Specialty Synthetic Graphite Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433757 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Specialty Synthetic Graphite Market Size

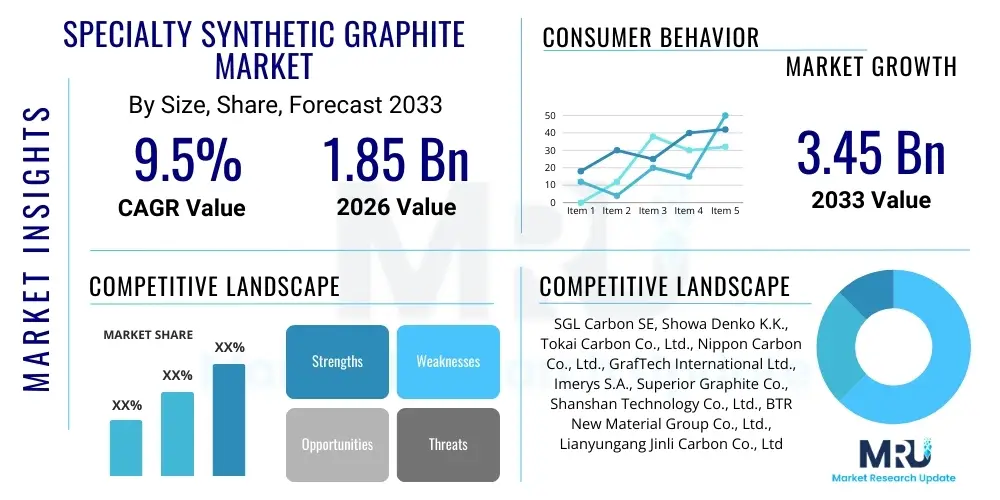

The Specialty Synthetic Graphite Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $1.85 Billion in 2026 and is projected to reach $3.45 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily driven by the escalating global demand for high-performance energy storage solutions, particularly in the electric vehicle (EV) sector, where synthetic graphite serves as a crucial anode material due to its superior purity and structural consistency compared to natural alternatives.

Specialty Synthetic Graphite Market introduction

The Specialty Synthetic Graphite Market encompasses high-purity, man-made carbon materials engineered for demanding technical applications requiring exceptional electrical conductivity, thermal stability, self-lubrication, and mechanical strength. Unlike natural graphite, synthetic graphite is produced through the controlled high-temperature graphitization of carbon precursors, such as petroleum coke or coal-tar pitch, yielding a product with customizable crystallinity, particle size, and pore structure. This highly controllable manufacturing process ensures the resultant material meets stringent specifications required by advanced industries, offering reliable performance where material failure is unacceptable.

The primary applications of specialty synthetic graphite span multiple high-growth sectors, including lithium-ion battery anodes, thermal management solutions in consumer electronics and data centers, electrical discharge machining (EDM) electrodes, nuclear reactors, and aerospace components. In the battery segment, synthetic graphite’s uniform structure allows for rapid lithium-ion intercalation and de-intercalation, enhancing charging speed and cycle life, which is critical for next-generation EV batteries. Furthermore, its superior purity levels are essential in semiconductor manufacturing and nuclear applications to avoid contamination that could compromise device performance or safety.

Key driving factors accelerating market expansion include the massive global investment in electromobility and renewable energy infrastructure, alongside the continuous miniaturization of electronic devices necessitating sophisticated thermal dissipation solutions. The inherent benefits of specialty synthetic graphite, such as ultra-high purity (often exceeding 99.99%), excellent anisotropy control, and customizable density, position it as an indispensable material for technological progress. Regulatory pressures favoring high-performance, energy-efficient components further solidify the material's market position, compelling manufacturers to substitute lower-grade materials with specialized synthetic variants.

Specialty Synthetic Graphite Market Executive Summary

The global Specialty Synthetic Graphite Market is characterized by intense technological innovation, driven predominantly by the escalating demand from the lithium-ion battery supply chain. Business trends indicate a strong focus on capacity expansion, particularly in Asian countries, coupled with vertical integration efforts by major graphite producers to secure precursor material supply and maintain cost competitiveness. Leading manufacturers are heavily investing in advanced purification and shaping technologies, such as chemical vapor deposition (CVD) techniques, to achieve the narrow tolerances required for high-end thermal interface materials (TIMs) and sophisticated semiconductor tooling, thereby reinforcing the high-value nature of this specialty segment.

Regionally, the Asia Pacific (APAC) region maintains overwhelming dominance, largely due to housing the world’s largest manufacturing bases for electric vehicle batteries, consumer electronics, and specialized semiconductor components. China, Japan, and South Korea are pivotal, not only as massive consumers but also as major innovators and producers of synthetic graphite. North America and Europe, while smaller in production scale, are rapidly increasing consumption, spurred by the establishment of localized Gigafactories and renewed focus on domestic supply chain resilience for critical materials, especially those related to defense and aerospace programs. Regulatory incentives, such as those promoting EV adoption, are significantly influencing procurement strategies in these Western markets.

Segmentation trends highlight the anode material segment’s leading contribution to market revenue, driven by the shift towards high-nickel cathodes and the need for high-stability anodes to prevent thermal runaway. The thermal management segment is exhibiting the fastest growth rate, fueled by the proliferation of 5G infrastructure, high-power computing, and advanced driver-assistance systems (ADAS) in vehicles, all of which generate substantial heat requiring efficient dissipation via graphite sheets or films. Furthermore, there is a distinct trend towards micronized and nano-scale synthetic graphite powders, crucial for advanced coatings and composite reinforcement, suggesting a move toward materials engineering at the particle level to unlock next-generation performance characteristics.

AI Impact Analysis on Specialty Synthetic Graphite Market

User inquiries regarding the intersection of Artificial Intelligence (AI) and the Specialty Synthetic Graphite Market primarily revolve around operational efficiency gains, material discovery acceleration, and quality control enhancement. Key themes include how AI-driven predictive modeling can optimize the highly energy-intensive graphitization process, minimizing energy consumption and maximizing yield; the potential for AI algorithms to screen and predict the performance of novel carbon precursors for specific applications (e.g., solid-state battery electrolytes); and the implementation of machine vision systems for real-time, ultra-fine inspection of graphite purity and microstructure uniformity, which is paramount for high-reliability applications like microelectronics and aerospace. Users are seeking quantifiable impacts on production cost reduction and R&D cycle times.

The implementation of AI is expected to revolutionize the traditionally empirical and high-variability process of synthetic graphite manufacturing. AI and machine learning models are deployed to analyze vast datasets pertaining to temperature profiles, gas flow rates, material composition, and heating duration during the graphitization stage. This analysis leads to dynamic process adjustments, ensuring consistent material quality while drastically reducing the incidence of off-spec batches. Furthermore, in R&D, generative AI tools are used to simulate the intercalation behavior of lithium ions within various synthetic graphite microstructures, allowing researchers to virtually prototype and refine anode designs before expensive physical trials.

The integration of AI technologies supports the market trend towards ultra-high purity and customization. AI facilitates the swift analysis of spectroscopic and diffractometric data, providing instant feedback on crystal lattice defects and contamination levels. For manufacturers dealing with thousands of customized specialty graphite products—from large EDM blocks to thin thermal films—AI-powered supply chain management and demand forecasting optimize inventory levels and production scheduling, mitigating the risks associated with volatile energy and raw material costs. This focus on intelligent manufacturing not only improves profitability but also meets the increasingly demanding quality standards set by end-users in critical infrastructure sectors.

- AI optimizes energy utilization in the graphitization process, reducing production costs.

- Machine learning algorithms accelerate the discovery and testing of new carbon precursors.

- Predictive maintenance models reduce downtime for high-temperature processing equipment.

- AI-driven machine vision systems ensure real-time, high-precision quality control and purity verification.

- Generative AI simulates material performance, speeding up Li-ion battery anode design cycles.

DRO & Impact Forces Of Specialty Synthetic Graphite Market

The Specialty Synthetic Graphite Market is fundamentally shaped by powerful growth drivers stemming from the electrification trend and technological acceleration, balanced against significant operational restraints related to manufacturing complexity and cost volatility. The foremost driver is the exponential growth of the Electric Vehicle (EV) industry, which relies heavily on high-density synthetic graphite for its anode materials, ensuring safety and extended range. Concurrently, the proliferation of data centers, 5G networks, and high-performance computing necessitates advanced thermal management solutions utilizing synthetic graphite films, which are critical impact forces sustaining robust demand across diverse technological ecosystems. These drivers create compelling market pull, motivating large-scale capital investments.

However, the market faces considerable restraints, primarily concerning the intensive energy consumption associated with the graphitization process, which involves sustained temperatures up to 3000°C. This dependence exposes manufacturers to volatile global energy prices and increases operational expenditure, challenging cost competitiveness, especially against cheaper natural graphite alternatives in specific lower-end applications. Furthermore, the supply chain for key precursors, such as needle coke and specialized pitches, can be constrained and influenced by the oil refining industry, leading to price instability and supply bottlenecks, which requires manufacturers to prioritize long-term, secure sourcing agreements.

Significant opportunities exist in emerging fields, notably the development of hybrid anodes incorporating silicon-graphite composites, offering vastly increased energy density for batteries, and the utilization of synthetic graphite in next-generation solid-state battery technology. Additionally, the growing focus on sustainable manufacturing and the recycling of battery materials presents an opportunity for companies that can develop circular economy models for graphite recovery and reprocessing. The impact forces acting on the market demonstrate a strong gravitation toward performance and purity; any material that can offer marginal improvements in thermal conductivity or electrochemical stability commands a significant premium, making innovation in microstructural control a key competitive differentiator.

Segmentation Analysis

The Specialty Synthetic Graphite Market is comprehensively segmented based on product form, application, and process technology, reflecting the specialized requirements of diverse end-use industries. The product segmentation includes graphite powder, blocks/rods, and sheets/films, each tailored to specific functions, such as powder for compounding and battery anodes, blocks for EDM tooling and heating elements, and films for thermal dissipation. Application segmentation is dominated by Li-ion batteries, followed by electrodes for specialty metallurgy, nuclear components, and thermal interface materials, indicating the critical role of these materials in high-stakes technological systems. Analyzing these segments provides strategic insights into investment priorities and technological bottlenecks across the value chain.

- By Product Form:

- Powder/Granules (Anode materials, metallurgical additives)

- Blocks/Rods (EDM electrodes, heating elements, crucibles)

- Sheets/Films (Thermal management, flexible electronics)

- By Application:

- Lithium-ion Batteries (Anode material)

- Electrical Discharge Machining (EDM) Electrodes

- Thermal Management Solutions (Smartphones, laptops, data centers, EVs)

- Aerospace and Defense (High-temperature components)

- Nuclear Reactors and Components (Moderator/reflector material)

- Specialty Metallurgy and Refractories

- By Purity Grade:

- High Purity Grade (>99.9%)

- Ultra-High Purity Grade (>99.995%)

- By Processing Technology:

- Acheson Process

- Graphitization Furnaces (Castner, Longitudinal, and Continuous)

- Chemical Vapor Deposition (CVD) for Films

Value Chain Analysis For Specialty Synthetic Graphite Market

The value chain for specialty synthetic graphite is capital-intensive and highly specialized, beginning with the procurement of high-quality carbon precursors. Upstream activities involve sourcing specific grades of petroleum coke, coal-tar pitch, or synthetic resins, where purity and structure are critical determinants of the final product quality. The availability and pricing volatility of these raw materials, often linked to the petroleum and chemical industries, pose the initial challenge. Specialty producers frequently engage in long-term supply agreements or integrate backward to secure consistent access to preferred cokes, ensuring the narrow technical specifications required for applications like battery anodes are met.

Midstream processing constitutes the core value addition, encompassing calcination, mixing, molding, baking, and the highly energy-intensive graphitization phase, where temperatures can exceed 2,500°C. This step requires advanced thermal engineering and meticulous process control, which defines the material's crystallinity, density, and electrical/thermal properties. Specialized manufacturers differentiate themselves through proprietary graphitization techniques and post-processing methods, such as purification (halogen or solvent treatment) and surface coating (e.g., carbon coating for battery materials), transforming bulk material into high-performance specialty products. Efficiency in energy usage during this stage is a crucial competitive battlefield.

Downstream activities focus on machining, shaping, and distribution to end-users. Distribution channels are typically direct for large-volume customers like battery manufacturers and aerospace primes, ensuring tight control over specifications and logistics. For smaller volume, highly specialized products (like EDM electrodes or thermal films), indirect channels involving specialized distributors and agents are utilized. The critical interaction point in the downstream sector is close technical collaboration with end-users to co-develop customized material solutions, as slight variations in particle size or purity can significantly affect the performance of the final application, especially in semiconductor or EV components.

Specialty Synthetic Graphite Market Potential Customers

Potential customers for specialty synthetic graphite are concentrated in high-technology, high-reliability sectors that demand materials with exceptional thermal, electrical, and mechanical properties unattainable with conventional alternatives. The primary consumer segment consists of lithium-ion battery cell manufacturers (OEMs and tier-one suppliers), which require vast quantities of synthetic graphite powder tailored for anode applications, prioritizing cycling stability and power density. These customers drive the majority of volume and require materials meeting rigorous quality standards enforced by the automotive industry.

Another significant customer base includes manufacturers of advanced thermal management systems for consumer electronics, automotive power electronics, and high-density data centers. These customers utilize synthetic graphite sheets and films for heat dissipation, where high thermal conductivity and low weight are crucial for system efficiency and device lifespan. Aerospace and defense contractors also represent a premium customer segment, demanding ultra-high purity graphite for missile components, rocket nozzles, and nuclear applications where material integrity under extreme conditions (high temperature, radiation) is non-negotiable.

Furthermore, the manufacturing industry utilizes specialty synthetic graphite in Electrical Discharge Machining (EDM) electrodes, valued for their low wear rate, easy machineability, and high resistance to thermal shock. Precision engineering companies and mold makers rely on consistent quality synthetic graphite blocks for creating high-precision tooling. The diversification of the customer base across energy storage, electronics, and heavy industry ensures market resilience against fluctuations in any single sector, driving continuous demand for tailored, high-specification synthetic carbon solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.85 Billion |

| Market Forecast in 2033 | $3.45 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SGL Carbon SE, Showa Denko K.K., Tokai Carbon Co., Ltd., Nippon Carbon Co., Ltd., GrafTech International Ltd., Imerys S.A., Superior Graphite Co., Shanshan Technology Co., Ltd., BTR New Material Group Co., Ltd., Lianyungang Jinli Carbon Co., Ltd., Graphite India Limited, SEC Carbon, Ltd., Toray Industries, Inc., Asbury Carbons Inc., NeoGraf Solutions LLC, Cabot Corporation, Mersen Corporate, Kureha Corporation, Graphene Manufacturing Group Ltd., Teijin Limited |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Specialty Synthetic Graphite Market Key Technology Landscape

The technological landscape of the Specialty Synthetic Graphite Market is dominated by refinement processes aimed at enhancing purity, controlling microstructure, and enabling novel geometries. The modified Acheson process remains the foundational technology for bulk production, but continuous innovation focuses on optimizing furnace design and energy efficiency, often incorporating advanced insulation materials and induction heating methods to reduce the enormous energy footprint. The primary technical differentiation lies in specialized graphitization furnaces, such as continuous graphitization systems, which offer higher throughput and improved material consistency compared to traditional batch processes, making them economically viable for high-volume applications like battery anodes.

A crucial technological area is ultra-purification, vital for semiconductor and nuclear grades. This involves post-graphitization treatments, primarily employing halogen gas purification or high-temperature solvent washing, to reduce impurities (ash, metals) to parts per million (ppm) or even parts per billion (ppb) levels. Furthermore, the development of synthetic graphite films for thermal management relies heavily on Chemical Vapor Deposition (CVD) techniques, where carbon-containing gases are decomposed onto a substrate at high temperatures to form highly ordered, thin graphite layers with exceptional planar thermal conductivity. Continuous refinement of CVD parameters is enabling thinner, more flexible films, meeting the stringent demands of bendable and flexible electronic displays.

In the battery sector, technological advancements focus on coating and composite preparation. Anode materials are often coated with an amorphous carbon layer to stabilize the solid electrolyte interface (SEI) layer, enhancing safety and cycle life. Research is rapidly progressing in integrating synthetic graphite with silicon nanoparticles (Si-C composites) to boost volumetric and gravimetric energy density significantly. This requires advanced material handling and mixing technologies to ensure homogeneous dispersion and stable composite structure. The interplay between particle engineering, surface chemistry, and high-temperature processing defines the performance ceiling of next-generation specialty synthetic graphite products.

Regional Highlights

The global demand for specialty synthetic graphite is highly skewed towards the Asia Pacific (APAC) region, which commands the largest market share both in terms of production capacity and consumption volume. This dominance is intrinsically linked to the region’s established leadership in the manufacturing of lithium-ion batteries—specifically in China, Japan, and South Korea—which collectively account for the vast majority of global EV and consumer electronics battery output. China, in particular, holds a commanding position in both the raw material supply chain (petroleum coke) and finished synthetic graphite anode production. Continuous government subsidies and robust domestic demand for EVs ensure that APAC remains the epicenter of market growth, driving technological standards for graphite material purity and performance.

North America represents a high-value, high-specification market segment, driven primarily by demand from the aerospace, defense, and specialized semiconductor industries. While the volume is lower than in APAC, the need for ultra-high purity graphite for nuclear applications and sophisticated thermal systems ensures premium pricing and stable demand. Recent investments in domestic battery manufacturing capacity (Gigafactories) spurred by governmental initiatives aimed at localizing the supply chain are set to substantially increase North American consumption of synthetic graphite anodes over the forecast period. Companies are prioritizing sourcing reliability and traceability, favoring domestic or allied-nation suppliers.

Europe is experiencing rapid growth, fueled by ambitious renewable energy targets and the parallel expansion of its EV and battery manufacturing ecosystem. Germany, France, and the UK are key markets, investing heavily in Giga-factory establishment and associated battery component supply chains. Furthermore, Europe maintains strong demand for specialty graphite in industrial applications, particularly in advanced metallurgy, high-performance seals, and EDM applications. Regulatory frameworks, such as the European Union’s push for sustainable material sourcing and reduced carbon footprint, are compelling manufacturers in this region to innovate cleaner and more energy-efficient production methods for synthetic graphite.

- Asia Pacific (APAC): Dominates consumption and production, driven by Li-ion battery manufacturing hubs (China, South Korea, Japan). Focuses on cost-effective, high-volume anode material production.

- North America: High-value market focused on ultra-high purity grades for aerospace, defense, and nuclear applications. Rapid growth projected due to new domestic EV battery production facilities.

- Europe: Rapidly expanding market due to electric vehicle commitments and the establishment of local battery supply chains (Gigafactories). Emphasizes sustainable production methods and advanced metallurgy.

- Latin America (LATAM) & Middle East and Africa (MEA): Emerging markets with moderate demand, primarily focused on industrial applications, refractory uses, and specialized oil and gas tooling requiring high thermal stability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Specialty Synthetic Graphite Market.- SGL Carbon SE

- Showa Denko K.K.

- Tokai Carbon Co., Ltd.

- Nippon Carbon Co., Ltd.

- GrafTech International Ltd.

- Imerys S.A.

- Superior Graphite Co.

- Shanshan Technology Co., Ltd.

- BTR New Material Group Co., Ltd.

- Lianyungang Jinli Carbon Co., Ltd.

- Graphite India Limited

- SEC Carbon, Ltd.

- Toray Industries, Inc.

- Asbury Carbons Inc.

- NeoGraf Solutions LLC

- Cabot Corporation

- Mersen Corporate

- Kureha Corporation

- Graphene Manufacturing Group Ltd.

- Teijin Limited

Frequently Asked Questions

Analyze common user questions about the Specialty Synthetic Graphite market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for specialty synthetic graphite?

The primary factor is the exponentially growing demand for high-performance lithium-ion battery anodes required by the Electric Vehicle (EV) industry. Synthetic graphite provides the superior purity, structural stability, and consistent performance necessary for fast charging, long cycle life, and enhanced safety in automotive batteries.

How does synthetic graphite differ from natural graphite in performance?

Synthetic graphite offers higher purity levels (often >99.99%), better crystallinity control, and highly engineered structural consistency compared to natural graphite. This control allows synthetic variants to excel in applications like EDM electrodes and battery anodes, providing better electrical conductivity and tailored thermal properties, mitigating inconsistencies inherent in mined materials.

What role does synthetic graphite play in modern thermal management?

Synthetic graphite, especially in film or sheet form, is crucial for thermal management in compact and high-power electronic devices (like 5G smartphones, high-performance processors, and EV power electronics). Its superior planar thermal conductivity allows for efficient heat spreading and dissipation, preventing overheating and ensuring the longevity and reliability of sophisticated electronic systems.

Which regions lead the production and consumption of specialty synthetic graphite?

The Asia Pacific (APAC) region, led by China, Japan, and South Korea, dominates both the production capacity and consumption of specialty synthetic graphite. This regional concentration is due to the strong presence of the global lithium-ion battery and consumer electronics manufacturing ecosystem within these countries.

What are the major challenges facing synthetic graphite manufacturers?

Key challenges include the extremely high energy consumption and associated costs of the graphitization process (requiring temperatures up to 3000°C), volatility in the pricing and supply of carbon precursors (petroleum coke and pitch), and the stringent capital requirements necessary for maintaining ultra-high purity production environments required by semiconductor and aerospace customers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager