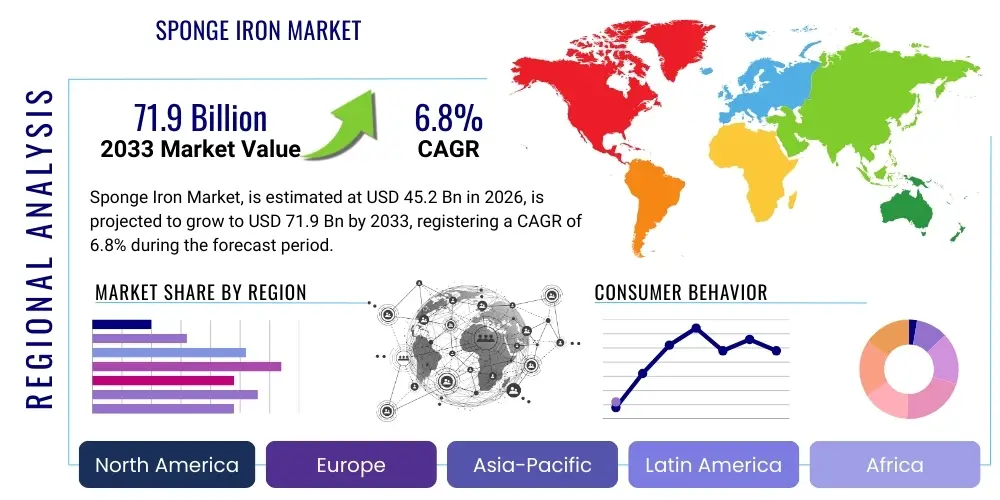

Sponge Iron Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437643 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Sponge Iron Market Size

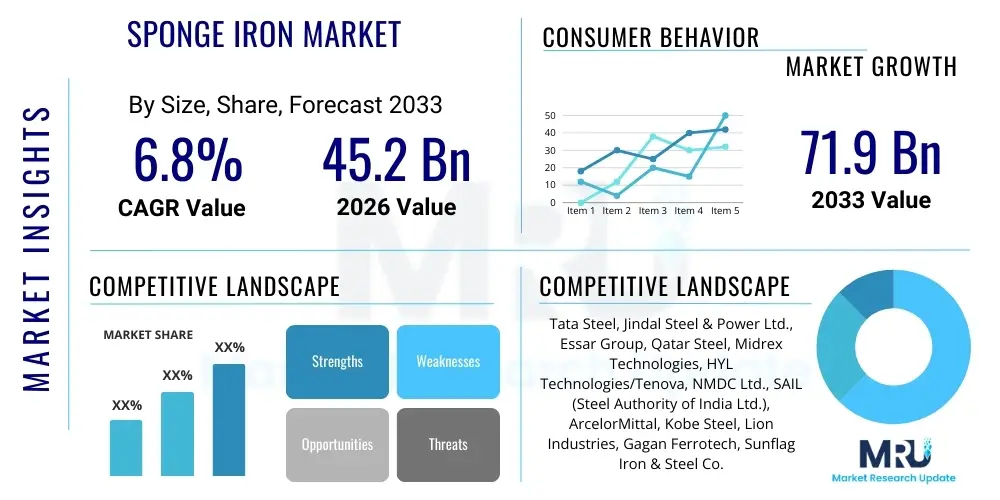

The Sponge Iron Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 45.2 Billion in 2026 and is projected to reach USD 71.9 Billion by the end of the forecast period in 2033.

The consistent expansion of the global steel industry, particularly the rise in utilization of Electric Arc Furnaces (EAF) and Induction Furnaces (IF), serves as the primary catalyst for the sustained growth observed in the sponge iron sector. Sponge iron, or Direct Reduced Iron (DRI), acts as a high-quality substitute for scrap metal, offering purity and consistency crucial for manufacturing high-grade steel products, thus mitigating the supply risks associated with ferrous scrap and positioning it centrally within modern steelmaking methodologies.

Market expansion is further supported by significant governmental initiatives globally focused on infrastructure development, residential construction, and automotive manufacturing, predominantly in emerging economies across the Asia Pacific region. These activities generate robust demand for steel products, consequently driving the need for reliable, high-purity inputs like sponge iron. However, the market faces constraints related to the high energy intensity of production, whether coal-based or gas-based, requiring continuous technological innovation to improve energy efficiency and align with global decarbonization goals, a factor that will define competitiveness over the forecast period.

Sponge Iron Market introduction

The Sponge Iron Market encompasses the production and trade of Direct Reduced Iron (DRI), a highly porous, metallic product created by reducing iron ore without melting it, usually in the form of lumps, pellets, or briquettes. This product is characterized by its high metallic iron content and low levels of harmful impurities like sulfur and phosphorus, making it an essential raw material in steel production, particularly within EAF and IF processes. Historically, the shift towards cleaner and more flexible steel production methods has elevated the role of sponge iron, positioning it as a preferred metallic charge over traditional methods that rely heavily on primary resources and polluting processes.

Major applications of sponge iron are concentrated within the secondary steelmaking sector, where it is used as a superior alternative or supplement to ferrous scrap. Its chemical purity allows steel manufacturers to produce specialized, high-performance steel grades required in critical end-use sectors such as automotive components, high-rise construction, and specialized machinery. The benefits of using sponge iron include improved control over the chemical composition of the final steel product, reduced operational costs in the furnace due to minimized slag formation, and enhanced overall productivity and efficiency in the steelmaking process, driving its adoption across mature and developing industrial landscapes.

Driving factors underpinning the market include the global push for lower carbon emissions in steel manufacturing, favoring the use of DRI/HBI (Hot Briquetted Iron) processes which, especially when fueled by natural gas or emerging green hydrogen, offer a significantly cleaner pathway compared to conventional blast furnace methods. Furthermore, the volatility and localized shortages in the scrap metal market compel steel producers to seek stable, quality-assured raw materials, solidifying sponge iron's crucial supply chain role. Continuous investments in infrastructure projects worldwide, especially high-speed rail networks, urban development, and energy infrastructure, ensure a perpetually strong demand baseline for foundational steel materials.

Sponge Iron Market Executive Summary

The Sponge Iron Market is currently experiencing robust business trends driven primarily by the global shift towards EAF-based steel production, offering higher energy efficiency and lower capital intensity compared to traditional blast furnaces. A major trend involves the increasing utilization of Hot Briquetted Iron (HBI), a densified form of DRI, which facilitates safer and more economical long-distance transportation and storage, thereby expanding the potential global supply chain reach for key producers, particularly those located near abundant natural gas sources. Furthermore, strategic vertical integration by major steel producers, acquiring or establishing dedicated DRI production facilities, is a key characteristic enhancing operational stability and raw material security across the industry.

Regionally, the Asia Pacific (APAC) dominates the market, largely propelled by the massive production capacities in India, which is a major global consumer and producer, often relying on the coal-based reduction route due to indigenous coal availability. However, regions rich in natural gas, such as the Middle East and North Africa (MENA), exhibit strong growth in gas-based DRI production, positioning them as key exporters of HBI. North America and Europe, while having mature steel industries, are increasingly focusing on technological improvements and green hydrogen-fueled DRI projects to comply with stringent environmental regulations and capitalize on circular economy initiatives, shifting the competitive landscape toward sustainability and technology leadership.

Segmentation analysis reveals that the Coal-based process segment, although challenged by environmental concerns, holds a substantial share due to its cost-effectiveness and prevalence in countries with limited natural gas infrastructure. However, the Gas-based segment is forecasted to witness the highest CAGR, spurred by advancements in mid-sized plant technology and the pursuit of lower carbon intensity processes. In terms of application, the Electric Arc Furnace segment remains the largest consumer, reflecting its flexibility and efficiency in steel recycling and high-purity steel manufacturing, confirming its centrality in future steel market dynamics.

AI Impact Analysis on Sponge Iron Market

Users frequently inquire about how Artificial Intelligence (AI) can optimize the notoriously energy-intensive and complex processes involved in sponge iron production, particularly focusing on energy efficiency, predictive maintenance, and raw material quality control. Key concerns revolve around the feasibility and ROI of implementing AI in highly physical industrial settings, the requirements for data infrastructure, and how AI might assist in managing the volatile factors of temperature, pressure, and gas composition crucial for efficient reduction. The general expectation is that AI will be a transformative tool in optimizing both the traditional coal-based kilns and the modern gas-based shafts, leading to reduced operational variability, significant cost savings, and enhanced product consistency, which are paramount for maintaining competitive advantage in global steel markets.

- AI-powered Predictive Maintenance: Utilizes sensor data from kilns, reactors, and material handling equipment to forecast failures, minimizing unplanned downtime and maximizing asset utilization, which is critical in capital-intensive DRI plants.

- Optimized Energy Management: AI algorithms dynamically adjust fuel feed rates (natural gas or coal) and oxidant levels based on real-time feedback, ensuring optimal reduction efficiency and substantial reductions in specific energy consumption (SEC).

- Enhanced Process Control: Machine learning models analyze complex thermodynamic variables (temperature profiles, pressure fluctuations) to maintain precise control over the reduction zone, leading to higher metallization rates and improved sponge iron quality consistency.

- Supply Chain and Logistics Optimization: AI systems predict demand fluctuations, optimize inventory levels of iron ore pellets and reductants, and streamline the logistics of HBI export, reducing working capital requirements and transport costs.

- Automated Quality Inspection: Computer vision and AI are used to analyze the physical and chemical properties of the produced sponge iron (e.g., degree of metallization, porosity) in real-time, ensuring stringent quality specifications are met instantly before dispatch.

- Green Technology Integration: AI assists in modeling and optimizing the integration of nascent technologies, such as hydrogen injection or capture of process gases, accelerating the transition towards low-carbon or 'green' DRI production methods.

- Safety and Risk Mitigation: AI monitors operational parameters for anomalies indicative of hazardous conditions, such as temperature runaways or gas leaks, enhancing worker safety and protecting high-value industrial assets.

DRO & Impact Forces Of Sponge Iron Market

The dynamics of the Sponge Iron Market are shaped by powerful Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces dictating market trajectory. The primary driver is the accelerating global preference for EAF-based steel production, catalyzed by its lower environmental footprint compared to traditional integrated steel mills, alongside the scarcity and fluctuating quality of conventional scrap metal, which positions high-purity DRI as an indispensable charge material. Concurrently, rapid urbanization and massive infrastructure build-out programs, especially across Asia and parts of Africa, create sustained and inelastic demand for steel, directly translating into robust requirements for metallic raw materials like sponge iron.

However, significant restraints temper the market's explosive growth potential. Foremost among these is the inherent energy intensity of both coal-based and gas-based reduction processes. Volatile and often high prices for reductants (coal, natural gas) directly impact production costs, making profitability highly sensitive to global energy market fluctuations. Furthermore, the coal-based route, prevalent in major producing nations like India, faces increasing regulatory pressure and public scrutiny due to high carbon emissions, necessitating substantial capital investment in cleaner technologies or a complete transition to gas-based or hydrogen-based methods.

The most compelling opportunity lies in the burgeoning 'Green Steel' movement, which views hydrogen-fueled Direct Reduction (H-DRI) as the most viable path to decarbonize the primary steel industry. This potential technological pivot attracts enormous public and private investment, promising a future where sponge iron production aligns with global net-zero targets. Additionally, geographical expansion into regions with underdeveloped steel industries and strategic diversification into higher-value products like Hot Briquetted Iron (HBI) or Cold Briquetted Iron (CBI) offer avenues for sustainable growth, mitigating logistical challenges and accessing new export markets efficiently.

Segmentation Analysis

The Sponge Iron Market is systematically segmented based on the manufacturing process, application, end-use industry, and physical size, reflecting the diverse technological pathways and varied industrial requirements for this metallic input. The manufacturing process segmentation distinguishes between the prevalent Coal-based and Gas-based methods, which fundamentally dictates the product's quality, energy consumption profile, and regional applicability. The application segment, primarily Electric Arc Furnace (EAF) and Induction Furnace (IF), highlights the end-user preference for sponge iron's purity in different steelmaking configurations. Understanding these segments is vital for producers to tailor their product offerings and geographical strategies, ensuring alignment with specific industrial demands and regulatory environments worldwide.

The analysis reveals significant technological disparity between segments; while the Gas-based method offers superior metallization and lower impurities, making it ideal for high-grade steel production, the Coal-based route remains critical in areas with abundant domestic coal reserves, capitalizing on cost advantages despite environmental constraints. Furthermore, end-use segmentation underscores the market's dependence on cyclical sectors such as Construction and Automotive, emphasizing the sensitivity of sponge iron demand to global economic health and infrastructure spending patterns. The move towards specialized, infrastructure-heavy projects, such as high-performance bridges and specialized industrial machinery, inherently boosts demand for the high-purity steel enabled by quality sponge iron inputs.

- By Manufacturing Process:

- Coal-based

- Gas-based

- By Application:

- Electric Arc Furnace (EAF)

- Induction Furnace (IF)

- Basic Oxygen Furnace (BOF)

- By End-Use Industry:

- Construction and Infrastructure

- Automotive and Transportation

- Machinery and Equipment

- Oil and Gas

- By Size and Form:

- Lumps (Direct Reduced Iron - DRI)

- Pellets (Direct Reduced Iron - DRI)

- Hot Briquetted Iron (HBI)

- Cold Briquetted Iron (CBI)

- By Grade:

- High Metallization Grade (92%+)

- Standard Metallization Grade (88%-92%)

Value Chain Analysis For Sponge Iron Market

The value chain of the Sponge Iron Market commences with the upstream analysis, primarily focusing on the extraction and beneficiation of high-quality raw materials, specifically iron ore (pellets or lumps) and reductants (metallurgical coal, natural gas, or increasingly, hydrogen). Reliable access to iron ore, characterized by high iron content and low gangue, is critical for efficient direct reduction. Major iron ore miners often form strategic alliances or integrate vertically with sponge iron producers to ensure stable supply and quality consistency. The cost of these primary inputs, particularly energy sources, represents the largest component of the overall production cost, making feedstock procurement strategy a decisive factor in market competitiveness.

The core of the value chain involves the reduction process itself, spanning various technologies such as Midrex (gas-based), HYL/Energiron (gas-based), and Rotary Kiln (coal-based). Efficiency and technological sophistication at this stage directly impact the quality (metallization rate) and profitability of the sponge iron produced. Distribution channels play a vital role, especially for HBI, which is often shipped globally. Direct sales channels, involving long-term contracts between large sponge iron manufacturers and steel mills (both EAF and BOF operators), ensure stable volume off-take. Indirect channels rely on established trading houses and specialized metals brokers to move smaller volumes or handle spot market transactions, bridging geographical gaps between suppliers (e.g., MENA) and major consumers (e.g., Southeast Asia, Europe).

Downstream analysis centers on the consumption of sponge iron in the steelmaking process, predominantly in EAFs and IFs, and its subsequent role in shaping end products used in Construction, Automotive, and specialized machinery. The effectiveness of the supply chain is measured by the ability to deliver high-quality, non-oxidized material promptly, influencing the operational continuity and cost structure of downstream steel producers. Continuous investment in briquetting technology (HBI) is an ongoing upstream trend aimed at maximizing downstream handling efficiency and minimizing material degradation during transit, thereby adding critical value and reducing risk for end-users requiring reliable material feedstock.

Sponge Iron Market Potential Customers

The primary potential customers and end-users of sponge iron are global steel manufacturers operating secondary steelmaking facilities, predominantly those utilizing Electric Arc Furnaces (EAFs) and, to a lesser extent, Induction Furnaces (IFs). These customers rely on sponge iron to achieve the desired high-purity chemical composition in specialty steel products where contamination from scrap metal is unacceptable. Major integrated steel companies that utilize Basic Oxygen Furnaces (BOFs) also represent a growing customer base, as they sometimes incorporate small amounts of DRI/HBI into their charge mix to cool the process and dilute impurities, particularly when producing specific grades of structural or sheet steel.

Beyond the core steel industry, there is an increasing demand from specialized ferrous alloy producers and foundries. Foundries require clean metallic charge for casting high-integrity components used in demanding sectors such as aerospace and defense, where material consistency is paramount. The increasing focus on electric vehicle (EV) production globally necessitates higher quality, specialized steel grades for components and charging infrastructure, making automotive component manufacturers, through their steel suppliers, indirect yet crucial consumers of high-purity sponge iron, driving demand for the premium gas-based DRI segment.

Geographically, customers in rapidly urbanizing economies, particularly in the APAC region (India, Southeast Asia) and MENA, represent the largest and fastest-growing customer segment due to immense infrastructural needs. Developed markets in North America and Europe, constrained by strict carbon emission reduction targets, show a preference for HBI and are key potential customers for emerging low-carbon or green-hydrogen based DRI/HBI, reflecting a willingness to pay a premium for materials supporting their decarbonization strategies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.2 Billion |

| Market Forecast in 2033 | USD 71.9 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tata Steel, Jindal Steel & Power Ltd., Essar Group, Qatar Steel, Midrex Technologies, HYL Technologies/Tenova, NMDC Ltd., SAIL (Steel Authority of India Ltd.), ArcelorMittal, Kobe Steel, Lion Industries, Gagan Ferrotech, Sunflag Iron & Steel Co. Ltd., Godawari Power & Ispat Ltd., BSRM Steels, Electrosteel Steels Ltd., Monnet Ispat & Energy Ltd., Rungta Mines, Kalyani Steel Ltd., MSP Steel & Power Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sponge Iron Market Key Technology Landscape

The technology landscape of the Sponge Iron Market is dominated by two primary technological families: Gas-based direct reduction and Coal-based direct reduction. The Gas-based route, championed by technologies like Midrex and HYL/Tenova (Energiron), utilizes shaft furnaces and natural gas (or synthesis gas) as the reductant. This process is highly favored for its continuous operation, ability to produce high-metallization DRI and HBI (Hot Briquetted Iron), and significantly lower emissions profile compared to coal-based methods. Continuous advancements in gas utilization efficiency and heat recovery within these processes are essential R&D priorities, aimed at lowering operating expenditures and decreasing the carbon footprint, maintaining their dominance in regions with abundant gas reserves like the Middle East and Russia.

Conversely, the Coal-based route, typically utilizing rotary kilns or multiple hearth furnaces, remains vital, particularly in countries like India where non-coking coal is domestically available and cost-effective. While inherently more polluting, technological efforts in this segment focus on waste heat recovery, improving the thermal efficiency of the kilns, and developing methods to manage and utilize the generated off-gases more effectively. Innovations such as enhancing the quality of iron ore feed and optimizing the solid reductant mixture are ongoing to improve the resulting sponge iron quality and reduce the overall environmental impact, ensuring this technology remains relevant in resource-constrained environments.

The most significant disruptive technological trend is the development and commercialization of Hydrogen-based Direct Reduction (H-DRI). This emerging technology replaces natural gas or coal entirely with green hydrogen (produced via renewable energy) as the reducing agent, resulting in water vapor as the only major byproduct, effectively achieving near-zero carbon emissions in the ironmaking stage. Major global steel players are heavily investing in pilot and commercial-scale H-DRI projects, often partnering with renewable energy producers. While still in its nascent stages and reliant on affordable green hydrogen infrastructure, H-DRI represents the long-term future of the sponge iron market and is expected to drive massive shifts in plant location and operational strategies throughout the forecast period, positioning early adopters for a strong competitive advantage in the future low-carbon economy.

Regional Highlights

Geographically, the Sponge Iron Market exhibits distinct regional dynamics, influenced by raw material availability, regulatory environments, and domestic steel demand. The Asia Pacific (APAC) region stands out as the global powerhouse, dominating both consumption and production volumes, largely driven by India, which operates the world's largest number of coal-based DRI plants. China's shift towards high-quality steel production and environmental controls has also increased demand for imported HBI and premium scrap alternatives, although its domestic production is heavily scrutinized. Infrastructure expenditure across Southeast Asia further underpins this regional dominance, ensuring continued high capacity utilization.

The Middle East and Africa (MEA), particularly countries within the Gulf Cooperation Council (GCC), are pivotal players in the global gas-based DRI market, benefiting from vast, low-cost natural gas reserves. These nations are major exporters of high-quality HBI to Europe and Asia. Their strategic focus on monetizing natural gas through high-value steel inputs has established them as key influencers in global sponge iron pricing and supply dynamics, with ongoing plans to expand capacity and explore hydrogen potential.

Europe and North America represent high-value, technology-focused markets. While domestic production capacity is moderate compared to APAC, these regions are at the forefront of decarbonization efforts. Demand is overwhelmingly concentrated on high-quality, often imported, HBI, and domestic focus is shifting rapidly toward pilot and commercial H-DRI projects, driven by governmental mandates and robust carbon pricing mechanisms. These regions set the benchmark for sustainable production practices, influencing global technological adoption rates and demanding stringent environmental criteria from their international suppliers.

- APAC (Asia Pacific): Dominant market in volume due to India's coal-based production and massive steel consumption in construction and manufacturing sectors; shifting focus toward gas-based imports and domestic HBI production to meet quality standards.

- MEA (Middle East and Africa): Key global exporter of Gas-based DRI and HBI, leveraged by low-cost natural gas; high focus on expanding export infrastructure and early adoption of hydrogen reduction technologies (H-DRI).

- North America: Stable demand driven by EAF steelmaking (mini-mills); increasing reliance on high-quality HBI imports and domestic efforts to utilize clean energy for future DRI plant conversions.

- Europe: Highly regulated market with a strong emphasis on decarbonization; significant investments in green steel initiatives and development of H-DRI facilities to meet ambitious EU Green Deal targets; high dependency on premium imported metallic charges.

- Latin America: Moderate growth market with domestic gas-based production (e.g., Mexico, Venezuela); market stability linked to regional infrastructure projects and commodity price cycles for iron ore and natural gas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sponge Iron Market.- Tata Steel

- Jindal Steel & Power Ltd.

- Essar Group

- Qatar Steel

- Midrex Technologies, Inc.

- HYL Technologies/Tenova

- NMDC Ltd.

- SAIL (Steel Authority of India Ltd.)

- ArcelorMittal

- Kobe Steel, Ltd.

- Lion Industries

- Gagan Ferrotech

- Sunflag Iron & Steel Co. Ltd.

- Godawari Power & Ispat Ltd.

- BSRM Steels

- Electrosteel Steels Ltd.

- Monnet Ispat & Energy Ltd.

- Rungta Mines

- Kalyani Steel Ltd.

- MSP Steel & Power Ltd.

Frequently Asked Questions

Analyze common user questions about the Sponge Iron market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between sponge iron and scrap metal for steel production?

Sponge iron (DRI) is a high-purity iron source with significantly lower residual elements like copper, nickel, and tin compared to typical ferrous scrap. Its chemical consistency is superior, making it essential for producing high-grade and specialty steels, whereas scrap purity is often variable and requires extensive processing.

How does the type of manufacturing process (coal vs. gas) affect sponge iron quality?

Gas-based sponge iron generally achieves higher levels of metallization and lower residual impurities (sulfur, phosphorus) due to the nature of the reductant and process control. Coal-based sponge iron, while cost-effective, typically has slightly lower metallization and higher impurity content, limiting its use in the most stringent high-grade steel applications.

What role does Hot Briquetted Iron (HBI) play in the global sponge iron supply chain?

HBI is densified DRI produced at high temperatures, making it physically robust, stable, and non-pyrophoric. This form significantly reduces the risk during international shipping and storage, transforming DRI from a localized product into a globally tradable commodity and expanding the market reach of major gas-based producers.

What is the outlook for hydrogen-based Direct Reduced Iron (H-DRI)?

H-DRI is considered the cornerstone of future decarbonization efforts in the steel industry. While currently constrained by the cost and availability of green hydrogen, the outlook is highly positive, with massive industry investments and government support forecasting commercial viability and rapid scale-up within the next decade, fundamentally reshaping the market structure.

Which regional market is driving the most demand for sponge iron currently?

The Asia Pacific (APAC) region, driven primarily by India’s robust domestic steel sector and ongoing massive infrastructure development projects, is currently the largest consumer and producer of sponge iron globally, accounting for the majority of the market volume.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager