Spherical Aluminum Oxide Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434699 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Spherical Aluminum Oxide Market Size

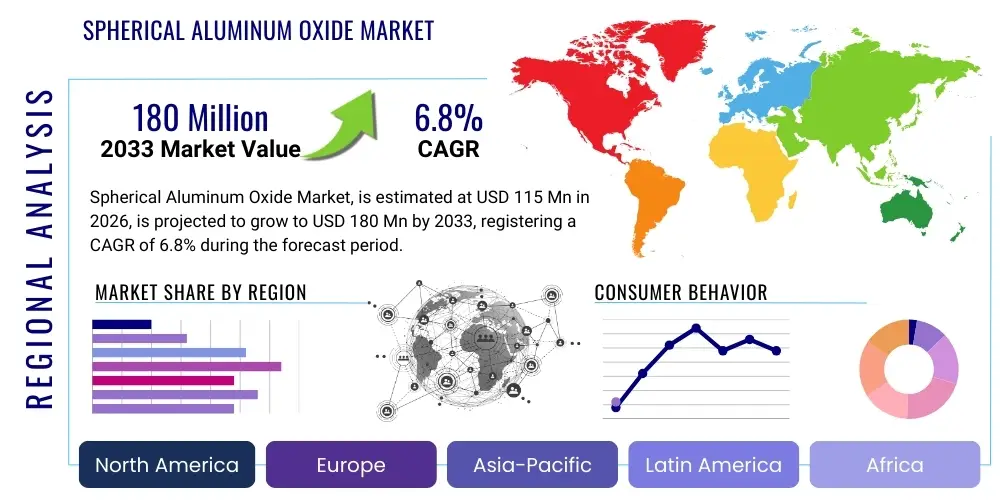

The Spherical Aluminum Oxide Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 115 million in 2026 and is projected to reach USD 180 million by the end of the forecast period in 2033.

Spherical Aluminum Oxide Market introduction

The Spherical Aluminum Oxide Market encompasses the production and utilization of highly engineered alumina powders characterized by their precise spherical morphology, narrow particle size distribution, and exceptional thermal conductivity combined with high electrical insulation properties. These unique characteristics position spherical aluminum oxide as a critical advanced material essential for thermal management solutions, particularly within rapidly expanding sectors such as electric vehicles (EVs), 5G infrastructure, high-power electronics, and advanced lithium-ion battery technology. The inherent benefits, including improved flowability, superior packing density, and reduced abrasion, make it a preferred filler material over traditional irregular-shaped alumina.

The primary driving factor sustaining the robust growth of the Spherical Aluminum Oxide Market is the global imperative for enhanced thermal dissipation in miniaturized and high-performance electronic devices. As electronic components increase in power density, the generation of waste heat accelerates, demanding sophisticated thermal interface materials (TIMs) that can efficiently transfer this heat away from sensitive components. Spherical aluminum oxide serves as a fundamental component in these TIMs—including thermal grease, thermal pads, and encapsulants—due to its high thermal conductivity (often exceeding 30 W/m·K for high-purity grades) and low dielectric constant. This synergy of thermal and electrical properties is non-negotiable for modern electronics where operational stability and longevity are paramount.

Furthermore, the accelerating adoption of electric vehicles and the resultant demand for high-capacity, high-safety lithium-ion batteries represent a substantial application segment for spherical aluminum oxide. In battery technology, these powders are increasingly utilized as functional coatings on battery separators or cathode materials. The spherical alumina coating enhances the thermal stability of the separator, preventing thermal runaway and improving overall battery safety and lifespan. The superior flowability of the spherical particles ensures uniform coating thickness, crucial for maintaining optimal ionic movement and ensuring consistent battery performance across diverse operating conditions. The versatility and necessity of spherical aluminum oxide in solving complex thermal and safety challenges across multiple high-growth industries cement its strategic importance in the global advanced materials landscape.

- Product Description: Highly pure aluminum oxide (Al2O3) with controlled spherical morphology, ensuring superior packing density and low viscosity in formulations.

- Major Applications: Thermal Interface Materials (TIMs), structural ceramics, lithium-ion battery coatings, LED encapsulation, and semiconductor packaging.

- Key Benefits: Exceptional thermal conductivity, high electrical resistance, low abrasion, enhanced flowability, and improved structural integrity in composite materials.

- Driving Factors: Exponential growth in electric vehicle production, increasing power density in microelectronics, and rising demand for highly reliable thermal management solutions.

Spherical Aluminum Oxide Market Executive Summary

The Spherical Aluminum Oxide Market is poised for significant expansion, driven primarily by fundamental shifts in the electronics and automotive industries toward higher performance and greater energy efficiency. Global business trends indicate a strong focus on high-purity grades (4N and 5N), which command premium pricing and are essential for advanced semiconductor and aerospace applications, contrasting with the standard grades used in general thermal pastes. Competition is intensifying, particularly in Asia Pacific, where manufacturing capacity expansion is aggressively addressing the spike in demand from battery and EV manufacturers. Strategic partnerships focused on securing stable raw material supplies (aluminum hydroxide) and optimizing spheroidization technology (e.g., plasma melting) are key competitive vectors defining the market landscape.

From a regional perspective, Asia Pacific maintains undisputed leadership, fuelled by its dominance in global electronics manufacturing, lithium-ion battery production, and the massive scale of its domestic EV markets, notably China, South Korea, and Japan. The region's robust infrastructure and lower production costs facilitate mass adoption. North America and Europe, while smaller in volume, exhibit high growth rates driven by stringent regulatory environments mandating higher safety standards for electronics and batteries, fostering demand for ultra-high-purity spherical aluminum oxide, especially in military, medical, and aerospace sectors. Investment in localizing advanced materials supply chains in these Western markets is becoming a significant trend to mitigate geopolitical risks and shipping complexities.

Segment trends reveal that the Thermal Management application segment, particularly the sub-segment of Thermal Interface Materials (TIMs), holds the largest market share, reflecting the universal need for heat dissipation across all electronic devices, from consumer gadgets to industrial machinery. However, the fastest-growing segment is undeniably Lithium-ion Batteries, fueled by the accelerating global transition away from internal combustion engines. Within the segmentation by purity, the 4N and 5N grades are witnessing the highest demand growth, driven by their necessity in high-reliability applications where minimal impurities are critical to device performance and longevity. Manufacturers are responding by scaling up purification and particle size control technologies to meet these exacting specifications, driving innovation in advanced processing techniques.

- Business Trends: Emphasis on high-purity (4N/5N) materials, capacity expansion in Asia Pacific, focus on supply chain security for raw aluminum hydroxide, and intense R&D for advanced spheroidization techniques.

- Regional Trends: Asia Pacific dominance in consumption and production; rapid growth in North America and Europe driven by high-reliability applications and domestic EV initiatives.

- Segments Trends: Thermal Management remains the largest segment; Lithium-ion Batteries exhibit the highest Compound Annual Growth Rate (CAGR); increasing differentiation based on particle size distribution (PSD) and surface modification.

AI Impact Analysis on Spherical Aluminum Oxide Market

User queries regarding AI's influence on the Spherical Aluminum Oxide Market primarily center on how artificial intelligence can optimize manufacturing processes, predict material performance in novel applications, and accelerate R&D cycles for new formulations. Users seek to understand if AI-driven simulations can replace expensive physical prototyping when testing the thermal conductivity of TIMs incorporating spherical alumina, and whether machine learning algorithms can enhance quality control by detecting subtle flaws in particle morphology or purity levels in real-time. Another key theme involves AI's role in optimizing the complex plasma or flame fusion processes used for spheroidization, aiming for tighter particle size distribution and reduced energy consumption.

The integration of artificial intelligence and machine learning (ML) is fundamentally transforming the manufacturing and application development of spherical aluminum oxide. AI algorithms are increasingly deployed in raw material sourcing and quality assessment, analyzing spectral data to ensure incoming aluminum hydroxide purity, which directly impacts the final product quality. In the manufacturing phase, predictive maintenance models utilizing ML optimize plasma torch operational parameters, such as gas flow rates and temperature profiles, leading to significantly tighter control over particle size distribution (PSD) and reduced batch variability, a critical requirement for high-performance thermal materials. This optimization minimizes waste and energy consumption, enhancing overall production efficiency.

Beyond manufacturing, AI significantly accelerates the development and formulation of new composite materials utilizing spherical aluminum oxide. Generative AI models and deep learning simulations are used to predict the thermal, mechanical, and electrical properties of polymer composites or thermal pastes based on variables like alumina loading concentration, particle size blend ratios, and surface functionalization chemistries. This capability allows end-users (e.g., TIM producers) to rapidly iterate on formulations, drastically cutting down the time and cost associated with traditional experimental methods. For example, in high-power semiconductor packaging, AI can simulate stress points and heat flow paths in 3D structures, optimizing the placement and specification of spherical alumina fillers for maximum thermal efficiency and reliability.

- AI-driven optimization of spheroidization parameters, enhancing particle uniformity and yield.

- Machine learning for real-time quality control and flaw detection in high-purity material batches.

- Predictive modeling of thermal interface material (TIM) performance based on spherical alumina filler loading and morphology.

- Optimization of supply chain logistics and demand forecasting for high-grade spherical alumina raw materials.

- Accelerated discovery of novel surface modification chemistries to improve filler compatibility with various polymer matrices.

DRO & Impact Forces Of Spherical Aluminum Oxide Market

The Spherical Aluminum Oxide Market is influenced by a dynamic interplay of factors: exponential growth in the EV and 5G sectors drives demand (Drivers), high production costs and dependence on energy-intensive processes act as brakes (Restraints), while technological advancements in miniaturization and the transition to solid-state batteries present substantial growth pathways (Opportunities). These factors collectively define the market structure and competitive landscape. The market's responsiveness to these forces is modulated by its dependence on the global electronics manufacturing cycle and volatility in aluminum-related raw material prices, making strategic capacity management and long-term supply agreements crucial for market stability and sustained growth.

Drivers: The primary growth driver is the relentless pursuit of high-performance thermal management solutions across multiple industries. Modern computing, automotive, and industrial power electronics generate immense heat, which, if not effectively dissipated, leads to system failure, reduced battery life, and overall decreased reliability. Spherical aluminum oxide’s unique combination of high thermal conductivity and electrical isolation makes it irreplaceable in thermal greases, adhesives, and potting compounds used in cooling systems. Furthermore, the mandatory push for increased safety in Li-ion batteries through ceramic coatings ensures continued high volume consumption, as regulators and consumers prioritize safer energy storage solutions globally. The ongoing transition to higher power density devices necessitates materials that can handle extreme thermal loads efficiently.

Restraints: Significant barriers to market growth include the exceptionally high capital expenditure required for setting up spherical powder production facilities, specifically those using plasma or flame spheroidization techniques, which demand substantial energy input and specialized equipment. Achieving ultra-high purity (5N) and controlling the precise particle size distribution (PSD) are technically complex and result in high manufacturing costs, limiting adoption in cost-sensitive, low-performance applications. Moreover, the vulnerability of the global supply chain to disruptions, coupled with reliance on a few primary producers of high-quality aluminum hydroxide precursor, poses a logistical constraint. Potential alternatives, such as spherical boron nitride or silicon carbide, though often more expensive, represent a persistent competitive threat, especially in niche ultra-high-performance applications.

Opportunities: Emerging applications provide substantial avenues for market expansion. The development of next-generation power electronics, such as Gallium Nitride (GaN) and Silicon Carbide (SiC) devices, requires advanced packaging solutions where spherical alumina can serve as an ideal thermal filler due to its chemical inertness and superior thermal properties at higher operating temperatures. The promising field of solid-state batteries (SSBs) presents a major long-term opportunity, as SSBs will likely utilize ceramic components, including advanced fillers, in their construction to enhance ionic conductivity and structural stability. Furthermore, advancements in surface modification techniques that improve the dispersion and loading percentage of spherical alumina in polymer matrices without significantly increasing viscosity unlock new potential in producing thinner, more efficient thermal films and coatings.

Drivers

- Accelerating demand for superior thermal interface materials (TIMs) in high-power electronics and servers.

- Mandatory requirements for enhanced thermal safety coatings on lithium-ion battery separators in electric vehicles (EVs).

- Miniaturization of electronic components, demanding higher efficiency heat dissipation per unit volume.

- Expansion of 5G and data center infrastructure requiring specialized cooling solutions.

Restraints

- High manufacturing costs associated with plasma or flame spheroidization technology and high energy consumption.

- Technical complexity in achieving ultra-high purity (5N) and precise, narrow particle size distribution (PSD).

- Competition from alternative high-performance thermal fillers like spherical boron nitride and diamond powder in niche markets.

Opportunity

- Growing adoption in advanced semiconductor packaging, particularly for GaN and SiC power devices.

- Potential utilization in the development and manufacturing of solid-state battery components.

- Development of cost-effective surface treatment processes to enhance filler compatibility and loading capacity in polymer systems.

Segmentation Analysis

The Spherical Aluminum Oxide Market is comprehensively segmented based on Purity Grade, Particle Size, and Application, reflecting the diverse and specialized requirements of end-user industries. This segmentation is crucial as the performance characteristics—such as thermal conductivity, electrical insulation, and material compatibility—are intrinsically linked to the purity and morphology of the powder. The Purity Grade (3N, 4N, 5N) dictates suitability for mission-critical applications, while the Particle Size (Micron, Nano) influences packing density and the overall viscosity of the final composite material, such as thermal grease. The dominance of the Thermal Management segment underscores the fundamental role of these materials in modern electronics, but the fastest growth trajectory lies within the demanding specifications required by the Li-ion battery sector.

- By Purity Grade:

- 3N Grade (99.9% Al2O3)

- 4N Grade (99.99% Al2O3)

- 5N Grade (99.999% Al2O3)

- By Particle Size:

- Micron-sized Spherical Aluminum Oxide (>1 µm)

- Nano-sized Spherical Aluminum Oxide (<1 µm)

- Bimodal/Multimodal Particle Distribution

- By Application:

- Thermal Management Materials (TIMs, Heat Dissipation Fillers, Thermal Paste/Grease, Adhesives, Encapsulants)

- Lithium-ion Batteries (Separator Coatings, Cathode Material Coatings)

- Electronic Packaging and Substrates

- Advanced Ceramics and Abrasives

- By End-Use Industry:

- Automotive (EV/HEV)

- Electronics and Semiconductors

- Aerospace and Defense

- Energy Storage

Value Chain Analysis For Spherical Aluminum Oxide Market

The value chain for Spherical Aluminum Oxide is characterized by high technical barriers at the transformation stage and significant integration between manufacturers and highly specialized downstream consumers. The upstream segment involves the mining and purification of bauxite, followed by the refinement into high-purity aluminum hydroxide (Al(OH)3), which serves as the critical precursor. This precursor quality directly determines the feasibility of achieving 4N or 5N spherical alumina. Ensuring consistent supply and high purity of Al(OH)3 is a major competitive advantage, as slight variations can compromise the expensive spheroidization process. Key suppliers in this phase often include major chemical and aluminum producers.

The core midstream process involves the highly technical spheroidization phase, typically achieved through sophisticated methods like plasma fusion, flame fusion, or spray pyrolysis. This stage requires significant investment in specialized equipment, controlled atmospheric conditions, and proprietary technical expertise to ensure a narrow particle size distribution (PSD) and perfect spherical morphology. Following spheroidization, the material often undergoes post-processing treatments, including surface functionalization (e.g., silane treatment) to enhance compatibility with various organic resins used in thermal pastes and polymer matrices. Quality control is rigorous here, focusing on particle sphericity, surface area, and thermal conductivity verification before packaging.

The downstream segment involves formulators and end-users. Direct distribution channels are prevalent for high-volume, standardized products sold to major Thermal Interface Material (TIM) producers or battery manufacturers who integrate the spherical alumina directly into their formulations. Indirect channels, involving specialized chemical distributors, cater to smaller custom formulators or specialized ceramic manufacturers. End-users in the automotive and semiconductor industries exert significant influence on the value chain, driving demand for increasingly higher specifications (smaller particle size, higher purity, tailored surface chemistry) necessary for performance optimization in cutting-edge devices and next-generation battery architectures. The value addition substantially increases from the precursor stage to the final functionalized spherical product.

Spherical Aluminum Oxide Market Potential Customers

The primary customers and end-users of spherical aluminum oxide are entities requiring materials with high thermal conductivity and excellent dielectric properties to manage heat efficiently or enhance safety in electrical systems. The largest customer base resides within the Thermal Interface Materials (TIMs) manufacturing sector, encompassing companies that formulate thermal greases, gap fillers, thermal adhesives, and potting compounds used widely in consumer electronics, data centers, and industrial power modules. These customers seek materials that offer maximized thermal loading with minimal viscosity increase, making spherical morphology ideal for high-performance products.

Another major, rapidly expanding customer segment is the Electric Vehicle (EV) and Energy Storage Systems (ESS) industry. Specifically, manufacturers of lithium-ion batteries and battery management systems (BMS) are key buyers. They utilize spherical aluminum oxide for coating battery separators to prevent thermal runaway and internal short circuits, significantly enhancing the safety profile and durability of the battery pack. They also incorporate these fillers into encapsulation materials for power components within the BMS, demanding high purity and fine particle size for thin, uniform coatings and high-voltage resistance.

Beyond thermal applications, advanced ceramics manufacturers and aerospace/defense contractors represent critical niche markets. In advanced ceramics, spherical alumina is used for precision abrasive applications and as a dense, wear-resistant filler in specialized structural components. Aerospace customers, requiring materials that perform reliably under extreme conditions, utilize ultra-high-purity spherical alumina in substrates and specialized electronic packaging where reliability, light weight, and sustained thermal performance are non-negotiable mission requirements. The diversity of these end-users ensures sustained demand across fluctuating economic cycles, though specific purity requirements vary drastically between segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 115 Million |

| Market Forecast in 2033 | USD 180 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sumitomo Chemical, Adma Products, Showa Denko, Denka, Nabaltec, Aluchem, Aluminum Corporation of China Limited (CHALCO), Nippon Light Metal, SkySpring Nanomaterials, A-Star Materials, Saint-Gobain, Zibo Shengkai, Jiangsu Jinggu, Shandong Weifang Sanxing, Zhejiang Fenghua. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Spherical Aluminum Oxide Market Key Technology Landscape

The technological landscape of the Spherical Aluminum Oxide Market is dominated by advanced spheroidization techniques necessary to transform irregular alumina powder into highly uniform spheres. The selection of technology is crucial, as it directly influences the final product’s characteristics, including purity, particle size distribution (PSD), and surface quality, which, in turn, dictates the material’s performance in thermal management or battery applications. The prevailing technology is the Plasma Fusion Spheroidization method. This highly energy-intensive process involves feeding precursor powder through an induction plasma torch, where temperatures can exceed 10,000°C. The rapid melting and subsequent surface tension ensure the formation of highly spherical particles upon cooling, offering exceptional control over morphology and enabling the processing of ultra-high-purity (4N and 5N) materials essential for high-end electronics and demanding defense applications.

An alternative, commercially viable method is Flame Spheroidization, which utilizes a combustion flame (oxy-hydrogen or other gas mixtures) to melt the fine aluminum oxide particles. While generally more cost-effective than plasma fusion, flame spheroidization typically offers slightly less control over the uniformity of the particles and is often used for producing lower-purity or micron-sized spherical alumina suitable for standard thermal pastes or lower-grade ceramic applications. Continuous innovation focuses on optimizing the feed rate, gas mixture, and cooling rates in both plasma and flame methods to minimize internal defects, maximize sphericity, and achieve narrower PSDs, which are key requirements for achieving high filler loading in viscous resins without compromising flow characteristics.

A burgeoning technological area involves surface modification and functionalization techniques. Once the spherical particle is formed, its surface must be treated—typically using silane coupling agents, titanates, or other proprietary organic coatings—to ensure excellent interfacial adhesion and dispersion within the polymer or epoxy matrix of the final product. This surface engineering is critical for preventing agglomeration, maintaining low viscosity in the final compound, and ensuring long-term thermal stability. Furthermore, advancements in developing bimodal or multimodal particle size distribution blends—where large and small spherical particles are combined to achieve maximum packing density—are crucial for maximizing thermal conductivity in high-end Thermal Interface Materials (TIMs) without compromising the material’s mechanical integrity or processability.

Regional Highlights

The global distribution and consumption of Spherical Aluminum Oxide are heavily skewed towards the Asia Pacific (APAC) region, driven by its undeniable role as the global manufacturing hub for electronics, semiconductors, and electric vehicles. China, South Korea, and Japan are the primary consumers, fueled by large domestic production volumes of Li-ion batteries and advanced consumer electronics. China, in particular, dominates both production and consumption, with significant investments in both thermal management components and mass-market EV manufacturing, leading to sustained, high-volume demand for micron-sized spherical alumina. South Korea and Japan focus heavily on high-purity (4N/5N) materials, essential for their specialized semiconductor packaging and high-end automotive battery segments, establishing the region as the powerhouse for the market.

North America and Europe represent mature markets characterized by high adoption rates in specialized and high-reliability sectors, such as aerospace, defense, and high-performance computing (HPC) data centers. While consumption volume is lower than APAC, the average selling price and demand for ultra-high-purity materials are significantly higher. European growth is stimulated by ambitious goals for EV adoption and associated battery gigafactories, creating a localized demand surge for battery-grade spherical alumina. North America focuses on stringent quality control for semiconductor packaging and robust thermal solutions required for extreme operating environments, driving technological leadership in specialized surface treatments and particle blending techniques. Both regions are actively seeking to establish localized, robust supply chains to reduce dependence on Asian production.

Latin America, the Middle East, and Africa (LAMEA) currently hold the smallest market share but are projected to exhibit gradual growth, primarily driven by increasing urbanization, rising penetration of consumer electronics, and nascent electric mobility initiatives, particularly in large economies like Brazil and South Africa. Demand in the Middle East is tied to infrastructure development, specifically telecommunications (5G) and data center projects, which require foundational thermal management materials. However, the region’s market remains largely reliant on imports from Asia and Europe, lacking significant domestic production capacity for the sophisticated spheroidized powder. Future growth will be contingent upon local electronics assembly growth and governmental support for renewable energy storage projects, which mandate thermal efficiency and safety.

- Asia Pacific (APAC): Market leader, driven by electronics manufacturing, Li-ion battery production (China, South Korea, Japan), and massive EV market scale. Focus on high-volume production and purity differentiation.

- North America: High-value market focused on defense, aerospace, high-performance computing, and specialized semiconductor packaging. Strong emphasis on R&D for advanced thermal interface materials.

- Europe: Rapidly growing market fueled by domestic EV manufacturing expansion (Gigafactories) and stringent safety standards for automotive electronics; high demand for 4N grade materials.

- Latin America (LATAM): Emerging market primarily driven by infrastructure development and increasing demand for consumer electronics, heavily reliant on imports.

- Middle East & Africa (MEA): Growth tied to telecommunications infrastructure and renewable energy projects; smallest market share currently, focused on essential thermal management imports.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Spherical Aluminum Oxide Market.- Sumitomo Chemical Co., Ltd.

- Showa Denko K.K. (Resonac)

- Denka Company Limited

- Adma Products, Inc.

- Nabaltec AG

- Aluchem, Inc.

- Aluminum Corporation of China Limited (CHALCO)

- Nippon Light Metal Co., Ltd.

- SkySpring Nanomaterials, Inc.

- A-Star Materials Co., Ltd.

- Saint-Gobain S.A.

- Zibo Shengkai New Materials Co., Ltd.

- Jiangsu Jinggu New Materials Co., Ltd.

- Shandong Weifang Sanxing New Material Co., Ltd.

- Zhejiang Fenghua Advanced Technology Co., Ltd.

- KAISEI Co., Ltd.

- Materion Corporation

- Micron Metals, Inc.

- Wuxi South Nanomaterials Co., Ltd.

- Guangdong Orient Zirconic Ind Sci & Tech Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Spherical Aluminum Oxide market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Spherical Aluminum Oxide?

The dominant driving factor is the intense global requirement for highly efficient thermal management solutions in high-power density electronics, particularly in electric vehicle (EV) battery systems and 5G infrastructure, where excellent heat dissipation and electrical insulation are critical to device safety and performance.

How does the purity grade of Spherical Aluminum Oxide influence its application?

Purity grade significantly impacts application: 3N (99.9%) is used for general thermal fillers, while 4N (99.99%) and 5N (99.999%) grades are mandatory for highly sensitive and mission-critical applications such as advanced semiconductor packaging, aerospace components, and high-performance lithium-ion battery coatings, where impurities can compromise electrical integrity and long-term reliability.

What technological challenge is most critical in producing high-quality Spherical Aluminum Oxide?

The most critical challenge is achieving precise control over particle size distribution (PSD) and perfect spherical morphology during the energy-intensive spheroidization process (e.g., plasma fusion). A narrow PSD is essential for maximizing filler loading in polymer matrices without excessively increasing the viscosity, a vital characteristic for effective thermal interface materials (TIMs).

Which application segment holds the highest growth potential for Spherical Aluminum Oxide?

The Lithium-ion Battery segment is projected to show the highest Compound Annual Growth Rate (CAGR). This growth is driven by the rapid global adoption of electric vehicles, necessitating massive volumes of spherical alumina for separator coatings to enhance thermal stability and prevent dangerous thermal runaway events.

How does spherical morphology benefit thermal interface materials (TIMs) compared to irregular alumina?

Spherical morphology ensures superior benefits, including reduced viscosity (better flowability) allowing for higher filler loading, enhanced packing density (maximizing thermal transfer pathways), and lower abrasion, which prolongs the life of processing equipment used by TIM manufacturers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager