Spices and Herbs Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432087 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Spices and Herbs Market Size

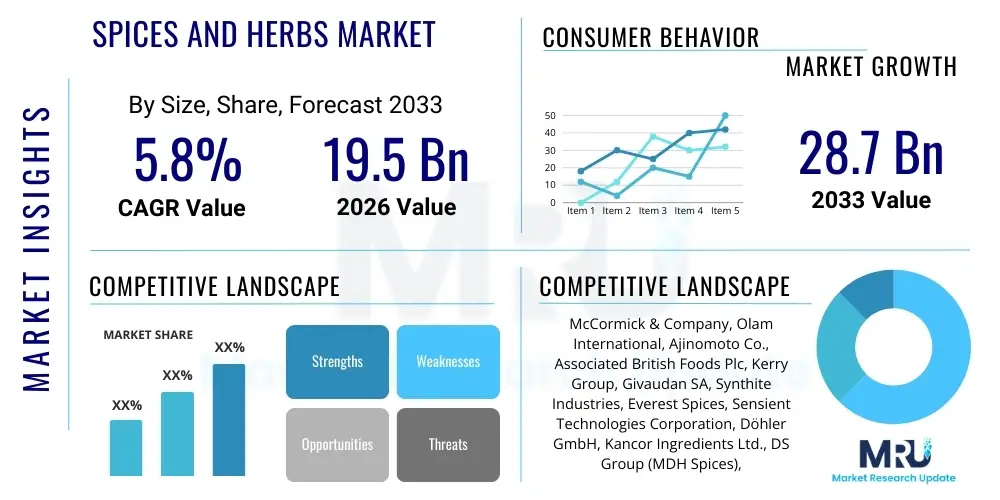

The Spices and Herbs Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 19.5 Billion in 2026 and is projected to reach USD 28.7 Billion by the end of the forecast period in 2033.

Spices and Herbs Market introduction

The Spices and Herbs Market encompasses the global trade, processing, and consumption of plant-derived substances primarily utilized for flavoring, coloring, and preserving food, as well as for medicinal, cosmetic, and traditional applications. Spices generally originate from the seeds, fruits, roots, bark, or flowers of plants, while herbs typically come from the leafy green parts. This extensive product portfolio includes staples like pepper, chili, turmeric, and cinnamon, alongside specialty herbs such as oregano, basil, and rosemary, catering to diverse culinary traditions across the world. The fundamental function of these products is to enhance the sensory appeal of food, acting as indispensable ingredients in both household kitchens and large-scale food manufacturing.

Major applications span across several critical sectors, prominently including the processed food and beverage industry, which utilizes standardized spice blends for ready-to-eat meals, snacks, and convenience foods. Furthermore, the burgeoning demand for natural ingredients in pharmaceuticals, nutraceuticals, and traditional medicine systems (such as Ayurveda and Traditional Chinese Medicine) significantly drives market growth. The increasing consumer awareness regarding the health benefits associated with spices and herbs—such as anti-inflammatory, antioxidant, and antimicrobial properties—bolsters their integration beyond just flavor enhancement, positioning them as functional ingredients.

The market’s expansion is heavily driven by shifting global dietary patterns, specifically the rise of fusion cuisine and the increasing demand for ethnic foods in Western markets, which necessitates the import and utilization of diverse, exotic spices. Additionally, urbanization and busy lifestyles have led to greater reliance on pre-packaged, spiced, and ready-to-cook meal kits. Key benefits include natural flavoring, potential reduction of artificial additives, and the documented health advantages linked to bioactive compounds present in many spices. Regulatory emphasis on food safety and quality, particularly concerning contaminants like aflatoxins and heavy metals, influences supply chain management and processing technologies used within this sector.

Spices and Herbs Market Executive Summary

The Spices and Herbs Market is characterized by robust growth, primarily fueled by the accelerating globalization of cuisine and increasing consumer preference for natural, clean-label ingredients over synthetic flavorings. Business trends indicate a strong move toward supply chain transparency, ethical sourcing, and organic certification, driven by demand from developed economies for sustainable products. Major market players are investing heavily in advanced processing technologies, such as supercritical fluid extraction (SFE) and sophisticated blending machinery, to improve flavor consistency, extend shelf life, and meet stringent international quality standards, especially concerning microbial load and pesticide residues.

Regional trends highlight Asia Pacific (APAC) as the largest producer and consumer, dominating the raw material supply due to favorable climatic conditions and traditional usage patterns, while North America and Europe remain key consumption hubs, distinguished by high per capita spending on specialty and organic products. The increasing middle-class population and rapid urbanization in regions like China and India are spurring domestic consumption of pre-packaged, branded spices, shifting the market structure from loose bulk sales toward value-added, processed formats. Political stability and trade agreements significantly impact the procurement and pricing volatility of essential commodities like black pepper and vanilla.

Segmentation trends show that the application segment is dominated by the food and beverage sector, followed closely by the nutraceutical and pharmaceutical industries, which utilize high-value extracts and essential oils. In terms of product type, chili, pepper, and garlic maintain high volume shares, but the specialty spices and herbs segment (e.g., saffron, vanilla, exotic blends) is exhibiting the fastest growth due to premiumization. The ground/processed form segment is growing faster than the whole form segment, reflecting the consumer shift towards convenience and the manufacturing sector's need for ready-to-use ingredients. Furthermore, the emphasis on food traceability, supported by digital tracking solutions, is becoming a decisive factor for procurement managers in high-volume industries.

AI Impact Analysis on Spices and Herbs Market

Common user questions regarding AI in the Spices and Herbs Market center on how technology can solve endemic industry challenges, particularly supply chain volatility, quality control consistency, and efficient crop management. Users frequently inquire about AI's role in predicting yield based on environmental factors, detecting adulteration and contaminants in processed spices, and optimizing blending ratios for consistent flavor profiles across large batches. There is significant interest in using predictive analytics to manage fluctuating global prices and inventory levels, minimizing waste and ensuring timely procurement of raw materials. The overarching theme is the application of AI and machine learning (ML) to enhance operational efficiency, ensure product safety, and deliver superior, standardized quality in a highly fragmented and agriculture-dependent global market.

- AI-driven predictive analytics optimizes crop yield forecasting, minimizing pre-harvest losses due to weather variability or pests.

- Machine learning algorithms enhance quality control by analyzing spectral data (NIR, hyperspectral imaging) to detect contaminants, adulteration (e.g., adding starch or sawdust), and heavy metal presence in real-time during processing.

- Computer vision and robotics automate sorting and grading of raw spices based on size, color, and integrity, improving processing speed and standardization.

- AI models are used to optimize complex spice blending formulas, ensuring precise flavor consistency across different manufacturing locations and reducing reliance on manual sensory testing.

- Predictive supply chain modeling mitigates price volatility risks by forecasting global market trends, geopolitical impacts, and inventory needs for crucial commodities like vanilla and saffron.

- Generative AI assists in product development by suggesting novel flavor combinations and ingredient pairings tailored to regional consumer preferences and dietary trends (e.g., low-sodium or high-antioxidant blends).

DRO & Impact Forces Of Spices and Herbs Market

The Spices and Herbs Market is subject to a complex interplay of Drivers, Restraints, and Opportunities (DRO) that collectively define its growth trajectory and structure. The primary driver is the accelerating consumer shift toward natural food ingredients, catalyzed by growing awareness of the potential dangers associated with artificial colorings and flavorings. This fundamental demand for clean-label products is amplified by the globalization of food tastes, which encourages the integration of diverse, often exotic, spices into mainstream culinary applications across developed nations. Furthermore, the documented medicinal and functional properties of spices, such as turmeric's curcumin and cinnamon's antioxidant profile, position them favorably within the rapidly expanding functional food and nutraceutical sectors, generating sustained premium demand.

Restraints, however, pose significant challenges to continuous, stable market expansion. The high volatility of raw material prices, heavily influenced by weather patterns, geopolitical stability in key producing regions, and seasonal harvest yields, creates instability for manufacturers relying on consistent supply. Moreover, stringent international regulations regarding pesticide residues, microbial contamination (like Salmonella), and aflatoxins necessitate costly and sophisticated processing and testing infrastructure, particularly challenging for small-scale processors and exporters in developing countries. The ongoing issue of adulteration, driven by economic motivations, continues to erode consumer and industrial buyer trust, requiring substantial investment in advanced detection technologies and supply chain transparency measures.

Opportunities for future growth lie predominantly in technological innovation and market penetration strategies. The adoption of controlled environment agriculture (CEA), such as vertical farming for high-value herbs like basil and mint, promises to mitigate reliance on unpredictable outdoor farming and ensure localized, consistent supply. Developing standardized, high-quality essential oils and oleoresins using advanced extraction techniques (e.g., Supercritical CO2 extraction) opens lucrative avenues in the pharmaceutical and fragrance industries. The leveraging of digital platforms for direct sourcing, combined with blockchain technology for enhanced traceability, provides manufacturers the necessary tools to address transparency concerns, capture premium value for ethically sourced products, and build stronger, resilient supply chains, positioning them favorably against traditional, opaque trading methods.

Segmentation Analysis

The segmentation of the Spices and Herbs Market provides critical insights into purchasing patterns and value chain dynamics across different product forms, applications, and distribution channels. The market is fundamentally segmented by the type of product—encompassing all major spices (e.g., pepper, chili, ginger) and culinary herbs (e.g., oregano, thyme, rosemary)—each exhibiting unique supply chain characteristics, price points, and geographical concentration. Analysis reveals a distinct shift in demand from traditional whole spices towards processed forms, such as ground, blended, and extracted formats, driven by the convenience demanded by both household consumers and industrial users who require standardized ingredient inputs for automated manufacturing processes.

Further granularity is achieved through segmenting by application, distinguishing the high-volume usage in the Food and Beverage (F&B) industry—covering meat processing, snacks, and ready meals—from the specialized, high-purity requirements of the Nutraceutical and Pharmaceutical sectors. The F&B segment remains the dominant volume driver, but the health-focused segments command significantly higher margins due to the need for documented efficacy and purity standards. The market is also segmented by nature, differentiating between conventional, traditionally farmed products and the fast-growing organic segment, which appeals to health-conscious consumers willing to pay a premium for products free from synthetic pesticides and fertilizers.

Geographically, the market is highly fragmented in terms of production but consolidated in terms of major consumption centers, necessitating robust international trade infrastructure. The North American and European markets prioritize quality, safety, and traceability, while emerging markets in Asia and Latin America demonstrate exponential growth potential, driven by increased disposable incomes and urbanization leading to greater consumption of processed foods that utilize spices and herbs heavily. Understanding these segmentation nuances is crucial for strategic planning, allowing market players to tailor product formats, packaging, and marketing strategies to specific regional and end-user demands, maximizing both market penetration and profitability across the diverse product portfolio.

- Product Type:

- Spices (Pepper, Chili/Paprika, Ginger, Turmeric, Cinnamon, Cumin, Cloves, Cardamom, Nutmeg, Others)

- Herbs (Oregano, Basil, Thyme, Rosemary, Mint, Bay Leaves, Parsley, Others)

- Form:

- Whole

- Ground/Powder

- Blended

- Extracts (Essential Oils, Oleoresins)

- Application:

- Food and Beverage Industry (Meat Products, Sauces & Dressings, Snacks & Confectionery, Soups & Ready Meals)

- Pharmaceutical & Nutraceutical Industry

- Personal Care & Cosmetics

- Others (Industrial Flavoring, Perfumery)

- Nature:

- Conventional

- Organic

- Distribution Channel:

- B2B (Direct Sales to Manufacturers)

- B2C (Retail Stores, Supermarkets/Hypermarkets, E-commerce)

Value Chain Analysis For Spices and Herbs Market

The value chain for the Spices and Herbs Market is complex, beginning with upstream activities dominated by fragmented agricultural production, often involving smallholder farmers in developing nations such as India, Vietnam, and Indonesia. Upstream analysis focuses on cultivation, harvesting, and initial drying/curing processes, which significantly dictate the raw material quality and price stability. These stages face challenges related to yield variability, pest control, and adherence to sustainable farming practices. Initial processing, including cleaning, sorting, and primary grinding, typically occurs close to the cultivation areas, preparing the materials for international trade or advanced processing.

Midstream activities involve sophisticated processing and manufacturing, where raw materials are transformed into value-added products like standardized powders, oleoresins, and essential oils. This stage includes critical quality control checks for microbial load, heavy metals, and adulteration detection, often involving advanced technology. Major processors and flavor houses dominate this segment, leveraging extraction techniques (e.g., CO2 extraction) to achieve high purity, which is essential for the nutraceutical and flavor manufacturing sectors. Branding, packaging, and blending expertise are key differentiators at this stage, enabling market players to capture premium prices.

Downstream analysis focuses on distribution and end-user consumption. Distribution channels are bifurcated into Direct (B2B) and Indirect (B2C) routes. Direct channels involve large-scale transactions supplying food manufacturers, flavor houses, and pharmaceutical companies with bulk ingredients, necessitating rigorous documentation and certification. Indirect channels rely on a network of importers, wholesalers, retailers (supermarkets, specialty stores), and increasingly, e-commerce platforms, which cater primarily to household consumption. The final consumption is driven by both the large-scale processed food industry and individual consumers, with e-commerce witnessing robust growth due to increased access to specialty and international spice varieties, bypassing traditional retail bottlenecks.

Spices and Herbs Market Potential Customers

The potential customer base for the Spices and Herbs Market is highly diversified, encompassing industrial entities requiring large, standardized volumes and individual consumers seeking varied culinary and wellness solutions. The primary end-users are large multinational Food and Beverage manufacturers, including those specializing in processed meat, ready meals, bakery, and confectionery, who rely on standardized spice blends and extracts to ensure consistent product flavor and shelf stability across global production lines. These customers demand strict quality assurance, high-volume consistency, and competitive pricing, making B2B contracts a cornerstone of market revenue.

A rapidly growing segment of potential customers includes pharmaceutical and nutraceutical companies, which procure high-purity extracts and essential oils. These buyers are focused less on flavor and more on the bioactive compound concentration, requiring detailed scientific documentation, clinical trial support, and compliance with pharmaceutical-grade standards. For example, customers seeking curcumin require highly concentrated turmeric extracts, driving demand for advanced extraction technology. The rise of preventative healthcare and dietary supplement consumption globally directly fuels demand from this high-value customer group.

Finally, the retail and HORECA (Hotel, Restaurant, Catering) sectors constitute significant customer segments. Retail customers, ranging from major supermarket chains to specialized ethnic grocery stores, purchase packaged spices for direct consumer sales. The HORECA sector demands consistent quality and bulk packaging for professional kitchens, often preferring pre-ground and custom blends for efficiency. E-commerce platforms are increasingly serving individual consumers directly, offering unique and imported spices that were traditionally difficult to access, thereby expanding the consumer base for specialty and premium organic spice producers globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 19.5 Billion |

| Market Forecast in 2033 | USD 28.7 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | McCormick & Company, Olam International, Ajinomoto Co., Associated British Foods Plc, Kerry Group, Givaudan SA, Synthite Industries, Everest Spices, Sensient Technologies Corporation, Döhler GmbH, Kancor Ingredients Ltd., DS Group (MDH Spices), Frutarom Industries Ltd., SHS Group, B&G Foods, Archer Daniels Midland (ADM), Symrise AG, InterGrow Foods, Robertet SA, The Spice Hunter. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Spices and Herbs Market Key Technology Landscape

The technological landscape of the Spices and Herbs Market is continuously evolving, focusing predominantly on enhancing product safety, quality standardization, and maximizing the extraction of beneficial compounds. In the processing domain, Supercritical Fluid Extraction (SFE), particularly using CO2, has become crucial. SFE technology allows for the solvent-free extraction of oleoresins and essential oils at low temperatures, preserving the volatile flavor compounds and functional components (like curcumin or capsaicin) while minimizing residual solvent risks, thereby meeting the high purity demands of the nutraceutical and pharmaceutical industries. This advanced method ensures greater standardization compared to traditional solvent extraction.

Furthermore, automation and digital technology are revolutionizing quality control and supply chain management. Hyperspectral imaging and Near-Infrared (NIR) spectroscopy are increasingly utilized in processing lines for rapid, non-destructive analysis of raw materials and powders. These technologies accurately detect foreign materials, moisture content, and chemical adulteration (e.g., Sudan dyes or synthetic additions) in real-time, significantly improving food safety compliance and reducing the need for costly and time-consuming laboratory testing. Digital solutions, particularly the integration of Internet of Things (IoT) sensors in storage and transport, monitor environmental conditions to prevent microbial growth and spoilage, extending the market reach of sensitive products.

Upstream technology advancements include Controlled Environment Agriculture (CEA), specifically vertical farms, which offer consistent, year-round production of high-demand fresh herbs like basil, mint, and cilantro, irrespective of local climate changes. While capital-intensive, CEA minimizes water usage and eliminates pesticide needs, addressing two critical industry restraints. Simultaneously, blockchain technology is emerging as a critical tool for establishing end-to-end traceability. By creating immutable digital records of every step—from farmer harvest to retail sale—blockchain addresses consumer skepticism regarding ethical sourcing and origin, adding significant value and transparency, particularly for premium and organic certified products.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest regional market in terms of production volume and is a significant consumption hub, driven by traditional culinary practices and large populations. Countries like India, China, Vietnam, and Indonesia are major exporters of spices such as chili, pepper, and turmeric. The domestic market growth in this region is fueled by rising disposable incomes, urbanization, and the corresponding shift toward packaged and processed foods. The regulatory environment is evolving, with increasing harmonization of standards with international bodies to facilitate exports, though domestic quality control remains a key challenge.

- North America: North America is characterized by high consumption value, primarily driven by the demand for clean-label, organic, and specialty herbs and spices. The U.S. market is highly focused on convenience (pre-blended seasonings, rubs) and functionality (nutraceutical applications). Stringent FDA regulations concerning food safety and traceability necessitate sophisticated sourcing and processing technologies among market participants. E-commerce penetration for specialty spice sourcing is particularly high in this region.

- Europe: Europe is a mature and highly regulated market, with Germany, the UK, and France serving as major importers and consumers. The market exhibits a strong preference for sustainable and ethically sourced ingredients, often requiring Fair Trade or specific organic certifications. The European Union's strict regulations regarding pesticide residues (MRLs) and contaminants are arguably the most demanding globally, forcing suppliers to adopt advanced quality control measures, thus contributing to premium pricing for high-compliance products.

- Latin America (LATAM): This region is experiencing steady growth, supported by rising consumption in the processed food sector, particularly in Brazil and Mexico. LATAM is also a key producer of tropical spices like vanilla and specific chili varieties. Market expansion is closely linked to economic stability and modernization of local food manufacturing facilities, which are increasingly replacing traditional bulk sourcing with industrialized ingredient procurement.

- Middle East and Africa (MEA): The MEA market is heavily influenced by historical trade routes and traditional regional cuisines, maintaining high per capita consumption. The region is a vital producer of specific herbs and high-value spices like saffron and certain types of pepper. Market dynamics are driven by a mix of bulk commodity trade and luxury consumer goods, with GCC countries showing strong demand for high-end packaged international spice blends due to expatriate populations and high tourism.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Spices and Herbs Market.- McCormick & Company Inc.

- Olam International Limited

- Ajinomoto Co. Inc.

- Associated British Foods Plc

- Kerry Group plc

- Givaudan SA

- Synthite Industries Pvt. Ltd.

- Everest Food Products Pvt. Ltd.

- Sensient Technologies Corporation

- Döhler GmbH

- Kancor Ingredients Ltd.

- DS Group (MDH Spices)

- Frutarom Industries Ltd. (part of IFF)

- SHS Group

- B&G Foods Inc.

- Archer Daniels Midland Company (ADM)

- Symrise AG

- InterGrow Foods Pvt. Ltd.

- Robertet SA

- The Spice Hunter

Frequently Asked Questions

Analyze common user questions about the Spices and Herbs market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current growth of the organic Spices and Herbs market?

The organic segment is primarily driven by rising consumer awareness regarding health, environmental sustainability, and the avoidance of pesticide residues. Consumers in developed markets are increasingly willing to pay a premium for certified organic products, especially for commonly consumed spices and culinary herbs, aligning with global clean-label trends.

Which geographical region dominates the production of raw spices globally?

The Asia Pacific (APAC) region, specifically countries like India, China, and Vietnam, dominates the global production of raw spices and herbs. Favorable tropical climates, traditional farming expertise, and cost-effective labor enable APAC to serve as the world's largest supplier of high-volume spices such as chili, turmeric, and black pepper.

What are the primary technological challenges faced by the Spices and Herbs supply chain?

Key technological challenges involve ensuring consistent quality control and detecting economically motivated adulteration. The industry relies heavily on advanced analytical methods like NIR spectroscopy and chromatography to rapidly screen for contaminants, microbial load, and unauthorized chemical additives, which is essential for meeting stringent import standards in Europe and North America.

How is the market segmented by application, and which segment offers the highest growth potential?

The market is segmented across Food and Beverage (dominant volume), Nutraceuticals, and Personal Care. While the Food and Beverage industry accounts for the largest volume, the Nutraceutical and Pharmaceutical segment offers the highest growth potential, driven by demand for high-purity spice extracts and essential oils used in functional foods and supplements.

What role does blockchain technology play in enhancing market transparency?

Blockchain technology is utilized to create an immutable ledger for tracking spices and herbs from the farm gate through processing and distribution to the consumer. This ensures verifiable data on origin, processing steps, and quality certifications, effectively combating fraud and guaranteeing supply chain transparency, particularly for high-value and ethically sourced products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager