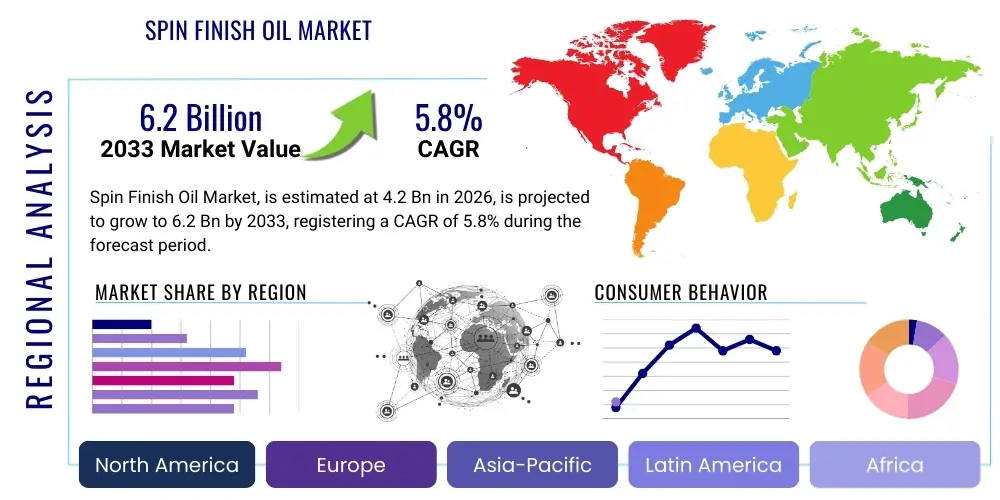

Spin Finish Oil Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440166 | Date : Jan, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Spin Finish Oil Market Size

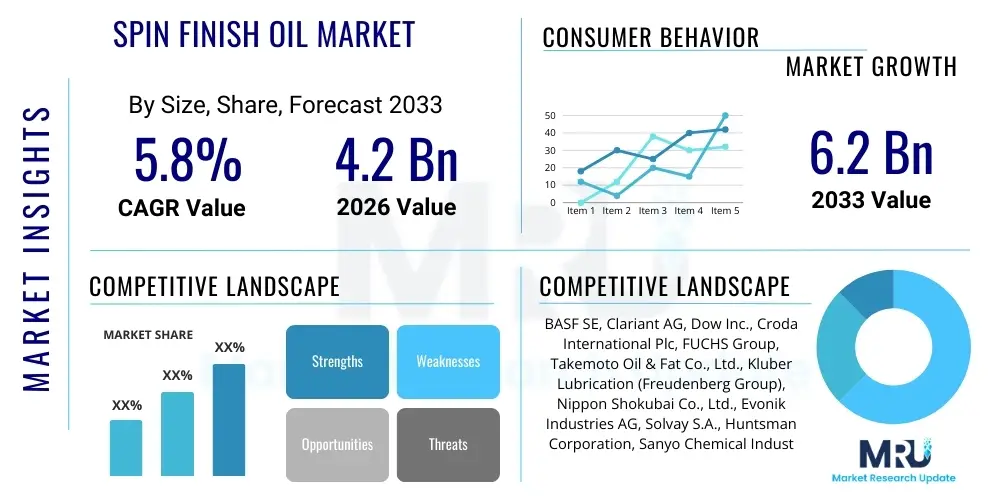

The Spin Finish Oil Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.2 billion in 2026 and is projected to reach USD 6.2 billion by the end of the forecast period in 2033.

Spin Finish Oil Market introduction

The Spin Finish Oil Market is a vital segment within the specialty chemicals industry, providing essential lubricants and processing aids for the production of synthetic fibers. Spin finish oils are complex formulations of various chemicals, including base oils, emulsifiers, anti-static agents, anti-oxidants, and corrosion inhibitors. These formulations are meticulously engineered to ensure optimal performance during the high-speed spinning, drawing, texturizing, and winding processes of synthetic filaments such as polyester, nylon, polypropylene, and rayon. The primary objective of spin finish application is to impart lubricity to the fibers, reduce friction between fibers and machine parts, prevent static electricity buildup, and enhance fiber cohesion and processability, thereby preventing damage and ensuring consistent product quality.

Major applications of spin finish oils span across a broad spectrum of industries, predominantly driven by the robust demand for synthetic textiles. These applications include apparel, where they contribute to the smooth production of fabrics for clothing; industrial textiles, encompassing automotive upholstery, geotextiles, and technical fabrics; home furnishings, such as carpets, curtains, and upholstery; and medical textiles, including surgical gowns and bandages. The performance characteristics of spin finish oils are crucial for meeting the stringent requirements of modern fiber processing, which demands high speeds and minimal defects, ultimately impacting the efficiency of textile manufacturing and the aesthetic and functional properties of the final product.

The benefits derived from high-quality spin finish oils are multifaceted, ranging from improved operational efficiency to enhanced product attributes. They significantly reduce yarn breakage and fiber fly, leading to higher productivity and lower waste in textile mills. Furthermore, these oils protect the fibers from degradation during processing, contributing to the longevity and strength of the final textile product. Key driving factors for market growth include the continuously expanding global demand for synthetic fibers, particularly in emerging economies, the rising adoption of technical textiles for diverse industrial applications, and ongoing advancements in fiber production technologies that necessitate sophisticated spin finish formulations. Additionally, the increasing focus on sustainable and eco-friendly products is spurring innovation in bio-based and biodegradable spin finish oils, further shaping market dynamics.

Spin Finish Oil Market Executive Summary

The Spin Finish Oil Market is characterized by a dynamic interplay of global business trends, regional growth patterns, and evolving segment demands. Key business trends underscore a strong emphasis on research and development to create advanced, high-performance formulations that cater to increasingly sophisticated fiber production processes and specialized textile applications. Manufacturers are focusing on developing products that offer enhanced lubricity, superior antistatic properties, and improved thermal stability, crucial for high-speed machinery. Furthermore, the market is witnessing a significant shift towards sustainable solutions, with growing investments in bio-based and environmentally friendly spin finish oils, driven by regulatory pressures and consumer preferences for eco-conscious products. Strategic partnerships and collaborations between chemical manufacturers and fiber producers are becoming more prevalent, fostering innovation and ensuring product compatibility with new fiber types and processing technologies.

Regional trends indicate that the Asia Pacific (APAC) region continues to dominate the Spin Finish Oil Market, primarily due to the presence of large-scale synthetic fiber manufacturing bases in countries like China, India, and Southeast Asia. The region benefits from robust textile production capacities, competitive manufacturing costs, and a burgeoning domestic demand for apparel and industrial textiles. Europe and North America, while mature markets, are experiencing growth driven by the demand for high-value technical textiles and specialty fibers, as well as a strong focus on sustainable and high-performance spin finish solutions. Latin America, the Middle East, and Africa are emerging as promising markets, propelled by industrialization, increasing textile manufacturing investments, and rising disposable incomes leading to higher consumption of synthetic-fiber-based products.

Segment trends highlight the continued dominance of polyester fiber production in consuming the largest share of spin finish oils, attributed to polyester's widespread use in apparel, home furnishings, and industrial applications. However, significant growth is also observed in segments catering to polyamide (nylon) for performance wear and industrial uses, and polypropylene for non-woven fabrics and geotextiles. The market is also seeing increased demand for customized spin finishes designed for specific fiber types, deniers, and end-use applications, indicating a move towards specialized rather than generic solutions. Technological advancements in fiber manufacturing, such as microfibers and纳米fibers, are also influencing segment demands, requiring spin finishes that can effectively lubricate and protect these finer, more delicate filaments without compromising their integrity or performance characteristics.

AI Impact Analysis on Spin Finish Oil Market

The integration of Artificial Intelligence (AI) holds transformative potential for the Spin Finish Oil Market, addressing common user questions about optimizing product formulation, enhancing manufacturing efficiency, and predicting market demands. Users are increasingly interested in how AI can streamline the R&D process for new spin finish formulations, predict performance characteristics based on molecular structures, and accelerate the development of sustainable alternatives. There is also a keen focus on AI's ability to optimize supply chain logistics, manage inventory, and provide predictive maintenance for machinery, thereby minimizing downtime in fiber production. The expectation is that AI will lead to more precise application of spin finishes, reducing waste and ensuring higher quality, while also offering insights into market trends for proactive product development and strategic decision-making.

- AI-driven predictive analytics for optimal spin finish formulation based on fiber type and processing conditions.

- Machine learning algorithms to enhance quality control and defect detection during spin finish application.

- AI in supply chain management for demand forecasting, inventory optimization, and raw material procurement, reducing lead times and costs.

- Robotics and automation, guided by AI, for precise and consistent application of spin finishes in high-speed production.

- Utilization of AI for simulating new molecular structures and properties of additives, accelerating sustainable product development.

- AI-powered systems for real-time monitoring of processing parameters to optimize spin finish usage and minimize waste.

- Enhanced customer service and technical support through AI chatbots and expert systems for troubleshooting spin finish-related issues.

- Predictive maintenance for spinning machinery, leveraging AI to prevent breakdowns and ensure continuous, efficient application of spin finishes.

DRO & Impact Forces Of Spin Finish Oil Market

The Spin Finish Oil Market is shaped by a complex interaction of drivers, restraints, and opportunities, collectively known as DRO & Impact Forces. A primary driver is the relentless expansion of the global synthetic fiber industry, fueled by increasing population, urbanization, and rising disposable incomes, particularly in developing economies. Synthetic fibers like polyester, nylon, and polypropylene offer cost-effectiveness, durability, and versatility, making them indispensable in apparel, home furnishings, and a rapidly growing array of industrial and technical textile applications. The continuous innovation in fiber technologies, including the development of high-performance and specialty fibers, also necessitates advanced spin finish formulations, thereby sustaining demand. Furthermore, the global push for enhanced manufacturing efficiency and reduced production costs in textile mills implicitly drives the adoption of high-quality spin finishes that minimize breakage and optimize throughput.

Conversely, several significant restraints challenge the market's growth trajectory. Volatility in the prices of key raw materials, such as base oils derived from petroleum and various chemical additives, can directly impact manufacturing costs and product pricing, leading to profit margin pressures for producers. Environmental concerns surrounding the use and disposal of petrochemical-based chemicals pose a substantial restraint, driving stringent regulatory frameworks that mandate greener formulations and sustainable manufacturing practices. The shift towards circular economy principles and increasing awareness about microplastic pollution from synthetic textiles are compelling manufacturers to invest heavily in research for biodegradable and bio-based spin finish alternatives, which often come with higher development costs and present technical challenges in achieving comparable performance to conventional products.

Opportunities within the Spin Finish Oil Market are abundant and largely revolve around sustainability, technological advancements, and market diversification. The burgeoning demand for bio-based and eco-friendly spin finish oils presents a significant growth avenue, as companies strive to align with global environmental mandates and consumer preferences. Innovation in nanotechnology and smart textile applications offers a niche for specialized spin finishes that impart additional functionalities, such as moisture-wicking, anti-bacterial properties, or flame retardancy, directly onto the fibers during processing. Furthermore, the untapped potential in emerging markets, coupled with continuous investments in textile manufacturing infrastructure, provides fertile ground for market expansion. The strategic development of customized spin finishes for highly specialized technical textile applications, including composites, automotive components, and medical implants, also represents a lucrative opportunity for market players to differentiate their product offerings and capture premium segments.

Segmentation Analysis

The Spin Finish Oil Market is comprehensively segmented to provide a detailed understanding of its diverse landscape and to identify key growth drivers within specific product categories and end-use applications. This segmentation allows for targeted market strategies and highlights the varying demands and technological requirements across the synthetic fiber industry. The market is primarily segmented by fiber type, including polyester, polyamide, polypropylene, and others, reflecting the unique chemical and physical properties required for each synthetic filament. Further segmentation by chemical composition encompasses categories like synthetic-based, mineral oil-based, and bio-based spin finishes, indicating the shift towards more sustainable options. The application spectrum is crucial, differentiating demand from apparel, industrial textiles, home furnishings, and other specialized uses, each with distinct performance criteria. Additionally, the market is analyzed across various geographic regions, identifying global consumption patterns and regional growth opportunities.

- By Fiber Type:

- Polyester (PET) Spin Finish Oil

- Polyamide (Nylon) Spin Finish Oil

- Polypropylene (PP) Spin Finish Oil

- Rayon/Viscose Spin Finish Oil

- Acrylic Fiber Spin Finish Oil

- Other Synthetic Fibers (e.g., Spandex, Aramids) Spin Finish Oil

- By Chemical Composition:

- Synthetic-based Spin Finish Oil (e.g., Esters, Ethers)

- Mineral Oil-based Spin Finish Oil

- Bio-based Spin Finish Oil (e.g., Vegetable Oils, Fatty Acid Esters)

- By Functionality:

- Lubricating Agents

- Anti-Static Agents

- Emulsifiers

- Cohesive Agents

- Anti-Corrosive Agents

- Anti-Oxidants

- By Application:

- Apparel Textiles

- Industrial Textiles (e.g., Automotive, Geotextiles, Filtration)

- Home Furnishings (e.g., Carpets, Upholstery)

- Medical & Hygiene Textiles

- Non-Woven Fabrics

- Technical Textiles

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Spin Finish Oil Market

The value chain for the Spin Finish Oil Market is intricate, beginning with the upstream supply of raw materials and extending through various stages of manufacturing, distribution, and end-use. Upstream activities involve the sourcing of diverse chemical components that form the basis of spin finish formulations. This includes crude oil derivatives for mineral oil-based finishes, various alcohols and organic acids for synthetic esters, fatty acids and vegetable oils for bio-based formulations, alongside a wide range of specialty additives such as emulsifiers, anti-static agents, anti-oxidants, and corrosion inhibitors. Key suppliers in this stage are large chemical companies and petrochemical firms. The quality and availability of these raw materials significantly influence the cost and performance of the final spin finish product, necessitating robust supply chain management and strategic partnerships to ensure consistency and cost-effectiveness.

The midstream segment of the value chain is dominated by spin finish oil manufacturers and formulators who engage in the complex process of blending and synthesizing these raw materials into specific formulations. This stage requires extensive R&D capabilities to develop new products, optimize existing ones, and ensure compliance with evolving environmental and performance standards. Manufacturers often possess proprietary technologies and expertise in emulsion stability, rheology, and surface chemistry to tailor spin finishes for various fiber types and processing conditions. The ability to offer customized solutions and technical support is a key differentiator in this highly specialized market, where product performance directly impacts the efficiency and quality of fiber production.

Downstream, the distribution channels play a critical role in connecting manufacturers to end-users. Distribution can occur through direct sales channels, where spin finish producers sell directly to large fiber manufacturers or integrated textile mills, often involving technical consultation and tailored solutions. Indirect distribution channels involve a network of specialized distributors and agents who possess localized market knowledge and can cater to a broader range of smaller and medium-sized textile enterprises. These distributors often provide logistical support, inventory management, and technical services. The end-users are primarily synthetic fiber producers and textile mills, who apply spin finishes during the spinning, drawing, and texturizing processes of fibers destined for a vast array of applications including apparel, automotive, medical, and home furnishings. The effectiveness of the spin finish oil directly impacts the processability of the fibers, the efficiency of the textile production line, and the quality and functional properties of the final textile product, making it a critical component in the entire synthetic fiber value chain.

Spin Finish Oil Market Potential Customers

Potential customers for spin finish oils are primarily entities involved in the production of synthetic fibers and their subsequent processing into textiles. The largest segment of end-users comprises synthetic fiber manufacturers, who produce a wide array of filaments such as polyester, polyamide (nylon), polypropylene, rayon, and acrylic. These manufacturers require spin finishes to facilitate high-speed spinning operations, prevent static buildup, reduce friction, and ensure the integrity and quality of the nascent fibers as they are formed and wound. The specific requirements for spin finish formulations vary significantly based on the type of polymer, the denier of the fiber, and the intended end-use, necessitating a diverse portfolio of products from spin finish oil suppliers.

Beyond primary fiber producers, textile mills and integrated textile manufacturers also represent a significant customer base. These entities utilize spin finishes during various stages of fiber processing, including drawing, texturizing, and weaving or knitting. In these processes, spin finishes contribute to smooth machine operation, minimize yarn breakage, improve fabric hand feel, and prepare fibers for subsequent treatments like dyeing and finishing. The demand for spin finish oils from these customers is intrinsically linked to the global production volume of synthetic textiles, which continues to expand driven by both conventional applications in apparel and innovative uses in technical textiles.

Furthermore, manufacturers of non-woven fabrics, often utilized in hygiene products, medical textiles, and geotextiles, are also key consumers. Their processes involve unique fiber bonding and mat formation techniques where spin finishes play a role in optimizing fiber dispersion and reducing processing inconsistencies. The growing adoption of technical textiles across various industries, including automotive, construction, and healthcare, is expanding the customer base for specialized spin finish oils that can impart specific functionalities or withstand rigorous processing conditions. Therefore, any enterprise engaged in the creation or advanced processing of synthetic filaments and fibers stands as a potential customer for the specialized products offered by the spin finish oil market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.2 Billion |

| Market Forecast in 2033 | USD 6.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Clariant AG, Dow Inc., Croda International Plc, FUCHS Group, Takemoto Oil & Fat Co., Ltd., Kluber Lubrication (Freudenberg Group), Nippon Shokubai Co., Ltd., Evonik Industries AG, Solvay S.A., Huntsman Corporation, Sanyo Chemical Industries, Ltd., Indofil Industries Limited, Resil Chemicals Pvt. Ltd., Shandong Qiaochang Chemical Co., Ltd., Zschimmer & Schwarz GmbH & Co KG Chemische Fabriken, NICCA Chemical Co., Ltd., Emerald Kalama Chemical (Lanxess), Tanatex Chemicals B.V., Sarex Chemicals. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Spin Finish Oil Market Key Technology Landscape

The key technology landscape of the Spin Finish Oil Market is characterized by continuous innovation aimed at enhancing product performance, sustainability, and application efficiency. A foundational technological aspect involves advanced emulsification techniques. Spin finishes are typically applied as aqueous emulsions, and the stability, homogeneity, and particle size distribution of these emulsions are critical for consistent application and optimal fiber processing. Manufacturers leverage sophisticated surfactant chemistry and high-shear mixing technologies to create stable micro-emulsions and nano-emulsions, ensuring uniform coating of fibers and preventing deposition on machinery. This allows for precise control over the lubricant layer, which is essential for minimizing friction and maximizing processing speeds in modern spinning operations.

Another pivotal area of technological advancement is additive chemistry. Spin finish oils are complex cocktails of various additives, each designed to impart specific functionalities. Ongoing research focuses on developing high-performance anti-static agents, anti-oxidants, anti-corrosive components, and fiber-to-fiber cohesive agents that can withstand high temperatures and mechanical stresses encountered during fiber production. The development of fluorine-free anti-static agents and halogen-free fire retardants, for instance, addresses environmental and regulatory concerns. Moreover, the integration of bio-based components, derived from vegetable oils or fatty acid esters, into new formulations represents a significant technological shift. These bio-based alternatives aim to reduce reliance on petrochemicals, improve biodegradability, and meet the growing demand for sustainable textile chemicals without compromising performance.

Furthermore, the application of nanotechnology and smart materials is beginning to influence the spin finish oil market. Nanoparticles can be incorporated into spin finishes to impart advanced properties such as enhanced UV protection, antimicrobial activity, or improved thermal conductivity directly onto the fiber surface. Analytical techniques also form a crucial part of the technology landscape, with advanced spectroscopy (FTIR, NMR), chromatography (GC, HPLC), and rheology techniques being used for detailed characterization of formulations, quality control, and performance evaluation. These technologies not only enable the development of next-generation spin finishes but also ensure their consistent quality and optimal functionality, contributing significantly to the efficiency and environmental footprint of the synthetic fiber industry. The convergence of material science, chemical engineering, and process optimization continues to drive evolution in this specialized market.

Regional Highlights

The Spin Finish Oil Market exhibits significant regional variations in terms of production, consumption, and growth dynamics, largely driven by the distribution of synthetic fiber manufacturing hubs and evolving industrial policies. Asia Pacific (APAC) stands as the undisputed leader in both the production and consumption of spin finish oils. This dominance is attributed to the presence of major synthetic fiber manufacturing giants in countries like China, India, and other Southeast Asian nations, which collectively account for a substantial portion of global textile output. The region benefits from abundant labor, favorable governmental policies supporting industrial growth, and a rapidly expanding domestic demand for textile products, driving continuous investment in fiber production capacities. The competitive manufacturing landscape in APAC fuels the demand for cost-effective yet high-performance spin finish solutions.

Europe and North America represent mature markets characterized by a strong emphasis on high-value, specialized, and sustainable spin finish solutions. While the volume of synthetic fiber production in these regions may not match APAC, there is a significant demand for advanced spin finishes catering to technical textiles, smart textiles, and high-performance applications in automotive, aerospace, and medical sectors. Regulatory pressures regarding environmental sustainability are particularly stringent in Europe, pushing manufacturers to innovate in bio-based and environmentally friendly formulations. North America also sees growth in niche segments, with a focus on localized production and specialized performance requirements, often driven by innovation in advanced materials and textiles.

- Asia Pacific: Dominant market due to extensive synthetic fiber manufacturing in China, India, and Southeast Asia; significant textile industry expansion and consumer demand.

- Europe: Growth driven by demand for technical textiles, stringent environmental regulations fostering bio-based product innovation, and focus on high-performance applications.

- North America: Stable market with emphasis on specialized fibers, high-performance applications, and sustainability initiatives; local manufacturing for niche segments.

- Latin America: Emerging market with increasing investments in textile production, rising domestic demand for synthetic fabrics, and potential for industrialization-driven growth.

- Middle East & Africa (MEA): Nascent but growing market, influenced by industrial development initiatives, diversification away from oil economies, and increasing local textile manufacturing capabilities.

- China: The largest producer and consumer, central to global supply chains, continuous investment in new fiber capacities and textile technology.

- India: Significant growth driven by large textile industry, increasing domestic consumption, and government support for manufacturing.

- Germany & Italy: Key European countries for high-tech textile machinery and specialized fiber production, driving demand for advanced spin finishes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Spin Finish Oil Market.- BASF SE

- Clariant AG

- Dow Inc.

- Croda International Plc

- FUCHS Group

- Takemoto Oil & Fat Co., Ltd.

- Kluber Lubrication (Freudenberg Group)

- Nippon Shokubai Co., Ltd.

- Evonik Industries AG

- Solvay S.A.

- Huntsman Corporation

- Sanyo Chemical Industries, Ltd.

- Indofil Industries Limited

- Resil Chemicals Pvt. Ltd.

- Shandong Qiaochang Chemical Co., Ltd.

- Zschimmer & Schwarz GmbH & Co KG Chemische Fabriken

- NICCA Chemical Co., Ltd.

- Emerald Kalama Chemical (Lanxess)

- Tanatex Chemicals B.V.

- Sarex Chemicals

Frequently Asked Questions

Analyze common user questions about the Spin Finish Oil market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is spin finish oil and why is it crucial in synthetic fiber production?

Spin finish oil is a specialized chemical formulation applied to synthetic fibers during their manufacturing process. It's crucial because it provides essential lubrication, reduces friction, prevents static electricity buildup, enhances fiber cohesion, and protects fibers from damage during high-speed spinning, drawing, and texturizing. This ensures smooth processing, improves production efficiency, and maintains the quality of the final textile product, making it indispensable for modern synthetic fiber manufacturing.

What are the primary types of spin finish oils available in the market?

The primary types of spin finish oils are typically categorized by their chemical composition and the fiber type they are designed for. By composition, they include synthetic-based (e.g., esters, ethers), mineral oil-based, and increasingly, bio-based formulations (e.g., vegetable oils, fatty acid esters). By fiber type, specific formulations exist for polyester, polyamide (nylon), polypropylene, rayon, and acrylic fibers, each tailored to the unique processing requirements and properties of that particular polymer.

How do environmental regulations and sustainability trends impact the spin finish oil market?

Environmental regulations and sustainability trends significantly impact the market by driving demand for eco-friendly alternatives. Stricter mandates on chemical usage, waste discharge, and microplastic concerns compel manufacturers to develop biodegradable, non-toxic, and bio-based spin finish oils. This shift leads to increased R&D investments in sustainable chemistry, influencing product innovation, market offerings, and supply chain practices to meet evolving environmental standards and consumer preferences for greener products.

Which regions are leading in the consumption and production of spin finish oils, and why?

The Asia Pacific (APAC) region, particularly countries like China and India, leads in both the consumption and production of spin finish oils. This dominance is primarily due to the region's vast synthetic fiber manufacturing capabilities, driven by competitive labor costs, supportive industrial policies, and a large domestic and export market for textiles. Europe and North America also contribute significantly, focusing on high-performance and specialized spin finishes for advanced technical textiles, albeit with lower overall volumes compared to APAC.

What are the key technological advancements driving innovation in spin finish oil formulations?

Key technological advancements driving innovation include sophisticated emulsification techniques for stable and uniform application, advanced additive chemistry to enhance specific functionalities (like anti-static properties, anti-oxidation, cohesion) under extreme processing conditions, and the development of bio-based and environmentally friendly formulations to meet sustainability demands. Nanotechnology and AI-driven optimization are also emerging, allowing for customized performance properties and more efficient product development and application processes, pushing the boundaries of traditional spin finish capabilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager