Specialty Metallic Pigments Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432657 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Specialty Metallic Pigments Market Size

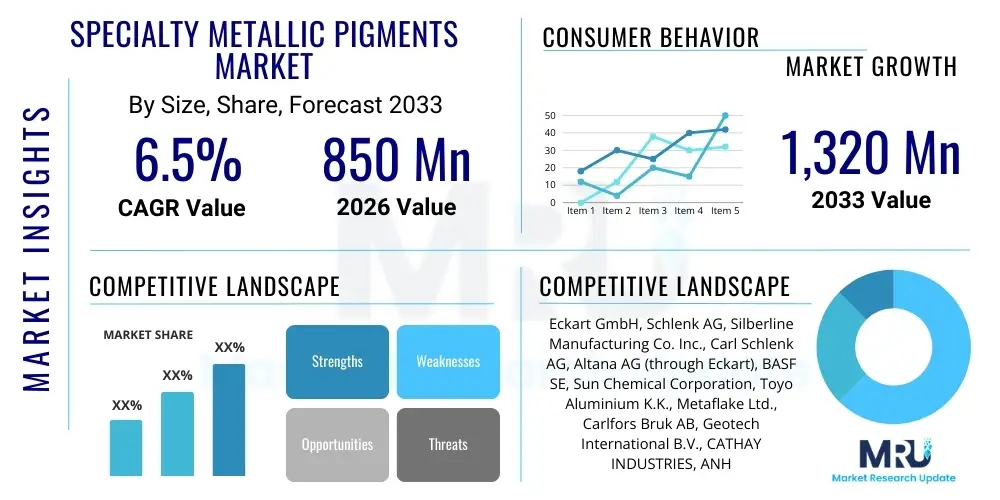

The Specialty Metallic Pigments Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,320 Million by the end of the forecast period in 2033.

Specialty Metallic Pigments Market introduction

Specialty metallic pigments are sophisticated colorants composed primarily of finely ground metal particles, such as aluminum, copper, zinc, and stainless steel, engineered to impart unique visual effects, including metallic luster, chroma, and sparkle, to various end-use products. These effects are achieved through precise control over particle size distribution, geometry (flake, spherical, dendritic), and surface treatments, which dictate the light reflection and scattering properties. The primary function extends beyond aesthetics, often providing functional benefits such as barrier protection, electrical conductivity, or heat reflectivity in specialized coatings and composite materials. The rising consumer demand for premium, high-impact finishes in industries ranging from automotive and architectural coatings to printing inks and cosmetic formulations is fundamentally fueling the adoption of these advanced pigment systems globally. Their unique ability to simulate deep gloss and high-definition metallic finishes is unmatched by traditional organic or inorganic pigments.

The product portfolio within the specialty metallic pigments domain is highly diversified, encompassing leafing and non-leafing aluminum pigments, bronze and copper powders, and various effect pigments often coated with silica or alumina layers to enhance weatherability and chemical resistance. Major applications center on the automotive sector, where these pigments are crucial for original equipment manufacturer (OEM) finishes and refinish coatings, delivering the sought-after chromatic shifts and durability required for exterior body panels. Beyond automotive, the pigments are extensively used in high-performance industrial coatings for infrastructure protection, consumer electronics casings for premium appearance, and in plastics masterbatches used in packaging and appliances. The specialized nature requires high consistency in manufacturing, often involving techniques like atomization, wet milling, and vacuum metallization, ensuring superior performance characteristics under challenging environmental conditions and processing parameters.

Key driving factors for market expansion include the continuous innovation in pigment technology, specifically the development of micronized grades that offer enhanced opacity and smoother texture while maintaining high sparkle intensity. Furthermore, stringent regulatory demands in North America and Europe concerning Volatile Organic Compound (VOC) emissions in coatings have spurred the development and adoption of waterborne and powder coating systems, which frequently incorporate specialty metallic pigments optimized for these low-solvent formulations. The inherent benefits, such as excellent hiding power, superior chemical inertness, and resistance to ultraviolet (UV) degradation, make them indispensable for high-value applications where long-term visual integrity and performance are paramount. This technological trajectory, coupled with expanding industrial production in Asia Pacific, ensures sustained market growth.

Specialty Metallic Pigments Market Executive Summary

The Specialty Metallic Pigments Market is characterized by robust growth, primarily driven by escalating demand from the automotive, coatings, and plastics industries seeking differentiated, high-performance aesthetic solutions. Business trends indicate a strong focus on sustainability, with leading manufacturers investing heavily in developing chrome-free and heavy metal-free pigment compositions, aligning with global environmental compliance standards, notably REACH in Europe and similar initiatives in APAC. Consolidation activities, including strategic acquisitions and mergers, are common as companies seek to expand their geographic reach, integrate specialized manufacturing technologies, and secure key raw material supply chains, particularly for high-purity aluminum and copper sources. Furthermore, the shift towards functional pigments that offer electromagnetic shielding or anti-corrosion properties, in addition to metallic effects, represents a significant avenue for value creation and premium pricing across industrial sectors.

Regionally, the Asia Pacific (APAC) region dominates the market share and is projected to exhibit the highest growth rate, fueled by rapid urbanization, massive infrastructure development projects, and the surging production volume within the automotive and consumer electronics manufacturing sectors, particularly in China, India, and Southeast Asian nations. North America and Europe, while mature, remain critical markets characterized by high consumption of premium-grade, complex-effect pigments utilized in luxury goods, high-end automotive coatings, and sophisticated packaging. These regions are also the primary incubators for advanced material science research, pushing the boundaries for smaller particle sizes and novel surface encapsulation techniques designed for durability and ease of dispersion in advanced coating systems. Regulatory frameworks in these developed economies heavily influence product formulation, driving innovation toward safer, more environmentally compliant materials.

Segment trends highlight the dominance of aluminum pigments due to their cost-effectiveness, high brilliance, and versatility across aqueous, solvent, and powder systems. However, the fastest growth is anticipated in specialized effect pigments, including vacuum-metallized pigments (VMPs) and colored metallic pigments, which offer enhanced optical properties such as intense reflection, deeper color travel, and superior saturation, catering to specialized applications like security inks and high-fashion accessories. The end-use segments reflect a strong reliance on the coatings industry (architectural, protective, and decorative) as the largest consumer, while the plastics segment, driven by the need for attractive consumer product housings and durable composite materials, shows substantial upward momentum. The increasing miniaturization and complexity of end-user products necessitate pigments with ultra-fine particle sizes and high resistance to shear forces during processing.

AI Impact Analysis on Specialty Metallic Pigments Market

Users frequently inquire about AI's potential to revolutionize the highly specialized field of pigment manufacturing, focusing on how predictive modeling can optimize complex chemical synthesis processes and improve the consistency of critical characteristics like particle size distribution and aspect ratio. Common concerns revolve around AI's ability to handle the subtle variability inherent in metallic pigment production, specifically in relation to achieving reproducible optical effects across different batches. The consensus expectation is that AI will primarily drive R&D efficiency by rapidly simulating millions of formulation permutations, accelerating the development of new, high-performance pigments tailored for specific coating matrices (e.g., waterborne systems) and regulatory requirements, ultimately leading to faster time-to-market for innovative metallic finishes and reducing material waste through precise process control.

- AI-driven optimization of wet milling and atomization parameters to ensure uniform particle morphology and tight control over aspect ratio, critical for metallic luster.

- Predictive maintenance analytics for high-precision manufacturing equipment, minimizing downtime and ensuring continuous quality in high-value production lines.

- Machine learning algorithms utilized for advanced color matching and effects simulation, optimizing pigment loading and dispersion stability across different resin systems.

- AI enhanced supply chain forecasting and inventory management for critical raw materials (high-purity aluminum powder, copper) to mitigate volatility and ensure production continuity.

- Automated quality control systems using computer vision to detect subtle defects or irregularities in pigment batches that affect flake orientation and reflective properties.

- Accelerated discovery of novel surface treatment chemistries (encapsulation materials) to enhance pigment corrosion resistance and weather fastness.

DRO & Impact Forces Of Specialty Metallic Pigments Market

The Specialty Metallic Pigments Market is significantly influenced by a delicate balance of demand for aesthetic excellence, stringent environmental regulations, and the constant need for material innovation. Key drivers include the global expansion of the premium and luxury goods segments, particularly in the automotive and high-end consumer electronics sectors, where metallic finishes signal superior quality and contemporary design. Furthermore, the persistent growth of the aerospace and defense sectors, requiring pigments for durable anti-corrosion and radar-absorbent coatings, provides a stable, high-value demand stream. These drivers are fundamentally supported by advancements in pigment stabilization techniques, which allow metallic particles to be seamlessly incorporated into complex modern coating chemistries without compromising integrity or performance over the product lifecycle. The continuous desire for unique chromatic effects and dynamic color changes ensures steady investment in R&D.

Conversely, the market faces notable restraints, predominantly related to environmental and health regulations. The handling and disposal of metallic powders, particularly fine aluminum and copper dusts, pose safety and environmental challenges, necessitating high compliance costs for manufacturers. Furthermore, the inherent price volatility of essential raw materials (aluminum, copper) and energy-intensive production processes can compress profit margins, especially for standardized pigment grades. The market also suffers from the technical challenge of achieving superior orientation and dispersion stability in low-VOC, waterborne systems, as metallic particles often react poorly or settle quickly in aqueous environments, requiring specialized surface treatments and additives that increase production complexity and final product cost. These technical hurdles impede widespread adoption in certain cost-sensitive applications.

Opportunities for exponential growth lie in the development of sustainable and highly functional pigment solutions. This includes the commercialization of bio-based or recycled content metallic pigments and the expansion into advanced functional coatings, such as those providing thermal management, electromagnetic interference (EMI) shielding, or advanced fingerprint resistance for touch-sensitive devices. The growing adoption of powder coatings in industrial and architectural applications presents a fertile ground for metallic pigments engineered specifically for high-transfer efficiency and consistent aesthetic effects in dry application systems. The inherent impact forces are governed by the speed of regulatory adaptation and the ability of manufacturers to innovate new encapsulation technologies that deliver performance parity or superiority while complying with tightening global toxicity standards, making product differentiation through performance a critical competitive lever.

Segmentation Analysis

The Specialty Metallic Pigments Market is comprehensively segmented based on the composition of the metal utilized, the form in which the pigment is marketed, and the primary industry utilizing the final coating or material. Segmentation by type is crucial as it dictates the specific optical properties and chemical resistance of the final product, with aluminum, copper, and specialized alloy pigments forming the backbone of the market. The form segment, differentiating between powder, paste, and granulated forms, reflects the diverse needs of end-user formulation processes, such as ease of dispersion, required solids content, and compatibility with various solvent systems. Understanding these segment dynamics is vital for market players to tailor product offerings and optimize supply chain strategies to meet the exacting performance standards of sectors like automotive OEM and high-performance industrial coatings, which demand superior weatherability and color consistency.

-

By Type

- Aluminum Pigments (Leafing and Non-leafing)

- Copper & Bronze Pigments (Powders and Flakes)

- Zinc Pigments

- Stainless Steel Pigments

- Specialty Effect Pigments (VMPs, Colored Metallic)

-

By Form

- Powder

- Paste

- Granules/Pellets (used in plastics)

-

By Application

- Coatings (Automotive OEM & Refinish, Industrial, Architectural, Protective)

- Plastics (Masterbatches, Composites)

- Printing Inks (Flexographic, Gravure, Screen Printing)

- Cosmetics & Personal Care

- Others (Aerosols, Security Applications)

Value Chain Analysis For Specialty Metallic Pigments Market

The value chain for specialty metallic pigments begins upstream with the procurement of high-purity metal ingots and powders, typically aluminum, zinc, or copper, which are sourced globally, often from specialized metallurgical operations. This raw material phase is highly capital intensive and subject to global commodity price fluctuations. The subsequent core manufacturing stage involves complex processing techniques, including dry milling, wet ball milling, atomization, and highly controlled vacuum metallization (for VMPs). Manufacturers must invest significantly in sophisticated equipment and proprietary knowledge to control particle morphology, surface treatments (e.g., silane or phosphate coatings), and anti-flocculation stabilizers, ensuring the pigments achieve the desired optical and dispersion characteristics required for high-end applications. The efficiency and yield of these processes are paramount to maintaining competitive pricing and product quality consistency.

The downstream segment involves intermediate product formulation, where pigment manufacturers or specialized compounders convert raw metallic powders or pastes into ready-to-use concentrates, dispersions, or masterbatches. This step is critical for ensuring the metallic flakes are properly wetted and dispersed without damage, maximizing the visual effect upon application. Distribution channels for specialty metallic pigments are dual: direct sales are typically employed for large-volume, highly technical clients such as major automotive OEM coating suppliers and global ink manufacturers who require specific technical support and tailored products. Indirect channels utilize specialized distributors and agents, particularly in fragmented markets or for smaller-volume customers in the plastics, cosmetics, or general industrial coating sectors, leveraging local logistics and inventory management expertise.

The effectiveness of the value chain is largely determined by the logistical efficiency and technical service capabilities provided across these channels. Direct sales allow for tighter quality feedback loops and faster adaptation to evolving customer needs, especially regarding new color trends or regulatory compliance shifts. Conversely, indirect distribution ensures market penetration into diverse geographical areas and smaller industrial consumers. Successful players focus on backward integration into raw material processing or forward integration into highly specialized dispersion technologies, reducing reliance on third parties and capturing additional margin. Maintaining high ethical standards regarding sourcing and environmental practices throughout the chain is increasingly important for brand reputation and regulatory compliance in developed economies.

Specialty Metallic Pigments Market Potential Customers

Potential customers for specialty metallic pigments are diverse, spanning multiple high-value manufacturing sectors that prioritize aesthetic appeal, material durability, and functional performance. The most significant end-users are major global coating formulators, supplying products for the automotive industry (both OEM finishes and aftermarket refinish coatings), architectural protective coatings for infrastructure and high-end residential projects, and general industrial applications for machinery and appliances. These buyers require pigments with exceptional chemical resistance, high gloss retention, and flawless batch-to-batch color consistency, often demanding certification against rigorous industry standards (e.g., QUV testing for weathering). The complexity of integrating metallic flakes into advanced coating systems makes these customers highly reliant on the technical support and product quality assurance provided by pigment manufacturers.

Beyond traditional coatings, the plastics industry represents a rapidly expanding buyer base. Plastic compounders and masterbatch producers utilize specialty metallic pigments to create visually stunning effects in consumer electronics casings (smartphones, laptops), durable automotive interior parts, and high-quality packaging materials. These customers require pigments that can withstand the high shear and temperature processes of injection molding and extrusion without degradation or loss of metallic effect. Similarly, the printing ink sector, particularly for flexible packaging, high-security documents, and decorative labels, constitutes a key customer segment, demanding ultrafine, highly dispersible pigments suitable for high-speed printing technologies like gravure and flexography. These diverse end-user requirements necessitate a broad portfolio of metallic pigments tailored to specific processing conditions and performance outcomes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,320 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Eckart GmbH, Schlenk AG, Silberline Manufacturing Co. Inc., Carl Schlenk AG, Altana AG (through Eckart), BASF SE, Sun Chemical Corporation, Toyo Aluminium K.K., Metaflake Ltd., Carlfors Bruk AB, Geotech International B.V., CATHAY INDUSTRIES, ANHUI HONGRUI METALLIC PIGMENTS CO. LTD., Kuncai Group, Sparkle Pigments. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Specialty Metallic Pigments Market Key Technology Landscape

The manufacturing of specialty metallic pigments relies on several highly advanced and proprietary technological processes designed to precisely control the particle shape, size, and surface chemistry necessary for achieving specific optical and functional effects. A cornerstone technology is wet ball milling, often conducted in dedicated solvent environments, which is crucial for generating aluminum and copper flakes with optimal aspect ratios—a measure of flake diameter to thickness—directly impacting the brilliance and opacity of the pigment. Advanced milling techniques now incorporate narrow distribution control systems, ensuring a tighter particle size range, which minimizes scattering and maximizes specular reflection, a critical requirement for high-gloss automotive finishes. Furthermore, chemical vapor deposition (CVD) and physical vapor deposition (PVD) techniques are increasingly utilized for creating Vacuum Metallized Pigments (VMPs) and functional coatings on metallic flakes, offering ultra-thin, highly reflective films with superior purity and consistency compared to traditional grinding methods.

Surface modification technology constitutes another pivotal element in the landscape, directly addressing the primary challenges of metallic pigments: chemical stability and ease of dispersion. Manufacturers employ advanced encapsulation technologies, such as plasma polymerization or inorganic surface treatments (e.g., using silica or titanium dioxide shells), to shield the reactive metal core from moisture, chemical attack, and shear forces encountered during formulation. This stabilization is especially vital for integrating pigments into modern waterborne coating systems, preventing gassing (reaction with water) and maintaining long-term shelf stability. The development of proprietary surface agents allows for tailored pigment compatibility, ensuring uniform orientation within various resin matrices and maximizing the "flop" or color travel effect crucial for specialized automotive colors. The focus is shifting toward environmentally benign, chrome-free treatments to comply with tightening global regulations.

Digitalization and process automation are rapidly influencing the technological landscape. High-resolution in-line particle analysis instruments and sophisticated software controls are being deployed to monitor and adjust critical process parameters in real-time, drastically reducing batch variation and improving yield. Additionally, advanced dispersion equipment, including high-shear mixers and proprietary sonication units, is used by formulators to incorporate metallic pastes into liquid systems without damaging the delicate flake structures. The interplay between raw material quality, manufacturing precision (achieving nanometer-scale control over thickness), and the effectiveness of surface chemistry defines the competitive edge in this highly technical market, pushing technology providers towards integrated solutions that cover both production and application challenges.

Regional Highlights

The global consumption and production landscape for Specialty Metallic Pigments exhibits significant regional variations influenced by industrial output, regulatory environments, and consumer preferences for specific aesthetic finishes. Asia Pacific (APAC) stands out as the unequivocal leader in both volume consumption and manufacturing growth. Driven by robust expansion in automotive production, particularly in China and India, coupled with massive infrastructure investments requiring protective industrial coatings, APAC manufacturers are rapidly scaling up production capacities. The region benefits from lower manufacturing costs and increasing local expertise, though regulatory compliance is a growing area of focus, moving towards standards prevalent in Western markets. The sheer size of the manufacturing base for consumer electronics and appliances further solidifies APAC's dominant market position.

North America and Europe represent mature, high-value markets characterized by a demand for premium, highly sophisticated metallic effects, primarily in the luxury automotive OEM, architectural, and high-fashion packaging sectors. These regions are characterized by stringent environmental regulations, notably the EU’s REACH legislation, which mandates manufacturers to innovate rapidly, shifting toward low-VOC, waterborne, and chrome-free pigment solutions. Consequently, innovation centers and key R&D facilities of major global players are heavily concentrated here, focusing on advanced surface chemistries and nano-scale pigment technologies that ensure both compliance and superior performance in high-solids systems. High purchasing power supports the adoption of premium-priced, bespoke metallic finishes.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging markets showing promising growth. LATAM's market is driven by recovery in the domestic automotive sector and expanding architectural projects. MEA, particularly the GCC countries, is witnessing substantial demand fueled by large-scale construction, oil and gas infrastructure requiring high-performance protective coatings, and a strong preference for high-end automotive finishes. While production capabilities are less developed in these regions, they serve as critical end-user markets, relying heavily on imports from major global suppliers in Europe and APAC. Future growth in these regions will be highly dependent on economic stability and localized manufacturing development across the key application industries.

- Asia Pacific (APAC): Dominant in volume, led by China and India; high growth driven by automotive OEM and rapid infrastructure development; major hub for manufacturing scale-up.

- Europe: Key market for regulatory compliance and high-performance, chrome-free pigments; strong demand from high-end refinish and protective coatings sectors; innovation leader in surface modification.

- North America: Significant consumption of premium aluminum pigments for architectural and general industrial coatings; stable growth fueled by aerospace and specialty ink applications.

- Latin America (LATAM): Emerging market with increasing demand linked to domestic automotive recovery and expansion of construction activities.

- Middle East & Africa (MEA): Growing segment primarily driven by infrastructure protective coatings (oil & gas) and luxury automotive finishes in the GCC region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Specialty Metallic Pigments Market.- Eckart GmbH

- Schlenk AG

- Silberline Manufacturing Co. Inc.

- Toyo Aluminium K.K.

- Altana AG (through Eckart)

- BASF SE

- Sun Chemical Corporation

- Metaflake Ltd.

- Carlfors Bruk AB

- Geotech International B.V.

- CATHAY INDUSTRIES

- ANHUI HONGRUI METALLIC PIGMENTS CO. LTD.

- Kuncai Group

- Sparkle Pigments

- Midas Pigments

- Asahi Kasei Corporation

- Fujian Kuncai Material Technology Co., Ltd.

- CQV Co., Ltd.

- Tronox Holdings plc

- Rolfes Color Solutions

Frequently Asked Questions

Analyze common user questions about the Specialty Metallic Pigments market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between leafing and non-leafing metallic pigments, and where are they used?

Leafing pigments orient horizontally on the coating surface, forming a barrier layer that maximizes reflectivity and opacity, primarily used in reflective and barrier coatings. Non-leafing pigments disperse throughout the film, allowing for deeper color effects, making them essential for high-end automotive finishes and complex chromatic systems where 'flop' effect is desired.

How do regulatory changes, such as REACH, impact the formulation and cost of specialty metallic pigments?

Regulations like REACH necessitate the removal of heavy metals (e.g., specific chromium compounds) and restrict VOCs, driving up research and development costs. This forces manufacturers to invest in developing eco-friendly surface treatments and dispersion technologies compatible with waterborne and high-solids systems, increasing final product costs but enhancing safety and sustainability.

Which application segment drives the highest growth rate for specialty metallic pigments?

The automotive coatings segment, specifically in premium OEM and refinish applications, consistently drives the highest value growth due to the persistent demand for dynamic, complex metallic colors and highly durable finishes. The plastics segment is also exhibiting substantial volume growth, particularly in Asia Pacific.

What technological advancements are crucial for integrating metallic pigments into waterborne coating systems?

Crucial advancements include developing robust inorganic encapsulation technologies (silica or ceramic layers) and specialized surface treatments. These innovations prevent gassing (reaction of aluminum with water), enhance dispersion stability, and ensure the pigments maintain optimal orientation and weather resistance in aqueous, low-solvent environments.

How does the particle size of specialty metallic pigments affect their final visual performance?

Smaller particle sizes (micronized grades) produce a smoother, silkier metallic sheen with higher opacity and better hiding power, suitable for consumer electronics and refined automotive basecoats. Larger particle sizes deliver a coarse, sparkling effect, often used for dramatic sparkle in exterior architectural finishes or decorative inks.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager