Spiral Wound Nanofiltration Membrane Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435827 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Spiral Wound Nanofiltration Membrane Market Size

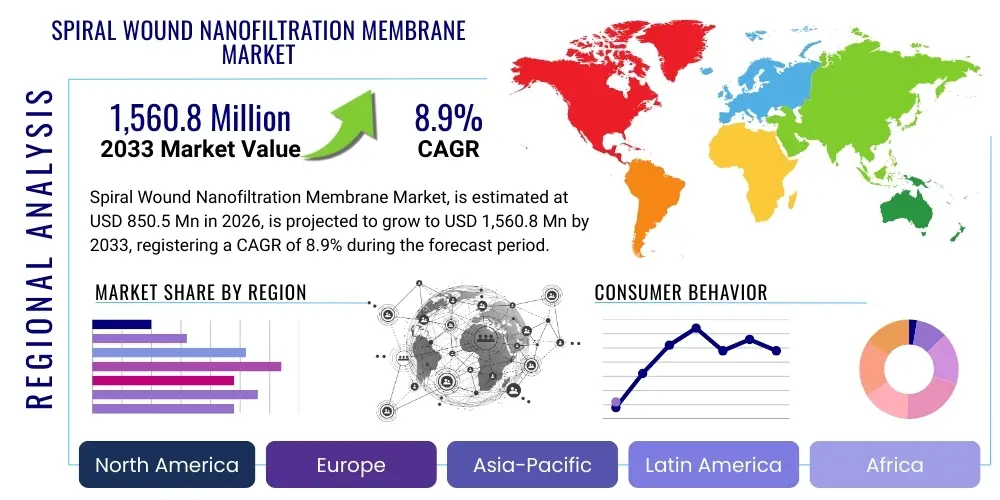

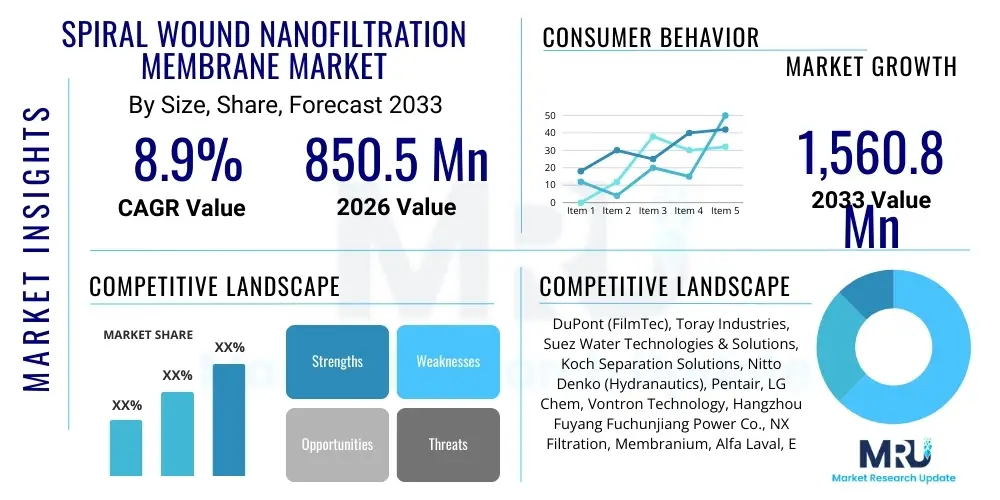

The Spiral Wound Nanofiltration Membrane Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2026 and 2033. The market is estimated at USD 850.5 Million in 2026 and is projected to reach USD 1,560.8 Million by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by the accelerating global demand for high-quality processed water in industrial applications and the critical need for efficient contaminant removal in municipal water systems. The inherent advantages of the spiral wound configuration, including high surface area to volume ratio and ease of system integration, solidify its position as a preferred technology over alternative filtration methods.

Spiral Wound Nanofiltration Membrane Market introduction

The Spiral Wound Nanofiltration Membrane Market centers on specialized separation technology crucial for selective purification processes across diverse industries. Nanofiltration (NF) occupies a distinct position between ultrafiltration (UF) and reverse osmosis (RO), offering superior rejection of multivalent ions, low molecular weight organics, and color bodies, while allowing monovalent ions to pass, typically operating at lower pressures than RO systems. The spiral wound configuration, characterized by multiple flat membrane sheets separated by mesh spacers and rolled around a central permeate collection tube, maximizes the membrane surface area packed within a standardized housing, leading to exceptional volumetric efficiency and lower system footprint.

These membrane elements are primarily utilized in applications requiring precise solute separation, such as the softening of hard water by removing calcium and magnesium, color removal in textile and wastewater streams, and the separation or concentration of specific components in the food and beverage industry. Major applications also include pre-treatment for reverse osmosis systems, significantly reducing fouling and operational costs of downstream high-pressure processes. The efficiency and relatively low energy consumption inherent to nanofiltration make it economically viable for large-scale industrial and municipal operations seeking sustainable water management solutions.

Key market driving factors include increasingly stringent global environmental regulations mandating reduced effluent discharge and higher water reuse rates, coupled with rapid industrialization in developing economies, which generates substantial demand for tailored water treatment solutions. Furthermore, advancements in membrane material science, particularly the development of high-performance Thin Film Composite (TFC) membranes with enhanced anti-fouling characteristics and chemical stability, continue to expand the scope and feasibility of nanofiltration adoption across traditionally challenging waste streams.

Spiral Wound Nanofiltration Membrane Market Executive Summary

The Spiral Wound Nanofiltration Membrane Market is experiencing vigorous growth driven by critical business trends focused on water scarcity mitigation and industrial efficiency. Key business trends involve the integration of nanofiltration into Zero Liquid Discharge (ZLD) and Minimum Liquid Discharge (MLD) systems, especially in sectors like power generation and chemical manufacturing, aiming to minimize environmental impact and maximize resource recovery. Furthermore, manufacturers are concentrating R&D efforts on developing high-flux, low-fouling membranes and standardized, modular systems that reduce installation complexity and operational downtime. The competitive landscape is marked by strategic acquisitions and partnerships aimed at strengthening regional supply chains and integrating advanced digital solutions for remote monitoring and performance optimization of membrane units.

Regional trends indicate that Asia Pacific (APAC) holds the largest market share and is projected to exhibit the highest growth rate, primarily attributed to rapid urbanization, expansive industrial development, and escalating governmental investments in modernizing municipal water infrastructure in countries like China and India. North America and Europe demonstrate mature markets characterized by high technology adoption, stringent regulatory frameworks related to PFAS and microplastic removal, and a strong emphasis on water reuse initiatives, sustaining steady demand. The Middle East and Africa (MEA) region is witnessing accelerated adoption, particularly in Gulf Cooperation Council (GCC) countries, where NF is utilized extensively for brackish water desalination pre-treatment and water injection processes in the oil and gas sector.

Segment trends reveal that the Water Treatment and Purification application segment remains dominant, driven by municipal water softening and advanced wastewater reclamation projects. Within material types, Polyamide Thin Film Composite (TFC) membranes continue to dominate due to their superior chemical resistance and customizable separation characteristics. Industrial end-users, notably the food and beverage sector for product concentration and clarification, and the pharmaceutical industry for solvent separation and purification, represent rapidly growing sub-segments demanding highly specific and hygienic membrane solutions, pushing the market towards specialized, application-specific membrane chemistries and module designs.

AI Impact Analysis on Spiral Wound Nanofiltration Membrane Market

Common user questions regarding AI's impact on the nanofiltration sector frequently revolve around how artificial intelligence can mitigate the persistent challenges of membrane fouling, optimize energy consumption, and extend membrane element lifespan. Users are highly interested in predictive maintenance models, asking if AI can accurately forecast the need for cleaning cycles or replacement before significant performance degradation occurs. There is also substantial curiosity regarding the use of machine learning algorithms to dynamically adjust operating parameters (flow rate, pressure, pH) in real-time, especially in response to highly variable feed water quality, thereby maximizing permeate flux while minimizing specific energy consumption. The core user expectation is that AI integration will transform NF systems from reactive operational models to highly autonomous, self-optimizing separation units, significantly lowering the total cost of ownership and increasing overall system reliability across diverse industrial and municipal environments.

- AI-driven Predictive Maintenance: Utilizing machine learning algorithms to analyze historical operating data, flux decay rates, and sensor inputs (pressure drop, conductivity) to accurately predict imminent fouling or scaling events, scheduling automated cleaning cycles proactively rather than reactively, significantly extending the time between shutdowns.

- Dynamic Process Optimization: Implementing reinforcement learning models to instantaneously adjust NF system variables, such as cross-flow velocity and applied pressure, to maintain optimal energy efficiency and consistent permeate quality despite fluctuations in raw feed water temperature, total dissolved solids (TDS), or organic load.

- Enhanced Fouling Detection and Diagnosis: Employing deep learning techniques to analyze complex datasets from spectroscopic sensors and digital imaging of membrane surfaces, enabling rapid, non-invasive identification and classification of fouling types (biological, colloidal, scaling), allowing for the application of targeted, more effective cleaning protocols.

- Automated Membrane Material Screening and Design: Leveraging AI and computational chemistry to simulate molecular transport phenomena across new membrane materials, accelerating the development cycle for next-generation nanofiltration membranes with improved chemical resistance, higher selectivity, and inherent anti-fouling properties, reducing physical prototyping requirements.

- Supply Chain and Inventory Management: Using AI to forecast the demand for replacement spiral wound elements across various regional markets and end-use sectors, optimizing manufacturing production schedules and stocking levels, thereby reducing lead times for critical industrial customers.

DRO & Impact Forces Of Spiral Wound Nanofiltration Membrane Market

The Spiral Wound Nanofiltration Membrane Market is governed by a dynamic interplay of factors. Key drivers (D) include the escalating crisis of global water scarcity and the subsequent political and regulatory pressures requiring higher water reuse and recycling rates, particularly in water-intensive industrial hubs. Restraints (R) primarily involve the high initial capital investment required for NF systems and the pervasive challenge of membrane fouling, which necessitates frequent chemical cleaning and leads to operational complexity and increased downtime. Opportunities (O) are plentiful, driven by the emergence of new high-value applications, such as resource recovery (brine mining for lithium and magnesium) and the precise fractionation of components in the pharmaceutical and nutraceutical industries, which demand highly selective separation capabilities. These forces collectively shape the market trajectory, creating a strong imperative for technological innovation focusing on durability and operational simplicity.

The dominant driving force remains the tightening global regulatory landscape. Governments, especially in North America and Europe, are imposing stricter limits on the discharge of specific contaminants, including pharmaceuticals, endocrine disruptors, and emerging pollutants (like PFAS), which conventional treatment methods cannot effectively address. Nanofiltration, with its ability to reject molecules larger than 1 nanometer, is increasingly being adopted as a robust tertiary treatment barrier. Furthermore, the economic incentive for industrial users to minimize water intake costs by implementing closed-loop systems, where NF plays a central role in polishing wastewater for internal reuse, significantly stimulates market expansion. The high efficacy of nanofiltration in color and partial hardness removal also makes it indispensable for applications where aesthetic water quality is paramount, such as beverage production.

However, the technological constraint posed by membrane fouling—a reduction in permeate flux over time due to contaminant deposition—acts as a significant market impediment. While technological advancements have introduced anti-fouling coatings and improved feed spacers, frequent cleaning remains an operational necessity, increasing chemical usage and maintenance costs, which can deter adoption in smaller facilities. Another critical restraint is the sensitivity of many standard polyamide NF membranes to high concentrations of oxidizers (like chlorine) and extreme pH conditions, limiting their application in aggressive industrial streams. Despite these challenges, the overwhelming opportunity presented by the integration of NF into sustainable water management systems—coupled with ongoing material science breakthroughs promising more robust and selective membranes—ensures a favorable long-term market outlook.

Segmentation Analysis

The Spiral Wound Nanofiltration Membrane Market is highly fragmented, segmented primarily based on the fundamental characteristics of the membrane (Material Type), its ultimate purpose (Application), and the context in which it is employed (End-Use Industry). This segmentation allows market players to specialize in manufacturing elements tailored for specific requirements, optimizing performance parameters such as salt rejection rates, operating pressure, and chemical resistance. The performance demands vary significantly across these segments; for instance, membranes used in pharmaceutical applications require extreme cleanliness and solvent resistance, while those used in municipal water softening prioritize high flow rates and efficient divalent ion rejection.

Analysis of these segments reveals that the Polyamide TFC material type continues to dominate due to its versatility, stability, and established manufacturing processes. The application segmentation underscores the dominance of the Water Treatment and Purification sector, which encompasses vast governmental and industrial projects focused on securing potable water supplies and managing industrial effluents. The rapid expansion of the Food & Beverage and Pharmaceutical segments is driving demand for custom-sized and validated hygienic membrane elements, often utilizing specialized materials or surface modifications to prevent biofouling and ensure compliance with regulatory standards like FDA and USP. Understanding these segment dynamics is crucial for strategic investment and product development planning.

- Material Type

- Polyamide Thin Film Composite (TFC)

- Cellulose Acetate/Triacetate

- Polyethersulfone (PES)

- Other Polymers (e.g., Polyethylene oxide (PEO))

- Application

- Water Treatment & Purification (Municipal Water Softening, Desalination Pre-treatment)

- Food & Beverage (Juice Concentration, Dairy Processing, Alcohol Separation)

- Pharmaceutical & Biotechnology (Antibiotic Concentration, Solvent Recovery, Fermentation Broth Clarification)

- Chemical Processing (Dye Removal, Catalyst Recovery, Effluent Polishing)

- End-Use Industry

- Municipal Water Treatment Utilities

- Industrial Water Treatment (Power Generation, Oil & Gas, Pulp & Paper)

- Wastewater Recycling and Reuse

- Specialized Manufacturing (Pharma, F&B, Chemicals)

Value Chain Analysis For Spiral Wound Nanofiltration Membrane Market

The value chain for the Spiral Wound Nanofiltration Membrane Market begins with Upstream Analysis, which focuses heavily on the procurement and synthesis of highly specialized polymer precursors, monomers, and casting solvents, primarily supplied by large chemical companies. Key raw materials include materials necessary for the substrate layer (e.g., polyester or non-woven fabric) and the active layer components, typically polyamides resulting from interfacial polymerization. Ensuring the consistent quality and chemical purity of these precursors is paramount, as even minor variations can drastically impact the selectivity and flux of the final membrane element. Technological partnerships between membrane manufacturers and polymer suppliers are essential to drive innovations in low-pressure, high-rejection chemistries. This upstream segment is characterized by high barriers to entry due to stringent quality control requirements and proprietary polymerization processes.

The Core Manufacturing stage involves the highly technical steps of membrane sheet fabrication (via solution casting or interfacial polymerization), followed by the complex rolling process that creates the spiral wound element structure, including the integration of permeate carriers, feed spacers, and anti-telescoping devices. Manufacturing efficiency and yield optimization are critical profitability factors in this middle segment. Downstream Analysis encompasses system integrators and Original Equipment Manufacturers (OEMs) who design, assemble, and install large-scale NF systems, incorporating peripheral components like pumps, pre-filtration units, and automated cleaning systems. These integrators often work closely with consulting engineering firms to design customized solutions based on the client’s feed water characteristics and purification objectives.

Distribution Channels for spiral wound NF elements are typically bifurcated into Direct and Indirect sales. Direct channels are utilized for large, high-volume contracts with major municipal utilities or integrated industrial conglomerates, often involving custom-sized elements and long-term service agreements. Indirect channels involve a network of specialized regional distributors, agents, and service providers who handle sales, inventory, and technical support for smaller industrial clients and replacement market demand. The aftermarket for replacement elements constitutes a significant, stable revenue stream for manufacturers. Effective channel management, including rapid response technical service and training, is crucial for maintaining customer loyalty and penetrating niche markets requiring specific technical expertise, such as brine concentration or pharmaceutical API purification.

Spiral Wound Nanofiltration Membrane Market Potential Customers

The primary End-User/Buyers of spiral wound nanofiltration membranes are highly diverse, spanning both public utilities and heavy industrial sectors, all unified by the critical requirement for precise water quality control and separation efficiency. Municipal Water Treatment Utilities constitute a massive segment, utilizing NF primarily for water softening—removing hardness-causing multivalent ions like calcium and magnesium—and increasingly for removing color, disinfection by-products precursors, and emerging contaminants, ensuring compliance with strict potable water standards. These utilities prioritize longevity, operational stability, and low maintenance costs in their membrane selections, often driving large, long-term contracts for standardized elements.

The Industrial Water Treatment sector represents the most technologically demanding and rapidly growing customer base, including the Power Generation industry (boiler feed water pre-treatment, cooling tower blowdown recycling), the Oil & Gas sector (produced water treatment, sulfate removal), and the Chemical Processing industry (catalyst recovery, purification). These industries seek customized, chemically resistant membranes capable of handling high temperatures, aggressive solvents, or extreme pH ranges. The economic viability of industrial operations is increasingly tied to effective water management and reuse, positioning NF as a core technology for achieving water stewardship goals and minimizing effluent discharge costs.

Furthermore, specialized manufacturing industries, particularly Food & Beverage (F&B) and Pharmaceutical & Biotechnology, represent high-value potential customers. F&B companies use NF for concentrating sugars, separating amino acids, polishing juices, and maintaining highly specific product quality profiles. Pharmaceutical companies employ NF for solvent purification, separation of Active Pharmaceutical Ingredients (APIs), and production of ultra-pure water (UPW). These end-users require membranes that meet stringent sanitary design standards, possess high selectivity for low molecular weight compounds, and are supplied with necessary validation documentation, often necessitating partnerships with niche membrane providers capable of delivering customized, sterile products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850.5 Million |

| Market Forecast in 2033 | USD 1,560.8 Million |

| Growth Rate | 8.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DuPont (FilmTec), Toray Industries, Suez Water Technologies & Solutions, Koch Separation Solutions, Nitto Denko (Hydranautics), Pentair, LG Chem, Vontron Technology, Hangzhou Fuyang Fuchunjiang Power Co., NX Filtration, Membranium, Alfa Laval, Evoqua Water Technologies, CSM (Woongjin Chemical), Rochem Technical Services, Keensen Technology, Microdyn-Nadir, Novasep, Applied Membranes, Pure Aqua. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Spiral Wound Nanofiltration Membrane Market Key Technology Landscape

The technological landscape of the Spiral Wound Nanofiltration Membrane Market is dominated by advancements in Thin Film Composite (TFC) membrane manufacturing and proprietary module design innovations aimed at improving performance and durability. TFC membranes, typically constructed via interfacial polymerization on a porous support layer, allow for independent optimization of the active selective layer and the structural support, yielding higher fluxes and customizable selectivity profiles compared to older asymmetric membranes. Recent technological focus includes techniques like coating TFC surfaces with zwitterionic or highly hydrophilic polymers to significantly enhance anti-fouling resistance against organic and biological materials, thereby reducing the frequency of chemical cleaning and extending the operational lifespan of the spiral elements in challenging wastewater streams.

Module configuration innovations are also pivotal to market growth. Standard spiral wound elements offer high surface area, but manufacturers are continuously refining feed spacer geometry to minimize pressure drop and mitigate concentration polarization, which exacerbates fouling. Advanced spacer designs, including corrugated or patterned spacers, promote turbulent flow patterns near the membrane surface, effectively scouring away deposited foulants. Furthermore, the development of specialized low-fouling NF elements capable of operating efficiently at lower trans-membrane pressures (L-NF) is crucial, as it directly translates to reduced energy consumption, addressing one of the primary operational expenditures for system operators and enhancing the economic appeal of nanofiltration technology.

A significant emerging technological frontier involves the commercialization of robust ceramic and polymeric-hybrid NF membranes, offering enhanced tolerance to extreme chemical environments and high temperatures common in industrial waste processing. These novel materials challenge the conventional dominance of polyamide TFCs by offering stability in highly acidic or caustic conditions. Concurrently, the integration of real-time monitoring technologies, utilizing sophisticated sensors and software systems for continuous measurement of flux, temperature, and pressure, allows for highly accurate digital twinning of the membrane system. This digital oversight is essential for proactive operational adjustments and seamless integration with AI-powered predictive maintenance platforms, driving the market toward smart, self-regulating membrane filtration plants.

Regional Highlights

Regional dynamics play a crucial role in shaping the Spiral Wound Nanofiltration Membrane Market, driven by variances in water resource availability, industrialization levels, and the stringency of environmental regulations. Asia Pacific (APAC) represents the largest and fastest-growing market segment globally. Countries such as China, India, and Southeast Asian nations are undergoing rapid industrial expansion, leading to massive increases in industrial wastewater discharge requiring advanced treatment. Governments in these regions are actively implementing large-scale infrastructure projects focused on water purification and recycling to support burgeoning urban populations and manufacturing hubs, creating immense demand for cost-effective, high-efficiency NF solutions. The use of NF for pre-treatment in major desalination plants across the Australian and Indian coastal regions further fuels regional growth.

North America maintains a technologically mature market, characterized by high adoption rates in municipal water treatment and stringent regulation regarding emerging contaminants. The region focuses heavily on tertiary treatment to remove trace organic compounds (TOCs), pharmaceuticals, and endocrine disruptors, contaminants for which NF is highly suited. The U.S. market is significantly driven by industrial reuse initiatives, particularly in the oil and gas (shale water) and power generation sectors, where compliance with federal and state effluent limitations mandates advanced filtration technologies. Innovation in anti-fouling NF membranes and modular, decentralized treatment systems is highly prioritized in this region, often utilizing sophisticated monitoring and control systems.

Europe exhibits sustained growth, primarily propelled by its strong commitment to the Circular Economy and stringent directives regarding wastewater reuse and quality, such as the EU Water Framework Directive. European markets, particularly Germany, the Netherlands, and France, lead in the integration of nanofiltration into municipal sewage treatment plants for water reuse and agricultural irrigation purposes. Furthermore, the extensive food and beverage industry in Europe utilizes NF membranes for product fractionation and concentration, demanding specialized, sanitary design elements. The Middle East and Africa (MEA) market is rapidly expanding, fueled by significant investments in desalination infrastructure, particularly in the Arabian Peninsula, where NF is essential for reducing the salinity and hardness of brackish feed water before reverse osmosis, optimizing the overall energy expenditure of critical water supply systems.

- Asia Pacific (APAC): Dominant market share and highest growth rate due to rapid industrialization, large-scale urbanization, and significant governmental investments in water infrastructure, particularly in China and India, driving municipal water quality improvements and wastewater recycling adoption.

- North America: Mature market focused on compliance with strict regulations regarding emerging pollutants (PFAS removal) and large-scale industrial water recycling projects in the power, refining, and semiconductor manufacturing sectors.

- Europe: Driven by strong circular economy policies, emphasizing wastewater reuse, agricultural irrigation safety, and extensive application in the stringent food and pharmaceutical manufacturing industries requiring high-purity separation.

- Middle East & Africa (MEA): Rapidly growing market centered on large desalination projects, where NF serves as an essential pre-treatment step to reduce scaling and fouling in hyper-saline environments, ensuring sustainable water supply in arid regions.

- Latin America: Emerging market with accelerating demand driven by resource extraction industries (mining, oil and gas) requiring efficient water management solutions and growing urbanization pressuring municipal water utilities to upgrade treatment capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Spiral Wound Nanofiltration Membrane Market.- DuPont (FilmTec)

- Toray Industries

- Suez Water Technologies & Solutions

- Koch Separation Solutions

- Nitto Denko (Hydranautics)

- Pentair

- LG Chem

- Vontron Technology

- Hangzhou Fuyang Fuchunjiang Power Co.

- NX Filtration

- Membranium

- Alfa Laval

- Evoqua Water Technologies

- CSM (Woongjin Chemical)

- Rochem Technical Services

- Keensen Technology

- Microdyn-Nadir

- Novasep

- Applied Membranes

- Pure Aqua

Frequently Asked Questions

Analyze common user questions about the Spiral Wound Nanofiltration Membrane market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a spiral wound nanofiltration membrane compared to Reverse Osmosis (RO) membranes?

Spiral wound nanofiltration (NF) membranes primarily focus on selective separation, rejecting divalent ions (like calcium, magnesium) and larger organic molecules (color bodies) while allowing monovalent ions (like sodium, chloride) to pass. Unlike Reverse Osmosis (RO), NF operates at lower pressure, minimizing energy consumption, and is ideal for water softening or color removal where full TDS removal is not required.

Which industries are the major end-users driving the growth of the NF membrane market?

The major end-users are Municipal Water Treatment Utilities, utilizing NF for water softening and removal of disinfection by-product precursors, and the Industrial Water Treatment sector, specifically the Food & Beverage industry for concentration and purification, and the Chemical sector for catalyst recovery and effluent polishing. Industrial water reuse mandates are a significant growth driver.

How does membrane fouling affect the operational efficiency and lifespan of spiral wound NF systems?

Membrane fouling, caused by the deposition of organic, inorganic, or biological contaminants on the membrane surface, is the primary operational challenge. It reduces permeate flux, increases the required operating pressure, significantly raises energy costs, and necessitates frequent chemical cleaning, ultimately shortening the membrane element's effective lifespan if not proactively managed through advanced pre-treatment and anti-fouling technologies.

What technological advancements are leading to enhanced nanofiltration membrane performance?

Key technological advancements include the development of highly selective, low-pressure Thin Film Composite (TFC) membranes, the introduction of advanced anti-fouling coatings (e.g., highly hydrophilic surfaces) to minimize chemical cleaning frequency, and innovations in feed spacer geometry to reduce pressure drop and concentration polarization within the spiral wound element.

Why is the Asia Pacific region projected to exhibit the highest growth rate in this market?

The Asia Pacific region's high growth rate is attributed to rapid, massive-scale industrial expansion and urbanization, leading to increased water stress and stringent environmental regulations concerning industrial effluent. Large government investments in upgrading municipal water and wastewater infrastructure across countries like China and India necessitate the adoption of advanced, high-efficiency separation technologies like spiral wound nanofiltration.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager