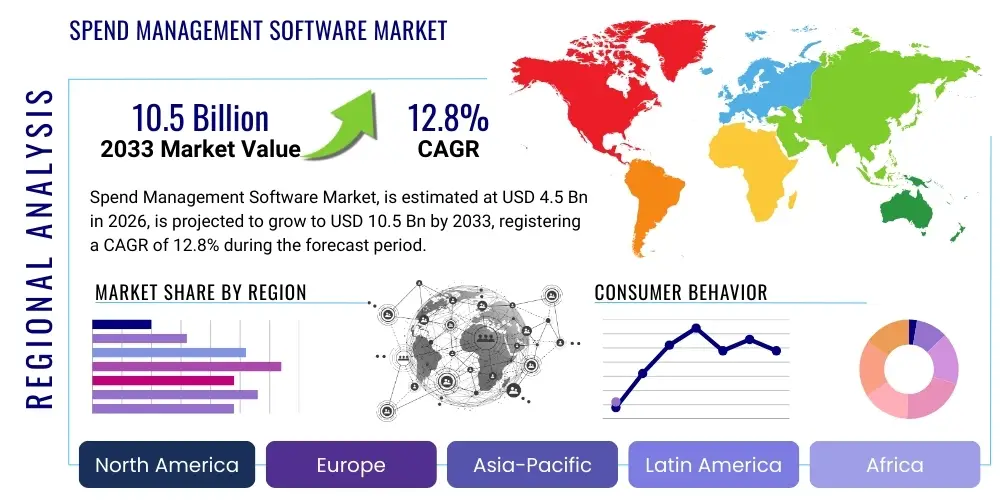

Spend Management Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436012 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Spend Management Software Market Size

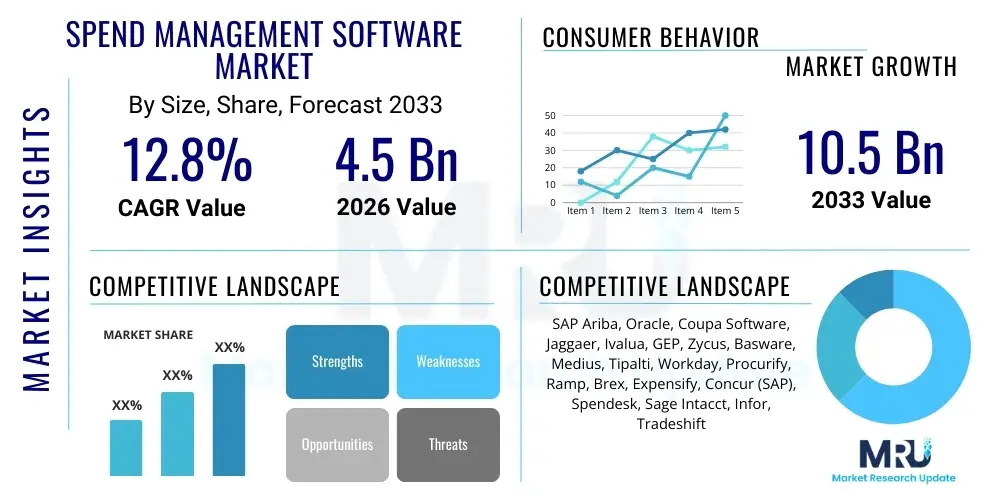

The Spend Management Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 10.5 Billion by the end of the forecast period in 2033. This robust growth trajectory is underpinned by the increasing need for organizations across all sizes to gain granular visibility into their expenditures, optimize procurement processes, and enforce compliance policies in an increasingly complex global economic environment. The transition from legacy, manual processes to integrated, cloud-based solutions is a primary factor accelerating this market expansion.

Spend Management Software Market introduction

Spend Management Software encompasses a suite of digital tools designed to provide enterprises with comprehensive control and visibility over their entire expenditure lifecycle, spanning from initial requisition and procurement to payment and reconciliation. These integrated platforms typically consolidate functionalities such as expense management, procurement and sourcing, accounts payable (AP) automation, and contract management, enabling organizations to systematically identify cost-saving opportunities, reduce maverick spending, and streamline financial operations. The core objective of these solutions is to transform decentralized, reactive spending habits into a proactive, strategic function that directly contributes to margin improvement and financial resilience. Modern software utilizes advanced analytics and real-time data processing to offer actionable insights into purchasing patterns and supplier performance, moving beyond simple transaction recording to strategic spend intelligence.

Major applications of Spend Management Software are critical across various business functions, including automating employee travel and expense (T&E) reporting, managing complex sourcing events through digital platforms, and optimizing the procure-to-pay (P2P) cycle. Key benefits derived from adopting these solutions include enhanced budgetary control, significant reduction in fraud and compliance risks, improved supplier relationships through faster payment cycles, and increased efficiency via the elimination of paper-based and labor-intensive financial administration tasks. Furthermore, the integration capabilities with existing Enterprise Resource Planning (ERP) and financial systems ensure data consistency and accuracy across the organization, which is vital for accurate forecasting and statutory reporting.

The primary driving factors fueling the market growth are multifaceted. Firstly, the imperative for digital transformation across finance and procurement departments is pushing companies towards automation to maintain competitiveness and scalability. Secondly, the volatile global supply chain and inflationary pressures necessitate better cost control and risk management, making advanced spend analysis indispensable. Thirdly, the rise of remote and hybrid work models has increased the complexity of managing employee expenses and corporate card programs, driving demand for mobile-friendly and highly automated expense management modules. Finally, stringent global regulatory requirements mandate higher standards of transparency and auditability, which dedicated spend software inherently provides, ensuring compliance and mitigating legal exposure.

Spend Management Software Market Executive Summary

The Spend Management Software market is characterized by intense innovation and consolidation, driven primarily by the shift towards unified, cloud-native platforms that offer end-to-end P2P capabilities. Business trends highlight a strong movement away from siloed applications, with organizations preferring integrated suites that combine strategic sourcing, operational procurement, and financial settlement in a single interface. Major market players are heavily investing in Artificial Intelligence (AI) and Machine Learning (ML) to enhance predictive spend analysis, identify non-compliant spending patterns in real-time, and automate complex processes like invoice matching and contract creation. The subscription-based Software-as-a-Service (SaaS) model dominates the deployment landscape, offering scalability and reduced capital expenditure for adopting enterprises, particularly appealing to Small and Medium-sized Enterprises (SMEs) seeking rapid implementation and lower total cost of ownership (TCO).

Regional trends indicate that North America maintains its leadership position due to the high concentration of technologically advanced enterprises, established cloud infrastructure, and early adoption of enterprise automation tools. However, the Asia Pacific (APAC) region is poised to exhibit the fastest growth, propelled by rapid industrialization, increasing digitalization of local businesses, and growing awareness regarding the benefits of formal procurement processes in emerging economies like India and Southeast Asia. Europe remains a significant market, heavily focused on compliance and regulatory management (such as GDPR and country-specific e-invoicing mandates), driving demand for highly localized and compliant spend management solutions. The Middle East and Africa (MEA) and Latin America (LATAM) are witnessing accelerated uptake, largely fueled by multinational corporations expanding operations and local governments prioritizing transparency in public spending.

Segment trends underscore the robust expansion of the Cloud deployment model, overshadowing on-premise solutions due to superior flexibility and accessibility. Regarding organization size, while large enterprises historically constituted the primary customer base, the SME segment is experiencing the most dynamic growth, aided by user-friendly interfaces and tiered pricing models offered by SaaS providers. Functionality-wise, the convergence of Travel and Expense (T&E) management with core Accounts Payable (AP) automation is a key trend, reflecting the market’s demand for a holistic view of all corporate expenditures. Furthermore, vertical segmentation shows specialized requirements emerging in sectors such as Manufacturing, Healthcare, and Financial Services, necessitating solutions capable of handling industry-specific regulatory compliance and complex purchasing workflows.

AI Impact Analysis on Spend Management Software Market

Common user questions regarding AI's influence in the Spend Management Software market frequently revolve around its practical application: "How can AI predict future spending spikes?" "Will AI fully automate invoice processing and eliminate human error?" "What is the role of AI in detecting sophisticated fraud or collusion among suppliers?" and "How does ML enhance strategic sourcing and supplier negotiation capabilities?" Users are primarily concerned with AI's ability to transition spend management from a reactive cost-cutting exercise to a proactive, strategic intelligence function. They expect AI to not only eliminate manual tasks but also provide deep, actionable insights that traditional analytics cannot uncover, ensuring better resource allocation and risk mitigation across the entire procurement ecosystem. The consensus expectation is that AI will redefine the role of procurement professionals, shifting their focus from transactional duties to strategic decision-making and value creation.

The integration of Artificial Intelligence and Machine Learning algorithms is fundamentally transforming the capabilities and value proposition of modern spend management platforms. AI enables advanced predictive analytics, allowing organizations to forecast spending needs based on historical data, seasonal variations, and external macroeconomic indicators, thereby facilitating more accurate budgeting and treasury management. Furthermore, machine learning models are continuously trained on transactional data to identify anomalous spending patterns, non-compliant purchases, or potential fraudulent activities in real-time, significantly improving internal controls and reducing financial exposure. This shift represents a major enhancement over traditional rule-based systems, offering dynamic risk assessment and proactive intervention capabilities.

Beyond risk and prediction, AI substantially boosts operational efficiency by automating high-volume, repetitive tasks. This includes Optical Character Recognition (OCR) coupled with ML for touchless invoice processing, automatically capturing, validating, and coding invoices with minimal human intervention. AI is also critical in optimizing strategic sourcing by analyzing complex supplier data, benchmarking contract pricing against market rates, and recommending optimal negotiation strategies. This technological evolution allows procurement teams to focus their efforts on high-value strategic activities, such as supplier relationship management and category management, rather than getting bogged down in administrative overhead, ultimately driving higher strategic value from every dollar spent.

- AI-driven Predictive Analytics: Forecasting future cash flow requirements and potential budget overruns with high accuracy.

- Automated Invoice Processing: Utilizing OCR and ML for touchless three-way matching, reducing processing time and errors.

- Fraud and Anomaly Detection: Real-time identification of suspicious transactions, duplicate invoices, or policy violations.

- Intelligent Contract Compliance: Monitoring spending against negotiated contract terms and automatically flagging deviations.

- Enhanced Supplier Management: Scoring supplier risk, performance, and compliance using sophisticated data analysis.

- Optimized Guided Buying: Recommending preferred suppliers and enforcing compliance through intelligent, in-platform prompts.

DRO & Impact Forces Of Spend Management Software Market

The Spend Management Software market is shaped by powerful Drivers, constrained by notable Restraints, and presents significant Opportunities, all contributing to the complex matrix of Impact Forces determining its future trajectory. Key drivers center around the global push for digital transformation, the necessity for stringent cost control in uncertain economic climates, and the inherent inefficiencies associated with manual, paper-based procurement and finance operations. These drivers create an unavoidable imperative for companies seeking operational agility and competitive advantage to invest in integrated, cloud-based spend solutions. The compelling promise of reducing operational expenditure through automation and enhancing strategic decision-making provides a constant upward force on market adoption rates.

Conversely, significant restraints temper the market’s full potential realization. High initial implementation costs, particularly for large-scale enterprise deployments involving complex integrations with legacy ERP systems, often present a barrier to entry, especially for mid-market companies with limited IT budgets. Data security and privacy concerns, particularly when moving highly sensitive financial data to cloud environments, remain a hurdle, requiring robust vendor assurances and compliance certifications. Moreover, organizational resistance to change and the required cultural shift within procurement and finance teams often slow down the deployment and full utilization of new spend management platforms, necessitating substantial investment in user training and change management initiatives.

Opportunities in this market are vast and concentrated in several key areas: the rapid expansion into the underserved Small and Medium-sized Enterprise (SME) segment through scalable, modular SaaS offerings; the integration of advanced technologies like Blockchain for enhanced transparency in supply chain payments and smart contracts; and the development of specialized solutions tailored for niche vertical markets such as highly regulated healthcare or government sectors. Furthermore, the burgeoning demand for sustainability and Environmental, Social, and Governance (ESG) compliant spending tracking offers a new, high-growth avenue for software providers to embed ethical sourcing and tracking features directly into their platforms. These dynamics collectively constitute the impact forces driving product innovation and market penetration.

Segmentation Analysis

The Spend Management Software market is meticulously segmented based on components, deployment modes, organization size, functionality, and vertical application, reflecting the diverse needs of the global enterprise landscape. Analyzing these segments provides a nuanced understanding of market dynamics, revealing where investment flows are concentrated and which adoption patterns are accelerating. The component segmentation differentiates between core software platforms and the associated professional services, crucial for implementation and customization. Deployment methodology determines the infrastructure choice, while organization size reflects the differing feature requirements between large corporations needing extensive customization and SMEs seeking rapid, out-of-the-box functionality. The functional segmentation highlights the specialized tools available, addressing specific pain points across the procure-to-pay cycle.

Segmentation by functionality is particularly insightful, illustrating the strong market demand for comprehensive suites that cover Travel & Expense (T&E) management, Sourcing & Procurement, and Contract Management, moving beyond simple invoice processing. The vertical segmentation underscores the necessity for specialized compliance modules, as different industries like Financial Services and Manufacturing face unique regulatory and inventory management challenges. This level of granularity in segmentation allows vendors to tailor their marketing strategies, product development roadmaps, and pricing models to capture specific pockets of high growth, ensuring their offerings remain highly relevant to the target customer base. The trend is moving towards cross-segment integration, where modular components can be combined to form a truly unified spend management environment, enhancing data consistency and user experience across all departments.

- By Component:

- Software (Platform and Modules)

- Services (Implementation, Consulting, Support, Training)

- By Deployment Mode:

- Cloud (SaaS)

- On-Premise

- By Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- By Functionality:

- Procurement and Sourcing

- Expense Management (Travel & Expense)

- Contract Management

- Invoice and Accounts Payable Automation

- Spend Analytics and Visualization

- By Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- Manufacturing

- Retail and E-commerce

- Healthcare and Life Sciences

- IT and Telecom

- Government and Public Sector

Value Chain Analysis For Spend Management Software Market

The value chain for the Spend Management Software market begins with upstream activities focused on core technology development and infrastructure provisioning. This stage involves deep research and development into proprietary algorithms for AI/ML, cloud infrastructure management (often leveraging hyperscalers like AWS, Azure, or GCP), and the development of core programming interfaces (APIs) crucial for seamless integration. Key upstream actors include specialized data analytics firms, infrastructure providers, and the in-house R&D teams of the major software vendors responsible for creating sophisticated, scalable, and secure application architectures. Success at this stage relies heavily on securing top-tier talent in data science and cloud engineering to ensure the platform remains cutting-edge and highly resilient against technical obsolescence and cyber threats, which forms the bedrock of the entire offering.

The midstream involves the core development, customization, and deployment of the software solution. This includes module creation (e.g., T&E, Sourcing, AP), platform hardening, rigorous quality assurance, and integration testing with major ERP systems (like SAP and Oracle). Distribution channels play a vital role here, dictating how the product reaches the end-user. Direct channels involve the vendor’s internal sales and account management teams selling directly to large enterprises, offering high-touch consultation, customization, and long-term support contracts. Indirect channels leverage a network of system integrators, value-added resellers (VARs), and implementation partners who specialize in regional deployment, industry-specific configurations, and providing localized support, particularly crucial for the SME market and complex multinational implementations.

The downstream component is focused on maximizing customer value through ongoing support, maintenance, and continuous improvement. This includes providing 24/7 technical support, offering regular software updates with new features and security patches, and delivering professional services such as training and strategic consulting to ensure optimal utilization of the platform’s capabilities. End-users (potential customers) are at the final stage, utilizing the software to manage expenditures, enforce compliance, and drive strategic procurement decisions. The relationship between the vendor and the downstream users is crucial for collecting feedback that informs the next generation of product enhancements, creating a closed-loop system of continuous value creation and product lifecycle management, ensuring the software evolves with the changing demands of global commerce and regulatory environments.

Spend Management Software Market Potential Customers

The primary potential customers, or end-users, of Spend Management Software are diverse, spanning virtually every sector and organization size that seeks to optimize financial operations and strategic sourcing. Large Enterprises, characterized by high-volume transactions, complex global supply chains, and demanding regulatory compliance requirements, constitute a foundational customer segment. These organizations require highly scalable, customizable, and integrated platforms capable of handling multiple currencies, varied regional tax laws, and deep integration into legacy systems. Their primary need is not just cost reduction, but also comprehensive risk management and strategic insights derived from vast datasets, making them prime targets for premium, comprehensive software suites and extensive professional service contracts.

The Small and Medium-sized Enterprises (SMEs) segment represents the fastest-growing customer base, driven by the increasing availability of affordable, user-friendly, and quickly deployable SaaS solutions. SMEs often lack dedicated procurement or AP staff and rely on automation to manage expenses efficiently without significant capital investment. Their demand is focused on simplicity, rapid return on investment (ROI), and core functionalities like automated expense reporting and centralized invoice processing. Vendors are increasingly tailoring pricing models, offering modular subscription packages specifically designed to scale with SME growth, thus lowering the adoption barrier and democratizing access to enterprise-grade spend management capabilities.

Furthermore, sectoral analysis reveals specific industries as key buyers. The Manufacturing sector requires robust solutions for direct and indirect spend, complex inventory management integration, and monitoring material costs. The Banking, Financial Services, and Insurance (BFSI) sector demands extremely secure, compliant platforms for managing internal expenses and external vendor engagements, prioritizing fraud detection and audit trails. The Healthcare sector requires specialized solutions to manage complex group purchasing organizations (GPOs), pharmaceutical supply chains, and stringent regulatory reporting, making them crucial, high-value customers needing highly specialized modules. The growing Government and Public Sector entities are also becoming vital customers due to mandates for increased fiscal transparency, accountability, and digital procurement transformation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 10.5 Billion |

| Growth Rate | 12.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SAP Ariba, Oracle, Coupa Software, Jaggaer, Ivalua, GEP, Zycus, Basware, Medius, Tipalti, Workday, Procurify, Ramp, Brex, Expensify, Concur (SAP), Spendesk, Sage Intacct, Infor, Tradeshift |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Spend Management Software Market Key Technology Landscape

The Spend Management Software market relies heavily on a sophisticated technological landscape centered on cloud computing, advanced data analytics, and integration technologies. Cloud-native architecture, primarily Software-as-a-Service (SaaS), is the dominant model, offering scalable, high-availability platforms that reduce the administrative burden on customers. This infrastructure facilitates rapid deployment and continuous updates, ensuring users always have access to the latest compliance features and security protocols. The backbone of modern spend platforms includes robust Application Programming Interfaces (APIs), which are critical for facilitating real-time, bidirectional integration with core financial systems (ERP), customer relationship management (CRM) systems, and external data sources like tax compliance tools and payment gateways. The move towards microservices architecture further enhances platform agility, allowing vendors to update individual modules without disrupting the entire suite, ensuring high resilience and reliability.

Artificial Intelligence (AI) and Machine Learning (ML) constitute the most impactful emerging technology within this domain. AI drives crucial functionalities such as intelligent data extraction from invoices, predictive analytics for demand forecasting and price volatility, and sophisticated pattern recognition for fraud detection. ML algorithms continuously refine these capabilities, learning from an organization's specific spending habits and market trends to provide increasingly accurate and actionable insights. This technological layer moves the software beyond mere recording and reporting, transforming it into a true decision-support tool. Furthermore, advancements in Natural Language Processing (NLP) are enhancing contract management modules, allowing the software to automatically interpret and summarize complex contract terms and obligations, ensuring better adherence and legal compliance.

Other vital technologies include enhanced mobile capabilities and the exploration of Distributed Ledger Technology (DLT), specifically Blockchain. Mobile applications are now mandatory for modern expense management, enabling employees to capture receipts, submit reports, and gain approvals instantaneously, supporting the needs of a mobile workforce. Blockchain holds significant promise, particularly in strategic sourcing and supply chain finance, by offering an immutable, transparent ledger for recording transactions, contracts, and supplier credentials. While still nascent in widespread adoption, DLT has the potential to drastically reduce disputes, ensure traceability, and accelerate secure cross-border payments, adding another layer of trust and efficiency to complex global procurement processes and establishing enhanced security protocols for sensitive financial interactions.

Regional Highlights

- North America (USA and Canada)

North America is the largest and most mature market for Spend Management Software, characterized by high technological penetration, robust IT infrastructure investment, and the presence of numerous market leaders. The region’s early and widespread adoption of cloud computing and SaaS models, coupled with a highly competitive corporate environment, compels enterprises to continuously optimize cost structures and seek operational efficiencies. The United States, in particular, drives demand due to its large concentration of multinational corporations with complex global spending needs and sophisticated requirements for real-time spend analytics and regulatory compliance, including Sarbanes-Oxley Act (SOX) stipulations. The market here is highly innovation-driven, with significant venture capital funding directed towards solutions specializing in next-generation functionalities like predictive intelligence and unified corporate card management, ensuring the region remains at the forefront of market development and technology deployment.

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

Europe represents a highly fragmented yet rapidly growing market, driven by varying national regulatory requirements and a strong focus on data privacy (GDPR). Countries like Germany and the UK are major contributors, exhibiting high adoption rates for AP automation and e-invoicing solutions driven by country-specific mandates to digitize public and private sector procurement processes. The market growth is also sustained by the strong need for cross-border expense management solutions capable of handling diverse Value Added Tax (VAT) rules and compliance across the EU single market. European businesses are increasingly prioritizing solutions that offer localization features and seamless integration with complex legacy ERP systems, leading to strong demand for customized professional services and highly robust compliance modules that can adapt quickly to evolving legal frameworks and reporting standards across the continent.

- Asia Pacific (APAC) (China, Japan, India, South Korea, Rest of APAC)

The Asia Pacific region is forecast to be the fastest-growing market, primarily fueled by the rapid pace of digital transformation, increasing foreign direct investment, and the industrialization of developing economies such as India and Southeast Asian nations. While the maturity levels vary significantly—with Japan and Australia exhibiting sophisticated usage similar to North America—emerging economies are rapidly adopting spend management tools to replace rudimentary, often manual, financial processes. The massive potential customer base in countries like China and India, coupled with the increasing need for transparency in procurement amidst massive infrastructure projects, drives demand. Vendors are focusing on offering localized, mobile-first solutions that cater to high-volume, low-value transactions prevalent in the region, adapting their products to diverse languages, financial standards, and complex local tax structures.

- Latin America (LATAM) (Brazil, Mexico, Rest of LATAM)

Latin America is an evolving market, characterized by complex tax regulations, high levels of financial volatility, and a strong preference for cloud-based deployment to bypass infrastructural limitations. Brazil and Mexico are the dominant markets, driven by mandates for e-invoicing and high tax enforcement, which necessitate automated and auditable financial systems. The demand for spend management software is often linked to the need for better control over cross-border trade expenses and managing fluctuating currency risks. Adoption is accelerating as multinational companies expand their operations and local enterprises recognize the necessity of formalizing procurement processes to achieve greater operational stability and regulatory adherence in a challenging economic environment.

- Middle East and Africa (MEA) (GCC Countries, South Africa, Rest of MEA)

The MEA market is poised for significant growth, spurred by large government-led digital initiatives, particularly in the Gulf Cooperation Council (GCC) countries focused on economic diversification (e.g., Saudi Vision 2030). Substantial investment in infrastructure and technology, coupled with the introduction of VAT and other standardized tax regimes, drives the need for sophisticated financial control systems. Demand is high among energy, construction, and financial services sectors. In Africa, the push for modernization and the increasing adoption of mobile payments are setting the stage for growth, although challenges related to internet connectivity and regulatory fragmentation remain factors influencing the pace of market penetration and requiring flexible, adaptable software solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Spend Management Software Market.- SAP Ariba

- Oracle

- Coupa Software

- Jaggaer

- Ivalua

- GEP

- Zycus

- Basware

- Medius

- Tipalti

- Workday

- Procurify

- Ramp

- Brex

- Expensify

- Concur (SAP)

- Spendesk

- Sage Intacct

- Infor

- Tradeshift

Frequently Asked Questions

Analyze common user questions about the Spend Management Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Spend Management Software and how does it differ from traditional ERP modules?

Spend Management Software is an integrated platform offering specialized tools for expense management, sourcing, and accounts payable, providing end-to-end visibility and control over expenditures. While ERP systems offer foundational financial ledgers, dedicated Spend Management solutions provide deeper functional specialization, automation via AI/ML, and better user experience across the procure-to-pay lifecycle, often integrating seamlessly with the existing ERP backbone for financial reconciliation and record keeping.

Which deployment model dominates the Spend Management Software Market?

The Cloud-based (Software-as-a-Service or SaaS) model currently dominates the market. SaaS offers superior benefits including reduced infrastructure costs, faster implementation timelines, enhanced scalability, and continuous updates. This model is preferred by both SMEs needing rapid deployment and large enterprises seeking operational agility and lower Total Cost of Ownership (TCO).

How significantly does AI impact fraud detection within spend management platforms?

AI significantly enhances fraud detection by moving beyond simple rule-based checks to utilizing machine learning algorithms that continuously analyze complex spending patterns, identifying anomalies, duplicate payments, and potential collusion in real-time. This predictive capability greatly reduces financial risk and enhances the integrity of internal financial controls compared to manual or legacy detection methods.

What are the primary challenges restraining the widespread adoption of spend management solutions?

Key challenges include the high cost and complexity of integrating new software with existing, often monolithic legacy ERP systems, organizational resistance to adopting new procurement processes, and persistent concerns regarding data security and regulatory compliance when transitioning highly sensitive financial data to a cloud environment.

Which geographical region exhibits the highest growth potential for Spend Management Software?

The Asia Pacific (APAC) region is projected to demonstrate the highest Compound Annual Growth Rate (CAGR) due to accelerating digital transformation initiatives, increasing corporate investment in formalizing procurement processes, and the large number of emerging economies rapidly adopting cloud-based enterprise solutions to enhance transparency and operational efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager