Sports Apparel and Footwear Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433521 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Sports Apparel and Footwear Market Size

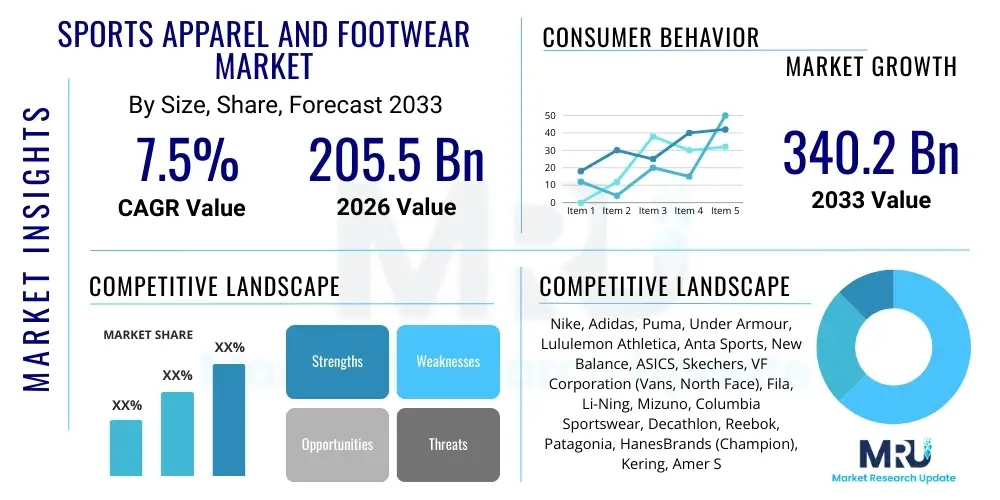

The Sports Apparel and Footwear Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at $205.5 Billion in 2026 and is projected to reach $340.2 Billion by the end of the forecast period in 2033.

Sports Apparel and Footwear Market introduction

The global Sports Apparel and Footwear Market encompasses all clothing, footwear, and accessories designed specifically for physical activity, athletic performance, or general activewear and leisure (athleisure). This market is characterized by rapid innovation in materials science, focusing on enhanced features such as moisture-wicking capability, thermal regulation, compression technology, and optimized cushioning systems in footwear. Products range from high-performance specialized gear used by professional athletes to mass-market items consumed by fitness enthusiasts and those adopting the growing athleisure lifestyle. The inherent demand is driven by the global increase in health consciousness and participation in organized sports and recreational fitness activities, establishing sports goods as essential components of a modern, active lifestyle.

The product segmentation within this market is extensive, covering categories like running shoes, basketball footwear, training apparel, outdoor sportswear, and team uniforms. Major applications span professional athletics, general fitness and training, recreational outdoor activities, and casual wear, which represents the largest volume segment due to the cultural shift toward comfortable and functional clothing. The core benefits derived from these products include improved performance through reduced drag and optimized body temperature, enhanced injury prevention via structural support and protection, and psychological benefits derived from wearing high-quality, aesthetically pleasing gear. These intrinsic values ensure sustained consumer interest, particularly as technology integration increases.

Key driving factors accelerating market expansion include significant investments in direct-to-consumer (D2C) channels by major brands, strategic focus on sustainable and ethical manufacturing practices responding to consumer preferences, and the powerful influence of social media and athlete endorsements that shape purchasing decisions. Furthermore, governmental initiatives promoting physical health and combating obesity in developed and developing nations bolster market fundamentals. The confluence of demographic shifts favoring active lifestyles and technological advancements leading to superior product offerings solidifies the long-term growth trajectory for both the apparel and footwear segments globally, making this a dynamic and highly competitive sector.

Sports Apparel and Footwear Market Executive Summary

The Sports Apparel and Footwear Market is experiencing a pivotal transformation driven by shifting consumer preferences towards comfort, versatility, and sustainability. A key business trend involves the rapid acceleration of the Direct-to-Consumer (D2C) model, allowing major brands to control the entire customer experience, manage inventory efficiently, and maximize profit margins by bypassing traditional retail intermediaries. Simultaneously, market penetration strategies are heavily focused on capitalizing on the athleisure trend, blurring the lines between athletic gear and everyday fashion. Innovation in material science, particularly the development of recycled fabrics and biodegradable components, has become a competitive necessity, addressing the growing environmental consciousness among the millennial and Gen Z consumer base.

Regionally, the market dynamic is characterized by the robust maturity of North America and Europe, which continue to drive premiumization and technological adoption, particularly in performance wear. However, the most significant growth impetus originates from the Asia Pacific (APAC) region, specifically China and India, where rising disposable incomes, expanding middle classes, and increasing government support for sports participation are fueling massive demand. Brands are aggressively localizing product lines and marketing campaigns to connect with culturally diverse consumers in these high-growth areas. Latin America and the Middle East also present burgeoning opportunities, driven by urbanization and rising engagement with global sporting events like the FIFA World Cup.

Segmentation trends highlight the dominant growth of the footwear segment, particularly in specialized running and training categories, propelled by continuous advancements in midsole technology and custom fitting solutions. Within apparel, the Women’s segment is demonstrating exceptionally strong performance, fueled by the rising participation of women in fitness activities and the resulting demand for specialized, stylish, and comfortable female-specific athletic wear. Distribution continues to favor the online channel, which provides greater convenience, customization options, and superior information transparency compared to traditional brick-and-mortar stores, although physical retail remains crucial for experiential shopping and instant product interaction. The integration of digital tools, such as augmented reality fitting rooms, is enhancing the omnichannel experience.

AI Impact Analysis on Sports Apparel and Footwear Market

User inquiries regarding Artificial Intelligence (AI) in the sports apparel and footwear sector typically revolve around hyper-personalization, optimized manufacturing efficiency, and predictive inventory management. Consumers and stakeholders are keen to understand how AI can tailor shoe designs to individual gait analysis, create personalized apparel based on biometric data, and streamline complex global supply chains to reduce waste and delivery times. Furthermore, there is significant interest in AI's role in fraud detection, combating counterfeiting, and enhancing the overall customer journey through sophisticated virtual assistants and personalized digital marketing campaigns. The core theme is leveraging machine learning for precision, efficiency, and a truly bespoke consumer offering, moving the industry towards 'smart' manufacturing and 'intelligent' products.

- AI-Driven Product Customization: Utilizing machine learning algorithms to analyze extensive biometric data, gait mechanics, and user performance records to design hyper-personalized footwear and compression apparel, optimizing fit and performance.

- Predictive Inventory and Demand Forecasting: Implementing AI models to forecast consumer demand with greater accuracy, minimizing overstocking and reducing logistical costs associated with unsold inventory and mitigating stock-outs during peak seasons.

- Optimized Supply Chain Management: Employing AI to monitor and manage complex sourcing, production, and distribution networks in real-time, identifying potential bottlenecks, optimizing transport routes, and improving overall supply chain resilience and responsiveness.

- Smart Fabric Development and Integration: AI accelerating material science research by simulating the performance characteristics of new textile blends and smart materials, leading to faster development cycles for advanced moisture-wicking and temperature-regulating fabrics.

- Enhanced Customer Experience (CX): AI-powered chatbots, virtual sizing tools, and recommendation engines deployed across e-commerce platforms to provide 24/7 personalized shopping assistance, improving conversion rates and reducing product returns related to poor fit.

- Counterfeiting and Brand Protection: AI algorithms analyzing marketplace data and consumer reports to quickly identify and flag fraudulent listings and counterfeit products, protecting brand integrity and revenue streams in the digital environment.

- Performance Tracking and Coaching Integration: Embedding AI components into wearable technology (smart apparel) to provide real-time performance feedback, injury risk assessments, and personalized training recommendations to athletes and general users.

DRO & Impact Forces Of Sports Apparel and Footwear Market

The Sports Apparel and Footwear Market operates under a dynamic set of driving, restraining, and opportunity factors that collectively shape its impact forces. The primary driver is the accelerating global focus on health, wellness, and preventative healthcare, leading to increased participation in recreational sports and fitness activities across all age demographics. This heightened health consciousness translates directly into demand for specialized, high-quality gear. Concurrent to this is the profound influence of the athleisure trend, transforming athletic wear into mainstream fashion and significantly broadening the consumer base beyond traditional athletes. Technological innovation in materials, such as bio-based textiles and enhanced cushioning systems like thermoplastic polyurethane (TPU) foams, also acts as a crucial driver, perpetually offering reasons for consumers to upgrade their equipment and apparel.

Conversely, the market faces significant restraints, notably the persistent threat of counterfeiting and the resultant intellectual property infringement, which dilutes brand value and erodes market share, particularly in emerging economies. High initial product development costs associated with advanced performance textiles and specialized manufacturing processes present an obstacle, often leading to premium pricing that limits accessibility for certain consumer segments. Economic volatility and inflation, impacting raw material costs (like petroleum-derived synthetics) and consumer discretionary spending, further act as substantial near-term constraints, influencing purchasing power and brand loyalty.

Opportunities abound, centering primarily on product customization and digital transformation. The ability to offer tailored footwear and apparel using 3D printing and digital fitting technologies represents a major untapped segment, catering directly to the personalized experience demanded by modern consumers. Furthermore, the integration of smart textiles and IoT capabilities, turning apparel into functional performance monitoring devices, promises new revenue streams and elevates product utility. The final significant opportunity lies in aggressively pursuing sustainability initiatives—implementing circular economy models, utilizing ethical sourcing, and promoting repair/reuse programs—which align brands with long-term consumer values and regulatory mandates, ensuring positive long-term market perception and resilience against supply chain shocks.

Segmentation Analysis

The segmentation of the Sports Apparel and Footwear Market provides a granular view of consumer behavior and growth pockets across product types, end-user demographics, and distribution models. Understanding these segments is crucial for brands seeking targeted marketing strategies and product portfolio optimization. The market is primarily divided based on the functional utility of the products, identifying core segments like performance footwear versus lifestyle apparel, and further refined by the specific needs of men, women, and children. The ongoing evolution of e-commerce has also necessitated a clear distinction in segmentation based on distribution channels, with digital platforms rapidly overtaking traditional retail in terms of growth velocity and market influence, especially for niche and specialized product offerings.

- By Product Type:

- Footwear (Running, Training, Basketball, Soccer, Hiking, Casual Sportswear)

- Apparel (Tops, Bottoms, Outerwear, Innerwear, Swimwear)

- Accessories (Bags, Caps, Socks, Protective Gear, Watches/Wearables)

- By End User:

- Men (Performance Gear, Lifestyle Athleisure)

- Women (Specialized Performance Apparel, Athleisure, Maternity Sportswear)

- Kids & Youth (School Sports, General Activewear)

- By Distribution Channel:

- Offline Stores (Specialty Stores, Branded Outlets, Department Stores, Hypermarkets)

- Online Channels (E-commerce Portals, Brand Websites, Third-party Aggregators)

- By Activity:

- Team Sports (Basketball, Football)

- Individual Sports (Running, Yoga, Cycling)

- Outdoor and Adventure (Hiking, Skiing)

Value Chain Analysis For Sports Apparel and Footwear Market

The value chain for sports apparel and footwear is complex, spanning raw material procurement, specialized manufacturing, global logistics, and multi-channel distribution. Upstream analysis focuses on the sourcing of high-performance raw materials, including synthetic fibers like polyester, spandex, and nylon, alongside natural materials such as cotton and specialized leathers. Key activities at this stage involve R&D into advanced material science (e.g., lightweight composites, smart textiles) and ensuring sustainable and ethical sourcing practices, which is becoming paramount for brand reputation. Manufacturing, often concentrated in Asia (Vietnam, China, Indonesia), requires specialized machinery for knitting, weaving, bonding, and complex sole production, demanding stringent quality control and proprietary technological processes to maintain product performance standards.

Midstream activities encompass design and development, where intellectual property is created, and primary production processes are finalized. This stage is followed by critical logistics and inventory management. Major brands leverage sophisticated global distribution networks to move finished goods from production hubs to consumer markets, utilizing both air freight for fast-moving, high-value items and sea freight for bulk replenishment. Effective logistics management is crucial for minimizing costs and maintaining stock levels for seasonal and limited-edition releases, often employing AI-driven warehouse optimization and supply chain traceability solutions to enhance efficiency and transparency.

Downstream analysis centers on market access and retail. Distribution channels are bifurcated into direct and indirect models. The indirect channel involves wholesale distribution to multi-brand specialty sports stores, department stores, and large format retailers. The direct channel, which is rapidly increasing its market share, encompasses brand-owned physical outlets and, crucially, brand-owned e-commerce websites and mobile applications. The shift towards D2C allows brands to capture higher margins, control pricing, and gather valuable first-party consumer data, enabling superior personalization and localized marketing efforts. Successful market players prioritize seamless omnichannel integration, allowing customers to move fluidly between online research and in-store purchase/pickup experiences.

Sports Apparel and Footwear Market Potential Customers

The primary consumers of sports apparel and footwear are broadly categorized into three major groups: professional and elite athletes, serious fitness enthusiasts and amateur competitors, and the expansive lifestyle/athleisure consumer segment. Professional athletes require highly specialized, performance-driven gear where cost is secondary to marginal performance gains and protection against injury. Their demand drives innovation and serves as the ultimate benchmark for product validation, influencing the aspirational purchases of the broader consumer base. Catering to this segment requires advanced R&D, personalized fitting services, and high-profile sponsorship deals.

The serious fitness enthusiast segment represents the largest volume market for performance products. These consumers are actively engaged in regular running, gym work, yoga, or specific team sports. They prioritize technical features such as durability, moisture management, cushioning technology, and ergonomic fit, often seeking a balance between premium quality and accessible pricing. This group is highly influenced by online reviews, fitness influencers, and comparative product testing, making digital engagement and detailed product information essential for conversion. They are frequent repeat buyers, driven by training schedules and the need for specialized gear for different activities.

The lifestyle and athleisure consumer segment has experienced explosive growth and now accounts for the majority of revenue for many top brands. These buyers use sports-inspired clothing and footwear for casual, everyday wear, valuing comfort, style, and brand aesthetics over pure technical performance features. Their purchasing decisions are heavily influenced by fashion trends, celebrity endorsements, and social media visibility. Brands strategically target this group by collaborating with fashion designers and releasing limited-edition drops, ensuring that athletic gear remains relevant in the broader fashion ecosystem. This segment’s growth has fundamentally redefined the scope and marketing strategies of the entire industry.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $205.5 Billion |

| Market Forecast in 2033 | $340.2 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nike, Adidas, Puma, Under Armour, Lululemon Athletica, Anta Sports, New Balance, ASICS, Skechers, VF Corporation (Vans, North Face), Fila, Li-Ning, Mizuno, Columbia Sportswear, Decathlon, Reebok, Patagonia, HanesBrands (Champion), Kering, Amer Sports |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sports Apparel and Footwear Market Key Technology Landscape

The technological landscape of the Sports Apparel and Footwear Market is defined by a rigorous pursuit of performance enhancement, driven by advances in materials science, digital manufacturing, and integrated smart capabilities. The primary focus remains on developing next-generation textiles that offer superior functionality. This includes moisture-wicking technologies like specialized polyester blends, high-stretch elastane for compression gear, and proprietary waterproof-yet-breathable membrane technologies essential for outdoor and extreme sports apparel. In footwear, innovation is centered on midsole foam compounds (e.g., PEBAX, boost, or proprietary compressed air systems) that maximize energy return and minimize weight, alongside advanced knitting technologies (like flyknit) that provide precision fit with reduced material waste.

Digitalization is rapidly transforming the manufacturing process. Additive manufacturing (3D printing) is moving beyond prototyping and into mass customization, particularly for complex shoe components like midsoles and specialized orthotics, allowing brands to tailor products based on individual foot scans and performance metrics. This shift supports the growing demand for personalized products and accelerates the design-to-market cycle. Furthermore, the industry is increasingly adopting Product Lifecycle Management (PLM) software and digital twins to simulate product performance and manufacturing logistics before physical production begins, optimizing material usage and reducing the environmental footprint of development.

Another pivotal technological area is the integration of electronics and Internet of Things (IoT) into apparel and footwear, creating 'smart wear.' This involves embedding flexible sensors, micro-processors, and connectivity modules directly into textiles to monitor biometric data, track performance, and provide real-time feedback on parameters such as heart rate, muscle fatigue, and biomechanics. While still a nascent segment, smart apparel holds immense potential for high-performance training and rehabilitation markets. Alongside product innovation, retail technology, including augmented reality (AR) try-ons and virtual fitting rooms powered by computer vision, is enhancing the online shopping experience and reducing the high costs associated with product returns.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand, product preferences, and competitive environment of the global Sports Apparel and Footwear Market. While North America and Europe remain the largest revenue contributors, driven by high purchasing power and established sports cultures, the future growth engine is unequivocally the Asia Pacific (APAC) region. Market strategies must be highly localized to capitalize on these diverse geographic opportunities.

- North America (NA): Characterized by high maturity and brand saturation, focusing intensely on performance innovation (especially running and basketball footwear) and the widespread cultural acceptance of athleisure. The region leads in the adoption of D2C models and sustainable product lines. Significant market drivers include professional sports leagues (NBA, NFL) and robust fitness participation rates.

- Europe: A highly segmented market dominated by soccer (football) apparel and outdoor sports gear (hiking, skiing). Sustainability regulations and consumer demand for ethical manufacturing are stronger here than globally. Western Europe leads in high-end, premium segment growth, while Eastern Europe presents growing potential fueled by urbanization and rising fitness interest.

- Asia Pacific (APAC): The fastest-growing region globally, propelled by substantial population size, increasing disposable incomes, and government promotion of health and fitness (e.g., China’s emphasis on sports development). Key growth markets include China, India, and Southeast Asia. Demand is strong for both affordable mass-market products and premium global brands, particularly in urban centers.

- Latin America (LATAM): Growth is primarily driven by mass participation sports like soccer and a young demographic profile. Economic instability often restrains high-end product purchases, leading to a focus on mid-range and value brands. E-commerce penetration is rising rapidly, opening new distribution possibilities for international players.

- Middle East and Africa (MEA): A diverse region with demand concentrated in affluent GCC countries (UAE, Saudi Arabia) where high-end luxury sportswear and fitness infrastructure development are significant. Specific climatic conditions drive demand for technologically advanced temperature-regulating apparel. Africa represents a vast, largely untapped market with long-term potential tied to rising urbanization and improving economic conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sports Apparel and Footwear Market.- Nike, Inc.

- Adidas AG

- Puma SE

- Under Armour, Inc.

- Lululemon Athletica Inc.

- Anta Sports Products Limited

- New Balance Athletics, Inc.

- ASICS Corporation

- Skechers USA, Inc.

- VF Corporation

- Fila Holdings Corp.

- Li-Ning Company Limited

- Mizuno Corporation

- Columbia Sportswear Company

- Decathlon S.A.

- Reebok (Authentic Brands Group)

- Patagonia, Inc.

- HanesBrands Inc. (Champion)

- Kering S.A. (Historical ownership/influence)

- Amer Sports Corporation

Frequently Asked Questions

Analyze common user questions about the Sports Apparel and Footwear market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the Sports Apparel and Footwear Market?

Market growth is primarily driven by increasing global health and wellness awareness, the sustained popularity of the athleisure fashion trend which integrates sportswear into daily life, and continuous material science innovations enhancing product performance and comfort.

How is sustainability impacting product development in sports wear?

Sustainability is a core focus, compelling brands to adopt circular economy models, utilize recycled materials (like ocean plastic), and implement transparent supply chains. Consumers increasingly demand eco-friendly products, pushing R&D towards bio-based and biodegradable textiles.

Which distribution channel is experiencing the fastest growth?

The online channel, encompassing brand-owned e-commerce platforms and third-party aggregators, is experiencing the fastest growth due to enhanced convenience, personalized marketing, and the successful implementation of Direct-to-Consumer (D2C) strategies by major brands.

What technological advancements are key in the footwear segment?

Key technological advancements include the use of advanced midsole foam technologies for superior energy return and cushioning, 3D printing for customizable components, and sophisticated knitting techniques that provide lightweight, precision-fit uppers.

Which geographic region offers the highest growth potential?

The Asia Pacific (APAC) region, particularly China and India, offers the highest growth potential, driven by rapid urbanization, rising middle-class disposable incomes, and governmental initiatives promoting sports participation and healthy lifestyles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager