Specialty Pharmacy Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434549 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Specialty Pharmacy Services Market Size

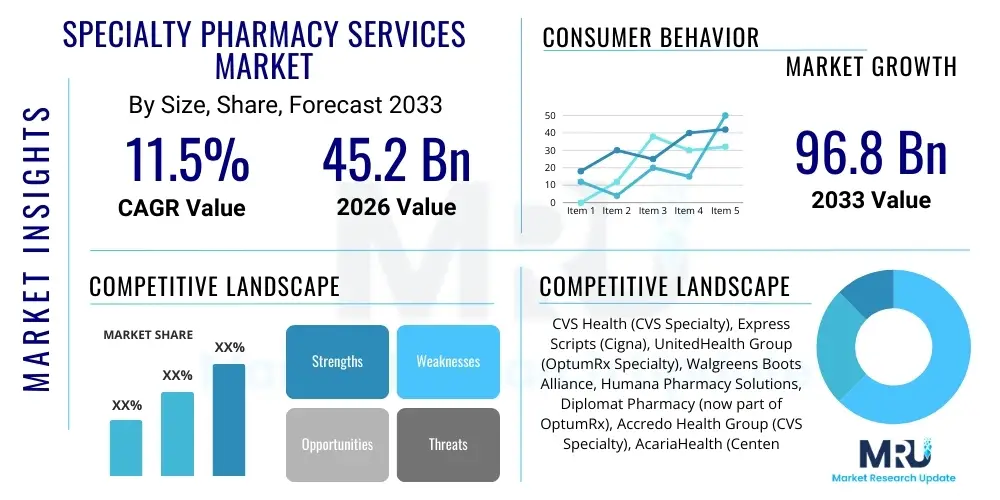

The Specialty Pharmacy Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 45.2 Billion in 2026 and is projected to reach USD 96.8 Billion by the end of the forecast period in 2033.

Specialty Pharmacy Services Market introduction

The Specialty Pharmacy Services Market encompasses the complex distribution, dispensing, patient management, and support services necessary for high-cost, high-touch specialty medications. These pharmaceuticals, often biologics or injectables used to treat complex chronic or rare diseases such as cancer, multiple sclerosis, and rheumatoid arthritis, require specialized handling, adherence monitoring, and intensive clinical support far beyond traditional retail pharmacy capabilities. The inherent complexity of these drugs, including specialized storage requirements (e.g., cold chain logistics), intricate reimbursement processes, and the necessity for continuous patient education and monitoring, drives the demand for dedicated specialty pharmacy services. This sector acts as a crucial link connecting pharmaceutical manufacturers, payers, providers, and patients, ensuring optimal therapeutic outcomes while managing significant financial risks associated with these therapies.

Major applications of specialty pharmacy services span across several critical therapeutic areas, notably oncology, immunology, and virology. These services are essential for managing diseases where patient adherence directly impacts quality of life and treatment efficacy. Key benefits include improved patient compliance through personalized care coordination, optimized inventory management reducing waste of expensive medications, and enhanced data collection for manufacturers and payers regarding real-world effectiveness and safety profiles. The growth of this market is intrinsically linked to the increasing pipeline of specialty drugs approved by regulatory bodies, coupled with a rising global prevalence of chronic and complex conditions that necessitate these advanced treatments. Furthermore, the shift toward personalized medicine and gene therapies further entrenches the need for highly specialized distribution and clinical support networks.

Driving factors propelling the Specialty Pharmacy Services Market include the escalating prevalence of chronic conditions requiring complex pharmacological interventions, robust investment in biotechnology leading to a steady influx of novel specialty drugs, and the increasing trend among payers and health systems to consolidate specialty drug management to control costs and improve quality. Regulatory environments, particularly those promoting integrated care models and value-based contracting, also favor specialty pharmacies which can provide comprehensive outcome data and superior patient engagement programs. These services are becoming indispensable components of modern healthcare infrastructure, focusing on clinical excellence and operational efficiency in handling the most expensive category of pharmaceuticals.

Specialty Pharmacy Services Market Executive Summary

The global Specialty Pharmacy Services Market is experiencing robust expansion, primarily fueled by the accelerating approval rate of specialty medications for chronic and rare diseases and the intensifying efforts by healthcare stakeholders to mitigate the escalating costs associated with these therapies. Business trends indicate a strong move toward vertical integration, where Pharmacy Benefit Managers (PBMs) and major payers (like CVS, Cigna, and UnitedHealth Group) are acquiring or expanding their in-house specialty pharmacy operations to capture the high margins and control the drug value chain, thereby creating tightly controlled networks. This consolidation pressures independent and hospital-based specialty pharmacies to form strategic partnerships or enhance their technology platforms to compete effectively on patient experience and data transparency. The market dynamic is shifting from simple dispensing toward comprehensive patient support, adherence programs, and real-time clinical data reporting, emphasizing value over volume.

Regional trends highlight North America, particularly the United States, as the dominant market due to its high healthcare expenditure, established specialty drug infrastructure, and favorable reimbursement policies for specialty therapies. However, the Asia Pacific region is demonstrating the highest growth trajectory, driven by improving healthcare access, increasing prevalence of non-communicable diseases, and rising investments in specialty drug manufacturing and distribution capabilities in countries like China and India. European markets, governed by strict pricing controls and nationalized health systems, are focusing on optimizing logistics and improving access for rare disease treatments under centralized procurement models. The regulatory framework across regions is heavily influencing market growth, dictating the scope of services specialty pharmacies can offer, particularly concerning patient data privacy and drug traceability.

Segment trends confirm that Oncology remains the largest therapeutic area segment, given the complexity and cost of cancer treatments, but rare diseases and inflammatory conditions are showing the fastest growth rate as new targeted therapies enter the market. In terms of service model segmentation, PBM-owned specialty pharmacies dominate the market share due to their ability to steer prescriptions through managed care contracts, while hospital-owned specialty pharmacies are gaining traction by providing highly coordinated care adjacent to the prescribing provider, ensuring seamless transition from inpatient to outpatient care. Technology integration, specifically in areas like predictive analytics for adherence and telehealth services, is becoming a mandatory investment for differentiation across all segments.

AI Impact Analysis on Specialty Pharmacy Services Market

User inquiries regarding AI's influence in the Specialty Pharmacy Services Market predominantly revolve around three critical themes: efficiency improvements in prior authorization and claims processing, personalization of patient support and adherence programs, and enhanced predictive modeling for inventory management and adverse event detection. Users are keen to understand how AI can reduce the administrative burden associated with high-cost specialty drugs, streamline the complex reimbursement landscape, and ultimately improve the patient journey by predicting adherence risks before they manifest. Key concerns center on data privacy and the ethical use of patient health information (PHI) within AI models, alongside the necessity for human oversight in clinical decision-making, ensuring that technological automation does not compromise the high-touch care ethos intrinsic to specialty services. Expectations are high for AI to transform operational bottlenecks into streamlined, proactive processes, making high-cost treatments more accessible and manageable.

AI technologies, including machine learning (ML) and natural language processing (NLP), are revolutionizing the administrative backbone of specialty pharmacy services. NLP applications are dramatically reducing the turnaround time for prior authorization requests by intelligently analyzing vast documentation sets, identifying missing information, and automating communication with payers and prescribing physicians. This significantly accelerates patient access to crucial medications. Simultaneously, ML algorithms are being deployed to optimize inventory and logistics. Given the high cost and sensitivity of specialty drugs, forecasting demand accurately based on prescription patterns, seasonality, and regional disease outbreaks minimizes waste and ensures that life-saving medications are available precisely when and where they are needed, enhancing supply chain resiliency.

Clinically, AI is enabling unprecedented levels of personalized patient care management. By analyzing aggregated patient data—including demographics, adherence history, refill patterns, and social determinants of health—ML models can accurately predict which patients are at high risk of non-adherence or adverse drug events. This predictive capability allows specialty pharmacists to proactively intervene with targeted educational resources, counseling, or scheduling adjustments, transforming reactive care into predictive care. The integration of AI tools within patient engagement platforms enhances the effectiveness of adherence programs, moving beyond generic reminders to individualized support protocols, thereby maximizing the therapeutic benefits of highly complex specialty drugs.

- AI-driven automation of prior authorization processes using NLP reduces approval times and administrative overhead.

- Machine Learning models enhance patient adherence prediction, enabling proactive intervention strategies.

- Predictive analytics optimize specialty drug inventory management, minimizing waste and ensuring cold chain integrity.

- AI assists in identifying and flagging potential drug interactions and adverse events early in the treatment cycle.

- Data integration tools powered by AI enable real-time tracking of treatment outcomes for value-based contracting.

DRO & Impact Forces Of Specialty Pharmacy Services Market

The Specialty Pharmacy Services Market is dynamically influenced by powerful forces centered around the cost and complexity of modern pharmacotherapy. Driving factors include the continuous launch of high-cost biologic and gene therapies, the increasing desire among payers to control specialty drug spend through closed networks, and the mandate for detailed patient data to support value-based care agreements. These drivers push specialty pharmacies to enhance their clinical support and data analytics capabilities. Restraints, conversely, include intense regulatory scrutiny over drug pricing and distribution channels, the high capital investment required for establishing secure cold chain logistics and advanced IT infrastructure, and the constant threat of generic and biosimilar competition potentially eroding exclusivity. Opportunities are vast in the expansion of limited distribution drugs (LDDs), the penetration into nascent markets, and the adoption of cutting-edge technologies like AI and blockchain for supply chain transparency and adherence monitoring. These drivers, restraints, and opportunities interact to create intense impact forces, driving consolidation, demanding superior clinical outcomes, and accelerating technological adoption to manage the inherent risks of specialty drug treatment.

Segmentation Analysis

The Specialty Pharmacy Services Market is strategically segmented based on the type of service offered, the therapeutic areas addressed, and the models through which these services are delivered. This segmentation allows stakeholders—including payers, providers, and manufacturers—to precisely target specific needs within the complex drug management ecosystem. Service type segmentation differentiates between core dispensing activities and value-added services like comprehensive patient education and sophisticated data reporting. Therapeutic area analysis highlights the primary disease states driving market growth, while service model segmentation reveals the competitive landscape dominated by vertically integrated giants, independent providers, and health system entities. Understanding these segments is critical for market participants to tailor their offerings, optimize resource allocation, and address the specific regulatory and clinical challenges inherent to each niche.

- Type: Core Services, Patient Support Programs, Distribution & Logistics, Data & Analytics.

- Therapeutic Area: Oncology, Rare Diseases, Inflammatory Conditions, Infectious Diseases (Hepatitis C, HIV), Multiple Sclerosis, Rheumatoid Arthritis, Hemophilia, Pulmonary Hypertension.

- Service Model: Payer-Owned, PBM-Owned, Independent Specialty Pharmacies, Hospital-Owned Specialty Pharmacies, Manufacturer-Owned Services.

Value Chain Analysis For Specialty Pharmacy Services Market

The value chain for Specialty Pharmacy Services is intricate and characterized by high collaboration and significant control points. Upstream activities involve pharmaceutical manufacturers developing and producing specialty drugs, often designating them as Limited Distribution Drugs (LDDs) to maintain strict control over dispensing and data collection. This upstream control dictates which specialty pharmacies can access specific therapies. Midstream activities encompass specialized logistics and distribution, requiring validated cold chain management, secure warehousing, and rigorous inventory tracking due to the high value and sensitive nature of the medications. The core midstream function is the dispensing and fulfillment carried out by specialty pharmacies, which must navigate complex insurance verification and prior authorization processes.

Downstream activities center intensely on the patient and the prescriber. Specialty pharmacies provide essential patient support programs, including adherence counseling, financial assistance coordination, and continuous clinical monitoring. These services are crucial for ensuring treatment efficacy and managing side effects, representing the high-touch element that defines the specialty sector. The distribution channel is heavily influenced by the service model; PBM-owned specialty pharmacies often mandate direct distribution to patients via mail order or courier, bypassing traditional retail settings. Direct channels dominate the high-cost specialty segment, ensuring better control over the cold chain and facilitating robust data collection, which is then fed back to manufacturers and payers. Indirect channels, although less prevalent, may involve hospital-owned specialty pharmacies integrated within the provider network for specific immediate needs.

The entire chain is underpinned by data and technology platforms. Information flow—from manufacturers reporting dispensing data to payers tracking patient outcomes—is the core driver of value. The ability of a specialty pharmacy to manage this complex data stream, ensuring compliance with HIPAA and providing actionable insights for payers and providers, often determines its competitive advantage and inclusion in restrictive specialty networks. Control over the distribution channel, whether direct (PBM/Payer) or through partnerships (Independent), dictates market access and profitability.

Specialty Pharmacy Services Market Potential Customers

The primary customers and end-users of Specialty Pharmacy Services are multifaceted, reflecting the complex financial and clinical ecosystem surrounding specialty drugs. The most significant customer base comprises Managed Care Organizations (MCOs), commercial insurance payers, and government programs (like Medicare and Medicaid). These entities are the ultimate financial risk bearers and utilize specialty pharmacies, particularly PBM-owned or integrated models, as a critical tool for cost management, utilization review, and ensuring high clinical standards for expensive treatments. Their objective is to negotiate competitive reimbursement rates, enforce formulary compliance, and monitor patient outcomes to justify the high investment in specialty therapies.

Another crucial customer segment consists of Pharmaceutical and Biotechnology Manufacturers. For manufacturers, specialty pharmacies are not merely distributors; they are integral partners for limited distribution drugs (LDDs). Manufacturers rely on these specialized services for precise patient access logistics, comprehensive clinical reporting, adherence data, and often, the implementation of risk evaluation and mitigation strategies (REMS). The quality and scope of data provided by the specialty pharmacy network are paramount for manufacturers tracking real-world product performance and meeting regulatory requirements.

Finally, Healthcare Providers (Hospitals, Clinics, and Physician Groups) and the Patients themselves represent the clinical end-users. Providers benefit from specialty pharmacy coordination, which relieves their staff of complex insurance and administrative burdens, ensuring their patients receive medications accurately and on time. Patients are direct recipients of the high-touch services, including clinical counseling, financial support navigation, and logistical scheduling, which are essential for managing chronic, complex, or rare conditions. The increasing shift toward integrating specialty pharmacy services directly into hospital systems underscores the value proposition of seamless care transition for providers and patients alike.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.2 Billion |

| Market Forecast in 2033 | USD 96.8 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CVS Health (CVS Specialty), Express Scripts (Cigna), UnitedHealth Group (OptumRx Specialty), Walgreens Boots Alliance, Humana Pharmacy Solutions, Diplomat Pharmacy (now part of OptumRx), Accredo Health Group (CVS Specialty), AcariaHealth (Centene), AllianceRx Walgreens Prime, Kroger Specialty Pharmacy, PANTHERx Rare Pharmacy, BioScrip (now part of OptumRx), PharMerica, Curascript SD, Caremark, Senderra Rx, Archway Health, Onco360, ProCare Rx, Omnicare. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Specialty Pharmacy Services Market Key Technology Landscape

The technological landscape in the Specialty Pharmacy Services Market is defined by the necessity for precision, security, and integration, driven primarily by the demands of complex logistics and mandated data transparency. Core technologies involve highly specialized Pharmacy Management Systems (PMS) that extend beyond conventional dispensing software to manage intricate prior authorization workflows, patient financial assistance programs, and detailed clinical reporting specific to limited distribution drugs. These systems must seamlessly integrate with Electronic Health Records (EHRs) used by providers and claims processing platforms used by payers, ensuring a fluid exchange of clinical and administrative data while maintaining strict HIPAA compliance. The foundational need for rigorous compliance and verifiable data drives continuous investment in robust IT infrastructure capable of handling high transaction volumes of high-value medications.

Advanced technologies are increasingly focusing on optimizing the logistical and clinical aspects of specialty care. Cold chain management relies on sophisticated Internet of Things (IoT) sensors embedded within packaging and storage units, providing real-time temperature and humidity monitoring during transit, critical for maintaining the efficacy of biologics. This data is often linked via cloud platforms accessible to logistics partners and specialty pharmacies, ensuring regulatory compliance and immediate intervention if conditions deviate. Furthermore, telemedicine and digital patient engagement platforms are paramount, utilizing secure video conferencing and mobile applications to deliver high-touch clinical counseling and adherence coaching remotely, extending the reach of pharmacists beyond the traditional setting.

The future of the technology landscape is heavily influenced by Generative Engine Optimization (GEO) principles, where data analytics and Artificial Intelligence (AI) transform reactive services into proactive clinical management. Blockchain technology is emerging as a potential solution for enhancing supply chain traceability and combating counterfeit specialty drugs, offering an immutable ledger for tracking medications from manufacturing to the patient's hand. Predictive analytics, utilizing machine learning algorithms, moves beyond simple adherence reminders, identifying patients with high likelihood of discontinuing therapy based on behavioral and clinical data, allowing for preemptive, personalized clinical intervention, thereby maximizing treatment efficacy and minimizing payer costs.

Regional Highlights

- North America Dominance: North America, particularly the United States, holds the largest market share globally due to the highest per capita spending on specialty drugs, advanced reimbursement mechanisms (driven by PBMs and private insurance), and a robust pipeline of FDA-approved specialty therapies. The region is characterized by intense vertical integration, with major payers actively controlling the specialty distribution channel to manage costs. Market growth here is primarily driven by oncology, immunology, and the rapid adoption of personalized medicine and gene therapies, which necessitate highly specialized services. Regulatory changes impacting drug rebates and pricing transparency remain key variables influencing regional market profitability and structure.

- Europe Market Maturity: The European market is mature but highly segmented by national healthcare policies and drug pricing controls. Growth is steady, driven by increasing patient access to innovative treatments, particularly for rare and orphan diseases, often managed under nationalized health programs. Specialty pharmacy services in Europe tend to focus heavily on optimizing logistics efficiency and demonstrating real-world evidence (RWE) to justify high costs to centralized procurement agencies. Germany, the UK, and France are key contributors, emphasizing coordinated care models that integrate specialty dispensing with hospital and community services to enhance patient access and adherence.

- Asia Pacific (APAC) Rapid Growth: The APAC region is projected to exhibit the highest CAGR during the forecast period. This rapid expansion is attributed to improving healthcare infrastructure, rising awareness and diagnosis rates of complex chronic diseases, and increasing government and private investment in specialty care capabilities. Key drivers include the urbanization of populations, rising disposable incomes facilitating access to expensive treatments, and the establishment of local manufacturing hubs for biologics. China, India, and Japan are pivotal markets, focusing on overcoming logistical challenges in expansive geographies and developing localized patient support programs that adhere to diverse regional regulatory standards and cultural contexts regarding medication use.

- Latin America and MEA Expansion: Latin America (LATAM) and the Middle East & Africa (MEA) represent emerging markets for specialty pharmacy services. Growth in these regions is heavily reliant on improving economic stability, expanding insurance coverage, and addressing significant challenges in supply chain integrity and cold chain logistics. Government initiatives to improve access to essential and specialty medicines are key market drivers. In the MEA, high spending power in Gulf Cooperation Council (GCC) countries drives demand for advanced treatments, while regulatory harmonization and investment in digital health infrastructure are crucial for unlocking the full market potential.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Specialty Pharmacy Services Market.- CVS Health (CVS Specialty)

- Express Scripts (Cigna)

- UnitedHealth Group (OptumRx Specialty)

- Walgreens Boots Alliance

- Humana Pharmacy Solutions

- Diplomat Pharmacy (now part of OptumRx)

- Accredo Health Group (CVS Specialty)

- AcariaHealth (Centene)

- AllianceRx Walgreens Prime

- Kroger Specialty Pharmacy

- PANTHERx Rare Pharmacy

- BioScrip (now part of OptumRx)

- PharMerica

- Curascript SD

- Caremark

- Senderra Rx

- Archway Health

- Onco360

- ProCare Rx

- Omnicare

Frequently Asked Questions

Analyze common user questions about the Specialty Pharmacy Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the high growth rate of the Specialty Pharmacy Services Market?

The market's high growth rate is primarily driven by the escalating research and development leading to the continuous approval of high-cost, complex specialty drugs, particularly biologics and gene therapies, coupled with the increasing global prevalence of chronic diseases requiring these specialized treatments.

How is vertical integration affecting the specialty pharmacy competitive landscape?

Vertical integration, primarily through PBMs and major payers acquiring specialty pharmacy assets, is consolidating market share, intensifying competition for independent pharmacies, and leading to the establishment of controlled, narrow distribution networks designed to manage utilization and control specialty drug costs for the payer.

What role does technology, specifically AI, play in improving patient adherence in specialty pharmacy?

AI utilizes machine learning and predictive analytics to analyze diverse patient data (clinical, behavioral, and logistical) to accurately identify patients at high risk of non-adherence. This allows specialty pharmacists to deploy proactive, personalized, and targeted interventions, significantly improving clinical outcomes and treatment consistency.

Which therapeutic area contributes the most significant revenue to specialty pharmacy services?

Oncology (cancer treatments) currently represents the largest therapeutic area segment by revenue within the Specialty Pharmacy Services Market, driven by the complexity, high cost, and intensive patient management required for cancer biologics and targeted therapies.

What are Limited Distribution Drugs (LDDs) and how do they impact the market?

Limited Distribution Drugs (LDDs) are specialty medications whose manufacturers restrict dispensing to a select, small network of specialty pharmacies. This restriction significantly impacts market access and gives the contracted specialty pharmacies a distinct competitive advantage, demanding high levels of clinical expertise and data reporting capabilities.

The Specialty Pharmacy Services Market is undergoing a rapid evolution, moving far beyond mere dispensing towards becoming an indispensable clinical and financial management hub for the most sophisticated and expensive pharmaceuticals. This transition is necessitated by the increasing complexity of treatments for chronic and rare diseases, demanding seamless coordination between manufacturers, payers, providers, and patients. The market structure, increasingly dominated by vertically integrated giants such as major PBMs and health systems, reflects a drive for cost containment and quality control over the specialty drug spend, which often accounts for a disproportionate share of total healthcare expenditure.

Strategic growth across service segments is being fueled by technological advancements. Investments in advanced data analytics, AI-driven adherence modeling, and sophisticated cold chain logistics are foundational requirements for market participation. These technologies not only enhance operational efficiency—streamlining the notoriously complex prior authorization and reimbursement processes—but critically, they improve clinical outcomes by ensuring patients receive timely and appropriate support. The demand for robust data reporting, particularly real-world evidence (RWE), is becoming a critical differentiator, enabling specialty pharmacies to demonstrate value to payers operating under value-based contracting models. This data capability positions specialty pharmacies as essential partners in demonstrating the cost-effectiveness of high-priced therapies.

Geographically, while North America continues its market dominance due to early adoption and high healthcare spending, the Asia Pacific region presents the most significant long-term growth opportunity. Expanding access to specialty care in populous and rapidly developing economies necessitates the transfer of specialized logistical and clinical expertise. Regulatory environments globally are continually adapting to manage the influx of new specialty and gene therapies, leading to varying levels of pricing scrutiny and distribution network regulation. Future market success will be highly dependent on the ability of specialty pharmacy organizations to adapt to these diverse regulatory landscapes, successfully manage logistical challenges related to ultra-expensive and temperature-sensitive products, and consistently deliver superior, personalized patient care that results in measurable improvements in adherence and clinical status.

The emphasis on patient support programs underscores the high-touch nature of specialty care. Unlike traditional pharmaceuticals, specialty drugs often require intensive patient education, injectable training, and ongoing monitoring for side effects. Specialty pharmacies act as crucial navigators, assisting patients with financial aid applications, minimizing out-of-pocket costs, and ensuring compliance with complex dosing schedules. This combination of administrative mastery, clinical excellence, and logistical precision defines the core competency required to thrive in this specialized market sector, solidifying its role as a high-growth segment essential to modern medicine.

Market restraints, primarily centered around escalating drug prices and associated political and regulatory pressures, mandate that specialty pharmacies continually justify their value proposition beyond distribution. The rise of biosimilars, while offering potential cost savings, requires specialty pharmacies to integrate complex substitution policies and educate providers and patients on interchangeability, adding another layer of administrative and clinical complexity. Opportunities abound in niche therapeutic areas, such as personalized medicine and orphan drugs, where the low patient volume but extremely high product complexity necessitates bespoke, white-glove service models. The market is thus characterized by a relentless pursuit of efficiency and clinical differentiation, ensuring optimal access and efficacy for treatments often considered the last line of defense for life-threatening or debilitating conditions.

The integration of advanced supply chain technology remains critical, particularly for maintaining the integrity of the cold chain, which is essential for preserving the viability of biologic drugs. Solutions leveraging blockchain technology are being explored to enhance transparency and security across the supply chain, providing an immutable record of drug provenance and handling conditions, thereby mitigating risks associated with counterfeiting and temperature excursions. Furthermore, the workforce within specialty pharmacy requires continuous education and specialization, moving beyond traditional pharmacology roles to encompass data science, patient advocacy, and advanced clinical informatics. The future competitive edge will belong to organizations that successfully leverage specialized human capital and cutting-edge technology to deliver verifiable, high-quality outcomes within restrictive cost parameters set by payers.

Addressing the complex reimbursement maze is another defining feature of specialty pharmacy services. Navigating the nuances of commercial, Medicare Part B, Medicare Part D, and Medicaid coverage requires dedicated expertise in benefits investigation and prior authorization management. Specialty pharmacies invest heavily in dedicated teams that specialize in rapid turnaround times for these administrative processes, directly impacting time-to-therapy for patients. Any delay in authorization for a high-cost medication can have significant financial and clinical consequences. Therefore, optimizing these administrative workflows, increasingly through AI and robotic process automation (RPA), is a key operational imperative for maintaining high satisfaction scores among prescribers and patients, further cementing the specialty pharmacy’s indispensable role in the modern healthcare delivery system.

The consolidation trend among specialty pharmacies is not merely about achieving economies of scale; it is fundamentally driven by the need to aggregate massive amounts of patient data. Payers require integrated data sets to conduct comprehensive utilization management, assess real-world outcomes, and negotiate favorable prices with manufacturers. Organizations with larger patient populations and superior data analytics capabilities are better positioned to participate in lucrative limited distribution networks and secure preferred status within payer contracts. This data-centric approach transforms the specialty pharmacy from a service provider into a strategic partner for risk management and evidence generation within the high-cost drug market.

Finally, the movement towards hospital-owned specialty pharmacies represents a key evolution in care delivery. These integrated models aim to eliminate the care coordination gap often experienced when transitioning patients from inpatient to outpatient care. By keeping dispensing and clinical support services geographically and organizationally close to the prescribing provider, hospital-owned pharmacies can significantly improve communication, expedite access, and manage complex discharge medication regimens more effectively, ensuring continuity of care and better adherence rates, which are critical factors for complex chronic disease management.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager