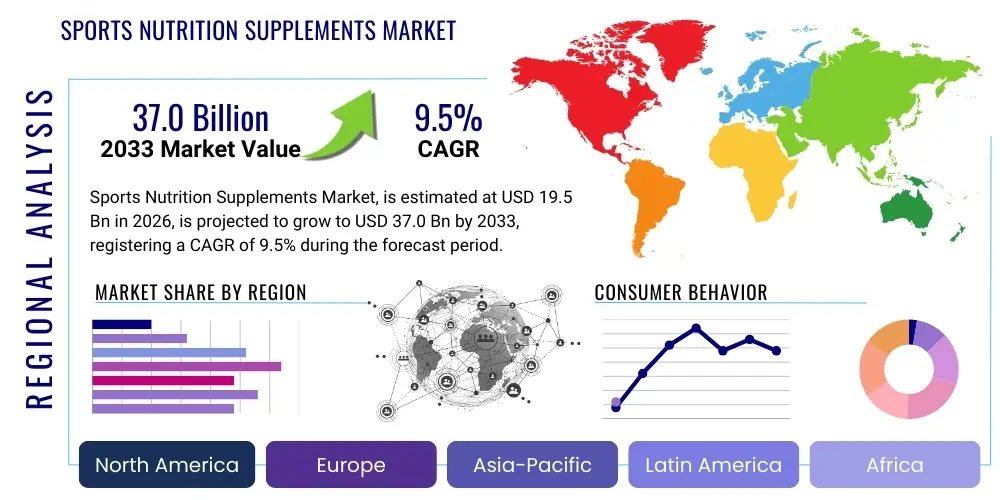

Sports Nutrition Supplements Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437337 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Sports Nutrition Supplements Market Size

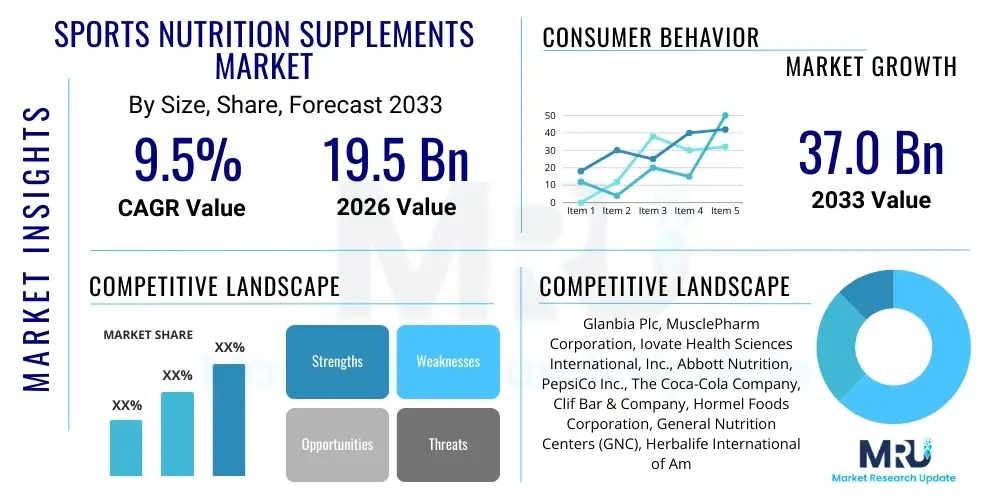

The Sports Nutrition Supplements Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 19.5 Billion in 2026 and is projected to reach USD 37.0 Billion by the end of the forecast period in 2033.

Sports Nutrition Supplements Market introduction

The Sports Nutrition Supplements Market encompasses a diverse range of dietary products consumed by athletes, bodybuilders, and recreational fitness enthusiasts to enhance physical performance, expedite recovery, increase muscle mass, and manage weight. These products typically include protein powders, branched-chain amino acids (BCAAs), creatine, energy drinks, meal replacement shakes, and various vitamin and mineral complexes tailored for strenuous activity. The primary objective of these supplements is to fill nutritional gaps, optimize metabolic function under stress, and support structural tissue repair. Historically confined to professional athletic circles, the market scope has significantly broadened, driven by the global mainstreaming of fitness culture and preventive healthcare paradigms, positioning these products as essential components of an active lifestyle.

Major applications of sports nutrition products span professional sports training, amateur fitness regimens, rehabilitation therapy, and general wellness maintenance, particularly among aging populations seeking to maintain muscle synthesis and bone density. The product category is witnessing profound innovation, moving beyond basic macronutrient delivery to sophisticated formulations incorporating specialized ingredients like adaptogens, nootropics, and targeted microbiome enhancers, reflecting a consumer preference for functional and scientifically backed solutions. Furthermore, the shift towards clean label products, vegan formulations, and third-party tested supplements addresses growing consumer concerns regarding ingredient transparency and product safety, reinforcing trust in established brands and driving premiumization across segments.

Key benefits derived from these supplements include improved endurance, faster recovery times post-exercise, enhanced strength and lean muscle development, and better immune function support. Driving factors underpinning market expansion include the exponential rise in health consciousness globally, increasing disposable income in emerging economies, robust investments in fitness infrastructure (gyms, sports centers), and aggressive marketing strategies linking supplement consumption to aspirational lifestyle goals. The continuous professionalization of sports and the pervasive influence of social media fitness personalities further accelerate adoption, making specialized nutrition strategies accessible and desirable to a wider demographic than ever before.

Sports Nutrition Supplements Market Executive Summary

The Sports Nutrition Supplements Market is characterized by vigorous business trends, notably the rapid adoption of personalization technologies and the consolidation of the fragmented supplement industry through strategic mergers and acquisitions. E-commerce platforms are transforming the distribution landscape, allowing niche brands to gain visibility and offering consumers unprecedented access to specialized products, thereby influencing traditional retail sales models. A significant trend involves the integration of sports nutrition into the broader functional food and beverage sector, blurring the lines between traditional supplements and fortified daily consumables like protein-enriched snacks and performance beverages, which enhances convenience and expands the consumer base beyond conventional athletes.

Regionally, North America and Europe maintain dominance, driven by high consumer awareness, established regulatory frameworks, and mature fitness industries. However, the Asia Pacific (APAC) region is demonstrating the most accelerated growth trajectory, fueled by rapidly expanding middle-class populations, increasing urbanization, rising obesity rates prompting fitness intervention, and the growing popularity of international sports. Countries such as China and India are emerging as critical markets, not only for consumption but also for localized production and innovation tailored to regional dietary habits and economic considerations. Regulatory harmonization across various regions remains a critical factor influencing market entry and operational strategies for multinational corporations.

Segment trends highlight the sustained dominance of the Protein Powder category, although specialized supplements like Creatine and amino acids are gaining traction due to targeted efficacy claims. Within distribution channels, the shift towards Online Retail remains paramount, offering extensive product catalogs and competitive pricing, complementing the specialized advice often sought in brick-and-mortar specialty stores. Consumer demographic trends indicate significant growth in the female sports nutrition segment and among older adults (active aging), demanding products specifically formulated for hormonal balance, joint health, and muscle preservation, moving away from male-centric bodybuilding aesthetics toward holistic health optimization.

AI Impact Analysis on Sports Nutrition Supplements Market

Common user questions regarding AI's impact on the Sports Nutrition Supplements Market center primarily on how Artificial Intelligence can revolutionize personalization, improve product efficacy testing, and streamline the supply chain. Users frequently ask if AI-driven diagnostics will lead to supplements perfectly tailored to their genetic makeup and workout goals, moving beyond generic recommendations. Concerns often arise about the privacy implications of sharing detailed biometric and genomic data required for deep personalization, and the transparency of algorithms used in formulating 'smart' supplements. Furthermore, there is significant interest in how AI can detect and prevent counterfeit products, ensuring consumer safety and authenticity across online purchasing channels, given the high rate of mislabeling and fraud in the supplement industry.

The adoption of AI tools is fundamentally changing the R&D phase, allowing companies to simulate complex metabolic interactions and predict the bioavailability and efficacy of new ingredient combinations with unprecedented speed. Machine learning algorithms analyze vast datasets encompassing genetic markers, dietary intake, exercise performance metrics, and physiological responses, enabling the creation of hyper-personalized nutrition programs and customized supplement stacks. This transition from 'one-size-fits-all' supplements to precision nutrition is expected to drive higher consumer loyalty and superior outcomes, justifying the premium price point associated with bespoke formulations. This data-intensive approach also aids in optimizing clinical trial design and identifying ideal target populations for specific product benefits, reducing time-to-market for innovative products.

Beyond product development, AI is crucial for optimizing market operations. Predictive analytics models assist in inventory management, forecasting demand fluctuations based on seasonality, sporting events, and marketing effectiveness, thereby minimizing waste and stockouts. Chatbots and AI-powered recommendation engines enhance the consumer experience online, providing instant, personalized advice on dosage and product selection, acting as a scalable extension of human nutritional experts. In manufacturing, computer vision systems and predictive maintenance protocols, driven by AI, ensure rigorous quality control and efficiency, bolstering consumer confidence in the consistency and safety of the nutritional products they consume.

- AI-driven hyper-personalization of dosage and ingredient profiles based on genomic and phenotypic data.

- Accelerated R&D and formulation testing through predictive modeling and simulation of metabolic pathways.

- Enhanced supply chain transparency and traceability using machine learning to detect fraud and ensure compliance.

- Optimized manufacturing processes via predictive maintenance and automated quality control checks.

- Improved customer engagement and personalized shopping experience through AI-powered recommendation engines and virtual coaching interfaces.

DRO & Impact Forces Of Sports Nutrition Supplements Market

The market dynamics of sports nutrition are governed by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and potent Impact Forces. Key drivers include the exponential increase in global participation in recreational and organized sports, the rising awareness regarding the critical role of nutrition in achieving specific fitness goals, and significant endorsement from professional athletes and influential figures across digital platforms. Furthermore, the growing prevalence of chronic lifestyle diseases is compelling consumers to adopt proactive health management, often incorporating sports supplements for general vitality, muscle maintenance, and immune support. The aging population's focus on sarcopenia prevention also fuels demand for high-quality protein and specific amino acids, broadening the market beyond the traditional younger demographic.

Restraints primarily revolve around stringent regulatory environments and concerns regarding product safety and standardization. The industry faces challenges related to misleading labeling, the presence of banned substances (doping risks), and the frequent emergence of unverified or unsubstantiated health claims, which erode consumer trust and necessitate continuous, costly monitoring and compliance efforts by manufacturers. Additionally, the relatively high cost of premium, scientifically validated supplements can act as a barrier to entry for lower-income consumers, particularly in price-sensitive emerging markets. The perceived lack of necessary regulation in some regions creates market volatility, favoring players who invest heavily in third-party certifications and transparent ingredient sourcing to differentiate themselves.

Opportunities abound in functional innovation, particularly in developing plant-based protein sources, integrating specialized probiotics and prebiotics for gut health, and creating convenient, ready-to-drink formulations that fit modern, fast-paced lifestyles. The digital transformation offers immense leverage through direct-to-consumer (D2C) models, allowing companies to collect proprietary consumer data and iterate product offerings quickly based on real-time feedback. Impact forces are shaped by socioeconomic shifts, such as rising disposable incomes globally and a profound cultural shift toward preventive health. Technological innovation, especially in biotechnology and personalized diagnostics, acts as a powerful force, fundamentally changing how supplements are formulated, marketed, and consumed, pushing the industry toward a performance-based, evidence-driven paradigm.

Segmentation Analysis

The Sports Nutrition Supplements Market is intricately segmented based on product type, application, distribution channel, and form (e.g., powder, tablets, ready-to-drink). Understanding these segments is crucial for strategic planning, as consumer preferences within each sub-category reflect distinct needs and purchasing behaviors. The segmentation analysis reveals shifts towards convenience, efficacy, and clean labeling. For instance, while powder supplements remain dominant due to cost-effectiveness and flexibility, the Ready-to-Drink (RTD) category is exhibiting the highest growth rate, driven by consumer demand for portability and immediate consumption solutions, particularly among casual fitness enthusiasts and busy professionals.

The product segmentation highlights the dominance of protein supplements (powders, bars, and drinks), which serve as the foundation of sports nutrition due to their essential role in muscle repair and satiety. However, the fastest-growing niche segments are performance enhancers like creatine, specialized pre-workouts, and recovery aids that focus on targeted physiological benefits, such as nitric oxide boosters for pump or specialized ingredients for joint support. Segmentation by application clearly divides the market between professional bodybuilders and athletes, who prioritize maximum performance and high-dose formulations, and the rapidly growing recreational and lifestyle user segment, which favors lower dosages focused on general wellness, weight management, and energy maintenance.

Distribution channel segmentation confirms the increasing strategic importance of online retail, which provides global reach and sophisticated algorithmic recommendations, though physical channels like supermarkets and specialty stores remain critical for impulse buying, product discovery, and expert consultation. Companies are increasingly employing omnichannel strategies to cater to diverse consumer journeys, ensuring brand consistency and inventory accessibility across digital and physical touchpoints. This detailed segmentation allows manufacturers to tailor marketing efforts and product portfolios, effectively addressing the heterogeneity of the global sports nutrition consumer base.

- Product Type:

- Protein Powders (Whey, Casein, Plant-based)

- Amino Acids (BCAAs, Glutamine, Arginine)

- Creatine

- Vitamins and Minerals

- Electrolytes and Hydration Products

- Energy Bars and Gels

- Meal Replacement Products

- Application/End-User:

- Bodybuilders

- Professional Athletes

- Recreational Users

- Lifestyle Users/Active Consumers

- Distribution Channel:

- Online Retail (E-commerce Websites, Company Portals)

- Supermarkets and Hypermarkets

- Specialty Stores (GNC, Vitamin Shoppe)

- Pharmacies and Drug Stores

- Formulation:

- Powder

- Tablets/Capsules

- Ready-to-Drink (RTD)

- Gels and Chews

Value Chain Analysis For Sports Nutrition Supplements Market

The value chain for the Sports Nutrition Supplements Market begins with upstream activities focused on sourcing raw materials, which are primarily proteins (dairy, soy, pea), specialized amino acids, and botanical extracts. Key considerations at this stage include supplier quality verification, adherence to safety standards (e.g., non-GMO, organic certification), and managing volatility in commodity prices, particularly for whey protein. Manufacturers often invest heavily in securing long-term contracts with specialized ingredient providers and implementing advanced traceability systems to ensure the purity and origin of components, a critical factor given the high regulatory scrutiny and consumer demand for transparency in the finished products.

Midstream activities involve processing, formulation, quality testing, and packaging. This stage is dominated by specialized contract manufacturers or large integrated firms capable of handling complex blending, flavoring, and encapsulation processes under strict Good Manufacturing Practices (GMP). Innovation in this phase includes microencapsulation technologies to improve ingredient stability, enhanced mixing techniques to ensure optimal solubility, and rigorous third-party testing to confirm label claims and absence of contaminants, especially banned athletic substances. Effective quality control procedures are paramount, as product safety directly impacts brand reputation and regulatory compliance across international markets.

Downstream activities center on distribution, sales, and marketing. The distribution channel is multifaceted, comprising direct (D2C websites, brand stores) and indirect channels (supermarkets, specialty supplement retailers, e-commerce giants). Direct channels offer better margins and valuable consumer data, while indirect channels provide scale and accessibility. Effective marketing strategies leverage digital platforms, influencer endorsements, and performance-based claims to reach target demographics. The final stage involves the consumer purchase experience, which is increasingly influenced by factors such as transparent labeling, digital engagement (reviews, personalized advice), and efficient last-mile logistics, particularly for temperature-sensitive ready-to-drink products.

Sports Nutrition Supplements Market Potential Customers

The primary customer base for the Sports Nutrition Supplements Market traditionally comprised professional athletes, competitive bodybuilders, and powerlifters whose consumption is dictated by rigorous training schedules and the need for peak physiological performance. These consumers are highly knowledgeable about ingredient efficacy, often seek science-backed formulations, and are generally less price-sensitive, prioritizing quality and specific performance outcomes. Their purchasing decisions are heavily influenced by coaching staff, nutritionists, and documented performance results. This segment remains crucial for setting industry standards and driving demand for premium, high-concentration products, often utilizing specialized channels like team sponsorships and licensed dietary advisors.

However, the most significant growth trajectory is observed in the recreational user and active lifestyle segment. This broad demographic includes gym-goers, marathon runners, weekend warriors, and individuals seeking supplements for general health, energy, and weight management. These consumers are driven by convenience, taste, and mainstream accessibility. They seek approachable products integrated into daily life, such as protein snacks or functional energy drinks, rather than specialized powders. Marketing efforts targeting this group emphasize holistic wellness, aesthetic goals, and ease of use, often relying on social media trends, accessible retail locations (supermarkets), and celebrity endorsements to build trust and drive purchase decisions.

A rapidly expanding segment involves the "Active Aging" population and individuals focused on specialized dietary needs. Older adults increasingly consume protein supplements and specific nutrients (like collagen or Vitamin D) to combat age-related muscle loss (sarcopenia) and improve bone health, seeking longevity benefits rather than high performance. Furthermore, consumers adhering to specific dietary constraints, such as veganism, keto, or gluten-free diets, represent a growing niche, demanding specialized plant-based proteins and innovative formulations that meet their dietary requirements without compromising nutritional quality or taste. Manufacturers must cater to these diverse needs through targeted product development and clear, verified labeling.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 19.5 Billion |

| Market Forecast in 2033 | USD 37.0 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Glanbia Plc, MusclePharm Corporation, Iovate Health Sciences International, Inc., Abbott Nutrition, PepsiCo Inc., The Coca-Cola Company, Clif Bar & Company, Hormel Foods Corporation, General Nutrition Centers (GNC), Herbalife International of America, Inc., Optimum Nutrition, NOW Foods, Bio-Engineered Supplements and Nutrition (BSN), Quest Nutrition, Transparent Labs, CytoSport (owned by PepsiCo), NBTY Inc., BioSteel Sports Nutrition Inc., Ultimate Nutrition, Red Bull GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sports Nutrition Supplements Market Key Technology Landscape

The technological landscape of the Sports Nutrition Supplements Market is rapidly evolving, driven by advancements in biotechnology, nutrigenomics, and precision manufacturing. Key developments center around improving ingredient bioavailability and stability. Techniques such as liposomal encapsulation and micronization are being widely adopted to enhance the absorption rate of crucial compounds like curcumin, vitamins, and certain amino acids, ensuring that the body can utilize nutrients more effectively and quickly. Furthermore, flavor masking technologies are crucial for plant-based proteins, which often possess undesirable sensory profiles, making them palatable to a broader consumer base and competing effectively with traditional dairy-based alternatives.

Another dominant technological trend is the integration of digital health and wearable technology to facilitate personalized nutrition. Genetic testing kits provide consumers with unique insights into their metabolic response to macronutrients and their predisposition to muscle injury, allowing for truly customized supplement recommendations. Wearable devices track real-time biomarkers, such as hydration levels, heart rate variability, and sleep quality, feeding this performance data into AI algorithms that adjust daily supplement intake automatically. This convergence of hardware, software, and biochemical analysis provides a closed-loop system for optimizing physical performance and recovery, moving supplement usage from a generalized strategy to a data-driven science.

Manufacturing technologies are also undergoing transformation. Advanced analytical testing instruments, including High-Performance Liquid Chromatography (HPLC) and Mass Spectrometry, are essential for rigorous quality assurance, verifying the identity, purity, and potency of raw materials and finished goods, which is non-negotiable in an industry scrutinized for potential adulteration. The adoption of aseptic filling and high-shear mixing equipment ensures consistency and safety in Ready-to-Drink (RTD) and powdered formats. Sustainable packaging innovations, utilizing biodegradable materials and reduced plastic usage, align with corporate social responsibility goals and resonate strongly with environmentally conscious consumers, representing a critical technological response to global sustainability pressures.

Regional Highlights

Geographic analysis reveals distinct consumption patterns and growth drivers across major regions. North America, particularly the United States, is the largest and most mature market, characterized by high consumer spending on health and fitness, a deeply entrenched gym culture, and robust market saturation of both established global brands and innovative niche startups. The region benefits from significant R&D investment and early adoption of novel ingredients like adaptogens and nootropics in performance formulations. Strict, yet clear, regulatory bodies like the FDA shape market operations, emphasizing the need for comprehensive product safety and labeling compliance, driving market maturity and consumer confidence.

Europe represents a highly fragmented yet significant market, driven by varying national regulations regarding supplement claims and ingredient approval. Western European countries, such as the UK and Germany, exhibit high per capita consumption, fueled by strong traditions in sports and an increasing focus on active aging and preventive health maintenance. The shift towards plant-based diets is particularly pronounced here, accelerating the demand for vegan protein supplements and clean-label products. Regulatory complexity, particularly across the EU, remains a challenge, necessitating tailored product registration and marketing strategies for each member state.

Asia Pacific (APAC) is projected to be the fastest-growing region, presenting enormous potential due to rapid economic expansion, increasing urbanization, and a growing youth demographic adopting Western fitness lifestyles. Countries like China, India, and Australia are driving demand. While Australia possesses a mature market similar to North America, China and India are characterized by immense untapped potential, driven by rising disposable incomes and aggressive expansion by global fitness chains. The challenge in APAC lies in navigating diverse consumer preferences, lower baseline regulatory standardization, and the necessity to localize product offerings to align with traditional diets and cultural perceptions of health and wellness.

- North America: Market leader, high spending on personalized nutrition, mature regulatory environment, high penetration of performance-enhancing supplements.

- Europe: Strong demand for clean label and plant-based proteins, fragmented regulatory landscape, significant focus on active aging and general wellness supplements.

- Asia Pacific (APAC): Fastest growing region, driven by urbanization and rising disposable income in China and India, increasing demand for ready-to-consume formats.

- Latin America (LATAM): Emerging market, growth driven by rising fitness culture in Brazil and Mexico, but constrained by economic volatility and higher import costs.

- Middle East and Africa (MEA): Niche but growing markets, primarily focused on high-end, imported products catering to expatriate and affluent local populations, coupled with increasing infrastructure investment in sports.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sports Nutrition Supplements Market.- Glanbia Plc

- MusclePharm Corporation

- Iovate Health Sciences International, Inc.

- Abbott Nutrition

- PepsiCo Inc.

- The Coca-Cola Company

- Clif Bar & Company

- Hormel Foods Corporation

- General Nutrition Centers (GNC)

- Herbalife International of America, Inc.

- Optimum Nutrition (owned by Glanbia)

- NOW Foods

- Bio-Engineered Supplements and Nutrition (BSN)

- Quest Nutrition (owned by The Simply Good Foods Company)

- Transparent Labs

- CytoSport (owned by PepsiCo)

- NBTY Inc.

- BioSteel Sports Nutrition Inc.

- Ultimate Nutrition

- Red Bull GmbH

Frequently Asked Questions

Analyze common user questions about the Sports Nutrition Supplements market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key growth drivers for the Sports Nutrition Supplements Market?

The market is primarily driven by the exponential global increase in health and fitness consciousness, rising disposable incomes in emerging economies, the widespread adoption of active lifestyles beyond professional athletics, and significant advancements in ingredient science and personalized nutrition technology. E-commerce expansion also plays a crucial role in improving product accessibility worldwide.

How does personalized nutrition impact the future of sports supplements?

Personalized nutrition, enabled by AI, genetic testing (nutrigenomics), and wearable technology, allows companies to move away from standardized formulas. It leads to the creation of supplements precisely tailored to an individual's unique physiological needs, optimizing efficacy, improving consumer loyalty, and driving the premium segment of the market towards bespoke formulations.

Which product segment holds the largest share in the sports nutrition market?

Protein supplements, including protein powders, bars, and ready-to-drink shakes, hold the largest market share. This dominance is attributed to their fundamental role in muscle synthesis, recovery, and satiety, serving both the high-performance athletic population and the general health and wellness consumer aiming for increased protein intake.

What are the main regulatory challenges faced by supplement manufacturers?

Key challenges include navigating the stringent and often varied national regulations concerning health claims, ensuring product safety and freedom from banned substances (anti-doping compliance), managing risks of product adulteration, and maintaining label accuracy and ingredient purity standards to sustain consumer trust and avoid costly recalls.

Is the Asia Pacific (APAC) region a high-growth market for sports nutrition?

Yes, APAC is the fastest-growing regional market. This high growth is fueled by rapid urbanization, substantial increases in middle-class disposable income, the emulation of Western fitness trends, and aggressive market entry strategies by global brands catering to large populations in countries like China and India, making it critical for future expansion.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager