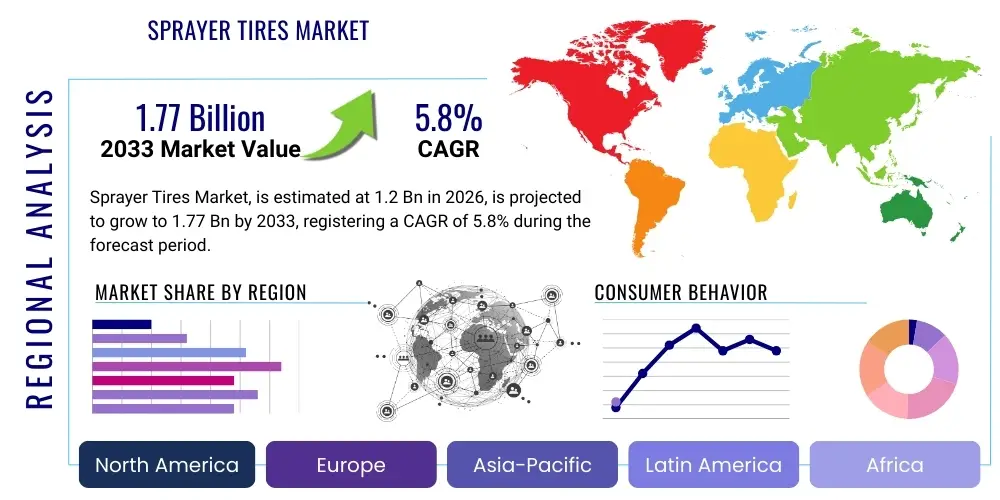

Sprayer Tires Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439283 | Date : Jan, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Sprayer Tires Market Size

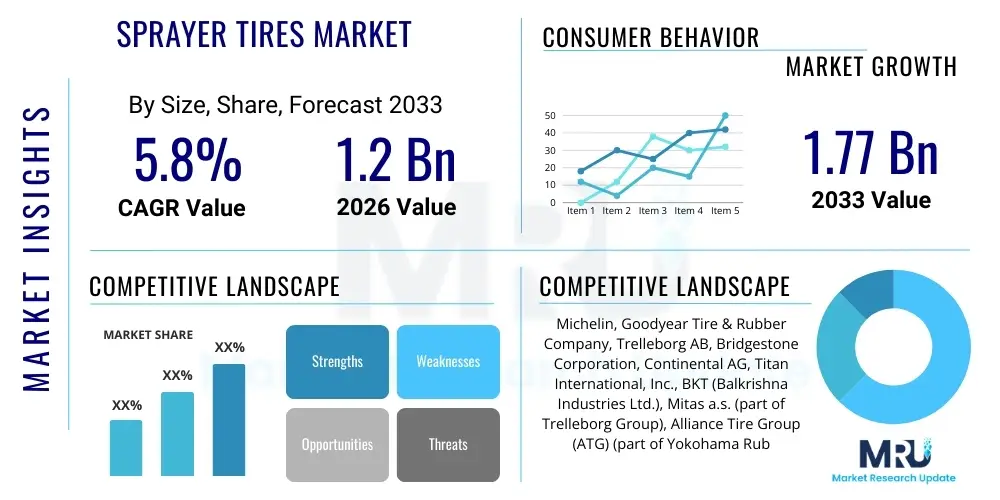

The Sprayer Tires Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.77 Billion by the end of the forecast period in 2033.

Sprayer Tires Market introduction

The sprayer tires market encompasses the global industry involved in the manufacturing, distribution, and sale of specialized tires designed for agricultural sprayers. These tires are engineered to support the heavy loads of sprayers, which often carry large volumes of liquid, while minimizing soil compaction and maximizing traction across various field conditions. They are crucial components in modern precision agriculture, enabling efficient and timely application of fertilizers, herbicides, and pesticides.

Key product features include robust construction, advanced tread patterns, and often, technologies like Increased Flexion (IF) and Very High Flexion (VF), which allow for operation at lower inflation pressures without compromising load capacity. Major applications span across large-scale commercial farming, horticulture, vineyards, and specialty crop cultivation, where the need for precise and uniform application is paramount. The inherent benefits of these specialized tires include enhanced crop yield due to reduced soil disruption, improved fuel efficiency for agricultural machinery, and extended operational windows, particularly in challenging soil or weather conditions. The driving factors behind market growth are primarily the global push for increased agricultural productivity, the rising adoption of advanced farming techniques and machinery, and the continuous innovation in tire technology aimed at optimizing farm operations.

Furthermore, the growing demand for food security worldwide, coupled with the diminishing availability of arable land, necessitates the efficient use of agricultural inputs and machinery. Sprayer tires play a pivotal role in this efficiency equation by mitigating potential damage to crops and soil structure, which can directly impact yields. The market is also propelled by government subsidies and initiatives promoting sustainable farming practices, which often involve investments in modern, high-efficiency agricultural equipment. As farming operations become more sophisticated and data-driven, the integration of smart technologies into sprayer tires, such as sensors for pressure and temperature monitoring, is also emerging as a significant growth catalyst.

Sprayer Tires Market Executive Summary

The Sprayer Tires Market is experiencing robust growth driven by significant business trends, evolving regional dynamics, and innovative advancements across its various segments. A primary business trend is the increasing consolidation among agricultural machinery manufacturers and tire producers, leading to integrated solutions and enhanced product development capabilities. There is also a strong emphasis on sustainability and eco-friendly farming practices, which drives demand for tires that minimize soil compaction and improve resource efficiency. Technological advancements, particularly in smart farming and autonomous agricultural vehicles, are creating new market opportunities and shifting product development priorities towards more intelligent and durable tire solutions.

From a regional perspective, North America and Europe continue to be dominant markets, characterized by high adoption rates of advanced agricultural machinery and a strong focus on precision agriculture. The Asia Pacific region, particularly countries like China and India, is emerging as a high-growth market due to increasing mechanization in agriculture, government support for modern farming, and a vast agricultural land base. Latin America also presents considerable growth potential as farmers increasingly invest in efficient spraying equipment to boost productivity. These regional trends are shaped by varying levels of agricultural modernization, disposable incomes of farmers, and diverse regulatory landscapes impacting agricultural practices and machinery imports.

Segmentation trends indicate a strong preference for radial tires over bias-ply tires due to their superior performance, longevity, and reduced soil impact. The IF/VF tire segment is witnessing accelerated growth, driven by their ability to carry heavier loads at lower inflation pressures, thus offering significant benefits in terms of soil preservation and operational efficiency. By application, large-scale crop farming remains the largest segment, but specialty crop applications are also growing rapidly. The aftermarket segment continues to hold a substantial share, reflecting the replacement demand and the need for specialized tires even for older sprayer models, while OEM sales are steadily expanding with the introduction of new sprayer fleets equipped with advanced tire technologies. The push for greater efficiency and sustainability across all farming scales ensures continued innovation and expansion across these core segments.

AI Impact Analysis on Sprayer Tires Market

The advent of artificial intelligence (AI) is poised to fundamentally transform the sprayer tires market, addressing key themes of efficiency, predictive maintenance, and operational optimization. Users frequently inquire about how AI can enhance the performance and longevity of sprayer tires, minimize downtime, and contribute to more sustainable farming practices. Concerns often revolve around the complexity of integrating AI systems, the cost implications, and the reliability of data generated by AI-enabled sensors. However, there are high expectations for AI to deliver unprecedented levels of precision in tire management, enabling proactive decision-making and contributing significantly to the overall profitability and environmental stewardship of agricultural operations. Farmers anticipate AI to move beyond simple monitoring to provide actionable insights for optimizing tire pressure based on real-time field conditions, predicting wear patterns, and even automating tire selection for specific tasks.

The integration of AI in sprayer tires manifests through various applications, from embedded sensors that feed data into AI algorithms for predictive analytics to autonomous sprayer systems that utilize AI for navigation and operational adjustments, directly impacting tire performance and requirements. AI-driven platforms can analyze vast datasets concerning soil conditions, weather patterns, sprayer load, and historical tire performance to recommend optimal tire pressure settings for specific fields and tasks, thereby reducing compaction and improving traction. This intelligent adaptation maximizes tire lifespan and fuel efficiency, directly influencing operational costs and environmental impact. Furthermore, AI can aid in the design and material selection for future sprayer tires, optimizing their structural integrity and performance characteristics based on simulated real-world conditions and historical data.

- AI-powered predictive maintenance for tire wear and failure, reducing unexpected downtime.

- Optimized tire pressure recommendations in real-time based on AI analysis of soil, load, and weather data.

- Integration of smart sensors in tires sending data to AI for enhanced performance monitoring.

- AI-driven automation in autonomous sprayers influencing tire requirements and design.

- Improved efficiency and fuel economy through AI-informed tire management strategies.

- Data-driven insights for tire design and material innovation based on AI simulations and analytics.

- Enhanced precision agriculture by minimizing soil compaction through AI-optimized tire settings.

DRO & Impact Forces Of Sprayer Tires Market

The Sprayer Tires Market is significantly shaped by a dynamic interplay of drivers, restraints, and opportunities, all contributing to various impact forces across the industry. Key drivers include the global imperative for increased food production and food security, which necessitates the widespread adoption of modern and efficient agricultural machinery, including advanced sprayers. The rising adoption of precision agriculture techniques and smart farming technologies further propels the demand for specialized, high-performance tires capable of operating efficiently in varied field conditions while minimizing environmental impact. Additionally, government initiatives and subsidies promoting agricultural mechanization and sustainable farming practices encourage farmers to invest in contemporary equipment and associated components like sprayer tires.

However, the market also faces notable restraints. The high initial cost of specialized sprayer tires, particularly those incorporating advanced technologies like IF/VF, can be a significant barrier for small and medium-sized farmers, especially in developing regions. Fluctuations in raw material prices, such as rubber and petrochemicals, can impact manufacturing costs and, subsequently, the final product prices, leading to market volatility. The reliance on agricultural cycles and unpredictable weather patterns also introduces an element of uncertainty into market demand. Furthermore, the limited awareness among some farmers regarding the long-term benefits of investing in premium sprayer tires over conventional alternatives can hinder market penetration.

Opportunities within the market primarily stem from continuous technological advancements, including the development of smarter tires with integrated sensors, sustainable and eco-friendly tire manufacturing processes, and innovative tread designs for enhanced performance. The expanding market for autonomous agricultural vehicles presents a substantial growth avenue, as these machines will require highly specialized and durable tires optimized for driverless operation. Moreover, increasing investments in agricultural infrastructure in emerging economies and the growing trend of contract farming offer new customer bases. The overall impact forces are pushing the market towards greater innovation, sustainability, and efficiency, albeit with persistent challenges related to cost, market education, and supply chain stability. The ability of manufacturers to address these restraints while capitalizing on emerging opportunities will dictate their success in this evolving landscape.

Segmentation Analysis

The Sprayer Tires Market is broadly segmented based on several critical parameters, including tire type, technology, application, sales channel, and tire size, providing a comprehensive view of market dynamics and consumer preferences. Each segment reflects distinct characteristics in terms of performance, cost, and suitability for specific agricultural needs. Understanding these segmentations is crucial for manufacturers to tailor their product offerings and for stakeholders to identify key growth areas and strategic investment opportunities within the diverse agricultural landscape. This granular analysis helps in mapping the competitive environment and anticipating future market shifts driven by technological advancements and evolving farming practices.

- By Type:

- Radial Tires

- Bias-Ply Tires

- By Technology:

- Standard Tires

- Increased Flexion (IF) Tires

- Very High Flexion (VF) Tires

- Low-Pressure Tires

- By Application:

- Field Sprayers (Self-Propelled, Trailed)

- Orchard & Vineyard Sprayers

- Utility & Specialty Sprayers

- Row Crop Sprayers

- Broadacre Sprayers

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

- By Tire Size:

- Small (e.g., up to 28 inches)

- Medium (e.g., 29-42 inches)

- Large (e.g., 43 inches and above)

- By Material:

- Natural Rubber

- Synthetic Rubber

- Blends & Composites

- By Load Capacity:

- Light Duty

- Medium Duty

- Heavy Duty

- By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Value Chain Analysis For Sprayer Tires Market

The value chain for the Sprayer Tires Market begins with robust upstream analysis, encompassing the procurement of essential raw materials such as natural rubber, synthetic rubber, carbon black, steel cords, and various chemical additives. Key suppliers in this stage are rubber plantations, petrochemical companies, and specialized chemical manufacturers. The quality and cost of these raw materials directly impact the final product's performance and pricing, making strong supplier relationships and efficient sourcing strategies critical for tire manufacturers. Innovations in sustainable materials and advanced compounds at this stage also contribute significantly to differentiation and market advantage.

The manufacturing phase involves complex processes including compounding, calendering, building, curing, and rigorous quality control. Tire manufacturers invest heavily in research and development to innovate tread patterns, sidewall designs, and internal structures that optimize for specific agricultural conditions, such as reducing soil compaction or improving traction. Downstream analysis then focuses on the distribution and end-user segments. This includes both the Original Equipment Manufacturer (OEM) channel, where tires are supplied directly to sprayer manufacturers for new equipment assembly, and the aftermarket channel, which caters to replacement demand from farmers and agricultural service providers. Each channel requires distinct marketing and sales strategies, with OEM requiring long-term partnerships and aftermarket focusing on retail networks, service, and brand loyalty.

The distribution channel plays a pivotal role, encompassing a network of wholesalers, distributors, specialized agricultural equipment dealers, and online retailers. Direct distribution channels involve tire manufacturers selling directly to large farming cooperatives or major agricultural equipment dealers. Indirect distribution, which is more common, leverages independent distributors and dealers who provide local sales, installation, and after-sales support to end-users. The effectiveness of this distribution network is crucial for market reach, timely product availability, and customer satisfaction, especially given the seasonal and regional variations in demand for agricultural tires. Efficient logistics and inventory management are also key components to ensure product availability and minimize lead times for farmers needing replacements.

Sprayer Tires Market Potential Customers

The primary potential customers for the Sprayer Tires Market are diverse, encompassing a wide range of agricultural entities and service providers that utilize sprayers for crop management. Large-scale commercial farmers, often operating vast tracts of land dedicated to row crops such as corn, soybeans, wheat, and cotton, represent a significant customer segment. These farmers prioritize durability, efficiency, and advanced tire technologies that can withstand continuous heavy-duty use, minimize soil compaction, and contribute to higher yields across extensive fields. Their purchasing decisions are often influenced by total cost of ownership, including fuel efficiency, tire longevity, and the impact on overall farm productivity, leading them to invest in premium IF/VF tires.

Beyond broadacre farming, specialty crop growers, including those in horticulture, viticulture (vineyards), and fruit orchards, also constitute a crucial customer base. These growers require specialized sprayer tires that can navigate narrow rows, protect delicate crops, and operate effectively in varied terrains without causing damage. The demand here often focuses on narrower profiles, specific tread patterns for stability on slopes, and low-pressure capabilities to preserve soil structure in sensitive growing environments. Agricultural contractors and custom spraying service providers are another vital segment, as they operate fleets of diverse sprayers for multiple clients and fields, requiring versatile and robust tires that can perform reliably across a multitude of conditions and machine types.

Additionally, government agricultural departments and research institutions that operate experimental farms or engage in large-scale land management also represent potential, albeit smaller, customer segments. The growing trend of autonomous farming and precision agriculture also creates a new category of customers: technology developers and integrators building the next generation of smart sprayers, which require tires designed to seamlessly integrate with advanced sensor systems and autonomous navigation. These customers are driven by innovation, data integration capabilities, and the potential for greater automation and precision, influencing the development of smart, sensor-embedded tires. The diverse needs of these end-users mandate a broad product portfolio from tire manufacturers, catering to varying load capacities, terrain requirements, and technological integration levels.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.77 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Michelin, Goodyear Tire & Rubber Company, Trelleborg AB, Bridgestone Corporation, Continental AG, Titan International, Inc., BKT (Balkrishna Industries Ltd.), Mitas a.s. (part of Trelleborg Group), Alliance Tire Group (ATG) (part of Yokohama Rubber Co.), Carlisle Companies Incorporated, Pirelli & C. S.p.A., Maxam Tire International, Firestone (part of Bridgestone Corporation), Cultor (part of Mitas), Galaxy Tire (part of Alliance Tire Group), Petlas Tire Industry and Trade Co. Inc., Apollo Tyres Ltd., CEAT Limited, Shandong Linglong Tire Co., Ltd., Double Coin Holdings Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sprayer Tires Market Key Technology Landscape

The Sprayer Tires Market is continuously evolving with significant advancements in tire technology aimed at enhancing performance, efficiency, and sustainability in agricultural operations. One of the most impactful technologies is the widespread adoption of radial tire construction, which offers superior traction, improved fuel economy, and reduced soil compaction compared to traditional bias-ply tires. Radial tires distribute weight more evenly, allowing for a larger footprint and better flotation, critical for heavy sprayer equipment that operates in diverse field conditions. This design significantly contributes to preserving soil health and minimizing crop damage, which are paramount concerns for modern farmers.

Further pushing the boundaries are Increased Flexion (IF) and Very High Flexion (VF) technologies. These tires are engineered with stronger, more flexible sidewalls that allow them to carry the same load as conventional radial tires at significantly lower inflation pressures, or carry up to 20% (IF) and 40% (VF) more load at the same pressure. The primary benefit of IF/VF technology is the expanded footprint, leading to even greater reduction in soil compaction, improved traction, and enhanced ride comfort for the operator. This translates directly into better crop yields, less fuel consumption, and extended operational windows in less-than-ideal soil conditions, making them a preferred choice for high-end sprayers and precision agriculture applications.

Beyond structural design, the key technology landscape also includes advancements in rubber compounds and tread patterns. Manufacturers are developing specialized compounds that offer enhanced resistance to wear, punctures, and weathering, thereby extending tire lifespan and reducing replacement costs. Innovative tread designs are being optimized for self-cleaning properties, improved grip on wet or loose soil, and reduced road noise during transit. Furthermore, the emergence of "smart tires" with integrated sensors for real-time monitoring of pressure, temperature, and wear is transforming tire management. These sensor technologies, often coupled with telematics and AI platforms, enable predictive maintenance, dynamic pressure adjustments, and data-driven insights, further optimizing sprayer performance and contributing to the overall efficiency and intelligence of agricultural machinery. These technological innovations collectively drive the market towards more durable, efficient, and intelligent tire solutions.

Regional Highlights

The global Sprayer Tires Market exhibits distinct characteristics and growth trajectories across various geographical regions, influenced by agricultural practices, economic development, and technological adoption rates. North America stands as a mature yet highly innovative market, driven by large-scale commercial farming operations, a strong focus on precision agriculture, and early adoption of advanced machinery and tire technologies. Europe also represents a significant market with high demand for premium, low-compaction tires, propelled by stringent environmental regulations and a continuous drive towards sustainable farming methods.

- North America: Dominant market share due to extensive agricultural lands, high adoption of advanced farming machinery, and a strong emphasis on precision agriculture technologies. Countries like the United States and Canada lead in implementing IF/VF tire technologies.

- Europe: Characterized by strong demand for specialized, high-performance tires, driven by environmental regulations focused on soil preservation and the prevalence of technologically advanced farming. Western European countries are key contributors.

- Asia Pacific (APAC): Fastest-growing region, fueled by increasing mechanization in agriculture, government initiatives to modernize farming practices, and a vast base of small and medium-sized farms transitioning to more efficient equipment. China, India, and Australia are major markets.

- Latin America: Emerging market with significant growth potential, particularly in Brazil and Argentina, owing to expanding agricultural exports and increasing investment in modern agricultural machinery to boost productivity.

- Middle East and Africa (MEA): Nascent market with growing opportunities, driven by initiatives to enhance food security, improve irrigation efficiency, and gradual mechanization of agricultural practices in key countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sprayer Tires Market.- Michelin

- Goodyear Tire & Rubber Company

- Trelleborg AB

- Bridgestone Corporation

- Continental AG

- Titan International, Inc.

- BKT (Balkrishna Industries Ltd.)

- Mitas a.s. (part of Trelleborg Group)

- Alliance Tire Group (ATG) (part of Yokohama Rubber Co.)

- Carlisle Companies Incorporated

- Pirelli & C. S.p.A.

- Maxam Tire International

- Firestone (part of Bridgestone Corporation)

- Cultor (part of Mitas)

- Galaxy Tire (part of Alliance Tire Group)

- Petlas Tire Industry and Trade Co. Inc.

- Apollo Tyres Ltd.

- CEAT Limited

- Shandong Linglong Tire Co., Ltd.

- Double Coin Holdings Ltd.

Frequently Asked Questions

Analyze common user questions about the Sprayer Tires market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of using specialized sprayer tires?

Specialized sprayer tires primarily offer enhanced flotation, reduced soil compaction, and improved traction, leading to higher crop yields, better fuel efficiency for agricultural machinery, and prolonged operational windows in diverse field conditions. Their design supports heavy loads while minimizing soil disruption, which is crucial for maintaining soil health and maximizing agricultural productivity.

What are IF and VF tire technologies, and why are they important for sprayers?

IF (Increased Flexion) and VF (Very High Flexion) are advanced tire technologies that allow sprayer tires to carry the same load at significantly lower inflation pressures, or carry heavier loads at standard pressures, compared to conventional radial tires. This innovation creates a larger footprint, drastically reducing soil compaction and improving traction, making them vital for preserving soil structure and enhancing operational efficiency in precision agriculture.

How do sprayer tires contribute to sustainable farming practices?

Sprayer tires contribute to sustainable farming by significantly reducing soil compaction, which is a major contributor to soil degradation. By enabling lower ground pressure, they improve soil aeration, water infiltration, and root development, thereby fostering healthier soil ecosystems. Additionally, their improved traction and fuel efficiency reduce the carbon footprint of agricultural operations, aligning with broader sustainability goals.

What are the key factors to consider when choosing sprayer tires?

Key factors include the sprayer's weight and capacity, the type of crops and soil conditions, the operating speed, and the overall budget. Farmers should consider tire type (radial vs. bias-ply), technology (IF/VF for reduced compaction), tread pattern for specific traction needs, and durability for longevity. Consulting with a tire specialist is recommended to match the best tire to specific operational requirements and maximize investment return.

What is the market outlook for sprayer tires, considering new agricultural trends?

The market outlook for sprayer tires is highly positive, driven by global food demand, the escalating adoption of precision agriculture, and the rise of autonomous farming vehicles. Continuous innovation in smart tire technologies, sustainable materials, and advanced designs focused on soil preservation and operational efficiency will fuel growth. Emerging markets and government support for agricultural modernization also present significant expansion opportunities, ensuring sustained demand for advanced sprayer tire solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager