Spectra Copy Paper Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431686 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Spectra Copy Paper Market Size

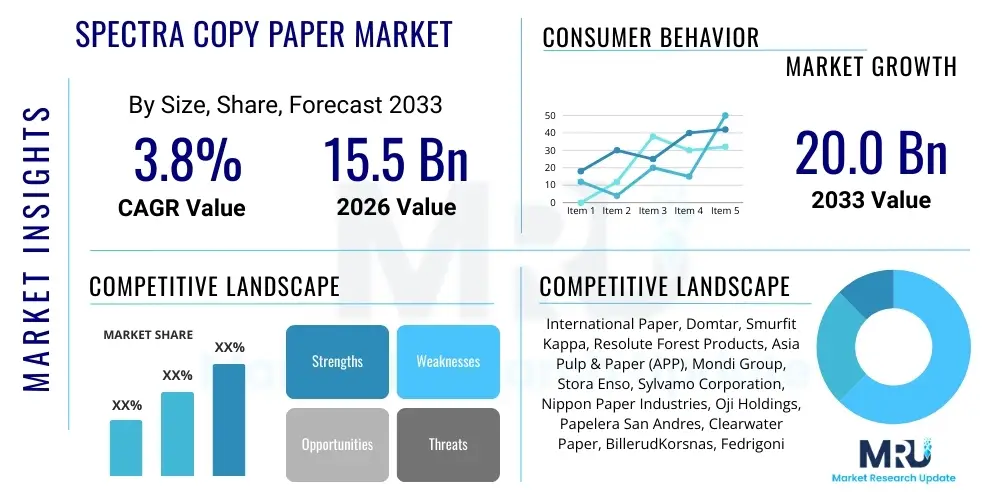

The Spectra Copy Paper Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 3.8% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 20.0 Billion by the end of the forecast period in 2033.

Spectra Copy Paper Market introduction

The Spectra Copy Paper Market encompasses the production, distribution, and consumption of high-quality uncoated free sheet paper, primarily utilized for printing, copying, and writing applications across professional and educational settings. Spectra refers to a specific branding or quality tier, signifying premium brightness, superior opacity, and advanced archival properties necessary for demanding corporate documentation and high-resolution color printing. This specialized paper caters to users who require consistent performance, minimal jamming, and excellent color reproduction, differentiating it from standard, multi-purpose office paper. The underlying industry is driven by infrastructural growth, educational demands, and the continuous, albeit challenged, need for physical record-keeping and official documentation globally.

Key applications of Spectra Copy Paper extend across numerous verticals, including government agencies requiring durable, official records; corporate offices for legal documents, reports, and presentations; and educational institutions for tests, handouts, and administrative paperwork. The product description emphasizes its optimized surface smoothness for high-speed laser and inkjet printers, alongside environmental certifications indicating sustainable sourcing practices, which is increasingly a decisive factor for corporate procurement teams. The benefits associated with using premium copy paper include reduced equipment downtime due to paper-related issues, enhanced professional appearance of printed materials, and longevity of critical records, contributing significantly to office efficiency and brand perception.

Driving factors for sustained growth, despite the overarching trend of digitalization, include stringent regulatory requirements mandating physical document retention in finance and healthcare sectors, the persistent popularity of hybrid work models necessitating home printing capabilities, and robust economic expansion in developing regions where paper consumption per capita continues to rise. Furthermore, continuous innovation in paper manufacturing, focusing on lighter weights with maintaining thickness and brightness, further supports market stability. Manufacturers are also heavily investing in biodegradable and recycled fiber content to meet evolving consumer expectations regarding environmental responsibility.

Spectra Copy Paper Market Executive Summary

The Spectra Copy Paper Market demonstrates resilience, primarily fueled by specialized usage requirements in regulated industries and sustained demand from educational sectors across APAC and Latin America. Current business trends indicate a critical shift toward sustainable sourcing, with major manufacturers prioritizing certifications such as FSC and PEFC to meet global corporate governance mandates. While overall volume growth faces headwinds from digitalization, the value segment, represented by premium Spectra papers, is growing due to higher margins derived from advanced technical specifications and superior end-user experience. Strategic mergers and acquisitions among large integrated paper manufacturers are consolidating market share, focusing on optimizing global distribution networks and achieving economies of scale in pulp production.

Regional trends highlight the Asia Pacific (APAC) region as the dominant and fastest-growing market, largely due to massive public infrastructure projects, rapid urbanization, and significant government spending on education, which inherently drives demand for office supplies. Conversely, mature markets like North America and Europe are characterized by stable, high-value demand focused on recycled and specialty paper products, with less emphasis on volume growth. Geopolitical stability and fluctuating raw material costs, particularly wood pulp and energy prices, exert noticeable influence on profitability and pricing strategies across different operational regions, forcing regional manufacturing bases to constantly adjust their supply chain logistics and energy consumption models.

Segmentation trends reveal that the 80 GSM weight segment maintains the highest revenue share, balancing quality, cost, and machine compatibility across most professional applications. However, the slightly lighter 75 GSM segment is gaining traction due to cost-saving initiatives and environmental optimization efforts to reduce shipping weights. Distributionally, the rise of e-commerce platforms is significantly impacting traditional stationery wholesalers, providing direct channels for consumers and small businesses, thus increasing price transparency and competitive pressure. The differentiation of paper based on end-use application (e.g., dedicated color printing paper vs. general office use) allows vendors to capture varied premium points throughout the forecast period.

AI Impact Analysis on Spectra Copy Paper Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Spectra Copy Paper Market predominantly revolve around two central themes: the acceleration of document digitization and the potential role of AI in optimizing paper manufacturing processes. Common questions explore how AI-powered Document Management Systems (DMS) might reduce the volume of physical printing required, leading to decreased paper demand, and whether machine learning algorithms can enhance quality control, minimize waste, and predict maintenance needs within large-scale paper mills. Users also frequently ask if AI-driven supply chain analytics can make paper distribution more efficient, indirectly impacting the final cost of products like Spectra paper.

The analysis reveals that while AI fundamentally accelerates the move toward paperless offices, particularly in transactional and repetitive documentation, its overall detrimental effect on premium paper remains mitigated by regulatory needs and human preference for certain physical documents. AI-driven DMS platforms automate workflows, reducing the necessity to print initial drafts, yet compliance requirements in sectors like banking and pharmaceutical manufacturing still mandate hard copies for legal validation and archival purposes. Therefore, AI is likely to shift demand from lower-quality, high-volume paper toward high-quality, long-lasting products like Spectra, where durability and print clarity are essential for archival longevity and data integrity.

Furthermore, the integration of AI within manufacturing is proving beneficial for market players. AI systems are deployed for predictive maintenance on paper machines, maximizing uptime and reducing operational expenditures, thereby stabilizing product pricing. Simultaneously, AI-based image analysis ensures flawless paper quality by detecting minute defects in real-time, which is crucial for maintaining the premium reputation of Spectra-branded products. This application of AI enhances the quality consistency required by sophisticated printing equipment, thus supporting the value proposition of specialized copy paper rather than replacing the underlying product itself.

- AI accelerates digitization of transactional documents, reducing demand for general-purpose paper volume.

- AI-driven Document Management Systems shift focus to essential, archival-grade physical printing.

- Predictive maintenance using AI optimizes mill operations, reducing manufacturing costs and enhancing supply stability.

- Quality control powered by machine learning ensures consistent premium specifications required by the Spectra brand.

- AI logistics optimization improves inventory management and reduces distribution lead times for paper products.

- Regulatory adherence in finance and healthcare continues to mandate hard-copy retention, acting as a demand floor.

DRO & Impact Forces Of Spectra Copy Paper Market

The Spectra Copy Paper Market is governed by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the market's trajectory and profitability. The primary drivers include the continuous demand for official documentation in government and legal sectors, the expansion of high-quality printing technologies (requiring smoother, high-opacity paper), and significant growth in educational enrollment across emerging economies. Restraints largely center around the pervasive trend of corporate digitization, coupled with mounting environmental pressure forcing manufacturers to utilize costlier recycled or sustainably certified pulp, which can compress margins. Opportunities lie in the penetration of niche markets, such as specialized archival paper and moisture-resistant stock, and the strategic expansion of manufacturing footprints into regions with abundant, sustainable fiber resources and lower operating costs.

Impact Forces within this market exert significant external pressure on supply chain stability and pricing. Supplier power is moderate to high, as the raw material (wood pulp) market is relatively consolidated, and environmental regulations heavily influence sourcing costs. Buyer power is also moderate, particularly among large corporate and government procurement agencies that purchase in immense volumes and can dictate price and sustainability standards. The threat of substitutes, predominantly digital alternatives (e-signing, cloud storage), remains high and represents the market's most enduring challenge to volume growth. However, the threat of new entrants is low due to the substantial capital expenditure required to establish large-scale integrated paper mills and the complexity of achieving necessary quality certifications for premium products like Spectra.

Technological impact forces are twofold: advancements in printing technology increase the performance requirements for paper, favoring premium products, while parallel advancements in digital communications reduce the overall need for physical output. Regulatory forces, particularly those governing forestry management, waste disposal, and recycling mandates (e.g., in the EU and North America), are becoming increasingly influential, necessitating significant investment in compliance and green technology. Successfully navigating these impact forces requires paper manufacturers to focus on product differentiation, operational efficiency derived from advanced automation, and robust engagement with global sustainability standards to secure long-term contracts with environmentally conscious organizations.

Segmentation Analysis

The Spectra Copy Paper Market is segmented based on several critical parameters, allowing manufacturers and distributors to tailor their strategies to specific consumer needs and operational requirements. Key segmentation dimensions include paper weight (GSM), end-use application, raw material source, and distribution channel. The detailed analysis of these segments highlights variations in demand elasticities and pricing power across different market niches. For instance, segments relying on virgin pulp often command a higher price point due to superior brightness and archival qualities, contrasting with the rapidly expanding recycled paper segment driven by corporate social responsibility mandates and circular economy initiatives.

The segmentation by end-use application is crucial, dividing the market into Corporate and Office Use, Educational Institutions, Government and Legal Agencies, and Commercial Printing Houses. Corporate and Office Use typically accounts for the largest share but is the most susceptible to digitization trends. Conversely, Government and Legal Agencies, requiring high-specification, durable paper for mandatory record-keeping, represent the most stable, high-value segment for premium Spectra products. Understanding the distinct needs within these segments, such as high-volume printing versus high-resolution color fidelity, dictates specialized product development and marketing efforts.

Furthermore, geographical segmentation remains paramount, defining operational strategies based on regional regulatory environments, fiber availability, and economic development stages. Segments within APAC are highly volume-driven and sensitive to price, while those in North America and Europe prioritize sustainability, brightness, and technical compatibility with advanced multifunction devices. This granular segmentation approach enables comprehensive market coverage and ensures that supply chain configurations are optimized to meet varied demand patterns, ranging from pallet-level wholesale orders to ream-level consumer purchases via e-commerce platforms.

- By Basis Weight (GSM):

- 70 GSM to 75 GSM (Cost-efficient, high-volume)

- 75 GSM to 80 GSM (Standard Office/Corporate use, dominant segment)

- 80 GSM and Above (Premium, high-opacity, specialized printing)

- By Raw Material Source:

- Virgin Pulp (Highest brightness and archival quality)

- Recycled Fiber (Eco-friendly, high market growth)

- Blended Pulp (Balance of cost and quality)

- By End-Use Application:

- Corporate Offices and Businesses

- Educational Institutions (Schools, Universities)

- Government and Legal Agencies

- Commercial Printing Houses

- Personal/Home Office Use

- By Distribution Channel:

- Wholesale/Distributors

- Stationery Retail Stores

- Online Retail/E-commerce

- Direct Institutional Sales

Value Chain Analysis For Spectra Copy Paper Market

The value chain for the Spectra Copy Paper Market begins with upstream activities centered on sustainable forestry and pulp manufacturing, requiring substantial investment in land management, harvesting logistics, and integrated pulp and paper mill operations. Upstream analysis focuses intensely on securing certified fiber supplies (FSC, PEFC), managing chemical inputs for bleaching and sizing, and controlling high energy costs associated with pulp processing. Efficiency in this stage directly determines the environmental footprint and the initial cost basis of the final paper product. Key players seek vertically integrated models to mitigate volatility in global pulp prices and ensure consistent fiber quality necessary for premium Spectra specifications.

Midstream activities involve the specialized paper manufacturing process, including sheet formation, coating (where applicable for color papers), calendering for smoothness, cutting, and packaging. Quality control is paramount in this stage to maintain the desired whiteness, opacity, and consistency required for high-speed printing. Spectra paper manufacturers often utilize advanced techniques such as elemental chlorine-free (ECF) bleaching and sophisticated surface treatments to enhance performance. The midstream is critical for achieving the high technical specifications that differentiate premium copy paper from standard grades, demanding rigorous monitoring of moisture content and sheet formation uniformity to prevent issues like paper curl or jamming.

Downstream analysis covers distribution channels, logistics, and sales to end-users. The distribution landscape is bifurcated into direct sales to large institutional buyers (government, universities) and indirect channels through wholesalers, retailers, and increasingly, e-commerce platforms. Direct channels allow for relationship pricing and tailored product fulfillment, while indirect channels provide wide market reach. The selection of distribution channel significantly impacts the final cost and speed to market. Efficient logistics, minimizing warehousing costs and optimizing transport weight, is essential, particularly given the bulk and weight characteristics of the product. The transition towards high-speed automated warehouses and fulfillment centers is a notable trend in the downstream sector.

Spectra Copy Paper Market Potential Customers

Potential customers for Spectra Copy Paper span a wide range of institutional, commercial, and individual buyers who prioritize print quality, reliability, and archival longevity. The primary end-user/buyer segments include large corporate entities, particularly those in finance, consulting, and manufacturing, where formal documentation, contracts, and detailed reports necessitate high-quality presentation and durability. These customers seek paper that minimizes misfeeds on expensive multifunction devices and provides superior color depth for branded materials, making Spectra's premium attributes highly attractive and often non-negotiable within their procurement specifications.

A secondary, yet profoundly stable, customer base consists of public sector organizations, including central and local government administration, judicial systems, and defense agencies. These entities are bound by strict statutory requirements for document preservation, sometimes spanning decades, necessitating acid-free and high-opacity paper to ensure legal validity and readability over time. Procurement cycles in the public sector are often based on large, long-term tenders, offering manufacturers consistent volume but demanding high levels of compliance with environmental and technical standards, positioning premium Spectra products favorably against lower-grade competition.

Additionally, educational institutions (universities, colleges, and school districts) represent significant volume buyers, using the paper for administrative functions, examinations, and student handouts, although this segment is generally more price-sensitive than the corporate sector. Finally, professional services like architectural firms, graphic design studios, and specialized commercial printers utilize Spectra paper for high-fidelity output where color accuracy and image sharpness are critical to client deliverables. Targeting these varied end-user groups requires customized sales strategies, leveraging both price competitiveness for bulk purchasers and quality assurance for premium buyers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 20.0 Billion |

| Growth Rate | 3.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | International Paper, Domtar, Smurfit Kappa, Resolute Forest Products, Asia Pulp & Paper (APP), Mondi Group, Stora Enso, Sylvamo Corporation, Nippon Paper Industries, Oji Holdings, Papelera San Andres, Clearwater Paper, BillerudKorsnas, Fedrigoni, Koehler Paper Group, The Navigator Company, ITC Limited (Paperboards & Specialty Papers Division), WestRock Company, DS Smith, UPM-Kymmene |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Spectra Copy Paper Market Key Technology Landscape

The technology landscape governing the production of Spectra Copy Paper is centered around optimizing the papermaking process for high performance, consistency, and sustainability. Key technological advancements involve the implementation of advanced control systems for managing the fiber suspension and sheet formation process (Fourdrinier and twin-wire machines), ensuring uniform weight distribution and optimal surface smoothness (calendering). Modern paper mills utilize sophisticated Distributed Control Systems (DCS) and quality control scanners (QCS) that employ optical sensors and algorithms to continuously measure brightness, opacity, moisture, and caliper in real-time. These technologies are crucial for maintaining the stringent, premium specifications expected of Spectra-grade paper, minimizing defects, and maximizing yield per unit of raw material input.

A significant area of technological focus is the bleaching and refining process. Environmentally conscious consumers and regulators drive the adoption of Elemental Chlorine-Free (ECF) and Totally Chlorine-Free (TCF) bleaching technologies, enhancing the paper's whiteness while reducing the environmental impact associated with traditional chlorine usage. Furthermore, fiber technology innovations include enhanced refining techniques that allow for the successful integration of higher proportions of short-fiber hardwood pulps and recycled fibers without compromising sheet strength or surface characteristics. Specialized additives, such as optical brightening agents (OBAs) and mineral fillers (like calcium carbonate), are precisely dosed using inline mixing technology to achieve the desired high brightness and opacity required for effective double-sided printing, a hallmark feature of premium copy paper.

In addition to manufacturing processes, advancements in packaging and logistics technology also influence the market. Automated high-speed wrapping and palletizing systems ensure that reams and cartons are protected from moisture damage and mechanical stress during distribution, preserving the paper's quality until the point of use. Furthermore, nanotechnology and advanced surface chemistry are being explored to develop future paper grades with enhanced properties such as antimicrobial resistance, improved ink absorption for higher resolution printing, and reduced dusting, which contributes to lower maintenance needs for office equipment. These technological refinements ensure the product remains competitive against digital substitutes by offering superior physical utility.

Regional Highlights

The regional analysis of the Spectra Copy Paper market reveals distinct patterns of consumption and growth influenced by local economic development, regulatory frameworks, and digitalization maturity. Asia Pacific (APAC) stands out as the primary growth engine, driven by massive population density, expanding literacy rates, and strong government investment in both administrative infrastructure and education. Countries like China, India, and Indonesia exhibit high volume demand, often prioritizing cost-effectiveness, although the corporate sector in major urban centers increasingly demands premium Spectra quality. The region benefits from abundant, low-cost labor and, in some areas, integrated pulp operations, though it faces challenges related to sustainable forestry management and regulatory harmonization.

North America (NA) and Europe represent mature markets characterized by stable, high-value demand. In these regions, the emphasis is heavily placed on environmental compliance, reflected in a strong preference for recycled fiber content and certified sustainable products. Although digitalization has peaked in penetration here, the reliance on high-quality Spectra paper for critical, non-negotiable legal, financial, and regulatory documentation ensures sustained profitability for premium segments. Manufacturers in these regions focus on innovation in lightweighting (reducing GSM while maintaining stiffness) and optimizing supply chains for efficiency, given the high labor and energy costs prevalent in Western economies.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging regions offering significant future potential. LATAM markets, particularly Brazil and Mexico, are strong paper producers and consumers, driven by commodity exports and domestic administrative needs. MEA markets, while smaller in scale, are experiencing rapid urbanization and economic diversification, leading to increased office formation and subsequent demand for professional copy paper. Challenges in these regions include geopolitical instability, fluctuating currency values impacting import costs, and infrastructural bottlenecks in distribution. Strategic market penetration in MEA often involves regional partnerships to navigate complex customs and logistics environments effectively.

- North America: Focus on sustainability (recycled content), stable demand for high-end archival paper, advanced e-commerce distribution networks.

- Europe: Driven by stringent environmental regulations (EU Timber Regulation), strong preference for FSC/PEFC certified products, high adoption of lightweight paper grades.

- Asia Pacific (APAC): Highest volume consumption and fastest growth rate globally, fueled by education and governmental administration, increasing demand for premium products in major corporate hubs.

- Latin America: Regional manufacturing bases utilizing native wood resources, susceptible to local economic volatility, growing professional services sector driving quality paper demand.

- Middle East and Africa (MEA): Emerging corporate and educational infrastructure growth, significant reliance on imports for premium grades, strategic opportunities in regional distribution hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Spectra Copy Paper Market.- International Paper

- Domtar

- Smurfit Kappa

- Resolute Forest Products

- Asia Pulp & Paper (APP)

- Mondi Group

- Stora Enso

- Sylvamo Corporation

- Nippon Paper Industries

- Oji Holdings

- Papelera San Andres

- Clearwater Paper

- BillerudKorsnas

- Fedrigoni

- Koehler Paper Group

- The Navigator Company

- ITC Limited (Paperboards & Specialty Papers Division)

- WestRock Company

- DS Smith

- UPM-Kymmene

Frequently Asked Questions

Analyze common user questions about the Spectra Copy Paper market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the continued demand for Spectra premium copy paper despite digitalization?

Demand is primarily driven by regulatory requirements in finance and legal sectors mandating physical archival records, the need for superior print quality for official corporate presentations, and continuous growth in educational enrollment across emerging economies. Premium paper minimizes printer jams and ensures document longevity.

How do sustainability mandates affect the pricing and manufacturing of Spectra copy paper?

Sustainability mandates, such as FSC certification and recycled content targets, increase operational costs due to the need for certified pulp sourcing, advanced recycling technologies, and investment in cleaner bleaching processes (ECF/TCF). This often translates into a slight premium price point for environmentally compliant Spectra products.

Which geographical region exhibits the highest growth potential for premium copy paper?

The Asia Pacific (APAC) region, specifically India and Southeast Asia, demonstrates the highest growth potential. This is attributed to rapid economic expansion, infrastructural development, and increasing corporate demand for international-standard, high-quality office supplies to reflect professionalism.

What is the significance of paper basis weight (GSM) in the Spectra Copy Paper market?

Basis Weight, typically 75 GSM to 80 GSM, is significant as it balances cost-efficiency with functional quality. 80 GSM is preferred for premium applications requiring high stiffness and opacity for reliable double-sided printing, ensuring compatibility with high-speed, modern multifunction devices.

How does e-commerce adoption influence the distribution landscape for copy paper?

E-commerce platforms are reshaping distribution by bypassing traditional wholesalers, providing small and medium businesses (SMBs) direct access, increasing price transparency, and necessitating optimized, protective packaging for individual ream and carton shipments to prevent damage during transit.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager