Spiral Drill Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436350 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Spiral Drill Market Size

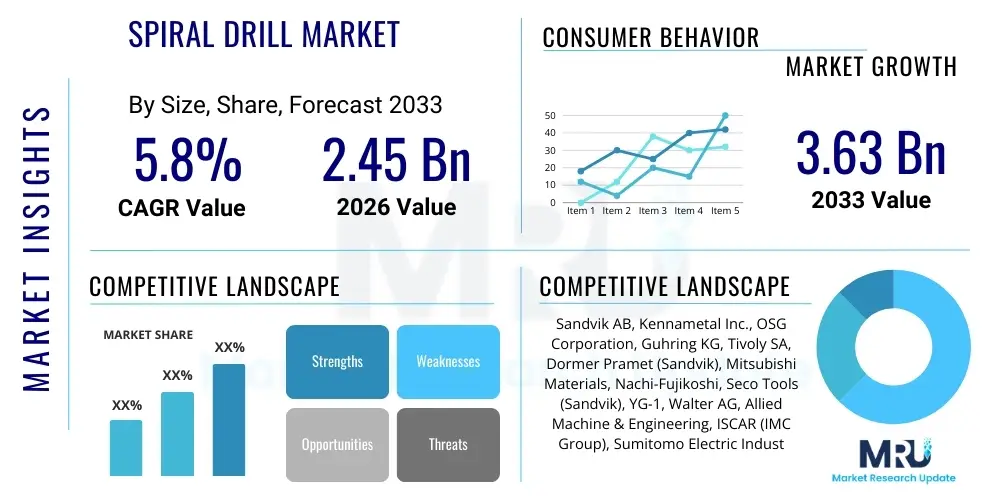

The Spiral Drill Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $2.45 Billion in 2026 and is projected to reach $3.63 Billion by the end of the forecast period in 2033.

Spiral Drill Market introduction

The Spiral Drill Market encompasses the global trade and utilization of twist drills, which are among the most common cutting tools used for creating cylindrical holes in various materials. These tools are defined by their distinct geometry, featuring spiral flutes that serve to evacuate chips from the cutting zone and allow coolant access. Primarily fabricated from materials like High-Speed Steel (HSS), solid carbide, and cobalt alloys, spiral drills are essential components in precision engineering and high-volume manufacturing sectors. Their operational efficiency and adaptability to different substrate hardness levels drive continuous demand across diverse industrial ecosystems globally. The complexity of modern manufacturing processes, particularly the increasing use of hard-to-machine materials such as titanium alloys and composites in aerospace and automotive applications, necessitates the constant evolution of spiral drill technology, focusing on advanced coatings and optimized geometries.

Spiral drills are pivotal in a wide array of industrial applications, extending across general engineering, woodworking, energy production, and, critically, infrastructure development. In the automotive industry, for example, they are indispensable for drilling engine blocks, chassis components, and brake assemblies with high precision and repeatability. Similarly, the construction sector relies heavily on robust spiral drills for fabricating steel structures and preparing anchors. The primary benefit of employing high-quality spiral drills lies in their ability to deliver superior hole tolerance, surface finish, and extended tool life, thus significantly reducing overall manufacturing costs and downtime. Furthermore, the development of specialized drills, such as those with through-coolant capabilities, has enhanced productivity by managing thermal stress and improving chip control, allowing for increased cutting speeds and feeds, which is vital for efficient operations in modern production lines.

The market growth is fundamentally driven by the robust expansion of the global manufacturing sector, particularly in emerging economies undergoing rapid industrialization. Key driving factors include increased capital expenditure on advanced CNC machining centers that demand high-performance tooling, the resurgence of aerospace production cycles, and continuous innovation in tool material science, specifically in the field of PVD and CVD coatings (like TiAlN and AlCrN). These coatings drastically improve the thermal stability and hardness of the drills, enabling them to operate effectively under demanding conditions. Additionally, the growing emphasis on automation and precision engineering across industries ensures sustained demand for sophisticated, reliable spiral drilling solutions that can integrate seamlessly into robotic manufacturing environments and smart factories.

Spiral Drill Market Executive Summary

The Spiral Drill Market is experiencing dynamic growth, propelled by accelerating trends in industrial automation, lightweight material usage, and expansion in high-precision manufacturing sectors like aerospace and medical devices. Business trends highlight a strong shift toward premium tooling, specifically solid carbide drills with advanced coatings, driven by the need for higher production rates and extended tool life. Manufacturers are increasingly focusing on digital integration, incorporating sensors and data analytics into tooling systems to enable predictive maintenance and optimize drilling parameters, aligning with Industry 4.0 principles. Consolidation remains a prominent feature, with leading global players acquiring specialized regional manufacturers to enhance technological capabilities and expand market reach, ensuring comprehensive portfolios that cater to diverse application demands, from general machining to specialized hard-material processing.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive investments in manufacturing infrastructure in countries like China, India, and South Korea, particularly within the automotive and electronics supply chains. North America and Europe, characterized by mature industrial bases, demonstrate stable demand, driven primarily by the high-value aerospace, defense, and medical sectors where precision and material capability are paramount. These developed regions lead the adoption of highly specialized and intelligent tooling solutions, demanding products tailored for difficult-to-machine superalloys and composites. Conversely, Latin America and the Middle East & Africa (MEA) offer emerging market opportunities, spurred by burgeoning construction activities and nascent diversification in local manufacturing capabilities, though adoption rates for advanced tooling lag behind the technologically mature markets.

Segment trends reveal that the Solid Carbide segment is poised for the fastest expansion, largely due to its superior rigidity, heat resistance, and capability to drill materials that challenge traditional HSS drills. In terms of application, the General Manufacturing and Automotive segments currently hold the largest market share, reflecting their sheer volume of production activities requiring drilling operations. However, the Aerospace & Defense segment is projected to exhibit the highest CAGR, driven by demanding specifications for drilling complex structural components, necessitating specialized geometries and materials that offer high stability and accuracy. Furthermore, within the product types, through-coolant drills are becoming standard practice across high-performance applications, effectively mitigating thermal stress and ensuring efficient chip evacuation, thus maximizing machining uptime.

AI Impact Analysis on Spiral Drill Market

User queries regarding the impact of AI on the Spiral Drill Market primarily center on themes of tool optimization, predictive failure analysis, and enhancing manufacturing efficiency. Users are keen to understand how AI algorithms can process complex data streams—including vibration, temperature, and torque readings—to dynamically adjust drilling parameters (feeds, speeds) in real time, thereby maximizing tool life and preventing premature breakage. A significant area of concern and expectation revolves around predictive maintenance: users want AI systems to accurately forecast the end of a drill's usable life, minimizing unplanned downtime. Furthermore, there is interest in how AI can aid in the initial design phase, optimizing flute geometry and coating selection based on simulated material interactions, effectively transitioning the market towards highly customized, intelligent tooling solutions that redefine precision manufacturing capabilities and significantly reduce material waste.

The integration of Artificial Intelligence transforms the spiral drill industry by shifting the focus from purely physical tool durability to intelligent operational optimization. AI-driven monitoring systems, leveraging machine learning on edge devices, analyze machining data collected through smart spindles and tool holders. This data-centric approach allows for unparalleled optimization of the drilling process, ensuring that the drill operates within its most efficient and least stressful parameter envelope, especially crucial when machining expensive materials like inconel or CFRP. This capability not only extends the tool’s lifespan but also ensures consistent quality output across large production runs, addressing one of the most significant challenges in high-precision drilling: tool wear variability.

The long-term impact of AI is the democratization of advanced manufacturing knowledge. AI systems can capture and replicate the expertise of highly skilled machinists by learning optimal settings for specific material-tool combinations. This knowledge distillation aids in automated process planning and provides real-time prescriptive analytics, informing operators exactly how to adjust machine settings to achieve desired outcomes or address immediate deviations. This level of process control minimizes human error, reduces scrap rates, and accelerates the adoption of highly complex drilling strategies, ensuring that the spiral drill remains a cornerstone of precision metalworking, constantly evolving through digital intelligence.

- AI-driven Predictive Tool Wear Modeling: Accurate forecasting of drill failure based on acoustic and vibrational signatures.

- Real-time Process Optimization: Dynamic adjustment of spindle speed and feed rate to maintain ideal cutting conditions.

- Automated Chip Control: AI algorithms optimize coolant delivery and cutting parameters to ensure efficient chip evacuation, preventing jamming.

- Enhanced Tool Design Simulation: Machine learning models analyze historical performance data to optimize flute geometry and helix angles for specific materials.

- Integration with Smart Factories: Enables seamless communication between tooling and CNC machines for fully autonomous operations and quality control.

- Prescriptive Maintenance Scheduling: Shifts maintenance from time-based to condition-based, maximizing tool utilization and minimizing downtime.

DRO & Impact Forces Of Spiral Drill Market

The Spiral Drill Market growth is primarily driven by the escalating demand from key end-user industries, particularly the automotive sector's pivot towards electric vehicles (EVs) and the burgeoning requirements of the aerospace industry for lightweighting structures. These sectors demand high-performance drills capable of precisely machining advanced materials, including composites, hardened steels, and superalloys, ensuring minimal tolerance deviation and maximum productivity. Market expansion is further fueled by continuous technological advancements, such as multi-layer coatings (e.g., AlTiN, TiSiN) and specialized micro-geometries engineered to maximize chip evacuation efficiency and thermal stability at elevated cutting speeds. These innovations enable drills to maintain integrity under strenuous conditions, directly boosting manufacturing throughput globally.

However, the market faces significant restraints, chiefly the inherent volatility and rising costs of raw materials, such as tungsten carbide, cobalt, and high-speed steel elements (molybdenum, vanadium). Price fluctuations directly impact the operational costs of tool manufacturers, subsequently increasing the final price of the product, which can affect adoption rates in price-sensitive markets. Furthermore, the increasing trend toward alternative drilling technologies, such as laser drilling and electron beam machining in specific micro-applications, presents a competitive challenge to conventional spiral drills, although these alternative methods are often cost-prohibitive for high-volume general manufacturing. The ongoing requirement for precision maintenance and replacement schedules also necessitates significant operational planning and inventory management for end-users.

Significant opportunities for growth reside in the expansion of high-value manufacturing segments, especially medical device manufacturing, which demands extremely precise, small-diameter drilling for implants and surgical instruments, often requiring specialized coatings for biocompatibility. The rising global emphasis on renewable energy infrastructure, particularly wind turbine manufacturing, requires large-diameter, high-stability drilling solutions for structural components. The impact forces driving market evolution include the accelerated adoption of Industry 4.0 principles, pushing manufacturers to integrate smart tools with embedded sensors for real-time data feedback. This transition toward intelligent tooling and connectivity fundamentally alters the value proposition of spiral drills, focusing on data-driven performance rather than just material capability. Additionally, stringent quality standards in industries like aerospace act as an accelerating force, mandating the use of only the highest precision and certified drilling tools.

Segmentation Analysis

The Spiral Drill Market segmentation offers a granular view of diverse product capabilities and application-specific demands, allowing manufacturers to tailor their offerings effectively. Segmentation by material is critical, reflecting performance benchmarks, cost structures, and suitability for varying workpiece hardness. Segmentation by application highlights the key demand centers, with Automotive, Aerospace, and General Engineering being the dominant consumers, each requiring specific tool geometry and material hardness. Furthermore, segmentation by product type, such as jobber length versus stub length, addresses the physical requirements of different machining setups, influencing rigidity and maximum drilling depth, which are essential considerations for optimal performance in diverse manufacturing environments.

The market analysis reveals a significant trend towards specialization within segments. For instance, the demand for solid carbide drills is bifurcating into standard micro-grain carbide and specialized nano-crystalline carbide, catering to general and ultra-high-performance applications, respectively. Similarly, within the application segment, the complexity of electric vehicle battery production necessitates specialized cooling channels and short-flute designs to manage thermal runaway risks and maintain tight dimensional tolerances during casing and structural drilling. Understanding these micro-segments is vital for forecasting technological investments and identifying niche market opportunities that yield higher profitability margins compared to the high-volume, low-margin HSS segment.

Geographical segmentation emphasizes regional manufacturing capabilities and technology maturity. While developed regions focus on advanced, coated, and customized tools for specialized superalloys, emerging economies often prioritize cost-effectiveness and volume, driving demand for standard HSS tools. This diverse segmentation landscape necessitates a multi-pronged market strategy for global players, requiring localized distribution networks and production facilities to efficiently cater to distinct customer requirements concerning product specification, delivery lead times, and price sensitivity across continents. The ability to cross-reference these segments—for example, targeting high-quality carbide drills for aerospace applications in North America—is key to strategic planning.

- By Material:

- High-Speed Steel (HSS)

- Cobalt Steel (HSS-E)

- Solid Carbide

- PCD (Polycrystalline Diamond) Tipped

- By Product Type (Length):

- Jobber Length Drills

- Stub Length Drills

- Taper Length Drills

- Extra Length Drills

- By Application:

- Automotive Industry

- Aerospace and Defense

- General Manufacturing and Machining

- Construction and Infrastructure

- Medical Devices

- Energy (Oil & Gas, Renewable)

- By Geometry/Coolant:

- Standard Helix Drills

- High Helix Drills

- Through-Coolant Drills

- Conventional (External) Coolant Drills

Value Chain Analysis For Spiral Drill Market

The value chain for the Spiral Drill Market begins with upstream activities dominated by raw material suppliers, primarily providers of tungsten carbide powder, cobalt binders, high-speed steel alloys, and advanced coating precursors (e.g., Titanium Aluminum Nitride). The quality and stability of raw material sourcing are paramount, given their direct correlation with the final tool performance and cost structure. Key upstream challenges involve managing geopolitical risks affecting metal supply and investing in specialized powder metallurgy techniques necessary for creating ultra-fine grain carbide blanks, which are essential for high-performance drilling. Tool manufacturers engage in complex processes including pressing, sintering, grinding, PVD/CVD coating, and quality assurance to transform raw materials into precision tooling, representing the core value-added stage.

Downstream analysis focuses on the distribution channels and end-user consumption. Distribution typically involves a mix of direct sales channels for large, specialized OEM contracts (e.g., major automotive lines, aerospace manufacturers) and indirect channels utilizing a network of industrial distributors, wholesalers, and specialized tooling vendors for small and medium-sized enterprises (SMEs). The effectiveness of the indirect channel is crucial for market penetration and timely delivery of replacement tools, often relying on sophisticated inventory management systems to minimize customer lead times. Service provision, including regrinding and recoating services, constitutes a significant part of the downstream value proposition, extending tool life and providing a critical after-sales revenue stream.

The modern value chain is increasingly influenced by digitalization, moving towards e-commerce platforms and digital inventory management systems that bypass traditional distributor layers, especially for standard tooling. Direct channels emphasize technical support and application engineering expertise, ensuring the correct tool selection and optimization for complex machining tasks. The final value captured by end-users is determined by the tool’s performance characteristics, such as reduced cycle time, improved surface finish, and prolonged tool life, which collectively lower the total cost of ownership (TCO) in manufacturing operations. Efficiency across the entire chain, from raw material sourcing to final application engineering support, dictates competitive advantage and market sustainability.

Spiral Drill Market Potential Customers

The primary customers for spiral drills are any entities involved in material removal processes where creating precise, deep, or repetitive holes is necessary. The most significant end-users are large-scale manufacturing enterprises across the Automotive, Aerospace, and General Engineering sectors, where drilling constitutes a fundamental and high-frequency operation. Within the automotive industry, demand is driven by engine assembly, chassis fabrication, and increasingly, specialized drilling required for electric vehicle battery casings and lightweight body structures using aluminum and composite materials. These customers prioritize high-volume reliability, specialized geometries for specific materials, and comprehensive supply contracts that include tool management services and inventory systems.

The aerospace and defense industry represents a high-value, low-volume customer segment, demanding tools with extreme precision, certification, and tailored solutions for superalloys (Inconel, Titanium) and carbon fiber reinforced plastics (CFRPs). These end-users, including major airframe and engine manufacturers, require complex, multi-flute geometries, specialized coatings like diamond-like carbon (DLC) for composites, and integrated coolant systems. Their purchasing decisions are heavily influenced by quality assurance, tool performance validation, and regulatory compliance, making them reliant on premium, specialized tool providers who can offer detailed technical support and adherence to stringent industry standards.

Other crucial potential customers include construction and heavy machinery manufacturers, seeking large-diameter, robust drills for steel fabrication; the energy sector (oil & gas, renewables), requiring durable tools for drilling components under harsh conditions; and the precision medical industry, which demands micro-drills for surgical instruments and orthopedic implants. General machining job shops and small and medium-sized enterprises (SMEs) constitute a broad base, typically relying on standardized HSS and standard carbide tools procured through indirect distribution channels, prioritizing versatility and cost-efficiency for diverse material processing needs, ensuring a stable, broad-market demand profile.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.45 Billion |

| Market Forecast in 2033 | $3.63 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sandvik AB, Kennametal Inc., OSG Corporation, Guhring KG, Tivoly SA, Dormer Pramet (Sandvik), Mitsubishi Materials, Nachi-Fujikoshi, Seco Tools (Sandvik), YG-1, Walter AG, Allied Machine & Engineering, ISCAR (IMC Group), Sumitomo Electric Industries, CERATIZIT Group, WIDIA (Kennametal), Regal Cutting Tools, Emuge-Franken, Mapal, LMT Tools. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Spiral Drill Market Key Technology Landscape

The technology landscape of the Spiral Drill Market is centered on enhancing tool material properties, optimizing geometric configurations, and integrating digital capabilities. A pivotal technological focus remains on advanced Physical Vapor Deposition (PVD) and Chemical Vapor Deposition (CVD) coatings. Modern coatings, such as nanoscale multi-layer compositions of Aluminum Titanium Nitride (AlTiN), Aluminum Chromium Nitride (AlCrN), and Diamond-Like Carbon (DLC), are specifically engineered to improve thermal stability, reduce friction, and increase hardness, thereby significantly extending tool life and enabling higher cutting speeds. The development of gradient coatings that transition seamlessly between the substrate and the outer layer minimizes crack propagation and delamination, which is a major technological advancement ensuring tool integrity under high mechanical and thermal stress, crucial for dry machining operations.

Geometric optimization is another crucial technological frontier. Manufacturers are utilizing sophisticated CAD/CAM and finite element analysis (FEA) software to design intricate flute profiles, helix angles, and web thicknesses tailored for specific materials, such as non-ferrous alloys or titanium. The development of variable helix geometry drills, which incorporate changing helix angles along the flute length, has been instrumental in breaking chips into smaller, manageable sizes and minimizing harmonic vibration, leading to superior hole quality and reduced tool chatter, especially in deep-hole drilling. Furthermore, precise edge preparation, often involving micro-honing techniques, creates a robust cutting edge that resists chipping while maintaining sharpness, balancing strength and cutting efficiency.

The integration of smart manufacturing principles, or Industry 4.0, is transforming the technology landscape from a purely mechanical perspective to a digitally augmented one. This involves embedding micro-sensors or utilizing external monitoring systems to capture real-time data on temperature, vibration, and cutting forces during operation. This data is then used for adaptive control of the machine tool, ensuring the spiral drill is always operating optimally. Future technological shifts will increasingly focus on additive manufacturing (AM) techniques to produce complex internal features, such as optimized through-coolant channels, which are impossible to achieve with traditional subtractive manufacturing, leading to next-generation tools with superior internal cooling efficiency and customized performance characteristics.

Regional Highlights

- Asia Pacific (APAC): The APAC region commands the largest market share and is projected to register the highest growth rate, driven primarily by the colossal manufacturing output in China, the expanding automotive and electronics sectors in South Korea and Japan, and rapid infrastructure development in India. The region benefits from lower labor costs and significant foreign direct investment (FDI) into establishing high-volume production facilities, leading to enormous demand for both standard HSS and advanced carbide drills. The shift towards sophisticated automation in countries like Japan and South Korea further fuels the need for high-performance, precision tooling required for advanced electronics and electric vehicle components.

- North America: Characterized by high technological maturity, North America represents a crucial market focused on high-value applications, particularly aerospace, defense, and medical device manufacturing. Demand is centered on premium, specialized spiral drills made from solid carbide and coated materials capable of handling difficult-to-machine superalloys (Titanium and Nickel-based alloys) and composites. The strong presence of major aircraft manufacturers and advanced machine tool builders ensures steady adoption of smart tooling and digital manufacturing solutions, prioritizing tool longevity and precision over unit cost.

- Europe: The European market is stable and mature, driven by the strong German automotive sector (focused on precision machining for premium vehicles), robust general engineering across Central Europe, and significant contributions from the medical and mold-making industries. European users exhibit a high preference for sustainability and tool quality, often leading in the adoption of advanced tooling materials and state-of-the-art coating technologies developed by local market leaders. Strict quality standards and the focus on highly complex machining tasks necessitate customized, high-reliability drilling solutions.

- Latin America (LATAM): The LATAM market, led by Brazil and Mexico, demonstrates growth primarily linked to the recovery of local automotive manufacturing and increased infrastructure and mining activities. While the market is highly price-sensitive and relies significantly on HSS tooling, there is a gradual shift towards better quality carbide tools, particularly in foreign-owned manufacturing plants that adhere to global quality standards. Market penetration relies heavily on efficient distribution networks and localized technical support.

- Middle East & Africa (MEA): The MEA region’s demand is intrinsically linked to the performance of the oil and gas sector, requiring specialized drilling tools for maintenance, repair, and overhaul (MRO) activities, as well as capital investments in construction and diversification projects. Countries like Saudi Arabia and UAE are investing in local manufacturing bases, increasing the localized demand for standard and specialized metalworking tools, though the overall market size remains smaller compared to APAC or North America.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Spiral Drill Market.- Sandvik AB

- Kennametal Inc.

- OSG Corporation

- Guhring KG

- Tivoly SA

- Dormer Pramet (Sandvik Group)

- Mitsubishi Materials Corporation

- Nachi-Fujikoshi Corp.

- Seco Tools (Sandvik Group)

- YG-1 Co., Ltd.

- Walter AG

- Allied Machine & Engineering Corp.

- ISCAR (IMC Group)

- Sumitomo Electric Industries, Ltd.

- CERATIZIT Group

- WIDIA (Kennametal Inc.)

- Regal Cutting Tools

- Emuge-Franken

- Mapal Präzisionswerkzeuge Dr. Kress KG

- LMT Tools

Frequently Asked Questions

Analyze common user questions about the Spiral Drill market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Spiral Drill Market?

The Spiral Drill Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033, driven by increasing industrial automation and demand from high-precision manufacturing sectors globally.

Which material segment holds the most potential for growth in the spiral drill market?

The Solid Carbide segment is expected to show the highest growth potential, largely due to its superior performance capabilities, necessary for drilling hard-to-machine materials like superalloys and composites used extensively in aerospace and automotive applications.

How is Industry 4.0 influencing the production and use of spiral drills?

Industry 4.0 integrates AI and sensor technology into tooling systems, enabling real-time monitoring of drilling parameters (smart tooling). This allows for predictive maintenance, optimized cutting conditions, and significantly extended tool life, improving overall manufacturing efficiency and quality control.

Which geographical region is expected to lead the Spiral Drill Market in terms of growth?

The Asia Pacific (APAC) region is forecasted to lead market growth due to expansive investments in manufacturing infrastructure, robust growth in the electronics and automotive industries, and rapid industrialization across major economies like China and India.

What are the main restraints affecting the growth and profitability of the spiral drill market?

The primary restraints include the high volatility and increasing cost of essential raw materials like tungsten carbide and cobalt, alongside intense competitive pressure from alternative non-conventional drilling technologies in niche, high-precision applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager