Spherical Alumina Powder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432523 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Spherical Alumina Powder Market Size

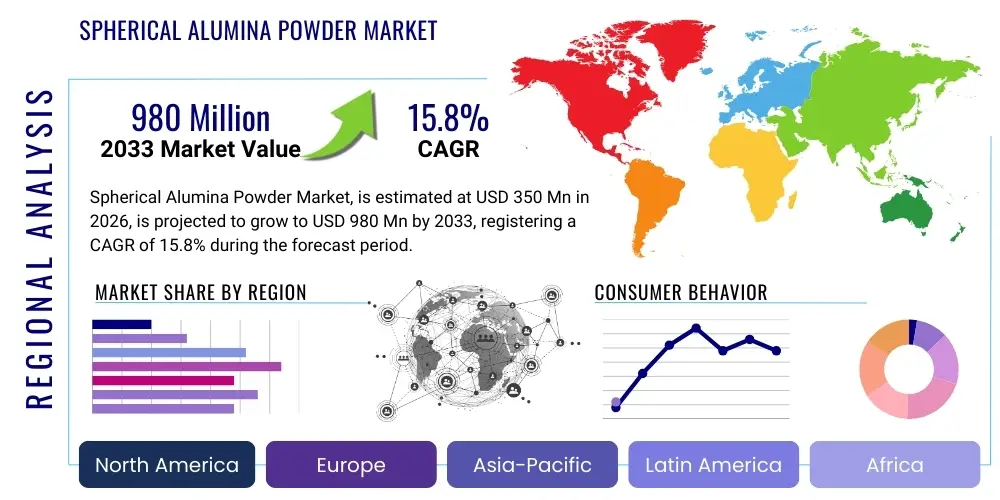

The Spherical Alumina Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 1,020.8 Million by the end of the forecast period in 2033.

Spherical Alumina Powder Market introduction

Spherical Alumina Powder, a high-purity ceramic material characterized by its perfectly globular shape and smooth surface, is fundamentally transforming high-performance material applications, particularly within the electronics and energy sectors. This material is derived from high-ppurity raw alumina through advanced processes like plasma fusion or spray drying, which manipulate the morphology of the particles to achieve uniform sphericity. This unique shape drastically improves several critical properties when compared to irregular or angular alumina particles, including enhanced flowability, higher packing density, and, most importantly, superior thermal conductivity coupled with electrical insulation.

Major applications of Spherical Alumina Powder revolve around its efficacy as a filler material in Thermal Interface Materials (TIMs), encapsulants, and composite ceramics used in advanced electronic packaging, LED lighting, and high-voltage power modules. The spherical structure minimizes contact resistance between particles, allowing heat to dissipate rapidly and efficiently, thereby crucial for managing thermal loads in modern high-power devices such as electric vehicle (EV) batteries and 5G infrastructure components. The material's ability to achieve high loading capacity while maintaining low viscosity makes it indispensable in advanced manufacturing processes.

The market is primarily driven by the escalating demand for miniaturization and high reliability in electronic components, necessitating highly efficient thermal management solutions. The global proliferation of electric vehicles, which rely heavily on advanced battery thermal management systems (BTMS) utilizing thermally conductive materials, serves as a significant growth catalyst. Furthermore, the expansion of high-performance computing (HPC) and data centers, which generate substantial heat, mandates the integration of superior thermal dissipation fillers, ensuring the long-term performance and reliability of sensitive electronic hardware.

Spherical Alumina Powder Market Executive Summary

The Spherical Alumina Powder market is witnessing robust growth, driven primarily by fundamental shifts in technological requirements across global industries, particularly the escalating need for efficient thermal management solutions in high-density electronic and energy storage systems. Business trends indicate a strong focus on capacity expansion, particularly in the Asia Pacific region, where manufacturing hubs for electronics and lithium-ion batteries are concentrated. Key market players are investing heavily in refining plasma processing technology to achieve tighter particle size distribution and higher purity levels (4N and 5N), thereby catering to the stringent demands of advanced semiconductor packaging and aerospace applications. Strategic alliances between raw material suppliers and end-user formulators are becoming increasingly common to secure supply chains and accelerate product development cycles for next-generation thermal greases and pastes.

Regionally, Asia Pacific maintains its dominant position, largely attributable to the massive production volumes of consumer electronics, automotive components, and battery cells in countries like China, South Korea, and Japan. North America and Europe demonstrate significant growth, driven by specialized, high-value applications in the aerospace, defense, and high-performance computing sectors, where premium spherical alumina grades are mandatory. Emerging markets in Latin America and the Middle East are beginning to show potential, driven by infrastructure development and increasing adoption of industrial LED lighting and renewable energy storage solutions.

Segment trends highlight the dominance of the Thermal Interface Materials (TIMs) application segment due to the pervasive thermal challenges in CPUs, GPUs, and power electronics. Furthermore, the segment focusing on Lithium-ion Batteries is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR), reflecting the explosive growth trajectory of the electric vehicle market. In terms of product type, ultra-fine spherical alumina powders (1-10 µm) are experiencing accelerated demand as electronic component density increases, requiring thinner bond lines and superior thermal conductivity performance in increasingly confined spaces.

AI Impact Analysis on Spherical Alumina Powder Market

User queries regarding AI's impact on the Spherical Alumina Powder Market frequently center on three main themes: the role of AI in material discovery and optimization, the influence of AI-driven electronics (such as advanced GPUs and specialized AI chips) on demand for thermal management solutions, and the potential for AI to optimize manufacturing processes. Users are keenly interested in how machine learning algorithms can predict and optimize the ideal spherical particle morphology, size distribution, and surface functionalization required for specific high-performance applications. Concerns also arise regarding whether AI processing power will drive device miniaturization to such an extent that current thermal materials become inadequate, necessitating faster innovation in spherical alumina composites.

The synthesis and integration of AI in advanced semiconductor manufacturing are directly correlated with the demand intensity for spherical alumina. AI hardware, particularly specialized accelerators and powerful data center processors, operates at incredibly high thermal densities. This mandates the use of ultra-high-performance TIMs, where spherical alumina, due to its exceptional conductivity and loading capacity, is irreplaceable. Consequently, the adoption of AI technologies worldwide acts as a profound multiplier for the market size of spherical alumina, demanding higher purity (4N, 5N) and increasingly narrow particle size distributions to ensure optimal heat transfer under continuous high-load operations.

Furthermore, AI algorithms are now being deployed in the production phase of spherical alumina itself. These systems analyze real-time data from plasma fusion reactors or spray towers, enabling immediate adjustment of process parameters—such as gas flow rates, temperature profiles, and precursor concentration—to minimize defects, maximize sphericity, and maintain stringent particle size uniformity. This AI-driven process optimization leads to reduced waste, increased yield, and the creation of highly customized spherical alumina grades tailored precisely for advanced electronic packaging, thus enhancing the material's market value proposition and ensuring supply chain stability for critical industries.

- AI drives demand for ultra-high thermal conductivity solutions, boosting the use of high-purity spherical alumina in high-density computing chips (GPUs, TPUs).

- Machine learning algorithms optimize raw material conversion processes (plasma fusion), improving sphericity, yield, and uniformity of particle size distribution.

- AI facilitates predictive maintenance and quality control in manufacturing plants, reducing operational costs and ensuring consistency of advanced spherical powders.

- Increased deployment of edge AI and 5G infrastructure necessitates robust thermal dissipation, directly increasing the application scope for spherical alumina fillers in electronic encapsulants.

- AI modeling assists in rapid prototyping of new composite materials, predicting the thermal performance of spherical alumina mixtures before extensive physical testing.

DRO & Impact Forces Of Spherical Alumina Powder Market

The Spherical Alumina Powder market is governed by a compelling interplay of drivers, restraints, and opportunities that collectively define its growth trajectory and resilience against external economic pressures. Key drivers include the relentless technological push towards higher electronic performance and miniaturization, which intrinsically generates more heat per unit volume, making effective thermal management using spherical fillers non-negotiable. Complementing this is the unprecedented global shift toward electromobility, specifically the massive scale-up of lithium-ion battery production for electric vehicles, where spherical alumina plays a vital role in thermal protection and stability within battery modules. These factors create strong foundational demand, ensuring sustained market expansion throughout the forecast period.

However, the market faces significant restraints, primarily related to the complex and capital-intensive manufacturing processes required to achieve the desired high sphericity and ultra-high purity (5N grade). Advanced techniques, such as plasma spheroidization, demand substantial energy input and sophisticated control systems, leading to high production costs. Furthermore, the market is subject to intense quality scrutiny; inconsistent particle size distribution or the presence of non-spherical particles can drastically reduce the performance of the final TIM or composite, posing a barrier to entry for new, less experienced manufacturers and limiting mass adoption in highly sensitive applications like advanced semiconductor packaging.

Opportunities for market players lie predominantly in the continuous innovation of surface modification techniques and the development of cost-effective spheroidization methods. Functionalizing the surface of spherical alumina particles allows for better dispersion and adhesion within various polymer matrices, enhancing the overall thermal conductivity of composites. Furthermore, the emerging hydrogen economy and solid-state battery technology present vast untapped application areas where spherical alumina’s thermal and dielectric properties will be highly sought after. Successfully addressing the cost constraints through technological advancements in manufacturing efficiency and securing long-term supply agreements will be crucial for capitalizing on these growth opportunities.

Segmentation Analysis

The Spherical Alumina Powder market is comprehensively segmented based on its defining characteristics, including purity levels, particle size distribution, manufacturing methods, and diverse end-use applications. This detailed segmentation allows for a precise understanding of industry dynamics, distinguishing between high-volume, standard-grade applications and highly specialized, high-margin niche uses. The analysis confirms that high-purity grades (4N and 5N) command premium pricing due to their essential role in sensitive electronics, while the largest volumes are driven by industrial applications requiring 3N grades. The segmentation by application clearly demonstrates the market's reliance on thermal management solutions, which is expected to remain the primary consumer throughout the forecast horizon.

Particle size is a critical differentiator, influencing both product performance and manufacturing technique. Ultra-fine powders (1-10 µm) are essential for achieving thin bond lines and high packing density in sophisticated microelectronics and IC packaging, whereas larger particles are often utilized in structural ceramics and certain potting compounds. The methodologies used in production, such as the energy-intensive plasma melting technique versus the more scalable but potentially lower-purity fusion methods, dictate the physical attributes and ultimately the target market for the resultant powder. Understanding these intersections is vital for manufacturers to tailor their production capabilities to specific industry needs and optimize pricing strategies.

- By Purity Level:

- 3N Grade (99.9%)

- 4N Grade (99.99%)

- 5N Grade (99.999%)

- By Particle Size Distribution:

- 1–10 µm (Ultra-fine)

- 10–50 µm (Fine)

- >50 µm (Standard/Coarse)

- By Application:

- Thermal Interface Materials (TIMs) (Greases, Pastes, Pads)

- Encapsulation and Potting Compounds

- Lithium-ion Battery Components (Separators and Thermal Spreads)

- High-Performance Composites and Ceramics

- LED and Lighting Components

- Semiconductor Packaging

- By Manufacturing Method:

- Plasma Spheroidization/Melting

- Flame Spheroidization/Fusion

- Spray Drying/Sintering

- Other Chemical Methods

Value Chain Analysis For Spherical Alumina Powder Market

The value chain for Spherical Alumina Powder commences with the upstream extraction and purification of high-purity raw alumina, typically derived from the Bayer process, where stringent quality control is paramount as minor impurities can significantly compromise the thermal and electrical performance of the final spherical product. This raw material then enters the specialized manufacturing stage, involving highly capital-intensive processes like plasma spheroidization, which represents the highest value-addition step due to the technological expertise required to control morphology and particle size uniformity. Manufacturers focus heavily on optimizing these spheroidization techniques to ensure scalability and cost efficiency while meeting the demanding specifications of the end-user industries.

The midstream involves post-processing steps such as particle classification, surface treatment (e.g., silane coupling agents for better polymer compatibility), and packaging. Distribution channels vary significantly based on the target application; high-volume standard grades often utilize indirect channels through chemical distributors and large-scale bulk suppliers, minimizing logistical complexity. Conversely, specialized ultra-fine, high-purity grades required for semiconductor or aerospace applications frequently rely on direct sales channels, fostering closer technical collaboration between the manufacturer and the end-user formulator to ensure precise integration into proprietary composite formulations.

The downstream portion of the value chain is dominated by formulators (e.g., manufacturers of TIMs, adhesives, and composite resins) who incorporate the spherical alumina as a high-performance functional filler. The ultimate end-users are vast and include automotive OEMs, consumer electronics assembly plants, aerospace contractors, and advanced power management module producers. The efficiency of the entire chain hinges on seamless coordination between the raw material quality, the precision of the spheroidization process, and the formulation expertise of the downstream partners, all aiming to deliver optimized thermal dissipation solutions that meet the increasing demands of modern technology.

Spherical Alumina Powder Market Potential Customers

The primary customers for Spherical Alumina Powder are entities requiring superior thermal management combined with electrical insulation, fundamentally targeting the electronics, automotive, and energy sectors. Large-scale manufacturers of thermal interface materials (TIMs), including thermal grease, gap fillers, and adhesive pads, form the most immediate customer base, as spherical alumina constitutes the critical high-conductivity component in these formulations. These formulators subsequently sell their materials to semiconductor companies and electronic device assemblers who require reliable heat dissipation solutions for CPUs, GPUs, and sensitive power modules to prevent performance degradation and failure.

Furthermore, the rapidly growing electric vehicle (EV) industry represents a major customer segment. EV battery manufacturers and automotive tier-one suppliers utilize spherical alumina in battery thermal management systems (BTMS) to enhance the safety and longevity of lithium-ion battery packs. The material is essential for formulating thermal potting compounds used to fill gaps within battery modules, ensuring efficient heat removal during charging and discharging cycles. Other significant customers include companies specializing in advanced ceramics for structural applications, high-power LED producers, and aerospace/defense contractors needing specialized composites that offer stability and insulation under extreme operational conditions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 1,020.8 Million |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Denka Company Limited, Admatechs Co., Ltd., Showa Denko K.K., Almatis GmbH, Aluminum Corporation of China Limited (CHALCO), Nippon Light Metal Co., Ltd., Sumitomo Chemical Co., Ltd., K.A. Refractories Co., Ltd., Sibelco Group, Futian Advanced Material, Baikowski SAS, Suzhou BTR New Energy Material Co., Ltd., Beijing Grinding & Firing Co., Ltd., Saint-Gobain Ceramic Materials, Resonac Holdings Corporation, Vesta Ceramics Co., Ltd., Shandong Aluminum Industry Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Spherical Alumina Powder Market Key Technology Landscape

The technology landscape governing the production of Spherical Alumina Powder is dominated by methods designed to achieve high temperature melting and controlled crystallization necessary for perfect sphericity, narrow particle size distribution, and defect-free surfaces. Plasma spheroidization, often involving induction coupled plasma (ICP) or direct current (DC) plasma torches, is currently the benchmark technology for producing ultra-high-purity (4N and 5N) spherical alumina powders, particularly those required in the demanding semiconductor and aerospace industries. This method excels because it can achieve extremely high temperatures (up to 10,000°C), fully melting the raw material and allowing surface tension forces to form near-perfect spheres before rapid cooling ensures particle stability. However, the energy consumption and capital expenditure associated with plasma systems remain significant barriers.

Another prevalent technology is flame spheroidization (or fusion melting), which utilizes high-temperature flame reactors to melt and spheroidize alumina particles. While generally more cost-effective and scalable for producing standard-grade powders (3N), this method sometimes struggles to achieve the fine particle size uniformity and the highest purity levels demanded by cutting-edge applications compared to plasma techniques. Recent technological advancements are focused on hybrid methods that combine elements of spray drying with high-temperature sintering or melting to optimize the balance between cost, scalability, and quality, specifically targeting the high-volume needs of the automotive battery market.

Beyond the core manufacturing processes, significant technological focus is placed on post-treatment and surface functionalization. Modern technology involves applying specialized coupling agents, such as silanes or titanates, to the surface of the spherical particles. This surface modification enhances the material’s wettability and dispersibility within organic polymer matrices (like epoxy or silicone), which is crucial for maximizing the thermal conductivity of the final composite material, ensuring optimal performance in TIMs and encapsulants. Continuous R&D is also exploring advanced particle classification systems and air separation techniques to ensure rigorous control over particle size distribution, which directly impacts the high-density packing efficiency essential for thermal performance.

Regional Highlights

The geographical distribution of the Spherical Alumina Powder market illustrates a clear correlation between advanced manufacturing capabilities, electronic production volumes, and regional demand dynamics. Asia Pacific (APAC) currently holds the dominant market share and is expected to exhibit the fastest growth over the forecast period. This dominance is due to the concentration of major consumer electronics, automotive (particularly EV battery manufacturing), and semiconductor fabrication hubs in countries like China, Japan, South Korea, and Taiwan. These nations not only lead in the production of spherical alumina but are also the largest consumers, driving both supply and demand.

North America and Europe constitute the secondary markets, characterized by demand for high-value, specialized grades of spherical alumina. In North America, demand is propelled by the defense sector, advanced data center expansion, high-performance computing, and a rapidly expanding domestic EV manufacturing base. European market growth is similarly tied to the automotive industry's electrification roadmap and stringent thermal management requirements in industrial automation and high-power electronics, demanding reliable, high-purity fillers for encapsulation and potting applications. These regions often prioritize 4N and 5N purity grades, justifying premium pricing.

Latin America and the Middle East & Africa (MEA) currently hold smaller market shares but represent areas of emerging opportunity. Growth in MEA is driven by increasing investment in renewable energy infrastructure, large-scale industrial LED lighting projects, and the initial stages of electronic manufacturing development. While these regions primarily import finished products, rising industrialization suggests future localized demand for both standard and fine-grade spherical alumina powders, particularly as power electronics and telecommunication infrastructure development accelerates.

- Asia Pacific (APAC): Market leader due to massive electronics manufacturing, high concentration of Li-ion battery gigafactories, and significant investments in 5G infrastructure. Key consumers: China, South Korea, and Japan.

- North America: Strong demand focused on aerospace, defense applications, advanced microelectronics packaging, and high-performance computing thermal solutions.

- Europe: Growth driven by electric vehicle production mandates, stringent thermal regulations in industrial electronics, and strong R&D in materials science and advanced manufacturing.

- Latin America & MEA: Emerging markets showing increasing adoption in industrial coatings, construction, and renewable energy storage projects; reliant on imports but localized production potential exists.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Spherical Alumina Powder Market.- Denka Company Limited

- Admatechs Co., Ltd.

- Showa Denko K.K. (Resonac Holdings Corporation)

- Almatis GmbH

- Aluminum Corporation of China Limited (CHALCO)

- Nippon Light Metal Co., Ltd.

- Sumitomo Chemical Co., Ltd.

- K.A. Refractories Co., Ltd.

- Sibelco Group

- Futian Advanced Material

- Baikowski SAS

- Suzhou BTR New Energy Material Co., Ltd.

- Beijing Grinding & Firing Co., Ltd.

- Saint-Gobain Ceramic Materials

- Toyo Aluminium K.K.

- Axens SA

- Treibacher Industrie AG

- Orchid Ceramic Materials

Frequently Asked Questions

Analyze common user questions about the Spherical Alumina Powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of using spherical alumina over irregular alumina particles?

Spherical alumina offers significantly enhanced thermal conductivity, improved flowability, and higher packing density compared to irregular particles. The smooth spherical shape minimizes viscosity increase when used as a filler, allowing for high material loading crucial for high-performance Thermal Interface Materials (TIMs) in electronics.

Which application segment drives the largest demand for Spherical Alumina Powder?

The Thermal Interface Materials (TIMs) segment currently drives the largest demand, primarily in applications like thermal greases, pads, and potting compounds used to manage heat in CPUs, GPUs, high-power LEDs, and advanced power electronics, ensuring system reliability and longevity.

How does the growth of the Electric Vehicle (EV) industry impact the Spherical Alumina market?

The rapid growth of the EV market significantly boosts demand, as spherical alumina is a crucial component in Battery Thermal Management Systems (BTMS). It is used in thermally conductive gap fillers and potting compounds within lithium-ion battery packs to efficiently dissipate heat and ensure battery safety and performance.

What is Plasma Spheroidization and why is it important for the market?

Plasma Spheroidization is a high-temperature manufacturing process utilizing plasma torches to melt raw alumina powder, allowing surface tension to form perfectly spherical particles before rapid cooling. It is critical because it produces ultra-high-purity (4N/5N) and fine spherical powders essential for high-end applications like semiconductor packaging.

Which geographical region dominates the global supply and consumption of Spherical Alumina Powder?

Asia Pacific (APAC), led by countries such as China, Japan, and South Korea, dominates both the production capacity and consumption of spherical alumina powder. This is primarily attributed to the region's concentration of global electronics and electric vehicle manufacturing hubs.

What is the future outlook for the use of 5N purity Spherical Alumina?

The demand for 5N (99.999%) purity spherical alumina is expected to accelerate significantly, driven by the increasing integration of advanced AI chips and next-generation semiconductors. This ultra-high purity is non-negotiable for achieving maximum thermal performance and electrical stability in highly sensitive, high-density electronic packaging.

Are there any substitutes for Spherical Alumina in thermal management applications?

While alternatives exist, such as spherical boron nitride (s-BN) and specific grades of silicon carbide, spherical alumina remains preferred for its optimal balance of high thermal conductivity, electrical insulation, cost-effectiveness, and ease of processing. s-BN offers higher thermal conductivity but is significantly more expensive.

How do particle size distribution and sphericity affect the final product performance?

Optimal particle size distribution (PSD) allows for maximum packing density within the polymer matrix, minimizing voids and maximizing particle-to-particle contact, thereby greatly enhancing thermal transfer. High sphericity is essential to maintain low viscosity and high loading capacity during the formulation process.

What role does surface modification play in enhancing spherical alumina performance?

Surface modification, typically using silane coupling agents, is vital to chemically bond the inorganic alumina particles to the organic polymer matrix. This improves dispersion, reduces sedimentation, and significantly enhances the overall thermal conductivity and mechanical strength of the resulting composite or TIM.

What are the key technological challenges currently restraining market growth?

The primary restraints include the high operational costs of plasma spheroidization technology, leading to high material prices. Additionally, maintaining perfect consistency in particle size and morphology across large-scale batches remains a technical challenge that manufacturers are actively working to overcome through process automation and AI integration.

Is Spherical Alumina Powder used in solid-state battery technology?

Yes, Spherical Alumina Powder is anticipated to play a critical role in next-generation solid-state batteries (SSBs). It can be used as a ceramic filler in solid electrolytes or as a coating material to improve the stability and performance of the electrode interfaces, particularly due to its high dielectric strength and thermal properties.

How is the aerospace industry utilizing high-grade spherical alumina?

The aerospace industry uses high-grade spherical alumina in specialized thermal protection systems, light-weight structural composites, and advanced electronic module encapsulation. Its excellent dielectric properties and thermal stability under extreme temperature fluctuations are crucial for avionics and satellite systems.

What is the expected long-term impact of 5G deployment on the market?

5G infrastructure relies on massive arrays of high-power transmission modules and small cells, all of which generate substantial heat. Spherical alumina is essential for creating robust, thermally conductive encapsulation materials for these modules, ensuring system longevity and boosting long-term demand.

Which segment of particle size (e.g., 1-10 µm) is witnessing the highest growth rate?

The Ultra-fine Particle Size segment (1-10 µm) is exhibiting the highest growth rate. Miniaturization in electronics requires thinner bond lines for TIMs, necessitating these ultra-fine particles to achieve maximum thermal efficiency and high packing density in increasingly small spaces.

What raw material is used for the production of Spherical Alumina Powder?

The raw material is typically high-purity, calcined alumina (aluminum oxide, Al2O3), which is sourced via the Bayer process. The purity of this raw material significantly influences the final grade and performance characteristics of the resulting spherical powder.

How do economic fluctuations affect the pricing strategy of spherical alumina manufacturers?

Economic fluctuations impact the costs of energy (crucial for plasma processing) and raw material (high-purity alumina). Manufacturers of specialized grades, however, often maintain relatively stable pricing due to the necessity and high performance value of their products in critical, high-margin applications like aerospace and high-end semiconductors.

What are the key regional differences in product requirements?

APAC demands high volume for standard and fine grades for consumer electronics and EVs. North America and Europe emphasize ultra-high purity (4N/5N) and specialized surface coatings for defense and automotive safety applications. Purity and specialization requirements dictate the technological preference in different regions.

Is there a noticeable trend toward sustainable or green manufacturing practices in this sector?

Yes, there is a growing trend focused on improving the energy efficiency of the highly intensive plasma spheroidization process and optimizing recycling practices for raw materials. Manufacturers are exploring advanced processing controls to minimize waste and reduce the substantial carbon footprint associated with high-temperature production methods.

What is the primary function of Spherical Alumina in composite materials?

In composite materials, spherical alumina primarily functions as a thermal conductor and structural reinforcement agent. It increases the material's thermal diffusivity while maintaining high electrical insulation, making the composite suitable for use in power modules and high-voltage electronics encapsulation.

Which major industry trend is expected to provide the strongest long-term driver for this market?

The strongest long-term driver is the pervasive requirement for power density management across all technological domains, particularly driven by electrification (EVs, industrial power) and the perpetual performance increase in data center components, both of which require constant innovation in high-efficiency thermal fillers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager