Spinosad Active Ingredient Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436031 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Spinosad Active Ingredient Market Size

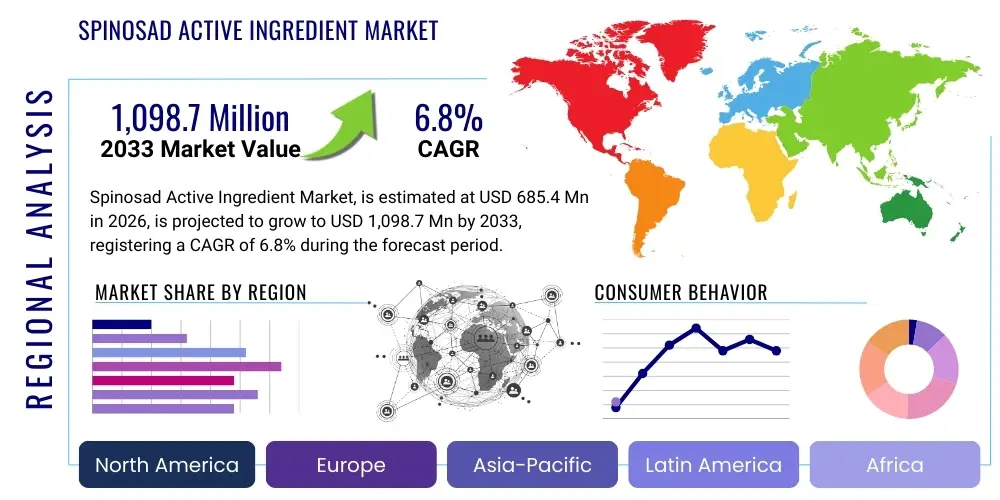

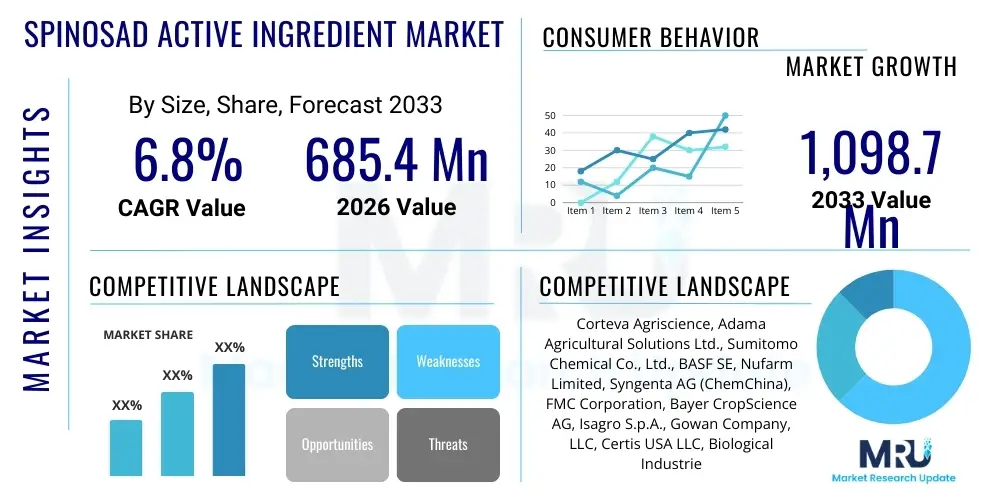

The Spinosad Active Ingredient Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 685.4 Million in 2026 and is projected to reach USD 1,098.7 Million by the end of the forecast period in 2033.

Spinosad Active Ingredient Market introduction

The Spinosad Active Ingredient Market encompasses the production, distribution, and utilization of Spinosad, a highly effective, naturally derived insecticide. Spinosad is a mixture of two compounds, spinosyn A and spinosyn D, which are isolated from the fermentation broth of the actinomycete bacterium Saccharopolyspora spinosa. Its unique mode of action, targeting the insect nervous system while exhibiting low toxicity to mammals and beneficial insects, positions it as a cornerstone in integrated pest management (IPM) strategies. This product is widely valued for its efficacy against a broad spectrum of pests, including Lepidoptera, Diptera, and Thysanoptera, across diverse agricultural and non-agricultural sectors. The market dynamics are heavily influenced by global shifts towards sustainable and organic farming practices, driven by stringent regulatory environments concerning synthetic pesticides and a consumer-led demand for residue-free food production.

The primary application sectors for Spinosad extend far beyond traditional crop protection, reaching into specialty agriculture, horticulture, animal health, and public health domains. In crop protection, it is indispensable for high-value crops such as fruits, vegetables, and ornamentals where residue management is critical, offering short pre-harvest intervals. The active ingredient’s favorable toxicological profile and subsequent registration for use in organic farming across major economic blocs provides a significant competitive advantage over conventional chemical alternatives. As consumer demand for certified organic produce accelerates globally, the reliance on biopesticides like Spinosad naturally increases, cementing its critical role in maintaining yield quality and quantity while adhering to environmental sustainability goals and promoting biodiversity preservation in agricultural ecosystems.

Major driving factors include the growing global adoption of formalized Integrated Pest Management (IPM) programs, the increasing incidence of target pest resistance to older, conventional chemical classes, and the systematic regulatory phase-out of older, less safe synthetic insecticides in key markets such as the European Union and North America. Furthermore, the rising awareness among farmers, applicators, and consumers regarding the long-term ecological benefits of biological controls supports continuous market expansion. While challenges persist, particularly concerning intense generic competition following patent expiry, the high cost associated with specialized fermentation production, and the need for continuous research to mitigate potential insect resistance development, the overall market trajectory remains robustly positive, sustained by strong regulatory tailwinds.

Spinosad Active Ingredient Market Executive Summary

The Spinosad Active Ingredient Market is characterized by robust growth, propelled by strong regulatory support for biological controls and the expanding global footprint of organic agriculture. Key business trends indicate a strategic focus among major agrochemical firms towards acquiring or partnering with specialized biopesticide producers to diversify portfolios away from purely synthetic products and to incorporate novel microbial technologies. There is a noticeable operational shift in manufacturing optimization, leveraging advanced fermentation technologies and potentially genetic engineering of the production strain to enhance yield and reduce manufacturing costs, thereby improving overall market accessibility, particularly in emerging economies where price sensitivity is high. Competitive pressure is intensifying due to the influx of generic versions of Spinosad (Spinosad Technical) following patent expirations, forcing leading manufacturers to differentiate through superior and innovative formulation technologies, extensive field trial data, and high-quality technical support for end-users regarding optimal resistance management strategies.

Regionally, Asia Pacific (APAC) is anticipated to exhibit the fastest Compound Annual Growth Rate, primarily driven by rapid agricultural modernization, increasing governmental subsidies and policy support for biopesticides and organic farming initiatives in highly populated countries like India and China, and the urgent necessity to manage multi-drug resistant insect pests in intensely cultivated areas. North America and Europe, while representing mature market landscapes, continue to contribute significantly through high adoption rates in premium specialty crop protection markets and exceptionally stringent environmental regulations that actively favor low-risk, biorational active ingredients. The European Union’s Farm to Fork strategy, specifically its ambitious targets for reducing reliance on chemical pesticides, serves as a powerful and ongoing regional catalyst for accelerating Spinosad adoption in both field and protected horticulture. Furthermore, Latin American markets are experiencing substantial uptake, driven by large-scale production of export-oriented crops requiring adherence to strict global MRL standards and effective control of pests like the fall armyworm.

Segmentation trends highlight the continued dominance of the crop protection application segment, specifically within high-value specialty crops such as fruits, vegetables, and cotton where efficacy and residue profiles are paramount. However, the non-agricultural segments, particularly animal health (e.g., systemic flea and tick control products for domestic pets) and public health (e.g., mosquito and fly larvicidal control programs in urban areas), are growing at an accelerated pace, benefiting significantly from heightened consumer and municipal preference for safer, lower-risk topical treatments and vector control solutions. The formulation segment demonstrates a growing technical preference for advanced Suspension Concentrates (SC) and Water-Dispersible Granules (WG) that offer enhanced stability, improved UV protection, and superior ease of application compared to legacy formulations. This sustained expansion across diverse and specialized application matrices underscores the versatility, broad regulatory acceptance, and significant commercial viability of Spinosad as a premier biological control agent in the modern pest management toolkit.

AI Impact Analysis on Spinosad Active Ingredient Market

User inquiries frequently center on how Artificial Intelligence (AI) and associated machine learning (ML) technologies can effectively optimize the inherently complex and cost-intensive production efficiency of Spinosad, particularly during the specialized microbial fermentation stage. Users are keen to understand if AI can generate sufficient efficiencies to lower the substantial manufacturing cost associated with biological production, thereby enhancing Spinosad’s price competitiveness against cheaper, conventional synthetic alternatives, especially in high-volume commodity markets. Key thematic concerns also revolve around using AI for advanced resistance management strategies, specifically leveraging predictive modeling to anticipate pest behavior shifts and resistance evolution patterns. This AI capability is expected to optimize application timing, fine-tune dosages, and recommend precise rotation schedules, ensuring the long-term biological efficacy and commercial sustainability of this vital active ingredient.

The practical integration of sophisticated AI and Machine Learning (ML) algorithms is fundamentally revolutionizing the process optimization critical for high-yield Spinosad production. By employing advanced predictive models, manufacturers are now capable of analyzing vast, multivariate datasets concerning input parameters such as nutrient composition, trace mineral profiles, temperature fluctuations, and metabolic outputs of the Saccharopolyspora spinosa microorganism in real-time within massive bioreactors. This highly granular and proactive control minimizes batch-to-batch variation, drastically maximizes the final yield of spinosyn A and D, and significantly reduces overall production overhead, energy consumption, and the volume of biological waste generated. Furthermore, AI is becoming indispensable in enhancing quality control protocols, utilizing spectroscopic data and image processing analysis to rapidly verify the purity, concentration, and isomer ratio of the technical grade active ingredient, thereby ensuring strict compliance with stringent global regulatory specifications before final formulation.

In downstream agricultural applications, AI is rapidly transforming the implementation of Integrated Pest Management (IPM) strategies centered around the use of Spinosad products. Commercial agricultural operators are increasingly adopting high-resolution drone-based surveillance, satellite imagery, and ground sensor data, which are subsequently analyzed by advanced ML models to identify localized pest outbreaks and population density hot spots with previously unattainable spatial and temporal accuracy. This capability facilitates genuine precision application of Spinosad, significantly reducing the total volume of product used, minimizing off-target environmental exposure, and simultaneously maximizing insect mortality rates at the point of application. Moreover, complex AI algorithms can effectively integrate disparate data sources—including hyperlocal meteorological forecasts, specific crop growth stage information, and historical regional pest pressure statistics—to generate highly dynamic, site-specific treatment protocols, which is the most effective way to proactively mitigate resistance development risks and enhance the overall economic returns for growers utilizing premium Spinosad products.

- AI optimizes microbial fermentation yield and purity through real-time predictive modeling of bioreactor conditions, directly contributing to lower production costs.

- Machine learning algorithms enhance quality control and ensure batch consistency in complex Spinosad manufacturing processes by analyzing spectral data.

- AI-driven precision agriculture platforms enable highly localized, dose-optimized application of Spinosad, minimizing environmental impact and overall usage volume.

- Predictive analytics supports sophisticated proactive resistance management by accurately modeling pest population dynamics, treatment efficacy under varied conditions, and cross-resistance potential.

- AI aids significantly in complex supply chain optimization, accurately forecasting regional and seasonal product demand based on integrated climatic variability and anticipated pest pressure cycles.

- Robotics and computer vision, powered by AI, are being developed for automated inspection and dosing in protected horticulture settings where Spinosad is frequently utilized.

- AI processes genomic data to accelerate research into enhanced Spinosad producing strains, potentially unlocking novel spinosyn variants with superior efficacy.

DRO & Impact Forces Of Spinosad Active Ingredient Market

The market trajectory for the Spinosad Active Ingredient is strongly influenced by a favorable combination of powerful regulatory drivers and compelling consumer-led opportunities, though its potential is continually moderated by inherent production constraints and intensifying generic competition. The overarching global shift toward developing and implementing sustainable food systems and the mandated reduction of the chemical load in agriculture acts as the primary and most significant catalyst, powerfully boosting sustained demand for biologically derived and environmentally safer insect control solutions. Conversely, the substantial high capital expenditure required for building and operating specialized microbial fermentation facilities, coupled with the constant technological challenge of maintaining high proprietary strain productivity, restrains the market’s capacity for rapid, low-cost scaling. Simultaneously, the persistent threat of regulatory re-evaluation based on evolving toxicological standards, albeit low for Spinosad currently, remains an underlying force impacting long-term investment decisions across the entire active ingredient value chain. These interacting forces fundamentally dictate strategic choices regarding product positioning, technology investment, and geographic market entry.

Drivers are predominantly centered around the global imperatives for enhanced food safety and rigorous environmental stewardship. The exceptionally favorable toxicological profile of Spinosad—characterized by its high efficacy, selective action against pests, and rapid environmental degradation in soil and water—makes it an ideal and often mandated substitute for older chemical classes like organophosphates and carbamates that are being systematically phased out worldwide due to environmental and human health concerns. Furthermore, its broad and unique registration for use in certified organic farming systems across all major economic regions provides direct access to premium agricultural markets that are expanding exponentially in North America, Europe, and increasingly in parts of Asia. The escalating frequency and severity of insect resistance observed with widely used older synthetic chemical classes necessitate the immediate integration of products featuring novel modes of action, effectively positioning Spinosad as an indispensable and crucial rotation tool within globally recognized resistance management programs, thereby securing its continuous and expanding demand.

Restraints primarily relate to inherent economic and technological complexities within its manufacturing process. The production of Spinosad through complex microbial fermentation inherently carries significantly higher operational and capital costs compared to the bulk industrial processes used for typical chemical synthesis, substantially affecting the final product price competitiveness, particularly when pitted against cheaper, high-volume conventional alternatives. The expiration of key product patents has triggered the market entry of numerous generic manufacturers, intensifying fierce price wars and consequently eroding profit margins for the original brand producers, demanding continuous cost management. Furthermore, maintaining effective long-term resistance management necessitates careful product formulation, mandatory adherence to strict usage protocols, and limits on annual applications; consequently, observed overuse in specific agricultural geographies poses a tangible risk of pest populations adapting, which would severely restrict future market potential and necessitate significant ongoing investment in regulatory stewardship and advanced technical research.

Opportunities lie significantly in the potential for rapid geographic expansion into major emerging economies where agricultural intensification is currently coupled with growing governmental and producer awareness regarding pesticide safety and an urgent, unmet demand for safer agricultural inputs. The strategic diversification of applications into specialty non-crop areas, such as forestry protection, vector control, and consumer-facing animal health products, provides invaluable new revenue streams that are resilient and independent of the cyclical fluctuations associated with traditional row crop commodity cycles. Crucially, the continuous development of enhanced, highly targeted formulations (e.g., advanced microencapsulation for superior UV protection and significantly extended field residual action) utilizing modern materials science presents a robust opportunity for market leaders to powerfully differentiate their premium offerings and strategically maintain superior pricing power above that of generic competitors based solely on enhanced performance characteristics.

Impact Forces encapsulate the dynamic and complex interactions between these drivers and restraints. The impact force generated by global environmental regulation (a Driver) is currently assessed as high and overwhelmingly positive, fundamentally reshaping the overall market structure in favor of biorational and biopesticide solutions like Spinosad. Conversely, the impact force stemming from generic competition and associated pricing pressure (a Restraint) is moderately high and negative, actively suppressing average selling prices across the technical ingredient segment and forcing core manufacturers toward mandatory strategic realignment focused heavily on formulation innovation, unique combination products, and specialized end-market focus. The overall net effect of these interacting forces strongly suggests a sustained high-growth trajectory for the Spinosad market, provided that core manufacturers successfully maintain technological superiority in fermentation efficiency, continuous innovation in field application technology, and rigorous adherence to global application stewardship protocols.

Segmentation Analysis

The Spinosad Active Ingredient Market is comprehensively segmented based on its application, the specific type of formulation utilized, and the geographical region of consumption, which collectively provides granular, actionable insights into highly specific demand patterns and the competitive dynamics across various sub-markets. Application segmentation readily reveals the broad and diverse utility of Spinosad across the traditional agricultural, specialized veterinary, and critical public health sectors, with crop protection maintaining the dominant market share primarily due to its widespread and essential use in high-value, residue-sensitive fruits, vegetables, and specialty row crops. Analysis focused on formulation type is exceptionally crucial as it directly reflects manufacturer capabilities in achieving superior product stability, maximizing ease of handling for end-users, and ensuring optimal field performance, where technologically advanced formats like Water Dispersible Granules (WG) and flowable Suspension Concentrates (SC) are aggressively gaining prominence over older, less stable dusts and rudimentary liquid forms.

This structured segmentation framework allows industry stakeholders to accurately gauge market penetration levels across highly specialized end-uses, such as certified organic production systems versus conventional Integrated Pest Management (IPM) programs, and provides the necessary foundation to tailor marketing, technical support, and complex distribution strategies precisely to the needs of the target segment. Understanding the differentiated growth dynamics within each major segment, particularly the accelerated adoption and rapid expansion observed within the animal health segment for both systemic and topical parasite control in companion animals, is absolutely vital for accurately forecasting future revenue streams, optimizing long-term capital investment, and ensuring successful navigation of the distinct regulatory pathways required for market access in varied professional and consumer end-markets.

Furthermore, segmentation by geography highlights highly distinct regional regulatory regimes, prevailing agricultural practices, and specific consumer preferences that profoundly influence localized demand. While developed markets (North America, Europe) prioritize low-residue profiles and organic certification compatibility, developing regions often prioritize baseline efficacy coupled with strong cost-effectiveness. Consequently, effective pricing strategies, channel management, and the required level of technical support vary drastically based on the targeted segment and geography. For instance, the demand for Spinosad larvicides in public health is highly localized, often driven by government tender processes in tropical regions. This emphasizes the critical necessity of a nuanced and highly detailed segmentation approach for achieving effective market planning, maximizing competitive advantage, and ensuring appropriate resource allocation across the global market landscape.

- By Application:

- Crop Protection (Fruits, Vegetables, Cotton, Cereals & Grains, Ornamentals, Specialty Crops)

- Animal Health (Flea & Tick Control in Companion Animals, Livestock Parasite Management, Veterinary Pharmaceuticals)

- Public Health (Mosquito and Fly Larvicides, Urban Pest Control, Vector Management Programs)

- Turf and Ornamental Protection (Golf Courses, Nurseries, Landscaping)

- By Formulation Type:

- Suspension Concentrates (SC) - Favored for stability and ease of application.

- Water Dispersible Granules (WG) - Preferred for safety and packaging convenience.

- Wettable Powders (WP) - Older, specialized formulations.

- Emulsifiable Concentrates (EC) - Less common due to solvent requirements.

- Dusts and Baits

- By Distribution Channel:

- Direct Sales (from TGAI Producers to Multinational Formulators)

- Distributors & Wholesalers (Regional Agricultural Supply Chains)

- Specialized Agricultural Cooperatives

- Veterinary and Pet Supply Channels

- Online Retail and E-commerce Platforms (Consumer Segment)

- By End-Use Sector:

- Certified Organic Farming

- Conventional Farming (Integrated Pest Management focusing on rotation)

- Commercial Greenhouse Production

- Household/Consumer Use

- Government/Municipal Use (Vector Control)

Value Chain Analysis For Spinosad Active Ingredient Market

The highly complex value chain for the Spinosad Active Ingredient market commences with the critical upstream production phase, which involves the specialized microbial fermentation of the specific proprietary strain, Saccharopolyspora spinosa, under rigorously controlled aseptic conditions. This stage is notably capital intensive, requiring significant investment in advanced bioreactors, sophisticated analytical instrumentation, and proprietary downstream processing techniques for the efficient extraction and purification of the complex spinosyn compounds from the fermentation broth. Due to the biological nature of the production process, supply chain stability and quality are critically dependent on effective proprietary strain management, rigorous quality assurance, and continuous optimization of fermentation yields, which collectively necessitate substantial, sustained R&D investments, thereby establishing intrinsically high barriers to entry for potential new competitors aiming to produce the technical grade active ingredient (TGAI) effectively.

Midstream activities in the value chain primarily involve the formulation of the technical grade Spinosad into commercial products that are suitable and stable for diverse end-use application methods. Formulators utilize various proprietary inert ingredients, dispersing agents, and stabilizers to create highly stable, highly efficacious, and user-friendly commercial products such as suspension concentrates (SC), water-dispersible granules (WG), or specialized baits. The strategic choice of formulation is paramount as it directly influences the product’s shelf life, ease of handling by applicators, compatibility with mixing tanks, and, critically, its field performance, particularly concerning enhancing resistance to rapid photodegradation under intense sunlight. Distribution channels are typically multi-tiered and complex, often starting with high-volume, direct sales transactions from TGAI manufacturers to large multinational formulators, followed by indirect channels where the finished, formulated products move through a network of regional distributors, specialized agricultural cooperatives, retail outlets, and finally reaching professional applicators and individual growers.

Downstream activities encompass comprehensive marketing, sales efforts, and the ultimate end-use application across highly divergent markets including large-scale agriculture, specialized veterinary practices, and municipal public health programs. Direct sales channels are frequently employed for servicing large commercial agricultural operations, often supplemented by extensive technical advisory services provided by the manufacturers to ensure correct dosage, optimal timing, and strict adherence to mandated resistance management protocols. Indirect distribution strategies heavily dominate the consumer-facing segments like over-the-counter animal health products, which rely heavily on specialized veterinary clinics, expansive pet supply retailers, and increasingly, efficient e-commerce platforms for market reach. The sustained commercial success in the downstream market hinges not only on demonstrated product efficacy but also on strict regulatory compliance (e.g., meeting global residue limits, achieving organic certification) and implementing effective grower and consumer education regarding the best practices for biological control and the precise use of Spinosad within formalized Integrated Pest Management (IPM) frameworks.

Spinosad Active Ingredient Market Potential Customers

The diverse array of primary consumers and end-users of the Spinosad Active Ingredient reflects its extensive application spectrum, but they can be largely and strategically categorized into three core groups: multinational and regional agrochemical formulators, large-scale commercial agricultural operators, and specialized manufacturers of animal health and consumer pest control products. Agrochemical formulators represent the immediate and most significant bulk buyers of the technical grade active ingredient (TGAI), utilizing it as a foundational key component in developing their proprietary biopesticide mixtures and finished products sold under numerous regional and global brand names. These sophisticated customers require assurances of exceptionally high purity, reliable and scalable supply volumes, and highly competitive pricing, particularly when procuring from generic TGAI suppliers who focus primarily on cost efficiency.

Commercial agricultural enterprises, encompassing major growers of high-value specialty crops (e.g., vineyards, orchards, leafy greens) and certified organic farms, constitute a critical direct or indirect customer base. These farmers critically prioritize insect control products that offer robust efficacy coupled with short pre-harvest intervals (PHI) and exceptionally favorable residue profiles, directly supporting the marketability and premium pricing of their produce in highly sensitive domestic and international markets demanding high food safety standards. Their complex purchasing decisions are heavily influenced by independent efficacy data, proven compatibility with other biological control agents, and strict adherence to specific crop residue standards (MRLs) set by key importing nations, making technical performance, robust data support, and continuous regulatory compliance the paramount purchasing criteria in this sector.

Finally, the veterinary pharmaceutical companies and consumer packaged goods (CPG) manufacturers represent an actively growing and vital potential customer base. They systematically integrate Spinosad into either systemic oral treatments or specialized topical formulations designed for the effective control of ectoparasites such as fleas and ticks in companion animals, valuing its superior safety profile when compared to older chemical classes used for animal treatment. Similarly, public health organizations and municipal vector control bodies worldwide utilize highly specific Spinosad formulations for larval control in proactive mosquito and fly management programs, prioritizing effectiveness and critically, its low environmental impact in sensitive urban, peri-urban, and aquatic environments. This dual demand across both professional veterinary channels and governmental public health contracts indicates a robust and diversified demand profile extending beyond traditional agriculture.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 685.4 Million |

| Market Forecast in 2033 | USD 1,098.7 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Corteva Agriscience, Adama Agricultural Solutions Ltd., Sumitomo Chemical Co., Ltd., BASF SE, Nufarm Limited, Syngenta AG (ChemChina), FMC Corporation, Bayer CropScience AG, Isagro S.p.A., Gowan Company, LLC, Certis USA LLC, Biological Industries, Koppert Biological Systems, Bionema, UPL Limited, Marrone Bio Innovations (Bioceres Crop Solutions), Futureco Bioscience, Novozymes A/S, Stockton Group, Kemin Industries, Lier Chemical Co., Ltd., Jiangsu Yangnong Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Spinosad Active Ingredient Market Key Technology Landscape

The technological landscape surrounding the Spinosad Active Ingredient market is fundamentally dominated by sophisticated advancements in microbial fermentation technology and continuous innovation in formulation science aimed at enhancing field performance and stability. In the critical upstream process, continuous improvements focus intensely on proprietary strain optimization, often achieved through techniques like directed evolution and, where regulations permit, advanced modern genetic techniques, all designed to drastically enhance the intrinsic productivity of the specialized Saccharopolyspora spinosa microorganism. Utilizing highly advanced sensor technologies and real-time Process Analytical Technology (PAT) within large-scale industrial bioreactors allows for unparalleled real-time monitoring and dynamic control of critical variables such as dissolved oxygen concentration, pH levels, and precise nutrient feed rates. This highly automated control significantly improves batch consistency and achieves substantially higher titers of the active spinosyn compounds, which directly and positively addresses the crucial market restraint of inherently high manufacturing cost.

A second critical area of sustained technological innovation is the downstream purification and extraction process. Leading manufacturers are systematically deploying advanced and highly efficient chromatography methods, specialized membrane filtration techniques, and solvent recovery systems to efficiently and reliably separate Spinosad from the complex biological matrix of the fermentation broth. This detailed separation ensures that the technical grade product meets the most rigorous purity standards mandated by formulators and regulatory agencies globally. The technological focus here is twofold: maximizing the overall yield of the active ingredient during the costly separation phase, while simultaneously minimizing the use of hazardous solvents and the generation of biological waste, thereby aligning manufacturing processes with global sustainability objectives and reducing environmental footprints. These highly efficient purification methods are essential for achieving the high concentration and isomer specificity required for developing modern, low-dose, high-performance commercial formulations.

Furthermore, formulation technology represents a highly significant competitive battleground and a crucial technological differentiator. Key recent technological advancements include the sophisticated development of microencapsulation techniques and specialized integrated UV protectants, which are absolutely crucial because Spinosad is inherently sensitive to rapid degradation upon exposure to strong ultraviolet light in real-world field conditions. These protective technologies significantly extend the residual efficacy of the product, providing commercial growers with substantially longer pest control windows after a single application. The pronounced market shift toward technologically advanced Water Dispersible Granules (WG) and flowable Suspension Concentrates (SC) necessitates specialized expertise in precise particle size reduction, surface chemistry, and dispersion kinetics to ensure optimal product stability, effortless mixing, and effective delivery through standard agricultural spray equipment. Continuous formulation science advancement is therefore essential for market maintenance and capturing premium segment demand.

Regional Highlights

Regional dynamics heavily influence the adoption rates, growth speed, and prevailing regulatory environment of the global Spinosad market, driven primarily by wide variations in local regulatory frameworks, the inherent structure of local agricultural economies, and divergent consumer demands for organic and sustainably produced products. North America and Europe currently represent the most mature and high-value markets, characterized by high levels of professional awareness regarding biopesticides, exceptionally stringent regulations that proactively phase out older synthetic chemicals, and the existence of robust, large-scale organic certification programs that favor Spinosad inclusion. In North America, specific demand is exceptionally strong across specialty agriculture sectors (including fruits, tree nuts, and vineyards) where Spinosad is a preferred and often mandated tool for effectively managing pervasive pests like thrips and codling moth while strictly adhering to demanding Maximum Residue Limits (MRLs) for lucrative export markets.

Asia Pacific (APAC) is distinctively projected to be the fastest-growing major region throughout the forecast period. This rapid acceleration is substantially fueled by increasing agricultural intensification across vast areas, proactive governmental initiatives and financial subsidies promoting sustainable and biopesticide-focused farming practices in large economic blocs like India, China, and key Southeast Asian nations, and the urgent necessity for efficacious products to manage increasingly severe and widespread insect resistance issues in traditional, high-volume row crops such as cotton and rice. While the initial capital cost of adoption can present a barrier in some developing sub-regions, the aggressive expansion of local, often generic, manufacturing capabilities and rapidly rising average farm income are collectively making Spinosad more widely accessible and economically viable for a broader base of growers across the region, particularly benefiting those involved in high-value export crop production.

Latin America, specifically large agricultural producers such as Brazil and Argentina, presents a significant and dynamic growth opportunity, largely driven by its vast, export-focused agricultural sectors and increasing awareness regarding the importance of pesticide safety and MRL compliance among large commercial growers. Demand in LATAM is often critically concentrated in sectors that require strict compliance with the rigorous import standards imposed by key trade partners in Europe and North America. Conversely, the Middle East and Africa (MEA) market remains comparatively nascent but demonstrates promising localized growth potential, particularly concentrated in high-value cash crops and, crucially, within essential public health vector control programs where the low mammalian toxicity and favorable environmental profile of Spinosad is highly valued for sensitive application in densely populated or water-scarce environments, indicating a diversified regional growth trajectory.

- North America (NA): Dominant in specialty crops and certified organic agriculture; high regulatory barriers for synthetics drive consistent demand for low-risk alternatives like Spinosad. Focus on stringent IPM protocols.

- Europe: Growth robustly accelerated by the binding EU Farm to Fork Strategy and specific pesticide reduction targets, positioning Spinosad as a core foundational replacement for numerous restricted conventional chemicals. Significant and growing uptake in professional greenhouse horticulture and protected cultivation.

- Asia Pacific (APAC): Expected to achieve the highest projected CAGR due to strong governmental financial support for biopesticides, rapid technological modernization of farming, and the critical necessity of managing widespread and emerging pest resistance in large agricultural markets.

- Latin America (LATAM): Strong market potential primarily driven by vast export-focused agricultural sectors (e.g., sugarcane, coffee, fresh fruits) that must adhere strictly to global food safety and MRL standards for international trade.

- Middle East & Africa (MEA): Emerging market primarily focused on essential public health vector control applications and selective protection of high-value crops; growth is intrinsically linked to local climate mitigation strategies and water resource management challenges.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Spinosad Active Ingredient Market.- Corteva Agriscience

- Adama Agricultural Solutions Ltd.

- Sumitomo Chemical Co., Ltd.

- BASF SE

- Nufarm Limited

- Syngenta AG (ChemChina)

- FMC Corporation

- Bayer CropScience AG

- Isagro S.p.A.

- Gowan Company, LLC

- Certis USA LLC

- Biological Industries

- Koppert Biological Systems

- Bionema

- UPL Limited

- Marrone Bio Innovations (Bioceres Crop Solutions)

- Futureco Bioscience

- Novozymes A/S

- Stockton Group

- Kemin Industries

- Lier Chemical Co., Ltd.

- Jiangsu Yangnong Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Spinosad Active Ingredient market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Spinosad and how does it fit into organic farming?

Spinosad is a highly effective, naturally derived insecticide produced through specialized microbial fermentation processes. It is widely approved for use in certified organic production systems globally because it successfully meets the stringent regulatory standards for natural origin, efficacy, and low environmental persistence, serving as a critical foundational tool for organic pest management programs.

What are the primary drivers of accelerating demand for Spinosad Active Ingredient?

The key market drivers include increasingly stringent global environmental regulations systematically restricting older synthetic pesticides, the rising and influential consumer demand for certified organic and low-residue produce, and the critical necessity for introducing novel modes of action to manage growing insect pest resistance across conventional agricultural systems worldwide.

How does the patent expiration significantly affect the competitive landscape of the Spinosad market?

The expiration of key product patents has strategically allowed numerous generic manufacturers to enter the market, thereby intensifying price competition for the technical grade ingredient (TGAI). Original brand manufacturers strategically respond by focusing intensely on advanced formulation science, providing comprehensive technical support, and diversifying product applications into specialized, non-crop sectors to maintain market differentiation and premium pricing.

In which application segment is Spinosad currently experiencing the fastest growth?

While traditional crop protection remains the largest volume segment, the highest proportional growth rates are consistently being observed in the non-agricultural sectors, specifically specialized animal health (for systemic pet ectoparasite control) and governmental public health vector control programs due to prevailing preferences for demonstrably safer biological treatments.

What technological innovations are important for ensuring the long-term sustainability of Spinosad production?

Critical technological innovations include the deployment of AI-driven optimization techniques to substantially enhance fermentation process efficiency and lower intrinsic manufacturing costs, alongside continuous advancements in formulation science such as microencapsulation technologies designed to effectively protect the active ingredient from rapid UV degradation and significantly extend its effective residual efficacy in the field.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager