly sophisticated buyers, requiring not only technical specifications and competitive pricing but also comprehensive regulatory support, clinical data substantiating efficacy claims, and assurance of sustainable and ethical sourcing practices. Specifically, premium and luxury cosmetic brands are the largest consumers of high-value active ingredients, as product differentiation is crucial for their market positioning, driving demand for specialized encapsulation technologies and unique bio-actives.

Beyond traditional finished product manufacturers, contract manufacturing organizations (CMOs) and private label developers constitute a rapidly expanding customer base. CMOs require a vast and varied portfolio of specialty ingredients to fulfill the diverse needs of their clients, often focusing on flexibility and speed in incorporating new market trends, such as CBD integration or highly specific natural extracts. Furthermore, pharmaceutical and cosmeceutical companies represent a high-value customer segment, utilizing specialty ingredients that bridge the gap between cosmetics and medicine, requiring clinical grade purity and robust scientific evidence for their products, particularly in the realm of advanced dermatological treatments and controlled delivery systems.

The customer landscape also includes raw material distributors and specialized chemical traders, who purchase large volumes of specialty ingredients for regional inventory and subsequent sale to smaller, localized cosmetic producers who lack direct relationships with major global suppliers. These indirect customers rely heavily on the supplier for technical training and localized regulatory documentation. Ultimately, the purchasing decision across all customer types is increasingly influenced by consumer transparency demands, compelling manufacturers to invest only in specialty ingredients that can demonstrate complete traceability from source to final formulation, aligning with global sustainability mandates and consumer trust requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 12.85 Billion |

| Market Forecast in 2033 | USD 20.30 Billion |

| Growth Rate | 6.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Dow Chemical Company, Evonik Industries AG, Croda International Plc, Ashland Global Holdings Inc., DSM Nutritional Products AG, Lubrizol Corporation (A Berkshire Hathaway Company), Clariant AG, Givaudan SA, Solvay SA, Momentive Performance Materials Inc., Lonza Group Ltd, Stepan Company, Symrise AG, Galaxy Surfactants Ltd, Rahn AG, Seppic SA (Air Liquide subsidiary), Spec-Chem Industry Inc., Wacker Chemie AG, Kemin Industries Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Specialty Cosmetics Ingredients Market Key Technology Landscape

The Specialty Cosmetics Ingredients market is undergoing a profound technological transformation driven by the need for superior efficacy, unparalleled purity, and sustainable production methods. Key enabling technologies revolve around advanced delivery systems, which include encapsulation techniques like liposomes, nanoemulsions, and solid lipid nanoparticles, designed to protect sensitive active ingredients (such as Vitamin C or Retinol) and ensure their controlled, targeted release into the dermal layers, thereby maximizing bioavailability and minimizing irritation. This micro-encapsulation technology is crucial for stabilizing otherwise volatile compounds and allows formulators to achieve high efficacy with lower active concentrations, meeting both performance and safety expectations of the modern consumer.

Another dominant technological trend is the utilization of white biotechnology, specifically precision fermentation, to produce highly pure, standardized, and sustainable specialty ingredients, such as hyaluronic acid, bio-peptides, and specialized ceramides, without relying on traditional petrochemical synthesis or resource-intensive agricultural harvesting. Fermentation offers significant advantages in terms of scalability, consistent quality, and reduced environmental footprint, making it the preferred route for next-generation active ingredients that adhere to clean beauty and vegan mandates. Furthermore, the application of supercritical fluid extraction (SFE) is gaining traction for isolating high-purity, solvent-free botanical extracts, preserving the bioactivity of thermosensitive compounds and fulfilling the demand for clean, minimally processed natural ingredients.

Beyond synthesis and delivery, formulation technologies are also advancing significantly. High-throughput screening and computational chemistry (assisted by AI) are revolutionizing the discovery phase by rapidly modeling and testing potential ingredient interactions and predicting stability, cutting down R&D time dramatically. Furthermore, the development of specialized materials, such as bio-mimetic polymers and second-skin technology, aims to enhance the sensory experience and functionality of finished products. These technologies provide unique functional benefits, such as enhanced breathability, extended wear, or immediate visual effects, forcing ingredient manufacturers to continuously innovate their offerings to match the complexity and sophistication demanded by these advanced cosmetic formats.

Regional Highlights

The global Specialty Cosmetics Ingredients Market exhibits substantial regional variation, dictated by local regulatory climates, consumer wealth, and dominant cultural beauty practices. North America, encompassing the United States and Canada, represents a high-value market driven by consumer willingness to invest in premium, innovative, and clinically backed specialty ingredients. This region leads in adopting clean label and sustainable sourcing practices, creating high demand for non-GMO, organic, and ethically sourced active ingredients. Regulatory clarity, particularly regarding emerging ingredients like cannabis derivatives (CBD), also accelerates innovation, focusing investment on advanced anti-aging and sun protection technologies.

Europe holds a commanding position, primarily due to the stringent regulatory landscape enforced by the European Union, which mandates rigorous safety assessments and transparency (e.g., REACH and the ban on numerous ingredients). This regulatory environment compels market participants to innovate continuously, focusing on developing sustainable alternatives to restricted substances like parabens and microplastics, driving leadership in specialty green chemistry and bio-based emollients. Germany, France, and the UK are key consumption hubs, with a strong cultural emphasis on dermatologically tested and high-quality, scientifically validated cosmetic formulations.

Asia Pacific (APAC) is projected to be the engine of growth, characterized by rapid market expansion fueled by the immense, rising middle-class populations in China, India, Japan, and South Korea. South Korea and Japan, in particular, serve as global trendsetters, driving massive demand for highly specialized ingredients centered around skin whitening, hydration, and multifunctional formulations often incorporated into complex multi-step routines. The increasing penetration of Western beauty standards combined with robust domestic innovation, particularly in biotechnology for ingredients sourced from marine and local botanicals, positions APAC as the most crucial market for future growth, despite varying regulatory standards across different nations within the region.

Latin America and the Middle East & Africa (MEA) represent emerging markets demonstrating robust potential. Latin American markets, notably Brazil and Mexico, are strong consumers of haircare and personal hygiene products, generating high demand for specialty surfactants, conditioning polymers, and colorants. The MEA region is witnessing high demand for luxury cosmetics and specialty sun protection ingredients suitable for extreme climates. Although currently smaller, these regions offer significant opportunities for specialty ingredient suppliers capable of adapting product profiles to specific local climatic conditions and diverse consumer needs, particularly those emphasizing halal certification and extreme moisturizing properties.

- North America (USA, Canada): Market leader in personalized beauty and clean label trends; high expenditure on advanced anti-aging actives; rapid adoption of AI-driven formulation R&D.

- Europe (Germany, France, UK): Focus on sustainability, stringent regulatory compliance, and green chemistry innovation; leading market for bio-based and eco-certified functional ingredients.

- Asia Pacific (China, Japan, South Korea, India): Fastest-growing region; driven by rapid urbanization, high demand for whitening/brightening and complex multi-step routine ingredients; dominance of advanced marine and fermentation-derived actives.

- Latin America (Brazil, Mexico): Strong demand for specialty haircare ingredients and highly localized natural extracts; focus on high-volume functional ingredients.

- Middle East & Africa (MEA): Emerging market with rising demand for high-end luxury cosmetics and specialty UV protection ingredients; increasing interest in halal-certified specialty components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Specialty Cosmetics Ingredients Market.- BASF SE

- Dow Chemical Company

- Evonik Industries AG

- Croda International Plc

- Ashland Global Holdings Inc.

- DSM Nutritional Products AG

- Lubrizol Corporation (A Berkshire Hathaway Company)

- Clariant AG

- Givaudan SA

- Solvay SA

- Momentive Performance Materials Inc.

- Lonza Group Ltd

- Stepan Company

- Symrise AG

- Galaxy Surfactants Ltd

- Rahn AG

- Seppic SA (Air Liquide subsidiary)

- Spec-Chem Industry Inc.

- Wacker Chemie AG

- Kemin Industries Inc.

- Lucas Meyer Cosmetics (IFF)

- Vantage Specialty Chemicals

- Hallstar Company

- Innospec Inc.

- Provital S.A.

- B&T S.r.l.

- Centerchem, Inc.

- Kobo Products, Inc.

- Merck KGaA

Frequently Asked Questions

Analyze common user questions about the Specialty Cosmetics Ingredients market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary segments driving growth in the Specialty Cosmetics Ingredients Market?

The primary growth segment is Active Ingredients, driven by accelerating consumer interest in scientifically proven anti-aging, hydration, and skin-brightening formulations. The Functional Ingredients segment is also critical, focusing on developing sustainable emulsifiers and emollients to meet clean beauty texture demands.

How does the clean beauty trend specifically impact ingredient sourcing and manufacturing?

The clean beauty trend mandates a shift away from petrochemical-derived components towards natural, sustainably sourced, and bio-technologically produced ingredients. This increases investment in precision fermentation and supercritical fluid extraction to ensure ingredient purity, traceability, and minimal environmental impact.

Which region offers the most significant future opportunity for specialty ingredient manufacturers?

Asia Pacific (APAC), particularly China and South Korea, offers the most significant future opportunity. This growth is underpinned by rapidly increasing consumer disposable incomes, complex localized beauty routines, and robust domestic innovation in active ingredient development, especially in areas like marine and botanical biotechnology.

What major technological advancement is most critical for future ingredient innovation?

Advanced delivery systems, such as encapsulation techniques (liposomes and nanoemulsions), are most critical. These technologies ensure the controlled and targeted delivery of high-efficacy, often sensitive, active ingredients, maximizing performance while enhancing stability and reducing the potential for dermal irritation.

What role do regulatory challenges play in the expansion of this market?

Regulatory challenges, specifically the lack of global harmonization and stringent safety requirements in key regions like the EU, act as significant restraints. They necessitate high R&D investment and lengthy approval processes, compelling manufacturers to continually reformulate and provide extensive toxicological data to ensure market compliance and consumer safety.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager