Spinal Surgery Tables Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432480 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Spinal Surgery Tables Market Size

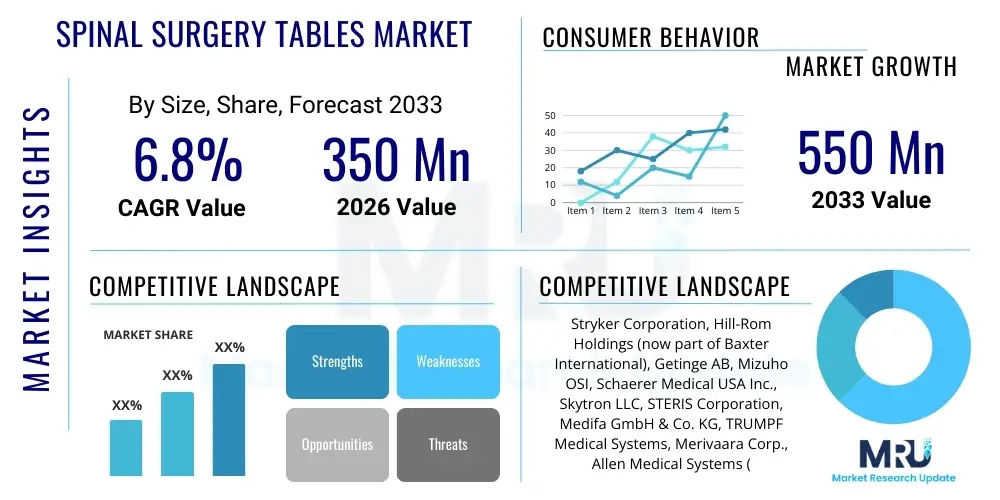

The Spinal Surgery Tables Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 350 million in 2026 and is projected to reach USD 550 million by the end of the forecast period in 2033.

Spinal Surgery Tables Market introduction

The Spinal Surgery Tables Market encompasses highly specialized operating room equipment designed to position patients accurately and safely during complex spine procedures, including fusion, decompression, and deformity correction. These tables are critical components in modern neurosurgical and orthopedic practices, primarily facilitating minimally invasive surgery (MIS) techniques by ensuring optimal access, reduced blood loss, and improved fluoroscopic imaging capabilities. The design innovation focuses heavily on radiolucency, articulation capabilities, and ergonomic features for surgical teams. Product descriptions often highlight modular carbon fiber construction, motorized controls for precise positional adjustments, and compatibility with various imaging modalities such, as C-arms and intraoperative CT scanners, which are essential for navigational surgery.

Major applications of spinal surgery tables span the entire spectrum of spinal pathologies. They are indispensable for procedures addressing degenerative disc diseases, spinal trauma, complex scoliosis and kyphosis corrections, and tumor resection. The inherent ability of these tables to maintain spinal alignment, minimize pressure points, and provide necessary flexion and extension capabilities directly contributes to better surgical outcomes. The rising global prevalence of chronic back pain and age-related spinal disorders, coupled with increasing accessibility to specialized spinal healthcare in emerging economies, are significant driving factors fueling market expansion. Furthermore, the global shift towards patient-centric care models emphasizes the use of equipment that minimizes post-operative complications and recovery time, positioning specialized surgical tables as high-demand capital equipment.

The key benefits derived from utilizing advanced spinal surgery tables include enhanced surgical site visualization, improved workflow efficiency in the operating theater, and superior patient safety through optimized positioning that prevents neurological or vascular compromise. These systems often integrate features like pressure-relieving pads and lateral support systems to mitigate the risk of pressure ulcers during lengthy operations. Driving factors include continuous technological advancements, such as the integration of sensor technology and robotic capabilities into table systems, increasing volumes of spinal fusion procedures, and robust investment in surgical infrastructure modernization, particularly in developed regions like North America and Western Europe. Regulatory approvals for new, highly modular systems also contribute significantly to the market momentum.

Spinal Surgery Tables Market Executive Summary

The Spinal Surgery Tables Market demonstrates robust growth driven by escalating demand for complex and minimally invasive spinal interventions globally. Current business trends indicate a strong focus on modularity and adaptability, allowing hospitals to utilize single table systems across a range of surgical specialties beyond just spine procedures, thereby maximizing return on investment. Furthermore, there is a pronounced shift towards incorporating advanced materials like carbon fiber to enhance radiolucency, which is critical for successful image-guided surgery. Key market players are concentrating on strategic collaborations and mergers to expand their geographical footprint and integrate supplementary technologies, such as patient monitoring systems, directly into the surgical table framework. Pricing pressure remains a constant element in procurement decisions, particularly in public healthcare systems, prompting manufacturers to innovate on cost-efficiency while maintaining high standards of clinical efficacy and safety.

Regional trends highlight North America’s dominance, primarily due to high healthcare expenditure, established reimbursement policies, and the rapid adoption of sophisticated surgical technologies and techniques, including robotic-assisted spine surgery. However, the Asia Pacific region is rapidly emerging as the fastest-growing market segment. This accelerated growth is attributed to improving healthcare infrastructure, a rapidly aging population facing increasing incidence of spinal conditions, and governmental initiatives aimed at expanding access to specialized medical services in countries like China and India. Europe maintains a steady market presence, characterized by stringent regulatory environments and a focus on long-term equipment reliability and serviceability. Latin America and the Middle East are experiencing growth driven by medical tourism and increasing foreign direct investment in private sector hospitals, leading to the upgrading of surgical suites.

Segment trends reveal that powered and specialized positioning systems hold the largest market share due to their precision and ease of use in complicated procedures. The segment focusing on minimally invasive spine (MIS) procedures is experiencing the fastest growth rate, correlating with patient preference for less invasive treatments and shorter hospital stays. By application, deformity correction and fusion surgeries account for the major consumption volume, necessitating tables capable of extreme articulation and stability. Service contracts and post-sales maintenance are also becoming critical components of revenue streams, underscoring the importance of long-term customer relationship management for table manufacturers. The overall market trajectory is highly sensitive to technological integration, procedural volumes, and global healthcare capital expenditure cycles, which typically rebound post-pandemic phases, fueling large equipment upgrades.

AI Impact Analysis on Spinal Surgery Tables Market

Analysis of common user questions regarding the impact of Artificial Intelligence (AI) on the Spinal Surgery Tables Market reveals core themes centered around automation, pre-operative planning accuracy, and intraoperative efficiency. Users frequently inquire whether AI will automate patient positioning, how AI integration can minimize human error in articulation, and what role machine learning plays in optimizing C-arm compatibility and radiation dose reduction. Concerns often revolve around the cost of integrating AI-enabled features into existing infrastructure and the required training for surgical staff to leverage these sophisticated tools effectively. Expectations are high regarding predictive analytics applied to patient outcome based on positioning data and real-time feedback loops to ensure optimal spinal curvature maintenance throughout long procedures. The consensus points towards AI acting as an enhancement layer rather than a replacement for core mechanical functions.

The immediate impact of AI is primarily felt in the realm of surgical navigation and intraoperative guidance systems that interface directly with the surgical table. AI algorithms are increasingly being used to analyze pre-operative imaging (MRI, CT) and automatically suggest or execute optimal table adjustments required to maintain anatomical alignment crucial for navigated or robotic procedures. This capability significantly reduces setup time and enhances the overall safety margin by eliminating subjective positioning errors. Future iterations are expected to incorporate deep learning models capable of detecting subtle changes in patient vitals or tissue strain during surgery and autonomously making micro-adjustments to the table position, thus minimizing the risk of nerve damage or positional complications during retraction or manipulation.

Furthermore, AI plays a crucial role in optimizing the utilization and maintenance of the capital equipment. Predictive maintenance analytics, driven by AI, monitor usage patterns, motor stress, and component wear in spinal surgery tables, allowing hospitals to schedule preventative maintenance before critical failures occur. This increases table uptime and extends the lifecycle of high-value assets. On the operational side, AI-driven scheduling tools can optimize operating room turnover times by integrating table setup requirements with patient data and logistical flows. As tables become more integrated into the digital operating room ecosystem, AI serves as the backbone for data processing and actionable insights, moving the market towards fully connected and intelligent surgical platforms. This shift elevates the value proposition of modern spinal surgery tables beyond mere positioning devices.

- AI-driven optimization of patient positioning for maximized surgical access and improved image quality.

- Integration of machine learning for predictive maintenance analytics, enhancing equipment uptime and lifespan.

- Real-time feedback loops facilitated by AI to maintain optimal physiological and anatomical parameters during long operations.

- Enhanced compatibility with robotic systems through AI-enabled spatial awareness and table movement synchronization.

- Automated documentation of positioning adjustments, improving procedural accuracy and compliance.

- Potential for reduced radiation exposure by optimizing C-arm paths based on AI interpretation of anatomical landmarks.

DRO & Impact Forces Of Spinal Surgery Tables Market

The dynamics of the Spinal Surgery Tables Market are dictated by a balanced interplay of robust drivers, operational restraints, and substantial market opportunities, which collectively define the impact forces. Key drivers include the exponential increase in the global elderly population, which inherently leads to a higher incidence of degenerative spinal conditions requiring surgical intervention, and the continuous advancement in minimally invasive surgical techniques that necessitate specialized, articulate tables. Restraints primarily involve the high initial capital investment required for these sophisticated systems, especially the fully motorized, carbon fiber models, and stringent regulatory approval processes that can delay market entry for innovative products. Opportunities are plentiful in emerging markets characterized by rapid healthcare infrastructure development and untapped potential for technological adoption, alongside the increasing demand for hybrid OR environments that require multi-functional table systems. The combined impact forces strongly favor market expansion, particularly in segments focused on premium, integrated surgical solutions.

Analyzing the drivers in more detail reveals that governmental and private funding directed towards improving surgical infrastructure globally acts as a foundational growth catalyst. Furthermore, the clinical benefits derived from proper patient positioning, such as reduced risk of nerve palsy, decubitus ulcers, and complications related to inadequate ventilation, are compelling hospitals and surgical centers to prioritize specialized tables over standard operating tables. Technological innovation is central to the driving forces, particularly the miniaturization of motors, improved battery life for mobile units, and seamless integration capabilities with advanced intraoperative imaging (O-Arm, 3D fluoroscopy). These advancements not only improve surgeon efficiency but also enhance patient safety records, strengthening the value proposition for high-end tables. The growing specialization within orthopedic and neurosurgery also demands tables tailored specifically for highly complex procedures like lateral access surgery (e.g., XLIF/DLIF), maintaining high procedural volume growth.

However, substantial restraints temper this rapid growth. The long replacement cycle inherent to capital medical equipment, often ranging from 7 to 10 years, limits the annual addressable market size. Additionally, intense competition, particularly from refurbished equipment providers and lower-cost manufacturers in Asia, puts downward pressure on average selling prices for entry-level and mid-range products. Regulatory hurdles and the associated time and cost of gaining clearances (e.g., FDA 510(k) or CE Mark) pose significant barriers, especially for radical product innovations. Despite these restraints, the opportunity landscape remains expansive. Key opportunities lie in developing software-as-a-service (SaaS) models for integrated table functionalities, capitalizing on the shift towards ambulatory surgical centers (ASCs) which require compact, efficient equipment, and designing tables optimized for bariatric patients, a growing demographic needing specialized support during spinal surgery.

Segmentation Analysis

The Spinal Surgery Tables Market is fundamentally segmented based on factors including product type, material composition, application area, and end-user facility. This granular segmentation allows manufacturers and stakeholders to precisely target their research, development, and marketing efforts towards high-growth areas such as minimally invasive procedures and ambulatory settings. Product type categorization typically distinguishes between motorized, hydraulic, and manual tables, with motorized systems dominating due to enhanced precision and ease of use. Material segmentation is dominated by carbon fiber, prized for its radiolucency, crucial for high-fidelity intraoperative imaging. Application-based segmentation provides insight into clinical demand, separating demand originating from fusion procedures, deformity correction, trauma care, and pain management interventions. Understanding these segments is vital for forecasting procurement trends and managing supply chain efficiency across different regional healthcare systems.

- By Product Type:

- Specialized Positioning Systems (e.g., Jackson Table, Prone Positioning Systems)

- Modular Surgical Tables

- Basic Operating Tables (Modified for Spine)

- By Technology:

- Powered/Motorized Tables

- Hydraulic and Manual Tables

- By Material:

- Carbon Fiber Radiolucent Tables

- Metal Alloy Tables

- By Application:

- Spinal Fusion Procedures (e.g., ALIF, TLIF, PLIF)

- Deformity Correction (Scoliosis, Kyphosis)

- Trauma and Fracture Management

- Decompression and Laminectomy

- Tumor Resection

- By End-User:

- Hospitals and Health Systems

- Ambulatory Surgical Centers (ASCs)

- Specialized Orthopedic and Neurosurgery Clinics

Value Chain Analysis For Spinal Surgery Tables Market

The value chain for the Spinal Surgery Tables Market begins with complex upstream activities involving the sourcing of highly specialized raw materials and components. Upstream analysis focuses heavily on key inputs such as high-grade carbon fiber composites for radiolucent surfaces, precision hydraulic and electronic motor systems, advanced control software, and specialty polymers for positioning pads. Suppliers in this phase face rigorous quality and regulatory demands, as the integrity of these components directly impacts patient safety and surgical efficacy. Manufacturers often maintain close relationships with a limited number of certified suppliers to ensure consistency and traceability, especially for critical components like actuators and software interfaces. Supply chain resilience, particularly post-global disruptions, has become a key strategic consideration, pushing manufacturers towards dual-sourcing strategies and regionalizing component supply chains where feasible to mitigate risk and shorten lead times.

The midstream segment involves manufacturing, assembly, and quality assurance. This phase requires significant investment in precision engineering capabilities, specialized assembly lines, and highly skilled technical labor due to the large size, complexity, and integration requirements of the tables. The manufacturing process includes integrating multiple technologies—mechanical articulation, electronic control systems, and software—into a seamless, regulatory-compliant final product. Distribution channels for spinal surgery tables are bifurcated into direct sales and indirect channels. Direct sales are typically favored for large hospital systems and key academic centers, allowing manufacturers to maintain tight control over pricing, service delivery, and direct customer feedback. Indirect channels, relying on specialized medical device distributors, are essential for penetrating geographically dispersed markets, particularly in emerging economies where local presence and logistical expertise are paramount.

Downstream analysis centers on installation, training, maintenance, and end-user deployment within hospitals and surgical centers. Post-sales service is a critical revenue and relationship driver in this market. Spinal surgery tables require regular preventative maintenance and immediate technical support to ensure operating room efficiency. Direct channels usually manage installation and long-term service contracts themselves, offering specialized technical support and continuous staff training on new features and safe operational practices. Indirect distribution often includes authorized service partners trained and certified by the manufacturer to handle maintenance contracts. The end-users—surgeons, nurses, and hospital administration—provide feedback that drives future product iterations, completing the value cycle. The efficiency and reliability of the distribution and service network directly impact the table's overall lifetime value and the manufacturer's reputation in the highly demanding surgical environment.

Spinal Surgery Tables Market Potential Customers

The primary purchasers and end-users of spinal surgery tables are high-acuity healthcare facilities specializing in complex orthopedic, neurosurgical, and trauma procedures. Hospitals, specifically large university teaching hospitals and specialized surgical centers, represent the largest customer segment due to their high volume of complex spinal cases, their budgetary capacity for major capital expenditure, and their requirement for advanced, integrated operating room technologies. These institutions often prioritize tables offering maximum modularity, seamless imaging compatibility (such as those accommodating O-Arms or robotics), and features designed for long duration, complex deformity correction surgeries. Purchasing decisions in this segment are typically multi-faceted, involving surgical staff, hospital administration, bioengineering teams, and procurement departments, emphasizing clinical validation, long-term support, and total cost of ownership.

Ambulatory Surgical Centers (ASCs) constitute a rapidly growing segment of potential customers, particularly in North America, driven by the increasing shift of elective, less complex spinal procedures (like certain microdiscectomies and single-level fusions) from inpatient hospitals to outpatient settings. ASCs generally seek highly efficient, reliable, and space-saving tables that facilitate quick turnover times and optimal workflow. While ASCs may opt for less specialized tables than major hospitals, they still demand high standards of radiolucency and ease of use, making them a target for focused marketing of specialized modular systems. Their purchasing criteria are heavily weighted towards reliability, footprint, and streamlined maintenance protocols, reflecting the cost-conscious nature of outpatient operations and their reliance on efficient resource utilization.

Furthermore, specialty orthopedic and neurosurgery clinics, particularly those involved in medical tourism or serving niche patient populations, are significant buyers. These clinics often require cutting-edge technology to maintain a competitive advantage and attract patients seeking premium care. Government and military hospitals also represent a stable customer base, focusing heavily on durable, reliable equipment capable of operating under diverse conditions. In emerging markets, private investment and multinational chain hospitals are the key potential customers, as they are often the first to adopt Western-standard specialized surgical equipment. Manufacturers tailor their offerings to these varied end-users by providing scalable solutions, ranging from high-end motorized systems for academic centers to robust, cost-effective hydraulic units suitable for smaller regional facilities or ASCs initiating spine programs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350 Million |

| Market Forecast in 2033 | USD 550 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Stryker Corporation, Hill-Rom Holdings (now part of Baxter International), Getinge AB, Mizuho OSI, Schaerer Medical USA Inc., Skytron LLC, STERIS Corporation, Medifa GmbH & Co. KG, TRUMPF Medical Systems, Merivaara Corp., Allen Medical Systems (A Division of Hill-Rom), Maquet (Getinge Group), OPT SurgiSystems, Lojer Group, AGA Sanitätsartikel GmbH, Biodex Medical Systems, Inc., Nuvo Surgical, Denyer, Transmotion Medical, Inc., ALVO Medical. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Spinal Surgery Tables Market Key Technology Landscape

The technological landscape of the Spinal Surgery Tables Market is characterized by a drive towards enhanced radiolucency, maximum articulation, and seamless digital integration. The pivotal technology remains the use of advanced carbon fiber composite materials. Carbon fiber provides superior structural rigidity while being nearly invisible to X-rays and fluoroscopy, which is non-negotiable for image-guided spinal procedures. This material enables the creation of highly cantilevered table frames and surgical platforms, allowing unrestricted movement and positioning of imaging equipment (like C-arms and O-Arms) around the patient, critical for accurate screw placement and fusion alignment. Modern tables utilize motorized actuation systems, often employing low-noise, high-precision electronic motors that allow minute, controlled positional changes via remote control or integrated operating system consoles. This precision is vital, as small positional errors can have significant clinical consequences in spine surgery.

Another major technological trend is the integration of digital features and smart sensing capabilities. Newer generation tables include integrated sensors that monitor the load distribution, pressure points, and real-time patient position relative to the imaging field. These data points can be fed back to the surgical team, ensuring patient safety and optimal surgical trajectory planning. Furthermore, compatibility with robotics and advanced navigation systems is mandatory. Tables are now designed with specific attachment points and synchronized movement protocols that allow robotic arms to operate safely and accurately in conjunction with the patient's position. This synchronized movement ensures that if the surgeon adjusts the patient's position slightly, the navigation system maintains its spatial reference, enhancing the precision required for complex robotic-assisted fusions and navigated biopsies.

The development of modularity and specialized positioning accessories is also central to the technology landscape. Manufacturers are offering highly adaptable systems where different segments (head rests, leg sections, lateral support beams) can be quickly exchanged or adjusted to accommodate various surgical approaches—prone, supine, or lateral access. Specialized positioning systems, such as the Jackson table or similar open-frame designs, utilize suspension systems to achieve the optimal position for reducing vena cava pressure, thereby minimizing blood loss during surgery. The software interfaces managing these complex movements are becoming more intuitive, often featuring pre-programmed positions for common procedures, reducing setup time, and mitigating the risk of human error during complex patient transfers and positioning procedures in the demanding and time-sensitive environment of the operating room.

Regional Highlights

Regional dynamics within the Spinal Surgery Tables Market are highly correlated with healthcare expenditure, the prevalence of spinal disorders, and technological adoption rates. North America, encompassing the United States and Canada, leads the market due to its advanced healthcare infrastructure, high reimbursement rates for complex spinal procedures, and the presence of major market players facilitating rapid product innovation and adoption. The robust acceptance of minimally invasive and robotic spine surgery drives demand for premium, integrated table systems. Europe holds a significant market share, driven by centralized healthcare systems in countries like Germany, France, and the UK, which prioritize high-quality capital equipment, though procurement cycles can be longer due to centralized budgetary constraints. Western European nations emphasize durability and clinical integration, ensuring long-term value from capital investments.

- North America: Dominant market share fueled by high surgical volumes, quick adoption of cutting-edge technology (robotics/navigation), established ASC network, and robust medical device R&D investment.

- Europe: Stable market growth underpinned by high standards of patient care, stringent regulatory environment ensuring quality, and increasing use of sophisticated spinal fixation devices necessitating advanced tables.

- Asia Pacific (APAC): Fastest growing region, propelled by rapid infrastructure expansion, rising geriatric population, increasing awareness of spinal treatment options, and significant government investment in modernizing healthcare facilities in China, India, and Japan.

- Latin America (LATAM): Growth driven primarily by increased private healthcare investment, improving medical tourism sectors, and gradual adoption of advanced surgical technologies, often sourced via distributor networks.

- Middle East & Africa (MEA): Emerging market characterized by substantial government expenditure in Gulf Cooperation Council (GCC) countries on high-tech hospital projects, focused on becoming regional medical hubs, leading to demand for premium equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Spinal Surgery Tables Market.- Stryker Corporation

- Hill-Rom Holdings (now part of Baxter International)

- Getinge AB

- Mizuho OSI

- Schaerer Medical USA Inc.

- Skytron LLC

- STERIS Corporation

- Medifa GmbH & Co. KG

- TRUMPF Medical Systems

- Merivaara Corp.

- Allen Medical Systems (A Division of Hill-Rom)

- Maquet (Getinge Group)

- OPT SurgiSystems

- Lojer Group

- AGA Sanitätsartikel GmbH

- Biodex Medical Systems, Inc.

- Nuvo Surgical

- Denyer

- Transmotion Medical, Inc.

- ALVO Medical

Frequently Asked Questions

Analyze common user questions about the Spinal Surgery Tables market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for carbon fiber spinal surgery tables?

The primary driver is the critical need for superior radiolucency. Carbon fiber minimizes image attenuation, allowing surgeons to utilize high-fidelity intraoperative imaging (fluoroscopy, O-Arm, CT) without obstruction, which is essential for navigated and minimally invasive spinal fusion and deformity correction procedures, ultimately enhancing surgical accuracy and patient safety.

How do specialized spinal surgery tables support minimally invasive surgery (MIS) techniques?

Specialized tables, such as those with an open frame design (e.g., Jackson tables), facilitate MIS by allowing the abdomen to hang free, thereby reducing intra-abdominal pressure. This reduction minimizes bleeding into the epidural venous system, offering better visualization, decreasing blood loss, and creating optimal anatomical alignment crucial for precise tubular retractors and percutaneous screw placement.

What is the expected long-term impact of integrating robotics with spinal surgery tables?

The long-term impact involves establishing fully integrated, synchronized operating ecosystems. Robotics and navigation systems require tables capable of communicating precise positional data and performing fine, stable adjustments. This integration will lead to increased procedural efficiency, reduced operative time, superior instrumentation accuracy, and standardized surgical outcomes across different facilities.

Which end-user segment is experiencing the fastest growth rate in adopting specialized tables?

Ambulatory Surgical Centers (ASCs) are experiencing the fastest growth in adoption. Driven by cost containment pressures and the shift of specific elective spine procedures to outpatient settings, ASCs demand modular, high-efficiency tables that can facilitate quick room turnover and provide the necessary positioning capabilities for advanced MIS techniques while managing capital expenditure efficiently.

What are the main regulatory and maintenance challenges faced by hospitals acquiring advanced spinal tables?

Main challenges include adhering to stringent regulatory requirements (e.g., FDA/CE Mark) ensuring safety and software validation, managing the high initial capital expenditure, and mitigating long-term operational costs. Maintenance requires highly specialized technicians trained on complex motorized, hydraulic, and electronic components, often necessitating premium service contracts to ensure high uptime and clinical readiness.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager