Spin Coating System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438952 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Spin Coating System Market Size

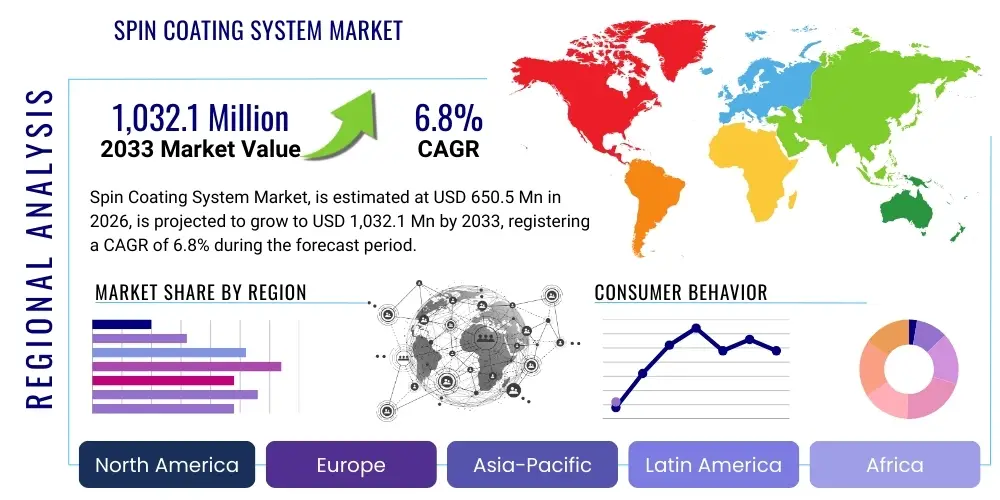

The Spin Coating System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 650.5 Million in 2026 and is projected to reach USD 1,032.1 Million by the end of the forecast period in 2033.

Spin Coating System Market introduction

The Spin Coating System Market encompasses highly specialized equipment used to deposit uniform thin films onto flat substrates, primarily utilized in microfabrication processes. These systems operate by dispensing a liquid coating material onto the center of a substrate, which is then rotated at high speed, allowing centrifugal force to spread the material evenly and remove excess liquid, resulting in a thin, uniform film. The precision and repeatability offered by modern spin coaters are critical for applications demanding nanometer-level control over film thickness and homogeneity, thereby positioning this technology as indispensable across high-tech manufacturing sectors.

Major applications of spin coating systems span across the semiconductor industry for applying photoresists and dielectric layers, in the production of Micro-Electro-Mechanical Systems (MEMS), and in the development of next-generation displays like OLEDs and quantum dots. Furthermore, they are extensively employed in advanced material science research, solar cell fabrication (especially perovskite solar cells), and bio-sensing applications requiring precise surface functionalization. The primary benefit of these systems lies in their ability to achieve exceptional uniformity over large areas efficiently, which is a fundamental requirement for mass production of integrated circuits and complex optical components.

The market is currently being driven by several key factors, including the relentless miniaturization trend in consumer electronics, which necessitates finer lithographic processes and higher-quality thin films. The global expansion of 5G infrastructure, coupled with growing investments in advanced packaging technologies such as fan-out wafer level packaging (FOWLP) and 3D stacking, significantly boosts the demand for high-throughput, automated spin coating solutions. Additionally, the rapid emergence of flexible electronics and the continuous need for advanced research tools in academic and industrial laboratories further underpin the market's robust growth trajectory, pushing manufacturers towards developing systems capable of handling diverse substrate materials and sizes with increased precision.

Spin Coating System Market Executive Summary

The Spin Coating System market exhibits strong business trends marked by a shift toward fully automated, high-throughput systems integrated with inline measurement capabilities to minimize human error and enhance process control crucial for complex manufacturing environments. Key industry players are focusing on developing advanced platforms capable of handling extremely large substrates (e.g., Generation 8 display glass and 300mm wafers) while maintaining nanometer precision. The semiconductor industry's continuous drive toward smaller nodes (below 7nm) and the surging demand for advanced memory solutions (e.g., HBM and DRAM) are dictating the core innovation roadmap, pushing for systems that offer minimal vibration, highly precise speed control, and advanced environmental control features, such as inert gas purging and temperature stabilization during the coating process.

Regionally, the Asia Pacific (APAC) market, spearheaded by countries like China, South Korea, Taiwan, and Japan, dominates the landscape due to its concentration of leading semiconductor foundries, display panel manufacturers, and significant governmental investment in domestic electronics manufacturing capabilities. North America and Europe remain crucial hubs, primarily focusing on high-end research applications, specialized military electronics, and the pioneering development of advanced MEMS and optoelectronic devices, driving demand for R&D-scale and semi-automated precision systems. Investment patterns indicate a global trend where companies are optimizing their supply chains to ensure quick delivery and installation of sophisticated, custom-designed coating platforms, reflecting the high capital expenditure nature of the equipment.

In terms of segments, the automated spin coaters segment is poised for the fastest growth, particularly within the semiconductor and large-scale display manufacturing end-user categories, owing to their requirement for scalability and high repeatability. The photoresist coating application maintains the largest market share, directly linked to lithography processes, while the thin film deposition segment, vital for solar cell and biomedical applications, shows accelerated growth potential. There is a noticeable trend towards modular systems that allow users to integrate peripheral functions, such as automated handling, solvent vapor treatment, and post-bake processing, reflecting a strong preference for integrated, multi-functional coating platforms designed to streamline the overall fabrication workflow and improve yield rates.

AI Impact Analysis on Spin Coating System Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can enhance the precision, efficiency, and predictive maintenance of spin coating systems. Common questions center on the feasibility of AI-driven optimization of coating parameters (such as spin speed profiles, acceleration ramps, and material dispense volume) in real-time to compensate for environmental fluctuations or material viscosity changes. There is significant interest regarding the use of ML algorithms for analyzing in-situ metrology data—thickness maps, uniformity measurements, and defect scans—to predict potential yield loss before a run is complete, facilitating proactive adjustments. Furthermore, concerns revolve around integrating AI for predictive maintenance schedules, minimizing unplanned downtime, and optimizing throughput, especially in high-volume manufacturing settings where even minor process variations can lead to significant financial loss.

The core theme summarizing user expectations is the shift from empirical, operator-driven parameter setting to autonomous, data-driven process control. AI promises to solve the long-standing challenge of achieving perfect uniformity across increasingly larger and more complex substrates by modeling the fluid dynamics and evaporative processes inherent in spin coating, which are often too complex for traditional deterministic models. By utilizing neural networks trained on vast datasets of successful and failed coating runs, the system can dynamically adjust variables based on feedback loops, moving beyond simple static recipes. This capability is paramount in advanced R&D and pilot production where new materials (e.g., complex polymers, organic semiconductors) require rapid, non-linear optimization of coating methodologies, significantly accelerating the material discovery-to-production timeline.

Ultimately, the impact of AI is expected to transform spin coating systems from standalone precision tools into highly intelligent, integrated nodes within the smart factory ecosystem. This integration enhances overall equipment efficiency (OEE) and reduces dependence on highly skilled technicians for routine parameter fine-tuning. While current systems offer robust control, AI’s intervention introduces a layer of cognitive processing that accounts for subtle, multi-variate correlations previously invisible to human operators or standard control software. This optimization will be particularly impactful in cost-sensitive applications like solar cell manufacturing and large-area electronics, where minimizing waste and maximizing uniformity directly translates into competitive advantages and improved profitability margins, solidifying AI as a critical differentiator in future system generations.

- AI-driven real-time parameter optimization for enhanced film uniformity and defect reduction.

- Machine learning algorithms utilized for predictive quality control based on inline metrology data analysis.

- Predictive maintenance schedules enabled by AI, reducing unplanned equipment downtime (OEE improvement).

- Autonomous recipe generation and optimization for novel or complex coating materials, accelerating R&D cycles.

- Enhanced process control compensation for environmental variables such as temperature, humidity, and atmospheric pressure.

DRO & Impact Forces Of Spin Coating System Market

The Spin Coating System Market is primarily driven by the exponential growth in the semiconductor and advanced electronics manufacturing sectors, particularly the expanding global capacity for fabricating smaller, more complex integrated circuits (ICs) utilizing advanced lithography techniques. The persistent demand for high-resolution displays, including OLEDs and micro-LEDs, along with increasing investment in flexible and wearable electronics, mandates the use of highly precise thin film deposition tools. Furthermore, the global push towards renewable energy technologies, specifically the commercialization of highly efficient perovskite solar cells, presents a significant opportunity, as spin coating is a foundational technique in their fabrication process. These drivers collectively necessitate continuous innovation in system speed, substrate handling capability, and process consistency, ensuring the market's upward trajectory.

However, the market faces significant restraints, chiefly stemming from the high initial capital investment required for acquiring high-end, automated spin coating systems, which limits adoption among smaller research facilities or startups. Additionally, the increasing complexity of materials and processes introduces challenges related to waste management and solvent toxicity, requiring manufacturers to develop more environmentally conscious and contained systems, adding to the operational cost. The inherent limitation of spin coating, which is primarily effective only on flat, planar substrates, restricts its applicability in non-planar or three-dimensional microfabrication structures, pushing certain end-users toward alternative deposition methods like atomic layer deposition (ALD) or chemical vapor deposition (CVD) for specific applications.

The opportunities within this market are centered on developing highly versatile systems capable of handling a wider range of substrate materials (e.g., flexible polymers, ceramics) and innovative coating techniques such as multiple-layer sequential spin coating for advanced optical filters and protective barriers. The integration of advanced diagnostics, including in-situ thickness monitoring and spectroscopic analysis, offers a path to premiumization and improved quality control. The key impact forces influencing the market are the rapid technology cycles in the semiconductor industry, which force continuous equipment upgrades, and the competitive pricing pressure from Asia Pacific-based manufacturers, compelling Western companies to focus heavily on automation, software intelligence, and exceptional long-term service contracts to maintain market share and profitability.

Segmentation Analysis

The Spin Coating System Market segmentation provides a detailed framework for understanding the diverse applications and end-user demands driving technological specialization. Segmentation by Type distinguishes between manual systems, which offer flexibility for R&D but low throughput; semi-automated systems, balancing control and moderate throughput; and fully automated systems, essential for high-volume manufacturing where repeatability and minimum human intervention are paramount. The choice of system type is directly proportional to the production scale and the required level of process integration.

Segmentation by End-User highlights the market's reliance on the Semiconductor & Electronics sector, which consumes the majority of high-end, large-substrate coaters for IC and display fabrication. Emerging segments like Solar Cells, particularly for thin-film PV and perovskite structures, and Biomedical applications (e.g., surface modification of biosensors and microfluidic devices) are experiencing high growth, demanding specialized low-volume, high-precision coaters. Application segmentation (Photoresist Coating, Polymer Coating, etc.) defines the functional requirements of the system, where photoresist applications require superior uniformity (TTV - Total Thickness Variation) across the wafer, while polymer and material science applications often require controlled solvent evaporation kinetics.

The segmentation structure is crucial for market participants as it dictates product development strategies, pricing models, and target marketing efforts. For instance, manufacturers targeting the 300mm semiconductor fabrication market must invest heavily in high-precision robotics and class 1 cleanroom compatibility, whereas those targeting academic research might prioritize modularity and user-friendliness in manual and semi-automated benchtop systems. The market is thus highly differentiated, with significant price disparity between basic R&D units and high-throughput production clusters.

- By Type: Automated Spin Coaters, Semi-Automated Spin Coaters, Manual Spin Coaters

- By Substrate Size: Small (up to 4 inches), Medium (6 to 8 inches), Large (12 inches and above, and Display Panels)

- By End-User: Semiconductor & Electronics, MEMS, Solar Cells, Biomedical, Optical Devices, Research & Academia

- By Application: Photoresist Coating, Polymer Coating, Thin Film Deposition, Planarization, Surface Functionalization

Value Chain Analysis For Spin Coating System Market

The value chain for the Spin Coating System Market begins with the upstream suppliers responsible for providing high-precision components, including specialized servo motors, high-grade stainless steel chambers, micro-controllers, sophisticated fluid dispensing pumps, and advanced robotic handling systems required for automated platforms. The quality and reliability of these components are paramount as they directly influence the ultimate precision and vibration characteristics of the final coating system. Key challenges in the upstream segment include maintaining tight tolerances for mechanical parts and managing the complex supply chain for highly specialized electronic controls and vacuum components, especially as systems become more integrated with metrology tools.

The manufacturing and assembly stage involves the integration of these components by the core equipment manufacturers, focusing on software development for precise process control, environmental management within the coating bowl (temperature and solvent control), and rigorous testing protocols for speed repeatability and film uniformity. The distribution channel is often direct, particularly for high-value, complex automated systems sold to major semiconductor fabs or display manufacturers, involving direct sales teams, technical consultations, and comprehensive pre-installation planning. This direct relationship is necessary due to the customization frequently required for specific wafer sizes, substrate materials, and cleanroom integration standards.

Downstream activities center around installation, calibration, ongoing maintenance, and technical support provided directly by the original equipment manufacturers (OEMs). Given the mission-critical nature of spin coaters in fabrication lines, prompt servicing and access to specialized spare parts are crucial elements of the downstream value proposition. Indirect channels, such as local distributors or third-party representatives, are more commonly used for distributing smaller, manual, or semi-automated benchtop systems primarily targeting the academic research community and smaller R&D labs globally, where localized support and quick delivery are prioritized over extensive customization.

Spin Coating System Market Potential Customers

Potential customers for spin coating systems span the entire microfabrication ecosystem, demanding equipment tailored to their scale of operation and precision requirements. The primary consumer base consists of large-scale semiconductor foundries (e.g., TSMC, Samsung, Intel) and OSAT providers (Outsourced Semiconductor Assembly and Test) that require fully automated, multi-chamber systems operating continuously for applying photoresists and polyimide layers critical for lithography and advanced packaging. These customers prioritize reliability, throughput, and seamless integration with existing track systems and metrology tools, often purchasing multi-million dollar platforms under long-term service agreements.

A secondary, high-growth customer segment includes manufacturers of flat panel displays (FPDs), especially those involved in OLED, QLED, and specialized sensor production. These companies require large-area spin coaters capable of handling glass substrates up to Generation 8 and above, primarily for depositing organic materials, conductive layers, and protective coatings, where uniformity over meters rather than centimeters is the defining requirement. This segment drives innovation toward larger, vibration-damped platforms with highly refined dispensing mechanisms to ensure minimum material wastage and maximum yield on large expensive substrates.

Finally, a significant portion of the market caters to academic and government research institutions, along with specialized biomedical and optics companies. These end-users typically purchase manual or semi-automated benchtop models, valuing versatility, small footprint, and the ability to rapidly change coating materials and substrate formats for experimentation. Biomedical labs use these systems for creating thin-film coatings on microfluidic chips or biosensor surfaces, while optics firms rely on them for anti-reflective coatings and precise patterning of diffractive optical elements, emphasizing flexibility and material compatibility over sheer throughput.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650.5 Million |

| Market Forecast in 2033 | USD 1,032.1 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Laurell Technologies Corporation, Süss MicroTec SE, Midas Technologies, Specialty Coating Systems (SCS), Cee – Brewer Science, Headway Technology, Spincoating Systems, S.A., KWJ Engineering, EV Group (EVG), Ossila Ltd., Dynatex International, MicroNano Tools, DISCO Corporation, Delta-T Systems, Inc., Precision Engineering Works, SUSS MicroTec, Specialty Coating Systems (SCS), Cee – Brewer Science, Laurell Technologies, Midas Technologies |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Spin Coating System Market Key Technology Landscape

The technological landscape of the Spin Coating System Market is characterized by continuous refinement aimed at increasing rotational precision, reducing material consumption, and enhancing overall process uniformity, particularly for handling ultra-thin films required by advanced semiconductor nodes. Modern systems utilize advanced servo motor technology coupled with sophisticated digital signal processing (DSP) control loops to maintain high-speed stability and rapid acceleration/deceleration profiles with extremely low Total Indicated Runout (TIR), crucial for minimizing radial thickness variations (TTV). Furthermore, the design of the coating bowl and associated exhaust system has evolved significantly, incorporating Computational Fluid Dynamics (CFD) modeling to optimize solvent evaporation kinetics and control boundary layer effects, which are critical factors influencing film quality and edge bead formation, especially in highly volatile solvents.

A crucial technological advancement involves the implementation of highly refined dispensing mechanisms, moving beyond simple static nozzles to dynamic dispensing systems that often include pre-wetting or multi-stage dispensing protocols to improve material utilization and film coverage on challenging substrate surfaces. Many high-end systems now incorporate integrated metrology tools, such as in-situ reflectometers or ellipsometers, allowing for real-time monitoring of film thickness and refractive index during the coating and drying phases. This tight integration of process and measurement facilitates instant feedback and adaptive process control, a feature highly valued in research and development settings exploring novel materials like metal-halide perovskites or advanced photoresists.

Current R&D is heavily focused on developing systems for non-standard substrates, including highly warped or flexible polymer films, requiring innovative chuck designs (e.g., porous ceramic or specialized vacuum rings) and dynamic height adjustments during the spin process to maintain substrate flatness. Furthermore, environmental control technologies are increasingly complex, involving nitrogen purging systems and precise temperature control of both the substrate and the dispense material to ensure consistent viscosity and evaporation rates, regardless of ambient cleanroom conditions. The shift towards cluster tool configurations, where spin coating, baking, and development modules are physically linked and managed by a centralized robot handler, represents the industry standard for high-volume automated production lines, maximizing throughput and minimizing contamination risks between process steps.

Regional Highlights

The Spin Coating System Market demonstrates significant geographic variation in demand and technological maturity, largely dictated by regional concentrations of semiconductor fabrication, display manufacturing, and material science research hubs. The Asia Pacific (APAC) region stands out as the undisputed leader, holding the largest market share globally. This dominance is driven by the massive investment pipelines in China, Korea, Taiwan, and Japan aimed at expanding domestic semiconductor capacity (memory, logic, and foundry services) and maintaining global leadership in advanced flat panel display production (OLEDs and large-area LCDs). Countries like South Korea and Taiwan, home to major global electronics giants, necessitate continuous purchases of high-throughput automated spin coaters (300mm wafer and large panel formats) for production scale, making APAC the primary growth engine for large-scale production equipment.

North America maintains a strong position, particularly within the specialized R&D, aerospace, defense, and high-performance computing sectors. While primary mass production has partially shifted overseas, North American demand remains high for specialized, low-to-medium volume, ultra-precision spin coating systems used in MEMS fabrication, advanced lithography research, and the development of next-generation optical components and quantum technologies. The presence of leading research universities and technology pioneers fosters continuous demand for flexible, high-specification manual and semi-automated systems that facilitate rapid prototyping and new material testing, pushing innovation in system flexibility and measurement integration.

Europe represents a mature market focusing on specialized industrial applications, including automotive electronics, niche photonics, and advanced medical device manufacturing. Countries like Germany, Switzerland, and the Netherlands lead in precision engineering and high-end material development, resulting in consistent demand for medium-volume, high-reliability spin coating solutions. The region's emphasis on stringent quality standards and sustainable manufacturing practices also drives interest in systems optimized for low solvent usage and enhanced containment features. The Middle East and Africa (MEA) and Latin America currently represent smaller market shares, primarily driven by investments in localized electronics assembly, renewable energy projects (solar cell pilot lines), and academic expansion, relying heavily on imports of reliable, cost-effective semi-automated systems.

- Asia Pacific (APAC): Dominates the market due to concentrated semiconductor fabrication (300mm wafers) and large-area display panel manufacturing. Key markets include China, Taiwan, South Korea, and Japan, focusing on high-throughput automated systems.

- North America: Strong market for high-precision R&D systems, MEMS manufacturing, and specialized defense/aerospace applications. Drives innovation in advanced process control and specialized substrate handling.

- Europe: Focuses on niche applications in automotive electronics, biomedical devices, and specialized optics. Demand is stable for high-reliability, quality-focused systems with strong environmental controls.

- Latin America & MEA: Emerging markets with growth tied to academic investment and nascent solar energy projects, generally favoring cost-effective, multi-purpose manual and semi-automated equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Spin Coating System Market.- Laurell Technologies Corporation

- Süss MicroTec SE

- Midas Technologies, S.A.

- Specialty Coating Systems (SCS)

- Cee – Brewer Science

- Headway Technology

- Spincoating Systems, S.A.

- KWJ Engineering

- EV Group (EVG)

- Ossila Ltd.

- Dynatex International

- MicroNano Tools

- DISCO Corporation

- Delta-T Systems, Inc.

- Precision Engineering Works

- SUSS MicroTec

- Laurell Technologies

- Specialty Coating Systems (SCS)

- Cee – Brewer Science

- Midas Technologies

Frequently Asked Questions

Analyze common user questions about the Spin Coating System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Automated Spin Coating Systems?

The primary factor is the relentless growth and scaling of high-volume semiconductor and advanced display manufacturing (OLED/micro-LED). Automated systems are essential for achieving the required high throughput, superior repeatability, and minimal contamination necessary for large-scale production using 300mm wafers and large glass panels.

How does AI impact the uniformity and yield of spin coating processes?

AI impacts yield by enabling real-time optimization of spin parameters based on in-situ data feedback. Machine learning algorithms analyze variations in material viscosity, temperature, and environment to dynamically adjust spin profiles, ensuring optimal film uniformity and significantly reducing defect rates, leading to higher overall yield.

Which end-user segment utilizes spin coating systems for non-semiconductor applications?

The biomedical segment is a key non-semiconductor user, employing spin coating systems for surface functionalization, creating precise polymer coatings on microfluidic devices, and depositing thin films required for biosensors and lab-on-a-chip technologies where precise film thickness is critical for device performance.

What are the key technical challenges associated with coating large substrates?

Key challenges include maintaining highly stable rotation speed across large diameters, ensuring uniform solvent evaporation across the wide surface area, and minimizing radial thickness variation (TTV) and edge bead formation, all while managing the vibration and handling of heavy, expensive substrates without damage.

Is the market experiencing a shift towards alternative thin film deposition techniques?

While spin coating remains dominant for planar photoresist and polymer applications, certain advanced 3D structures and highly conformal coatings are shifting towards techniques like Atomic Layer Deposition (ALD) or Chemical Vapor Deposition (CVD). However, spin coating systems are adapting by integrating pre- and post-processing steps to maintain competitive relevance in many high-precision fields.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager