Specialty Green Coffee Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438438 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Specialty Green Coffee Market Size

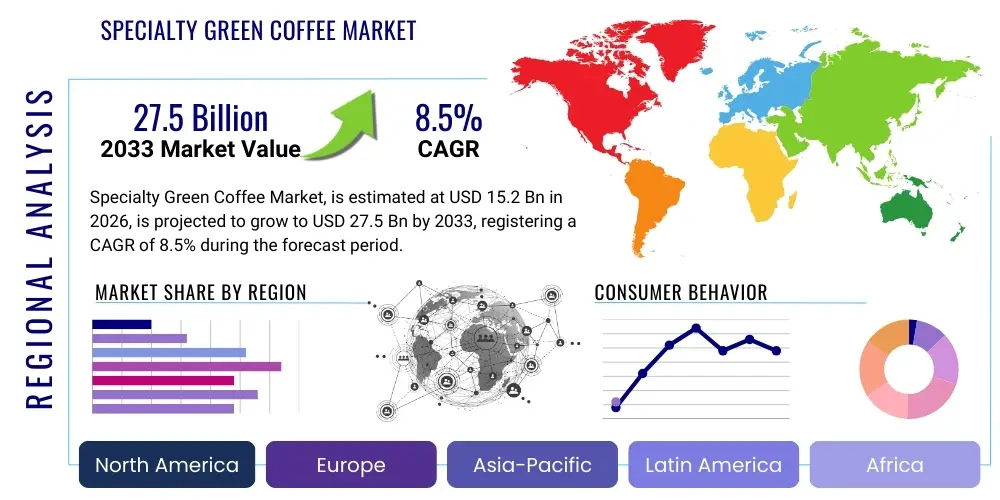

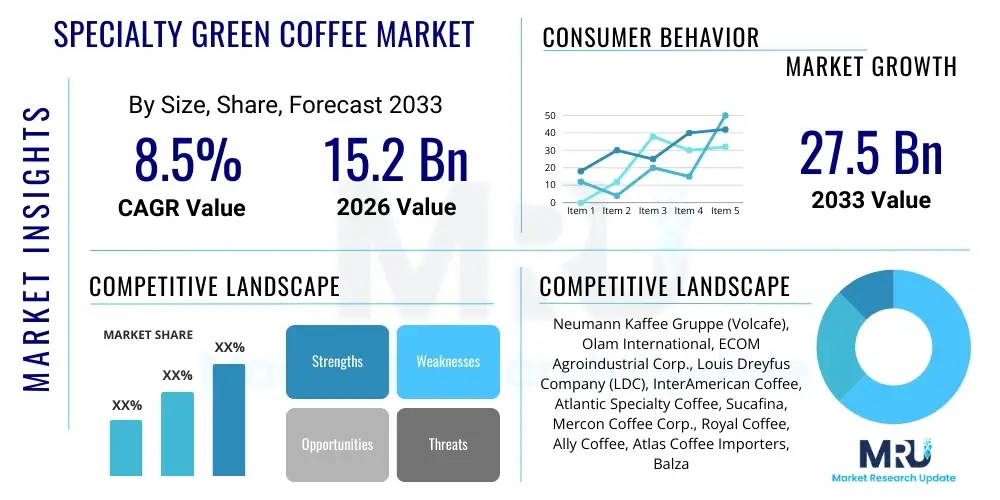

The Specialty Green Coffee Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 15.2 Billion in 2026 and is projected to reach USD 27.5 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by escalating global consumer demand for high-quality, traceable, and ethically sourced coffee, particularly among affluent demographic segments in developed economies. The specialty sector, defined by superior bean quality, unique flavor profiles, and strict grading standards (scoring 80 points or above on a 100-point scale), maintains a significant premium over the commodity market, ensuring robust revenue growth. Market dynamics are heavily influenced by climate resilience strategies in producing regions and technological advancements aimed at improving yield and consistency, positioning specialty green coffee as a cornerstone of future sustainable agriculture models.

Specialty Green Coffee Market introduction

The Specialty Green Coffee Market encompasses unroasted coffee beans of exceptional quality, meticulously sourced, prepared, and cupped to demonstrate unique characteristics, distinguishing them from standard commercial grades. These high-scoring beans are the raw material for premium roasted coffee products consumed globally. The market's distinction relies heavily on traceability, ensuring consumers are aware of the bean's origin, farm conditions, processing method, and specific varietal characteristics. Key product types include Arabica and high-end Robusta varieties, processed primarily through washed, natural, or honey methods, each imparting distinct flavor complexity. Major applications span high-end cafes, gourmet roasters, hospitality industries, and direct-to-consumer (D2C) subscription services focused on artisanal and single-origin offerings.

The core benefits driving market adoption include superior flavor and aroma complexity, higher perceived value, and established ethical sourcing standards which resonate strongly with modern, socially conscious consumers. Specialty green coffee beans often adhere to certifications like Fair Trade, Organic, and Rainforest Alliance, addressing consumer demands for sustainability and equity within the supply chain. Furthermore, the market benefits the producer by providing significantly higher prices, encouraging investment in quality infrastructure and sustainable farming practices. This symbiotic relationship between high consumer willingness to pay and producer incentives forms the structural backbone of the specialty coffee trade, insulating it somewhat from the price volatility experienced in the commodity coffee market.

Driving factors propelling this market include the global expansion of third-wave coffee culture, characterized by appreciation for craftsmanship and specific terroir; rising disposable incomes in emerging economies, enabling trade-up to premium beverages; and robust innovation in post-harvest processing techniques that enhance bean quality and flavor consistency. Increased awareness of the health benefits associated with minimally processed, high-quality coffee also contributes to sustained demand. Moreover, sophisticated logistics and cold chain management are facilitating the trade of exotic and rare micro-lot coffees across continents, widening consumer access and further fragmenting the premium segment. Technological integration for real-time monitoring of crop health and post-harvest drying also plays a crucial role in mitigating risks associated with climate change and ensuring consistent quality assurance necessary for specialty grading.

Specialty Green Coffee Market Executive Summary

The Specialty Green Coffee Market is undergoing rapid transformation, marked by significant investment in sustainable supply chain infrastructure and intensified competition among micro-roasters and large gourmet chains globally. Business trends indicate a strong shift towards direct trade models, reducing intermediaries and enhancing transparency, which is a major value proposition for specialty consumers. Furthermore, digitalization of sourcing platforms and increased application of blockchain technology for traceability are becoming standard practices, improving efficiency and credibility. Strategic mergers and acquisitions are observed as larger entities seek to secure reliable access to premium, high-scoring bean supplies, particularly those recognized for unique terroir characteristics. Brand storytelling focusing on environmental stewardship and social impact is critical to market success, differentiating premium brands in a crowded marketplace where basic quality expectations are already high.

Regionally, North America and Europe remain the dominant consumption centers, characterized by mature third-wave coffee markets and high purchasing power, although Asia Pacific (APAC), particularly China, South Korea, and Japan, demonstrates the fastest growth trajectory driven by rapid urbanization and the adoption of Western café culture. Latin America, specifically countries like Colombia and Brazil, maintains leadership in production, continuously innovating processing techniques, while African nations (Ethiopia, Kenya) capitalize on their reputation for distinctive, high-acidity heirloom varieties. Regional trends also show divergence in preference; while North America favors ethically sourced, single-origin brews, European markets often prioritize organic certification and blend consistency, creating varied requirements for green coffee exporters.

Segmentation trends highlight the dominance of Arabica beans due to their superior flavor complexity, though high-grade specialty Robusta is gaining traction, especially in espresso blends demanding strong crema and body. In terms of processing, washed coffees continue to command a premium due to consistency, but naturally processed and honey-processed lots are increasingly popular for their fruit-forward and complex flavor profiles, particularly in experimental micro-lots. The market is also segmenting based on distribution channels, with specialized green coffee importers and brokers adapting rapidly to provide tailored, smaller-volume sourcing for artisanal roasters, while larger distributors focus on bulk contracts necessary for national café chains. The rise of private labeling and subscription boxes further fragments the end-use segment, emphasizing personalization and curated bean selections.

AI Impact Analysis on Specialty Green Coffee Market

Common user questions regarding AI's impact on specialty green coffee typically revolve around how technology can enhance quality assurance, mitigate climate risks, and ensure fair pricing mechanisms. Users are primarily concerned with the implementation of AI for predictive modeling in flavor profiling (cupping score prediction based on sensor data), optimizing farm management (irrigation, pest detection), and establishing robust traceability across the complex global supply chain. There is a high expectation that AI will automate the traditionally subjective quality grading process, leading to greater consistency and reducing human error. Furthermore, users inquire about AI's role in correlating environmental data (soil, altitude, weather patterns) with specific flavor outcomes, essentially digitizing and optimizing the concept of terroir. Concerns often focus on data privacy, the cost of implementing such technologies for smallholder farmers, and the risk of algorithmic bias impacting marginalized producers, underscoring the need for transparent and equitable AI deployment strategies.

- AI-driven sensor technology enhances real-time monitoring of crop health, optimizing input usage and mitigating disease risk, leading to higher specialty yields.

- Machine learning algorithms predict potential cupping scores based on green bean physical characteristics (density, color) and processing parameters, streamlining quality control.

- AI optimizes supply chain logistics and inventory management, predicting demand fluctuations and reducing storage time, thereby preserving green bean quality.

- Advanced analytics correlate climate variability and soil chemistry data with specific flavor profiles, aiding producers in making informed decisions about varietals and processing techniques.

- Blockchain integration, often supported by AI validation layers, provides immutable traceability records, verifying ethical sourcing and combating fraud.

- Automated image recognition assists in defect sorting of green beans, surpassing manual inspection accuracy and speed, crucial for achieving 80+ specialty scores.

DRO & Impact Forces Of Specialty Green Coffee Market

The Specialty Green Coffee Market is driven by strong consumer demand for premium experiences and ethical sourcing (Drivers), while facing significant challenges related to climate volatility and price instability (Restraints). Opportunities lie in technological innovation, such as utilizing blockchain for enhanced traceability, and market expansion into rapidly developing economies. These factors collectively exert powerful Impact Forces on market evolution. Drivers include the rising global affluence, particularly the Millennial and Gen Z demographics prioritizing high-quality, ethically produced goods, and the proliferation of specialty cafes globally. Restraints are predominantly centered on environmental risks, which threaten supply consistency, and the complex logistics of maintaining optimal green coffee storage conditions during transit. Opportunities involve leveraging agro-tech for climate-resilient farming and developing innovative distribution channels, such as specialty auctions, that allow micro-lot producers to achieve maximum value. The cumulative impact force pushes the market towards higher sustainability standards, increased digitization, and greater geographical diversification of both production and consumption centers, favoring players capable of managing these complex supply chain risks efficiently.

Drivers are primarily socio-economic and cultural. The increasing sophistication of the coffee consumer, who seeks detailed information about origin and processing methods, mandates superior quality and transparency. Furthermore, specialty coffee often attracts higher retail prices, which incentivize the entire value chain—from farmer investment in better infrastructure to roaster investment in advanced roasting technology—thereby perpetuating quality improvements. Certifications and sustainability reporting are no longer viewed as niche requirements but as essential elements of corporate responsibility, further boosting the segment’s appeal over conventional coffee. The ongoing health trend also favors specialty coffee, as perceived purity and superior sourcing align with wellness goals.

Restraints pose persistent hurdles to stable growth. Climate change is the single largest threat, manifesting in unpredictable weather patterns, rising pest infestations (e.g., coffee leaf rust), and reduced arable land suitable for high-altitude Arabica cultivation. Price volatility in the futures market, although less pronounced than in commodity coffee, still affects long-term investment planning for producers. Additionally, the labor-intensive nature of harvesting and processing specialty coffee, often requiring hand-picking and meticulous sorting, presents operational challenges, especially as rural labor forces migrate. The high barrier to entry for small producers to meet rigorous specialty standards, including investment in advanced drying beds and milling equipment, also limits rapid supply growth.

Opportunities are largely technology-driven and market-expansion focused. The development and adoption of drought-resistant and disease-resistant hybrid coffee varieties offer a significant path toward climate resilience. Digital platforms that connect buyers directly with producers streamline the supply chain, enhancing efficiency and reducing costs. Furthermore, untapped consumer potential in high-growth regions like Southeast Asia and Eastern Europe provides expansive new avenues for market penetration. Strategic partnerships between established roasters and agricultural technology firms focusing on post-harvest treatment optimization (e.g., fermentation control) represent a key area for quality differentiation and secured intellectual property within the value chain.

Segmentation Analysis

The Specialty Green Coffee Market is primarily segmented based on bean type (Arabica vs. Robusta), processing method (Washed, Natural, Honey), and certification status (Organic, Fair Trade, Conventional Specialty). This segmentation reflects the varied consumer demand for specific flavor profiles, sustainability commitments, and price points. The market analysis heavily emphasizes the Arabica segment, which dominates due to its association with delicate aroma and complex acidity, mandatory for achieving high cupping scores. Processing methods determine the final flavor outcome, with Natural processed beans experiencing rapid growth due fueled by consumer interest in unconventional, fruit-forward tastes. Geographical segmentation is vital, contrasting the high-volume procurement in North America and Europe with the dynamic emerging markets in Asia, where unique consumption patterns necessitate customized sourcing strategies.

- By Bean Type:

- Specialty Arabica (Dominant)

- Specialty Robusta (Emerging)

- By Processing Method:

- Washed/Wet Processed

- Natural/Dry Processed

- Honey/Pulped Natural Processed

- Experimental Processes (Anaerobic, Carbonic Maceration)

- By Certification:

- Certified Organic

- Fair Trade Certified

- Rainforest Alliance Certified

- Conventional Specialty (Uncertified, but scoring 80+)

- By End-User:

- Specialty Roasters and Cafes

- Gourmet Retail Chains

- Hotels, Restaurants, and Cafes (HORECA)

- Direct-to-Consumer (D2C) Subscription Services

Value Chain Analysis For Specialty Green Coffee Market

The Specialty Green Coffee value chain is characterized by rigorous quality control and high levels of communication and collaboration between stages, differing significantly from the bulk commodity chain. Upstream analysis focuses intensely on the farm level, where investment in specific varietals, soil health management, and meticulous harvesting are critical. The value is created through careful post-harvest processing (washing, drying) and milling, which transform the coffee cherry into the green bean. Downstream activities involve specialized importing and brokerage, where cupping and grading are performed to verify quality specifications before the beans are sold to roasters. These roasters then transform the green bean into the final consumer product, packaging it for distribution.

The distribution channel for specialty green coffee is often shorter and more targeted than traditional routes. Direct trade is highly prevalent, allowing roasters to bypass traditional commodity exchanges and intermediaries, forging direct relationships with producer cooperatives or single estates. This enhances transparency and allows higher profit margins to flow back to the farmer, reinforcing quality incentives. Indirect distribution relies on highly specialized importers/brokers who manage complex logistics, financing, and quality assurance for smaller roasters who lack the resources for direct sourcing. These brokers are essential for consolidating micro-lots and managing the complex import regulations across diverse regions. The emphasis at every stage is maintaining the unique quality attributes that justify the specialty price premium, necessitating temperature and humidity control during shipping and storage.

Upstream analysis reveals that the initial costs are dominated by skilled labor and quality-enhancing infrastructure, such as raised drying beds and fermentation tanks, critical for achieving high cupping scores. The midstream involves specialized processing mills that conduct dry milling, hulling, sorting, and bagging. The ability to precisely sort beans by size and density using advanced machinery is vital here. Downstream market dynamics are influenced heavily by futures contracts and forward buying, where specialty roasters commit to purchasing crops months or years in advance, providing financial stability for producers. The effectiveness of the overall value chain hinges on credible third-party verification and consistent feedback loops regarding flavor profiles and defects, ensuring continuous improvement at the farm level.

Specialty Green Coffee Market Potential Customers

Potential customers for specialty green coffee are primarily entities focused on delivering a high-quality, differentiated consumer experience, valuing origin traceability, and willing to pay a premium for exceptional flavor and ethical assurances. The largest segment includes micro and mid-sized artisanal roasters globally, who utilize these beans to craft unique, signature blends and single-origin offerings, competing on quality and story rather than price. Large national and international specialty café chains, often categorized as the third-wave segment, represent another crucial buyer group, requiring consistent, high-volume supply of 80+ score beans for their core menu offerings, typically sourced through large import contracts or direct farm partnerships. Additionally, high-end grocery retailers and gourmet food distributors stock these beans for niche consumer segments that roast coffee at home or prefer premium, private-label specialty blends.

Beyond traditional coffee businesses, the HORECA sector, specifically luxury hotels and fine dining establishments, represents a high-value, albeit smaller, customer segment that seeks specialty coffee to complement their overall gourmet offering, emphasizing exclusivity and unique terroir characteristics. Furthermore, the rapid growth of e-commerce and D2C platforms has created a significant customer base in specialty coffee subscription services. These services purchase diverse, often experimental, micro-lots to provide a curated, rotating experience for home consumers. These buyers prioritize novelty, flavor complexity, and detailed provenance information, often favoring rare or limited-edition processing methods.

The purchasing criteria for these potential customers are stringent. Micro-roasters prioritize small lot sizes, detailed flavor notes (as verified by cupping scores), and established relationships with ethical suppliers. Large chains emphasize volume consistency, adherence to strict contractual quality specifications, and compliance with sustainability certifications. All major buyers place high importance on reliability and the exporter’s ability to manage quality control from farm gate to warehouse. Transparency regarding the use of pesticides, water management practices, and labor conditions is frequently scrutinized during the procurement process, demonstrating that ethical parameters are now inseparable from quality parameters in the specialty green coffee purchasing decision matrix.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.2 Billion |

| Market Forecast in 2033 | USD 27.5 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Neumann Kaffee Gruppe (Volcafe), Olam International, ECOM Agroindustrial Corp., Louis Dreyfus Company (LDC), InterAmerican Coffee, Atlantic Specialty Coffee, Sucafina, Mercon Coffee Corp., Royal Coffee, Ally Coffee, Atlas Coffee Importers, Balzac Brothers, Genuine Origin, Caravela Coffee, Crop to Cup Coffee Importers, S&D Coffee & Tea, Starbucks (Global Coffee Trading), Peet's Coffee (Mighty Leaf Tea), Coffeerama. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Specialty Green Coffee Market Key Technology Landscape

The Specialty Green Coffee Market is increasingly leveraging advanced technologies to enhance quality, ensure traceability, and optimize agricultural efficiency. Key technological innovations center around precision agriculture, post-harvest processing optimization, and digital supply chain integrity. Precision agriculture utilizes Internet of Things (IoT) sensors, drones, and satellite imagery to monitor variables such as soil moisture, nutrient levels, and localized weather patterns at the farm level. This allows producers to apply inputs like water and fertilizer precisely, minimizing waste and maximizing the health of high-value coffee cherry crops. These technologies are crucial for specialty producers who must maintain rigorous standards and consistency across harvests, directly influencing the final cupping score and market price. Furthermore, the use of Near-Infrared (NIR) spectroscopy and advanced chromatic sorters in milling facilities ensures highly accurate defect removal and consistent bean density sorting, preventing subpar beans from entering the specialty supply chain, a critical technological requirement.

In the domain of post-harvest processing, controlled fermentation environments are becoming essential. Specialty processors are adopting equipment that allows for the precise monitoring and adjustment of pH levels and temperature during the critical fermentation stage, which dramatically influences the flavor precursors in the green bean. Techniques such as anaerobic and carbonic maceration, adapted from the wine industry, rely on sophisticated gas monitoring and sealed tanks, representing high-tech investment focused purely on flavor innovation and differentiation. This technological refinement moves specialty coffee processing from an art dependent on intuition to a science driven by measurable parameters, offering greater replicability and control over exotic flavor profiles increasingly sought after by top-tier roasters globally. The utilization of specialized drying facilities, including solar dryers or mechanical driers with precise humidity control, also minimizes risks associated with inconsistent weather, ensuring uniform moisture content essential for prolonged green coffee freshness.

Supply chain integrity and consumer trust are heavily reliant on digital technologies, primarily blockchain. Blockchain technology provides an immutable and transparent record of every transaction and quality verification point, from the specific micro-lot harvest date to the final export warehouse inspection. This decentralized ledger verifies claims related to origin, ethical premiums paid to farmers, and certification status, offering unparalleled transparency to roasters and end consumers. Complementing blockchain are sophisticated Enterprise Resource Planning (ERP) and dedicated coffee traceability platforms that manage complex logistics, inventory, and documentation required for international trade. These digital tools ensure that the premium price paid for specialty quality is justified by auditable proof of origin and processing excellence, thereby solidifying the market’s premium positioning and addressing the growing AEO queries regarding sustainability and fairness.

Regional Highlights

- North America (United States, Canada): North America dominates the specialty coffee consumption market, characterized by high penetration of independent specialty coffee shops and national chains committed to 80+ score beans. Consumers exhibit a strong preference for ethically sourced, single-origin Arabica, particularly from Central and South America, and African regions like Ethiopia and Kenya. The region’s advanced e-commerce infrastructure drives substantial demand for premium D2C subscription services, focusing on rare and experimental micro-lots. Regulatory compliance concerning organic and Fair Trade certifications is crucial for market entry. The US market, in particular, sets global trends in roasting technology and retail concept innovation.

- Europe (Germany, UK, France, Italy): Europe is a highly mature market, where specialty coffee consumption is growing rapidly, challenging traditional commodity-based coffee traditions. The European consumer is highly sensitive to sustainability credentials, favoring Organic and Fair Trade certifications, often prioritizing environmental impact metrics alongside flavor profiles. Germany and the UK are leading importers, focusing on highly selective brokerage houses to source diverse bean types. Distribution is often fragmented, relying on localized specialty importers serving smaller, quality-focused artisanal roasters. Regulatory frameworks, particularly the EU’s forthcoming due diligence requirements, will increasingly mandate verifiable traceability, impacting sourcing strategies significantly.

- Asia Pacific (APAC) (Japan, South Korea, China, Australia): APAC represents the fastest-growing region, driven by rapid adoption of Western café culture, urbanization, and rising disposable incomes, particularly in China and South Korea. Japan and Australia have well-established specialty coffee scenes, serving as trendsetters for the rest of the region, focusing on meticulous preparation methods and premium imported beans. China’s emerging specialty market shows huge potential, favoring high-end retail experiences and brand storytelling centered on exclusivity and luxury. Demand in this region is diverse, encompassing both high-acidity African beans and smooth Latin American profiles, demanding versatile import logistics.

- Latin America (Brazil, Colombia, Central America): Latin America remains the powerhouse of specialty green coffee production, innovating constantly in processing and varietal selection. Colombia is renowned for its consistent, washed Arabica, while Brazil excels in producing high-volume specialty naturals and experimental lots. The regional market is increasingly focused on adding value domestically through improved milling and direct exporting, rather than selling through external intermediaries. Infrastructure improvements, especially cold storage and quality grading facilities, are key regional investments aimed at capturing higher value from the global specialty market.

- Middle East and Africa (MEA) (Ethiopia, Kenya, Saudi Arabia): MEA is critical as the historical birthplace of coffee (Ethiopia) and a key source of distinctive, high-scoring African beans (Kenya, Rwanda). Production in these areas is crucial for maintaining flavor diversity globally. The region faces infrastructural challenges but offers unmatched terroir. Consumption markets, particularly the UAE and Saudi Arabia, exhibit high-end demand for ultra-premium, rare specialty coffees, often serving as critical import hubs connecting African origins to Asian and European consumers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Specialty Green Coffee Market.- Neumann Kaffee Gruppe (Volcafe)

- Olam International

- ECOM Agroindustrial Corp.

- Louis Dreyfus Company (LDC)

- InterAmerican Coffee

- Atlantic Specialty Coffee

- Sucafina

- Mercon Coffee Corp.

- Royal Coffee

- Ally Coffee

- Atlas Coffee Importers

- Balzac Brothers

- Genuine Origin

- Caravela Coffee

- Crop to Cup Coffee Importers

- S&D Coffee & Tea

- Starbucks (Global Coffee Trading Division)

- Peet's Coffee (Green Coffee Sourcing)

- Rothfos Corporation

- Sustainable Harvest

Frequently Asked Questions

Analyze common user questions about the Specialty Green Coffee market and generate a concise list of summarized FAQs reflecting key topics and concerns.What defines specialty green coffee and how is quality graded?

Specialty green coffee is defined by its exceptional quality and unique flavor attributes, scoring 80 points or higher on the 100-point Cupping Protocol established by the Specialty Coffee Association (SCA). Grading assesses physical characteristics, defects, aroma, flavor, acidity, body, and balance, ensuring only premium beans enter this market segment.

How is climate change impacting the future supply of specialty Arabica beans?

Climate change poses a severe risk to specialty Arabica supply by increasing temperatures, altering rainfall patterns, and expanding the habitat of pests like the coffee berry borer. This necessitates the shift toward high-altitude, climate-resilient farming practices and the adoption of hybrid, disease-resistant coffee varietals to maintain consistent quality and volume.

What are the primary differences between Direct Trade and Fair Trade certification in the specialty market?

Fair Trade is a certification guaranteeing a minimum price and social premium, focusing on smallholder cooperative stability. Direct Trade is a sourcing model where roasters purchase directly from farms, often exceeding Fair Trade minimums, emphasizing transparency, quality premiums, and relationship-based supply chains, favored for micro-lots.

Which geographical regions are experiencing the fastest growth in specialty coffee consumption?

The Asia Pacific region, particularly China, South Korea, and emerging markets in Southeast Asia, is exhibiting the fastest growth in specialty coffee consumption. This surge is driven by rising middle-class disposable income, rapid urbanization, and the increasing adoption of global café culture, demanding high-end imported green beans.

How is technology enhancing traceability and ethical sourcing in the specialty green coffee supply chain?

Technology, primarily blockchain, is used to create immutable digital records tracing the coffee bean's journey from the farm to the roaster. This system verifies claims related to origin, processing, and premium payments, ensuring unparalleled transparency and compliance with ethical sourcing mandates required by premium buyers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager