Spiral Separator Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437466 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Spiral Separator Market Size

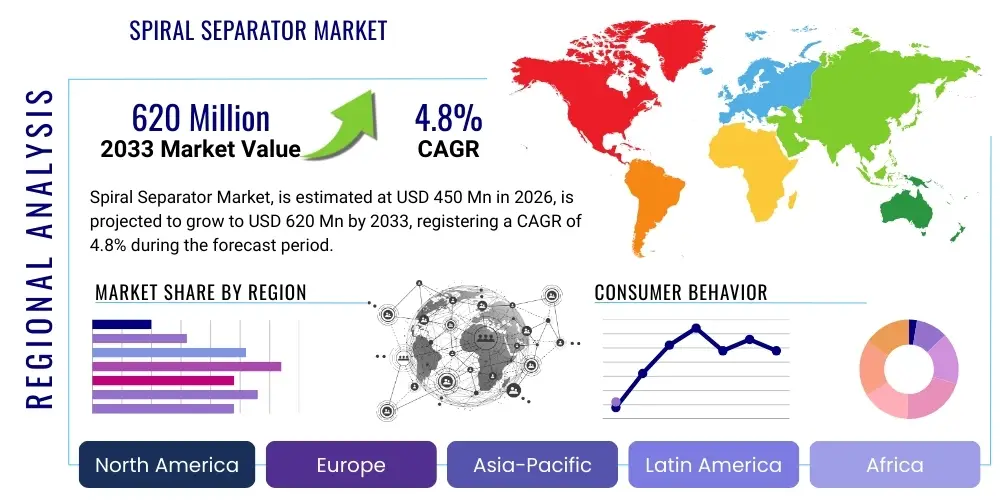

The Spiral Separator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 620 Million by the end of the forecast period in 2033.

Spiral Separator Market introduction

The Spiral Separator Market encompasses equipment utilized primarily in the mineral processing and aggregate industries for gravity-based separation of particles based on differences in specific gravity, size, and shape. This robust technology, characterized by its low operating cost, minimal moving parts, and high throughput capacity, is crucial for upgrading low-grade ores, particularly heavy minerals like titanium and zirconium, and for coal cleaning operations. The simplicity of the spiral separator design—a trough wrapped in a helix—allows for continuous, reliable separation without the need for complex media or significant energy input, making it highly favored in environments requiring efficient, large-scale processing.

Key applications driving market demand include the preparation of coal to reduce ash and sulfur content, which is critical for environmental compliance and increasing calorific value, and the concentration of various metal ores such as iron, chrome, and manganese. Furthermore, the construction industry relies on spiral separators for processing sand and aggregate materials, ensuring quality control by removing deleterious lightweight contaminants. The efficacy of these systems in handling large volumes of slurry efficiently positions them as foundational technology within major resource extraction and processing streams globally.

The market expansion is fundamentally driven by sustained global demand for industrial minerals and metals, coupled with the increasing necessity to process lower-grade ore deposits which require enhanced beneficiation techniques. Benefits such as environmental friendliness (due to reduced water consumption compared to older separation methods) and operational simplicity contribute significantly to their continued adoption. Moreover, regulatory pressures aimed at improving mineral recovery rates and minimizing waste generation compel mining operators to invest in optimized gravity separation solutions, thereby solidifying the market trajectory.

- Product Description: Equipment using gravity and centrifugal force along a helical flow path to separate particles based on specific gravity difference in a slurry.

- Major Applications: Mineral processing (iron ore, chromite, heavy sands), coal washing, sand and aggregate preparation.

- Benefits: Low capital cost, minimal maintenance, high capacity, energy efficiency, and environmentally sound operation.

- Driving Factors: Increasing global infrastructure development, necessity to process complex and low-grade ores, and stringent mineral recovery regulations.

Spiral Separator Market Executive Summary

The global Spiral Separator Market demonstrates resilience, driven primarily by robust demand from the Asia Pacific mining and infrastructure sectors and sustained technological standardization in mineral processing worldwide. Business trends indicate a strong focus on developing highly specialized spiral designs, such as multi-start systems, to improve recovery rates for fine particle fractions, addressing the challenge posed by diminishing ore quality. Equipment manufacturers are increasingly integrating materials science innovations, utilizing advanced polymers and abrasion-resistant linings to extend equipment lifespan and minimize operational downtime in harsh abrasive environments, thereby enhancing the overall Total Cost of Ownership (TCO) for end-users.

Regional dynamics highlight the Asia Pacific (APAC) as the dominant and fastest-growing region, fueled by massive coal preparation activities in China and India, and extensive mineral sands mining in Australia and Southeast Asia. North America and Europe, while mature markets, are experiencing stable growth, primarily driven by replacement cycles, stringent environmental regulations necessitating highly efficient separation, and the renewed focus on critical mineral extraction. Segment-wise, the coal preparation application maintains significant market share due to its established use in improving coal quality, though the mineral processing segment is projected to exhibit a higher CAGR, reflecting diversification into complex ore bodies.

Key segments driving future growth include the integration of advanced sensors for real-time monitoring of slurry density and feed rate, crucial for optimizing separation efficiency without manual intervention. Competitive strategies emphasize strategic acquisitions and partnerships to broaden geographic reach and integrate ancillary technologies like classifiers and hydrocyclones, offering comprehensive process solutions to clients. Overall, the market trajectory is positive, supported by continuous investment in mining capabilities globally and the fundamental reliance of various industrial sectors on cost-effective gravity separation techniques.

AI Impact Analysis on Spiral Separator Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Spiral Separator Market predominantly focus on how traditional, mechanical separation processes can be digitized and optimized. Common questions revolve around the potential for AI to enhance recovery efficiency, minimize operational variability caused by fluctuating ore grades, and facilitate predictive maintenance (PdM). Users are specifically interested in whether machine learning algorithms can analyze real-time feed characteristics (such as particle size distribution, slurry viscosity, and solid concentration) from advanced sensors to autonomously adjust operational parameters, thereby maximizing yield and reducing reliance on traditional, labor-intensive sampling methods.

While the spiral separator itself remains a purely mechanical device, AI significantly impacts its operational envelope by optimizing the upstream and downstream processes and improving the management of the separation circuit. Machine learning models are being deployed to predict optimal feed rates and water dilution requirements based on historical ore body data and live sensor input, ensuring the spiral operates consistently at its maximum separation efficiency point. This level of optimization is crucial because small variations in feed conditions can drastically affect the quality of concentrates and tailings, leading to substantial economic loss. AI systems enable rapid, closed-loop adjustments, far surpassing the speed and accuracy achievable through human monitoring.

Furthermore, AI-driven asset management is transforming the maintenance landscape. By analyzing vibration, temperature, and throughput data, AI models can forecast potential wear patterns, particularly on spiral linings and distributors. This shift from reactive or time-based maintenance to predictive maintenance minimizes unexpected equipment failures, reduces inventory costs for critical spare parts, and maximizes operational uptime. The overall integration of AI, therefore, positions spiral separators within smarter, more efficient mineral processing flowsheets, enhancing their value proposition despite their inherently simple mechanism.

- AI integration optimizes feed control systems (FCS) by analyzing slurry characteristics in real time.

- Machine learning algorithms predict optimal water washing rates to maximize specific gravity differentiation.

- Predictive Maintenance (PdM) powered by AI reduces downtime by forecasting liner wear and distributor failures.

- Enhanced throughput management through AI analysis of upstream crushing/grinding performance.

- Automated anomaly detection in separation performance ensures immediate corrective action, maintaining concentrate quality consistency.

DRO & Impact Forces Of Spiral Separator Market

The Spiral Separator Market is governed by a distinct set of Drivers, Restraints, and Opportunities (DRO) that collectively shape its growth trajectory, influenced significantly by external economic and regulatory impact forces. Primary drivers include the global depletion of high-grade mineral reserves, necessitating the processing of lower-grade and more complex ores, for which spiral separators offer an economically viable beneficiation solution due to their low operating cost per ton. The increasing stringency of environmental regulations, particularly regarding the reduction of chemical usage in mineral processing, favors the adoption of gravity-based physical separation methods like spirals.

However, the market faces significant restraints, chiefly stemming from the volatility in global commodity prices. When mineral prices decline, mining companies often postpone or cancel capital expenditure projects related to new separation equipment, leading to market stagnation. Furthermore, the inherent limitation of spiral separators to effectively handle very fine or extremely coarse particles, or ores lacking a sufficient specific gravity differential, restricts their applicability in certain specialized mining operations. This constraint necessitates the use of alternative, often more expensive, separation technologies, limiting market penetration in those niche areas.

Opportunities for growth are abundant, particularly in emerging economies where significant investments in mining infrastructure are underway. The strong global push toward sustainable mining practices and circular economy models drives opportunities in the recycling and waste material processing sectors, where spirals can recover valuable minerals from tailings or industrial waste streams. Moreover, continuous innovation in materials science allows for the development of spirals with improved surface friction characteristics and enhanced wear resistance, boosting performance and longevity, thereby creating replacement market demand and expansion into highly abrasive environments. These factors underscore a market where technological refinement and economic cycles exert constant influence.

- Drivers: Growing demand for critical and industrial minerals; exhaustion of easy-to-process ore bodies; low operational expenditure and environmental advantages of gravity separation.

- Restraints: High capital costs for new mining projects; volatility of global mineral commodity prices; limitations in separating materials with minor density differences.

- Opportunities: Expansion into high-value mineral recycling; integration with smart process control systems; investment in infrastructure across APAC and MEA.

- Impact Forces: Global commodity market cycles, stringent environmental policies (favoring physical separation), and technological advancements in materials engineering.

Segmentation Analysis

The Spiral Separator Market is comprehensively segmented based on Type, Application, and End-User, reflecting the diverse requirements across the mining and aggregate sectors. Segmentation by Type distinguishes between single-start and multi-start spirals, fundamentally differentiating them based on throughput capacity and the intended application. Single-start spirals are typically robust and used for high-volume, general separation tasks, while multi-start spirals—which integrate multiple helical troughs into a single unit—offer increased capacity per unit of floor space, crucial for modern, expansive processing plants.

The primary application segment, mineral processing, is highly diversified, covering the separation of heavy mineral sands (e.g., ilmenite, rutile), iron ore beneficiation, chromite, and tin concentration. This segment demands high separation efficiency and tailored trough designs to optimize recovery for specific mineral characteristics. Conversely, the coal preparation segment, although mature, remains stable, focusing on separating coal from rock, pyrite, and ash to meet energy standards. The demands of these applications dictate the material construction, angle, pitch, and wash-water addition points specific to the spiral equipment.

End-User segmentation reinforces the market dependency on core industries: the mining sector is the dominant consumer, requiring spirals for primary ore concentration. The construction sector utilizes spirals primarily for sand classification and separation of fine aggregates, ensuring material quality for concrete and asphalt production. The smaller, yet growing, recycling and waste processing segment utilizes spirals to recover valuable metals or materials from slag and industrial waste, showcasing the versatility of gravity separation technology in promoting resource efficiency and circular economy goals.

- By Type:

- Single-Start Spiral Separators

- Multi-Start Spiral Separators

- By Application:

- Coal Preparation

- Iron Ore Processing

- Heavy Mineral Sands (HMS) Separation

- Chromite and Manganese Processing

- Sand and Aggregate Processing

- Other Mineral Processing (Tin, Tungsten)

- By End-User Industry:

- Mining Industry

- Construction and Aggregate Industry

- Recycling and Waste Management

Value Chain Analysis For Spiral Separator Market

The value chain for the Spiral Separator Market begins with upstream activities involving the sourcing of raw materials, primarily specialized steel alloys and abrasion-resistant polymers, which are crucial for constructing the helical troughs and structural frames capable of withstanding corrosive and abrasive slurries. Suppliers of high-quality polyurethane and fiberglass liners play a critical role, as the wear life of these components directly impacts the operational expenditure (OPEX) of the end-user. Innovation at this stage focuses on developing advanced composite materials that offer superior longevity and reduced maintenance frequency.

Midstream activities involve the design, manufacturing, and assembly of the spiral separators. This stage requires significant technical expertise in fluid dynamics and gravity separation principles to optimize the helix profile, pitch, and angle for specific ore types. Manufacturing is often concentrated among specialized heavy equipment providers who possess the necessary fabrication capabilities and technical know-how. The distribution channel is bifurcated into direct sales channels, where large-scale manufacturers interact directly with major mining corporations for customized plant designs, and indirect channels, utilizing regional distributors and system integrators who provide localized sales, spare parts, and aftermarket support, especially for smaller projects or replacement units.

Downstream activities center on installation, commissioning, training, and extensive after-sales support, including the supply of replacement wear parts (linings, distributors). The overall value delivery is heavily influenced by the system integration capability—how effectively the spirals are incorporated into a larger processing circuit alongside screens, pumps, and classifiers. End-users require reliable performance data and efficient service logistics, making robust aftermarket support a crucial competitive differentiator that ensures sustained operational efficiency throughout the equipment’s lifecycle, often spanning several decades.

Spiral Separator Market Potential Customers

Potential customers for spiral separators are predominantly large-scale entities operating within the raw material extraction and processing sectors, characterized by their need for high-volume, continuous separation processes. The largest end-user demographic includes integrated mining corporations that operate globally, dealing with bulk commodities such as iron ore, coal, and heavy mineral sands. These companies seek separation equipment that offers high recovery rates while maintaining a low OPEX, which spiral separators efficiently deliver when dealing with ores requiring density-based concentration.

Another significant customer segment comprises independent coal preparation plants and contract mineral processors. These entities specialize in upgrading lower-quality feedstock from multiple smaller mines, relying on the robust, scalable nature of spirals to handle variable feed conditions efficiently. Furthermore, government bodies and public utilities involved in large-scale infrastructure projects, particularly those requiring vast amounts of standardized, high-quality sand and aggregate, represent steady demand for spiral separators used in material classification and purification.

Emerging buyers include recycling firms focused on urban mining and industrial slag recovery. As environmental compliance tightens and the economic viability of extracting residual minerals from tailings ponds increases, these specialized firms require precise, gravity-based separation technologies. In summary, the primary buyers are those organizations engaged in high-tonnage processing where separation efficiency is a direct determinant of product value and environmental stewardship.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 620 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Multotec, McLanahan Corporation, Eriez Manufacturing Co., Mineral Technologies Inc., Deister Machine Company, Sepro Mineral Systems Corp., Gravity Mining Pty Ltd, Metofabrik, FLSmidth, Westpro Machinery, Zhengzhou Yishang Machinery Equipment, Shicheng Wanshuntong Mining Equipment, Star Trace Private Ltd., Tega Industries, Shandong Xinhai Mining Technology & Equipment Inc., Jiangsu Pengfei Group, Weir Group, Tenova, Thyssenkrupp Industrial Solutions, Outotec (Metso). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Spiral Separator Market Key Technology Landscape

The core technology of spiral separation, rooted in the principles of differential gravity, is mature but continually refined through specialized material science and integrated control systems. Modern advancements focus heavily on optimizing the internal geometry of the spiral trough, including variations in pitch, slope, and cross-section profile, to achieve superior separation efficiency for ultrafine particles (typically below 75 microns) that are challenging for traditional gravity methods. Manufacturers are utilizing Computational Fluid Dynamics (CFD) modeling during the design phase to simulate slurry flow patterns and particle migration, enabling the creation of application-specific spiral designs tailored for maximum recovery of specific heavy minerals, such as optimizing designs for high-throughput iron ore fines.

Material innovation represents a significant technological focal point. The industry is moving away from purely steel construction toward high-density polyurethane, fiberglass, and specialized composite linings. These advanced materials provide vastly improved abrasion resistance, significantly extending the lifespan of the wear components, especially in high-velocity, highly abrasive applications like heavy mineral sands processing. Furthermore, the development of modular and portable spiral plants is a growing trend, offering rapid deployment and flexibility for mining operations that frequently move or require temporary processing capacity, thereby reducing overall capital investment and setup time for mobile processing units.

The integration of smart technology is the most transformative element in the current landscape. While the spiral itself is static, the surrounding systems incorporate advanced sensors—such as density gauges, ultrasonic flowmeters, and particle size analyzers—that feed real-time operational data into sophisticated Process Control Systems (PCS). These systems allow operators to make instantaneous, remote adjustments to critical variables like wash water addition rate and cutter/splitter positioning. This technological convergence ensures that the equipment consistently operates within optimal efficiency parameters, minimizing the loss of valuable minerals and maximizing product quality, aligning the physical process with modern digitalization mandates.

Regional Highlights

The regional analysis reveals distinct growth drivers and market maturity levels across key geographical areas, underpinned by differential resource endowments and varying regulatory landscapes. The Asia Pacific (APAC) region commands the largest market share and is expected to maintain the highest growth rate throughout the forecast period. This dominance is attributable to extensive mining activities in China, India, and Australia, particularly in coal processing and iron ore extraction to fuel rapid industrialization and massive infrastructure development. Government initiatives supporting domestic mineral production and investment in new metallurgical capacity further amplify the demand for high-capacity, low-maintenance spiral separation equipment in countries like Indonesia and Vietnam.

North America and Europe represent mature, stable markets characterized by high labor costs and stringent environmental protection regulations. Growth in these regions is primarily driven by technological upgrades, equipment replacement cycles, and the increasing focus on the extraction of critical minerals required for renewable energy technologies and electronics. In these geographies, the adoption of spiral separators is often motivated by their lower environmental footprint compared to chemical separation methods, supporting sustainable mining practices. Manufacturers in these regions focus on providing advanced controls and highly durable, certified equipment designed for long-term operational reliability.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging as high-potential growth areas. LATAM, rich in iron ore, copper, and precious metal deposits, is witnessing significant mining investments, particularly in Brazil and Chile, necessitating robust beneficiation equipment. The MEA region is experiencing a renaissance in mineral exploration, notably in South Africa (coal and platinum group metals) and resource-rich areas in West Africa. The demand here is centered on deploying cost-effective, durable separation solutions that can handle remote operational environments, making spiral separators an attractive option due to their operational simplicity and minimal reliance on external power infrastructure.

- Asia Pacific (APAC): Dominant market share due to unparalleled scale of coal and iron ore mining; rapid infrastructure expansion drives demand for aggregates and mineral processing.

- North America: Stable growth driven by modernization, strict environmental mandates, and resurgence in critical mineral mining projects.

- Europe: Mature market focused on replacement technology, high-efficiency systems, and utilizing spirals in specialized recycling and industrial mineral applications.

- Latin America (LATAM): High growth potential fueled by extensive iron ore and industrial mineral reserves, driven by large-scale mining capital expenditure projects in Brazil and Peru.

- Middle East & Africa (MEA): Emerging market expansion focused on new mineral exploration and the need for durable, low-cost processing solutions for regional commodities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Spiral Separator Market.- Multotec

- McLanahan Corporation

- Eriez Manufacturing Co.

- Mineral Technologies Inc.

- Deister Machine Company

- Sepro Mineral Systems Corp.

- Gravity Mining Pty Ltd

- Metofabrik

- FLSmidth

- Westpro Machinery

- Zhengzhou Yishang Machinery Equipment

- Shicheng Wanshuntong Mining Equipment

- Star Trace Private Ltd.

- Tega Industries

- Shandong Xinhai Mining Technology & Equipment Inc.

- Jiangsu Pengfei Group

- Weir Group

- Tenova

- Thyssenkrupp Industrial Solutions

- Outotec (Metso)

Frequently Asked Questions

Analyze common user questions about the Spiral Separator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary operational advantage of using spiral separators over other beneficiation methods?

The primary advantage of spiral separators is their simplicity, low operating costs, and minimal energy consumption. Being gravity-based, they require no chemical reagents and have virtually no moving parts, resulting in reduced maintenance, high reliability, and a significantly smaller environmental footprint compared to froth flotation or dense medium separation.

How does ore grade variability impact the performance and efficiency of spiral separation circuits?

Ore grade variability is a significant challenge, as spirals are sensitive to changes in particle size distribution and slurry density. Fluctuations in feedstock can lead to reduced recovery rates or lower concentrate quality. Modern systems mitigate this by integrating advanced sensors and automated control systems to adjust wash water and feed rates in real-time, maintaining optimal separation conditions.

Which regions are driving the highest demand for spiral separators in the current market cycle?

The Asia Pacific (APAC) region, driven by continuous investment in large-scale coal preparation, iron ore mining, and heavy mineral sands processing, accounts for the highest current demand. Emerging markets in Latin America and Africa also exhibit strong growth due to new exploration and infrastructure projects requiring cost-effective separation solutions.

What technological innovations are currently being implemented in spiral separator design?

Key innovations include the use of advanced, abrasion-resistant polymer and ceramic composite linings to enhance wear life, optimization of helical trough geometries using CFD modeling for finer particle separation, and the integration of smart sensor packages for precise, automated process control and predictive maintenance capabilities.

Are spiral separators considered suitable for sustainable mining practices?

Yes, spiral separators are highly suitable for sustainable mining. They rely solely on physical separation using gravity and water, minimizing the reliance on toxic chemical reagents and offering high-efficiency recovery. Their low energy requirement and robust design also contribute to reduced operational emissions and waste generation over the life cycle of the mine.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager