Spherical Active Carbon Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433875 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Spherical Active Carbon Market Size

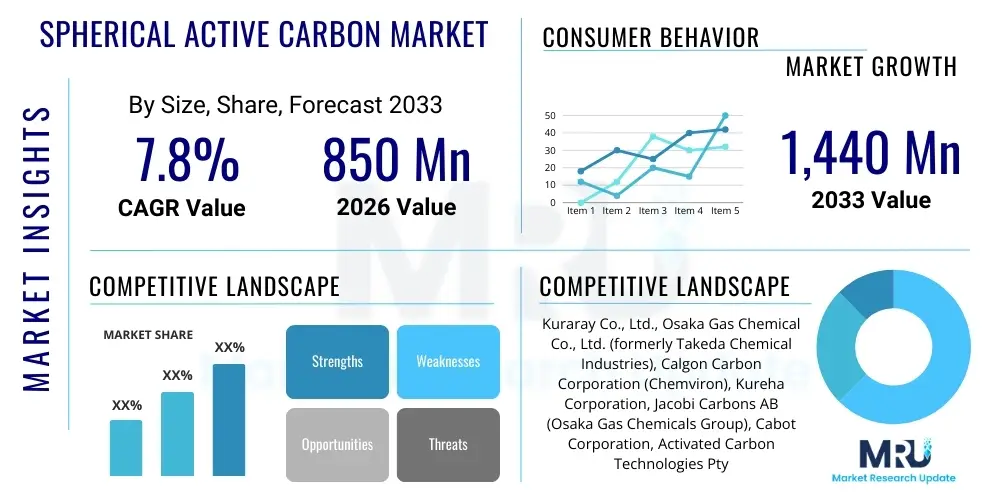

The Spherical Active Carbon Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $850 Million USD in 2026 and is projected to reach $1,440 Million USD by the end of the forecast period in 2033. This robust expansion is primarily driven by increasing global demand for advanced purification technologies, particularly in the semiconductor and ultra-pure water sectors, coupled with the escalating adoption of spherical active carbon (SAC) in high-performance energy storage devices such as supercapacitors and lithium-ion batteries.

Spherical Active Carbon Market introduction

The Spherical Active Carbon (SAC) market centers around highly specialized forms of activated carbon characterized by their near-perfect spherical geometry, narrow pore size distribution, high surface area, and superior mechanical strength. Unlike granular or powdered activated carbon, SAC offers enhanced fluid dynamic properties, making it ideal for column-based adsorption processes where uniformity and low pressure drop are critical requirements. The spherical morphology allows for dense packing and efficient mass transfer kinetics, significantly improving filtration and separation efficiencies across various demanding applications.

SAC is primarily derived from carbonaceous materials such as phenolic resins, pitch, and specialized polymers, undergoing carbonization and subsequent activation processes. Its unique structure provides exceptional adsorption capacity for specific pollutants, contaminants, and ions. Major applications span critical sectors including municipal and industrial water treatment, solvent recovery, gas separation, air purification, and crucially, serving as electrode material or catalyst support in advanced electrochemical systems. The precision and performance benefits derived from SAC's structural uniformity solidify its position as a high-value material in modern industrial processes.

The market growth is fundamentally propelled by stringent global environmental regulations concerning water quality and air emissions, particularly in industrialized nations and rapidly developing economies in Asia Pacific. Furthermore, technological advancements in material science, focusing on tuning the pore structure and surface chemistry of SAC for enhanced selectivity and kinetic performance, contribute significantly to its market traction. The increasing sophistication required in sectors like pharmaceuticals, food and beverage processing, and high-purity chemical manufacturing further mandates the use of these superior adsorbents, ensuring sustained market expansion throughout the forecast period.

Spherical Active Carbon Market Executive Summary

The global Spherical Active Carbon market exhibits dynamic business trends characterized by intense focus on capacity expansion and strategic collaborations aimed at serving high-growth applications, specifically in energy storage and advanced purification. Manufacturers are heavily investing in proprietary production techniques, such as the granulation of phenolic resins, to achieve ultra-high purity and tightly controlled pore distribution, essential for maximizing performance in niche markets like semiconductor fabrication. A prominent trend involves integration across the value chain, where resin producers are partnering with carbon specialists to secure raw material supply and optimize synthesis pathways, thereby stabilizing supply chains and capturing greater margins in this specialized chemical sector.

Regionally, the Asia Pacific (APAC) market dominates the consumption and production landscape, primarily fueled by rapid industrialization, large-scale infrastructure projects for water and wastewater treatment, and its leading role in the global electronics and battery manufacturing supply chain. Regulatory mandates in China and India pushing for cleaner industrial outputs significantly bolster the demand for SAC in pollution control. North America and Europe, while mature markets, are experiencing strong growth driven by the shift towards high-value applications, particularly in pharmaceutical purification, environmental remediation, and the burgeoning electric vehicle (EV) battery sector, where SAC is utilized for high-performance supercapacitor electrodes and electrolyte purification.

Segment-wise, the application of SAC in water purification remains the largest segment, but the fastest growth trajectory is observed within the energy storage and catalyst support segments. Within energy storage, SAC’s use in supercapacitors is accelerating due to its high conductivity and stability, supporting the growing demand for fast-charging and high-power delivery devices. Regarding raw materials, phenolic resin derived SAC commands a premium due to its superior purity and mechanical resilience, although pitch-based and coconut shell-derived carbons are gaining traction through innovations improving sphericity and pore structure while offering cost competitiveness, leading to competitive pressure and differentiation among suppliers globally.

AI Impact Analysis on Spherical Active Carbon Market

User queries regarding AI's influence on the Spherical Active Carbon market commonly revolve around optimization of synthesis processes, predictive quality control, and the acceleration of R&D for novel carbon materials. Users are highly interested in how machine learning can model complex adsorption kinetics, predict optimal pore structures based on target contaminants, and potentially automate the demanding activation processes to ensure batch consistency and reduce energy consumption. Key themes underscore the desire for AI to enable the production of tailored SAC materials with narrow, customized specifications faster and more efficiently than traditional iterative experimentation, thereby lowering production costs and unlocking new performance benchmarks in ultra-high purity applications.

The integration of Artificial Intelligence and advanced analytics is transforming the production paradigm of Spherical Active Carbon, moving it from empirical synthesis towards data-driven material engineering. AI algorithms can process vast datasets encompassing precursor characteristics, carbonization temperatures, activation parameters, and resulting adsorption isotherms. This predictive capability allows manufacturers to fine-tune the material properties—such as surface area, pore volume, and functional group density—to an unprecedented degree, optimizing performance for specific end-use cases like trace chemical removal in ultrapure water systems or improving capacitance in energy devices. This enhancement in process efficiency leads to higher yields, reduced batch failures, and a significant acceleration of product development cycles, giving early adopters a distinct competitive advantage in this specialized market.

Furthermore, AI-driven process control systems are crucial for maintaining the stringent quality standards required by industries such as pharmaceuticals and semiconductors. By continuously monitoring real-time sensor data during the pyrolysis and activation phases, AI can immediately detect deviations and adjust parameters to ensure uniform sphericity and pore homogeneity across large production volumes. This predictive maintenance and quality assurance capability minimizes waste, maximizes energy efficiency, and ensures that the final product meets exacting industry specifications, thus cementing AI's role as a critical enabler of next-generation, high-performance SAC manufacturing processes globally.

- AI-driven optimization of precursor selection and synthesis parameters.

- Predictive modeling of adsorption performance and kinetic behavior for targeted applications.

- Machine learning enhancement for real-time quality control and ensuring uniformity of spherical structure.

- Automation of activation processes (e.g., steam or chemical activation) to minimize energy consumption.

- Accelerated discovery of novel surface functionalizations for improved selectivity and capacity.

DRO & Impact Forces Of Spherical Active Carbon Market

The Spherical Active Carbon (SAC) market is governed by a complex interplay of high-performance drivers, significant structural restraints, and emerging opportunities, all collectively shaping its impact forces. The primary drivers include increasing global regulatory pressure on industrial discharge and potable water quality, the exponential growth in demand for high-efficiency energy storage solutions (supercapacitors and EV batteries), and the requirement for highly specific purification media in the electronics and pharmaceutical industries. Restraints largely center around the high capital expenditure required for specialized production facilities, the comparatively higher cost of SAC relative to conventional granular activated carbon (GAC), and volatility in the prices of key precursor materials like phenolic resins. Opportunities arise from breakthroughs in sustainable synthesis methods, the development of functionalized SAC for advanced catalysis, and penetration into emerging industrial filtration and gas separation markets.

A key driver is the relentless pursuit of high-performance materials in critical applications. SAC’s superior hydrodynamics—manifesting as lower pressure drop and improved contact efficiency in packed columns—makes it indispensable in high-throughput systems, such as large-scale ultrapure water plants utilized by semiconductor manufacturers. This structural advantage, coupled with tailored pore architecture for targeted pollutant removal (e.g., per- and polyfluoroalkyl substances (PFAS)), significantly elevates its value proposition over traditional adsorbents. Conversely, the high technological barrier to entry, specifically the need to control both particle sphericity and internal porosity simultaneously, restricts the competitive landscape and keeps initial investment costs for new entrants extremely high, acting as a major restraint on market proliferation, especially in developing regions.

The impact forces are predominantly defined by the accelerating pace of technological innovation in water remediation and energy storage. The push for green and sustainable technologies creates strong opportunities for SAC derived from biomass precursors or through low-energy activation methods, aligning with global environmental, social, and governance (ESG) objectives. The critical impact forces include the increasing specification demands from the automotive and electronics sectors, pushing manufacturers to continuously improve product purity and conductivity, and the evolving global standards for municipal water treatment, which mandate the removal of previously unregulated micro-contaminants. These forces ensure that only manufacturers capable of high precision and continuous innovation will capture significant market share in the forecast period.

Segmentation Analysis

The Spherical Active Carbon market is segmented primarily based on Raw Material Source, Application, and End-User Industry. This segmentation reveals distinct growth drivers and competitive landscapes across various sub-markets. Raw material segmentation highlights the cost and performance trade-offs, where phenolic resin derivatives offer the highest purity and mechanical strength suitable for electronic applications, while pitch and other precursors target bulk purification and energy storage uses. The application segmentation demonstrates the widespread utility of SAC, ranging from its dominant role in industrial water treatment and purification to its high-growth potential as electrode material in supercapacitors. Understanding these segments is crucial for strategic market positioning and resource allocation among key players.

- Raw Material Source:

- Phenolic Resin Based

- Pitch Based

- Coconut Shell Based

- Others (Petroleum Residue, Lignite)

- Application:

- Water Purification (Potable, Industrial Wastewater, Ultra-pure Water)

- Catalyst Supports and Carriers

- Energy Storage (Supercapacitors, Lithium-ion Batteries)

- Gas Separation and Air Purification

- Medical and Pharmaceutical Purification

- Solvent Recovery

- End-User Industry:

- Chemical and Petrochemical

- Electronics and Semiconductor

- Automotive (EV Batteries and Fuel Cells)

- Pharmaceutical and Biotechnology

- Food and Beverage

- Environmental and Municipal

Value Chain Analysis For Spherical Active Carbon Market

The value chain for the Spherical Active Carbon market is characterized by high complexity and specialized technical expertise required at each stage, leading to significant value addition from raw material procurement to final distribution. The upstream segment involves the sourcing and preparation of specialized carbonaceous precursors, predominantly high-quality phenolic resins or specific pitch fractions. This stage is capital intensive, requiring strict quality control to ensure the homogeneity and purity necessary for subsequent spherification. Midstream activities, involving the precise synthesis processes such as granulation, carbonization, and steam or chemical activation, are highly proprietary and determine the final product’s performance attributes like pore size distribution and surface area. Innovations at this stage, particularly in continuous processing techniques, significantly influence cost efficiency and scalability.

The downstream segment focuses on post-processing, quality testing, and specialized packaging tailored to end-user specifications, particularly the stringent requirements of the electronics and pharmaceutical industries. Distribution channels are typically specialized and bifurcated. Direct distribution is common for large, strategic accounts in the semiconductor or automotive sectors, ensuring technical support and customized supply agreements. Indirect distribution involves specialized chemical distributors and regional agents who manage smaller orders and provide inventory management for sectors like municipal water treatment and general industrial applications. The effectiveness of the distribution network relies heavily on maintaining product integrity, preventing contamination, and ensuring timely delivery of high-value specialized media.

The integration of high-level technical services is paramount throughout the value chain. Due to the performance-critical nature of SAC (e.g., in column chromatography or ultra-pure water loops), manufacturers often provide extensive technical consultation, application engineering support, and post-sales optimization services. This technical partnership model differentiates leading vendors from basic commodity suppliers. The complexity of regulatory compliance, particularly concerning material safety and environmental standards in Europe and North America, also adds substantial value at the distribution and application interface, compelling manufacturers to provide detailed documentation and certification, thereby reinforcing the specialized nature of the entire supply ecosystem.

Spherical Active Carbon Market Potential Customers

Potential customers and end-users of Spherical Active Carbon are concentrated in industries demanding highly efficient, precise, and contaminant-free purification or material support systems. The largest cohort includes municipal water treatment facilities and industrial wastewater plants that seek superior adsorption kinetics and lower maintenance costs due to reduced pressure drop compared to conventional media. However, the most value-driven customers are found within the high-tech sectors: semiconductor fabrication plants, where ultra-pure water is non-negotiable for chip manufacturing, and high-end chemical processing industries requiring selective removal of trace impurities from specialty solvents and intermediates.

A rapidly expanding customer base resides in the burgeoning energy storage sector, encompassing manufacturers of supercapacitors, advanced lithium-ion batteries, and fuel cells. These companies utilize SAC for its high conductivity, excellent porosity control, and stable cycling performance when used as electrode material or a purification agent for electrolyte solutions. Furthermore, pharmaceutical and biotechnology companies represent critical end-users, leveraging the high purity and selectivity of SAC for separation, purification, and decolorization processes in the production of APIs (Active Pharmaceutical Ingredients) and sensitive biological agents, where failure to meet purity standards can result in massive financial and regulatory consequences.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850 Million USD |

| Market Forecast in 2033 | $1,440 Million USD |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kuraray Co., Ltd., Osaka Gas Chemical Co., Ltd. (formerly Takeda Chemical Industries), Calgon Carbon Corporation (Chemviron), Kureha Corporation, Jacobi Carbons AB (Osaka Gas Chemicals Group), Cabot Corporation, Activated Carbon Technologies Pty Ltd, Carbon Activated Corp., Resintech, Inc., PICA USA, LLC, Mitsubishi Chemical Corporation, Chemstar Active Carbon (Wuxi) Co., Ltd., China South Active Carbon Co., Ltd., CarboTech AC GmbH, Ningxia Huahui Activated Carbon Co., Ltd., Ningxia Jinzheng Activated Carbon Co., Ltd., Suzhou Jinhong Activated Carbon Co., Ltd., Veolia Water Technologies, Continental Carbon India Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Spherical Active Carbon Market Key Technology Landscape

The core technology landscape of the Spherical Active Carbon market revolves around precision engineering of the particle structure and surface chemistry, differentiating high-performance SAC from standard activated carbon. The primary technological processes include the selection and preparation of high-purity precursors (like specialized phenolic resins), followed by advanced techniques such as suspension polymerization or melt spinning to achieve uniform spherical particle formation. The subsequent carbonization stage, often executed under controlled inert atmospheres, dictates the nascent mechanical strength and basic pore structure. This phase requires sophisticated temperature profiling and atmospheric management to prevent particle deformation and ensure consistent carbon yields, representing a significant technological barrier to entry.

The most critical technological advancement lies in the activation stage, which determines the final adsorption capacity and selectivity. Manufacturers leverage advanced activation methods, including controlled steam activation or chemical activation using phosphoric acid or potassium hydroxide, but with highly refined kinetic control optimized for spherical morphology. Recent technological efforts focus on functionalization—chemically modifying the surface of the activated carbon spheres post-activation—to introduce specific functional groups (e.g., carboxyl or nitrogen-containing groups). This targeted modification enhances selectivity toward specific hard-to-remove pollutants, such as heavy metal ions, organic dyes, or endocrine-disrupting compounds, significantly broadening SAC's application scope in complex chemical matrices and advanced environmental remediation projects.

Emerging technologies also include the development of magnetic SAC, where iron oxide nanoparticles are embedded or coated onto the carbon spheres. This innovation allows for easier separation and regeneration of the adsorbent media using magnetic fields, reducing sludge disposal costs and improving system efficiency in industrial wastewater treatment. Furthermore, the integration of computational materials science, often supported by AI algorithms, is playing a pivotal role in modeling and optimizing pore size distribution (micropores for gas separation, mesopores for liquid-phase adsorption) before physical production begins, drastically reducing R&D timelines and ensuring highly tailored products that meet the ultra-specific requirements of next-generation electronics and pharmaceutical processes.

Regional Highlights

- Asia Pacific (APAC): Dominance in Production and Consumption

- North America: Focus on High-Value and Remediation Applications

- Europe: Stringent Environmental Standards and Automotive Demand

- Latin America (LATAM): Emerging Industrialization and Infrastructure Investment

- Middle East and Africa (MEA): Water Scarcity and Industrial Diversification

The Asia Pacific region, led by China, Japan, and South Korea, constitutes the largest and fastest-growing market for Spherical Active Carbon, driven by simultaneous leadership in both manufacturing and end-user sectors. This dominance is intrinsically linked to the region’s massive, expanding base of electronics and semiconductor fabrication—industries that require the highest volumes of ultra-pure water, necessitating high-performance SAC for advanced polishing loops. Furthermore, significant governmental investment in large-scale infrastructure projects for municipal water supply and stringent enforcement of environmental regulations across major industrialized zones accelerate the adoption of high-efficiency filtration media.

Local production capabilities, particularly in China and Japan, are highly sophisticated, focusing on mass production techniques for pitch-based and resin-based SAC, often benefiting from integrated supply chains. Japan, home to several key innovators like Kuraray and Kureha, specializes in premium, high-pendulum SAC tailored for specific medical and high-end electronics applications. The increasing proliferation of EV manufacturing and renewable energy storage projects across APAC further bolsters demand for SAC electrodes and purification materials, ensuring this region maintains its leading market share throughout the forecast period due to continuous industrial and technological expansion.

The North American market for Spherical Active Carbon is characterized by high demand in specialized, high-value applications, supported by strong regulatory frameworks, notably those governing water quality (e.g., the EPA’s focus on emerging contaminants like PFAS). While production is less concentrated than in APAC, major global players maintain strategic manufacturing or functionalization facilities to serve sophisticated pharmaceutical, petrochemical, and environmental remediation customers. The growth is fueled by continuous technological upgrades in municipal water systems and large-scale environmental clean-up projects requiring precise and effective adsorption technologies.

Furthermore, the rapid expansion of the energy storage industry, particularly in the United States, drives significant demand for high-grade SAC used in supercapacitors and advanced battery electrolyte purification. Adoption in North America is highly sensitive to product performance specifications, with customers willing to pay a premium for certified, high-purity SAC that ensures compliance and optimal process reliability. Strategic partnerships between research institutions, government bodies, and manufacturers aimed at developing innovative solutions for persistent environmental pollutants further underscore the specialized nature of the North American market demand.

Europe represents a mature but growing market for Spherical Active Carbon, strongly influenced by the European Union’s rigorous environmental directives, particularly the Water Framework Directive and air quality standards. The market growth is primarily driven by the mandatory upgrade of industrial and municipal treatment facilities to meet increasingly strict effluent quality targets, thereby requiring advanced adsorbents with high kinetic efficiency and regenerability. European chemical and petrochemical sectors are major consumers, utilizing SAC for catalyst support and solvent purification, where high mechanical stability and thermal resilience are paramount.

Crucially, the massive transition of the European automotive industry towards Electric Vehicles (EVs) and associated energy storage infrastructure is a major demand accelerator. SAC finds significant use in high-performance supercapacitor systems required for regenerative braking and auxiliary power in EVs, as well as in hydrogen fuel cell purification processes. Germany, France, and the UK are key demand centers, necessitating a localized supply chain capable of delivering customized, environmentally compliant SAC products that integrate seamlessly into complex industrial and energy system designs.

The Latin American market is currently an emerging consumer of Spherical Active Carbon, with growth largely tied to ongoing urbanization, industrial development, and subsequent investment in improved public infrastructure, especially water and wastewater treatment facilities. While general activated carbon dominates bulk markets, SAC adoption is observed in specific, high-specification industries, such as specialty chemical manufacturing and advanced food and beverage processing, particularly in Brazil and Mexico. Regulatory enforcement, though variable, is improving, pushing industrial users toward better purification technologies.

Market penetration relies heavily on imports and establishing robust distribution channels. The main drivers include foreign direct investment into industrial manufacturing zones and the necessity to manage water scarcity and pollution challenges in heavily populated metropolitan areas. As infrastructure modernization accelerates across the region, especially in mining and resource processing (which require high-quality water recycling), the demand for high-efficiency adsorbents like SAC is anticipated to witness steady, albeit uneven, growth.

The Middle East and Africa region presents a unique market dynamic for Spherical Active Carbon, heavily influenced by extreme water scarcity and significant oil & gas and petrochemical investments. Demand in the Middle East is intensely focused on high-performance desalination pre-treatment, industrial water recycling, and petrochemical purification processes, where SAC’s thermal stability and efficiency in managing specific contaminants are highly valued. Major infrastructure projects, especially in Saudi Arabia and the UAE, drive high-specification adsorbent demand.

In Africa, growth is more fragmented, centered around specialized industrial sectors such as mining and pharmaceuticals, requiring high-purity water systems, particularly in South Africa and Nigeria. The future growth trajectory in MEA is closely linked to government-led initiatives for economic diversification away from oil, pushing investment into non-hydrocarbon industrial sectors and sustainable water management technologies, creating niche but high-value opportunities for SAC suppliers focusing on purification and catalysis.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Spherical Active Carbon Market.- Kuraray Co., Ltd.

- Osaka Gas Chemical Co., Ltd. (formerly Takeda Chemical Industries)

- Kureha Corporation

- Calgon Carbon Corporation (Chemviron)

- Jacobi Carbons AB (Osaka Gas Chemicals Group)

- Cabot Corporation

- Mitsubishi Chemical Corporation

- Activated Carbon Technologies Pty Ltd

- Carbon Activated Corp.

- Resintech, Inc.

- PICA USA, LLC

- Chemstar Active Carbon (Wuxi) Co., Ltd.

- China South Active Carbon Co., Ltd.

- CarboTech AC GmbH

- Ningxia Huahui Activated Carbon Co., Ltd.

- Ningxia Jinzheng Activated Carbon Co., Ltd.

- Suzhou Jinhong Activated Carbon Co., Ltd.

- Veolia Water Technologies

- Continental Carbon India Ltd.

- Sutong Carbon Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Spherical Active Carbon market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of Spherical Active Carbon over conventional Activated Carbon?

The primary advantage of Spherical Active Carbon (SAC) is its uniform spherical shape, which results in a significantly lower pressure drop and superior fluid dynamics in packed columns. This ensures efficient mass transfer kinetics and maximizes adsorption efficiency, especially crucial in high-flow and high-precision purification systems like those used in semiconductor manufacturing and advanced chromatography.

Which industry accounts for the largest demand for Spherical Active Carbon?

The Water Purification segment holds the largest share of the demand for Spherical Active Carbon, encompassing municipal potable water treatment, industrial wastewater purification, and the demanding production of ultra-pure water for the electronics industry. SAC’s high efficiency and structural integrity make it indispensable for contaminant removal in these high-volume processes.

How do raw materials affect the performance of Spherical Active Carbon?

Raw material source critically affects SAC performance; for example, Phenolic Resin-based SAC typically yields the highest purity, hardness, and controlled porosity, making it ideal for specialized chemical and electronic applications. Pitch-based and certain biomass-based precursors offer different cost structures and porosity profiles, suitable for bulk remediation and specific energy storage uses.

Is Spherical Active Carbon used in energy storage applications?

Yes, Spherical Active Carbon is increasingly utilized in energy storage. Its high surface area, controlled pore size, and high electrical conductivity make it a superior electrode material for high-performance supercapacitors and is also employed for electrolyte purification in advanced lithium-ion battery manufacturing, enhancing overall device performance and longevity.

Which region shows the fastest growth rate for the Spherical Active Carbon market?

The Asia Pacific (APAC) region is projected to exhibit the fastest market growth, driven by rapid industrial expansion, massive investments in electronics and automotive manufacturing (particularly EVs), and increasing government mandates aimed at improving industrial effluent and public water quality standards across key nations like China, Japan, and South Korea.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager