Spray Foam Insulation Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433439 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Spray Foam Insulation Market Size

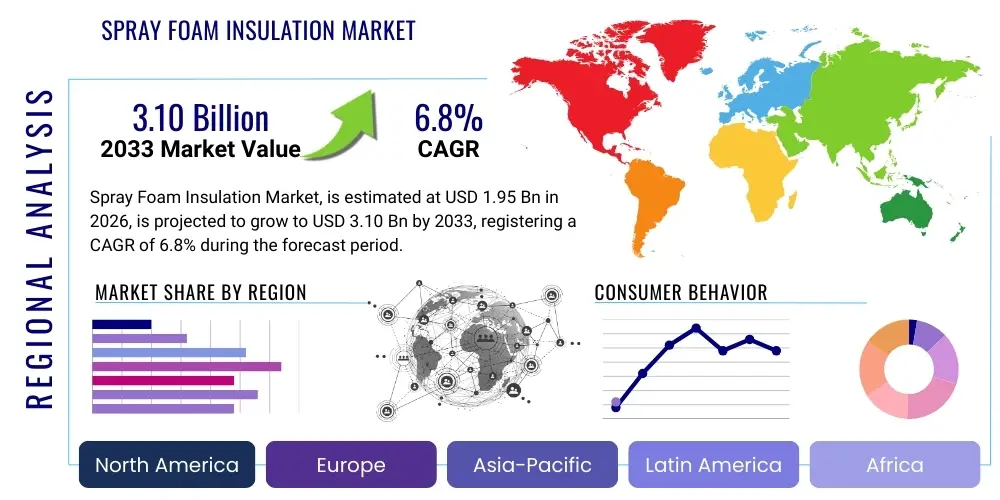

The Spray Foam Insulation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.95 Billion in 2026 and is projected to reach USD 3.10 Billion by the end of the forecast period in 2033.

Spray Foam Insulation Market introduction

The Spray Foam Insulation Market encompasses the production, distribution, and application of chemically reactive polyurethane and polyisocyanurate foam systems utilized primarily for thermal and acoustic insulation in residential, commercial, and industrial construction sectors. These systems involve two components, typically an A-side (isocyanate) and a B-side (polyol blend, catalyst, and blowing agents), which are mixed on-site using specialized equipment. The resultant foam expands rapidly upon application, conforming seamlessly to irregular shapes and surfaces, creating an airtight, monolithic barrier. This superior air sealing capability distinguishes spray foam from traditional insulation materials like fiberglass or cellulose, offering significantly enhanced energy efficiency and moisture control.

The product, predominantly categorized into Open-Cell Spray Foam (OCSPF) and Closed-Cell Spray Foam (CCSPF), serves critical functions across major applications including walls, roofs, attics, basements, and crawl spaces. Closed-cell foam, characterized by higher density and R-value per inch, also provides structural rigidity and functions as a vapor barrier, making it indispensable in high-humidity or structural environments. Open-cell foam is lighter, more cost-effective, and offers excellent sound attenuation properties, often preferred in interior wall assemblies where vapor permeability is acceptable or desired.

The market's robust growth is fundamentally driven by global mandates for energy conservation, increasingly stringent building codes focused on achieving net-zero energy buildings, and a rising awareness among property owners regarding the long-term cost benefits associated with superior thermal envelopes. Furthermore, the inherent ability of spray foam to mitigate air infiltration—often the largest source of energy loss in buildings—positions it as a premium solution addressing both energy performance and occupant comfort. Environmental concerns regarding traditional blowing agents have also spurred innovation, pushing manufacturers toward adopting low-Global Warming Potential (GWP) hydrofluoroolefins (HFOs) and other sustainable formulations, further cementing spray foam's position in the high-performance construction landscape.

Spray Foam Insulation Market Executive Summary

The Spray Foam Insulation Market is currently undergoing significant transformation, characterized by strong underlying business trends favoring sustainability, material science innovation, and digitalization of application processes. Key business trends include the consolidation of raw material suppliers and applicators, driving vertical integration aimed at securing supply chains and controlling quality from chemical formulation to on-site installation. Furthermore, the increasing demand for sustainable building materials and adherence to green building certifications (such as LEED and BREEAM) are compelling manufacturers to invest heavily in bio-based polyols and low-GWP blowing agents, enhancing the product's environmental profile. The market sees competitive differentiation based not only on R-value performance but also on fire rating, moisture management capabilities, and ease of installation, leading to the introduction of specialized systems designed for specific climates and structural requirements.

Regional trends indicate that North America, particularly the United States, remains the largest and most mature market, primarily due to well-established energy efficiency regulations and a high prevalence of professional applicators. However, the Asia Pacific region, led by rapidly urbanizing economies like China and India, is projected to exhibit the fastest growth trajectory, fueled by massive infrastructural development, burgeoning residential construction, and governmental initiatives promoting energy-efficient housing solutions. Europe is witnessing steady growth, largely spurred by the European Union's Energy Performance of Buildings Directive (EPBD) which mandates stringent energy efficiency upgrades for both new and existing buildings. Regulatory complexities, particularly surrounding chemical safety and disposal, are shaping market operations across different regions.

Segment trends reveal that the Residential Construction segment holds the largest market share, driven by homeowner demand for retrofitting existing structures and new high-performance housing builds. Conversely, the Commercial and Institutional segment, though smaller in volume, demands high-specification products such as those used in cold storage facilities and large industrial roofing applications, favoring high-density closed-cell formulations. Regarding product type, while Closed-Cell Spray Foam commands higher price points due to superior performance characteristics, Open-Cell Spray Foam is increasingly gaining traction in non-structural applications due to its cost-effectiveness and excellent soundproofing attributes, particularly within the multifamily and light commercial construction categories. The growth of the renovation and re-insulation segment is also outpacing new construction growth in mature markets, reflecting the massive potential in upgrading the existing aging building stock.

AI Impact Analysis on Spray Foam Insulation Market

User inquiries concerning the integration of Artificial Intelligence (AI) in the Spray Foam Insulation market primarily center on optimizing application efficiency, improving quality control, and automating compliance reporting. Common questions involve how AI can predict optimal mix ratios based on real-time ambient conditions (temperature, humidity), whether robotic application systems guided by machine vision can ensure uniform thickness and eliminate human error, and how AI-driven analysis of thermal imaging data can instantaneously verify installation quality post-application. Users are also keen on understanding AI's role in inventory management, demand forecasting for chemical components, and generating predictive maintenance alerts for specialized spraying equipment. The overarching expectation is that AI will significantly reduce material waste, enhance job site safety, lower labor costs, and provide auditable documentation proving adherence to complex building specifications, thus raising the professional standards of the application segment.

- AI-powered predictive maintenance scheduling for high-pressure spray rigs, minimizing costly on-site breakdowns.

- Machine learning algorithms optimizing chemical formulation supply chain logistics based on regional weather patterns and construction timelines.

- Computer vision systems utilizing drone or camera footage to map complex geometries, calculating precise material requirements and minimizing waste (digital twin construction models).

- Real-time quality control systems that monitor spray pattern, thickness, and component temperature, automatically adjusting parameters for consistent R-value performance.

- AI tools assisting applicators with regulatory compliance checks, ensuring chosen foam types meet specific regional fire and vapor barrier requirements before application commences.

DRO & Impact Forces Of Spray Foam Insulation Market

The dynamics of the Spray Foam Insulation Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming the market's impact forces. The primary drivers include the global imperative for improved energy efficiency in the building sector, mandatory implementation of high-performance insulation standards across major economies, and consumer willingness to invest in premium solutions that offer significant lifetime cost savings through reduced utility bills. Governmental incentives, subsidies, and tax credits designed to promote energy-saving retrofits further amplify market demand. Furthermore, the superior air sealing and moisture barrier properties of closed-cell foam are becoming increasingly valued in mitigating structural damage and improving indoor air quality, particularly in climates prone to extreme temperatures or high humidity.

Restraints largely pertain to regulatory hurdles and the inherent complexities of the product itself. The volatility in the price and availability of core raw materials, namely Methylene Diphenyl Diisocyanate (MDI) and polyols (which are petroleum derivatives), creates significant cost fluctuations for manufacturers and applicators. Furthermore, the application process requires highly specialized training and safety protocols, as improper mixing or venting can lead to hazardous conditions or subpar performance, leading to market skepticism regarding untrained contractors. Regulatory scrutiny concerning the toxicity of certain blowing agents and the fire safety characteristics of the foam during installation and throughout its lifespan also imposes stringent compliance costs, particularly in densely populated urban centers.

Opportunities are abundant, particularly in leveraging sustainable chemistry and expanding application fields. The shift toward utilizing bio-based polyols derived from soy or castor beans reduces reliance on petrochemicals and enhances the product's green credentials, appealing to environmentally conscious builders. The large untapped potential lies in the retrofitting market for commercial and residential buildings constructed before modern energy codes were implemented. Additionally, the increasing use of spray foam in non-traditional applications such as specialized protective coatings, geotechnical stabilization, and large-scale industrial storage tanks represents lucrative diversification pathways. The development of next-generation low-pressure, DIY-friendly kits is also expanding market access to smaller contractors and sophisticated homeowners, although this segment requires rigorous quality assurance mechanisms.

Segmentation Analysis

The Spray Foam Insulation Market is systematically segmented based on product type, application, end-use sector, and density, reflecting the diverse requirements across the construction industry. Analyzing these segments provides crucial insights into growth pockets and technological preferences. The distinction between closed-cell and open-cell foam systems is the most fundamental segmentation, dictating performance metrics such as R-value, compressive strength, and vapor permeability. Closed-cell systems dominate in structural applications and regions requiring high resistance to moisture penetration, while open-cell systems are favored for cost-sensitive interior wall and soundproofing projects. The choice of segmentation profoundly impacts manufacturing processes, distribution strategies, and regulatory compliance.

Further granularity is achieved by analyzing the market based on end-use, dividing demand between residential, commercial, and industrial construction, each exhibiting distinct cycles and specification requirements. The residential sector, particularly new home construction and remodeling, drives high volume but often demands applicator efficiency and competitive pricing. The commercial sector focuses heavily on large-scale roofing insulation and specific fire ratings for institutional buildings. Application segmentation, including walls, ceilings, roofing, and flooring/foundations, highlights the strategic importance of developing specialized nozzle designs and application techniques optimized for varying structural components. Continuous innovation in formulation is aimed at improving adhesion to diverse substrates (wood, steel, concrete) and enhancing cold-weather performance.

- Product Type:

- Closed-Cell Spray Foam (CCSPF)

- Open-Cell Spray Foam (OCSPF)

- End-Use Sector:

- Residential Construction (New Build and Renovation)

- Commercial Construction (Offices, Retail, Institutional)

- Industrial Construction (Cold Storage, Manufacturing Facilities, Warehouses)

- Application:

- Walls (Exterior and Interior)

- Roofing (Flat and Pitched Roofs)

- Attics and Ceilings

- Basements and Crawl Spaces

- Blowing Agent Type:

- Hydrofluoroolefins (HFO)

- Hydrofluorocarbons (HFC) - Decreasing

- Water-Blown Agents

Value Chain Analysis For Spray Foam Insulation Market

The value chain for the Spray Foam Insulation Market is complex, starting with the synthesis of petrochemical raw materials and concluding with specialized, on-site application and post-installation quality assurance. Upstream activities are dominated by major chemical companies that produce the two critical components: Isocyanates (primarily MDI) and Polyols (petroleum or bio-based). This segment requires massive capital investment in chemical plants and is highly sensitive to crude oil and natural gas prices. Suppliers must ensure consistent quality and availability, as any variability in the raw materials directly impacts the exothermic reaction and final foam properties. Technological advancements upstream focus on developing low-VOC (Volatile Organic Compound) and environmentally friendly component blends, particularly shifting away from high-GWP blowing agents to modern HFO technology, demanding significant R&D expenditure.

The midstream involves the foam system manufacturers—companies that take the raw isocyanates and polyols, blend them with catalysts, fire retardants, blowing agents, and surfactants, and package them into proprietary systems tailored for specific application requirements (e.g., roofing foam vs. wall foam). These manufacturers play a critical role in branding, quality control, and testing for required fire ratings and physical performance. Distribution channels are bifurcated into direct sales for very large industrial clients and indirect channels utilizing a network of specialized distributors. Distributors are essential as they manage inventory, handle complex logistics involving hazardous materials, and often provide technical support and training to the applicators.

Downstream activities involve the professional contractors and applicators who execute the on-site installation. This segment is characterized by specialized equipment (high-pressure proportioning machines, hoses, and spray guns) and highly skilled labor. The quality of the final installed product is heavily dependent on the applicator's expertise, including knowledge of substrate preparation, temperature control, and proper ventilation. Direct application involves the manufacturer operating its own specialized installation crews, ensuring maximum quality control but limiting reach. The indirect route, relying on independent certified applicators, facilitates broader market penetration. The value chain concludes with regulatory compliance checks, warranties, and disposal/recycling considerations, particularly for construction and demolition waste, which is increasingly becoming an area of focus for sustainable construction practices.

Spray Foam Insulation Market Potential Customers

The potential customer base for the Spray Foam Insulation Market is highly diversified, spanning various stages of the building lifecycle and ownership structure, though they are primarily categorized by the end-use sector. End-users are fundamentally seeking solutions to enhance energy efficiency, improve structural integrity, and achieve superior thermal performance in their assets. In the residential sector, key buyers include large-scale home builders, custom home constructors, and individual homeowners undertaking major renovations or seeking retrofitting solutions to address existing insulation deficiencies. These customers are primarily motivated by lower energy bills, increased home comfort, and higher resale value derived from green building features and reduced environmental footprint.

The commercial and institutional sector represents a demanding segment, with potential customers including developers of office buildings, large retail chains, school districts, hospitals, and governmental agencies responsible for public infrastructure. For these large-scale projects, the foam's ability to minimize lifecycle costs, ensure airtightness required for modern HVAC systems, and meet stringent fire and safety codes is paramount. Architects and engineering firms often specify spray foam in the design phase due to its superior performance in complex architectural designs, particularly for roofing and continuous insulation applications required by energy modeling software. This segment often purchases high-density, closed-cell foam directly or indirectly through large general contractors.

The industrial sector constitutes another critical group of buyers, focusing on highly specialized applications where conventional insulation fails. Key customers include operators of cold storage warehouses, food processing facilities, pharmaceutical manufacturers, and specialized industrial facilities requiring process temperature stability. For these customers, spray foam's ability to act as both a thermal barrier and an air/vapor barrier is crucial for preventing condensation, maintaining precise internal temperatures, and minimizing product spoilage or process inefficiency. Geotechnical applications, such as road bed stabilization and pipeline insulation, also represent niche, high-value potential customers requiring specific high-compressive-strength formulations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.95 Billion |

| Market Forecast in 2033 | USD 3.10 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Huntsman Corporation, Covestro AG, Lapolla Industries (a subsidiary of Huntsman), Carlisle Companies Inc., Recticel NV, Demilec, Icynene-Lapolla, CertainTeed Corporation, Saint-Gobain S.A., Owens Corning, Johns Manville, Fomo Products, The Dow Chemical Company, Premium Spray Products, SWD Urethane. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Spray Foam Insulation Market Key Technology Landscape

The technology landscape of the Spray Foam Insulation Market is characterized by continuous innovation aimed at improving environmental profiles, enhancing performance metrics, and optimizing application safety and efficiency. A crucial technological shift involves the replacement of older, high-Global Warming Potential (GWP) blowing agents (primarily HFCs like HFC-245fa) with next-generation Hydrofluoroolefin (HFO) agents, such as HFO-1233zd(E). HFO technology dramatically reduces the environmental footprint of closed-cell foam without compromising its high R-value and structural integrity, aligning formulations with global climate regulatory frameworks like the Kigali Amendment. This transition requires significant investment in re-engineering foam systems and proportioning equipment compatibility to handle the new chemical characteristics.

Another significant technological focus lies in advancing the chemistry of bio-based polyols. Manufacturers are increasingly incorporating renewable raw materials derived from agricultural waste, soybean oil, or other natural resources into the B-side component. These bio-based formulations not only reduce dependence on fossil fuels but also often contribute to lower VOC emissions during curing, addressing applicator and end-user health concerns. While bio-based foam may present slightly different curing characteristics than purely petrochemical-based systems, ongoing R&D is successfully maintaining, and in some cases, improving, crucial performance attributes such as fire resistance and long-term dimensional stability, making them highly competitive in the residential segment.

Furthermore, technology is rapidly evolving in the application hardware domain. Modern high-pressure proportioning units feature sophisticated electronic controls and telematics that allow for real-time monitoring of pressure, temperature, and mix ratio, ensuring precise chemical reactions regardless of ambient conditions or distance from the spray gun. Advancements include Wi-Fi enabled diagnostics, remote troubleshooting capabilities, and integrated software that tracks material usage per job, greatly improving accountability and quality assurance. The development of robotic and automated spray systems, although nascent, represents a future technological trajectory aimed at mitigating labor shortages and achieving highly consistent, quantifiable application quality, particularly in prefabricated construction environments and large commercial roofing projects.

Regional Highlights

The global distribution and market characteristics of spray foam insulation vary substantially based on regional building traditions, energy policies, and climate conditions. North America, comprising the US and Canada, currently dominates the market both in terms of value and volume. This dominance is attributed to a strong existing network of certified contractors, high consumer awareness regarding energy efficiency, and stringent federal and state-level energy codes (e.g., IECC requirements) that favor high-performance, airtight insulation solutions like closed-cell foam. The region also boasts a robust renovation market, driving significant demand for retrofitting existing, poorly insulated housing stock. Regulatory stability and the acceptance of innovative foam technologies contribute significantly to the high market penetration.

The Asia Pacific (APAC) region is projected to be the fastest-growing market, driven primarily by massive urbanization and industrial expansion, particularly in China, India, and Southeast Asian nations. Although fiberglass and mineral wool remain prevalent due to lower initial costs, the increasing adoption of Western building standards, coupled with governmental mandates focusing on sustainable city development (e.g., China's commitment to energy-saving buildings), is rapidly accelerating the uptake of spray foam insulation. The extreme climate variability across APAC, ranging from severe cold in the north to high humidity in tropical regions, highlights the necessity for high-performance insulation solutions capable of moisture management and superior thermal bridging mitigation.

Europe represents a mature but steadily expanding market, heavily influenced by the European Union’s ambitious climate targets, which mandate near-zero energy standards for new buildings. Countries like Germany, France, and the UK are driving demand, especially in the refurbishment sector, focusing on thermal upgrading of historical and pre-WWII buildings. Regulatory frameworks, such as the REACH regulation concerning chemical safety, impose strict guidelines on foam manufacturers, prompting swift adoption of low-GWP blowing agents and stringent testing for emissions and fire safety. Latin America and the Middle East & Africa (MEA) are emerging markets, with growth concentrated in commercial infrastructure projects (hotels, malls, government facilities) where superior insulation performance is critical for managing intense heat loads and reducing operational cooling costs, positioning closed-cell spray foam as a strategic necessity in these regions.

- North America: Largest market share; driven by established energy codes (IECC), high retrofit demand, and strong professional applicator network.

- Asia Pacific (APAC): Highest CAGR; propelled by rapid infrastructure development, urbanization, and increasing regulatory focus on building energy performance standards.

- Europe: Mature market; growth driven by EU directives (EPBD) focusing on deep energy retrofits and mandatory adoption of low-GWP blowing agents (HFOs).

- Latin America (LATAM): Emerging demand concentrated in urban centers and commercial construction due to climate control requirements.

- Middle East & Africa (MEA): Growth tied to large-scale commercial and industrial projects, emphasizing insulation to combat high solar heat gain and minimize extreme cooling costs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Spray Foam Insulation Market.- BASF SE

- Huntsman Corporation

- Covestro AG

- Carlisle Companies Inc.

- Recticel NV

- Saint-Gobain S.A.

- The Dow Chemical Company

- Icynene-Lapolla (now part of Huntsman Building Solutions)

- CertainTeed Corporation

- Owens Corning

- Johns Manville (Berkshire Hathaway)

- Demilec (now a brand of Huntsman)

- Fomo Products (a division of Fomo International)

- Premium Spray Products

- SWD Urethane

- Poly-Foam, Inc.

- VersaFlex Incorporated

- International Cellulose Corporation

- SES Foam LLC

- Gaco Western LLC

Frequently Asked Questions

Analyze common user questions about the Spray Foam Insulation market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference in performance between Open-Cell and Closed-Cell Spray Foam?

Closed-Cell Spray Foam (CCSPF) has a higher density, a superior R-value per inch (typically R-6 to R-7), provides structural reinforcement, and acts as an effective air and vapor barrier, making it ideal for exterior applications and moisture-prone environments. Open-Cell Spray Foam (OCSPF) is lower density, offers a lower R-value (R-3.5 to R-4.5), but provides excellent acoustic dampening and is more cost-effective for interior wall cavities where vapor permeability is acceptable.

How do global regulations affect the chemical composition and environmental impact of spray foam insulation?

Global regulations, notably the Kigali Amendment and regional standards like the EU’s F-gas regulation, mandate the phase-down of high Global Warming Potential (GWP) hydrofluorocarbon (HFC) blowing agents. This regulatory pressure is driving manufacturers to adopt low-GWP alternatives, primarily Hydrofluoroolefins (HFOs) or water-blown systems, significantly reducing the environmental footprint of the foam and ensuring long-term product viability in compliance-sensitive markets.

What are the primary factors driving the adoption of spray foam insulation in the residential retrofitting sector?

Residential retrofitting is driven by the foam's ability to achieve superior air sealing, which is crucial for maximizing energy savings in older, leakier structures where traditional insulation struggles. Its ability to conform to irregular surfaces and dramatically improve the home's thermal envelope and indoor air quality without extensive demolition makes it the preferred high-performance solution for homeowners seeking rapid and substantial utility cost reductions.

Is the volatility of raw material prices a major constraint for the Spray Foam Insulation market?

Yes, the volatility of petrochemical raw material prices, particularly MDI (Methylene Diphenyl Diisocyanate) and petroleum-based polyols, presents a significant constraint. Since these components are oil and gas derivatives, their costs fluctuate with global energy markets, leading to unpredictable pricing for manufacturers and applicators, which can slow down project approval in cost-sensitive construction segments.

What role does digitalization and AI play in improving the quality assurance of spray foam application?

Digitalization and AI are enhancing quality assurance by enabling real-time monitoring of application parameters (pressure, temperature, and mix ratios) via specialized equipment. Machine learning analyzes this data to ensure the chemical reaction occurs optimally, minimizing human error, material waste, and the risk of off-ratio foam application, leading to guaranteed R-values and formalized documentation of installation quality for compliance purposes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager