Specialty Gas Cylinder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432819 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Specialty Gas Cylinder Market Size

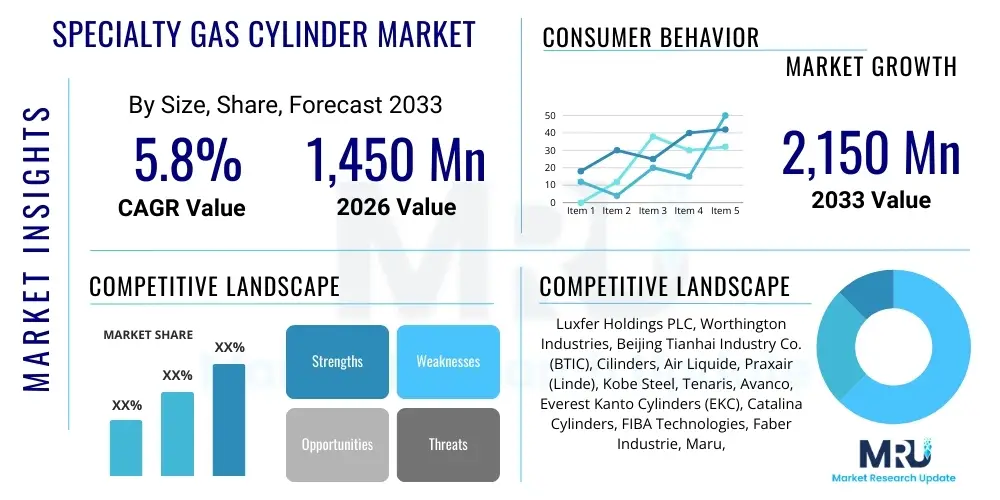

The Specialty Gas Cylinder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $1,450 million in 2026 and is projected to reach $2,150 million by the end of the forecast period in 2033.

Specialty Gas Cylinder Market introduction

Specialty Gas Cylinders are essential pressure vessels designed for the safe storage and transportation of high-purity, rare, or calibration gases, which are critical inputs across a vast spectrum of advanced industrial and scientific applications. These cylinders are differentiated from standard industrial gas cylinders by their stringent internal surface finish, purity maintenance capabilities, specific valve configurations, and robust construction materials necessary to prevent contamination or degradation of the contained specialty gases, such as ultra-high-purity (UHP) gases, precise gas mixtures, and rare inert gases. The integrity and material composition of these cylinders, often including high-grade stainless steel or specially treated aluminum, are paramount to ensuring the stability and traceability of the gas contents, which directly impacts the quality control in end-user processes, particularly in highly sensitive sectors like semiconductor manufacturing and clinical diagnostics.

The primary applications driving the demand for specialty gas cylinders include their indispensable role in the electronics industry for doping, etching, and inert atmosphere creation during microchip fabrication, where gas purity must often exceed 99.9999% (6.0 purity). Furthermore, the healthcare sector relies heavily on these vessels for medical diagnostics, respiratory therapy, and the administration of specialized anesthetic gases, requiring seamless regulatory compliance and material inertness. The market's robust growth trajectory is underpinned by the accelerating global expansion of the semiconductor and photovoltaic industries, coupled with rising governmental investment in advanced medical infrastructure and environmental monitoring technologies, all of which necessitate reliable, high-integrity specialty gas delivery systems.

Key benefits associated with the optimized use of these cylinders include enhanced operational safety due to superior design and rigorous testing protocols, ensuring compliance with international transportation standards (DOT, ISO, TPED). They offer unparalleled purity retention, minimizing process variability and maximizing efficiency in sophisticated manufacturing environments. The driving factors for market proliferation include stringent environmental regulations demanding precise calibration gases for emissions monitoring, the continuous miniaturization and complexity of electronic components necessitating purer input materials, and the globalization of the medical gas supply chain, requiring standardized and reliable containment solutions across diverse geographical regions.

Specialty Gas Cylinder Market Executive Summary

The Specialty Gas Cylinder Market exhibits a consistent upward trend, primarily driven by significant advancements in the global electronics and healthcare sectors. Business trends indicate a strong focus on lightweight materials, particularly composite cylinders and high-strength aluminum alloys, addressing logistics costs and enhancing portability for specialized field applications like environmental sensing and portable medical devices. Key manufacturers are increasingly investing in advanced cleaning and passivation techniques for internal cylinder surfaces to meet the ever-increasing purity demands from semiconductor fabrication plants (fabs). Strategic alliances between cylinder manufacturers and specialty gas producers are becoming common, aiming to streamline the supply chain and offer integrated gas delivery solutions, thus solidifying market competitiveness and intellectual property surrounding advanced valve technology.

Regional trends highlight the Asia Pacific (APAC) region as the primary growth engine, fueled by the massive concentration of semiconductor production capabilities in countries such as Taiwan, South Korea, China, and Japan, alongside rapidly expanding healthcare infrastructure in emerging economies like India and Southeast Asia. North America and Europe maintain stable demand, characterized by strict regulatory environments and a focus on high-value niche applications, including analytical laboratory gases and advanced R&D initiatives. The demand in Latin America and MEA is slowly increasing, correlated with infrastructural projects and the localization of industrial manufacturing facilities, particularly in welding and calibration services, though market penetration remains dependent on establishing robust distribution networks.

Segmentation trends indicate that the aluminum segment is gaining momentum due to its non-magnetic properties and suitability for highly reactive gases, critical in medical and analytical applications. However, carbon steel continues to dominate in volume applications due to its cost-effectiveness and high-pressure capabilities for industrial use. Application-wise, the electronics segment commands the largest market share, directly benefiting from the cyclical upswing and sustained capital expenditure in memory and logic chip production. The shift towards portable instrumentation is boosting demand for smaller, lightweight composite cylinders, impacting the design and manufacturing specialization across the market segments.

AI Impact Analysis on Specialty Gas Cylinder Market

Common user inquiries concerning the influence of Artificial Intelligence (AI) on the Specialty Gas Cylinder Market predominantly focus on how AI can optimize supply chain logistics, predict maintenance needs, and enhance safety compliance. Users are keenly interested in predictive maintenance models leveraging sensor data (IoT integration) to monitor cylinder conditions, pressure decay rates, and usage cycles, aiming to minimize costly unplanned downtime and ensure gas purity integrity throughout the cylinder lifecycle. Furthermore, questions arise regarding AI's role in refining gas mixing processes, optimizing inventory management for varied gas types and volumes, and improving demand forecasting, especially in volatile sectors like electronics manufacturing where demand swings rapidly. The core concern revolves around whether AI-driven systems can lead to a more efficient, safer, and ultimately more cost-effective management of high-value, high-purity gas assets.

- AI-driven Predictive Maintenance: Analyzing sensor data (pressure, temperature, valve cycles) to forecast cylinder repair or replacement needs, maximizing asset utilization and reducing risk of unexpected failure, ensuring continuous gas supply integrity.

- Supply Chain Optimization: Utilizing machine learning algorithms to forecast regional demand fluctuations for specific gas mixtures, optimizing cylinder stocking levels, and determining the most efficient transportation routes, minimizing overall logistics costs.

- Purity Assurance & Quality Control: AI vision systems integrated into the manufacturing process for non-destructive inspection of internal surface cleanliness and defect detection, surpassing human capability in identifying microscopic impurities critical for UHP gas containment.

- Automated Compliance Monitoring: AI platforms tracking regulatory changes (DOT, ADR, ISO) and automatically auditing cylinder records to ensure timely hydrostatic testing, requalification, and adherence to specific gas handling protocols, significantly reducing manual compliance burdens.

- Smart Inventory Management: Employing AI to manage large fleets of cylinders, optimizing allocation based on real-time end-user consumption patterns, improving traceability, and reducing the incidence of "lost" or misplaced high-value cylinders.

DRO & Impact Forces Of Specialty Gas Cylinder Market

The Specialty Gas Cylinder Market is profoundly influenced by a complex interplay of drivers, restraints, and opportunities that collectively determine its trajectory and profitability. The primary drivers stem from the exponential global growth of semiconductor manufacturing, the expansion of high-precision analytical chemistry techniques, and increasingly stringent global environmental mandates requiring highly accurate calibration gases. Conversely, market growth is often restrained by the extremely high capital expenditure required for specialized cylinder manufacturing and surface treatment facilities, coupled with the long re-qualification cycles and regulatory complexities imposed by international transportation bodies. The inherent volatility in raw material prices, particularly specialized alloys, also imposes cost pressures. Significant opportunities lie in the development and mass adoption of lightweight composite cylinders and the integration of smart cylinder technologies (IoT sensors) that offer real-time monitoring of gas consumption and cylinder location, addressing both efficiency and safety concerns in remote or high-tech operational environments.

Impact forces currently shaping the market are largely focused on technological innovation and regulatory harmonization. The push for ultra-high purity containment, driven by sub-10 nanometer semiconductor node fabrication, necessitates continuous material science advancements in cylinder linings and valve sealing technology. Furthermore, the global drive toward decarbonization and the use of specialized gases like hydrogen and its mixtures for energy applications presents a novel demand vertical requiring specialized, ultra-safe containment vessels. The reliance on sophisticated, proprietary valve technology creates high barriers to entry, strengthening the position of established manufacturers who possess the necessary intellectual property and economies of scale. These forces mandate a strategy centered on continuous quality improvement and adherence to evolving international safety standards (e.g., ISO 11114 series).

In summary, while the market is propelled by structural demand from high-tech industries and strict regulatory requirements favoring high-integrity vessels, it faces bottlenecks related to manufacturing complexity and capital intensity. Successful market players must capitalize on opportunities in material innovation (composites, advanced alloys) and digital integration (smart cylinders) to overcome existing restraints and leverage the robust long-term demand generated by the digital and medical revolutions. The critical balance lies between managing production costs and meeting the uncompromising purity and safety standards required by the end-user applications.

Segmentation Analysis

The Specialty Gas Cylinder Market is systematically segmented based on material type, cylinder size (capacity), operating pressure, and application, reflecting the diverse and highly specialized requirements of various end-user industries. Segmentation by material is crucial, as the choice of metal or composite dictates the suitability for specific corrosive or highly reactive specialty gases; carbon steel is generally preferred for inert and less reactive bulk gases, while stainless steel and aluminum are essential for medical, electronic, and high-purity mixtures requiring superior surface inertness and non-magnetic properties. Cylinder size segmentation ensures efficient transportation and handling, ranging from portable research cylinders to large stationary bundles for high-volume industrial use.

Further analysis focuses heavily on the application spectrum, which dictates both volume and margin. The electronics segment demands the highest purity levels and is often characterized by proprietary material requirements and bespoke valve configurations, resulting in higher average selling prices (ASPs). The healthcare and medical segment requires cylinders compliant with specific pharmacopeia and medical device standards, focusing on reliability and traceability. Meanwhile, environmental monitoring and calibration applications drive demand for highly accurate gas mixtures contained in smaller, more easily transportable vessels. Understanding these distinct segment needs is vital for manufacturers planning production capacity and optimizing their product portfolio.

- By Material Type:

- Carbon Steel Cylinders

- Stainless Steel Cylinders

- Aluminum Cylinders

- Composite Cylinders (Fiber-wrapped, fully wrapped)

- By Operating Pressure:

- High-Pressure Cylinders (150 Bar to 300 Bar+)

- Low-Pressure Cylinders (Below 50 Bar)

- By Cylinder Capacity:

- Portable Cylinders (Small, less than 10 liters)

- Medium Cylinders (10 liters to 50 liters)

- Bulk Cylinders/Bundles (Large capacity units)

- By Application:

- Electronics and Semiconductor Manufacturing (Etching, Doping, CVD)

- Healthcare and Medical (Anesthetic Gases, Calibration, Medical Oxygen)

- Analytical Laboratories and Research (Chromatography, Spectrometry)

- Industrial and Manufacturing (Welding, Laser Applications)

- Environmental Monitoring and Calibration

- Automotive and Transportation (Fuel Cell Testing)

Value Chain Analysis For Specialty Gas Cylinder Market

The value chain for the Specialty Gas Cylinder Market begins with upstream activities involving the sourcing of highly specialized raw materials, primarily high-strength steel alloys, specialized aluminum, and advanced composite fibers (carbon or glass). This stage is characterized by high quality control and traceability requirements. Midstream activities encompass the complex manufacturing processes: forging, heat treatment, precise internal surface cleaning (acid passivation or electro-polishing to achieve UHP standards), welding (for multi-piece cylinders), and the critical integration of sophisticated, proprietary valve assemblies and safety relief devices. Quality assurance and compliance testing (hydrostatic testing, burst tests) constitute a major cost element in this phase, ensuring adherence to stringent international safety norms.

The downstream segment involves specialized logistics, distribution, and lifecycle management. Specialty gas cylinders are typically distributed through two primary channels. Direct distribution involves major specialty gas producers (who often own large fleets of cylinders) procuring directly from manufacturers and then leasing or supplying the cylinders filled with gas directly to large industrial end-users (e.g., semiconductor fabs). Indirect distribution utilizes specialized industrial distributors and independent gas suppliers who manage regional inventory, cylinder refilling, and localized customer service, particularly catering to smaller laboratories, welding shops, and regional hospitals. Refurbishment and re-qualification centers, which perform mandatory periodic testing, are also integral to the downstream chain, extending the usable life of the asset.

Profitability within the value chain is concentrated at the manufacturing stage for patented cylinder designs and in the gas filling/distribution stage, where value is added through highly technical gas mixing and purity certification. Cylinder manufacturers must maintain robust inventory due to the long lead times for specialized materials, while distributors focus on optimizing the logistics loop (getting empties back for refilling). The movement of cylinders is intrinsically linked to the movement of the gas itself, making inventory management (tracking assets worth millions of dollars) a critical area for efficiency improvement and technological investment, often utilizing RFID or QR codes for seamless traceability across the supply network.

Specialty Gas Cylinder Market Potential Customers

The potential customer base for the Specialty Gas Cylinder Market is highly diverse, spanning multiple high-technology and mission-critical sectors where gas purity and reliable containment are non-negotiable prerequisites. Primary buyers include major global semiconductor fabrication plants (fabs) and integrated device manufacturers (IDMs), which consume vast quantities of ultra-high purity and toxic process gases essential for every stage of microchip creation, ranging from deposition to cleaning and etching. Secondly, large medical institutions, hospitals, and specialized clinical laboratories represent major buyers, utilizing cylinders for medical oxygen, nitrous oxide, and complex calibration mixtures required for blood gas analysis and diagnostic equipment validation.

In addition to these core segments, a substantial customer group comprises independent industrial gas distributors and large multinational gas companies (such as Linde, Air Liquide, and Air Products) who purchase cylinders in bulk from manufacturers to build and maintain their own rental fleets. These gas suppliers act as the intermediaries who service thousands of smaller end-users. Other key buyers are advanced research laboratories and university research facilities utilizing exotic gases for novel material synthesis or high-energy physics experiments, requiring highly specialized, often custom-designed, low-volume cylinders. Furthermore, environmental protection agencies and manufacturers of environmental monitoring equipment are crucial customers, demanding specialized vessels for maintaining certified reference gas mixtures used in emissions testing and air quality control systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1,450 Million |

| Market Forecast in 2033 | $2,150 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Luxfer Holdings PLC, Worthington Industries, Beijing Tianhai Industry Co. (BTIC), Cilinders, Air Liquide, Praxair (Linde), Kobe Steel, Tenaris, Avanco, Everest Kanto Cylinders (EKC), Catalina Cylinders, FIBA Technologies, Faber Industrie, Maru, Messer Group, SCI, Enric Group, Norris Cylinder Company, Taylor-Wharton, Hebei Baigong Industrial Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Specialty Gas Cylinder Market Key Technology Landscape

The technology landscape of the Specialty Gas Cylinder Market is continually evolving, driven primarily by the need for superior gas purity retention and enhanced safety standards. A major technological focus area is the internal surface treatment of the cylinders. Techniques such as electro-polishing, SilcoTek coating, and specialized acid passivation are essential for creating an inert, non-reactive interior surface capable of maintaining ultra-high purity levels (99.9999% purity) required by the electronics industry. These proprietary lining technologies prevent the cylinder material from adsorbing, absorbing, or reacting with the contained specialty gas mixtures, ensuring their efficacy and stability over long periods. The effectiveness of these treatments directly correlates with the ability of the manufacturer to serve the most demanding high-tech applications.

Another critical technological frontier involves the material science of the cylinders themselves, particularly the development and scaling of lightweight composite cylinders. These cylinders utilize carbon fiber or glass fiber windings over a thin metallic or plastic liner (Type 3 and Type 4 cylinders), offering significant weight reduction compared to traditional steel vessels. This lightweight advantage reduces transportation costs and improves handling in field applications, such as portable medical oxygen delivery and remote environmental monitoring stations. Furthermore, advancements in specialized valve technology—including high-performance, leak-tight diaphragm valves made from specialized alloys—are crucial for handling highly corrosive or toxic specialty gases, ensuring safety and minimizing fugitive emissions.

The integration of digital technologies, often referred to as "Smart Cylinder" technology, represents the future operational standard. This includes embedding IoT sensors, RFID tags, or telematics into the cylinder collars to monitor real-time parameters such as internal pressure, temperature, location, and fill status. This connectivity allows distributors and end-users to optimize inventory management, improve predictive maintenance scheduling for hydrostatic testing, and ensure compliance. This technological integration transforms the cylinder from a passive storage vessel into an active, traceable asset within the industrial internet of things (IIoT), dramatically improving operational efficiency and accountability across the complex specialty gas supply chain.

Regional Highlights

- Asia Pacific (APAC): The APAC region is projected to maintain its dominance in the Specialty Gas Cylinder Market, driven overwhelmingly by its status as the global hub for semiconductor and electronics manufacturing. Countries like Taiwan (TSMC), South Korea (Samsung, SK Hynix), and China are characterized by massive, continuous investments in new fabrication facilities (fabs), creating insatiable demand for UHP gas containment solutions. Additionally, the rapid urbanization and expansion of healthcare facilities across India, Vietnam, and other Southeast Asian nations are accelerating the need for reliable medical and calibration gas cylinder fleets. The regional market benefits from both high-volume industrial use and the growth of local manufacturing capabilities for cylinder production.

- North America: North America holds a mature and technologically advanced market share, distinguished by stringent safety regulations and a high demand for specialized, niche gas mixtures used in advanced research, aerospace, and high-end analytical laboratories. Growth is stable, focusing less on sheer volume and more on high-value products, including advanced composite cylinders for lightweight applications and specialized materials for handling high-purity hydrogen required by the emerging fuel cell industry. The US regulatory framework heavily influences safety standards and re-qualification cycles globally, setting a high bar for market entrants.

- Europe: The European market is characterized by robust demand from the healthcare sector, stringent environmental monitoring mandates (driving calibration gas demand), and a strong automotive industry utilizing specialized gases for emissions testing and component manufacturing. Germany, France, and the UK are key contributors. European manufacturers often lead in the development of lightweight Type 4 composite cylinders due to their focus on sustainability and logistical efficiency. Regulatory compliance under directives like TPED (Transportable Pressure Equipment Directive) is a primary market barrier and differentiator for regional players.

- Latin America (LATAM): The LATAM market is in a developing phase, with demand primarily tied to core industrial sectors like mining, petrochemicals, and basic manufacturing, requiring industrial-grade specialty gases and welding mixtures. The market size is smaller, heavily dependent on imports, and characterized by price sensitivity. Brazil and Mexico are the largest consumers, exhibiting increasing requirements driven by localized medical infrastructure improvements and expansion of R&D facilities.

- Middle East & Africa (MEA): Growth in MEA is concentrated around oil & gas processing (requiring instrument and calibration gases), large infrastructure projects, and the expansion of modern healthcare services in Gulf Cooperation Council (GCC) countries. The market requires high-durability cylinders suitable for harsh climate conditions. Local sourcing and distribution networks are critical challenges, making partnerships with global gas suppliers essential for market penetration.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Specialty Gas Cylinder Market.- Luxfer Holdings PLC

- Worthington Industries

- Beijing Tianhai Industry Co. (BTIC)

- Cilinders

- Air Liquide

- Praxair (Linde)

- Kobe Steel

- Tenaris

- Avanco

- Everest Kanto Cylinders (EKC)

- Catalina Cylinders

- FIBA Technologies

- Faber Industrie

- Maru

- Messer Group

- SCI

- Enric Group

- Norris Cylinder Company

- Taylor-Wharton

- Hebei Baigong Industrial Co. Ltd.

- Metal Mate Co., Ltd.

- Hengyang Steel Tube Group

- Guangzhou Pearl River Cylinder Co., Ltd.

- GCE Group

Frequently Asked Questions

Analyze common user questions about the Specialty Gas Cylinder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between standard industrial gas cylinders and specialty gas cylinders?

Specialty gas cylinders are engineered for ultra-high purity retention, featuring specialized internal surface treatments (like electro-polishing or coatings) and high-integrity valve assemblies, ensuring the contained gases, such as UHP electronics gases or certified mixtures, maintain purity levels often exceeding 99.999%. Standard cylinders are designed for general industrial gases where purity requirements are less stringent.

Which material type holds the largest market share in the specialty gas cylinder segment?

Carbon steel cylinders currently hold the largest market share by volume due to their cost-effectiveness and robustness for high-pressure industrial applications and non-corrosive inert gases. However, aluminum and composite cylinders are rapidly increasing their share in critical applications demanding lightweight construction, superior internal surface inertness, and non-magnetic properties, especially in healthcare and electronics.

How is the growth of the semiconductor industry impacting the demand for specialty gas cylinders?

The semiconductor industry is the single largest driver of the specialty gas cylinder market. As fabrication moves to smaller process nodes (sub-10nm), the demand for ultra-high-purity (UHP) and complex specialty gas mixtures for etching and deposition increases exponentially, directly boosting demand for high-specification, contamination-free stainless steel and aluminum cylinders capable of retaining this extreme purity.

What role do smart cylinders play in modern specialty gas management?

Smart cylinders integrate IoT sensors and connectivity (RFID/telematics) to provide real-time data on pressure, temperature, location, and remaining gas volume. This technology enhances safety, optimizes logistics by predicting reordering needs, reduces inventory loss, and ensures compliance with mandatory re-qualification schedules, shifting gas management from reactive to proactive.

What are the key regulatory requirements governing specialty gas cylinder use and manufacturing?

Manufacturing and use are strictly governed by international standards, including ISO 11114 (gas compatibility), ISO 9809 (design and testing), and regional transportation regulations such as DOT (US Department of Transportation), ADR (European Agreement concerning the International Carriage of Dangerous Goods by Road), and TPED (Transportable Pressure Equipment Directive) in Europe. Compliance requires mandatory periodic hydrostatic testing (re-qualification) and visual inspection.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager