Specification Management Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437255 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Specification Management Software Market Size

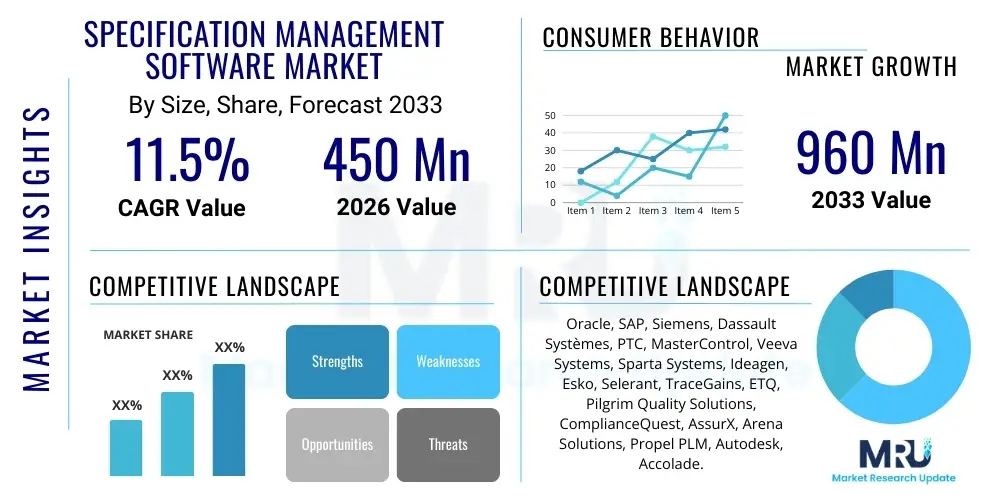

The Specification Management Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 960 Million by the end of the forecast period in 2033.

Specification Management Software Market introduction

Specification Management Software encompasses a suite of digital tools designed to create, manage, control, and communicate product specifications, formulas, materials data, and regulatory requirements across the product lifecycle. This critical enterprise solution ensures data integrity, minimizes compliance risks, and facilitates efficient collaboration among R&D, manufacturing, quality assurance, and supply chain departments. The core objective of these systems is to centralize highly technical and detailed product specifications, which often involve complex documentation related to ingredients, packaging, performance metrics, and handling procedures, ensuring that all stakeholders operate from a single source of truth, thereby accelerating time-to-market and reducing errors inherent in manual processes.

Major applications for this software span heavily regulated industries, including Food and Beverage (managing nutritional facts and allergen data), Pharmaceuticals (maintaining precise chemical compositions and regulatory submissions), and advanced Manufacturing (controlling material specifications and Bill of Materials, or BOMs). The primary benefits derived from adoption include enhanced regulatory adherence, particularly vital in environments governed by FDA, EMA, or ISO standards; improved supply chain resilience through better supplier specification data exchange; and significant operational efficiencies resulting from automated change control and version tracking. The market driving factors include the escalating complexity of global supply chains, stringent governmental mandates concerning product safety and labeling, and the industry-wide shift towards digital transformation initiatives aimed at enhancing data governance and transparency across organizational silos.

Specification Management Software Market Executive Summary

The Specification Management Software Market is undergoing robust expansion, fundamentally driven by the increased volume and complexity of product data, coupled with the critical necessity for comprehensive regulatory compliance across diverse geographical jurisdictions. Current business trends indicate a strong shift towards integrated platforms that offer seamless connectivity with existing Enterprise Resource Planning (ERP) and Product Lifecycle Management (PLM) systems, moving beyond standalone documentation tools to holistic data management environments. Furthermore, providers are heavily investing in user-friendly interfaces and mobile accessibility to enhance adoption rates among technical and non-technical staff alike. The competitive landscape is characterized by both large, established enterprise software vendors expanding their portfolio capabilities and specialized niche providers offering highly tailored solutions for specific vertical markets, particularly within the life sciences and complex manufacturing sectors, signaling a sustained environment of innovation and consolidation.

Regional trends highlight North America and Europe as the dominant markets, owing to the early adoption of advanced manufacturing practices, the presence of major pharmaceutical and food corporations, and exceptionally strict regulatory frameworks that necessitate sophisticated specification control systems. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, spurred by rapid industrialization, increasing foreign direct investment in manufacturing facilities, and the harmonization of regional quality and safety standards, particularly in countries like China and India, making it a critical area for future market penetration. Segment trends reveal that the cloud-based deployment model is experiencing accelerating adoption due to its scalability, lower upfront costs, and ease of maintenance, appealing strongly to Small and Medium-sized Enterprises (SMEs). Concurrently, the application segment focused on regulatory compliance is witnessing substantial demand, as organizations prioritize risk mitigation related to audits and product recalls, confirming compliance needs as a principal investment catalyst.

AI Impact Analysis on Specification Management Software Market

Common user questions regarding AI's impact on Specification Management Software frequently revolve around the potential for automation, predictive compliance capabilities, and improved data quality assurance. Users are keen to understand how AI and Machine Learning (ML) can move these systems beyond static documentation archives into proactive, intelligent decision-support tools. Specific concerns often include how AI handles legacy data migration, ensures data privacy when learning from sensitive product compositions, and accurately predicts the impact of material substitutions or formulation changes on regulatory adherence across multiple global standards. The core expectation is that AI will significantly reduce the manual effort currently required for data entry, change impact assessment, and the continuous monitoring of evolving global specifications and regulatory text, ultimately transforming the role of the specification manager from a data keeper to a strategic compliance analyst. These inquiries reflect a readiness to embrace intelligent automation, provided it integrates seamlessly and reliably enhances the precision and speed of specification workflows.

AI's primary influence is manifesting in enhancing data governance and automating complex decision-making processes within specification management ecosystems. AI algorithms are increasingly being used for natural language processing (NLP) to parse unstructured data, such as supplier certifications or regulatory documents, automatically extracting critical parameters and populating structured fields within the specification database. This capability drastically improves the consistency and completeness of data, which is foundational for effective management. Furthermore, machine learning models analyze historical product failures, compliance issues, and change requests to predict potential risks associated with proposed specification modifications before they are implemented. This predictive modeling shifts quality assurance from a reactive inspection regime to a proactive risk management approach, ensuring specifications remain robust and compliant throughout the entire product lifecycle.

The integration of deep learning and predictive analytics allows specification software to perform sophisticated scenario planning. For instance, in the food industry, AI can simulate the effect of substituting one ingredient for another, instantly calculating the resulting nutritional information, allergen declaration changes, and regulatory status across targeted markets (e.g., EU, US, China). This accelerated impact assessment significantly cuts down on R&D time and compliance validation cycles. While AI offers immense potential, the successful implementation requires high-quality, normalized training data, and ethical considerations surrounding data bias must be meticulously managed to prevent systematic errors in automated compliance checks, thereby demanding robust validation protocols and human-in-the-loop oversight to maintain accountability and trust in the system outputs.

- Automated Data Extraction: Utilizing NLP to scan, categorize, and extract structured data from unstructured documents (e.g., PDF specifications, vendor contracts).

- Predictive Compliance Analysis: ML models assessing proposed specification changes against thousands of regulatory rules to flag potential non-compliance risks instantly.

- Intelligent Workflow Automation: Automating routing and approvals based on the complexity and regulatory impact score of a specification change request.

- Data Quality Enhancement: AI identifying and correcting inconsistencies, ambiguities, and duplicate entries within large specification databases.

- Supplier Specification Monitoring: Real-time tracking of supplier specification updates and automatically flagging deviations from accepted baseline parameters.

- Advanced Change Impact Simulation: Simulating the downstream effects of formulation or material changes on final product labels, packaging, and manufacturing procedures.

DRO & Impact Forces Of Specification Management Software Market

The trajectory of the Specification Management Software Market is profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the critical Impact Forces shaping its evolution. The primary drivers stem from the fundamental business necessity for centralized data governance and the relentless pressure exerted by global regulatory bodies demanding greater product transparency and traceability, particularly in sectors dealing with consumer health and safety. The ongoing trend of globalized sourcing and manufacturing necessitates sophisticated systems that can manage specifications across multi-site operations and diverse cultural and legal environments, making manual or disparate systems obsolete. Simultaneously, the opportunities arising from integrating emerging technologies, such as IoT and advanced analytics, promise to create highly differentiated and efficient specification platforms, pushing market growth beyond traditional bounds.

Key drivers include the pervasive trend of digital transformation initiatives across industries, where companies seek to eliminate paper-based processes and integrate core business functions digitally, making centralized specification management a foundational element of a cohesive digital ecosystem. The increasing complexity of modern products, especially those with custom configurations or personalized variants, demands robust software capable of managing thousands of linked component specifications and their intricate interdependencies. Furthermore, the persistent threat of product recalls, which carry significant financial and reputational damage, acts as a powerful catalyst, compelling organizations to invest proactively in software solutions that guarantee specification accuracy and traceability from raw material procurement through to final consumer delivery, proving compliance during audits.

However, market growth is constrained by significant restraints, primarily the high initial cost of deploying comprehensive enterprise-grade specification management software, coupled with the substantial training and integration expenses required to transition away from deeply entrenched legacy systems. Data migration from diverse sources (spreadsheets, older databases) into a new, normalized structure poses a major technical hurdle, often causing implementation delays. Opportunities, conversely, lie in expanding service models, such as Software-as-a-Service (SaaS), which lowers the barrier to entry for SMEs, and developing highly specialized solutions tailored for niche but rapidly growing markets, such as sustainable packaging or clean label food products, thereby offering vendors new avenues for high-value client acquisition. These forces—regulatory demands, technological advancement, and cost sensitivity—create a high-impact environment where innovation and proven ROI are essential determinants of market success.

Segmentation Analysis

The Specification Management Software Market is meticulously segmented based on Deployment Model, Enterprise Size, Application, and Industry Vertical, allowing for a granular understanding of user needs and vendor specialization. Analyzing these segments reveals shifting preferences, most notably the transition from traditional on-premise solutions to flexible, subscription-based cloud deployment models, which offer enhanced agility and accessibility, crucial for businesses managing dynamic supply chains. The differential needs of Large Enterprises requiring highly customized and deeply integrated PLM capabilities contrast with the standardized, quick-to-implement requirements of SMEs, driving product differentiation strategies among vendors. Furthermore, the application segment highlights the prioritizing of compliance and quality assurance functions, signaling where the bulk of current enterprise investment is directed.

The industry vertical segmentation underscores the critical role specification management plays in highly regulated environments. The pharmaceutical and food and beverage sectors lead adoption due to mandatory requirements surrounding batch traceability, ingredient declarations, and stringent health and safety standards. Conversely, general manufacturing, while also a significant consumer, focuses more intensely on material composition, performance specifications, and engineering change management. This diversity requires vendors to offer highly configurable platforms capable of handling sector-specific data taxonomies (e.g., FDA standards versus automotive component tolerances). The increasing demand for vertical-specific functionality, particularly for complex regulatory environments, dictates that future market growth will be heavily reliant on solutions that offer depth of features rather than broad, generalized capabilities, confirming the trend toward specialization.

- By Deployment Model

- Cloud-Based: Preferred for scalability, lower TCO, remote accessibility, and rapid updates, particularly popular among SMEs and global organizations.

- On-Premise: Chosen by large enterprises in highly sensitive sectors (e.g., defense, major pharmaceuticals) requiring maximum data control and deep integration with proprietary internal systems.

- By Enterprise Size

- Small and Medium-sized Enterprises (SMEs): Demand cost-effective, readily deployable SaaS solutions with standardized features.

- Large Enterprises: Require highly customizable, robust solutions capable of managing complex global specifications, multi-language support, and enterprise-wide integration (ERP, MES, PLM).

- By Application

- Product Lifecycle Management (PLM) Integration: Managing specifications as part of the overall product development and retirement process.

- Regulatory Compliance and Quality Management: Ensuring adherence to regional and international standards (e.g., FDA, GMP, ISO) and automating audit trail generation.

- Research and Development (R&D): Documenting and controlling experimental formulations and early-stage material specifications.

- Supply Chain and Sourcing Management: Facilitating accurate exchange and validation of supplier specifications and raw material data.

- By Industry Vertical

- Food and Beverage (F&B): Focus on nutritional facts, allergen control, labeling compliance, and recipe management.

- Pharmaceutical and Biotechnology: Emphasis on formulation control, GxP compliance, dossier preparation, and clinical trial material specifications.

- Chemical and Cosmetics: Management of safety data sheets (SDS), ingredient declarations, and hazard classifications.

- Manufacturing (Automotive, Aerospace, Industrial Equipment): Control over technical drawings, material properties, performance parameters, and change control procedures.

- Retail and Consumer Goods: Focus on packaging specifications, sustainability metrics, and private label product definitions.

Value Chain Analysis For Specification Management Software Market

The Value Chain for Specification Management Software commences with upstream activities centered on core technology development and foundational infrastructure provision. This stage involves software development firms focusing on creating robust, scalable platforms utilizing cloud infrastructure providers (like AWS, Azure, Google Cloud). Key activities here include R&D into AI/ML integration, database architecture optimization for handling complex material data, and ensuring compliance with global data security standards. The upstream performance directly dictates the platform's reliability, integration capability, and functional depth, which are crucial differentiators in the highly competitive market landscape. Software vendors must continuously invest in intellectual property and maintain partnerships with critical technology stack providers to secure their competitive edge and ensure long-term viability and performance.

The downstream segment focuses heavily on deployment, integration, and post-sales support, directly interacting with the end-user organizations. Distribution channels play a vital role, often leveraging a mix of direct sales teams for large enterprise contracts and indirect channels, such as specialized System Integrators (SIs) and value-added resellers (VARs), who localize the implementation and provide industry-specific configuration expertise. Direct distribution is crucial for managing complex, bespoke installations requiring deep customization and long-term strategic partnerships. Conversely, indirect channels are essential for market penetration in new geographical areas and for servicing the SME segment efficiently. The provision of comprehensive training, ongoing technical support, and continuous software updates constitutes the final and ongoing step in the value delivery process, critically impacting customer satisfaction and long-term retention.

Successful execution across the value chain requires strong collaboration between the core software providers and the ecosystem of partners, particularly in specialized vertical industries where domain expertise is non-negotiable. For instance, in the pharmaceutical sector, system integrators often need specialized knowledge of GxP validation requirements to ensure the deployed system is audit-ready. The efficiency of the distribution channel—both direct and indirect—determines the speed and reach of market adoption. Indirect channels often provide localization and tailored services that are vital for global clients, ensuring the software can handle region-specific regulations and linguistic requirements, thereby maximizing the delivered value and accelerating the return on investment for the end-user organization.

Specification Management Software Market Potential Customers

Potential customers for Specification Management Software span a broad range of industries characterized by stringent regulatory environments, complex product formulations, and reliance on accurate material documentation. The primary buyers are typically large organizations operating in manufacturing sectors, particularly those with sophisticated global supply chains and a high volume of SKUs (Stock Keeping Units). Decision-makers often reside in Quality Assurance, Regulatory Affairs, Research and Development, and Procurement departments, with Chief Operations Officers (COOs) and Chief Information Officers (CIOs) driving the final strategic investment decisions, viewing the software as an essential tool for enterprise risk management and operational excellence.

Specific high-priority end-user segments include multinational Food & Beverage companies facing continuous pressure related to transparency, nutritional labeling mandates, and allergen management. Similarly, pharmaceutical and biotechnology firms are critical buyers, where the software is fundamental for maintaining Good Manufacturing Practice (GMP) compliance, managing Investigational New Drug (IND) submissions, and ensuring complete batch traceability for life-saving products. Beyond heavily regulated industries, companies in the aerospace and automotive sectors, managing complex Bill of Materials (BOMs) and highly precise engineering specifications for safety-critical components, represent a significant customer base prioritizing version control and engineering change management features. The growing SME segment, increasingly focusing on digital maturity, also represents a burgeoning pool of potential customers, particularly those adopting cloud-based solutions to mitigate compliance risks inherent in smaller, rapidly scaling operations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 960 Million |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Oracle, SAP, Siemens, Dassault Systèmes, PTC, MasterControl, Veeva Systems, Sparta Systems, Ideagen, Esko, Selerant, TraceGains, ETQ, Pilgrim Quality Solutions, ComplianceQuest, AssurX, Arena Solutions, Propel PLM, Autodesk, Accolade. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Specification Management Software Market Key Technology Landscape

The Specification Management Software market relies heavily on a sophisticated technological stack primarily centered around robust cloud computing architecture, advanced database management systems, and specialized integration frameworks. Modern solutions are predominantly built on multi-tenant SaaS platforms hosted on major cloud infrastructures (like AWS or Azure), ensuring high availability, disaster recovery, and global accessibility, which is crucial for multinational companies managing distributed R&D and manufacturing sites. The use of structured query language (SQL) and NoSQL databases is critical for efficiently managing the vast and varied data types inherent in specifications—ranging from text descriptions and performance metrics to graphical data and complex formulas—while ensuring instantaneous retrieval and version control capabilities, which forms the bedrock of system reliability and scalability.

Furthermore, the integration layer is a significant technological focus, utilizing application programming interfaces (APIs) and standardized communication protocols (such as XML and JSON) to facilitate seamless, real-time data exchange with adjacent enterprise systems. These integrations are essential for connecting the specification platform with ERP for inventory tracking, PLM for product structure management, and MES (Manufacturing Execution Systems) for quality checks on the production floor. The ability to integrate effortlessly reduces data redundancy and guarantees that the specification documents used in operations are always synchronized with the master data, mitigating risks associated with outdated information being used during manufacturing or compliance submissions.

In addition to core infrastructure and integration technologies, the adoption of cutting-edge analytical tools, including embedded AI and Machine Learning components, defines the current technological advancements in the sector. These technologies enable predictive analytics for risk assessment, automated classification of input data, and sophisticated reporting dashboards that utilize business intelligence (BI) tools to visualize specification health, compliance status, and change request throughput. Blockchain technology, although still nascent, is also being explored by key vendors for enhancing traceability and securing the immutable record of specification changes across complex, untrusted supply chains, offering a future path toward ultra-secure and transparent specification data management, especially relevant in high-risk food and pharmaceutical sectors.

Regional Highlights

The Specification Management Software Market demonstrates distinct adoption patterns and growth characteristics across key global regions, driven primarily by differing regulatory environments, industrial concentration, and digital maturity levels.

- North America: As the largest market, North America is characterized by high levels of technological maturity and the presence of numerous large pharmaceutical, food and beverage, and aerospace corporations. Strict regulatory mandates, particularly those enforced by the FDA and USDA, necessitate investment in advanced specification systems to manage complex labeling, safety requirements, and traceability. The region is a leader in adopting cloud-based solutions and integrating AI for predictive compliance, maintaining its dominance through early adoption of cutting-edge technology and robust spending on enterprise software infrastructure.

- Europe: Europe represents a highly mature market, driven by the need to comply with comprehensive regulations such as the EU Food Information Regulation (FIC) and GMP standards. Demand is particularly strong in Germany, the UK, and France, where major manufacturing and life sciences hubs require centralized systems to navigate complex cross-border regulatory harmonization efforts. European companies prioritize solutions that offer multi-language capabilities and robust data localization features to meet diverse national requirements, showing consistent, stable growth fuelled by continuous compliance updates.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, stimulated by rapid industrialization, increasing consumer awareness regarding product quality, and significant foreign investment establishing advanced manufacturing bases. Countries like China, India, and Japan are investing heavily in modernizing their supply chain infrastructure. While initial adoption was slower, the shift towards digital factories and global export ambitions are forcing companies to adopt international best practices in specification management, leading to explosive growth in demand for scalable, affordable cloud solutions.

- Latin America (LATAM): The LATAM market is in an emerging phase, with adoption concentrated in major economies like Brazil and Mexico. Growth is driven by local manufacturers aligning with global export standards and improving domestic quality control. The market is highly price-sensitive, favoring SaaS models that reduce upfront capital expenditure. Regulatory harmonization across regional trade blocs is a key factor pushing increased system implementation.

- Middle East and Africa (MEA): MEA is the smallest but rapidly developing segment. Investment is concentrated in sectors related to oil and gas specifications (in the Middle East) and food safety and pharmaceutical manufacturing (in South Africa and GCC countries). Adoption is often tied to large-scale government or national industrial projects that mandate the highest international quality and safety standards, making specification software a required component for global market access and quality assurance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Specification Management Software Market.- Oracle Corporation

- SAP SE

- Siemens AG

- Dassault Systèmes SE

- PTC Inc.

- MasterControl, Inc.

- Veeva Systems

- Sparta Systems (Acquired by Honeywell)

- Ideagen Plc

- Esko-Graphics NV

- Selerant Corporation

- TraceGains, Inc.

- ETQ, LLC (A Bentley Systems Company)

- Pilgrim Quality Solutions (Acquired by IQVIA)

- ComplianceQuest

- AssurX, Inc.

- Arena Solutions (A PTC Business)

- Propel PLM

- Autodesk, Inc.

- Accolade (Acquired by Optimizely)

Frequently Asked Questions

Analyze common user questions about the Specification Management Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Specification Management Software and why is it essential for regulatory compliance?

Specification Management Software centralizes and controls all technical product details, ensuring that every version of a product specification is accurate, approved, and traceable. It is essential for compliance because it automates change control, generates audit trails, and validates specifications against mandatory governmental and industry regulations (like FDA or ISO standards), significantly reducing the risk of costly non-conformance.

How does cloud deployment compare to on-premise solutions in this market?

Cloud-based (SaaS) deployment offers lower total cost of ownership (TCO), faster deployment, and superior scalability, making it ideal for SMEs and multinational corporations needing global accessibility and frequent updates. On-premise solutions offer maximum data control and deep integration with proprietary legacy systems, often preferred by highly regulated organizations with stringent internal security requirements.

Which industry verticals are the primary adopters of Specification Management Software?

The primary adopters are industry verticals with complex product compositions and stringent regulatory oversight, most notably Food & Beverage (due to allergen and nutritional labeling) and Pharmaceutical & Biotechnology (due to GxP compliance and formulation control). Manufacturing sectors like Automotive and Aerospace also heavily utilize the software for material and component precision management.

What role does AI and Machine Learning play in future specification management platforms?

AI integrates through Natural Language Processing (NLP) to automate the extraction of data from supplier documents and utilize Machine Learning (ML) for predictive compliance analysis. This allows the software to proactively assess the impact of specification changes on regulatory status, improve data quality, and automate routine verification tasks, transforming systems into intelligent decision-support tools.

What are the major challenges faced during the implementation of specification software?

Major challenges include the high initial capital investment required for enterprise systems, the complexity of migrating large volumes of legacy specification data from disparate sources (such as spreadsheets or old databases), and resistance to change among technical users accustomed to traditional, manual documentation workflows.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager